Contracts for difference (CFDs) are a popular financial product in the UK.

CFDs offer low-cost access to thousands of markets – such as stocks, currencies, gold, and oil – without needing to own the underlying asset. Plus, CFDs offer leverage in addition to short-selling capabilities.

In this comparison guide, we discuss the most popular CFD brokers in the UK and cover everything traders need to know about regulation, fees, payments, supported markets, trading tools, and more.

The Most Popular CFD Brokers UK in 2023

The 10 most popular CFD brokers in the UK can be found in the list below:

- eToro -Overall Best CFD Broker with Copy Trading Tools

- XTB – Popular CFD Broker for Low Spreads

- Axi – Award-Winning CFD Broker Offering Copy Trading

- AvaTrade – Trade CFDs Without Paying Any Commission

- Pepperstone – Access Institutional-Grade Spreads

- IG – More Than 18,000 CFDs Supported by This Established Broker

- Skilling – User-Friendly App for Mobile Traders

- Plus500 – Popular CFD Platform for Trading International Stocks

- XM – CFD Broker that Enables Small Stakes

- CMC Markets – Thousands of Markets at Competitive Fees

When compiling our list of CFD brokers in the UK, we found that no two platforms are the same. Therefore, scroll down to read our reviews before choosing a provider.

UK CFD Brokers Reviewed

Selecting a CFD broker in the UK requires traders to explore the regulatory status of the provider, in addition to metrics surrounding supported markets, fees, spreads, and more.

Below, we offer in-depth reviews of the most popular CFD trading platforms in the UK.

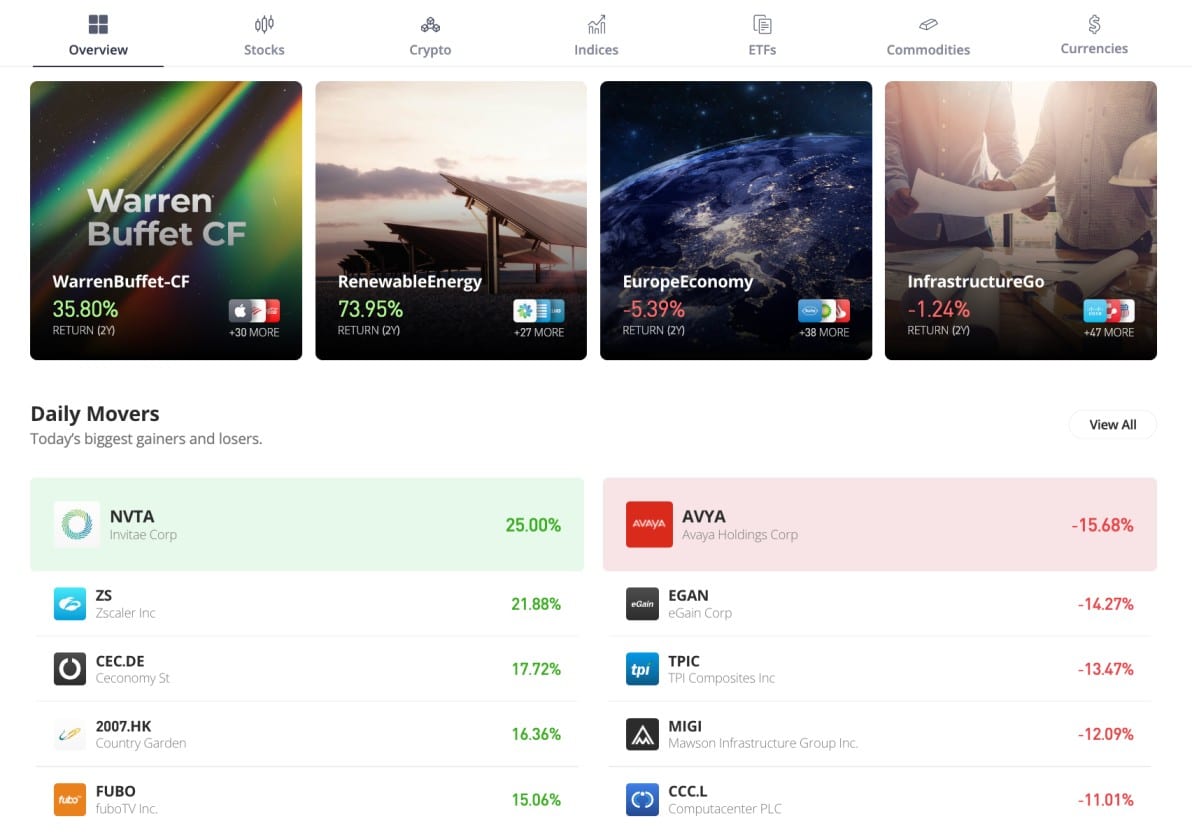

1. eToro – Overall Best CFD Broker With Copy Trading Tools

With more than 25 million clients on its books, eToro is one of the most popular trading platforms globally. In the UK market, traders are covered by the FCA, albeit, regulation also comes from licensing bodies in the US, Cyprus, and Australia. Moreover, when buying real stocks and ETFs here, clients are covered by the FSCS.

eToro caters to casual traders that wish to start off with small sums of money. For instance, UK residents can open an account in just minutes by making a first-time deposit of $10 – or about £8. Moreover, there are no ongoing account fees and GBP deposits attract a small charge of 0.5%.

After setting up the account, UK residents will then have access to thousands of stocks from the UK, US, Europe, Asia, and more. When buying a stock on the eToro platform without leverage, this will represent real ownership of the underlying shares. This is also the case with ETFs. No commissions are charged on stock and ETF trading and the minimum stake is just $10.

Furthermore, those electing to buy shares listed on the London Stock Exchange will not be required to pay the 0.5% stamp duty fee, as this is waivered by eToro. However, when short-selling a stock or ETF, or applying leverage, this will convert the positions into a CFD instrument. eToro also supports CFD markets across commodities, forex, and indices.

eToro also enables traders to buy cryptocurrency in the UK. This will represent real ownership, as crypto CFDs are no longer accessible for UK retail investors. When electing to buy Bitcoin and other cryptocurrencies on eToro, a fee of 1% will be applied to the position.

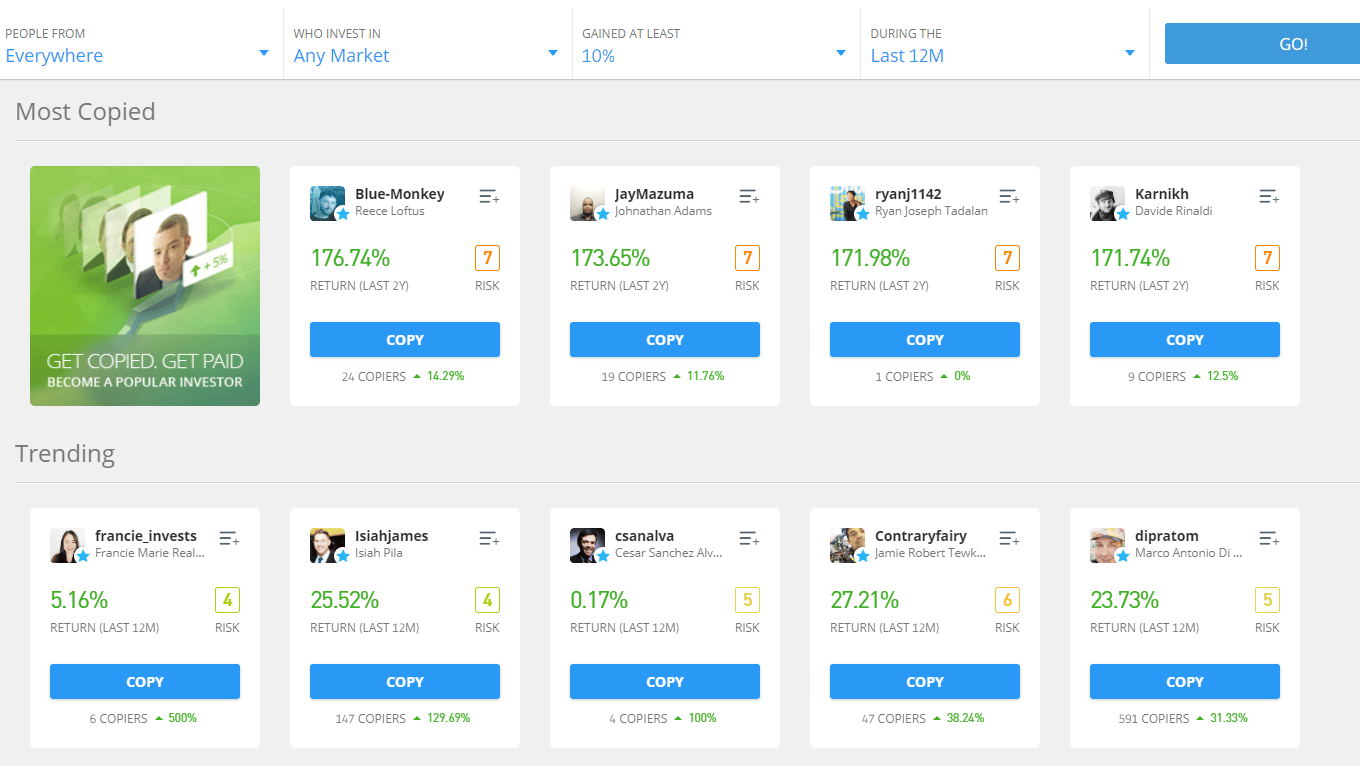

Fees on other CFD instruments, such as forex or commodities, are charged on a spread-only basis. For instance, when trading EUR/USD here, the spread starts at just 1 pip. eToro is also popular in the UK with investors that wish to trade passively. Its native Copy Trading tool, for instance, offers the capacity to mirror the investments of a successful eToro trader.

For example, if the trader enters a long position on gold and silver, the same investment will be copied over to the eToro user’s portfolio. Another way to trade passively at eToro is through its Smart Portfolio tool. This consists of dozens of pre-built stock and crypto portfolios that are tasked with tracking a specific market.

Smart Portfolios are professionally managed by the eToro team. Beginners will also appreciate the eToro Academy, which offers lots of educational videos and trading guides. There is also a free demo account on eToro, which comes without any time limitations. The eToro app is also free to download and is compatible with iOS and Android devices.

Our full eToro UK review can be found here.

| CFD assets | Stocks, ETFs, forex, commodities, indices |

| Number of CFD contracts | 3,000+ |

| Pricing system | 0% commission on real stocks and ETFs. 1% on real crypto. Spread-only on CFD markets. |

| Deposit fee | 0.5% on GBP payments |

| EUR/USD spread | 1 pip |

| Cost of trading Amazon stock | $0.15 spread |

| Trading Platforms | Proprietary eToro platform for web browsers and mobile devices |

| Min Deposit | $10 (about £8) |

Pros

Cons

78% of retail investor accounts lose money when trading CFDs with this provider.

2. XTB – Popular CFD Broker for Low Spreads

XTB offers exclusively CFD instruments. Across more than 2,100 markets, this CFD broker offers access to a wide range of commodities, stocks, ETFs, and indices. XTB is often regarded as one of the most popular forex brokers in the UK among traders that seek access to low fees.

The reason for this is that XTB offers 0% commission not only on forex but on all supported markets. In terms of spreads, Amazon stock can be traded from $0.50 per slide, and EUR/USD starts at 0.1 pip. XTB offers UK traders leverage on all markets, in line with FCA limits.

This means a maximum of 1:30 on major currency pairs and less on other assets. XTB offers its own native trading platform – xStation, which is available online or via a mobile app. xStation also comes in the form of downloadable desktop software. Other notable features offered by XTB include a demo account, educational tools, and market analysis.

| CFD assets | Stocks, ETFs, forex, commodities, indices |

| Number of CFD contracts | 2,100+ |

| Pricing system | 0% commission on all markets |

| Deposit fee | $0 on debit/credit cards, 2% on Skrill |

| EUR/USD spread | From 0.1 pip |

| Cost of trading Amazon stock | $0.5 spread |

| Trading Platforms | xStation for mobile, desktop, and web browsers |

| Min Deposit | No minimum deposit requirement |

Pros

Cons

81% of retail investor accounts lose money when trading CFDs with this provider.

3. Axi – Award-Winning CFD Broker Offering Copy Trading

Forex traders can access more than 70 currency pairs, and stock traders can choose more than 50 shares across the UK, US and European markets. Besides offering low spreads, Axi enables traders to choose accounts best suited to their trading goals. Traders can choose between standard, pro and elite accounts. Standard accounts don’t incur commissions unlike the other two accounts — offer spreads from 0.0 pips. An elite account offers 400:1 leverage but requires a minimum deposit of $25,000.

Axi provides a platform convenient for beginner traders to use and for pro traders to incorporate advanced tools. Traders can enhance their trading strategies by incorporating PsyQuation and AutoChartist. Psyquation reduces trading mistakes by providing performance analytics, and AutoChartist scans the market and alerts traders of specific trade set ups.

Another way for traders to benefit is by copying the trades of professionals. The CopyTrading feature is free and enables beginners to mimic the trades or professionals by copying their trades. Axi’s top 50 traders have achieved more than 263% returns.

| CFD assets | Stocks, precious metals, forex, commodities, indices |

| Number of CFD contracts | 50+ CFD instruments |

| Pricing system | 0% commission |

| Deposit fee | $0 on standard and pro accounts, $25,000 elite account |

| EUR/USD spread | From 1 pip |

| Cost of trading Amazon stock | N/A |

| Trading Platforms | MT4 PC, Mac, iOS and Android, MT4 Webtrader |

| Min Deposit | No minimum deposit requirement |

Pros

Cons

81.6% of retail investor accounts lose money when trading CFDs with this provider.

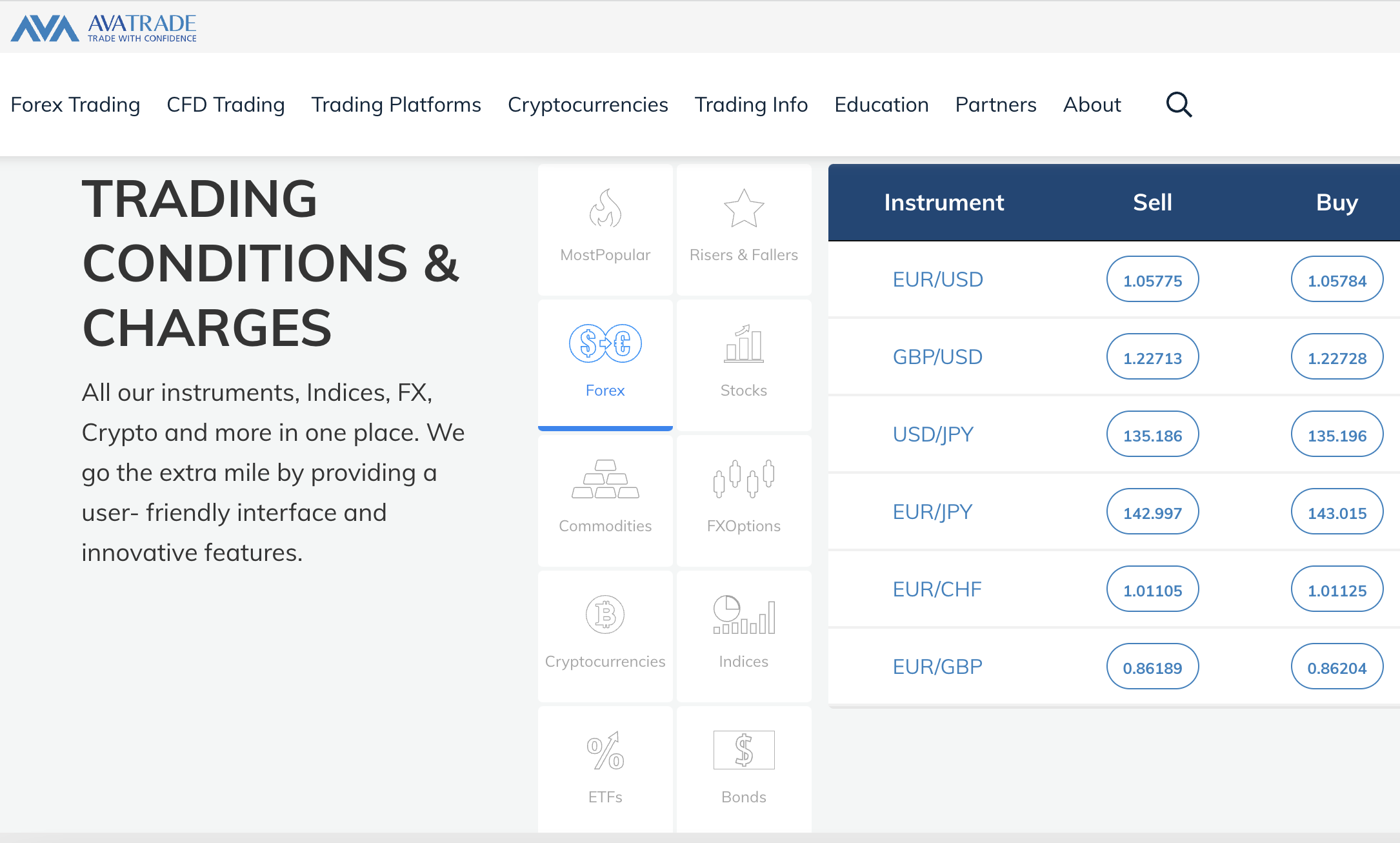

4. AvaTrade – Trade CFDs Without Paying Any Commission

Getting started with AvaTrade requires a minimum first-time deposit of £100 and UK traders can opt for a debit/credit card, e-wallet, and bank transfer. Many traders consider AvaTrade to be a low-cost CFD broker, not least because all supported markets can be traded at 0% commission alongside competitive spreads.

EUR/USD and Amazon stock, for instance, can be traded at a spread of 0.9 pips and 0.14%, respectively. AvaTrade supports multiple platforms across web, mobile, and desktop trading. In addition to its own native platform, this includes MT4 and MT5. Passive traders also have the option to use AvaTrade with DupliTrade or ZuluTrade.

| CFD assets | Stocks, ETFs, forex, commodities, indices, bonds, options |

| Number of CFD contracts | 1,000+ |

| Pricing system | 0% commission on all markets |

| Deposit fee | None |

| EUR/USD spread | From 0.9 pips |

| Cost of trading Amazon stock | 0.14% spread |

| Trading Platforms | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, DupliTrade, ZuluTrade |

| Min Deposit | £100 |

Pros

Cons

71% of retail investor accounts lose money when trading CFDs with this provider.

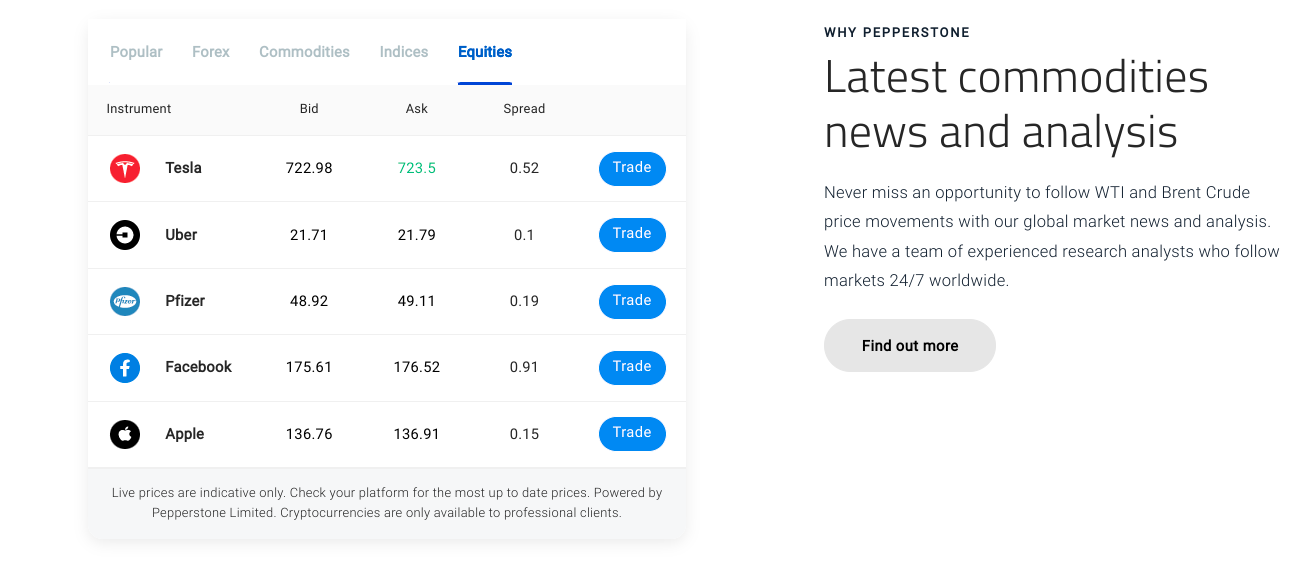

5. Pepperstone – Access Institutional-Grade Spreads

Pepperstone is a CFD broker that offers trading tools and features for a wide variety of traders. Many casual traders say they appreciate the standard account, with offers access to CFDs at 0% commission and a minimum spread of 0.6 pips.

Seasoned traders that wish to invest larger amounts can try the Pepperstone Razor account. While this account type attracts a commission of $3.50 (about £3) for every lot traded, it offers access to institutional-grade spreads. This means that major markets like EUR/USD can often be traded at a spread of 0.0 pips.

Both account types come without a minimum deposit requirement and funding can be initiated with a debit/credit card or bank transfer. Pepperstone supports multiple stock exchanges, in addition to forex, indices, precious metals, and energies. Although there is no native trading platform offered by Pepperstone, there is support for MT4, MT5, and cTrader.

| CFD assets | Stocks, ETFs, forex, commodities, indices |

| Number of CFD contracts | 1,200+ |

| Pricing system | $3.50 (about £3) commission per lot on razor account, 0% commission on standard account |

| Deposit fee | None |

| EUR/USD spread | From 0.0 pips on razor account, 0.6 pips on standard account |

| Cost of trading Amazon stock | $0.02 per share |

| Trading Platforms | MT4, MT5, cTrader, TradingView |

| Min Deposit | No minimum deposit requirement |

Pros

Cons

74% of retail investor accounts lose money when trading CFDs with this provider.

6. IG – More Than 18,000 CFDs Supported by This Established Broker

IG is a UK-based brokerage that offers a wide spectrum of trading markets. This is inclusive of more than 18,000 financial instruments across both CFDs and spread betting. Furthermore, IG also offers real ownership of stocks and funds, with trading fees amounting to £3 or £8 per position.

This will depend on how many trades are placed within a 30-day period. All CFD markets, apart from stocks, can be traded on a 0% commission basis. This includes everything from forex and indices to precious metals and energies. Stock CFDs, on the other hand, will attract a variable commission – which is dependent on the market.

For example, UK and European stocks can be traded at a commission of 0.10%. US stocks will cost $0.02 per share traded. IG offers leverage to all UK retail clients in line with FCA limits.

Note that deposits on IG can be expensive. The minimum deposit £250 and Visa and MasterCard payments attract a fee of 1% and 0.5%, respectively.

| CFD assets | Stocks, ETFs, forex, commodities, indices, options, futures, bonds, interest rates |

| Number of CFD contracts | 18,000+ |

| Pricing system | 0% commission on all CFD markets other than stocks |

| Deposit fee | 1% on Visa, 0.5% on MasterCard |

| EUR/USD spread | From 0.6 pips |

| Cost of trading Amazon stock | $0.02 per share |

| Trading Platforms | Native platform for web and mobile trading, MT4 |

| Min Deposit | £250 |

Pros

Cons

7. Skilling – User-Friendly App for Mobile Traders

For example, traders can perform technical analysis on the Skilling app, in addition to entering positions. The app is also known for its fast execution speeds and fully customizable charting screens. Both the Skilling app and main web trading platforms offer access to 900 financial markets.

This includes forex, stocks, indices, and commodities. The standard account offers 0% commission access to CFDs at spreads that start from 0.7 pips. The minimum deposit at Skilling is £100 and the platform supports debit/credit cards, Paypal, Skrill, and more.

| CFD assets | Stocks, forex, commodities, indices |

| Number of CFD contracts | 900+ |

| Pricing system | 0% on standard accounts |

| Deposit fee | Debit/credit cards are free, e-wallets range from 0-2.9% |

| EUR/USD spread | From 0.7 pips |

| Cost of trading Amazon stock | $0.53 spread |

| Trading Platforms | Native platform for web and mobile trading, MT4, cTrader |

| Min Deposit | £100 |

Pros

Cons

8. Plus500 – Popular CFD Platform for Trading International Stocks

Plus500 is a UK-based CFD trading platform that is regulated by multiple bodies, including the FCA. This platform requires a minimum first-time deposit of £100 and no transaction fees are charged. Plus500 can be a suitable platform for UK traders who wish to trade international stocks.

Across thousands of foreign stocks, this includes markets based in the US, Ireland, South Africa, Japan, Australia, Germany, France, and many others. With that said, Plus500 also supports UK equities across the London Stock Exchange and the AIM. Plus500 does not charge trading commissions.

In addition to stocks, Plus500 supports forex, commodities, ETFs, indices, and more. Plus500 offers its own native trading platform that can be accessed via web browsers or an app for Android and iOS. Read our full Plus500 UK review for further details about this leading CFD broker.

| CFD assets | Stocks, ETFs, forex, commodities, indices, options |

| Number of CFD contracts | 2,800 |

| Pricing system | 0% on all markets |

| Deposit fee | None |

| EUR/USD spread | From 0.8 pips |

| Cost of trading Amazon stock | 0.74% spread |

| Trading Platforms | Native platform for web and mobile trading |

| Min Deposit | £100 |

Pros

Cons

9. XM – CFD Broker that Enables Small Stakes

Another provider on our list of UK CFD brokers is XM. This platform supports more than 1,000 CFD instruments across forex, stocks, indices, and commodities. The minimum first-time deposit across all account types is just $5 – or about £4.

Both the micro and standard accounts at XM offer a 0% commission trading experience, with spreads starting at 1 pip. The XM zero account, however, offers spreads from 0 pips alongside a standard commission. Islamic accounts are offered by XM too, which means no overnight financing fees on CFD swaps.

After opening an account, XM users can access their trading dashboard via MT4 or MT5. XM also supports a trading app for iOS and Android smartphones.

| CFD assets | Stocks, ETFs, forex, commodities, indices |

| Number of CFD contracts | 1,000+ |

| Pricing system | Standard account offers 0% commission |

| Deposit fee | None |

| EUR/USD spread | 1 pip on standard account |

| Cost of trading Amazon stock | 5.85 pips |

| Trading Platforms | MT4, MT5, proprietary app for iOS and Android |

| Min Deposit | $5 (about £4) |

Pros

Cons

10. CMC Markets – Low-Cost CFD Broker With 12,000+ Markets

CMC Markets is the final provider that we will discuss on this list of popular CFD brokers in the UK. This platform offers a huge range of markets across thousands of financial instruments – all represented by CFDs. This means that UK traders can access leverage and short-selling positions with ease.

Asset classes include stocks, ETFs, forex, commodities, and indices. When it comes to fees, stocks and ETFs attract a commission here, while other CFD markets do not. Spreads are competitive across most instruments, with EUR/USD available to trade at 0.7 pips per slide.

There is no minimum deposit requirement at CMC Markets and in most cases, UK residents can open an account in under five minutes. Customer support at CMC Markets is highly rated and the broker is regulated by the FCA.

| CFD assets | Stocks, ETFs, forex, commodities, crypto, indices, treasuries, |

| Number of CFD contracts | 12,000+ |

| Pricing system | 0% on all markets apart from stocks and ETFs |

| Deposit fee | None |

| EUR/USD spread | From 0.7 pips |

| Cost of trading Amazon stock | $0.02 per share |

| Trading Platforms | Native NGEN platform for web and mobile trading, MT4 |

| Min Deposit | No minimum deposit requirement |

Pros

Cons

Popular CFD Trading Platforms UK Compared

Selecting the right CFD broker online in the UK is no easy feat considering the many metrics at hand. As such, below we offer a comparison table that outlines key statistics concerning the CFD brokers reviewed in the sections above.

| CFD Brokers in the UK | CFD Assets | Total CFDs | Pricing System | Deposit Fee | EUR/USD Spread (From) | Cost to Trade Amazon Stock | Min. Deposit (From) | Trading Platforms |

| eToro | Stocks, ETFs, forex, commodities, indices | 3,000+ | 0% commission on stocks and ETFs. 1% on crypto. Spread-only on CFD markets. | 0.50% | 1 pip | $0.15 spread | $10 (about £8) | Proprietary eToro platform for web browsers and mobile devices |

| XTB | Stocks, ETFs, forex, commodities, indices | 2,100+ | 0% commission on all markets | $0 on debit/credit cards, 2% on Skrill | 0.1 pip | $0.50 spread | £0 | xStation for web, mobile, tablets, and desktop software |

| Avatrade | Stocks, ETFs, forex, commodities, indices, bonds, options | 1,000+ | 0% commission on all markets | None | 0.9 pips | 0.14% spread | £100 |

WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, DupliTrade, ZuluTrade

|

| Pepperstone | Stocks, ETFs, forex, commodities, indices | 1,200+ | $3.50 commission per lot on razor account, 0% commission on standard account | None | From 0.0 pips on razor account, 0.6 pips on standard account | $0.02 per share | £0 | MT4, MT5, cTrader, TradingView |

| IG | Stocks, ETFs, forex, commodities, indices, options, futures, bonds, interest rates | 18,000 | 0% commission on all CFD markets other than stocks | 1% on Visa, 0.5% on MasterCard | 0.6 pips | $0.02 per share | £250 | Native platform for web and mobile trading, MT4 |

| Skilling | Stocks, forex, commodities, crypto, indices | 900+ | 0% on standard accounts | Debit/credit cards are free, e-wallets range from 0-2.9% | 0.7 pips | $0.53 spread | €100 | Native platform for web and mobile trading, MT4, cTrader |

| Plus500 | Stocks, ETFs, forex, commodities, indices, options | 2,800+ | 0% commission on all markets | None | 0.8 pips | 0.74% spread | €100 | Native platform for web and mobile trading |

| XM | Stocks, ETFs, forex, commodities, indices, options | 1,000+ | Standard account offers 0% commission | None | 1 pip on standard account | 5.85 pip spread | $5 (about £4) | MT4, MT5, proprietary app for iOS and Android |

| CMC Markets | Stocks, ETFs, forex, commodities, indices, treasuries, | 12,000+ | 0% on all markets apart from stocks and ETFs | None | 0.7 pips | $0.02 per share | £0 | Native NGEN platform for web and mobile trading, MT4 |

How We Find UK CFD Brokers

Traders are advised to conduct their own independent research when comparing CFD brokers in the UK.

Therefore, in the sections below, we explain the core factors and metrics to look for during the research process.

Regulation

One priority when choosing the most popular CFD broker in the UK is regulation and safety.

As such, the first step is to ensure that the provider is regulated by the FCA. Some CFD platforms – including eToro, are also regulated by other tier-one bodies, such as ASIC and CySEC.

Supported CFD Instruments

Users looking for the best ways to invest £5,000 in the UK may be interested in speculating on CFDs. Popular CFD brokers in the UK offer access to several thousand markets across multiple asset classes. For example, traders can place trades on UK and international stocks, ETFs, forex, commodities, and indices.

Note: Those wondering how to invest cryptocurrency in the UK will not be able to do so via CFDs, as per the FCA. Of the brokers we discussed above, only eToro enables traders to buy and sell real crypto assets.

Fees

All of the CFD brokers discussed today offer competitive fees and commissions.

For a recap of what fees to expect when choosing a popular broker for CFDs in the UK, refer to the comparison table below:

| CFD Brokers UK | Pricing System | Deposit Fee | EUR/USD Spread (From) | Account Fees |

| eToro | 0% commission on real stocks and ETFs. 1% on real crypto. Spread-only on CFD markets. | 0.50% | 1 pip |

0.5% deposit fee, $10 inactivity fee, $5 withdrawal fee

|

| XTB | 0% commission on all markets | $0 on debit/credit cards, 2% on Skrill | 0.1 pip | £10 inactivity fee |

| Avatrade | 0% commission on all markets | None | 0.9 pips | £50 inactivity fee |

| Pepperstone | $3.50 commission per lot on razor account, 0% commission on standard account | None | From 0.0 pips on razor account, 0.6 pips on standard account | None |

| IG | 0% commission on all CFD markets other than stocks | 1% on Visa, 0.5% on MasterCard | 0.6 pips |

1% on Visa, 0.5% on MasterCard, $18 inactivity fee

|

| Skilling | 0% on standard accounts | Debit/credit cards are free, e-wallets range from 0-2.9% | 0.7 pips | None |

| Plus500 | 0% commission on all markets | None | 0.8 pips | £12 inactivity fee |

| XM | Standard account offers 0% commission | None | 1 pip on standard account | $5 inactivity fee |

| CMC Markets | 0% on all markets apart from stocks and ETFs | None | 0.7 pips | £10 inactivity fee |

Tools and Analysis

Another important factor to look for when comparing top CFD brokers in the UK is the availability of trading features. These could include copy trading, which allows UK residents to mirror the buy and sell positions of an experienced investor. In addition, traders may need high-level trading tools and charting features, alongside technical indicators and advanced pricing analysis.

Minimum Deposit

Many CFD brokers require no minimum deposit at all. Others stipulate a first-time minimum of £250. For example, in our GO Markets UK review we found that this leading CFD broker has a minimum deposit of £200 while eToro has a minimum first deposit of just $10.

Demo Account

Demo trading facilities can be important to the success of traders. This enables traders to test strategies without risking real money.

Mobile App

Many traders want the ability to place trades on the go, and this is enabled by a user-friendly and fully optimized mobile app. CFD trading apps in the UK should offer full functionality regarding placing orders, conducting analysis, and account management.

Payment Methods

Many UK retail clients will elect to deposit funds into a CFD brokerage via a debit or credit card. This payment type is supported by many popular CFD brokerages on a fee-free basis, in addition to e-wallets and bank transfers.

Customer Service

Some CFD brokers in the UK offer customer support around the clock. Phone or live chat support may enable traders to get an answer faster.

Conclusion

In conclusion, the most popular CFD brokers in the UK generally offer access to thousands of markets at low or even zero commission. Traders can access stocks, indices, commodities, forex, and more. UK residents can open a verified account with eToro in less than five minutes by meeting the minimum stipulated deposit of just £20.

78% of retail investor accounts lose money when trading CFDs with this provider.