Bitcoin’s popularity has prompted institutional investors to establish exchange-traded funds (ETFs). Most Bitcoin ETFs consist of futures contracts or stocks of companies, but the Securities and Exchange Commission (SEC) is apprehensive about approving Bitcoin spot ETFs—trades based on the price of Bitcoin, not a futures ETF.

While the market waits for more regulatory clarity, many investors have staked their money into Bitcoin ETF stock. If you’re looking to invest in the best Bitcoin ETFs, we’ve analyzed the best options and will show you how you can invest today.

Best Bitcoin ETFs for 2023

Let’s have a look at the best Bitcoin ETFs to see what makes them a viable investment.

- ProShares Bitcoin Strategy ETF – The first US ETF that provided investors with Bitcoin futures investing.

- Valkyrie Bitcoin Strategy ETF – Actively managed ETF trading on Nasdaq.

- VanEck Bitcoin Strategy ETF – Available to US investors and qualified offshore investors.

- Grayscale Bitcoin Trust – Issues a fixed number of shares traded over the counter (OTC).

- Fidelity Advantage Bitcoin ETF – It allows you exposure to Bitcoin.

- Global X Blockchain & Bitcoin Strategy ETF – Invest in blockchain stocks and bitcoin futures.

- Simplify US Equity Plus GBTC ETF – Invests in the S&P 500 and 10% in Bitcoin.

- Purpose Bitcoin ETF – Offers a capped managed expense ratio.

- Bitwise Crypto Industry Innovators ETF – Invests in Bitcoin and other cryptocurrencies.

Cryptoassets are a highly volatile unregulated investment product.

A Closer Look at the Best Bitcoin ETFs to Invest in

Every Bitcoin ETF would invest in cryptocurrencies and securities, so we wanted to dig deeper into each one to see their offerings.

1. ProShares Bitcoin Strategy ETF

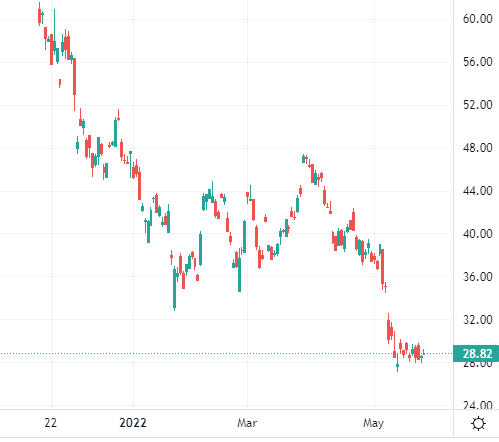

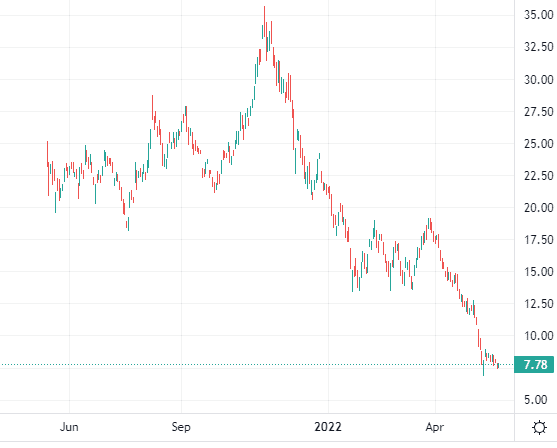

Investing in the ProShares Bitcoin Strategy ETF (BITO) means being part of the first US Bitcoin-linked ETF. Such a fund is also known as a Bitcoin futures ETF. The fund’s inception in October 2021 eventually resulted in it becoming one of the most traded ETFs in the market, generating an asset management value of more than $1 billion in a few weeks.

The fund provides investors managed exposure to bitcoin futures contracts, but it doesn’t directly invest in Bitcoin. The bitcoin futures contracts it invests in are cash-settled and have the shortest time to maturity. BITO also consists of treasury bills and cash.

This is an actively-managed fund, tracking the price of Bitcoin and offering a monthly distribution. Investing in this fund means you’ll incur an expense ratio of 0.95%—an annual fee the fund deducts for management. You can learn how to trade ETFs with our comprehensive guide.

Commodity Futures Trading Commission regulates BITO’s futures contracts, and they’re traded on the Chicago Mercantile Exchange (CME). The fund also invests in repurchase agreements and sometimes uses leverage.

Considering Bitcoin’s all-time high of $69,000 in November 2021 and its fall since, the fund’s total assets have dropped. Yet, it still boasts an impressive holding, and BITO’s approval was a big leap for cryptocurrencies and ETFs.

Cryptoassets are a highly volatile unregulated investment product.

2. Valkyrie Bitcoin Strategy ETF

Following in the footsteps of the ProShares ETF, Valkyrie Bitcoin Strategy ETF (BTF) launched a few days later. This is another actively-managed fund and invests primarily in bitcoin futures. It’s available on Nasdaq and aims to track the value of the CME.

Instead of investing directly in Bitcoin, BTF uses bitcoin futures contracts to ensure that the notional value of the bitcoin underlying the futures contracts is as close to 100% of the fund’s net assets.

One of the main advantages of investing in this fund is that US investors don’t have to file a K-1 form with the IRS. The reason is that it invests in futures through a Cayman Islands subsidiary, so Commodity Futures Trading Commission regulates trading.

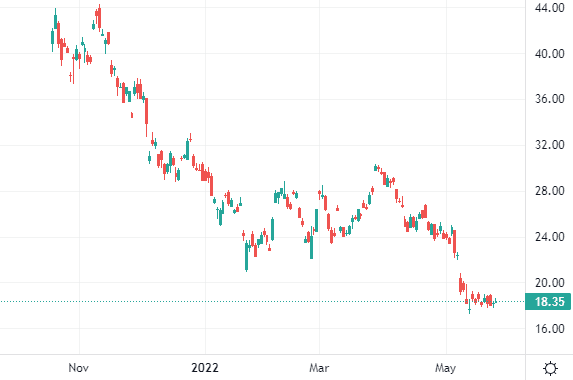

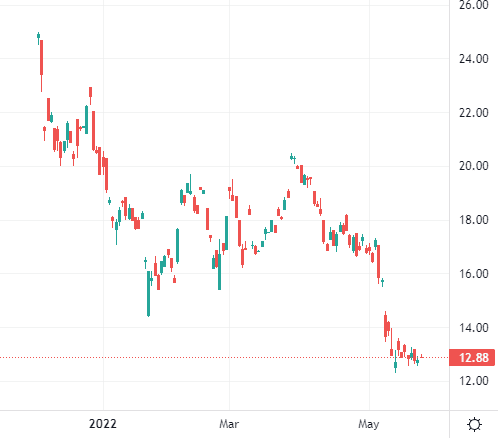

If you want to invest in Valkyrie Bitcoin Strategy ETF, you’ll pay annual management fees of 0.95%. At the end of May 2022, the fund had just over $20 million in net assets. That’s much lower than some Bitcoin ETFs, but Valkyrie CEO Leah Wald believes that it will grow.

Valkyrie has classified the fund as non-diversified, and it’s unsuitable for investors wanting direct exposure to Bitcoin’s price. The company also offers trusts for various cryptocurrencies such as Algorand and Polkadot.

Cryptoassets are a highly volatile unregulated investment product.

3. VanEck Bitcoin Strategy ETF

The VanEck Bitcoin Strategy ETF (XBTF) provides one of the lowest expense ratio funds of Bitcoin ETFs—0.65%. This is another Bitcoin futures ETF. At the time of its launch in November 2021, XBTF was the market leader for the lowest cost Bitcoin-linked in the US.

VanEck’s strategy to lure in long-term investors resulted in providing them with tax benefits. The company accomplished that by structuring the fund as a C-corporation. That provides investors tax efficiency because C-corps aren’t required to distribute long-term capital gains as dividends. As a result, investors can keep more money invested in funds because of the lower taxable distributions.

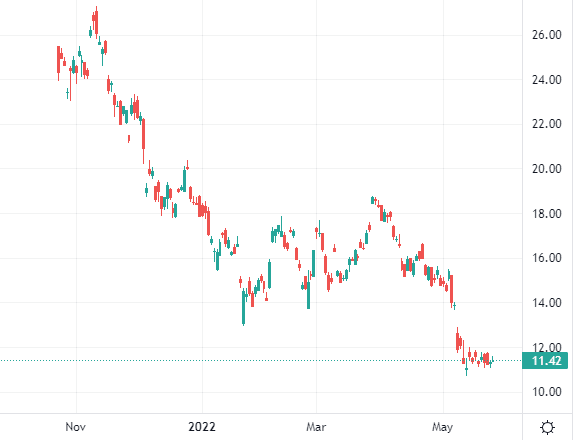

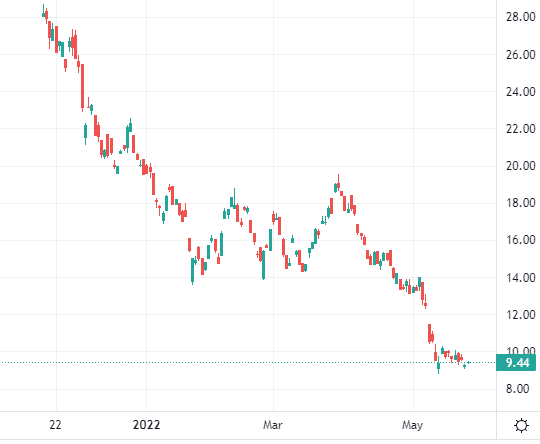

XBTF is another actively-managed fund that invests in bitcoin futures contracts and is the third Bitcoin ETF in the US. At the end of May 2022, the fund consisted of $22 million in total net assets. Besides bitcoin futures contracts, XBTF also invests in treasury bills and cash.

The fund gained significant momentum during its launch, but subsequent launches of other funds stifled its growth. Since then, the fund grew to just under $30 million before reaching present levels.

Cryptoassets are a highly volatile unregulated investment product.

4. Grayscale Bitcoin Trust

The Grayscale Bitcoin Trust (GBTC) is slightly different to Bitcoin ETFs we featured. It’s not considered an ETF, rather it’s regarded as a closed-end grantor trust. The key difference with a bitcoin trust is that it issues a fixed number of shares at the time of going public. Investors can purchase those shares over the counter.

A bitcoin trust also differs from an ETF in its investments. A typical Bitcoin ETF has a majority of its investments in bitcoin futures. Whereas GBTC solely invests in Bitcoin. It derives its value from Bitcoin’s price and is a passive investment.

The Grayscale Bitcoin Trust is ideal for investors seeking exposure to Bitcoin as a security. The benefit of doing it through Grayscale is that you don’t have to worry about buying, storing and safekeeping Bitcoins. Grayscale does all of that for you.

If you’d like to invest in GBTC, you need a minimum investment of $50,00. The trust charges 2% annual management fees, making them one of the highest in the industry. The one way Grayscale can justify its high management fees is the significant costs of buying and selling Bitcoin.

GBTC started in 2013 and has more than $18 billion in assets under management.

Cryptoassets are a highly volatile unregulated investment product.

5. Fidelity Advantage Bitcoin ETF

Fidelity Advantage Bitcoin ETF (FBTC) followed other Bitcoin ETFs after the SEC gave the green light by establishing itself at the end of November 2021. Fidelity has been a powerhouse in offering securities for decades, and it wanted to give cryptocurrency investors access to ETFs.

Investing in the Fidelity Bitcoin ETF means investing in a fund that exposes you to Bitcoin, so you own physical Bitcoin. This fund has a low correlation to the stock, bonds and cash, so it allows you to diversify your portfolio. One of the key benefits of this ETF is the low management fees. FBTC charges 0.40% annually, making it one of the cheapest.

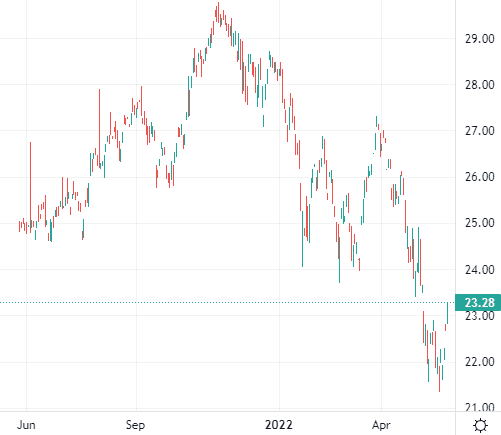

Since this fund follows Bitcoin’s price, you should keep in mind the crypto market’s volatility. At the end of May 2022, FBTC had net assets of just over $30 million. And the number of Bitcoins in its storage was just over 811.

The Fidelity Bitcoin ETF is eligible for tax advantages if you have a registered account. This fund trades on the Toronto Stock Exchange, offering it in Canadian dollars and a US dollar version.

Cryptoassets are a highly volatile unregulated investment product.

6. Global X Blockchain & Bitcoin Strategy ETF

Global X provides passively and actively-managed cryptocurrency EFTs. The Global X Blockchain & Bitcoin Strategy ETF (BITS) is actively managed. The Global X Blockchain ETF (BKCH) is passively managed.

BITS uses a combination trading strategy by investing your funds into bitcoin futures and blockchain stocks—consisting of companies in digital asset transactions and mining, as well as blockchain application companies and software services. The best blockchain stocks could provide significant returns in the future.

The majority of the fund consists of bitcoin futures, and a significant portion is invested in BKCH. BITC owns shares in BKCH, enabling it to diversify the fund. At the end of May 2022, BITS’s net assets valued at just under $10 million.

Although actively managed, BITS charges management fees of 0.65%. Its distribution is semi-annually, and the fund aims to achieve long-term capital appreciation.

Global X’s investing strategy of targeting bitcoin futures and Bitcoin-related equities aims to provide investors with the best of both worlds and evenly divide the allocation. By doing so, Global X will avoid major roll-cost issues with the futures curve being relative to spot prices.

BITS trades on Nasdaq and has five holdings.

Cryptoassets are a highly volatile unregulated investment product.

7. Simplify US Equity Plus GBTC ETF

Simplify US Equity Plus GBTC ETF (SPBC) was established in May 2021 and follows a mixed investing strategy. Simplify stated that its fund targets a 100% investment in US equities and provides 10% exposure to Grayscale Bitcoin Trust.

In theory, it offers a 110% investment. Simplify invests the majority of its fund in iShares Core S&P 500 ETF—one of the leading S&P 500 ETFs. SPBC invests a small portion of its assets in E-mini S&P 500 Futures. That gives the fund greater exposure to the broader market. The exposure enables SPBC to invest about 10% in the Grayscale Bitcoin Trust.

At the end of May 2022, SPBC had $95 million in assets. The fund has an expense ratio of 0.74% and provides quarterly distributions. Your portfolio is diversified by investing in SPBC because you get exposure to equities and cryptocurrencies.

SPBC investors take advantage of tax efficiencies and don’t file K-1s. Simplify designed the fund’s investing to be suitable for investors looking for long-term capital appreciation.

Cryptoassets are a highly volatile unregulated investment product.

8. Purpose Bitcoin ETF

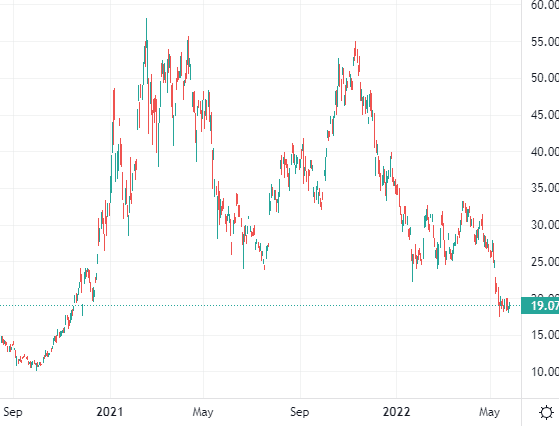

Purpose Bitcoin ETF (BTCC) was the first Bitcoin ETF in the world, launched in February 2021. Considering its novelty, BTCC received a lot of attention, and the hype didn’t fizzle after the launch. It trades on the Toronto Stock Exchange and tracks the price of Bitcoin.

Investing in this fund means that you own Bitcoin. Considering Bitcoin’s price volatility, you shouldn’t be surprised to see significant changes in your portfolio’s value.

Registered accounts can use tax-free savings accounts (TFSA) or retirement savings plan (RRSP) to save on taxes. Currently, BTCC has a management expense ratio (MER) of 1%, which is high. It has capped that expense at 1.50%, and it passes on the savings to you if it falls below that mark.

The fund has slightly more than 36,000 Bitcoins, and its net assets were valued $810 million at the end of May 2022. The company specialises in crypto ETFs and offers another popular fund called Purpose Crypto Opportunities ETF.

Purpose has ensured that BTCC contains high liquidity, so you can buy and sell shares as necessary to rebalance your portfolio.

Cryptoassets are a highly volatile unregulated investment product.

9. Bitwise Crypto Industry Innovators ETF

Bitwise Crypto Industry Innovators ETF (BITQ) started in May 2021 and invests its fund into cryptocurrency equities. BITQ enables investors exposure to one of the largest crypto asset funds in the world, tracking the Bitwise Crypto Innovators 30 Index.

Being part of the index means that a company has generated most of its profits from the cryptocurrency ecosystem. Or the company needs to have a majority of its profits in a liquid crypto asset.

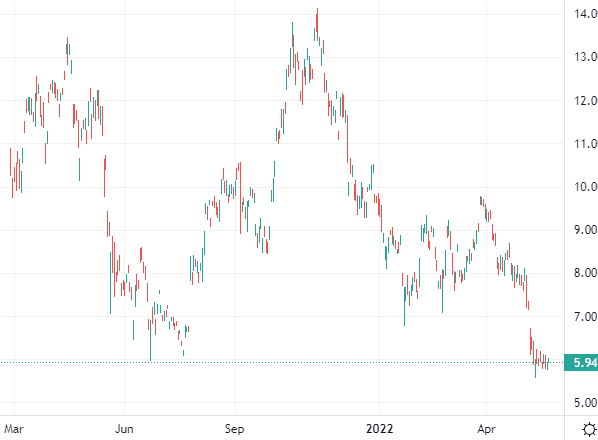

At the end of May 2022, BITQ’s net assets consisted of just over $60 million, and it had 30 holdings. Its top three holdings were Galaxy Digital Holdings, Microstrategy and Coinbase Global. Investing in BITQ means that you’ll have to pay 0.85% annually for management fees.

Bitwise makes a case for investing in its fund by allowing investors to invest in crypto companies without holding cryptocurrencies. That enables you to avoid the volatility of the cryptocurrency market. A BITQ investment also lets you participate in the crypto ecosystem by investing in companies involved in Bitcoin mining and ones offering trading platforms.

Cryptoassets are a highly volatile unregulated investment product.

What is a Bitcoin ETF?

It’s similar to a securities ETF. An ETF consists of a pool of money that a fund manager uses to invest in different companies. Some fund managers choose to track a particular market index such as the S&P 500, aiming to match its performance, at the very least.

A Bitcoin ETF is similar to a securities ETF, but it has a few differences. Some say that it offers a few advantages over a regular ETF. Depending on the Bitcoin ETF, you could invest in Bitcoin. That means you get exposure to Bitcoin’s price and have to stomach the volatility.

The other option is investing in a fund that offers Bitcoin futures. That usually has less volatility than a fund investing directly into Bitcoin. A Bitcoin ETF usually is comprised of Bitcoin and assets related to Bitcoin’s price. It trades on regulars exchange and not on cryptocurrency exchanges.

One of the benefits of investing in a Bitcoin ETF is that it helps you to diversify your portfolio.

Some Bitcoin ETFs invest in bitcoin futures and the stock market. One example is Simplify US Equity Plus GBTC ETF (SPBC). It invests the majority of its fund in iShares Core S&P 500 ETF and a small portion of its assets in E-mini S&P 500 Futures. The exposure to the broader market enables SPBC to invest about 10% in the Grayscale Bitcoin Trust.

A securities ETF doesn’t allow you the option to invest a portion of your portfolio in cryptocurrency. Its fund managers generally avoid buying stocks of cryptocurrency companies.

The main reason for investing in a Bitcoin ETF is to invest in the crypto ecosystem without incurring high trading fees and the hassle of finding secure storage. A Bitcoin ETF manager handles all of that and rebalances the portfolio to provide you with long-term capital appreciation.

The Road to Bitcoin ETF Approval

Currently in the US, the SEC has not approved any Bitcoin ETF that holds Bitcoin. But it has approved Bitcoin ETFs linked to bitcoin futures contracts. Countries such as Canada, Brazil and Dubai offer Bitcoin spot ETFs.

SEC’s Crypto Futures Approval

The reason the SEC approved a Bitcoin ETF holding crypto futures is that US financial regulators oversee such products on platforms. Its apprehension of a spot-Bitcoin ETF approval is that it has limited-to-no surveillance of platforms offering digital assets.

Grayscale’s Push for Approval

The SEC has rejected several requests for an EFT linked to Bitcoin, even though Grayscale wants to convert its $40 billion Bitcoin trust into an EFT. Thousands of crypto investors have penned a letter that accompanied Grayscale’s plea because they believe that the Bitcoin ETF deadline approval has long passed. But the SEC stated that it wouldn’t succumb to any pressure.

In an effort to offer a Bitcoin spot ETF to clients, Grayscale has threatened to sue the SEC for approval.

Are Bitcoin ETFs a Good Investment?

Investors are constantly looking for ways to make investing easier and get the highest returns. A Bitcoin ETF could be the ideal investment option if you want to reap several benefits.

The Fund is Actively Managed

Most Bitcoin ETFs are actively managed. A fund manager handles the buying and selling of bitcoin futures or Bitcoin. So you don’t have to worry about the hassle of rebalancing your portfolio.

The key benefit of actively-managed ETFs is that the manager aims to outperform the market. Passively-managed funds usually aim to match the performance of a fund it tracks. So ETFs are ideal if you want exposure to Bitcoin and crypto with less risk than directly buying coins.

Can Lower Your Trading Fees

If you open an account on a cryptocurrency exchange to buy or sell coins, you have to endure the arduous process of registering an account and verifying your information by uploading documents.

Once you’ve done that, you want to trade. That means you’re investing more time into buying and selling. Moreover, you’re incurring costs every time you log a trade. The more trades you place, the higher the costs.

With a Bitcoin ETF, not only does a manager save you time, but you don’t incur costs for every trade. The fund charges you a set annual percentage fee of your investment. Some funds offer a low expense ratio, enabling you to save money if you transacted a lot on a crypto exchange.

Allows You to Diversify

The major difference between a securities ETF and a Bitcoin ETF is the selection of investments. A securities ETF focuses on stocks and bonds. But a Bitcoin ETF enables you to diversify your portfolio by investing in crypto and stocks. The added benefit is that it enables investment in bitcoin futures, avoiding the volatility investors experience when buying coins.

Moreover, some funds enable you to get direct exposure to Bitcoin. Other funds allow you to invest in bitcoin futures and the stock market. You can own stocks in companies in the cryptocurrency ecosystem—involved in Bitcoin mining sites and crypto trading platforms.

Where to Buy Bitcoin ETFs

We found two options that provide ideal crypto investing and trading.

eToro – Best Platform to Invest in Crypto

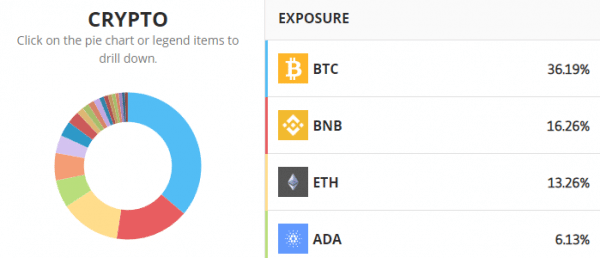

You can also use eToro’s advanced social trading tool Smart Portfolio (formerly known as CopyPortoflio). The choices are Top Trader Portfolios, Thematic Market Portfolios and Partner Portfolios. The options enable you to invest in different regions, industries, assets and investment strategies.

It’s like investing in a Bitcoin ETF because of the diversification, but it’s even better. The minimum investment in a Smart Portfolio is $500. Most Bitcoin ETFs charge at least $1,000. The Thematic Market Portfolio is a collection of assets that are periodically rebalanced to optimize returns.

For beginners, investing in the Smart Portfolio is cheaper and easier than a Bitcoin ETF. Fund managers charge for rebalancing an ETF, but eToro’s Smart Portfolio has no management fee. Even closing the Smart Portfolio isn’t charged. If you completely close your portfolio, eToro automatically returns funds to your available balance.

If you don’t want to stomach the volatility of intraday crypto trading, you can seek long-term profits by purchasing Bitcoin and other ETFs. Instead of trading, you can build up a portfolio of crypto assets such as Ethereum, XRP, Binance, Cardano and other coins.

Otherwise, if day-trading crypto or other assets is your thing, you’ll benefit in several ways with eToro’s platform. It provides you access to multiple asset classes and more than 17 international markets. You can trade over 3,000 equities and more than 150 ETFs. Other trading options are bonds, commodities and forex pairs.

Trading Bitcoin with eToro means paying a low fee of 1%. After buying them, you can store Bitcoins in the eToro money crypto wallet. eToro has made crypto trading convenient on its mobile app. The platform is user-friendly on your mobile screen and contains all the features found on eToro’s site.

eToro is regulated by the SEC, FCA, ASIC and CySEC and registered with FINRA. Opening an account with eToro is simple, and the platform enables you to deposit funds with a debit/credit card, bank wire or ACH.

eToro’s goal is for you to get the most returns while interacting with professional traders and learning from them. That’s the reason the platform operates as a social network. It offers CopyTrade, enabling you to copy trades of successful traders.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

Webull – Low Minimum Deposit Platform

Trading cryptos on Webull requires a minimum investment of only $1. It enables instant settlement, so your funds are always available. Trading on this platform is simple as Webull provides real-time data, customizable charts and indicators.

If you’re new to trading, Webull provides a library of learning tools. You can watch free videos about crypto trading, options and stocks. Webull even provides tutorial videos about using the platform.

Traders can communicate via the Webull Community, making it simple to exchange ideas and strategies with top traders.

This broker provides an array of investment assets. Webull enables you to trade thousands of stocks and allows fractional share ownership for $5. You can also trade options, ETFs and invest in foreign companies.

Webull even allows you to save for retirement by investing in a traditional, Roth or rollover individual retirement account (IRA). The platform doesn’t require a minimum deposit and offers 0% commissions.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

Conclusion

Investors have several choices for investing in Bitcoin ETFs. The decision of which one to invest in depends on the preferred diversification of the portfolio. Funds such as Global X Blockchain & Bitcoin Strategy ETF consist of blockchain companies and bitcoin futures. The risk of investing in such funds is lower than investing in Fidelity Advantage Bitcoin ETF, allowing investors exposure to Bitcoin. Funds that track Bitcoin's price are more volatile than ones tracking a market index.

Regardless of which fund you choose, you need a reliable broker. We found that eToro offers 264 ETFs to invest in and charges low fees. Its mobile application is convenient, and the platform's simplicity helps beginners trade with ease, but it's also got advanced tools for pro traders to optimize strategies.

The benefit of choosing eToro is that you can invest in a Smart Portfolio. It’s similar to a traditional ETF, but it eToro has made it cheaper and easier to invest. You can also copy different investing strategies.

Cryptoassets are a highly volatile unregulated investment product.