One of the main reasons why Mac users have a hard time finding accounting software that’s specifically curated for Apple systems is that most software developers prioritize Windows performance owing to its larger user base. Software built around a particular operating system – in this case, Windows – in mind might not perform as well on other operating systems such as Apple devices.

If you are struggling to find the best accounting software for your MacBook, MacBook Air, MacBook Pro, iMac, etc. in 2023, you are at the right place. We bring you eight equally adept Mac accounting software that’s been handpicked based on parameters like security, pricing, flexibility, etc.

Read on, as we review the best accounting software for Mac for 2023.

Best Accounting Software for Mac 2023

Accounting software is a great way to organize your business. It helps you keep track of your finances and is also a useful tool for managing payroll and invoicing. But what if you’re an accountant who works primarily on a Mac? Don’t worry; we’ve covered you with Mac’s top 9 best accounting software.

- Zoho Books – Numerous Payment Gateways

- FreshBooks – Extremely Customizable for Different Industries

- Patriot – Best for Small Businesses

- Intuit Quickbooks – Numerous Integrations to Choose From

- Sage Accounting – Most Adaptable to Company Size

- Xero – Create Tailored Reports in a Flash

- Bonsai – Powerful Mac Accounting Tool for Automation

- Free Agent – Most User-Friendly Interface for Onboarding Clients

- Tax Slayer – Smoothest and Most Polished Interface

- Liberty Tax – Lightning Fast Page Loading Speed

Compare Quotes on Accounting Tools for Macs in 2023

Looking for a quick answer tailored to the needs of your business? Use the widget below to compare quotes from the best accounting software providers.

Best Accounting Software for Mac and Apple Devices | Compared

If you’re a Mac user, you already know how much better it is to use an Apple computer than a PC. But what’s the best accounting software for Mac? There are so many options out there! We’ve created this list of Mac’s top 9 best accounting software to help you find the right one for your business.

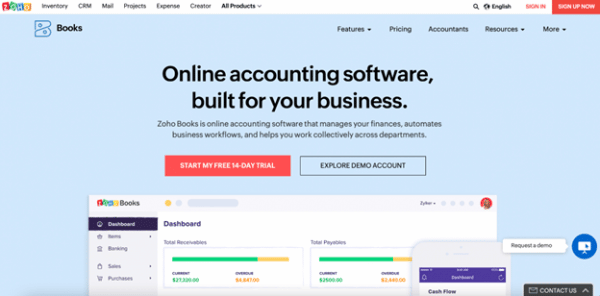

1. Zoho Books – Best Small Business Accounting Software Mac

Zoho Books is a user-friendly accounting software that is packed with advanced features that make personal accounting easy for those who may not have extensive knowledge in finance management, personal accounting, or tax filing

One of the standout features of Zoho Books is the ability to track expenses by uploading pictures of paper receipts. Additionally, the software automatically records any payments made online or through a bank account, providing a comprehensive expense chart that allows users to see where their funds are being allocated.

Zoho Books helps users avoid overspending and optimize their spending by tracking expenses and allowing for the creation of recurring payments for expenses like subscription services and phone bills.

The software also offers seamless transaction tracking and management by automatically reconciling all entries with the user’s bank account.

Zoho Books’ automatic reconciliation feature compares every payment made, whether through a credit or debit card or bank account, with the corresponding records from the user’s bank to ensure accuracy and catch any potential errors or unauthorized payments.

In addition to automatic reconciliation, Zoho Books also offers the option to manually review transactions and categorize them based on payment type and purpose for easier organization and searching. By grouping similar payments together, users can more easily locate specific entries.

| Starting Price | Top Features | Free Trial | Customer Support |

| $0 | 1. Invoice creation too

2. Time tracking 3. Automated follow-ups |

14 days | 24×5 – email or |

Pros

- A feature-packed end-to-end accounting solution

- Offers several payment gateways

- Straightforward to navigate and understand

- Automates various repetitive tasks

- Offers an inventory management module

- Detailed and customizable records

Cons

- Not ideal for tracking fixed assets.

- A limited pool of accountant partners

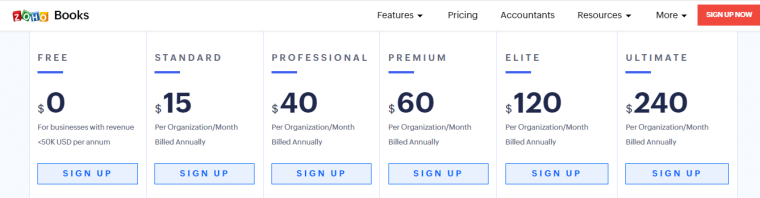

Pricing

In addition to its robust set of features, Zoho Books is also highly affordable and scalable, with a free forever plan and five additional pricing options to choose from. This makes it one of the best options for accounting software on the market.

For small businesses with annual revenue under $50,000, Zoho Books’ free plan is an excellent choice. It allows for the management of up to 1,000 invoices and includes features like multilingual invoicing, expense tracking, and email support.

The Standard and Premium plans of Zoho Books offer additional features, integrations, and support. The Standard plan allows for integration with Zendesk, Zoho People, Zoho Projects, and Avalara, while the Premium plan adds support for Zoho Sign and Twilio as well.

All paid plans of Zoho Books come with a 14-day free trial period, giving users the opportunity to try out the software and decide if it meets their needs before committing to a purchase

2. FreshBooks – Best Home Accounting Software for Mac

FreshBooks is a personal finance and revenue management tool designed specifically for solopreneurs and freelancers, offering flexible features that make it easy to keep track of financial information.

Like other accounting software options like Zoho Books and QuickBooks, FreshBooks also offers automatic transaction recording for payments made through a bank or credit card.

FreshBooks’ automatic transaction recording feature saves users the time and effort of manually entering financial information and reduces the risk of errors or missed entries. This real-time updating of expenses allows users to check their live budget balance before a significant investment.

FreshBooks offers multiple payment options, including PayPal, credit cards, and direct bank deposits, making it an ideal choice for start-ups and small businesses. These options allow customers to pay faster and more conveniently.

By providing multiple payment options, FreshBooks allows customers to choose their preferred method of payment, potentially increasing their satisfaction with the service.

FreshBooks Advanced Payments includes some additional features, such as the ability to set up recurring billing profiles to automatically send out payments each month. This helps users avoid missed payment deadlines and late fees.

FreshBooks’ integration with Stripe allows users to easily make and accept international payments in different currencies. This integration provides a secure and encrypted platform for transactions with minimal fees and no hidden charges, making it easy to manage both local and international payments on one platform.

| Starting Price | Top Features | Free Trial | Customer Support |

| $6/month | 1. Expense tracker

2. FreshBooks Payments 3. Compatible with major banks |

30 days | Call |

Pros

- Offers different settings for different clients and users

- Top-notch customer support

- Allows you to create proposals, project statements, and retainers for each client

- Time and mileage tracking options

- Allows you to track inventory across multiple products

- A 30-day free trial

Cons

- Banking connections take time to build up

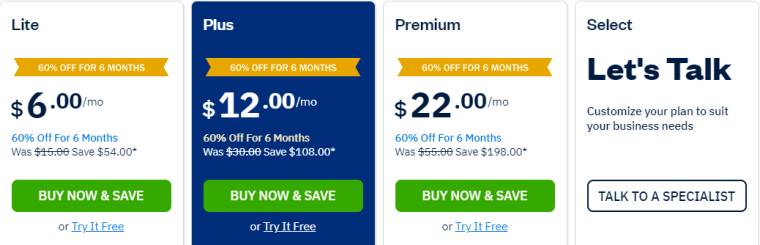

Pricing

FreshBooks’ Lite plan includes unlimited invoicing for up to 5 clients, unlimited expense tracking, and the ability to send unlimited estimates.

While the Lite plan offers many features, it does not allow for accountant collaboration. FreshBooks’ higher-end plans, however, do include this option in addition to advanced features like automatic expense tracking, the ability to get paid with checkout links, and the option to remove FreshBooks branding from client emails.

Users can try FreshBooks risk-free with a 30-day free trial to see if it meets their needs.

3. Patriot – Best for Small Businesses

Patriot has been created using inputs from accountants and business owners like you, making it one of the only business accounting software that’ll fully understand your financing needs.

Our favorite thing about Patriot is that it lets you manage unlimited vendors even on the basic plan. You can easily log all your vendors in a centralized database, track their invoices, approve payments, and print paychecks — all from one place. Plus, since it’ll have an automated history of all transactions, there’ll be no scope for disputes.

If you have independent contractors working for your company, you’ll have to take care of forms 1099 and 1096 to file information regarding income types other than wages & tips and summarize the payments made out to those independent contractors, respectively. With Patriot, you can track as many of these forms at no extra charge so that you don’t get in trouble with the IRS.

If you want to file 1099 digitally, you can do so directly from Patriot. Here, you’ll be charged a nominal fee to process the form. But since Patriot will take care of handing it over to the IRS and managing the proceedings too, we say it’s 100% worth it. Handling financial legalities and taxes has never been this easy.

| Starting Price | Top Features | Free Trial | Customer Support |

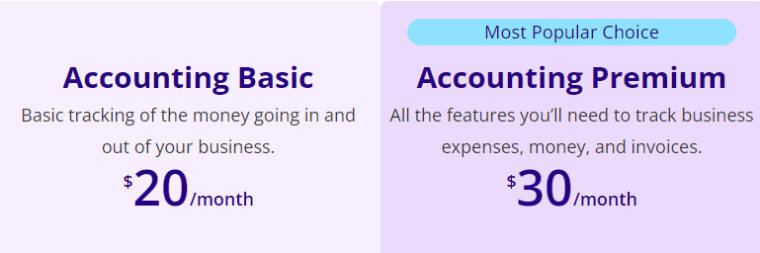

| $20/month |

|

30 days | Call, chat and e-mail |

Pros

- Very easy to use and understand

- Excellent customer support

- An intuitive format makes learning easy

- Excellent for streamlining invoices for small business

- More affordable than its peers

Cons

- Limited reporting functions

Pricing

Patriot starts at an affordable $20 per month with its “Accounting Basic” plan. Here, you’ll be able to create and track unlimited customers and invoices and enjoy easy data imports, free expert support, the ability to bring unlimited users on board, and whatnot.

That said, if you’d also like user-based payments, account reconciliation, custom invoice templates, and more such premium features, consider getting the “Accounting Premium” plan at just $30 per month.

Unsure about Patriot? Try it risk-free for a full month, thanks to its 30-day free trial.

4. Intuit QuickBooks – Best Web-Based Accounting Software for Mac

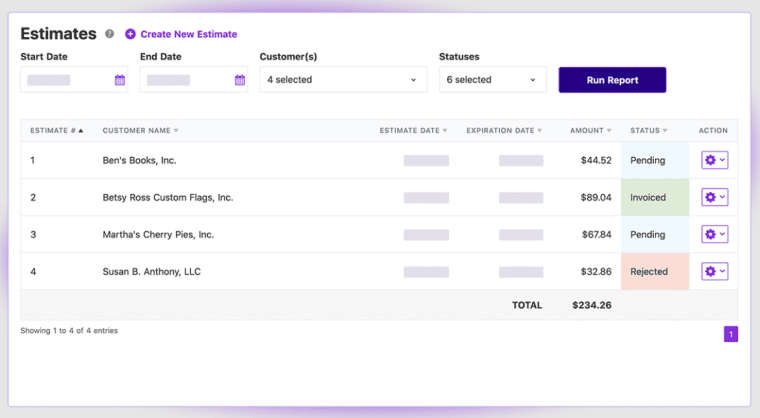

Quickbooks is a web-based solution that can be accessed from any web browser. No need to download or set up the software before using it since invoices may be photographed and submitted as evidence of spending or shared with necessary stakeholders. Credit card transactions can be downloaded and reconciled.

The software is an excellent option for any small company, particularly those that intend to work with a bookkeeper or accountant regularly since it is widely recognized as the industry standard for small business accounting software.

What’s it best for?

Intuit Quickbooks is an excellent tool for managing income and expenses, keeping track of the financial health of a business, and even automating some of your bookkeeping tasks.

It’s straightforward to use—you can set it up in minutes and start using it immediately. In addition, there are no hard setup processes since you can manually input or import transactions from your bank account and credit card bills.

Pros

- Lots of third-party integrations

- Offers robust features

- Resources are easy to find

Cons

- Expensive price plans

- Limited account users for each plan

- Steep learning curve

Pricing

Intuit QuickBooks’ pricing plan is pretty straightforward; you need to join one of the three available pricing plans to get the best out of it.

- Simple Start – Send custom invoices & quotes, connect your bank, track VAT, and for one user, plus your accountant for $17 a month.

- Essentials- Everything in the simple start plan plus Insights & reports, employee management, multi-currency, three users, and your accountant for $26 a month.

- Plus – Everything in the Essentials plan plus recurring transactions, inventory tracking, budget management, and for five users plus your accountant for $36

5. Sage Accounting- Best Personal Accounting Software for Mac

Sage is a well-known and commonly used accounting program. Sage for Mac is one of the accounting software packages used by Mac users on a scale comparable to that of PC users.

It is one of the most scalable accounting systems available for Mac users, making it an excellent choice if your company is anticipated to expand quickly. In addition, the system is highly customizable, making it easy to change or add features as your business grows.

What’s it best for?

Sage is best for businesses that need to track a lot of data very organized manner. Sage has a modern, intuitive layout that can be used by anyone with little or no accounting knowledge, making it easy to compare and report your consumption data.

Pros

- Adaptable to a variety of company sizes, from startups to multinational corporations.

- The user interface is simple and intuitive.

- 24/7 phone-based assistance for free bank feeds

Cons

- There isn’t a desktop application for Mac

- Several features are too complex to use

- There is a shortage of information and assistance

- The Journal entry is sluggish

Pricing

With Sage, you can choose from three different pricing plans to fit the size of your company. And if you’re growing, you’ll never have to worry about upgrading—Sage’s pricing is constantly changing to meet your needs.

Sage Accounting – Automatic bank reconciliation, invoice creation and sending, unlimited users, forecast cash flow, and manage purchase invoices for $25 a month.

6. Xero – Best Inventory Management Accounting Software

Xero is an accounting software that is hosted in the cloud and is intended for use by small and medium-sized enterprises. Xero not only connects small company owners with their trusted advisers but also provides them with real-time financial insights.

Xero can be accessed from any device with an internet connection since it is web-based. Small companies can keep track of their cash flow, transactions, and account data no matter where they are thanks to Xero’s complete accounting services.

What’s it best for?

Xero is best for small business owners who want to manage their finances from anywhere.

Since it’s cloud-based accounting software, it allows you to manage your company’s accounts on the go and stay up-to-date at all times, even when you’re out of the office. It also has fantastic integrations with other apps and services that make it easy to pull data from other tools and platforms into Xero.

Pros

- Customizable reports and dashboards

- Inventory management in all plans

- Interactive quotes

Cons

- An entry-level plan limits invoices and bills

- No phone support

- Hard to navigate through the user interface

Pricing

Xero Accounting’s pricing plans are simple, straightforward, and easy to understand.

There are three plans to choose from Starter, Standard, and Premium. The more you play, the more features you get.

- Starter – Send quotes and 20 invoices†, enter 5 bills, and reconcile bank transactions for $22 per month.

- Standard – Capture bills and receipts with Hubdoc, bulk reconcile transactions, and short-term cash flow and business snapshot for $35 a month.

- Premium – Bulk reconciles transactions, uses multiple currencies, and short-term cash flow and business snapshot for $47 a month.

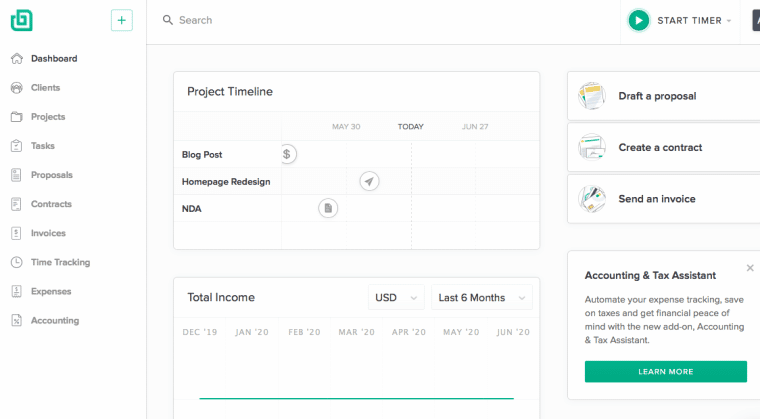

7. Bonsai – Powerful Mac Accounting Tool for Automation

Bonsai is a popular Mac accounting software for small businesses and freelancers looking to automate their bookkeeping and streamline their financial processes — from proposal to tax preparation, Bonsai helps you with it all.

As a tool for both accounting and tax, Bonsai strikes a powerful balance between ease of use and power and makes managing these aspects of any business, far easier.

What’s it best for?

Bonsai is best for small businesses and self-employed individuals looking to automate things like invoicing, expense, income, and time tracking — it’s designed to save you time, help keep your business organized, and ensure fewer late payments.

It’s a solid option for managing all your projects, tasks, finances, and clients under one roof and collaborating with contractors and others involved in your day-to-day processes for free, and with ease.

Pros

- Offers superb value for money

- The automation saves ample time

- Top-notch customer service

- User-friendly, modern interface

- Great for tracking your financials

Cons

- Lacks customization

- Can be expensive for some

- Payment reminders don’t reflect in the sent folder

Pricing

Bonsai has 3 payment options, plus a 14-day free trial and money-back guarantee. Here are the price tags and what you get with each plan:

- Starter — $17/month — Includes all templates, unlimited clients and projects, invoicing and payments, proposals, and contracts, expense tracking, and up to 5 collaborators

- Professional — $32/month — The above, plus custom branding, forms, questionnaires, workflow automations, client portal, integrations + up to 15 collaborators

- Business — $52/month — Subcontractor management + onboarding, accountant access connect multiple bank accounts, unlimited subcontractors and collaborators

Overall, considering what’s on offer even with the Starter plan, Bonsai offers phenomenal value for small businesses looking for reliable Mac accounting software.

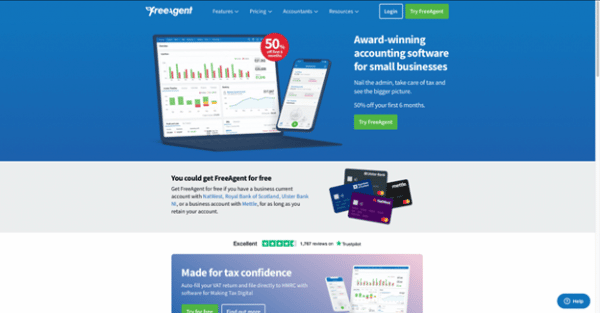

8. Free Agent – Best for Onboarding New Clients

Online accounting software FreeAgent has won several awards for its focus on small companies, independent contractors, and the accountants who serve them. As of this writing, more than 100,000 small company owners rely on FreeAgent to keep track of their finances in a simple, straightforward, and pleasant way.

There are a lot of valuable features in FreeAgent for small enterprises. Every aspect of operating a company, from controlling costs to conducting payroll and time tracking that complies with RTI to making and sending invoices to tracking cash flow, is made easier with the aid of this software.

What’s it best for?

Free Agent is a platform that helps small businesses grow by providing them with resources and tools to help them reach new heights. With its straightforward interface, even novices can access all of this program’s features.

Pros

- Easy to onboard clients

- Customer support is quick and knowledgeable

- Has a lot of great features for small businesses

Cons

- Exporting information is a bit tricky in some areas

- The system requires knowledge to be able to use it properly

- Using the software was very awkward and restrictive

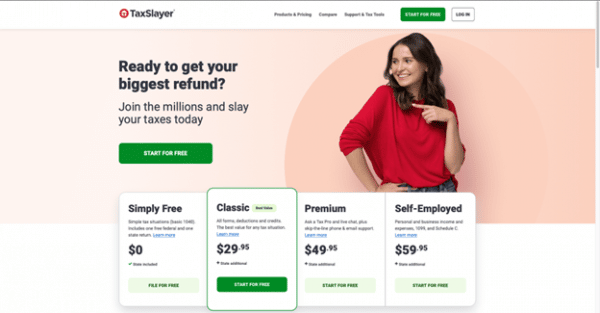

9. Tax Slayer – Best for Compliance

Rhodes-Murphy & Co-founded TaxSlayer in Augusta, Georgia, in the United States, in 1965. Traditional tax preparation services gave way to the development of software for accountants and other professional tax preparers during this industry’s history.

It progressively evolved into a tool that the average individual could use to prepare their taxes during their life. It has been in business for over a century, and the same family has controlled it from its headquarters in Augusta.

What’s it best for?

TaxSlayer’s extensive features make it a valuable tool for individuals, small businesses, and the tax professionals who serve them. Its interface is straightforward, and its data management tools are easy to understand and powerful as the user becomes more familiar with them.

Pros

- Polished and smooth user interface

- Supports all primary IRS forms and schedules

- Good knowledge base

Cons

- There is no contextual assistance on the Q&A screen

- The quality and quantity of help materials are not that good.

- IRS guidelines and publications should not be relied upon excessively

Pricing

Look no further than Tax Slayer if you’re looking for one of the best accounting software that’s easy on your wallet.

Tax Slayer offers four plans to choose from, all of which are affordable and work for any level of filer:

- Free – Includes W-2 Income, student loan interest, and education expenses, and free phone and email support for $0 state included.

- Classic – Everything in the free plan, plus all deductions and adjustments to income, no form or schedule restrictions to all income types, and fast-fill your info with W-2 imports and PDF uploads for $29.95 plus state charge.

- Premium – Everything in classic plus phone and chat support priority, IRS Audit Assistance for three years, and live chat support for $49.95 plus state charges.

- Self-Employed – Everything in premium plus guidance with 1099 income, ability to maximize work expense deductions on your Schedule C, quarterly estimated tax payment reminders, and personalized guide to self-employed taxes for $59.95 plus state charges.

10. Liberty Tax – Quickest Page Loading Speeds

Liberty Tax is an internet service that helps consumers file their tax forms electronically. This firm is one of the handfuls that the IRS has approved to provide e-filing services.

This tax software makes it easier to complete tax forms by breaking them into smaller, more manageable pieces. In addition, it verifies your input on each form to verify compliance and eliminate the risk of mistakes. Tax information is also conveniently available, ensuring that you are never out of date and are always well-informed.

What’s it best for?

Liberty Tax is designed to help you itemize your taxes in a way that makes sense for your situation. It is best for individuals with W-2, investment, and retirement income who want to itemize their deductions.

Pros

- Pages load quickly

- Simple, clean user interface

- Good review process

Cons

- Little context-sensitive help

- Some atypical navigation

- No warning for upgrading pricing plans

Pricing

Liberty Tax offers four different pricing plans, so you can get strictly the return you need.

- Free – $0 for federal and one state return

- Basic – $24.95 for federal returns and $36.95 for state returns

- Deluxe – $44.95 for federal returns and $36.95 for state returns

- Premium – $64.95 for federal returns and $36.95 for state returns

What is Accounting Software for Mac?

Finance Accounting software for Mac is a system that records and stores a company’s financial transactions, accessed by authorized personnel. This helps analyze the company’s performance and helps decide on different strategies to adopt for the future. All these financial transactions are stored in the form of records that any user can access by opening their accounts.

How Does Accounting Software for Mac Work?

Finance Accounting software for Mac is a supplementary tool used by many companies to manage their financial records. It helps the company control its finances and lets them decide which direction to take going forward. In addition, the accounting process can be easily managed when it comes to the accounting software for Mac.

What Are the Advantages of Using an Accounting Software on Mac?

There are no significant disadvantages to using accounting software for Mac. On the contrary, this software is useful and valuable, so you would not have any reasons against it. Moreover, it is straightforward and widely appreciated by many self-employed individuals who need to manage their businesses properly.

When you are in the business world and want to take care of your finances without getting bogged down with these things, it is a good idea to use accounting software for Mac.

It makes your life easier by automating a lot of things. In addition, the program will ensure that you are on top of all that is going on, so you can get back to doing what you like the most—running your business.

It can also make sure that you are keeping track of all the expenses that you make during the day, so you won’t have any problems when it comes to calculating your taxes.

The software will help you manage all the expenses for your business and keep everything organized and in one place. You won’t have to go through stacks and stacks of papers when you have good accounting software for Mac.

Conclusion — What’s the Best Accounting Software for Mac?

The best choice for accounting software for Mac is Intuit QuickBooks. This software is ideal for small businesses and those who want to keep track of their finances.

It is simple to use, making it a practical choice for accounting software for Mac. You don’t have to be a business expert to figure out how this software works since the interface is easy-to-use.

It also has some additional features you would not expect from accounting software for Mac.

For example, it has inventory management, time tracking, reports, and other valuable features that will help you keep track of your finances and outsmart the IRS. As a result, Intuit QuickBooks is an excellent choice for those who want to focus on their business instead of their finances.