The biggest crypto exchange in terms of trading volume, Binance, is a popular trading platform that lets users invest in multiple cryptocurrencies. However, users have the opportunity to compare and review multiple other suitable options to begin trading with.

This article reviews the best Binance alternatives for 2023. We also provide a detailed analysis of every top crypto exchange’s available features and key attributes.

The 7 Best Binance Alternatives for 2023

The table below provides a list of the best alternatives to Binance for 2023.

- eToro – Best Binance Alternative with Copy Trading Tools and Features

- Crypto.com – Earn Passive Income via Staking Cryptos

- Bitstamp – Multiple Payment Options

- Coinbase – Two Platforms to Invest in Digital Assets

- Kraken – Crypto Exchange with 7 Supported Fiat Options

- Gemini – Crypto Exchange with Multiple Use-Cases

- CEX.io – Leverage Your Crypto Trades

Cryptoassets are a highly volatile unregulated investment product.

The Best Binance Alternatives Reviewed

Before choosing an alternative to the Binance exchange, users may want to learn about the available assets, trading fees and more by referring to our Binance review. Thus, we have reviewed 7 of the best alternatives to Binance in the sections below.

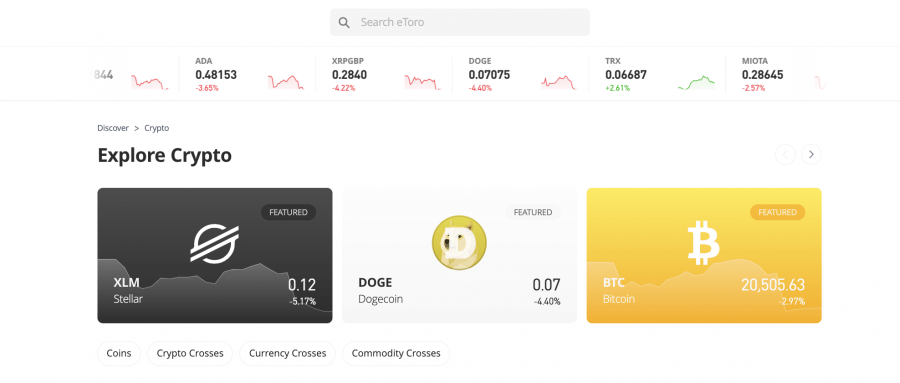

1. eToro – Best Binance Alternative with Copy Trading Features

We recommend eToro as the best Binance alternative to use in 2023. This crypto auto trading platform is available in 140 + countries and used by more than 27 million viewers. eToro is registered by some top-tier regulatory bodies, including the FCA, ASIC, FINRA and CySEC.

Users need to make a $10 deposit (U.S and UK) to get started. Among the available payment options are credit/debit cards, bank transfers and multiple e-wallets. For example, users can buy BTC with PayPal on eToro. Compared to Binance, which charges high credit card fees, eToro investors do not pay any additional fees on credit cards.

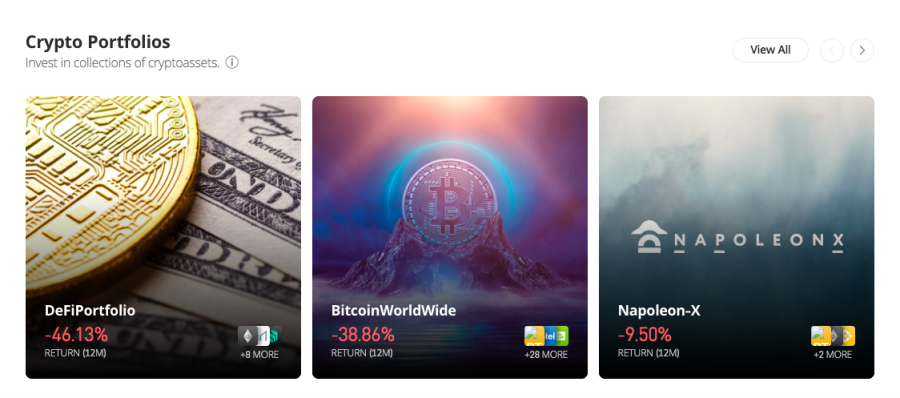

Along with 70 + tradable assets, eToro investors can gain access to multiple tools and portfolios. For example, eToro offers crypto portfolios – a bundle of multiple cryptocurrencies that cater to a specific market. Users can also invest in metaverse-cryptos and buy Decentraland, Axie Infinity and other digital assets.

A social trading platform, eToro offers extensive news and research options to view historic data and important market updates. Additionally, eToro users can share their thoughts and opinions on various tokens and communicate with each other on the intuitive platform.

Regarding fees, eToro charges a 1% trading fee per transaction and a bid/ask spread price. Another feature that users can take advantage of is the eToro money crypto wallet.

This is a secure digital crypto wallet where users can store multiple assets. The app provides an unsolvable private key, letting users recover their wallets and have complete access to their cryptos.

What We Like

- Low trading fees

- eToro crypto wallet

- DDoS protection for safety purposes

- Well-regulated crypto exchange

- Multiple tools & features for beginners

| Crypto Exchange | eToro | Binance |

| Cryptos Available | 73 | 600+ |

| Pricing Structure | Commission fee + bid/ask spread | Maker/Taker model |

| Price for Buying BTC | 1% + bid/ask | Beginning at 0.1% |

| Digital Wallet | Yes | Yes |

| Top 3 Features |

|

|

| Regulation | Registered with multiple top-tier regulatory bodies | Regulated globally by multiple regulatory bodies |

Cryptoassets are a highly volatile unregulated investment product.

2. Crypto.com – Earn Passive Income via Staking Cryptos

With Crypto.com, users will gain access to one of the most intuitive user apps to buy, sell and trade cryptos easily. Crypto.com’s

Furthermore, Crypto.com earn is an exciting feature that rewards users with returns by staking crypto tokens. This feature allows investors to earn up to 14.5% on cryptos and 9% on stablecoins.

Crypto.com offers credit cards, wire transfers and e-wallets as payment methods, with the former costing 2.99% per transaction. However, the platform lets users take out a local Crypto.com VISA card.

While using the VISA card, investors are rewarded with 5% to 8% cashback when purchasing cryptocurrencies on the platform. This handy accessory can also be used to access the Crypto.com NFT marketplace – to buy and sell thousands of unique digital assets.

Another exciting feature is the ability to purchase CRO – the local crypto of Crypto.com. With CRO tokens, users can earn an additional 2% APY (Annual Percentage Yield) on stakings.

In terms of fees, Crypto.com charges a maker/taker fee beginning at only 0.40% per transaction. Along with the mobile app, users can access the Crypto.com DeFi wallet – a custodian wallet that gives users control of their private keys to store multiple cryptos.

What We Like

- 250 + tradable assets

- DeFi crypto wallet

- Earn interest on cryptos & stablecoins

- Low trading fees

- Cashback when using local VISA card

| Crypto Exchange | Crypto.com | Binance |

| Cryptos Available | 250+ | 600+ |

| Pricing Structure | Maker/Taker pricing model | Maker/Taker model |

| Price for Buying BTC | 0.40% | Beginning at 0.1% |

| Digital Wallet | Yes | Yes |

| Top 3 Features |

|

|

| Regulation | Globally regulated broker | Regulated globally by multiple regulatory bodies |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

3. BitStamp – Multiple Payment Options

BitStamp is another potential Binance alternative to review and look into in 2023.

A fiat getaway platform, BitStamp supports fiat deposits in EUR and USD and offers 70 crypto trading pairs on the platform. BitStamp supports Tradingview, allowing users access to real-time insights and the use of multiple order types when charting strategies.

Since the platform supports high-performing APIs, users can deploy their own algorithmic patterns. Keeping instant card purchases, BitStamp lets users buy crypto directly with a bank card.

However, credit card transactions can cost an 8% fee for a small trading volume. The rate decreases to 5% when trading volume increases. Alternatively, users can deposit cash directly from a bank account with a wire or SEPA transfer.

In terms of fees, BitStamp charges a maker/taker fee beginning at 0.50% per transaction. The platform also demonstrates whitelisting capabilities, creating a list of trusted recipients to protect users’ funds from being intercepted by hackers.

Users can start investing with a minimum deposit of $25 on BitStamp.

What We Like

- Offers 70+ trading pairs

- Lets users access multiple order types

- Low minimum deposit

- High-performing API keys

| Crypto Exchange | BitStamp | Binance |

| Cryptos Available | 50+ crypto assets | 600+ |

| Pricing Structure | Maker/Taker fee | Maker/Taker model |

| Price for Buying BTC | 0.50% | Beginning at 0.1% |

| Digital Wallet | No | Yes |

| Top 3 Features |

|

|

| Regulation | Regulated by the CSSF | Regulated globally by multiple regulatory bodies |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

4. Coinbase – Two Platforms to Invest in Digital Assets

Coinbase is one of the most popular crypto exchanges, that offers one of the best crypto apps to over 98 million verified users.

The Coinbase platform supports a standard platform and Coinbase Pro – its advanced trading platform that gives users access to more cryptos and technical indicators to assist in trades. With the standard platform, users can invest in 100+ crypto assets and buy Bitcoin and other popular digital currencies.

Coinbase charges a 1.49% commission per trade and a maker/taker fee of 0.50% per transaction. On top of this, the platform charges a hefty commission of 2.99% for credit card transactions.

On the other hand, Coinbase Pro supports 250+ crypto assets. Users can also buy cryptos with credit cards for no additional fees. Coinbase Pro supports multiple order types like limit and stop orders, which the standard platform does not offer.

Coinbase users can also stake digital assets, however, a staking fee of 25% is applied. Furthermore, Coinbase supports an NFT marketplace, letting users buy, sell and mint NFTs.

With the Coinbase platform, 98% of all users’ assets are stored in cold storage.

What We Like

- Over 100/250 digital assets

- Low credit card fees with Coinbase Pro

- Staking opportunities

- NFT marketplace

| Crypto Exchange | Coinbase | Binance |

| Cryptos Available | 100 – 250+ assets | 600+ |

| Pricing Structure | Trading fee +maker/taker fee | Maker/Taker model |

| Price for Buying BTC | 1.49% + 0.50% | Beginning at 0.1% |

| Digital Wallet | Yes | Yes |

| Top 3 Features |

|

|

| Regulation | Registered with global regulatory bodies | Regulated globally by multiple regulatory bodies |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. Kraken – Crypto Exchange with 7 Supported Fiat Options

Kraken is a centralised and U.S-based crypto exchange used to trade over 120 crypto assets.

This exchange prides itself in providing low transaction processing times and high liquidity levels by supporting the instant trades of popular assets like ETH, XRP, BTC and more. Kraken supports 7 fiat currencies, letting users deposit cash using USD, EUR, GBP and other currencies.

Kraken also supports multiple payment options such as SEPA, wire transfers, e-wallets and Apple Pay. Each payment method may charge a differing transactional charge. For example, users pay a 0.50% fee when depositing money with bank transfers.

Kraken Pro is an available advanced trading option, allowing users to access high-risk options like margin & leverage trading. The fees on Kraken Pro abides by a maker/taker pricing structure. Users pay a fee beginning at 0.16%/0.26% per transaction.

On the other hand, standard platform users must pay a 1.5% trading fee for cryptocurrencies or a 0.9% trading fee for stablecoins.

What We Like

- Two Platforms available to users

- Cheaper fees with Kraken Pro

- Margin & Leverage trading supported

- Multiple Fiat currencies supported

| Crypto Exchange | Kraken | Binance |

| Cryptos Available | 120+ assets | 600+ |

| Pricing Structure | Trading fee/ Maker/taker fee | Maker/Taker model |

| Price for Buying BTC | 1.50%/ 0.16% & 0.26% Maker/Taker Fee | Beginning at 0.1% |

| Digital Wallet | Yes | Yes |

| Top 3 Features |

|

|

| Regulation | Regulated by FinCEN | Regulated globally by multiple regulatory bodies |

6. Gemini – Crypto Exchange with Multiple Use Cases

Another one of the best Binance alternatives is the Gemini exchange.

Firstly, users benefit from a minimum deposit of only 0.00001 when purchasing BTC. This equates to lesser than $1. Additionally, users stand a chance to earn $50 worth of free BTC after registering with Gemini. This can be availed when users invest over $1,000 within 30 days of opening a new account.

Gemini Earn is another feature that lets users earn interest on cryptocurrencies and stablecoins. Furthermore, Gemini Pay is a feature accessible through the Gemini app – letting users pay using cryptos in more than 30,000 retail locations in the U.S.

Gemini also supports a cryptopedia educational library – allowing users to learn about trading, blockchain, cryptos and more. To begin trading with Gemini, users should know the complex pricing structure.

On trades below $200, a fixed fee between $0.99 to $2.99 is applied on transactions. After a trade increases in volume, Gemini charges a 1.49% trading fee. In terms of payment options, Gemini supports credit cards. However, this involves an additional fee of 3.49% per transaction.

What We Like

- Gemini Earn to earn interest

- Gemini Pay to use cryptos in 30,000+ retail locations

- Educational resources for beginners to take advantage of

| Crypto Exchange | Gemini | Binance |

| Cryptos Available | 50+ cryptos | 600+ |

| Pricing Structure | Fixed Trading Fee | Maker/Taker model |

| Price for Buying BTC | $0.99 – $2.99 under $200 trading volume/ 1.49% above $200 | Beginning at 0.1% |

| Digital Wallet | Yes | Yes |

| Top 3 Features |

|

|

| Regulation | Regulated by NYDFS in the U.S | Regulated globally by multiple regulatory bodies |

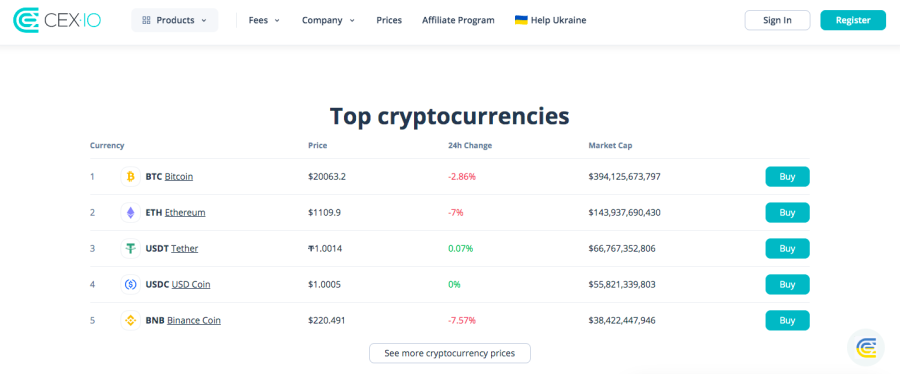

7. CEX.io – Leverage Your Crypto Trades

Launched in the U.S, CEX.io is one of the oldest crypto brokerages that is now U.S licensed and regulated.

Additionally, users can earn interest by staking cryptos, opening a CEX.io savings account and accessing the super-instant buy option to purchase cryptos directly. However, fees can go as high as 7% when buying cryptos with the instant buy option.

In total, CEX.io supports 110 cryptocurrencies and more than 225 trading pairs. Crypto-backed loans and crypto rewards debit cards are also supported with CEX.io. However, users in the U.S do not have access to these features as of yet.

CEX.io boasts a simple pricing structure, charging a maker/taker fee beginning at 0.15% and 0.25% simultaneously. Users can start investing using VISA or a MasterCard, which requires a further 2.99% transaction fee and a $20 minimum deposit.

What We Like

- CEX.io offers leverage trading options

- Users can stake tokens to earn interest

- Investors may access a crypto savings account (Outside U.S)

- Instant Buy options for cryptos

| Crypto Exchange | CEX.io | Binance |

| Cryptos Available | 110 cryptocurrencies | 600+ |

| Pricing Structure | Maker/Taker fee | Maker/Taker model |

| Price for Buying BTC | 0.15%/0.25% maker/taker | Beginning at 0.1% |

| Digital Wallet | Yes | Yes |

| Top 3 Features |

|

|

| Regulation | Regulated by FCA | Regulated globally by multiple regulatory bodies |

Best Binance Alternatives Compared

The below table compares the best Binance alternatives based on fees, available assets, regulations and more.

| Exchange | Cryptos | Pricing Structure | BTC Trading Fee | Digital Wallet | Top 3 Features | Regulation |

| Binance | 600+ | Maker/Taker model | 0.1% | Yes |

|

Regulated globally |

| eToro | 73 | Commission fee +bid/ask spread | 1% + bid/ask spread | Yes |

|

Registered with multiple regulatory bodies |

| Crypto.com | 250+ | Maker/Taker fee | 0.40% | Yes |

|

Globally Regulatedbroker |

| BitStamp | 70+ | Maker/Taker fee | 0.50% | No |

|

Regulated by the CSSF |

| Coinbase | 100-250 + assets | Trading fee + Maker/Taker fee | 1.49% + 0.50% | Yes |

|

Registered with Global regulatory bodies |

| Kraken | 120+ | Trading fee for standard account/ Maker/taker for PRO | 1.5%/ 0.16% + 0.26% maker-taker | Yes |

|

Regulated by FinCEN |

| Gemini | 50+ | Fixed fee/ trading fee over $200 | $0.99 - $2.99/ 1.49% | Yes |

|

Regulated by NYDFS |

| CEX.io | 110+ | Maker/Taker model | 0.15%/ 0.25% | Yes |

|

Regulated by FCA |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Why Use a Binance Alternative? Binance Limitations

Binance is the biggest cryptocurrency in daily trading volume and offers more than 600 assets. Despite this, users have the opportunity to review and assess some of the best Binance alternatives, such as cryptos on Uniswap.

The sections below discuss some of the limitations of Binance and unique features that the best Binance alternative crypto exchanges provide.

User Interface

First-time crypto investors may be a little unfamiliar with the Binance setup and platform interface. Binance provides various complex features like staking, leverage options and more.

Users looking for an entry in the crypto field may benefit by using a platform like eToro. This crypto platform is popular since it is simple to use and offers many social trading tools that bring the community together. With eToro, users can quickly deposit cash and begin trading.

Staking Disadvantages

One of Binance’s unique features is Binance Earn. With this feature, users can stake cryptos and earn an APY at the end of their staking period. However, exchanges like Crypto.com offer more benefits from staking.

With Crypto.com, users can earn up to 14.5% APY. Furthermore, users can hold CRO tokens to increase their earnings by 2%.

Lacking Beginner-Friendly Features

Binance does not have multiple beginner-friendly tools and features at its disposal. For example, eToro attracts new investors by offering smart portfolios and CopyTrading tools.

Furthermore, Crypto.com offers diversification opportunities with an NFT marketplace and lets users get cashback with their VISA card. Thus, there are other options for users to available multiple benefits from.

High Credit Card Fees

While Binance offers some of the lowest trading fees, it also charges a very high payment fee on transactions. With credit cards. When using Binance, users can pay up to 4.5% fees per transaction when buying cryptos with a credit card.

This number is one of the highest in the market. Alternatively, exchanges like Kraken support multiple payment options at more affordable rates. Even eToro supports credit and debit card purchases with no additional fees.

Long Verification Confirmation Periods

Another limitation of Binance is the long verification periods that users may face. While the verification process takes no more than 15-20 minutes, Binance can take up to 10 business days to verify the profile.

This may be too long a period for users looking to enter the market straightaway. Conversely, platforms like eToro and Crypto.com verify accounts within the same day.

Conclusion

This article has reviewed and compared the best alternatives to Binance in 2023. We have compared the available assets, fees, regulations and more between Binance and 7 popular crypto exchanges for users to analyse.

After analysing the different options, we recommend eToro as the best Binance alternative. eToro supports crypto trading at a reasonable price and offers multiple beginner-friendly tools, mobile wallets and apps to support crypto trading.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.