Play-to-earn games have become extremely popular within the crypto ecosystem and are expected to be one of the biggest growth markets in the space in the next decade.

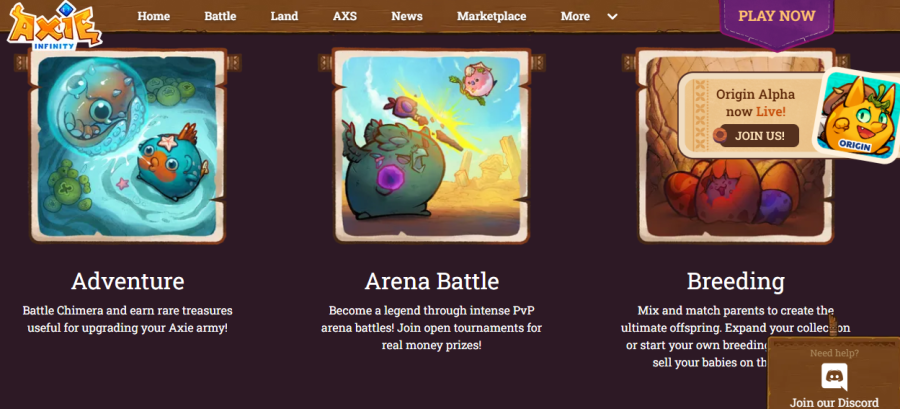

Axie is one of the platforms leading the pack. Its online video game enables players to collect and mint NFTs, representing digital pets known as Axies.

Playing the game requires players to hold the platform’s native token, AXS. Investors holding the Axie token have been on a tumultuous ride, and some are wondering about the coin’s future price action. We made an AXS coin price prediction for 2023 and 2025. Moreover, we detailed the coin’s use cases and factors influencing its price.

Axie Infinity Price Prediction

Axie Infinity and the AXS token exploded into life during the 2021 bull run, surging from around $5 at the end of June to an all-time high of $165 – an increase of 3,200% – in November 2021.

However, the token has since crashed due to a multitude of factors and issues in the ecosystem, as well as because of the crypto winter and macroeconomic conditions.

Let’s explore the potential prices AXS could reach in the next few years.

- End of 2023: AXS will face strong resistance at all the way up, given the number of investors who bought the coin at highs and want to exit their positions. Its myriad issues and ever-falling player base suggest the coin may struggle to even reach $50 by the end of 2023, unless another bull run appears and Axie regains its place at the top of the GameFi world.

- End of 2025: It’s possible that cryptocurrencies have returned to a bull market by 2024 and 2025, given the incoming Bitcoin halving. The GameFi sector is only expected to grow but while Axie Infinity was a trailblazer, many more projects have now entered that market, seen Axie’s issues, and worked to build game mechanics that will not fall into the same trap. Optimistic investors may see AXS at test new highs to $200 by the end of 2025 – though it is equally likely the coin falls completely out of relevance.

Cryptoassets are a highly volatile unregulated investment product.

Axie Infinity

| ⟗ Coin Name | Axie Infinity |

| 💲 Price | $10.61 |

| 🔆 Coin Symbol | AXS |

| ⏳ Price Change 1h | 0.94% |

| 🌕 Price Change 24h | 9.71% |

| 💵 Market Cap | $1,072,090,816 |

| 🥇 Rank | 45 |

| 🌐 24h Volume | 45 |

| 🔄 Circulating Supply | 101,043,121 |

| 💰 Total Supply | 270,000,000 |

Axie Infinity Price History

Players found Axie Infinity to be extremely simple to play compared to most multiplayer games, while its reward system and positive news coverage, only drove the mania around the game.

The volume surge had a direct impact on AXS. At the beginning of April 2021, The Axie Infinity token had its initial coin offering (ICO), closing the first day at around $7.70.

High volatility ensued at the end of the month as AXS dipped to $6.50 before a short-term rally to almost $11.

The excitement didn’t last long as AXS kept making lower lows and eventually reached $3 by the end of May 2021. One month after its ICO, the Axie Infinity coin lost more than 50% of its value.

That would’ve shaken out the weak hands, but the diamond hands didn’t have to wait long for a massive spike.

AXS Price Pump and Crash

After reaching $3, the AXS coin ranged only for a month before massive buy volume entered the market at the end of June 2021. Not only did AXS set an ATH, but it rallied just over 5,200% to reach $165 in November 2021.

The mania around the coin drove its growth, with investors and players interested in news articles that described players in developing countries earning more from the game than the average wage and an ever-surging price.

At its peak, Axie Infinity was attracting nearly 3 million players every month.

November 2021 marked the top for AXS before falling just days later after setting an ATH. Bitcoin’s crash signified that it dragged the rest of the market with it, and the Axie Infinity cryptocurrency was one of the casualties.

While many of the major altcoins lost about 70% of their value, AXS plummeted even lower.

As the crypto winter lengthened and major coins struggled, investors moved quickly to sell off their AXS.

Problems with the game mechanics and supply outweighing demand meant that the token and game was already in major trouble before the Ronin Bridge Hack

Ronin Bridge Hack

In March 2022, hackers made away with approximately $625 million of assets after exploring a weakness in the Ronin cross-chain bridge.

It remains the biggest crypto hack ever and the game and coin have both been on a downward spiral ever since, with investor confidence gone and a massively falling player base.

As of last year, Axie Infinity had fewer than 200,000 monthly players, a huge decrease from its peak.

Recapping AXS Key Events

Despite its issues, Axie Infinity is still considered one of the best crypto games to play. Our Axie Infinity price prediction includes recapping key AXS events to highlight the massive volatility that the coin has experienced.

- AXS began trading on major exchanges at the beginning of April 2021 and closed the first day at $7.70.

- The coin dipped to $6.50 at the end of the month before a short-term rally to $11.

- By the end of May 2021, AXS had lost more than 50% of its value since the ICO as it dropped to $3.

- A month of consolidation followed before buyers stepped in at the end of June to launch AXS on an epic rally. The coin pumped just over 5,200% to reach an ATH of $165 in November 2021.

- Ronin Bridge hacked with $625 million stolen from the project’s developers Sky Mavis.

- AXS continues to amid a falling player base, issues with the game mechanics, and the wider crypto winter.

- AXS’s crash has resulted in the coin losing 93% of its value after setting an ATH.

AXS Coin Price Prediction 2023

Since our Axie Infinity price prediction doesn’t involve the coin setting a new ATH, we believe that it will face major resistance once it reaches the 0.702 Fibonacci level.

AXS may try to break through that level by dipping a bit, then retesting the resistance, but it will eventually start making lower lows.

Once AXS enters a downtrend, it may have a few price spikes along the way. But its trajectory at that point will be the next strong support, which is at $36. We know that level is significant because when AXS rallied in 2021, it spiked above that price point, then retested that level several times before continuing the bull run.

When AXS reaches strong support at $36, we foresee the coin consolidating for some time.

It may even have a spike because of the drop from $120. Our Axie Infinity price prediction is that the coin won’t hold that level.

If a bull market returns and a new catalyst for Axie or the wider GameFi asset class appears then AXS may reach triple figures again.

But the real question is, how low can it go?

Axie Infinity Price Prediction 2025-30 Prediction

The AXS price action has revealed to us that it can go lower than $36. Currently, the AXS token price is $10.

In 2025. We believe that the crypto market will be in a full-blown bear market. Considering that sentiment, we predict that AXS will break support at $36 and dip lower.

The market has revealed that a crypto winter can be brutal and it can dish out a tremendous amount of pain. AXS’s bottom will come in at around the same price region it dipped to after its ICO, at $4.

When AXS reaches $4, it should be oversold. Sellers would’ve completely exhausted their power, and AXS will lose about 97% of its value. At that point, the only way should be up. That’s not guaranteed, but the market has revealed to us the massive rallies AXS can achieve.

If AXS does a massive rally after reaching the bottom, how high could it pump by 2030?

A few altcoins that went on several bull runs usually outdo the previous high by about 120%. If the same were to happen with AXS, our Axie Infinity high price prediction for 2030 would be around $200.

However, given the issues in the Axie ecosystem, the range of new games that have come out – and learned from Axie’s mistake – and the lack of investor confidence in the project, it may well fall to $1 or below.

Potential Highs & Lows of Axie Infinity Coin

Considering the Axie coin price has experienced tremendous volatility in the short period that the coin has traded, it’s possible for it to bounce around a range. So we’ve compiled the possible AXS lows and highs for the next few years.

| Year | Potential High | Potential Low |

| 2023 | $100 | $2 |

| 2025 | $200 | >$1 |

What is Axie Infinity Used For?

The key reason investors buy cryptocurrency is for capital gains. But for the coin’s value to increase, adoption is necessary and that happens because of utility. Let’s take a look at AXS’s use cases.

Earn Rewards

The key attraction of playing Axie Infinity is that players earn while they’re entertained.

Many users in the DeFi ecosystem credit Axie Infinity as the pioneers of the play-to-earn concept. Now, the game has switched to play and earn. Players earn $ASX, which they can exchange for other currencies.

Payments

One of the key reasons for blockchain development was to offer a decentralized exchange to conduct peer-to-peer transactions without involving a third party.

We’ve discovered the best peer-to-peer exchanges. The Axie Infinity coin is part of that ecosystem, so AXS holders can send the coin globally. They can also use it to buy goods or services where AXS is accepted or to swap it for other assets.

Staking

Earning interest on coins is a way investors receive a passive income from crypto. By locking in coins on an exchange, investors receive interest. An exchange usually pays interest with the coin staked. AXS is one of the best staking coins.

Governance

Players use AXS, which serves as the platform’s governance token, to vote on future developments of the game’s infrastructure.

What Drives the Price of Axie Infinity?

Although Axie Infinity is largely responsible for influencing the AXS price, macroeconomic factors also play a role.

Utility

The AXS coin is central to Axie Infinity’s platform. Its use is essential for playing, earning and transacting. The demand for AXS increases as more users play the Axie Infinity game or transact with the coin. The bigger the demand for the coin, the higher its price should spike.

Market Sentiment

AXS’s price action has revealed to us that it’s closely tied to Bitcoin. When Bitcoin rallied in 2021 so did Axie Infinity. The same happened with Bitcoin’s crash, though AXS plummeted deeper than Bitcoin. The market’s sentiment has a significant impact on the price of AXS. If a large buying volume for Bitcoin emerges, the same could happen to AXS. The same applies to bear markets.

Where to Buy Axie Infinity

W

eToro is a well-regulated platform compliant with financial authorities such as the US SEC, FINRA, FCA, CySEC and ASIC – so investor funds are safe. It also provides secure asset storage offline in one of the best crypto wallets.

Besides AXS, investors have access to more than 70 cryptocurrencies. A minimum deposit of $10 is required, and no fees apply if funded in USD. A conversion cost of 0.5% applies to deposits other than USD. Payment options include bank wire, debit/credit cards, Paypal, Skrill, Neteller and Webmoney. Withdrawals incur a $5 fee. Inactive users are charged $10 monthly after 12-month inactivity. Trading AXS incurs a 1% fee.

The platform offers CopyTrading, enabling users to copy AXS trades of professionals. The service is free. Also, investors can diversify their portfolios by investing in a Smart Portfolio, a fund comprising of several cryptocurrencies. A manager rebalances the portfolio to achieve the best returns but doesn’t charge service fees. Some like Napoleon-X returned a profit even during the bear market.

eToro offers a platform convenient for beginners to buy AXS with a few clicks and provides professionals with advanced tools to incorporate into their technical analysis. Traders can test out their platform before going live by downloading the free $100,000 demo account. A mobile app is also available on iOS and Android.

What We Like

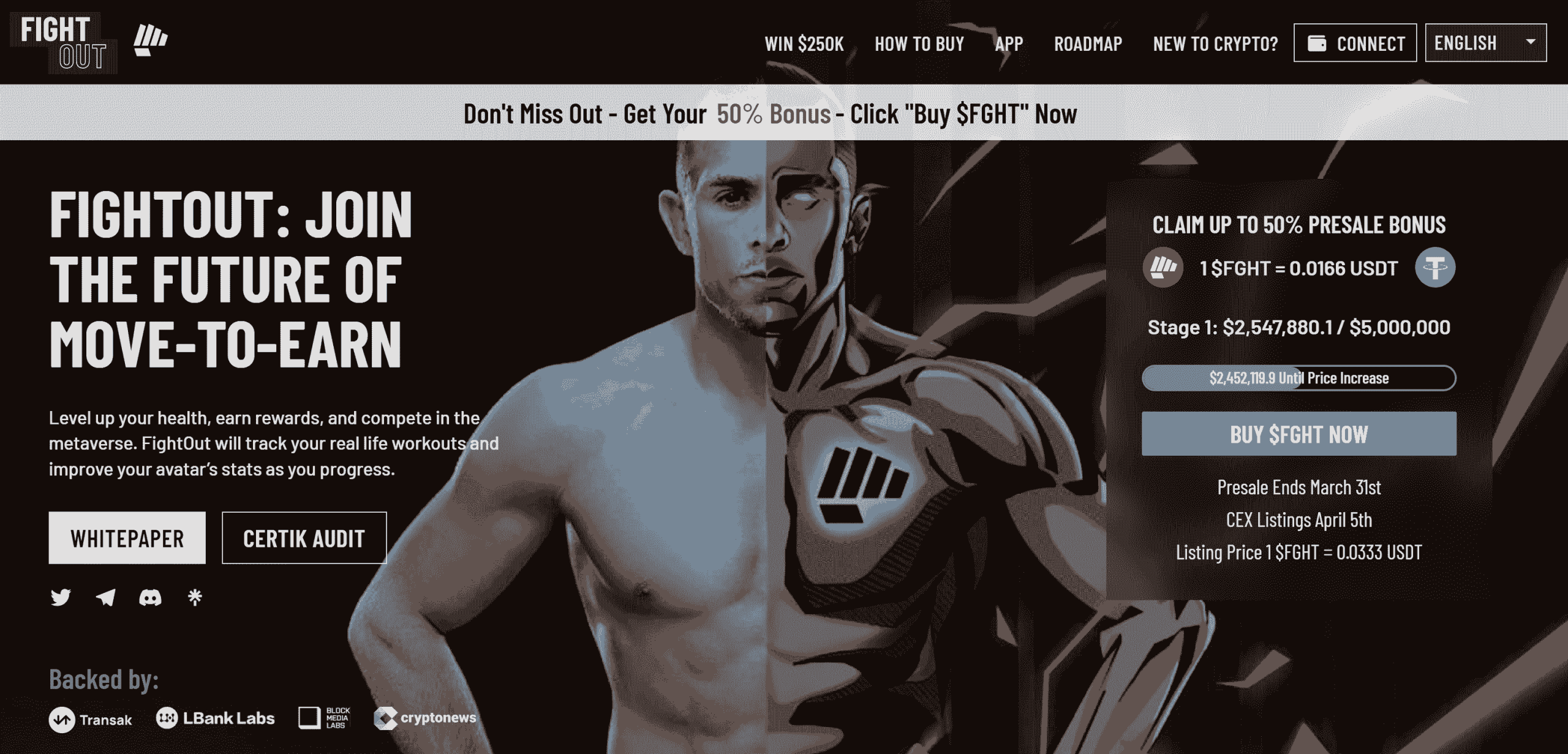

Cryptoassets are a highly volatile unregulated investment product. Axie Infinity’s platform offers players numerous benefits, and AXS investors who got in during the lows profited handsomely. However, if you are looking for the best play-to-earn games, there are several other crypto projects to consider. Tamadoge launched earlier this year to huge excitement and hype, as a meme coin with P2E gaming and NFT ownership in its ecosystem. The native TAMA coin pumped after launch and it should reach new highs when its game – based on 90s craze Tamagotchi – is released. Calvria: Duels of Eternity is a presale project that we’ve rated as one of the best GameFi crypto tokens to buy. The project will have both a P2E and free-to-play (F2P) versions to drive mass adoption of casual and traditional gamers to its ecosystem. We reviewed Axie Infinity and do not believe it represents a good investment at the time of writing, given the token’s poor performance, falling player base, and lack of investor confidence after the massive Ronin bridge hack. Although the game may recover in the next bull run, it is difficult to foresee that scenario play out as the game was already struggling to retain and attract players before the crypto winter set in. An alternative project, FightOut, which is in its presale phase may represent a better investment in the coming weeks and months. To help users elevate their fitness levels, FightOut has created a fitness app to reward its users for doing their daily workouts. The project has raised over 2.5 million USDT in just a few days of launching its first presale stage. At the time of writing, buyers can invest in the $FGHT tokens at a presale price of only 0.0166 USDT per token. With the CEX listings lined up from 5 April, the token will rise to 0.033 USDT per token. The platform has gone a step further to build a metaverse for its users and gamify the fitness lifestyle. FightOut allows users to create their own Soulbound NFT avatars. These avatars improve their stats in direct correlation to the users’ real-life fitness performance. Thus, users can also compete with other community members via the platform’s metaverse. The project has devised its in-app currency known as ‘REPS’ to reward users for doing various in-app fitness challenges. REPS can be utilized to avail membership discounts, purchase cosmetic NFTs for avatars, and so on. Users should read FightOut’s whitepaper to get a deeper understanding of its features. $FGHT is an Ethereum-based limited supply token native to the platform. From its total supply of 10 billion, 90% of the tokens are available for sale through the project’s presale stages. Investors buying $FGHT will receive purchase bonuses that start from 10%. To avail the bonus, buyers can start with a minimal investment of $500 along with 6 months of vesting. Users can also get membership rewards if they stake their $FGHT tokens. Furthermore, users can also get up to 50% additional tokens as rewards for taking part in the presale stages. Buyers should join FightOut’s Telegram channel to stay on top of the latest updates.

Is AXS the Best Coin to Buy in 2023?

Conclusion

FightOut – New Project Pioneering the Move-to-Earn Industry

$FGHT Tokenomics & Purchase Bonuses

Presale Started

14 December 2022

Purchase Methods

ETH, USDT

Chain

Ethereum

Min Investment

None

Max Investment

None

FightOut - Next 100x Move to Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $1M+ Raised

- Real-World Community, Gym Chain