There is a growing acceptance of legal marijuana among policymakers across the world. Despite this, cannabis stocks have mostly underperformed the broader market in recent years. However, cannabis stocks can provide a chance for users to diversify their portfolio.

In this guide, we take an in-depth look at the popular cannabis stocks to watch and where you can buy your chosen equities at 0% commission.

Popular Cannabis Stocks to Watch in 2023

Here is a breakdown of the 10 popular cannabis stocks:

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

A Closer Look at the Popular Marijuana Stocks

The cannabis industry is made up of several companies that are directly or indirectly engaged in the marijuana market. While some focus on research and development, others are involved in distributing and selling cannabis.

In other words, there are dozens of investment opportunities in this sector. As such, choosing the popular cannabis stocks can be done by creating a diversified basket of relevant companies.

In this section, we take a closer look at the 10 popular cannabis stocks in the market.

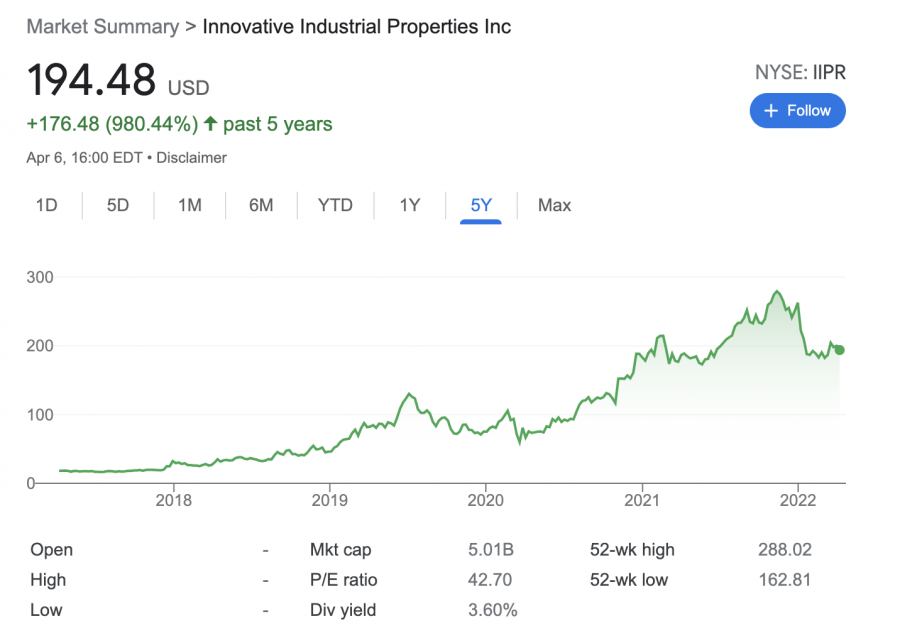

1. Innovative Industrial

The first cannabis stock is actually a real estate investment trust (REIT). Innovative Industrial is a San Diego-based company that manages medicinal cannabis facilities in the US. It caters to the industrial side of the marijuana industry by providing greenhouses and other facilities that support the cultivation and distribution of cannabis.

Put simply, the firm rents out real estate to cannabis companies in the US and receives a rental income in return. This business model has helped Innovative Industrial perform remarkably well over the past few years. In the last half-decade, the share value of this company has increased by nearly 1,000%.

Innovative Industrial also gives investors an indirect entry point into the cannabis sector. When you buy this marijuana stock, you will not have to bear much of the volatility that is often associated with this industry. And as such, the risk with this investment option is somewhat lower.

Moreover, with a running dividend yield of 3.6% as of writing, Innovative Industrial is one of the popular cannabis stocks. The company currently operates only in 19 jurisdictions, whereas there are a total of 37 US states where marijuana is legalized for medical and recreational purposes.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

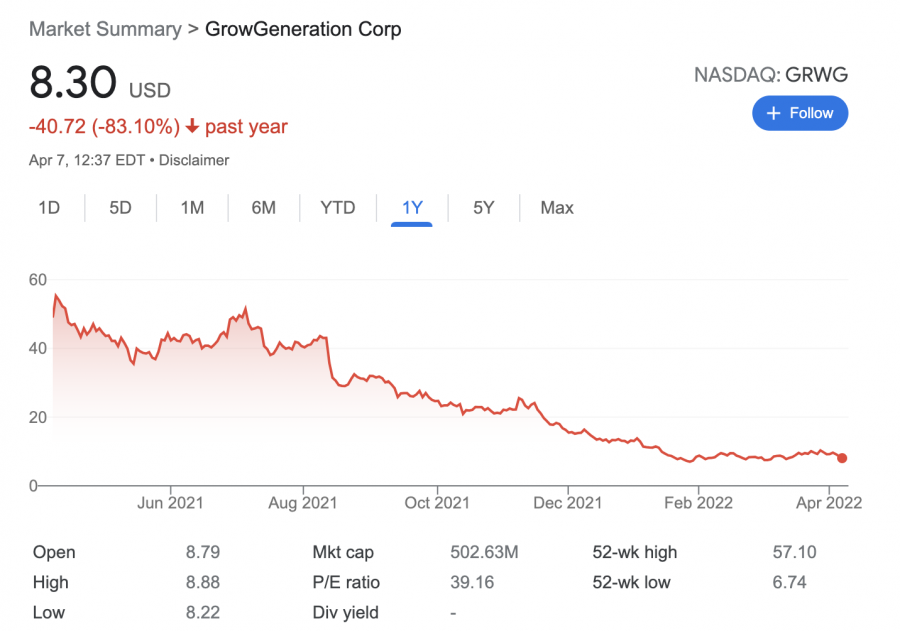

2. GrowGeneration

Hydroponics is a method used to grow plants in liquid nutrient solutions, without requiring soil and organic gardening. This type of horticulture has a fast-growing demand in the US cannabis industry.

That said, the company’s business is not solely focused on the cannabis sector. GrowGeneration owns and operates over 50 retail centers throughout the US, selling a variety of garden supplies. The firm also benefited from a surge in customers in the midst of the COVID-19 pandemic.

GrowGeneration sells hundreds of products, which include plant nutrients, agriculture soils, lighting, hydroponic and aquaponic equipment. It has also announced plans to expand and has partnered with Horticultural Rep Group, a specialty company focused on the marketing and sales organization of gardening products.

It has also purchased assets of Mobile Media inc and MMI Agriculture, in order to upgrade its mobile shelving and warehouse facilities. Looking at the firm’s earnings, GrowGeneration reported growth in revenues for the first few months of 2021. However, the retailer’s lowered guidance for the second half of 2021 led to a sharp decline in its share price.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

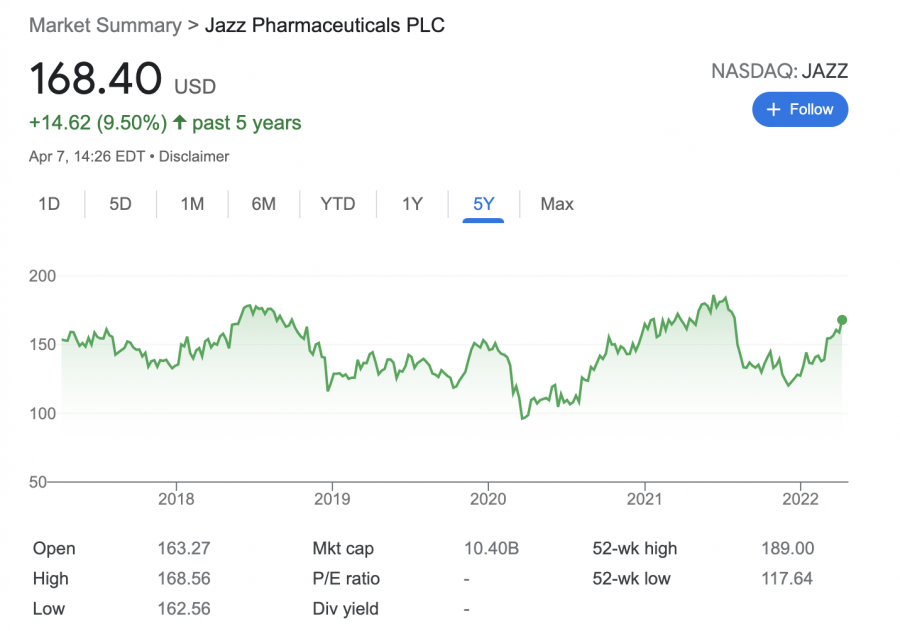

3. Jazz Pharmaceuticals

Jazz Pharmaceuticals entered the cannabis market in 2021, after acquiring GW Pharmaceuticals. GW’s drug Epidiolex is the first cannabis-based medicine to be approved by the FDA. This prescription drug, used for treating childhood epilepsy, has generated sales that exceeded the expectations of market commentators.

With that said, Epidiolex is just one of many products backed by this company. Another successful drug developed by Jazz Pharmaceuticals is Xywax, used in the treatment of sleep disorders. Furthermore, this company also has a robust oncology platform, which serves as another source of revenue for the firm.

Looking at the price action of this stock, Jazz Pharmaceuticals has experienced enhanced volatility in the market. Towards the end of 2021, the stock declined in value, primarily due to the temporary drop in the sales of Xylem. However, its share price has since recovered, increasing by nearly 30% within the first three months of 2022.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

4. Canopy Growth

Headquartered in Canada, Canopy Growth operates in the cannabis sector by making medical marijuana products. The firm distinguishes itself by being the first company to receive a New York State hemp license and is set to establish its US-based commercial operations.

Canopy Growth began trading on the NYSE in 2018. However, Canopy Growth has not turned a profit since 2018.

The firm has faced supply challenges in Canada and a slower-than-expected sales growth for its products in the US market. On top of this, the company has invested money into expanding its production, which has further affected cash flow levels. Due to these reasons, the share value of Canopy Growth has dropped by around 12% over the last five years.

However, in 2018, when the cannabis market was booming, Canopy Growth saw its share value increase by more than 500%.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

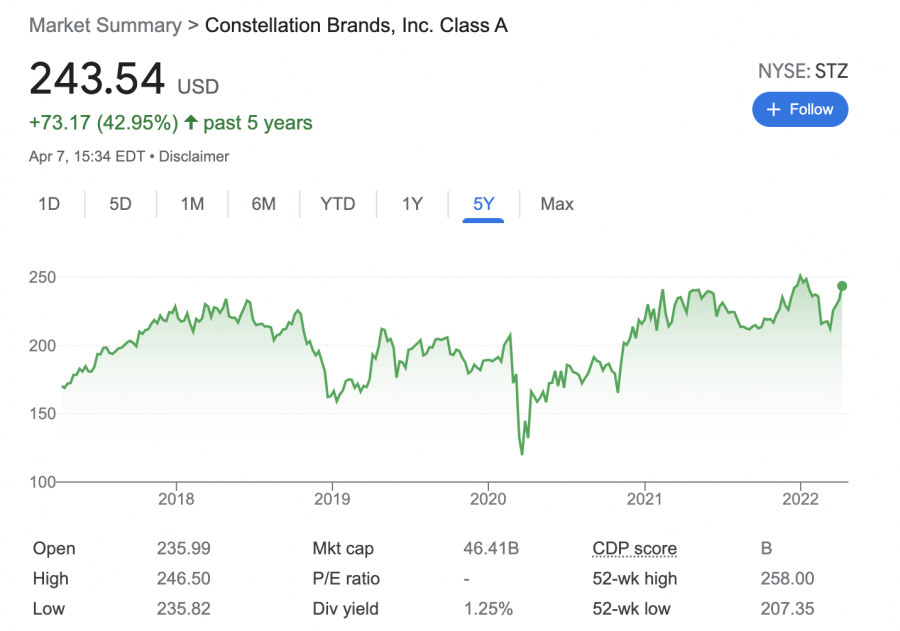

5. Constellation Brands

Constellation Brands is popular as a beer company, however, it has diversified into the cannabis market through its investment in Canopy Growth. In 2020, Constellation Brands increased its stake in Canopy Growth to approximately 36%. This partnership gained a substantial return for Constellation Brands between 2017 and 2020.

But since 2021, the investment has turned out to be a challenge for the firm. However, Constellation Brands continues to witness steady revenue growth in its consumer staples segment.

Constellation Brands is one of the largest beer suppliers and import companies in the US. As part of its development strategy, Constellation Brands is also focusing on high-end beer and wine, where consumer demand is growing rapidly. Over the past half-decade, the shares of this company have increased by around 45% in value.

It also offers a running dividend yield of 1.3% to its investors – based on prices as of writing.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

6. Scotts Miracle

Scott Miracle’s subsidiary, Hawthorne Gardening, is one of the leading suppliers of hydroponic gardening products to the cannabis industry. It has also built a 50,000 square foot research and development facility to study how its products affect the growth of cannabis.

However, it is important to note that the company still makes more than half of its total revenue from lawn and garden products. Like GrowGeneration, Scotts Miracle also benefited from the COVID-19 pandemic. Its share value reached an all-time high of $254 in April 2021. However, the price of this stock has since dropped.

Since Scotts Miracle is a large-cap stock, it is also able to offer you a dividend yield. At the time of writing, the company offers a running yield of 2.3%.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

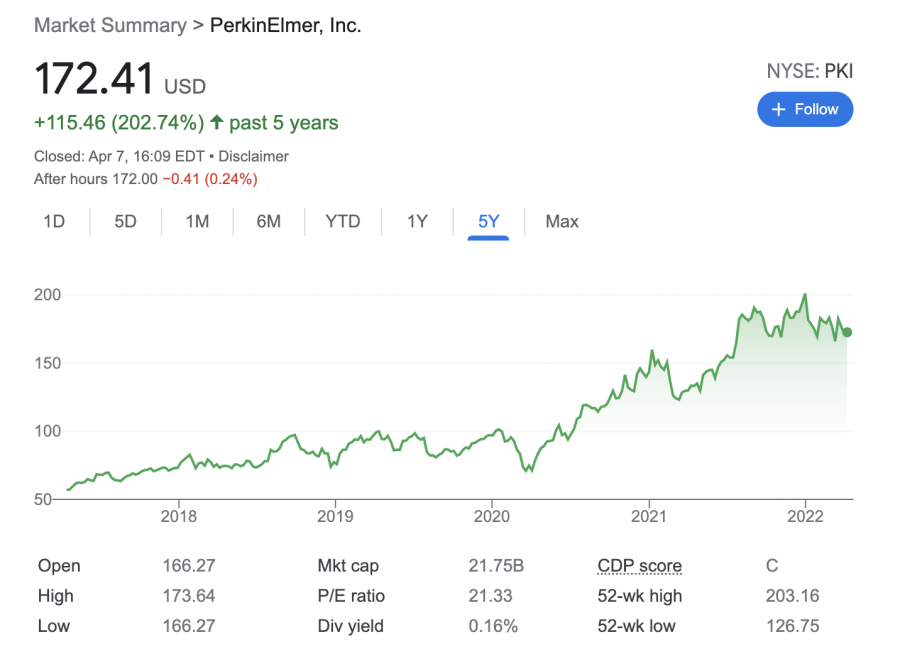

7. PerkinElmer

PerkinElmer is a laboratory testing equipment company with two major lines of business – diagnostics, and discovery & analytical. In 2019, this Massachusetts-based firm announced that it has started selling testing equipment for cannabis labs. In simple terms, this company conducts potency analyses to ensure the quality of cannabis products.

The global cannabis market is expected to achieve a compound annual growth rate of over 13% by 2026. However, what is driving the growth of PerkinElmer is not its investment in the cannabis sector.

Instead, its COVID-19 test kits have turned out to be the most successful products of the company in recent times. Over the past five years, PerkinElmer stocks have increased in value by over 200%. The firm also pays dividends, however, at the time of writing, the running yield being offered is only 0.16%.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

8. Cronos Group

One of the popular stocks under $5, Cronos is a Canadian-based company that makes a wide range of adult-use cannabis and CBD projects. The firm has operations in many different countries across the world, including the US and Australia. The stock gathered the attention of investors in 2019 when the tobacco giant Altria chose to invest $2.4 billion in the company.

This gave Altria a 45% share in Cronos, along with an option to buy a controlling stake in the firm. Despite this investment, Cronos has had a difficult couple of years, primarily due to increasing material and labor costs. However, Q4 2021 results reported over 50% growth in net sales.

That said, 68% of the company’s revenue comes from the ‘Rest of World’ segment. This means that Cronos is still struggling to generate notable growth in the US.

In the past five years, the stock of this firm has gained just over 50% in value. However, over the prior 12 months, its share price has dropped by 60%.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

9. Aurora Cannabis

Aurora Cannabis is involved in the growing and distribution of cannabis products across the world. This Canadian company also caters to markets in the US, Italy, Australia, Germany, and many more. However, as with the majority of pure-play cannabis stocks, Aurora Cannabis has also experienced tough market conditions over the past couple of years,

In the past five years, the stock value of Aurora Cannabis went down by nearly 90%.

Although the stock hasn’t performed well since 2020, that isn’t to say that its core business has not progressed. The company reported an increase of 10% in net revenue as per its earnings report for Q1 2022.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

10. Tilray

Tilray is a Canadian-based company that focuses on cultivating, processing, and distributing medical marijuana products. What sets Tilray apart is its resume. It is not only a leading exporter of medical cannabis products but also the biggest marijuana company in Europe.

On top of this, Tilray is also the first foreign firm to export CBD products into China. In other words, Tilray has established an extensive global footprint – with licenses to grow, sell, and import-export cannabis in over 20 countries. The company has also invested heavily in medical cannabis research.

As with the other cannabis stocks we have discussed today, Tilray has also experienced tough market conditions in recent years. Over the past five years, for instance, the share value of this company has plunged by nearly 80%.

One thing that makes Tilrey unique is that it does not sell cannabis in the US. The company has no interest in operating in the US unless marijuana is legalized nationwide.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Analyzing the Popular Cannabis Stocks

Due to the high level of risk involved, it can be a headache to find the popular cannabis stocks that align with your investment strategy.

Here’s what you need to know about marijuana stocks before proceeding.

Types of Cannabis stock

When looking for the popular cannabis stock for your portfolio, you should have an idea of what type of company you wish to invest in.

This can determine the exposure you will get to the wider cannabis sector, as well as the risks invoked.

There are three main categories of marijauna stocks to look at:

- Growers: These are companies that cultivate, sell, and distribute cannabis. This includes most of the pure-play stocks in this market, such as Canopy Growth and Aurora Cannabis.

- Biotechs: These are companies operating in the biotech sector that develop and bring medical marihuana products to the market. Examples include Jazz Pharmaceuticals and PerkinElmer.

- Supply Providers: This category of cannabis stock provides the tools and materials for growing marijuana. Some of the popular ancillary companies in the cannabis industry are Innovative Industrial, Scotts Miracles, and GrowGeneration.

You can pick the right marijuana stocks for your portfolio – depending on the exposure you seek as well as the risk you are comfortable taking.

Licensing and Regulations

To be clear, cannabis is still not legal in the US on a federal level. However, most US states have legalized the use and sale of medical marijuana.

Nevertheless, the licensing requirements vary from one state to another.

- In the US states where marijuana is legal, there is only a limited number of licenses for growers and distributors.

- This means that companies that hold licenses to operate dispensaries will benefit from a larger market share.

- One such example is Canopy Growth, a company that has a hemp license to operate in the state of New York.

It is crucial to understand that licensing for medical marijuana is different from recreational usage.

- At the time of writing, only Canada and Uruguay – in addition to a number of individual US states, have legalized the sale of recreational cannabis.

- Some of the popular cannabis stocks we discussed in the guide are licensed to operate in multiple countries – such as Canopy Growth, and Tilray, giving them a distinct advantage in the market.

All that being said, there is no way of knowing whether regulations will favor recreational sales in more countries and US states in the future.

Financial Strength

As with all other sectors, investing in cannabis stocks also requires you to study the companies. Since the marijuana industry is still in its early stages, it can be challenging to find pure-play cannabis stocks that are profitable.

In this case, you can consult the balance sheet of the company you are interested in. By reviewing free cash flow levels and outstanding debt, you will get an idea of the company’s financial standing.

Cannabis Penny Stocks

With some of the popular companies in the cannabis sector costing more than $100 per share, users may want to look at the popular penny stocks.

A penny stock refers to a small company that trades for less than $5 per share. And as such, these might come across as a tempting way to try to grow your money.

Here are a few popular penny stocks available in the market:

- Sundial Growers: Speculative cannabis penny stock with huge growth potential

- Hexo Corp: Canadian cannabis grower with a sizable market share

- Sorrento Therapeutics: San Diego-based biopharmaceutical firm involved in CBD drugs

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Where to Buy Cannabis Stocks

If you are wondering how to invest in cannabis stocks, the first step is to find a regulated and credible broker that gives you access to the equities you want to purchase. The sections below review a popular broker that allows users to invest in Cannabis stocks.

eToro

You can buy cannabis stock at 0% commission via this platform. This fee structure is applicable for not only US-based companies but also international marijuana stocks such as Canopy Growth and Tilray. Moreover, when funding your eToro account in US dollars, you do not have to pay any deposit fees.

On top of this, the minimum deposit and investment amount required is only $10 – making it simple for you to purchase fractional shares of popular marijuana stocks. You will be able to fund your account via many convenient payment methods, ranging from debit/credit cards, e-wallets, and bank transfers

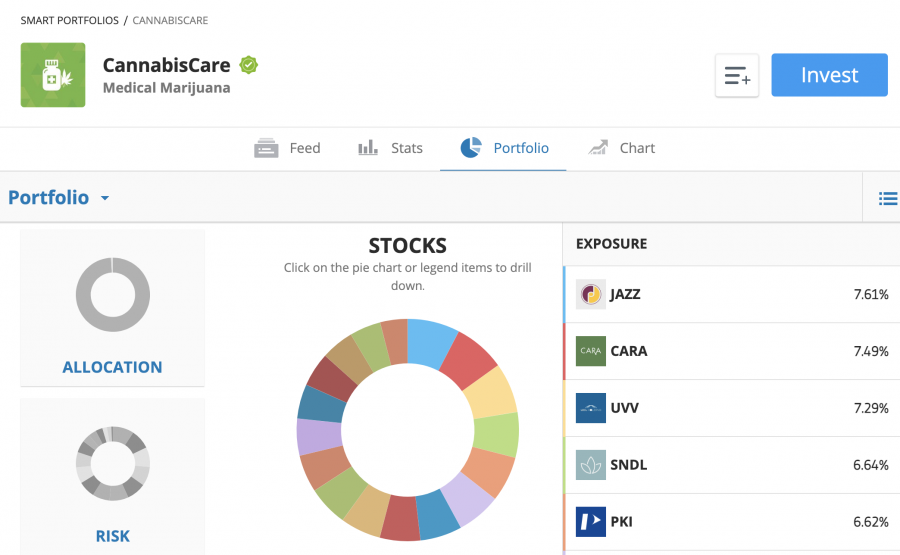

As a social trading site, eToro allows you to interact and share ideas with other users on the platform. eToro also allows you to copy the trades of other investors, repeating their positions in your portfolio like-for-like. It also features smart portfolios that allow you to diversify into a specific sector – such as cannabis.

For instance, if you wish to invest in the best CBD stocks via a single transaction, you can choose eToro’s CannabisCare smart portfolio. This gives you exposure to some of the popular cannabis stocks we analyzed in this guide.

Furthermore, this social trading platform also provides access to the popular oil stocks, metaverse stocks, and mainstream stocks such as Amazon, Gamestop and Tesla on a zero-commission basis. In addition to stocks, the broker offers access to ETFs, indices, commodities, and forex. You will also be able to buy cryptocurrency at low fees.

Finally, eToro offers demo accounts for you to practice stock trading. And if you are someone who prefers investing via your smartphone, eToro’s app also comes loaded with a full set of features.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

In summary, there are a variety of ways to invest in cannabis. However, like all emerging industries, it is crucial that you are aware of the risks involved and that you have a diversification strategy in place to absorb the inevitable volatility of this sector.