Cardano is one of the most long-established and popular crypto projects out there. But for anyone investing in ADA, finding out the best Cardano wallets to keep their holdings secure is a must. Cardano has been around since the days of Cryptopia in 2017 – an exchange that was hacked and closed down. Some investors got in early at $0.02 then lost their funds as they didn’t choose a reputable exchange wallet for ADA.

We’ve taken a careful look at some of the most popular Cardano wallets out there to provide useful and easy-to-digest reviews. We’ve analyzed a multitude of factors including fees, security, mobile experience, and more.

The Best Cardano Wallets Ranked

From our research these are some of the best Cardano wallets available right now.

- eToro – Overall Best Cardano Wallet

- Crypto.com – Store ADA & 250+ Other Assets

- Coinbase – Easiest to use Cardano Wallet

- Daedalus – Secure ADA Wallet Created by IOHK

- AdaLite – Software ADA Wallet with Ledger/Trezor Compatibility

- Ledger Nano X – Most Secure Cardano Wallet

- Trezor – Excellent Alternative Hardware Wallet

- Yoroi – Lightweight ADA Wallet

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

The Best Cardano Wallets Reviewed

It can be difficult to filter the best Cardano app from subpar platforms. However, we’ve done the research and reviewed 8 of the best Cardano wallets on the market.

1. eToro – Overall Best Cardano Wallet

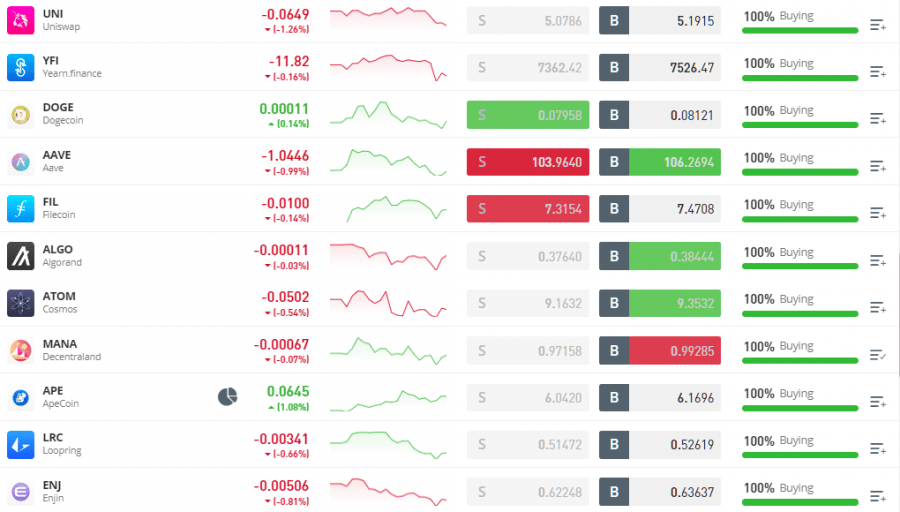

Founded in 2007, eToro is one of the best-known trading platforms on the planet. It has over 27 million users around the world and provides users with a phenomenal trading experience. It’s got features fit for investors of all skill levels, so regardless of your crypto knowledge, it’ll be good to use.

Security on eToro is excellent. It’s regulated by a number of leading authoritive bodies around the world, including the SEC, the FCA, and CySEC. Client information and funds are secured using SSL encryption and cold storage, greatly reducing the risk of attackers being able to steal anything valuable. Lastly, eToro gives every user the option of setting up 2-factor authentication to add an extra layer of protection to their accounts.

eToro’s fees are very competitive. For crypto purchases, eToro takes a 1% commission in addition to a small spread fee. However, deposits on eToro are some of the cheapest in the industry at just 0.5% for both credit/debit and e-wallet deposits.

With features that will appeal to everyone, eToro is a very well-rounded broker. Beginners can benefit from the extensive educational resources contained within the eToro Academy and use eToro’s social and Copytrading tools to practice trading strategies. On top of that, eToro offers a demo account that can be used to practice investing without wasting real money. More experienced investors can make use of the thousands of tradable assets and a good range of charting tools and technical indicators.

There’s something for everyone on eToro. The eToro Money Wallet provides a non-custodial wallet, making it the best wallet for Cardano for anyone planning on trading ADA, as well as those simply wanting to employ a buy and hold strategy.

eToro has listed 70+ cryptos one of which is ADA so you can also buy Cardano on the platform as well as store Cardano safely on eToro using its wallet.

Pros Cons

| Wallet Type | Pricing System | Fee to Buy ADA | Top 3 Features |

| Custodial / Non-Custodial | 1% Trading Fee + Spread | 1% | eToro Money Crypto Wallet

Buy/Sell/Trade ADA Extremely Secure |

2. Crypto.com – Store ADA & 250+ Other Assets

Crypto.com was founded in 2015 and quickly grew to become one of the most widely used crypto exchanges in the world with over 50 million users. It provides a well-rounded trading experience and has both custodial and non-custodial wallets.

Crypto.com’s security is first-rate. It holds 98% of client funds in air-gapped cold storage, greatly reducing the chance of an attacker being able to plunder any worthwhile amount. While the Crypto.com exchange wallet is mostly safe, users have the option of setting up the Crypto.com DeFi wallet that provides investors with access to the public and private keys linked to the wallet. This is a great choice for long-term storage as it means the risk of losing funds due to an account takeover is greatly reduced.

Fees on Crypto.com are fairly cheap at just 0.4% for purchases. However, card fees are slightly above the market average at 2.99%.

Crypto.com is divided into two platforms; the Crypto.com app and the exchange. The former is a beginner-friendly platform that makes buying and storing ADA a simple task. On the other hand, the Crypto.com exchange is packed full of incredibly powerful trading features and charting tools, making it one of the best Cardano and overall crypto wallets for anyone needing a little more out of their platform.

Pros Cons

| Wallet Type | Pricing System | Fee to Buy ADA | Top 3 Features |

| Custodial / Non-Custodial | 0.4% Trading Fee | 0.4% | Low Fees

DeFi Wallet Solid Design |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

3. Coinbase – Easiest to use Cardano Wallet

Coinbase is likely the most famous crypto exchange in the world. It’s home to over 98 million users spread across 100+ countries. Despite being a beginner-centric platform, Coinbase does have a few features that even more experienced investors will enjoy.

With almost 100 million users, Coinbase cannot afford to take its security lightly. The company keeps the vast majority of client funds offline, secured in hardware wallets following the latest security practices. Furthermore, every asset available on Coinbase has to undergo a strict verification process to ensure it’s a legitimate project.

Previous Coinbase and Coinbase Pro had separate trading fee structures, but thankfully that’s no longer an issue. Instead, both platforms charge a flat 0.6% taker and 0.4% maker fee. However, while the two platforms have become far more similar in recent times, Coinbase still charges 3.99% on credit/debit card deposits, far above the rates offered by Coinbase Pro.

Similar to eToro and Crypto.com, there are both custodial and non-custodial wallets available from Coinbase. This is great for splitting up trading assets and investments, helping to up the overall safety of the funds. Coinbase is a solid platform that can be gotten accustomed to quickly.

Pros Cons

| Wallet Type | Pricing System | Fee to Buy ADA | Top 3 Features |

| Custodial / Non-Custodial | 0.6% Taker / 0.4% Maker | 0.6% | Simple to Use

Store ADA Safely Massively popular |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

4. Daedalus – Secure ADA Wallet Created by IOHK

Daedalus is a full-node wallet (meaning it downloads the full Cardano blockchain) created by one of the founders of Cardano. It was originally launched in 2015 and has since become one of the most popular dedicated Cardano wallets out there.

Unlike some of the other platforms we’ve looked at, Daedalus is an ADA-only wallet without any buying or selling features. Despite this, it remains a solid option for investors looking for a non-custodial wallet to store their ADA. Furthermore, it’s an open-source project, meaning anyone can view the Daedalus code to ensure there’s nothing suspicious hidden away.

Investors are able to use Daedalus without the need for verifying themselves, making it a great choice for those trying to protect their anonymity. However, there’s no Daedalus Cardano app available so users are only able to access their wallet from a computer.

Pros Cons

| Wallet Type | Pricing System | Fee to Buy ADA | Top 3 Features |

| Non-Custodial | N/A | N/A | Created by a Cardano founding entity

Highly Secure Anonymous |

5. AdaLite – Software ADA Wallet with Ledger/Trezor Compatibility

AdaLite is an interesting platform. It doesn’t offer quite as much in the way of functionality compared to the other platforms we’ve looked at. Despite this, it’s lightweight, very simple, and surprisingly secure.

Like Daedalus, AdaLite lacks an option to buy or sell directly on the platform, meaning investors wanting to stock up on ADA will be better served by another broker like eToro. However, AdaLite makes up for its lack of features will some excellent security.

Investors can import their wallets directly to AdaLite using either a mnemonic (12-24 word passphrase), hardware wallet, or key file. Because of this, AdaLite is a solid choice for investors with a pre-created wallet looking to switch platforms.

There isn’t a whole lot to say about AdaLite. Outside of its simple interface and no-frills feature-set, it does operate a number of staking pools which can be used to earn interest on any ADA tucked away.

Pros Cons

| Wallet Type | Pricing System | Fee to Buy ADA | Top 3 Features |

| Non-Custodial | N/A | N/A | Simple

Highly Secure Hardware wallet support |

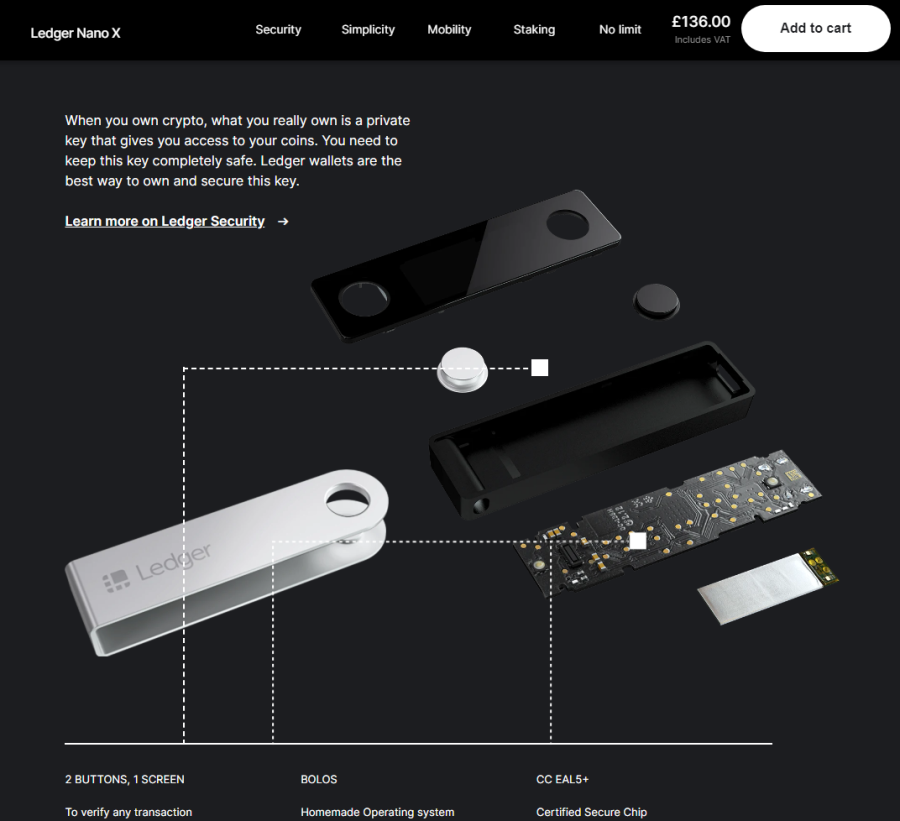

6. Ledger Nano X – Most Secure Cardano Wallet

Ledger is likely the most well-known manufacturer of hardware wallets on the market. As it’s relatively cheap and trusted, it’s the go wallet for many security-focused investors.

By storing crypto-assets offline and requiring access to the physical Ledger, as well as its passcode to buy/sell or transfer, it’s nearly impossible for a bad-actor to gain access to an investor’s funds.

While all of the wallets we’ve looked at previously are free to access and download, there are some costs involved with purchasing a Ledger. There are currently 3 different models of Ledger available, the cheapest, a Ledger Nano S costing $59, and the premium Ledger Nano X at $149.

Despite the initial purchase cost being fairly high, a Ledger is definitely a great investment for anyone wanting to store their crypto for the long run. It supports a multitude of cryptocurrencies and comes equipped with an in-built exchange for convenient purchases.

Pros Cons

| Wallet Type | Pricing System | Fee to Buy ADA | Top 3 Features |

| Non-Custodial

(Hardware) |

Dictated by

Coinify/Wyre |

Variable | Built-in Exchange

Offline Storage Lots of supported assets |

7. Trezor – Excellent Alternative Hardware Wallet

If Ledger’s offerings aren’t quite up to scratch, Trezor is an excellent alternative hardware wallet. Both Ledger and Trezor adhere to similar security principles. Like Ledger, Tezor encrypts private keys, requires physical access to the device to transact, and keeps funds safe from digital attacks.

As you’d expect from a hardware wallet, Trezor’s security is state of the art. It utilizes market-leading cryptography techniques to ensure the safety of investor funds. However, on top of its already excellent security offerings, Trezor also comes equipped with a password manager designed to take the confusion away from using long, unique passwords.

In terms of price, Trezor is definitely a slightly more premium option compared to Ledger. The basic model, a Trezor Model One costs $77 and the more advanced Model T a eye watering $280.

While Trezor does come at a slight premium to Ledger’s offerings, they achieve the same result using mostly the same methods. Ultimately, it’s a matter of preference when it comes to deciding the better option as both are extremely capable hardware wallets.

Pros Cons

| Wallet Type | Pricing System | Fee to Buy ADA | Top 3 Features |

| Non-Custodial

(Hardware) |

Various Based on Exchange | 1-5% | Very Secure

SD Card Support Free Password Manager |

8. Yoroi – Lightweight ADA Wallet

Founded in 2018, Yoroi is a non-custodial ADA wallet that allows users to store their Cardano-based assets securely.

In function, it’s very similar to Daedalus. Both are anonymous, Cardano-dedicated wallets created by founding entities of Cardano. However, the main difference between the two is the way transactions are recorded. Daedalus downloads the entire Cardano blockchain, whereas Yoroi is a lite wallet that pulls only what’s needed.

Unfortunately, there’s no way to purchase Yoroi directly on the platform so again, investors will need to use a broker like eToro to facilitate the initial ADA purchase. Luckily, there is a Yoroi Cardano app so mobile users are able to make full use of the wallet.

Likely AdaLite, Yoroi is compatible with hardware wallets like Ledger and Tezor making it very secure. It’s one of the best dedicated Cardano wallets on the market thanks to its ease of use, lightweight nature, and solid track record.

Pros Cons

| Wallet Type | Pricing System | Fee to Buy ADA | Top 3 Features |

| Non-Custodial | N/A | N/A | Lightweight

Easy to use Hardware wallet compatible |

The Top Cardano Wallets Compared

To make it easier to see how each wallet compares to one another, we’ve included this easy-to-reference table

| Platform | Wallet Type | Pricing System | Fee to Buy ADA | Top 3 Features |

| eToro | Custodial / Non-Custodial | 1% Trading Fee + Spread | 1% | eToro Money Crypto Wallet

Buy/Sell/Stake/Trade ADA Extremely Secure |

| Crypto.com | Custodial / Non-Custodial | 0.4% Trading Fee | 0.4% | Cheap Withdrawals

Stablecoin Staking Well Designed |

| Coinbase | Custodial / Non-Custodial | 0.6% Taker / 0.4% Maker | 0.6% | Simple to Use

Store ADA Securely Massive Userbase |

| Daedalus | Non-Custodial | N/A | N/A | Staking

Created by a Cardano founding entity Secure |

| AdaLite | Non-Custodial | N/A | N/A | Simple

Highly Secure Hardware wallet support |

| Ledger | Non-Custodial

(Hardware) |

Dictated by

Coinify/Wyre |

Variable | Store ADA Offline

In-built Exchange Physical Storage |

| Trezor | Non-Custodial

(Hardware) |

Various Based on Exchange | 1-5% | Extremely SecureExpandable Storage

Password Manager |

| Yoroi | Non-Custodial | N/A | N/A | Lightweight

Easy to use Hardware wallet compatible |

What is a Cardano Wallet?

A Cardano wallet is a piece of software (or sometimes hardware) that is designed for investors to store their ADA (Cardano’s native token) securely on the Cardano network. Think of it as a bank, a good Cardano wallet app allows an investor to deposit, withdraw, and transfer funds. For the wallet to function as intended it must be compatible with the Cardano network, sending ADA to non-compatible wallets can result in lost funds.

There are multiple types of wallets available, each varying greatly in terms of security, convenience, and ease of use. We’ll get into the specifics shortly but it’s important to be aware that although most wallets function in a similar way, they have key differences to be aware of.

Some specialized wallets like AdaLite are designed to only facilitates the storage of ADA and no other asset. However, the best Cardano wallets can be used to store a larger variety of assets, making them the better choice for investors wanting to manage all of their funds on a single platform. Therefore, it’s always worth checking ahead of time whether a particular wallet is asset or network-specific before depositing.

Why You Need a Cardano Wallet

Anyone wanting to invest in ADA needs to make sure they have the best Cardano wallet app. A wallet is used to store, transfer, and receive ADA, so without one, it’s impossible to do anything on the network.

The best Cardano wallet should not only support transactions but also offer an excellent level of security. Ultimately, the main purpose of an ADA wallet is to keep funds stored safely. In general, hardware wallets offer the greatest level of security, and exchange wallets the least. It’s important to understand that any exchange wallet is only as safe as the investor’s account. Choosing strong passwords and enabling 2FA is crucial for maintaining the wallet’s safety.

How do Cardano Wallets Work?

Although it can be difficult to understand exactly how a Cardano wallet app works, once the basics have been outlined, it’s far easier.

When an investor first creates a wallet, they will be given a unique Cardano wallet address. Similar to an account number in a bank, this Cardano wallet address identifies a specific wallet and makes it possible to receive ADA from a different wallet. When somebody sends ADA to a Cardano wallet address, the funds will be credited to the account linked to the address. Conversely, when sending ADA to a different wallet, the receiver will know which wallet address sent the transaction.

Next comes keys. Every Cardano wallet app will come with a set of keys, one called a public key, the other a private key. Before using a wallet, it’s imperative to understand the difference. When creating a wallet, the private key will usually be a series of 12-24 random words. The private key acts as a backup code, if access to a wallet is lost, the private key can be used to restore the wallet and the funds it contains. Because anyone with a wallet’s private key can restore it to any device they want, anywhere in the world, it’s crucial to securely store and never hand out the private key. Keeping it offline, written on a piece of paper, tends to be good practice.

The security of a public key is far less important. The public key is used to automatically create a Cardano wallet address, which can then be freely given out in order to receive crypto from others. While it’s still worth keeping the public key secure, it’s not curial to the integrity of the wallet.

Types of Cardano Wallets

There are a wide variety of popular Cardano wallets, each of which comes with a unique set of pros and cons. Distinguishing between them and selecting the one best suited to an investor’s individual needs can be rather challenging. However, there are some easy ways to differentiate between the best Cardano wallets.

Firstly, it’s important to understand the difference between a custodial and a non-custodial wallet. Earlier, we discussed private/public keys and their importance to a Cardano wallet. A non-custodial (sometimes referred to as self-custody) wallet means only the investor owns and controls the keys linked to a wallet. This provides a greater amount of security and privacy. However, these kinds of wallets are less recommended for beginners as ultimately the investor is the main point of failure, if the keys are lost, the funds within the wallet could be too.

On the other hand, a custodial wallet means that the wallet provider (eToro for example) controls the keys on behalf of the investor. While this is typically viewed as being less secure, it can be a good idea for beginners as it’s one less thing to worry about. With that said, if a platform becomes unavailable for whatever reason and the investor does not have access to the private key, it can be difficult to recover the funds it contains.

Software Wallets

The most common Cardano wallet apps are software wallets. Any Cardano wallet download can be considered a software wallet, as can browser-based wallets, and exchange wallets. While all three of these wallets are similar, there are a few important differences.

- Mobile Wallets – Mobile wallets are things like Cardano apps that are easily available to download and install on a phone. Many of the best Cardano wallets have dedicated mobile apps for on -the-go investors so it can be worth checking ahead of time whether a specific wallet has an official mobile app. For instance, both eToro and the eToro Money Wallet are available on mobile as well as desktop, making managing any assets incredibly simple.

- Desktop Wallets – Desktop wallets are also widely available and many investors prefer to keep their assets secured on a computer rather than a mobile device with greater potential for loss. There are two main types of desktop wallets; browser-based and downloadable. The former tends to be less sure but can be accessed from various devices. The latter is more secure but will only be easily available on a single device.

- Exchange Wallets – Lastly, exchange wallets. They can be both mobile or desktop (again, eToro is a perfect example) and tend to be custodial. Although exchange wallets are only as secure as the investor’s login details, they are far more convenient than any other type of wallet. For this reason, it can be a good idea to store trading funds on an exchange wallet and then move any long-term investments to either a non-custodial or hardware wallet.

Hardware Wallets

For security-conscious investors, there’s no beating a hardware Cardano wallet. Hardware wallets offer the greatest level of security by a sizable margin. However, as they require a physical device, hardware wallets do cost money (typically between $50-$300).

Most hardware Cardano wallets will come with a downloadable app that can be used to view any investments without needing to plug in the physical hardware wallet. While this does go a long way in terms of convenience, to transfer or buy/sell funds, the hardware wallet will need to be present. Making it difficult to perform transactions without a little bit of prior planning.

Paper Wallets

A paper Cardano wallet is, as the name would imply, a wallet printed on a piece of paper. Of course, you can’t print out an actual wallet but you can print the keys linked to a wallet. Paper Cardano wallets will contain both a public and private key, so it’s crucial they are stored in the correct conditions (dry, out of direct sunlight, etc). While paper wallets aren’t quite as popular following the rise of hardware wallets, they still have a place in the industry and are far more secure than storing the keys linked to a wallet on an internet-accessible device.

How to Choose the Best Cardano Wallet for You

Although we’ve provided a list of Cardano wallets, it can still be difficult to choose the one best fits for your needs. So, to make the selection process a bit simpler we’ve included a few of the most important things to consider before committing to a wallet.

Security

The primary purpose of every crypto wallet is to keepfunds secure. Therefore, the best Cardano wallet must have excellent security. As we’ve mentioned, selecting a non-custodial or hardware wallet offers the best protection. But even the more convenient exchange wallets can be secure as long as the platform is regulated and offers 2-factor authentication.

Supported Coins

As we mentioned, some Cardano apps are designed exclusively for ADA. However, there are platforms like eToro which support a larger range of coins, making it easier to manage a diverse portfolio. Depending on an investor’s strategy, it can be worth checking how many coins a platform supports ahead of time.

Fees

For the most part, there aren’t too many fees associated with the best ADA wallets. Whenever a transaction is sent, a network fee will be charged. However, some wallets tack on their own fees for transactions which can quickly add up. If a wallet is charging extremely high transaction fees, it’s probably worth keeping aware of as it’s a sign the platform values money over its users.

Mobile Experience

In the modern world, not many people are sitting behind a desk all day to trade/invest. Instead, much of the world’s investing happens on mobile. Therefore, it’s important that the best Cardano wallets have a good mobile app which is powerful and simple to use. eToro offers a great app that is highly rated on both the App & Play stores.

Convenience

Convenience is a very important part of every Cardano wallet, after all nobody wants to jump through hoops just to access their funds. It’s worth ensuring a wallet has an easy onboarding process and that no key features are hidden behind menus. Unfortunately, convenience does tend to come at the cost of security. Therefore, any investor should carefully consider what they value more before choosing a platform from our Cardano wallets list.

Best Cardano Wallet for NFT Trading

For any fans of the Cardano NFT ecosystem, Yoroi is likely the best Cardano wallet. As a dedicated Cardano platform, it supports all NFTs created on the Cardano network. Furthermore, it allows investors to send their assets for true cost and is constantly getting upgraded.

How to Get a Cardano Wallet

Figuring out how to get a Cardano wallet can be quite confusing without help. However, by following the below steps, any investor can set up their own Cardano wallet using the best ADA wallet and regulated broker eToro.

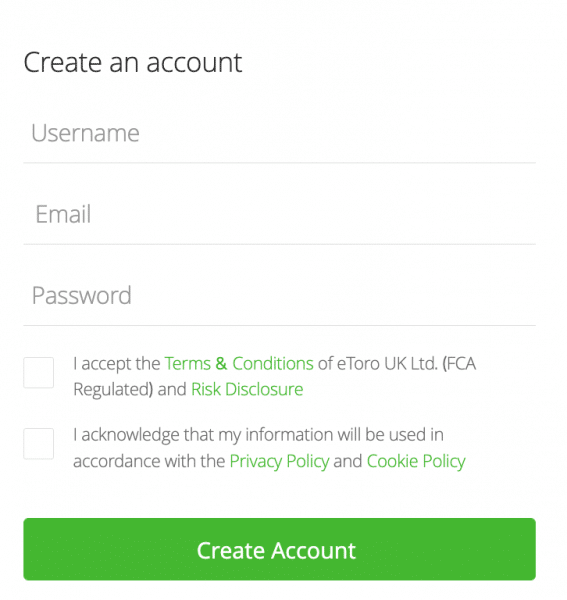

Step 1: Register with eToro

Firstly, visit the eToro.com homepage and complete the registration process. It takes a couple of minutes and requires just a few basic details like a name and email address.

Step 2: Verify Account

eToro is a regulated broker. While this had a lot of security benefits, it does mean any investor will have to go through the know-your-customer (KYC) verification process before they can use eToro. Luckily, it’s simple and can be completed quickly. The only documents needed are a photo ID (passport, driving license) and proof of address (bank statement, utility bill).

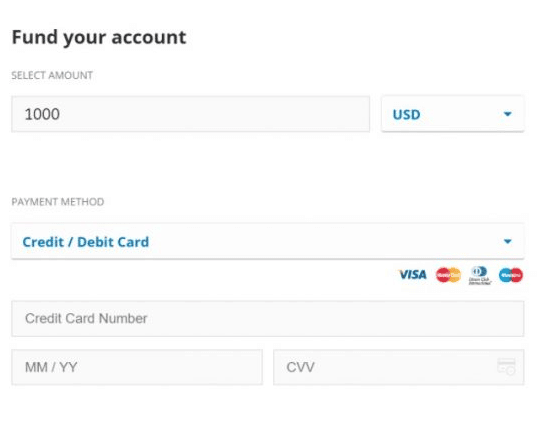

Step 3: Deposit Funds

Once the eToro account has been created and verified, it’s time to deposit. eToro supports payments using either a credit/debit card, bank transfer, or e-wallet (PayPal, Skrill). To deposit, simply press ‘Deposit Now’, select a payment method, decide how much to invest, then press ‘Deposit’. The funds will be credited shortly but first-time deposits can often take a short while longer.

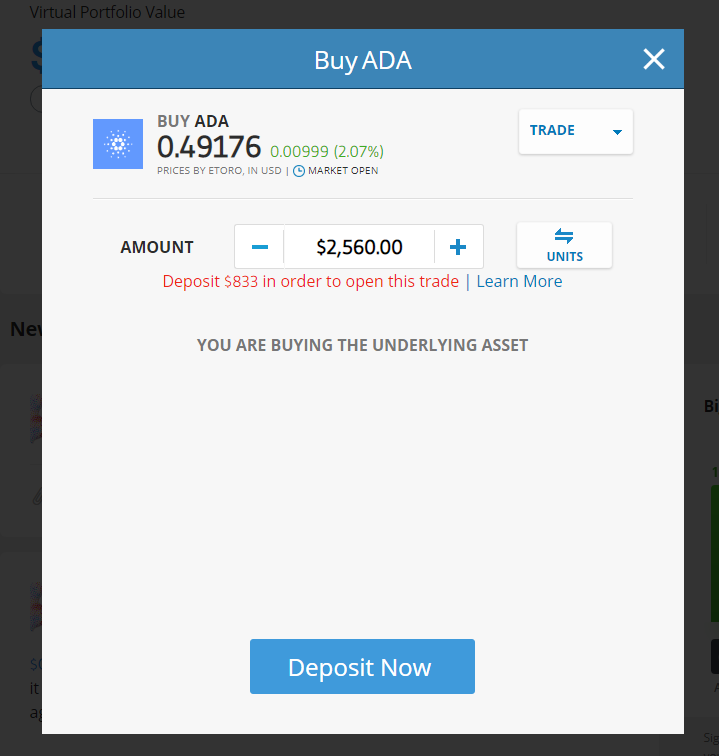

Step 4: Buy ADA

After the deposit has arrived, it’s possible to buy some ADA. To make a purchase just click on the eToro search bar, enter ‘ADA’, press ‘Trade’, decide how much ADA to buy, and lastly, press Open Trade’. The Cardano wallet will then be automatically created and the ADA sent to it. It’s possible to monitor the investment from the eToro portfolio.

Conclusion

Selecting the best Cardano wallet is a crucial part of the investment process. Anyone wanting to transact on the Cardano network will need to ensure they have one of the top Cardano wallets. Throughout this guide, we’ve reviewed some of the most popular Cardano wallets and provided a guide so investors can select the one best for their needs.

However, for those still unsure which wallet is right for them, eToro is a popular choice for beginners. It’s regulated, has a plethora of unique features, and is trusted by over 27 million users around the globe.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.