Algorithmic trading refers to investment strategies that are automated, both in terms of research and execution of orders.

These systems use a rule-based framework that can include everything from choosing trading instruments, finding opportunities, managing risk, and dynamically adjusting the position size.

If you wish to learn more about Algorithmic trading, then this guide is for you.

In addition to explaining the basics, we review the best Algorithmic trading platforms you can use right now to automate your investments.

List of the Best Algorithmic Trading Platforms of 2023

Here is a quick breakdown of the best Algorithmic trading platforms on the market this year:

- eToro Copy Trading – Overall Best Algorithmic Trading Platform

- The Uncharted – Best NFT Collection for Passive High-Frequency Trading Gains

- Bitcode AI – Top Bitcoin Algorithmic Trading Platform for Beginners

- Oil Profit – Great Algorithmic Trading Software for Commodities

- Bitcoin Prime – Popular Algorithmic Crypto Trading for CFDs

- NFT Profit – Algorithmic Trading Platform for NFT Derivatives

- Teslacoin – Leading Bitcoin Algorithmic Platform for Trading Cryptocurrencies

- Bitcoin Era – Beginner-Friendly Algo Trading Platform

- Immediate Edge – Algorithmic Trading Platform for Cryptocurrencies

- NAGA – Online Broker With Copy Trading Tools

- Ava Mirror Trader – CFD Platform with Algorithmic Trading Software

Bear in mind that no two Algorithmic trading systems are the same. As such, we suggest that you read our detailed reviews below before making up your mind.

Top 10 Algorithmic Trading Platforms Reviewed

Using Algorithmic trading software can help avoid human error when making investment decisions.

This allows you to make the most of potential trading opportunities, without having to research the markets by yourself.

Below you will find detailed reviews of the best Algorithmic trading platforms in the market today.

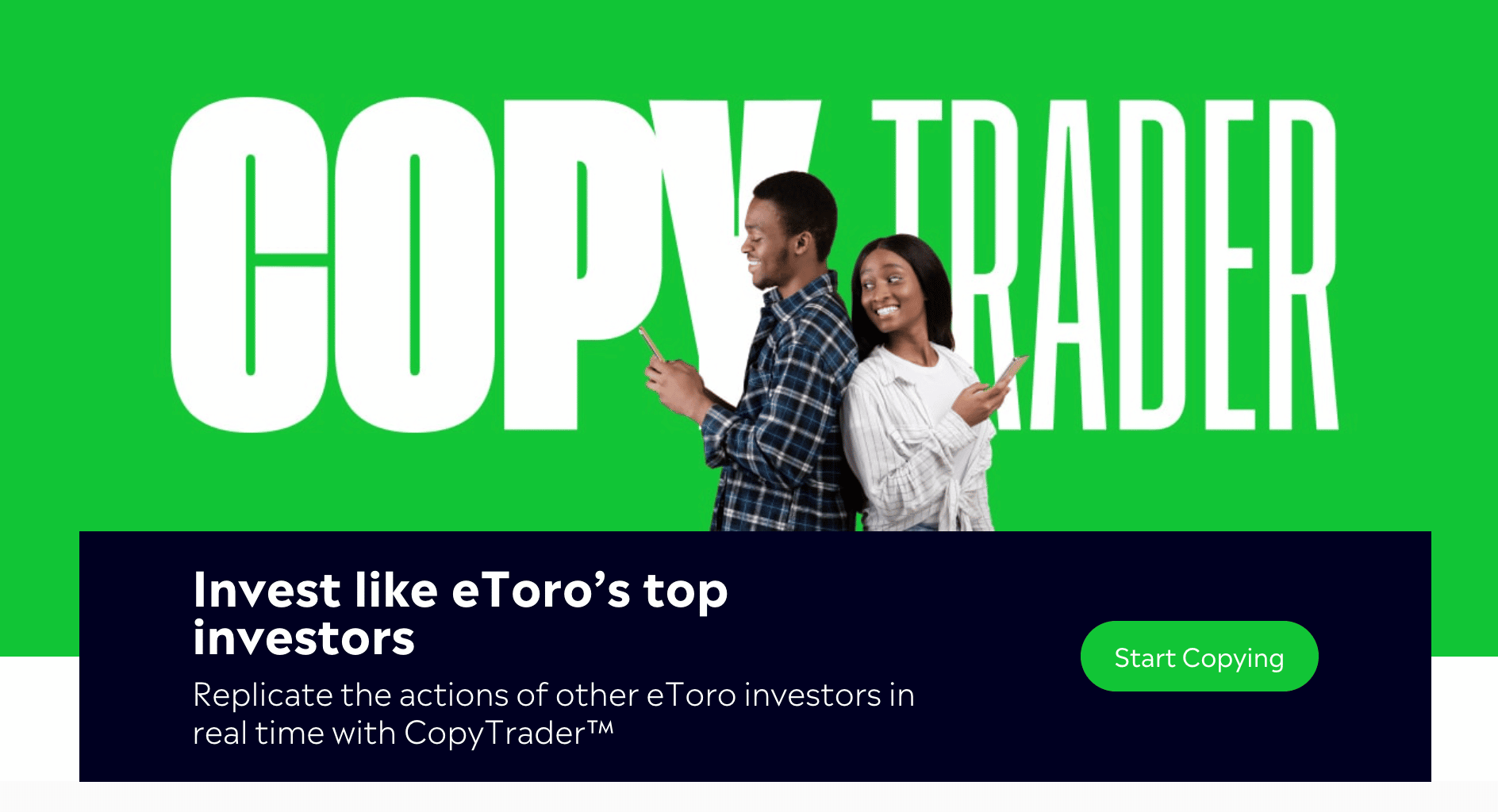

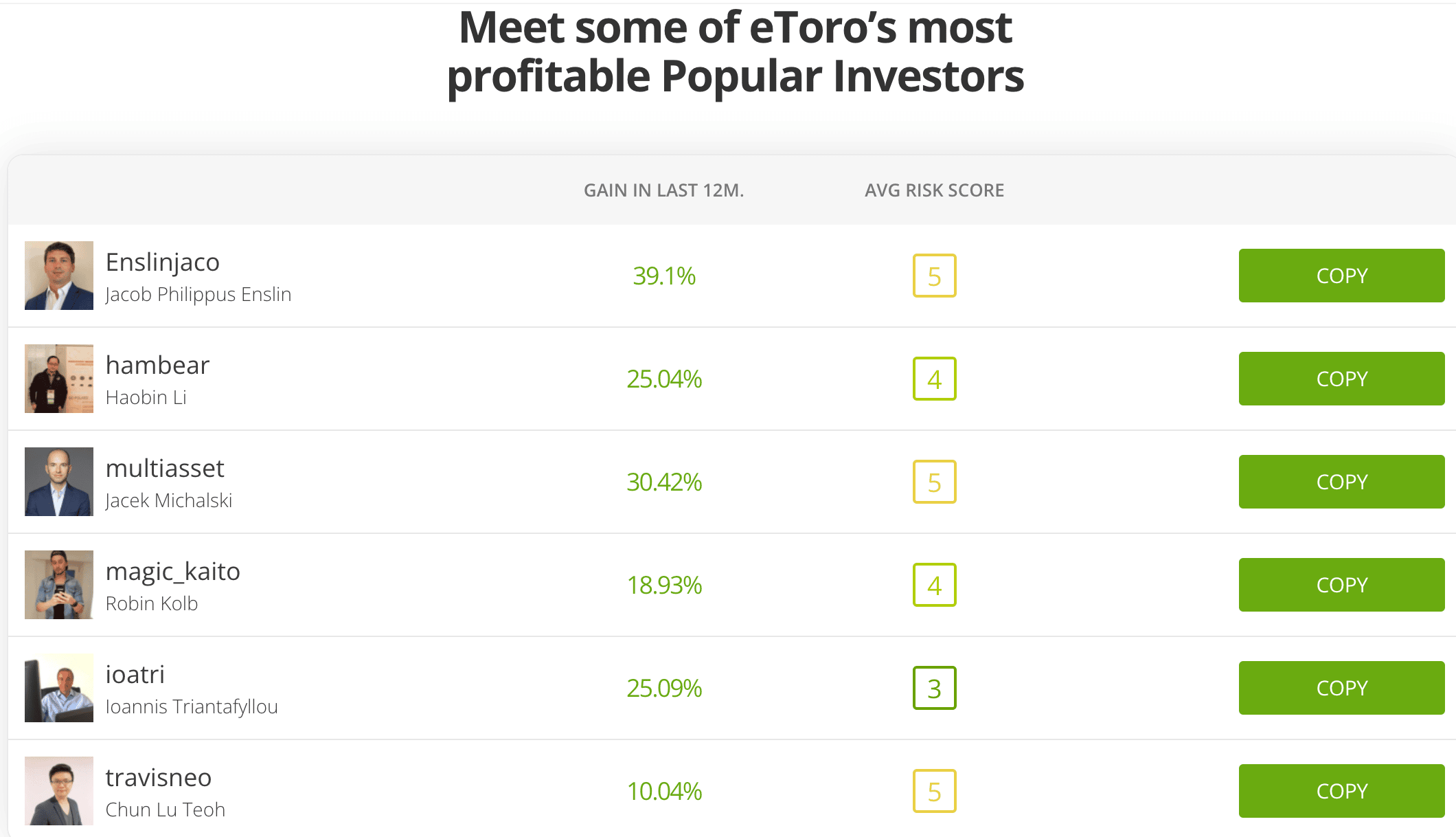

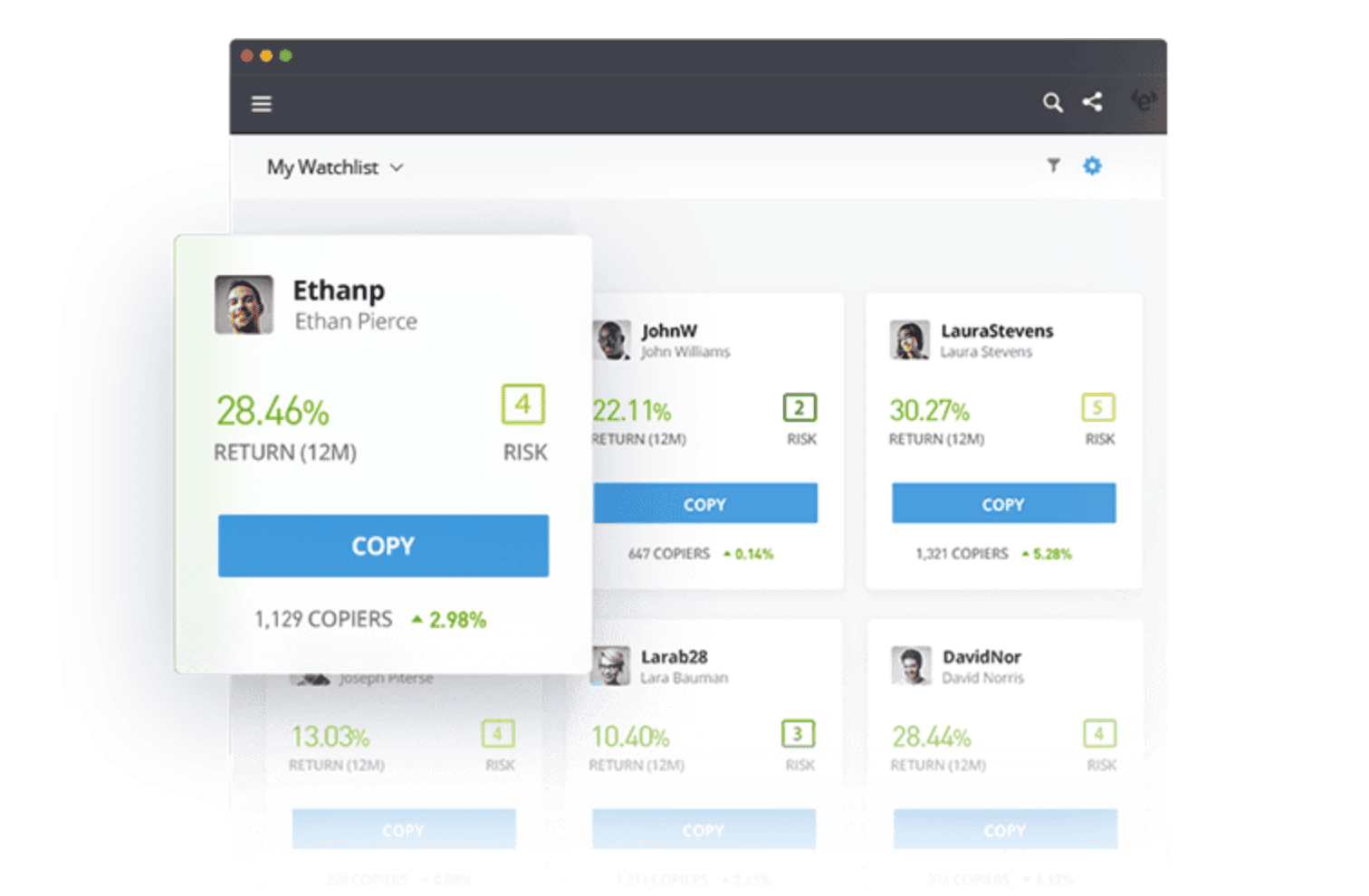

1. eToro Copy Trading – Overall Best Algorithmic Trading Platform

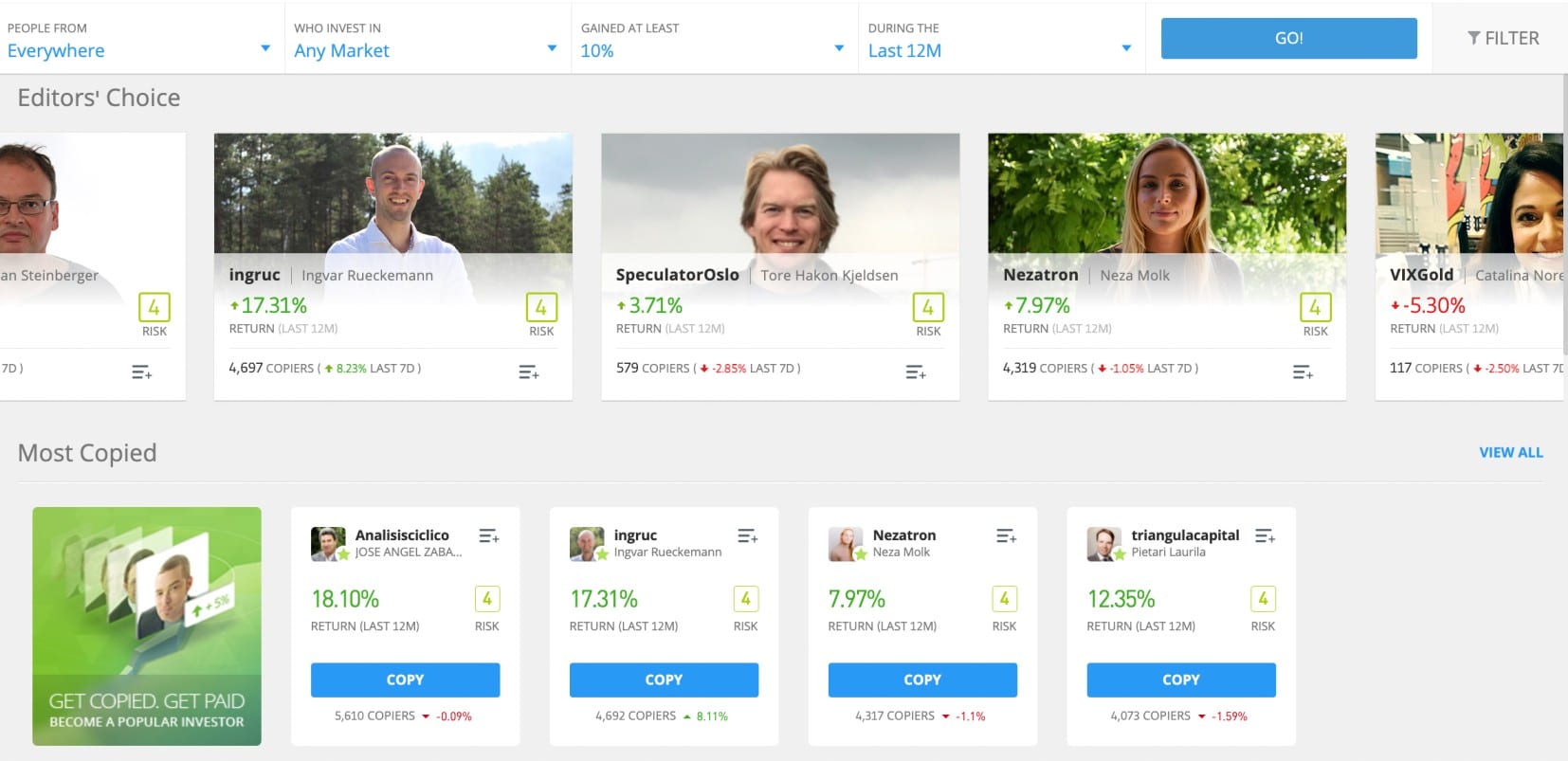

One of the most praised features of eToro is its copy trading tool. Put simply, this tool allows you to leverage other traders’ expertise – by copying the positions opened and closed by others. Moreover, this process is entirely automated and the trades will be instantly replicated in your own portfolio.

You can choose the trader you want to copy based on the risk level they adopt, their performance history, and more. You will also be in control of your positions and you can set your own stop-loss levels. Alternatively, you can also choose to copy the stop-loss parameters assigned by your chosen trader.

Once you have created an account on eToro you can start copying other traders at no extra charge. The minimum investment required to copy a trader is $200 and you have the option to pause at any point. However, you can start trading on this platform from just $10.

Apart from being one of the best copy trading platforms, eToro also lets you automate your investments using Smart Portfolios. These are diversified baskets of assets – such as stocks and cryptocurrencies – which are regularly rebalanced by the eToro team. All you need to do is to invest your money into a portfolio and the rest will be taken care of automatically.

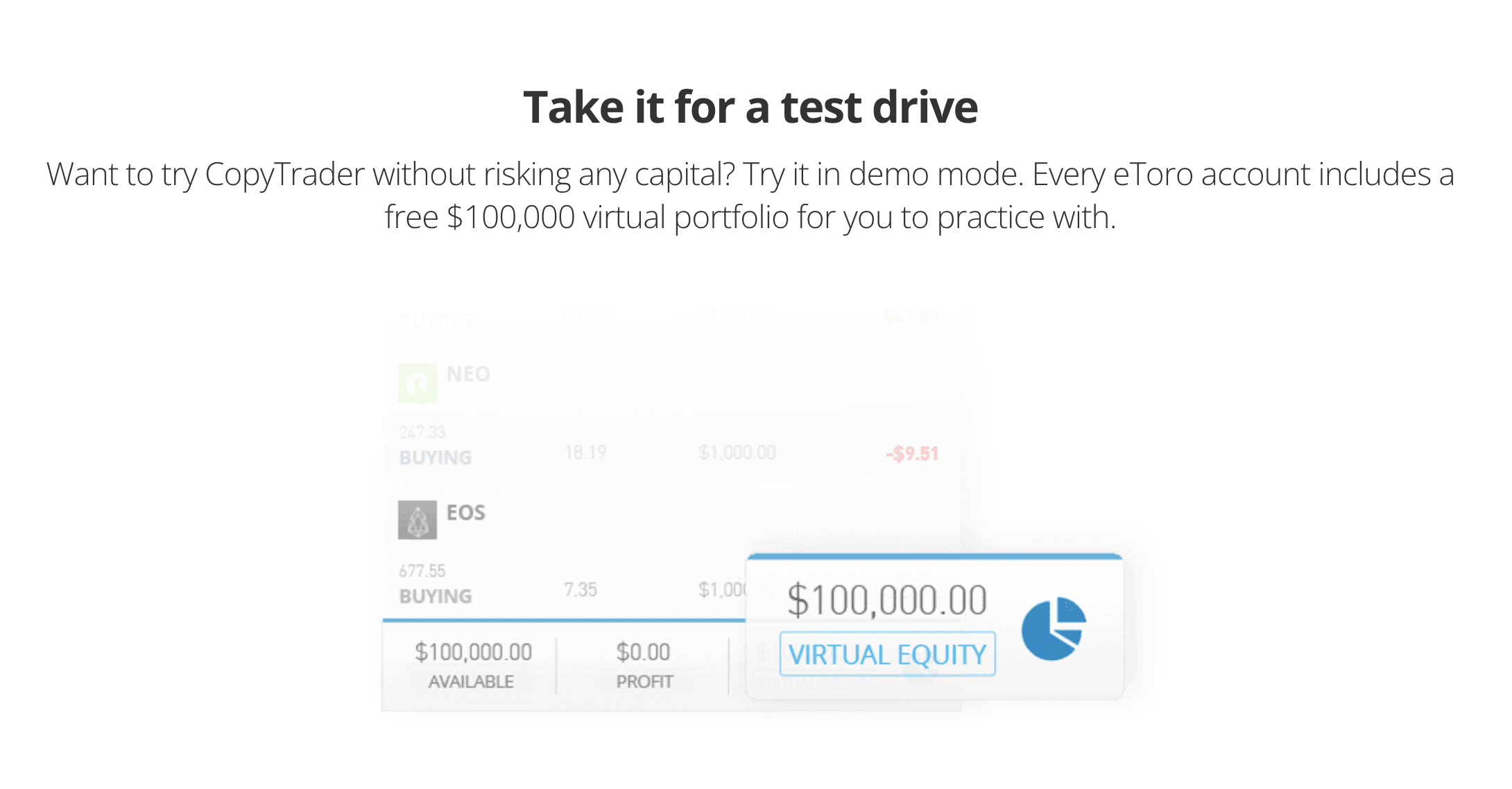

eToro is also a reliable broker to choose from for other reasons – such as high security, regulation, and low trading fees. This platform is regulated by multiple financial authorities – including the FCA, SEC, CySEC, and ASIC. Moreover, you can also practice trading using eToro’s demo account before you start speculating on the real markets.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

2. The Uncharted – Best NFT Collection for Passive High-Frequency Trading Gains

The Uncharted NFT collection provides a fantastic opportunity to invest in an NFT that distributes profits from a high-frequency trading fund with a glorious track record. The project aims to bridge the gap between the traditional TradFi world and Web3 technologies. It was created to open doors for regular investors and gain access to trading vehicles that were previously only accessible to high-net-worth individuals.

The first drop in the collection consists of the 5,000 Southern Ring Nebula NFTs, which will cost $295 in ETH apiece and allow holders to earn 20% per month, distributed each quarter through airdrops.

100% of the revenue generated from the NFT sale will be deployed in the HFT Fund of The Uncharted sister company, XETA Capital Fund (XCF). This fund has a past performance of up to 400% per annum and has delivered an outstanding minimum return of 20% per month since its inception.

The XETA Capital Fund has delivered extensive gains due to its complex and secure HFT algorithm and a team of experienced traders. The HFT algorithm was previously leased to financial institutions, and The Uncharted NFT collection provides access to regular investors today.

Each NFT from the collection represents a ticket to the spaceship that will explore Uncharted territory in outer space. It’s a three-year journey for investors who will see the capital inside the funds compound and grow to be distributed to holders. At the end of the investment term, all of the money in the fund will be evenly split amongst all NFT holders – providing a final lump payout depending on the success of the HFT Fund.

Overall, The Uncharted is undoubtedly one of the best algorithmic trading platforms that allow individuals to invest and make passive earnings from an intuitive high-frequency trading fund.

3. Bitcode AI – Top Bitcoin Algorithmic Trading Platform for Beginners

Bitcode AI is advertised as a trading software dedicated to cryptocurrencies. This Algo trading software claims to be fully automated and uses a superior AI to help you trade passively.

Its proprietary algorithm has the capabilities to scan the markets, gather valuable data, and make trading decisions on your behalf. As per the Bitcode AI website, there is no need for you to set any parameters manually. However, you will have the ability to customize the settings as needed.

If its claims are correct – Bitcode AI could be one of the best Algorithmic trading platforms for beginners. All users need to do is spend 20 minutes on the auto trading platform per day to check outstanding positions.

However, we were unable to verify or backtest this relatively new Algorithmic trading software. The Bitcode AI site mentions it supports over 20 cryptocurrencies and works with margin trading, i.e. CFDs and perpetual futures pairs.

Its Algo trading platform also claims that it works with a variety of brokers to execute those trades. However, there is limited information on which exchanges are supported prior to making a deposit.

The minimum investment stipulated by Bitcode AI is $250. See our full Bitcode AI review.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

4. Oil Profit – Great Algorithmic Trading Software for Commodities

While there are plenty of Algorithmic trading platforms for stocks and cryptocurrencies, it can be challenging to find one that is designed for a commodity like oil.

One main consideration here is that oil prices are often influenced by global economic and political conditions. Therefore, you need a platform that has an algorithm created specifically for oil.

Oil Profit portrays itself as one of the best Algorithmic trading platforms you can use for this purpose. It allows you to place automated trades with the help of advanced AI. Moreover, there are no deposit fees or commissions charged when using this platform.

It will take you less than five minutes to register as a new trader. You can start trading oil once you deposit at least $250. All that being said, it isn’t clear what kind of customization is provided by this Algorithmic trading software when it comes to setting your own strategies.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

5. Bitcoin Prime – Popular Algorithmic Crypto Trading for CFDs

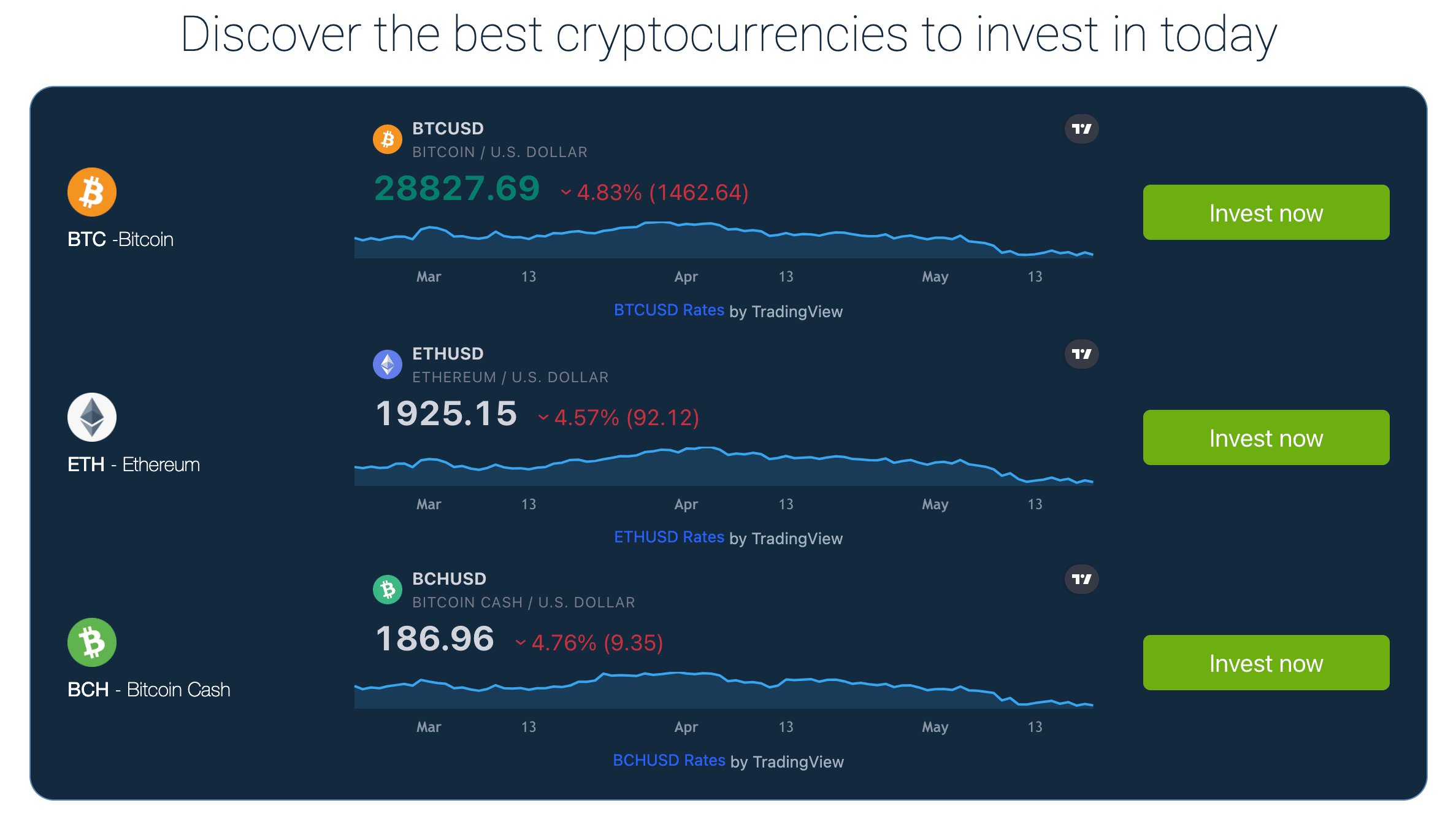

Bitcoin Prime is another Algo trading software that lets you trade a variety of digital assets. It supports many popular cryptocurrencies, including Bitcoin, Bitcoin Cash, Ethereum, Cardano, Neo, Binance Coin, and more. The platform also features high-frequency trading and incredibly fast execution of orders.

Bitcoin Prime requires you to make an initial deposit of $250 to start using the platform. Other than this condition, there are no deposit fees or commissions that are involved. It also gives you access to an advanced trading platform and supports optimal customization.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU protection. Your capital is at risk.

6. NFT Profit – Algorithmic Trading Platform for NFT Derivatives

NFTs are considered the hottest product in the cryptocurrency market right now. NFT Profit lets you capitalize on this growing investment scene by trading NFT derivatives. It is one of the few Algorithmic trading platforms that gives you access to this market.

This Algo trading software employs an innovative program to facilitate investment in NFTs. According to the platform, it first uses your funds to acquire Ethereum, which it then utilizes to purchase NFTs on your behalf. However, the provider does not offer much in terms of customization.

To register as a trader, NFT Profit requires your email address, full name, and phone number. As with the other Algo trading platforms listed above, NFT Profit also mandates a minimum investment amount from your end. Once you put up the required $250, you will be connected to an account manager, who will explain the process to you.

To know more, read our full review on NFT Profit.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU protection. Your capital is at risk.

7. TeslaCoin – Bitcoin Algorithmic Platform for Trading Cryptocurrencies

At first glance, TeslaCoin is similar to the other best Algorithmic trading platforms reviewed so far. However, it operates differently by using its own native cryptocurrency – TeslaCoin, or TES. In other words, your funds on this platform are held in TES coins, and not US dollars.

It also gives you access to other digital assets, including Bitcoin, Ethereum, and Dogecoin. TeslaCoin primarily trades cryptocurrencies via CFDs.

As such, this platform might be suited for trading digital assets in the short term, rather than to invest in crypto for the purpose of HODLing.

TES coin was launched in 2015 at a price of $0.0050. It reached its all-time high price of $0.1400 in 2018 and has retreated in value. At the time of writing, the TES token is priced at around $0.0023.

Crypto assets are a highly volatile unregulated investment product. Your capital is at risk.

8. Bitcoin Era – Beginner Friendly Algo Trading Platform

Bitcoin Era is another Algo trading software that lets you speculate on the cryptocurrency market. It comes with automated software that helps you find profitable trades in the volatile crypto market.

It is effortless to create an account, however, the registration slots are offered on a lottery basis. Therefore, you might have to wait a while before being able to register on this platform.

Bitcoin Era also claims that it features a demo trading account, which you can use as a training facility to get familiar with the platform. You also have the choice to set up your own conditions for trading and deploy unique strategies.

Bitcoin Era also requires you to verify your account in order to unlock access to its features. While you can access Algorithmic trading without verification, this is necessary for you to withdraw the proceeds.

Once you have created an account, you will also be assigned a dedicated manager to help you set up your trades.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU protection. Your capital is at risk.

9. Immediate Edge – Algorithmic Trading Platform for Cryptocurrencies

The platform boasts a super-fast trading system that can place up to 15 different trades per minute. As per the Immediate Edge website, you can also access leverage of up to 5000:1 when engaging in crypto Algo trading via this platform.

Immediate Edge lets you set up your own parameters in terms of when a trade should be triggered. Once you do this, the app searches the market for the right trading opportunities and executes them right away.

You can get started on this platform by signing up as a user, and funding your account. However, you will need to make a minimum deposit of $250 to access the Algorithmic trading software. Deposits are processed without any additional charges and you can make up to 10 free withdrawals per month.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU protection. Your capital is at risk.

10. NAGA – Online Broker With Copy Trading Tools

NAGA’s copy trading tool also employs an automated mechanism. On this platform, you can choose an investor you want to follow and elect to mirror their trades.

You can choose a fixed investment amount or a percentage from your account balance as a stake. Once you make the investment, any positions that the trader makes will be repeated in your account.

You will also receive real-time notifications when these trades are carried out. NAGA lets you get started with a minimum stake of just $0.99 per slide. The platform accepts payments via credit/debit cards, Skrill, and Neteller.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU protection. Your capital is at risk.

11. Ava Mirror Trader – CFD Broker with Algorithmic Trading Software

AvaTrade is a leading trading platform that gives you access to a long list of markets. You can use this platform to trade forex, stocks, ETFs, and cryptocurrencies, all in the form of CFDs. Notably, it comes with tons of features, including Algo trading software for making the investment process easier.

It has two different types of Algorithmic trading systems in place. DupliTrade is an MT4-compatible platform and lets you follow the signals and strategies of other experienced traders in real-time.

Zulu Trade is another Algo trading software that converts recommendations of experts and automatically executes them in your account. AvaTrade has also built a platform for traders to engage with each other. AvaSocial lets you find mentors, interact with them, and copy their trades. Like eToro, this tool also allows you to mirror the trades of others in your own portfolio.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU protection. Your capital is at risk.

What is Algorithmic Trading?

Algorithmic trading uses computer programs that follow a set of instructions to execute your positions. In other words, when using Algo trading software, you can define parameters on when and how your order should be carried out.

When the market meets these conditions, the software will identify the best profitable opportunities and execute the trade.

The main advantage of using Algorithmic trading software is that it automates the investment process. This eliminates the need for you to watch over the market at all times.

Instead, you only have to specify the prerequisites, and the trades will be executed on your behalf. This can save you time and allow you to benefit from the higher accuracy of the respective algorithm.

Furthermore, it also eliminates the chance of making behavioral trading mistakes, especially when the markets are volatile. In other words, Algorithmic trading can be an excellent tool for beginners, as well as experienced traders.

Types of Algo Trading Sytems

Due to the high demand for Algo trading systems, financial experts and developers have come up with innovative tools for you to automate your investment decisions.

In this section, we give you an overview of the most popular types of software available – so that you can choose the best Algorithmic trading platform to fit your needs.

Copy Trading

Copy trading is a type of algorithmic strategy where you mirror the positions opened and closed by other traders. It is often used by beginners who are not yet confident with placing trades themselves.

Copy trading is also suitable for experienced professionals who want to automate their strategies, enabling them to step away from their device if needed.

There are a variety of platforms offering copy trading services. Our top preference is eToro, which gives you sufficient information about each trader’s historical returns and risk threshold, so you can choose one that is fit for your financial standing.

eToro also gives you control of the trades you copy, using stop-loss orders and the option to pause the process.

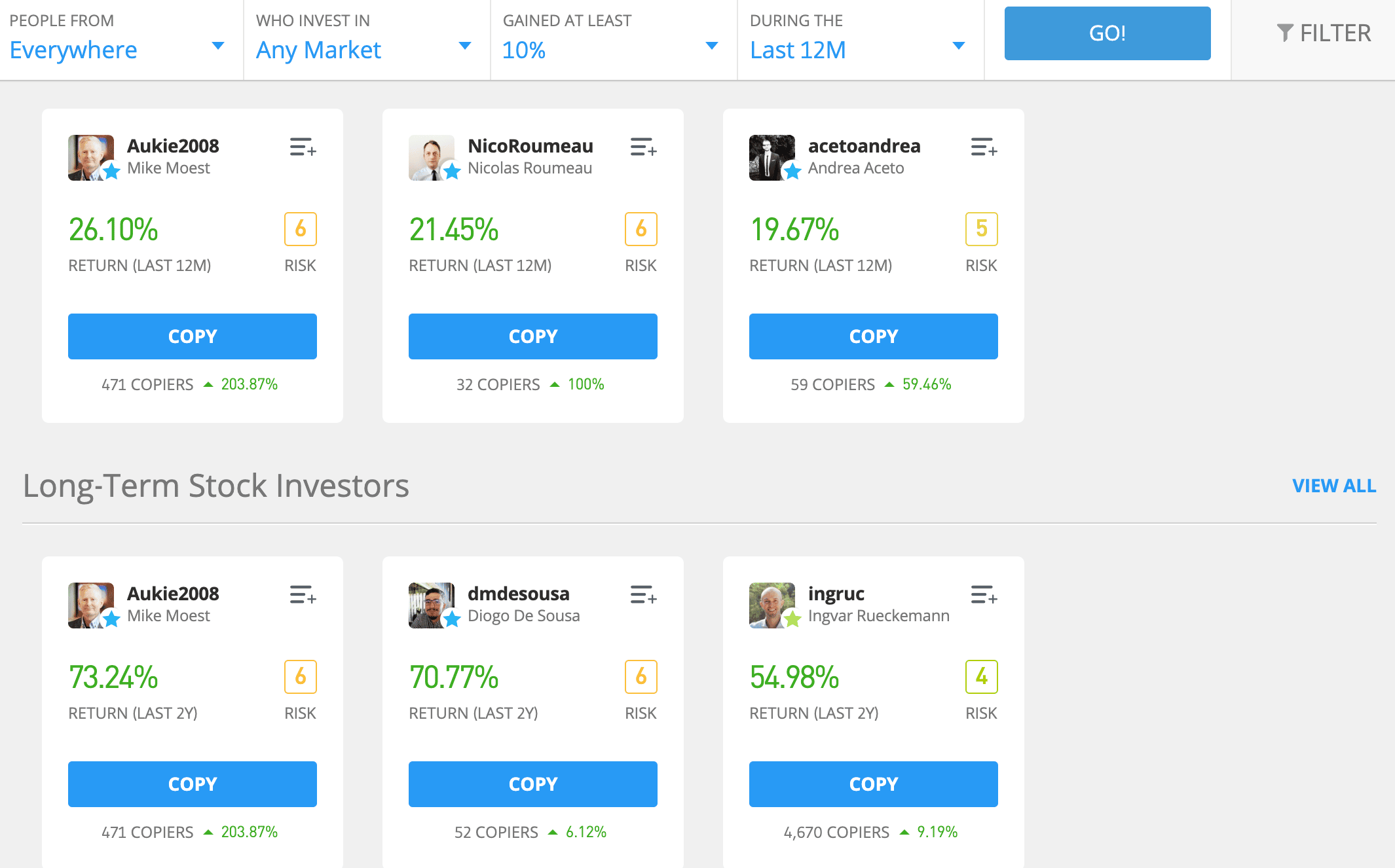

Here’s an example of how copy trading works on the eToro platform:

- After performing some research, you decide to invest $500 into an experience eToro crypto trader

- The trader risks 20% of their portfolio on Ethereum and 10% on Cardano

- In your portfolio, you now own $100 worth of Ethereum, which amounts to 20% of your investment

- You also own $50 worth of Bitcoin, which amounts to 10% of your investment

- The trader exits their Ethereum position at a profit of 40%

- On your $100 stake, this means that you have made $40 in profit

Crucially, copy trading on the eToro platform allows you to access automated investment strategies in a fully-regulated environment.

Moreover, once you have made an investment, you can sit back and let your chosen trader do the hard work for you.

Signals

Several Algorithmic trading platforms use signals as triggers to activate a buy or sell order of an asset.

- In simple terms, trading signals are suggestions that alert you of opportunities in the financial market.

- These recommendations could be based on human analysis, or in this case, mathematical algorithms.

- You can use Algorithmic trading software that uses these signals, or manually execute your positions based on these alerts.

- Like copy trading, these signals can be beneficial for both beginners and experienced traders.

However, remember that these signals are worth considering only if they are reliable – so ensure that you research the platform before signing up for their alerts.

Algo Trading Platforms

An Algorithmic trading platform is a program that executes transactions on the behalf of investors.

It watches for prospects in the market and triggers a trade when the given conditions are met. While some trading platforms require you to input parameters into the software, others come with in-built strategies.

This means that you only have to invest money and the trading platform will take care of the rest. They will scour through the data available and find the perfect time to enter and exit the market.

When looking for the best crypto trading platforms, you should also consider the past performance of the provider to figure out if they are worth investing in.

Is Algorithmic Trading Profitable?

Initially, Algorithmic trading was a strategy used by institutional investment firms such as hedge funds. However, today, the best Algorithmic trading platforms are available for retail clients too.

Whether or not Algorithmic trading is profitable will come down to the strategies you deploy as well as the platform you use.

However, in general, the best Algorithmic trading platforms offer you the following advantages:

Eliminates Bias Based on External Factors

Algorithmic trading requires each trade to be programmed. This means that traders can avoid reactionary buying or selling that often happens under the influence of emotions or other factors such as FOMO.

You can also take out the human error that can occur when placing a trade – such as missing a zero or entering the wrong stop-loss amount.

Backtesing Opportunities

In trading, backtesting refers to testing a strategy on historical data. It evaluates the practicality and profitability of the trading plan, to find out whether it will work out or fail based on previous market conditions.

This will help to an extent to avoid guessing and making mistakes. However, not every Algo trading software comes with the availability of historical data for backtesting.

Customization

The majority of Algo trading software comes with in-built programs. However, the best Algorithmic trading platforms also let you configure the parameters by yourself.

- For instance, on eToro, you can follow any trader you want to copy.

- However, you also have the option to set your own limits for stop-loss and remove funds when needed.

- Without such customization of rules, you will be constrained by the in-built functionality of the Algorithmic trading platform.

- It is always best to choose a platform that offers a decent degree of control over the configuration.

All that being said, some of these platforms are not entirely transparent and do not offer much information regarding the algorithms they use.

Therefore, we would urge you to proceed with caution. When in doubt, it is always best to use a regulated copy trading broker such as eToro.

Best Algorithmic Trading Strategies

As we pointed out above, the best Algorithmic trading platforms can simplify your investment journey in a number of ways.

However, it is critical to understand which strategies the algorithm follows and why trades are placed. Some Algorithmic trading systems execute orders based on one or two basic indicators.

However, some of the latest and most innovative Algo trading software collects data from financial statements and uses AI and Big data to identify trading opportunities.

That said, these are most suitable for experienced investors who know how to work with sophisticated strategies and complex data.

Nevertheless, there are some Algo trading strategies that are commonly used – such as:

- Trend following strategies – These follow trends in price levels moving averages and related technical indicators.

- Arbitrage trading strategies – This strategy simultaneously opens long and short positions on two platforms that have quoted different prices for the same asset.

- Mathematical model-based strategies: This algorithm uses proven mathematical models such as delta-neutral to find profitable opportunities in the trading market.

- Index arbitrage – Like arbitrage trading, this strategy also takes advantage of the temporary mispricing of an asset. But in this case, the Algo trading platforms look for price differences between equity and futures markets.

- Mean reversion strategies – This strategy follows the theory that prices tend to retreat to their average. They also use moving averages, oscillators, and market sentiment to spot extremes.

These are only a handful of the variety of Algorithmic trading strategies deployed by automated systems. As you can imagine, some of these are quite complex and has a steep learning curve.

If you are a beginner, it would be best to adopt a simple strategy such as copy trading offered by the likes of eToro.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

How to Start Algo Trading

Are you ready to get started with Algo trading?

If so, this section will show you how to start copy trading with eToro – one of the best Algorithmic trading platforms for beginners.

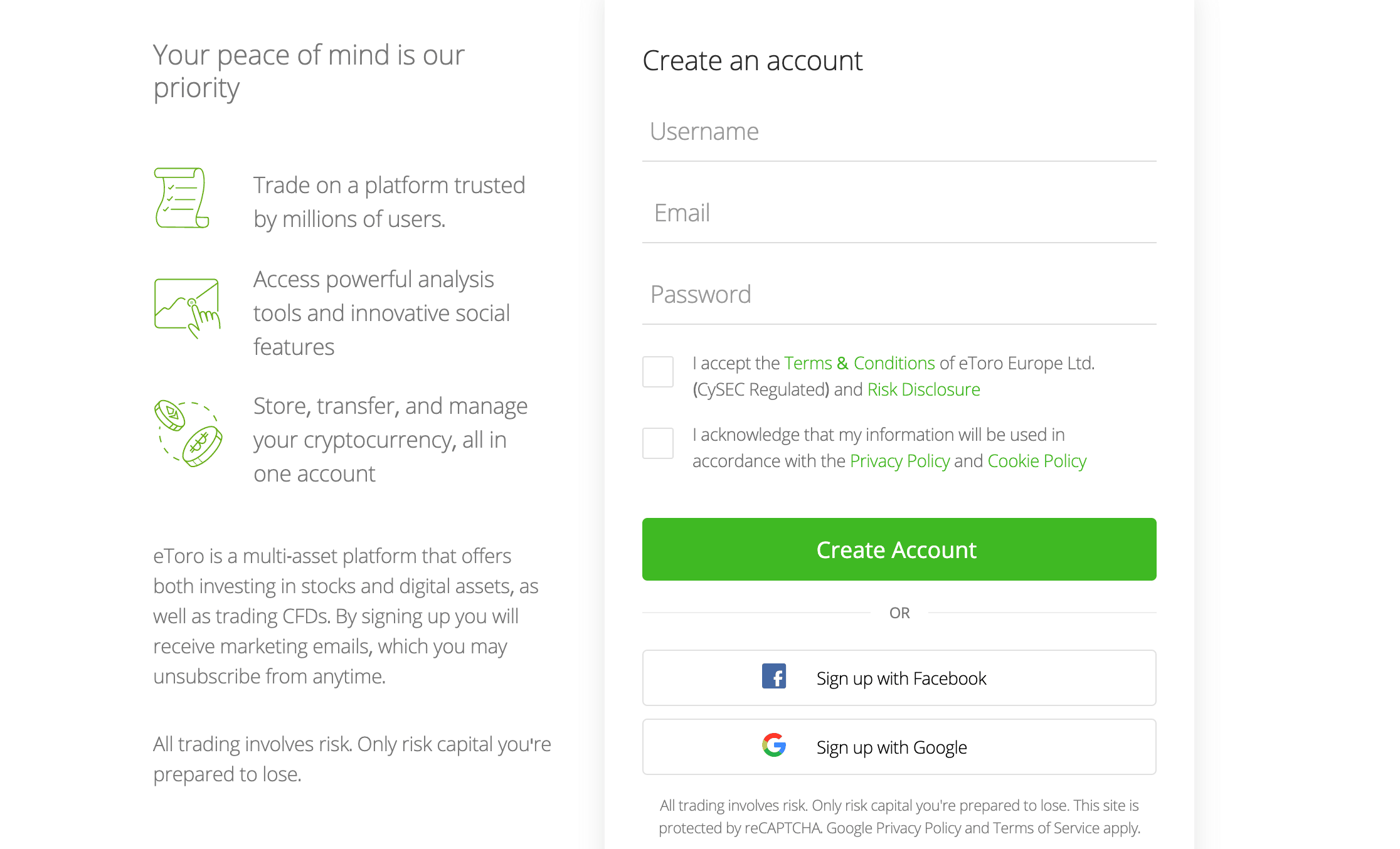

Step 1: Create an Account on eToro

Head to eToro and click on the ‘Join Now’ button to create your account. You will have to provide your email address and assign a username and password for your account.

Being a regulated broker, eToro also needs some personal information from you. This includes your full name, date of birth, home address, and phone number.

In addition to this, you will also have to submit documents that can verify the information you have provided. This can be a passport or driver’s license. For proof of address, you can attach a utility bill or bank statement.

Step 2: Deposit Funds

Make a deposit by credit card, debit card, or an e-wallet like PayPal. The minimum deposit to start investing via eToro is only $10.

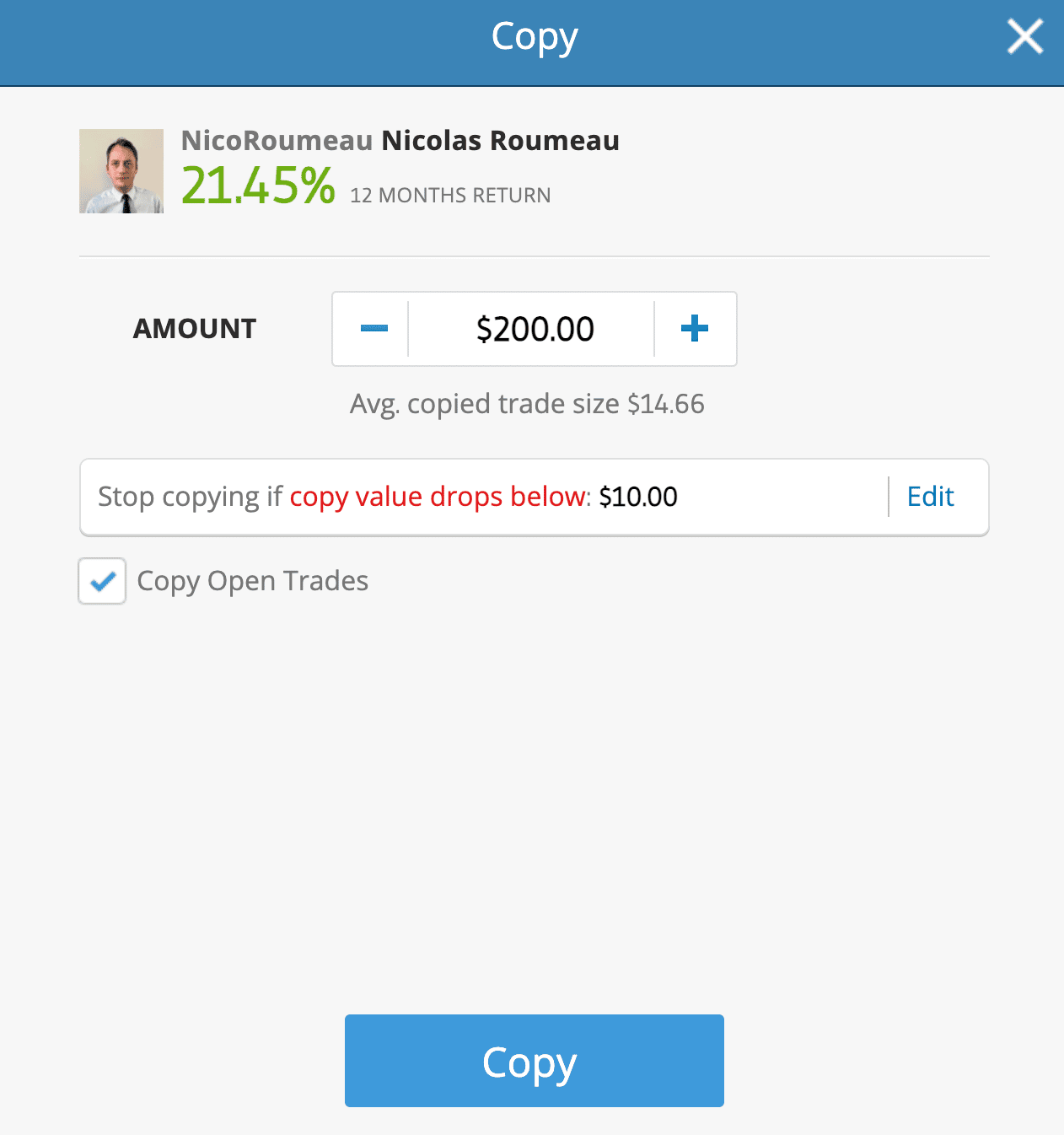

However, when using the copy trading feature, you will need to deposit at least $200.

And if you are a US-based client, you do not have to pay any deposit fees whatsoever when funding your account.

Step 3: Choose a Trader

Next, click on the ‘Discover’ tab on the left side panel on eToro.

Here, you will find the different markets and portfolios offered by the broker. Click on ‘CopyTrader’ to see the list of experts that allows you to replicate their strategies.

Here, eToro displays details such as the historical returns generated and the risk level for each trader.

You can also filter traders based on location and markets. Once you have chosen a trader, click on the ‘Copy’ button.

Step 4: Start Copying

On the next page, enter the amount you wish to invest. You can also set a stop-loss before you place the order.

eToro also gives you the option to copy all open trades or only those that will be placed in the future.

When ready, use the ‘Copy’ button to finalize.

You can then visit your eToro portfolio to track the performance of the investment. You can invest more funds, pause the investment, or stop copying at any time you want.

Python Algorithmic Trading

Typically, you do not need to know coding languages in order to use an Algorithmic trading platform.

However, if you are well versed in trading and are proficient in coding, you can also take advantage of such software that allows you to create custom strategies.

- There are a number of programming languages that you can use to write trading algorithms.

- However, Python is the most efficient and commonly used.

- Python’s functional approach makes it easier to write and evaluate strategies.

- Python also lets you create dynamic algorithms for fast executions.

Other programming languages such as C++ and Java can also be used. However, Algo trading software using these languages can take a longer time to develop, and the testing and maintenance of these algorithms can also be a hassle.

Conclusion

When using Algorithmic trading platforms for your investment needs, you are essentially trusting your hard-earned money to software.

And as such, it is paramount to ensure that you pick an efficient platform that has a proven track record and delivers accurate execution of trading orders. With the right software, you will be able to save time and profit from the precision of algorithms.

We found eToro to be one of the best Algo trading platforms to use. This top-rated platform – which is heavily regulated, lets you copy the positions of a successful trader like-for-like.

The minimum copy trading investment is just $200 and no additional fees or commissions apply.

eToro CopyTrader™ Tool

- Buy Crypto & Copy Trade Professionals

- Average 30.4% ROI in 2021

- Average 83.7% ROI in 2020

- Copy a DeFi or Metaverse Portfolio