CFDs (contracts-for-differences) enable Australian traders to gain exposure to stocks, crypto, index funds, commodities, currencies, and more at the click of a button.

The best CFD trading platforms in Australia typically offer 0% commission markets alongside leverage and short-selling tools.

In this guide, we review and rank the 10 best CFD brokers in Australia for supported assets, spreads and commissions, safety, and more.

The Best CFD Brokers Australia in 2023

Before reading our comprehensive reviews, investors can browse the 9 best CFD brokers in Australia via the list below:

- eToro – Overall Best CFD Broker in Australia

- XTB – Popular CFD Trading Platform for Raw Spreads

- AvaTrade – Buy and Sell CFD Instruments Without Paying Any Commission

- Pepperstone – Trade CFDs at Wholesale Market Prices

- IG – Gain Access to Over 18,000 CFD Markets

- Skilling – Popular CFD Trading App With Leverage

- Plus500 – Trade Thousands of CFDs at 0% Commission

- XM – Start Trading CFDs Today From Just $5

- CMC Markets – Low-Cost CFD Broker With 12,000+Markets

We have reviewed each of the above CFD trading platforms for fees, spreads, markets, and more in the subsequent sections of this guide.

79% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Best Australian CFD Brokers Reviewed

In the sections below, readers will find in-depth reviews of the 10 best CFD brokers in Australia – as per our market research. All brokers are regulated by ASIC or at least one other tier-one financial body, so safety is assured.

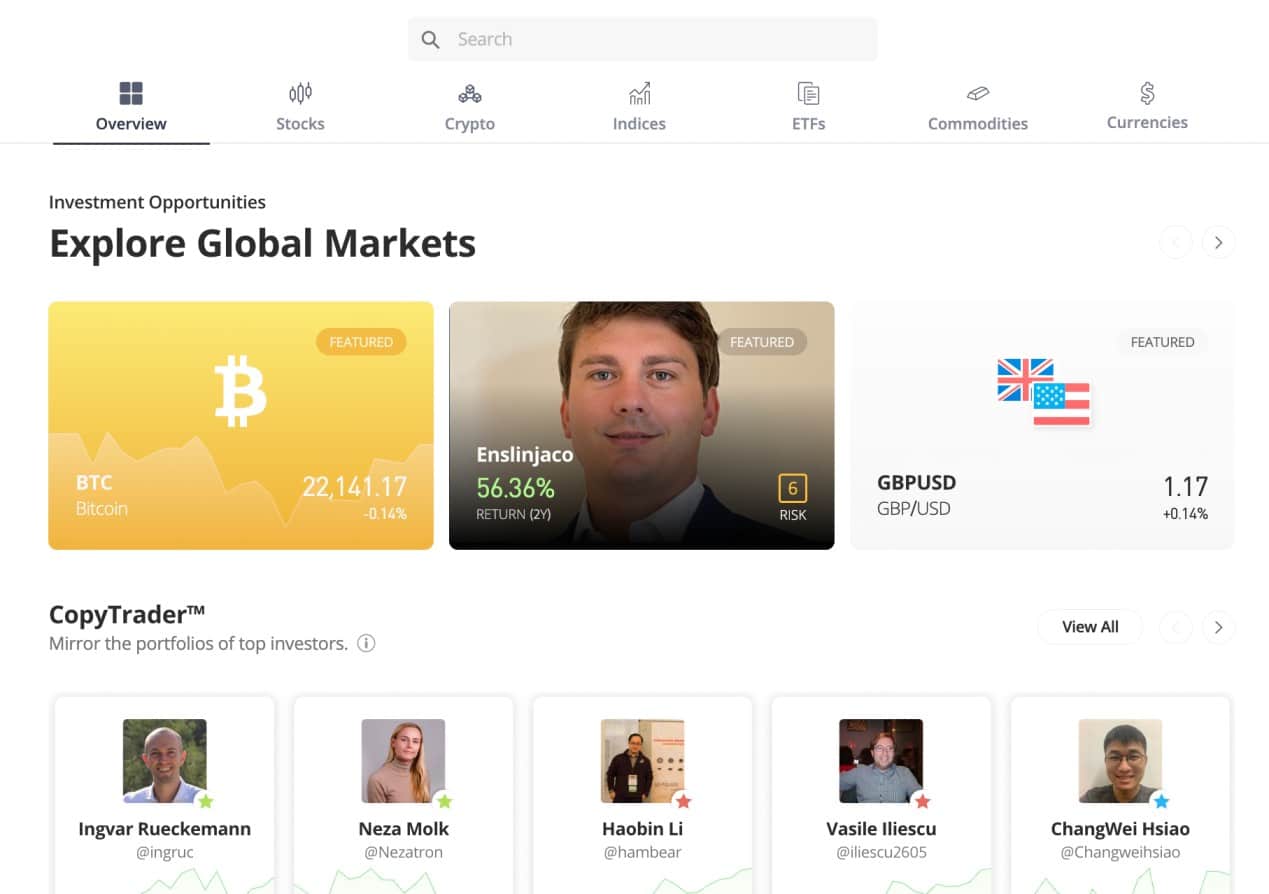

1. eToro – Overall Best CFD Broker in Australia

Beginners in the market for the best CFD broker online might consider eToro. This popular trading platform requires a minimum deposit of just $50 and AUD payments are supported across debit/credit cards, PayPal, Skrill, POLi, Neteller, bank transfers, and more.

eToro offers access to both real assets and CFDs. Regarding the former, eToro is one of the best places to buy shares in Australia, as it offers lists of companies at 0% commission. Stock markets from the US, Germany, the UK, Hong Kong, the Netherlands, Canada, France, and more are supported.

ETFs can also be purchased at 0% commission. eToro is also one of the best brokers to invest in cryptocurrency in Australia. Across more than 90 markets, users can buy Bitcoin, Ethereum, Ripple, and plenty of other cryptocurrencies at a fee of 1%. When trading stocks, ETFs, and crypto assets at eToro, the minimum stake amount is just $10.

These markets will convert from real assets to CFDs when one of two trading conditions are met. First, if the trader goes short on stocks, ETFs, or crypto, this will turn into a CFD position. Second, if the trader applies leverage, this will also be represented by a CFD. Leverage limits remain in line with ASIC regulations.

Additionally, eToro is one of the best forex brokers in Australia. It offers 49 currency pairs across the majors, minors, and exotics on a spread-only basis. EUR/USD spreads start at 1 pip per slide. eToro also offers access to dozens of indices – such as the Dow Jones and FTSE 100, as well as commodities like gold, silver, oil, natural gas, and corn.

It only takes a few minutes to register an account with eToro and this popular CFD broker is regulated by ASIC, as well as the FCA, CySEC, and the SEC. Before making a deposit, eToro users can also access a free demo account facility. This offers risk-free trading with a balance of $100,000 in demo funds.

eToro users can also switch between the online platform and the mobile app for iOS and Android. But perhaps the most popular feature offered by eToro is its Copy Trading service. As the name suggests, this allows eToro users to ‘copy’ the investments of an experienced trader. From the perspective of the eToro user, this offers a 100% passive trading process.

| CFD assets | Stocks, ETFs, forex, commodities, indices, crypto |

| Number of CFD contracts | 3,000+ |

| Pricing system | 0% commission on real stocks and ETFs. 1% on real crypto. Spread-only on CFD markets. |

| Deposit fee | 0.5% on AUD payments |

| EUR/USD spread | 1 pip |

| Cost of trading Amazon stock | $0.15 spread |

| Trading Platforms | Proprietary eToro platform for web browsers and mobile devices |

| Min Deposit | $50 |

Pros

Cons

79% of retail investor accounts lose money when trading CFDs with this provider.

2. XTB – Popular CFD Trading Platform for Raw Spreads

XTB is one of the best CFD brokers in Australia for low fees and super-tight spreads. In fact, there are no trading commissions to pay on any supported CFD markets at XTB and spreads can go as low as 0.1 pip on EUR/USD.

Stock spreads are very competitive too, with Amazon offered at just $0.50 per slide at the time of writing. Supported markets at XTB – all of which are represented by CFDs, include indices, crypto, commodities, ETFs, forex, and stocks. Although the provider offers high leverage limits, this doesn’t apply to Australians.

Once again, Australian traders will be capped at 1:30 when trading forex CFDs, and less on other markets. There is no minimum deposit requirement at XTB, although traders should ensure that they add enough money to cover their required position. Forex, for example, can be traded at lots of 0.01 – meaning the minimum trade size is 1,000 currency units.

| CFD assets | Stocks, ETFs, forex, commodities, indices, crypto |

| Number of CFD contracts | 2,100+ |

| Pricing system | 0% commission on all markets |

| Deposit fee | $0 on debit/credit cards, 2% on Skrill |

| EUR/USD spread | From 0.1 pip |

| Cost of trading Amazon stock | $0.50 spread |

| Trading Platforms | xStation for mobile, desktop, and web browsers |

| Min Deposit | No minimum deposit requirement |

Pros

Cons

81% of retail investor accounts lose money when trading CFDs with this provider.

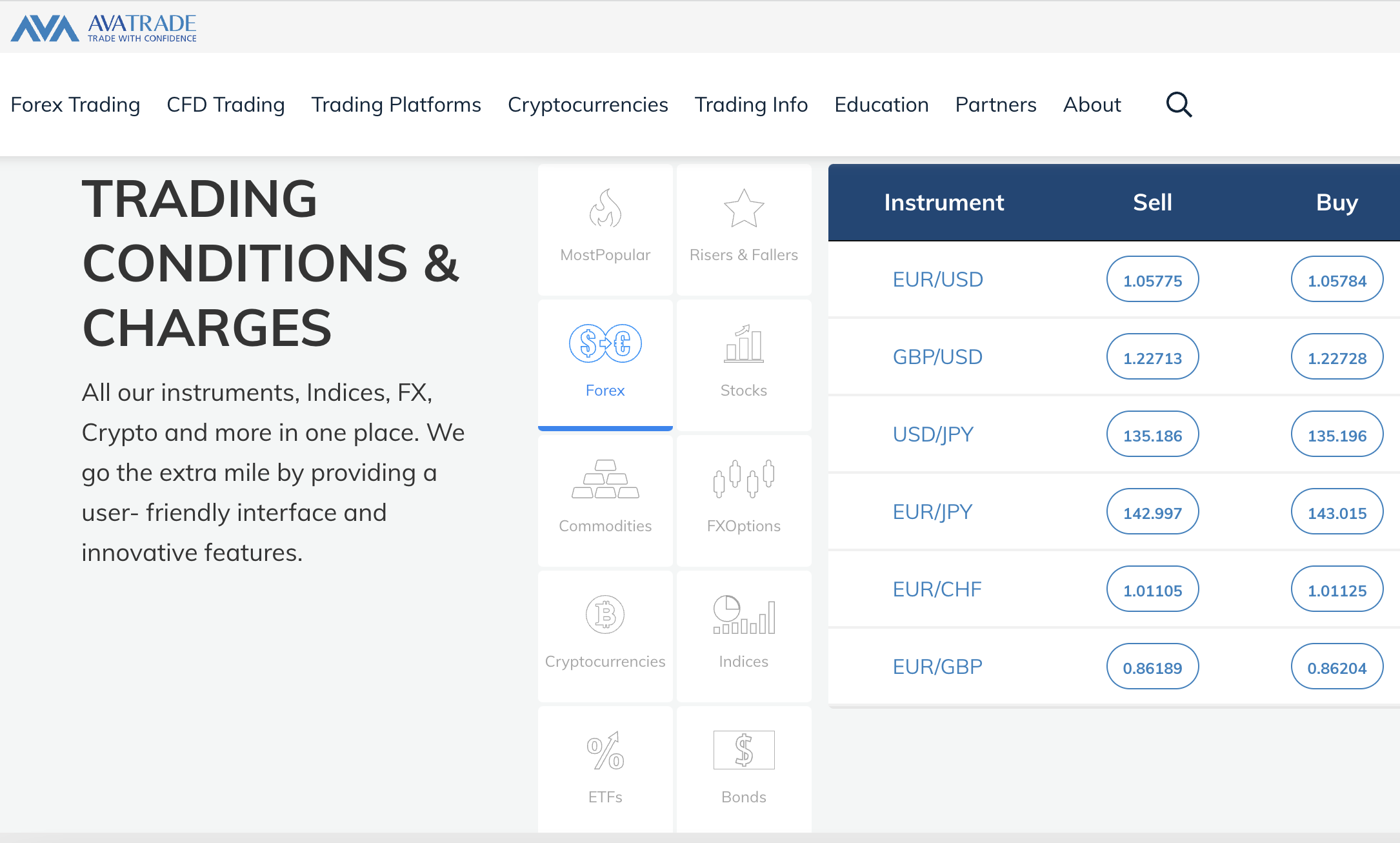

3. AvaTrade – Buy and Sell CFD Instruments Without Paying Any Commission

AvaTrade supports most asset classes, which include stocks, forex, ETFs, bonds, indices, and commodities. Both options and crypto assets are supported too. Leverage is offered on all markets within ASIC limits and the minimum AvaTrade deposit for first-time customers is $100.

AvaTrade is also popular for its wide range of supported trading platforms. This includes MT4, MT5, DupliTrade, and ZuluTrade. This CFD provider also offers its own native trading platform for web browsers and iOS/Android smartphones. When it comes to spreads, AvaTrade offers a competitive 0.9 pips on EUR/USD.

| CFD assets | Stocks, ETFs, forex, commodities, indices, bonds, options, crypto |

| Number of CFD contracts | 1,000+ |

| Pricing system | 0% commission on all markets |

| Deposit fee | None |

| EUR/USD spread | From 0.9 pips |

| Cost of trading Amazon stock | 0.14% spread |

| Trading Platforms | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, DupliTrade, ZuluTrade |

| Min Deposit | $100 |

Pros

Cons

71% of retail investor accounts lose money when trading CFDs with this provider.

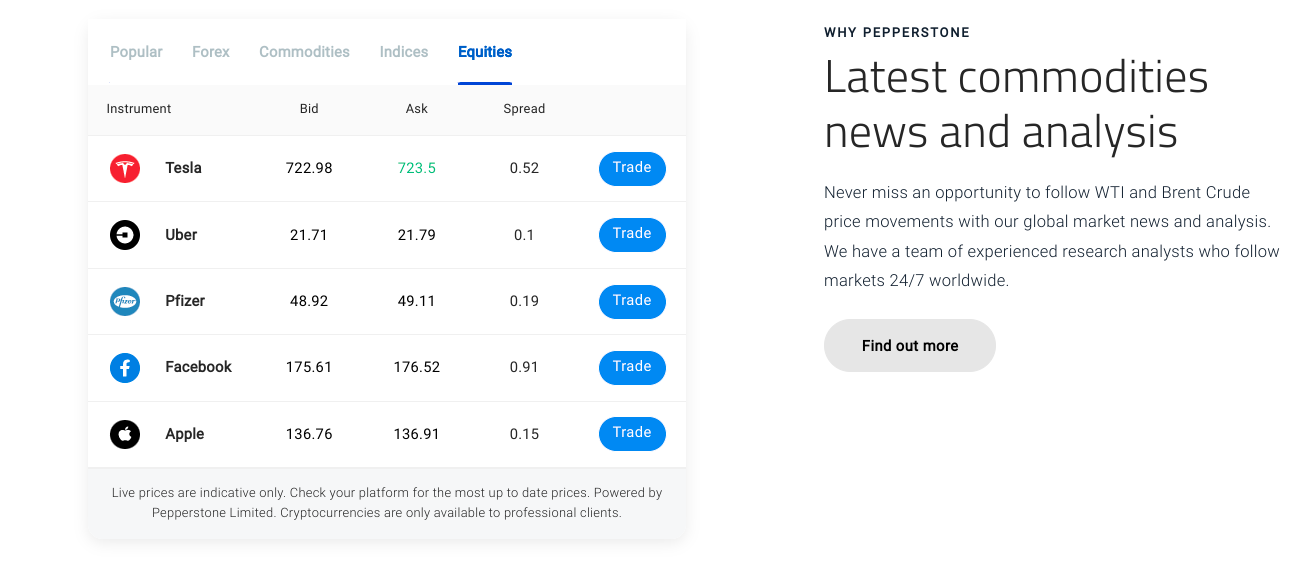

4. Pepperstone – Trade CFDs at Wholesale Market Prices

Pepperstone is another ASIC-regulated provider that makes our list of the best CFD brokers in Australia. This platform offers two core account types – one of which enables traders to buy and sell CFD instruments on a commission-free basis.

However, the broker’s razor account is well worth considering, as it offers access to some of the tightest spreads in the industry. In return for paying a commission of $3.50 per slide, the likes of EUR/USD can be accessed at 0.0 pips during standard hours. Both accounts support fee-free payments and there is no minimum deposit requirement.

Traders at Pepperstone will have plenty of options when it comes to finding market opportunities. CFD instruments can be found across ETFs, stocks, indices, crypto, commodities, and forex. To aid the decision-making process, traders can utilize the many technical indicators and tools offered by MT4, MT5, cTrader, and TradingView – all of which are supported by Pepperstone.

| CFD assets | Stocks, ETFs, forex, commodities, indices, crypto |

| Number of CFD contracts | 1,200+ |

| Pricing system | $3.50 commission per lot on razor account, 0% commission on standard account |

| Deposit fee | None |

| EUR/USD spread | From 0.0 pips on razor account, 0.6 pips on standard account |

| Cost of trading Amazon stock | $0.02 per share |

| Trading Platforms | MT4, MT5, cTrader, TradingView |

| Min Deposit | No minimum deposit requirement |

Pros

Cons

74% of retail investor accounts lose money when trading CFDs with this provider.

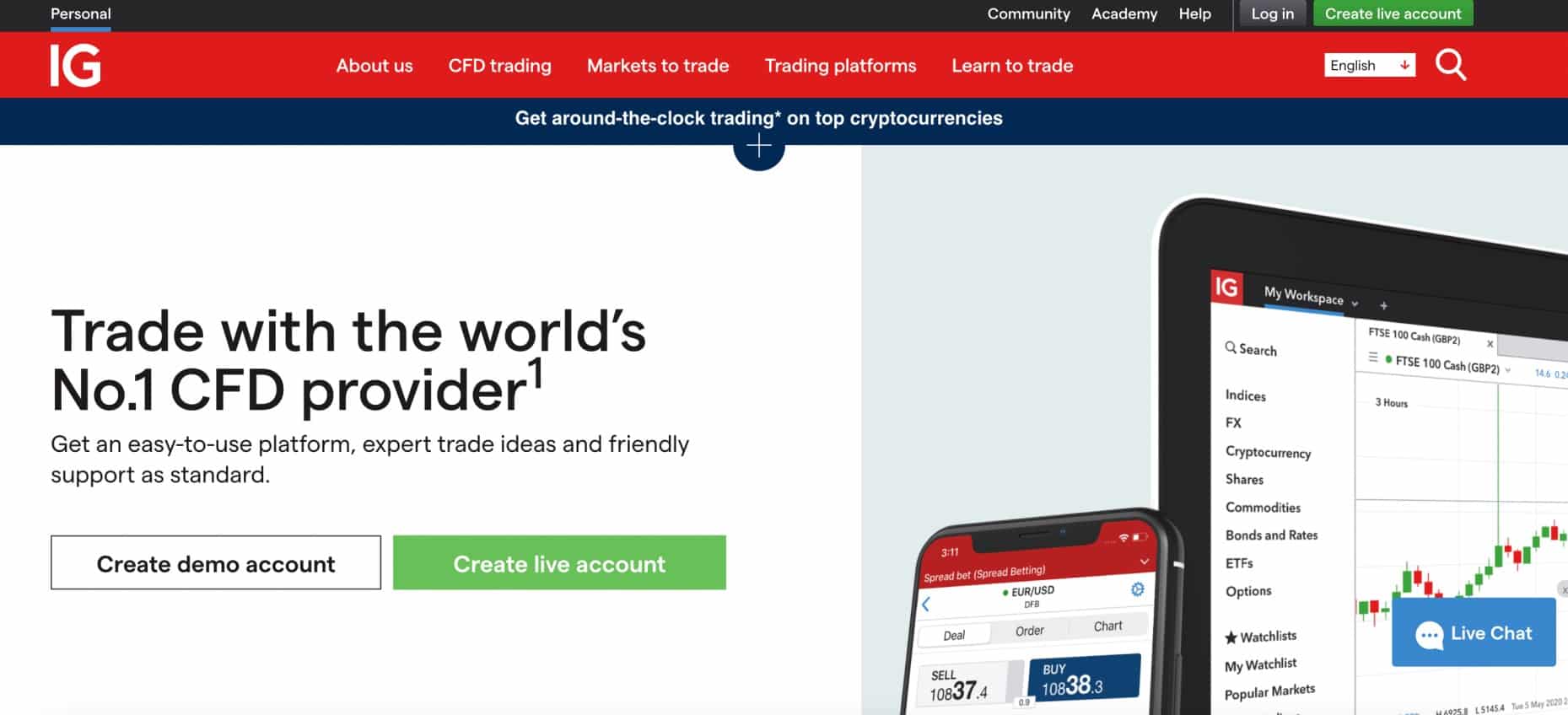

5. IG – Gain Access to Over 18,000 CFD Markets

IG is perhaps the best CFD broker in Australia for asset diversity. Across more than 18,000 markets, this regulated brokerage leaves no stone unturned. This is inclusive of stocks, ETFs, forex, commodities, indices, options, futures, bonds, interest rates, and more.

Fees will depend on the CFD asset being traded. For instance, stocks and ETFs attract a fee that is dependent on the exchange. Australian stocks/ETFs will cost 0.08%, while markets in NZ are slightly higher at 0.09%. US stocks cost $0.02 per share, while UK equities amount to 0.10%.

There is, however, a minimum commission when trading stocks, and this also varies depending on the exchange. The good news is that all other CFD asset classes can be traded at 0% commission. IG requires a minimum first-time deposit of $250 to get started. To make a deposit with a debit card, this will cost 0.5% (MasterCard) or 1% (Visa).

| CFD assets | Stocks, ETFs, forex, commodities, indices, options, futures, bonds, interest rates, crypto |

| Number of CFD contracts | 18,000+ |

| Pricing system | 0% commission on all CFD markets other than stocks/ETFs |

| Deposit fee | 1% on Visa, 0.5% on MasterCard |

| EUR/USD spread | From 0.6 pips |

| Cost of trading Amazon stock | $0.02 per share |

| Trading Platforms | Native platform for web and mobile trading, MT4 |

| Min Deposit | $250 |

Pros

Cons

6. Skilling – Popular CFD Trading App With Leverage

As a result, the trader never needs to be more than a click away from the CFD markets. Before downloading the Skilling app, traders will need to open an account and make a deposit. This CFD broker supports debit/credit cards, e-wallets, and traditional bank wires. Supported markets at Skilling include 900+CFD instruments.

This consists of stocks, forex, crypto, indices, and commodities. When opening a standard account – which is suitable for casual traders, there are no commissions to pay. EUR/USD spreads start from just 0.2 pips. Crypto spreads are even more competitive, starting at 0.0001. Do note that e-wallet payments can attract a fee of up to 2.9%.

| CFD assets | Stocks, forex, commodities, indices, crypto |

| Number of CFD contracts | 900+ |

| Pricing system | 0% on standard accounts |

| Deposit fee | Debit/credit cards are free, e-wallets range from 0-2.9% |

| EUR/USD spread | From 0.2 pips |

| Cost of trading Amazon stock | $0.53 spread |

| Trading Platforms | Native platform for web and mobile trading, MT4, cTrader |

| Min Deposit | $100 |

Pros

Cons

7. Plus500 – Trade Thousands of CFDs at 0% Commission

Next up on our list of the best CFD brokers in Australia is Plus500. This provider supports thousands of CFDs across the most traded asset classes globally. This is inclusive of crypto assets, forex, indices, ETFs, and commodities. Plus500 also supports stocks from nearly 20 markets.

This includes stocks listed in Australia, New Zealand, South Africa, the UK, the US, Germany, Canada, Singapore, Hong Kong, and more. All of the aforementioned markets can be traded at Plus500 on a 0% commission basis. Spreads can be reasonable here, but not on all markets. EUR/USD, however, is competitive at 0.8 pips.

The minimum deposit to open an account with Plus500 is $100. With that said, traders can get started with the Plus500 demo account, which doesn’t require a deposit. There is no support for third-party trading platforms here, which means EAs cannot be used. The Plus500 trading suite is, therefore, more suitable for casual traders.

| CFD assets | Stocks, ETFs, forex, commodities, indices, options, crypto |

| Number of CFD contracts | 2,800+ |

| Pricing system | 0% on all markets |

| Deposit fee | None |

| EUR/USD spread | From 0.8 pips |

| Cost of trading Amazon stock | 0.74% spread |

| Trading Platforms | Native platform for web and mobile trading |

| Min Deposit | $100 |

Pros

Cons

8. XM – Start Trading CFDs Today From Just $5

XM is one of the best CFD brokers in Australia for those on a budget. All supported account types here – of which there are many to choose from, come with a minimum first-time deposit of just $5. There are no deposit fees either. For casual traders, the standard account is perhaps a suitable option.

This offers access to commission-free markets across all supported CFDs. The spread starts at 1 pip on EUR/USD on this account type. There are also accounts that come with raw spreads alongside a commission, and this will likely suit more experienced traders.

Supported CFD assets include stocks, indices, crypto, ETFs, forex, and commodities. Although XM offers a native mobile app for iOS and Android, web traders will need to choose from either MT4 or MT5. Leverage of up to 1:1000 is offered by XM, but Australian traders will be capped at the usual limits of 1:30 on major currencies and less on other markets.

| CFD assets | Stocks, ETFs, forex, commodities, indices, crypto |

| Number of CFD contracts | 1,000+ |

| Pricing system | Standard account offers 0% commission |

| Deposit fee | None |

| EUR/USD spread | 1 pip on standard account |

| Cost of trading Amazon stock | 5.85 pips |

| Trading Platforms | MT4, MT5, proprietary app for iOS and Android |

| Min Deposit | $5 |

Pros

Cons

9. CMC Markets – Low-Cost CFD Broker With 12,000+Markets

CMC Markets is a CFD and spread betting broker. It is heavily regulated, so traders can speculate on CFDs in safety. After opening an account with CMC Markets – which does not require a minimum deposit to be met, traders will have access to more than 12,000 instruments.

This is inclusive of stocks, ETFs, forex, commodities, crypto, indices, and treasuries. No commissions are payable on the aforementioned assets, other than stocks. In this case, the commission will depend on the stock being traded and whether a long or short position has been entered. Going long on Amazon stock, for instance, will cost 0.0145%, plus the spread.

CMC Markets is behind the Next Generation trading platform, which is aimed at seasoned traders seeking high-level tools. This CFD broker also supports MT4.

| CFD assets | Stocks, ETFs, forex, commodities, crypto, indices, treasuries, |

| Number of CFD contracts | 12,000+ |

| Pricing system | 0% on all markets apart from stocks and ETFs |

| Deposit fee | None |

| EUR/USD spread | From 0.7 pips |

| Cost of trading Amazon stock | 0.0145% |

| Trading Platforms | Native NGEN platform for web and mobile trading, MT4 |

| Min Deposit | No minimum deposit requirement |

Pros

Cons

The Best CFD Brokers Australia in 2023

Still deciding on the best CFD trading platform in Australia? You might want to take a look at our review of GO Markets Australia for an alternative to those reviewed above.

Refer to the comparison table below for key metrics surrounding the 10 providers that we reviewed:

| Australia CFD Brokers | CFD Assets | Total CFDs | Pricing System | Deposit Fee | EUR/USD Spread (From) | Cost to Trade Amazon Stock | Trading Platforms |

| eToro | Stocks, ETFs, forex, commodities, indices, crypto | 3,000+ | 0% commission on stocks and ETFs. 1% on crypto. Spread-only on CFD markets. | 0.50% | 1 pip | $0.15 spread | Proprietary eToro platform for web browsers and mobile devices |

| XTB | Stocks, ETFs, forex, commodities, indices, crypto | 2,100+ | 0% commission on all markets | $0 on debit/credit cards, 2% on Skrill | 0.1 pip | $0.50 spread | xStation for web, mobile, tablets, and desktop software |

| AvaTrade | Stocks, ETFs, forex, commodities, indices, bonds, options, crypto | 1,000+ | 0% commission on all markets | None | 0.9 pips | 0.14% spread |

WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, DupliTrade, ZuluTrade

|

| Pepperstone | Stocks, ETFs, forex, commodities, indices, crypto | 1,200+ | $3.50 commission per lot on razor account, 0% commission on standard account | None | From 0.0 pips on razor account, 0.6 pips on standard account | $0.02 per share | MT4, MT5, cTrader, TradingView |

| IG | Stocks, ETFs, forex, commodities, indices, options, futures, bonds, interest rates, crypto | 18,000+ | 0% commission on all CFD markets other than stocks | 1% on Visa, 0.5% on MasterCard | 0.6 pips | $0.02 per share | Native platform for web and mobile trading, MT4 |

| Skilling | Stocks, forex, commodities, crypto, indices | 900+ | 0% on standard accounts | Debit/credit cards are free, e-wallets range from 0-2.9% | 0.2 pips | $0.53 spread | Native platform for web and mobile trading, MT4, cTrader |

| Plus500 | Stocks, ETFs, forex, commodities, indices, options, crypto | 2,800+ | 0% commission on all markets | None | 0.8 pips | 0.74% spread | Native platform for web and mobile trading |

| XM | Stocks, ETFs, forex, commodities, indices, options, crypto | 1,000+ | Standard account offers 0% commission | None | 1 pip on standard account | 5.85 pip spread | MT4, MT5, proprietary app for iOS and Android |

| CMC Markets | Stocks, ETFs, forex, commodities, indices, treasuries, crypto | 12,000+ | 0% on all markets apart from stocks and ETFs | None | 0.7 pips | 0.0145% | Native NGEN platform for web and mobile trading, MT4 |

How We Select the Best Australian CFD Brokers?

Choosing the best broker for CFDs in Australia can be challenging, considering the number of factors that need to be considered.

To help clear the mist, below we explain the core requirements that we look for in a top-rated broker.

ASIC Regulation

Make no mistake about it, traders should focus on CFD brokers that are regulated by ASIC – such as eToro. This offers a full suite of protections that ultimately – ensures that Australians can trade in a safe online environment.

Supported CFD Markets

Most of the CFD brokers reviewed today support a variety of markets across stocks, forex, crypto, and commodities. Indices, ETFs, and bonds are often supported too.

Fees

The best CFD brokers in Australia offer access to a low-cost trading environment.

Check out the fee table below for a recap of what fees to expect when engaging in CFD trading online:

| CFD Brokers | Pricing System | Deposit Fee | EUR/USD Spread (From) | Account Fees |

| eToro | 0% commission on real stocks and ETFs. 1% on real crypto. Spread-only on CFD markets. | 0.50% | 1 pip |

0.5% deposit fee, $10 inactivity fee, $5 withdrawal fee

|

| XTB | 0% commission on all markets | $0 on debit/credit cards, 2% on Skrill | 0.1 pip | $10 inactivity fee |

| Avatrade | 0% commission on all markets | None | 0.9 pips | $50 inactivity fee |

| Pepperstone | $3.50 commission per lot on razor account, 0% commission on standard account | None | From 0.0 pips on razor account, 0.6 pips on standard account | None |

| IG | 0% commission on all CFD markets other than stocks | 1% on Visa, 0.5% on MasterCard | 0.6 pips |

1% on Visa, 0.5% on MasterCard, $18 inactivity fee

|

| Skilling | 0% on standard accounts | Debit/credit cards are free, e-wallets range from 0-2.9% | 0.2 pips | None |

| Plus500 | 0% commission on all markets | None | 0.8 pips | $12 inactivity fee |

| XM | Standard account offers 0% commission | None | 1 pip on standard account | $5 inactivity fee |

| CMC Markets | 0% on all markets apart from stocks | None | 0.7 pips | $10 inactivity fee |

Tools and Analysis

Seasoned day traders will often require access to technical indicators and chart drawing tools. This is something offered by all of the CFD brokers discussed on this page.

Another popular tool to check out is the eToro Copy Trading service, which offers a 100% passive investment experience.

Minimum Deposit

The best CFD brokers in Australia support traders of all budgets. At eToro, traders can open an account for just $50.

Demo Account

Consider choosing a CFD broker that offers a free demo account without the need to make a deposit. This will enable traders to test the CFD broker out before making a financial commitment.

Mobile App

The best CFD brokers in Australia not only offer a mobile app that is optimized for Android and iOS smartphones, but full account functionality.

Payment Methods

Top CFD brokers in Australia – including eToro, support bank wires, multiple e-wallets, and debit/credit cards on a fee-free basis. This makes the funding process simple, convenient, and cost-effective.

Customer Service

Before choosing a CFD broker, check out its customer service department. For instance, what hours do the customer service team operate and what support methods are offered?

How to Start Trading CFDs With a Regulated Australian Broker

Trading CFDs online has never been more straightforward – at least in terms of getting set up and placing an order.

To highlight this, the tutorial below explains how to open an account, make a deposit, and place a CFD trading position with eToro in less than five minutes.

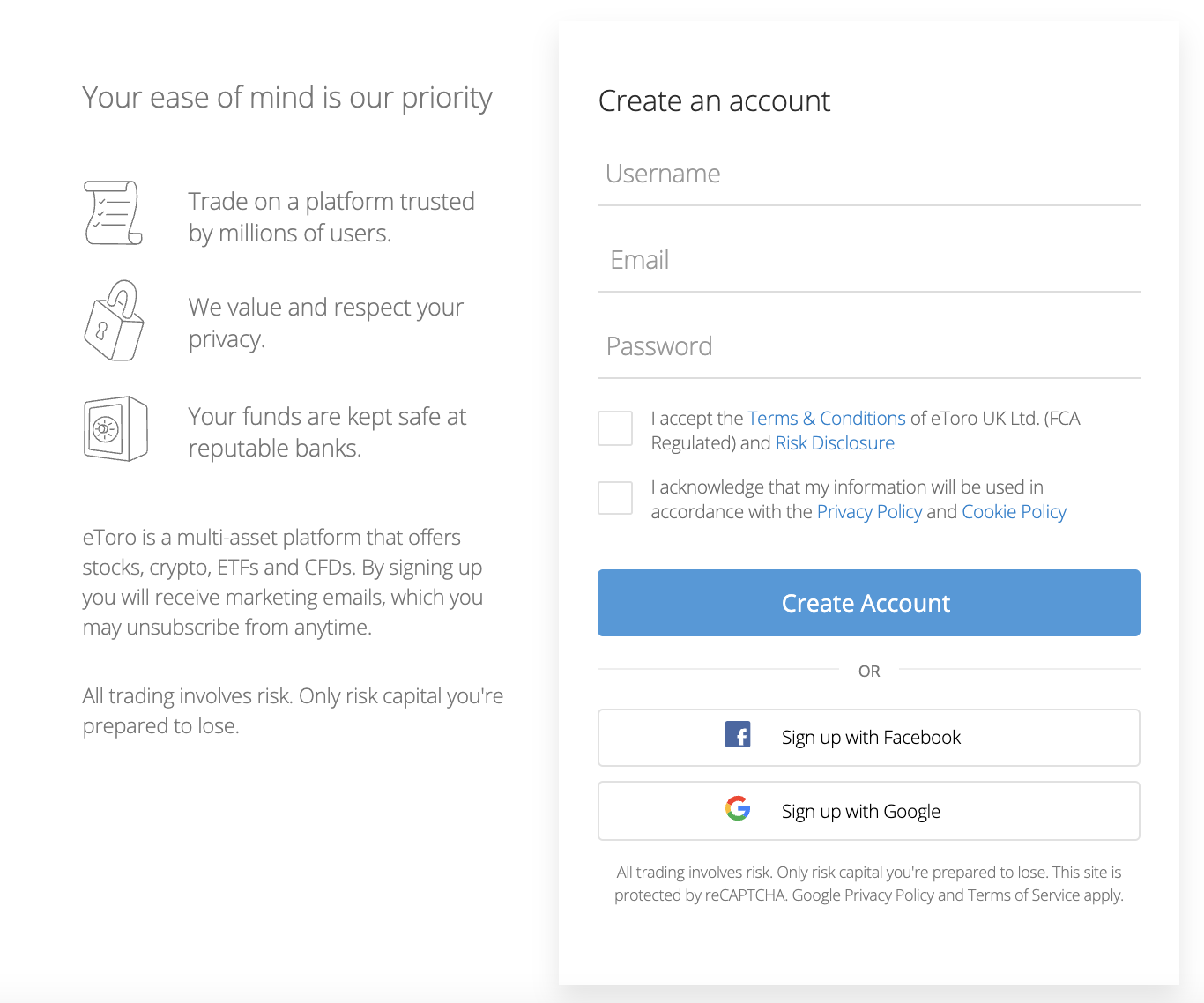

Step 1: Open an eToro Account

First, create an account with eToro by entering some basic personal information.

This includes a:

- Full Name

- Home Address

- Telephone Number

- Nationality

New customers will also need to choose a username and password.

As an ASIC-regulated provider, there is also a quick KYC process to complete at eToro.

This requires the user to upload a clear copy of a government-issued ID.

Step 2: Deposit Funds

eToro supports many payment methods, from Visa and MasterCard to bank wires and several e-wallets.

All payment methods, apart from bank wires, require a minimum deposit of $50.

Step 3: Search for Asset to Trade

The easiest way to find a market to trade is via the search box.

In the example above, we are searching for Amazon stock.

Step 4: Trade CFDs

Click on the chosen market to load up an order form. Choose from a buy (long) or sell (position), depending on predicted price movement. Enter a stake and if applicable, deploy leverage.

After confirming the order, the trade will be placed.

Conclusion

Australians have access to a wide selection of CFD providers – many of which offer thousands of markets alongside competitive spreads and commissions.

eToro is particularly popular and perhaps the overall best CFD broker in Australia for both beginners and seasoned pros.

After opening an account, this ASIC-regulated provider offers access to thousands of stocks, currencies, crypto assets, indices, and more, plus tight spreads and leverage.

79% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.