Contracts-for-differences (CFDs) enable retail clients to trade virtually any asset class imaginable – from stocks and crypto to commodities and forex. CFDs also enable traders to go long or short on their chosen market and in most cases, apply leverage.

In this comparison guide, we review and rank the 10 best CFD brokers in the market today for fees, spreads, trading tools, user-friendliness, supported assets, and more.

The Best CFD Brokers in 2023

The list below highlights the 10 best CFD brokers to consider today:

- eToro – Overall Best CFD Broker With Copy Trading Tools

- XTB – Trade Forex and Other CFDs From Just 0.01 Pips

- AvaTrade – 0% Commission CFD Broker With Tight Spreads

- Pepperstone – Raw Spread Accounts Offer ECN-Like Spreads

- IG – Trade 18,000+CFD Markets With an Established Broker

- Skilling – User-Friendly CFD Trading Platform With 900+ Markets

- CMC Markets – Seamless Access to Over 12,000 CFD Instruments

- Plus500 – 0% Commission CFD Broker With 2,800+Markets

- XM – Leverage of up to 1:1000 and Minimum Deposit of Just $5

The top CFD brokers listed above all differ when it comes to spreads, commissions, markets, and other core metrics. Read on to find out which CFD broker is suitable.

Best CFD Brokers Reviewed

This section of our guide will review the 10 best CFD brokers from top to bottom. This will ensure that traders choose the right CFD provider for their skillset and required goals.

Note: CFD markets are prohibited in the US. Clients from the US can, however, trade stocks and ETFs at 0% commission at eToro, as well as crypto assets at a fee of 1% per slide.

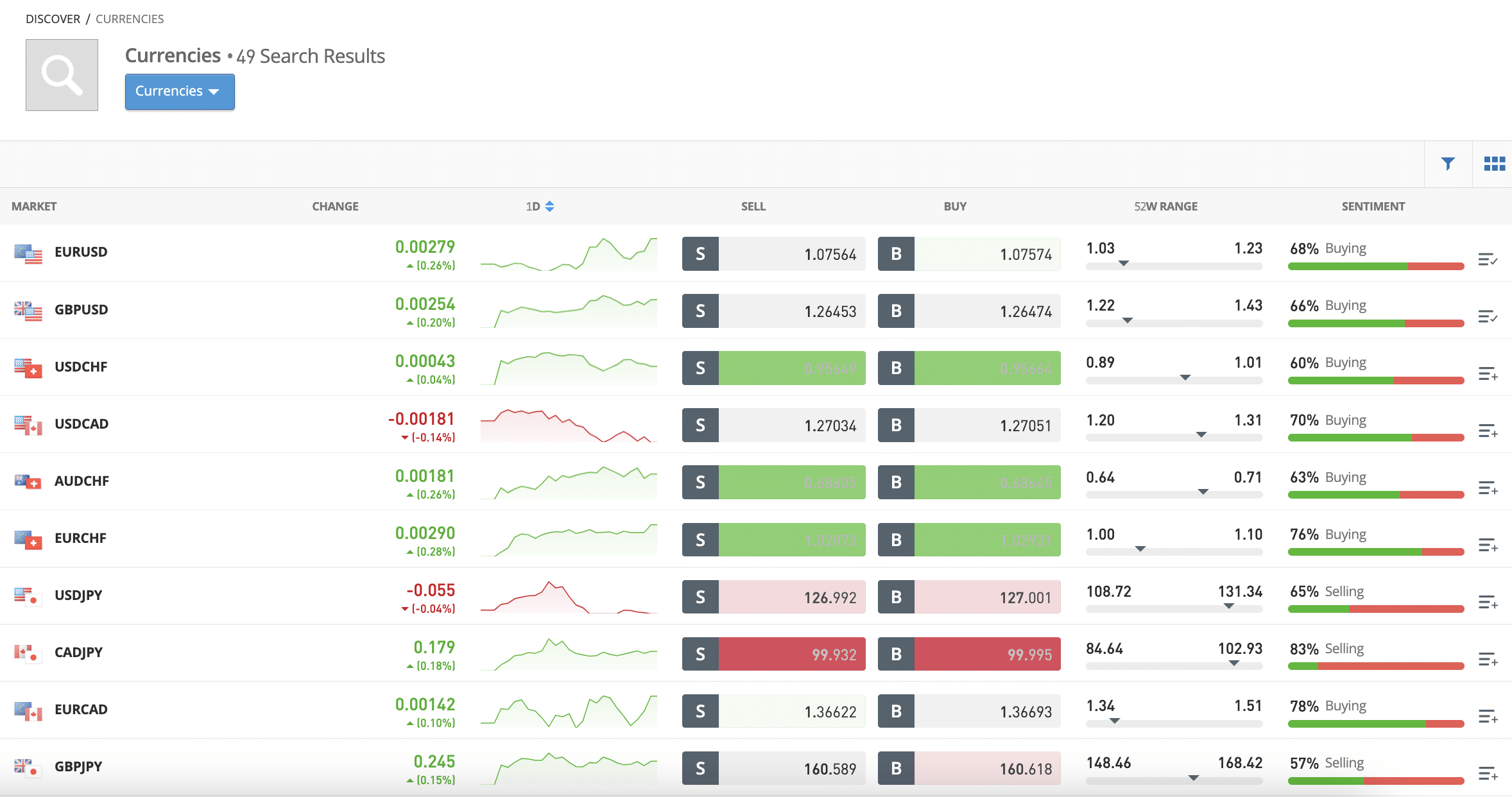

1. eToro – Top-Rated CFD Broker With Copy Trading Tools

eToro is a popular online broker that offers both ‘real’ assets and CFD instruments. Regarding the former, it is possible to invest in stocks and ETFs at 0% commission, from a minimum of $10 per trade. It is also possible to invest in cryptocurrency, with more than 90+ coins supported at a fee of just 1% per slide.

Those wishing to trade leveraged CFDs can do so across more than 3,000 instruments. This includes commodities, indices, stocks, ETFs, forex, and more. All CFD markets at eToro can be traded on a spread-only basis. To offer some insight into potential charges, spreads on forex start at 1 pip. eToro offers spreads of 5 pips on oil and silver, and 45 pips on gold.

Indices such as the S&P 500 are particularly competitive, with the S&P 500 offering a spread of just 0.75 points. eToro is very transparent with the fees it charges, especially when it comes to overnight funding on leveraged positions. This is because the broker displays the daily and weekend leverage fee in dollars and cents when setting up an order.

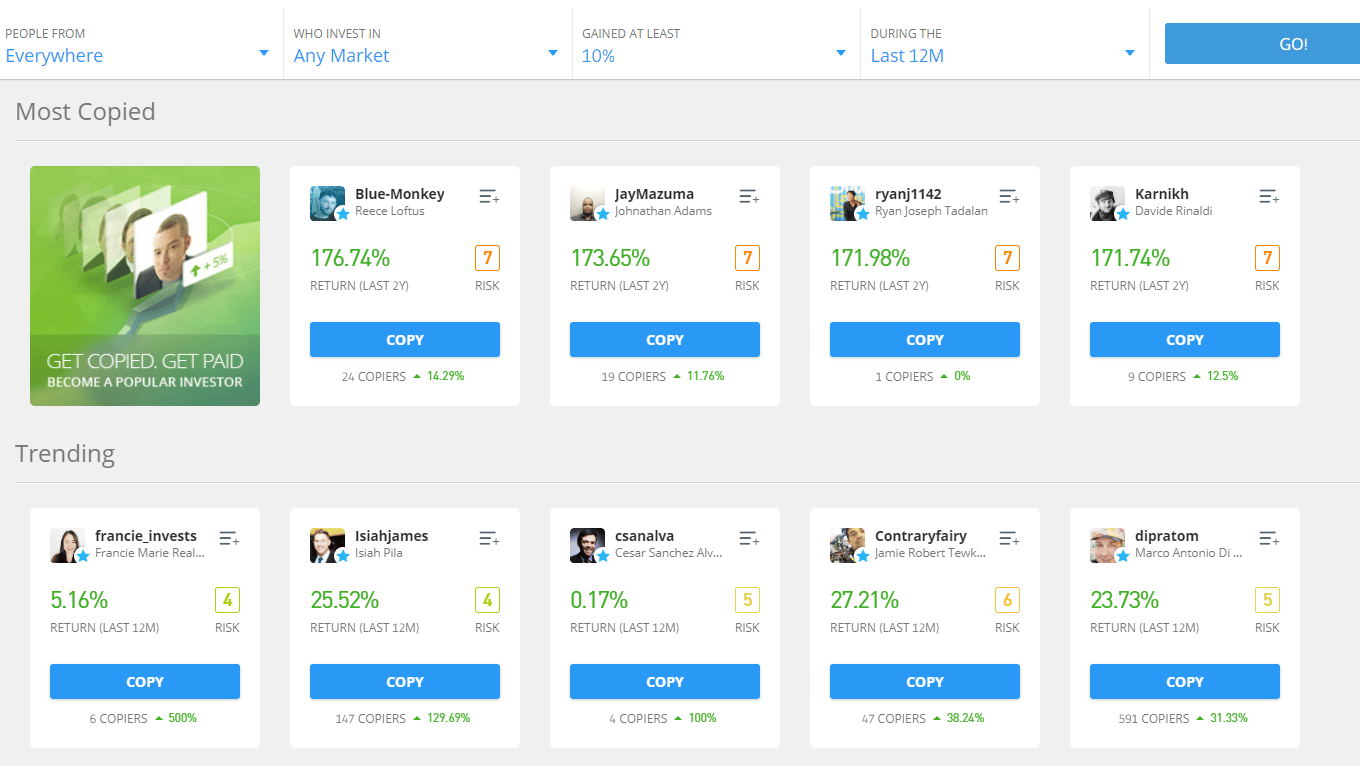

eToro also enables traders to deposit and withdraw funds for free when USD is the primary currency being used. Other currencies are supported too but these will attract an FX charge of 0.5%. When it comes to trading tools, eToro is very feature-rich. First, it offers a passive investment tool called Copy Trading.

This offers access to thousands of verified traders that use the eToro platform professionally. eToro users can choose a suitable trader to copy and then all future investments will automatically be copied over to the account portfolio. This popular feature does not attract any additional fees and the minimum per-trader investment requirement is just $200.

Another popular feature at eToro is its Smart Portfolios. These are professionally managed by the eToro brokerage platform and each Smart Portfolio tracks a certain marketplace. For instance, there are Smart Portfolios can offer exposure to stocks from the renewable energy, Big Tech, or driverless car niches. No additional management fees are charged on this feature.

Beginners might appreciate the eToro demo account facility, which comes with $100k in risk-free funds and no time limits imposed. There is also a CFD trading app for iOS and Android, which connects to the primary account. eToro is authorized and regulated by several leading bodies, inclusive of the SEC, ASIC, CySEC, and FCA.

| CFD assets | Stocks, ETFs, forex, commodities, crypto, indices |

| Number of CFD contracts | 3,000+ |

| Pricing system | 0% commission on stocks and ETFs. 1% on crypto. Spread-only on CFD markets. |

| Deposit fee | $0 on USD payments. 0.5% on other currencies. |

| EUR/USD spread | 1 pip |

| Cost of trading Amazon stock | $0.15 spread |

| Trading Platforms | Proprietary eToro platform for web browsers and mobile devices |

| Min Deposit | $10 for UK/US traders, $50 elsewhere |

Pros

Cons

78% of retail investor accounts lose money when trading CFDs with this provider.

2. XTB – Trade Forex and Other CFDs From Just 0.01 Pips

XTB is one of the best CFD brokers in this space for low spreads. By opening a standard account with this platform, traders will have access to forex spreads that start at just 0.01 pips. Moreover, there are no commissions to trade forex and other CFDs at this broker.

Additional CFD markets supported by XTB are inclusive of ETFs, stocks, crypto, indices, and commodities. In addition to offering low spreads, XTB supports fee-free deposits when opting for a debit/credit card. However, this XTB review found that those opting for an e-wallet like Skrill will be charged 2% of the transaction size.

The xStation trading suite – which is native to XTB, supports multiple device types. This includes desktop software, an app for iOS and Android, and standard web browsers. XTB offers leverage on all supported markets but limits will depend on the location of the trader. For instance, just like eToro and Capital.com, EU and Australian traders will be capped to 1:30.

| CFD assets | Stocks, ETFs, forex, commodities, crypto, indices |

| Number of CFD contracts | 2,100+ |

| Pricing system | 0% commission on all markets |

| Deposit fee | $0 on debit/credit cards, 2% on Skrill |

| EUR/USD spread | From 0.1 pip |

| Cost of trading Amazon stock | $0.5 spread |

| Trading Platforms | xStation for mobile, desktop, and web browsers |

| Min Deposit | No minimum deposit requirement |

Pros

Cons

81% of retail investor accounts lose money when trading CFDs with this provider.

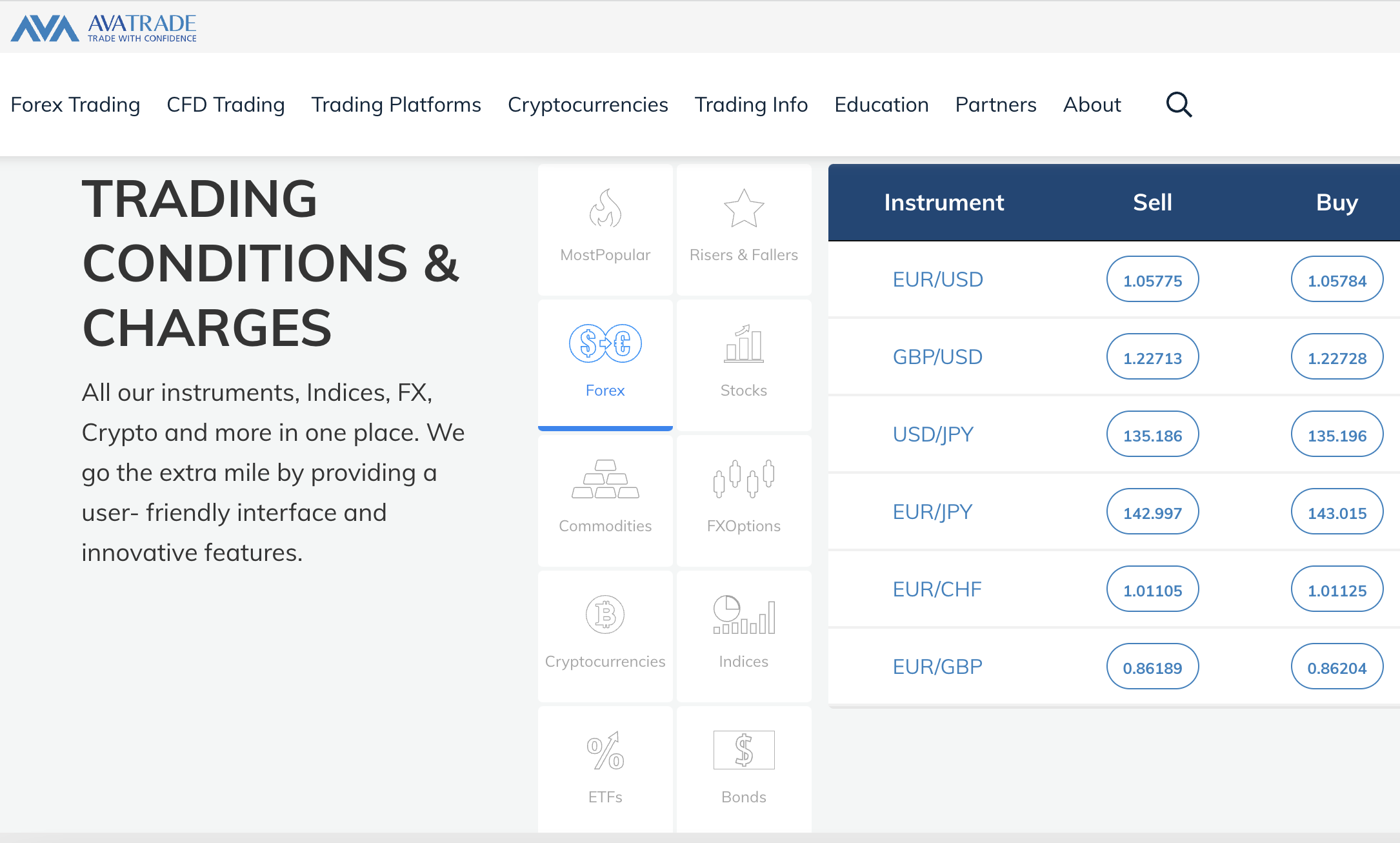

3. AvaTrade – 0% Commission CFD Broker With Tight Spreads

The most competitive spreads can be found in the forex department, with EUR/USD starting at 0.9 pips. Getting started with an AvaTrade account requires just $100 and no deposit fees are charged. AvaTrade offers its own native trading platform for web browsers and iOS/Android smartphone devices.

This CFD broker also supports a range of third-party platforms, which includes MT4 and MT5. There is also support for ZuluTrade and DupliTrade. Educational materials are offered by AvaTrade alongside a free demo account facility. AvaTrade offers leverage on all supported markets as well as the ability to go long or short.

| CFD assets | Stocks, ETFs, forex, commodities, crypto, indices, bonds, options |

| Number of CFD contracts | 1,000+ |

| Pricing system | 0% commission on all markets |

| Deposit fee | None |

| EUR/USD spread | From 0.9 pips |

| Cost of trading Amazon stock | 0.14% spread |

| Trading Platforms | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, DupliTrade, ZuluTrade |

| Min Deposit | $100 |

Pros

Cons

71% of retail investor accounts lose money when trading CFDs with this provider.

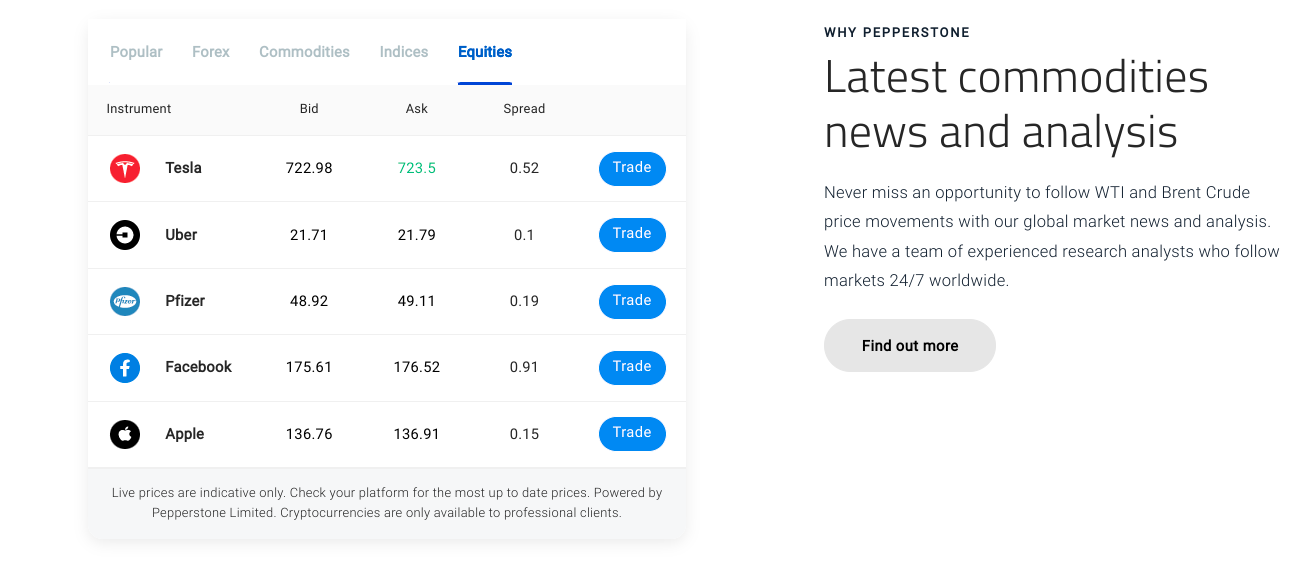

4. Pepperstone – Raw Spread Accounts Offer ECN-Like Spreads

Spreads are often the main fee that traders look for when searching for the best CFD broker. At Pepperstone, it is possible to get ECN-like spreads by opening a razor account. This account type not only offers access to institutional spreads without any markup but there is no minimum deposit to meet.

In most cases, during standard market hours, EUR/USD can be accessed with a spread of 0.0 pips. Razor accounts at Pepperstone come with a flat commission pricing structure of $3.50 per lot. This will appeal to those that generally trade large amounts. Casual traders, on the other hand, might prefer the commission-free account which comes with less competitive spreads.

In terms of supported markets, Pepperstone offers access to 1,200+ CFD instruments. In addition to dozens of forex pairs, this is inclusive of commodities, crypto, indices, stocks, and ETFs. Pepperstone is also popular for its customer support department, which operates 24 hours per day, 7 days per week.

| CFD assets | Stocks, ETFs, forex, commodities, crypto, indices |

| Number of CFD contracts | 1,200+ |

| Pricing system | $3.50 commission per lot on razor account, 0% commission on standard account |

| Deposit fee | None |

| EUR/USD spread | From 0.0 pips on razor account, 0.6 pips on standard account |

| Cost of trading Amazon stock | $0.02 per share |

| Trading Platforms | MT4, MT5, cTrader, TradingView |

| Min Deposit | No minimum deposit requirement |

Pros

Cons

74% of retail investor accounts lose money when trading CFDs with this provider.

5. IG – Trade 18,000+CFD Markets With an Established Broker

Most other nationalities will have access to the IG CFD trading suite. This covers more than 18,000 financial markets, which includes everything from forex, stocks, and indices to futures, options, and cryptocurrencies. When it comes to fees, all CFD markets at IG can be traded commission-free other than stocks.

US stocks, for example, can be traded at $0.02 per share. Stock exchanges in the UK and Europe can be accessed at a commission of 0.10%. Forex spreads on EUR/USD starts at 0.6 pips. Perhaps the main drawback with IG is that it requires a minimum first-time deposit of $250.

| CFD assets | Stocks, ETFs, forex, commodities, crypto, indices, options, futures, bonds, interest rates |

| Number of CFD contracts | 18,000+ |

| Pricing system | 0% commission on all CFD markets other than stocks |

| Deposit fee | 1% on Visa, 0.5% on MasterCard |

| EUR/USD spread | From 0.6 pips |

| Cost of trading Amazon stock | $0.02 per share |

| Trading Platforms | Native platform for web and mobile trading, MT4 |

| Min Deposit | $250 |

Pros

Cons

6. Skilling – User-Friendly CFD Trading Platform With 900+Markets

With that said, intermediate and seasoned traders are catered for too, with Skilling supporting MT4 and cTrader. In total, Skilling offers access to 900+financial markets, which covers forex, commodities, metals, energies, indices, stocks, and ETFs. It is also possible to trade more than 50+crypto pairs.

Skilling also offers a Copy Trading tool that enables investors to replicate proven strategies in real-time. This will appeal to those that wish to actively trade CFDs but in a passive nature. Skilling offers a maximum leverage ratio of 1:500 but limits will depend on the location of the trader.

| CFD assets | Stocks, forex, commodities, crypto, indices |

| Number of CFD contracts | 900+ |

| Pricing system | 0% on standard accounts |

| Deposit fee | Debit/credit cards are free, e-wallets range from 0-2.9% |

| EUR/USD spread | From 0.7 pips |

| Cost of trading Amazon stock | $0.53 spread |

| Trading Platforms | Native platform for web and mobile trading, MT4, cTrader |

| Min Deposit | €100 |

Pros

Cons

7. CMC Markets – Seamless Access to Over 12,000 CFD Instruments

The next provider to consider on our list of the best CFD brokers is CMC Markets. This platform offers access to a significant number of markets, with more than 12,000+CFD instruments supported. This includes more than 10,000 stocks from a wide range of US and international markets.

Stock and ETF trading fees start from 0.10% or $0.02 per share. All other markets can be traded without paying any commission. This is inclusive of over 330 forex pairs, 80 indices, 21 crypto assets, 50 treasuries, and 100 commodities. Spreads on EUR/USD and the S&P 500 start from 0.7 pips and 0.3 points, respectively.

There is no minimum deposit required to get started with CMC Markets. The broker offers its own native trading platform for web browsers, tablets, and iOS/Android smartphones. More experienced traders might wish to trade via MT4 – which CMC Markets supports.

| CFD assets | Stocks, ETFs, forex, commodities, crypto, indices, treasuries, |

| Number of CFD contracts | 12,000+ |

| Pricing system | 0% on all markets apart from stocks and ETFs |

| Deposit fee | None |

| EUR/USD spread | From 0.7 pips |

| Cost of trading Amazon stock | $0.02 per share |

| Trading Platforms | Native NGEN platform for web and mobile trading, MT4 |

| Min Deposit | No minimum deposit requirement |

Pros

Cons

8. Plus500 – 0% Commission CFD Broker With 2,800+Markets

The final option to consider when searching for the best CFD broker is Plus500. This established provider has 22 million clients and its parent company is publically listed on the London Stock Exchange. Plus500 supports more than 2,800 financial instruments across multiple CFD asset classes.

This includes stocks and ETFs from a variety of global exchanges, in addition to crypto, forex, indices, options, and commodities. All markets hosted by Plus500 can be accessed at 0% commission alongside tight spreads. Leverage is offered to all account holders, albeit, limits will depend on the market and the location of the trader.

Plus500 offers a free demo account facility and access to plenty of educational materials. Plus500 also offers a native mobile app for iOS and Android. Alternatively, account holders can trade via the Plus500 website via a standard web browser. Plus500 requires a minimum first-time deposit of $100, or an alternative currency equivalent.

| CFD assets | Stocks, ETFs, forex, commodities, crypto, indices, options |

| Number of CFD contracts | 2,800 |

| Pricing system | 0% on all markets |

| Deposit fee | None |

| EUR/USD spread | From 0.8 pips |

| Cost of trading Amazon stock | 0.74% spread |

| Trading Platforms | Native platform for web and mobile trading |

| Min Deposit | $100 |

Pros

Cons

9. XM – Leverage of up to 1:1000 and Minimum Deposit of Just $5

XM is a CFD trading platform that offers multiple account types. Those on a budget might appreciate the standard account, which not only comes with a minimum deposit of $5, but leverage of up to 1:1000. This means that a $10,000 CFD position would require a stake of just $10.

When it comes to fees, most account types offer a minimum spread of 1 pip. The exception here is the. XM Ultra Low account, which offers a minimum spread of 0.6 pips. More than 1,000 financial instruments are supported by XM, which covers everything from forex and commodities to stocks and indices.

XM also offers a mobile app that is compatible with both Android and iOS devices. This enables traders to enter and exit positions on the move, as well as access advanced charts and more than 9- technical indicators.

| CFD assets | Stocks, ETFs, forex, commodities, crypto, indices |

| Number of CFD contracts | 1,000+ |

| Pricing system | Standard account offers 0% commission |

| Deposit fee | None |

| EUR/USD spread | 1 pip on standard account |

| Cost of trading Amazon stock | 5.85 pips |

| Trading Platforms | MT4, MT5, proprietary app for iOS and Android |

| Min Deposit | $5 |

Pros

Cons

Top CFD Trading Platforms Compared

We compare and summarize our CFD broker reviews in the comparison table below:

| CFD Brokers | CFD Assets | Total CFDs | Pricing System | Deposit Fee | EUR/USD Spread (From) | Cost to Trade Amazon Stock | Min. Deposit (From) | Trading Platforms |

| eToro | Stocks, ETFs, forex, commodities, crypto, indices | 3,000+ | 0% commission on stocks and ETFs. 1% on crypto. Spread-only on CFD markets. | $0 on USD payments. 0.5% on other currencies. | 1 pip | $0.15 spread | $10 | Proprietary eToro platform for web browsers and mobile devices |

| XTB | Stocks, ETFs, forex, commodities, crypto, indices | 2,100+ | 0% commission on all markets | $0 on debit/credit cards, 2% on Skrill | 0.1 pip | $0.50 spread | $0 | xStation for web, mobile, tablets, and desktop software |

| XM | Stocks, ETFs, forex, commodities, crypto, indices | 1,000+ | From 0% commission | None | 1 pip on standard account | $5.85 pips spread | $5 | MT4, MT5, proprietary app for iOS and Android |

| AvaTrade | Stocks, ETFs, forex, commodities, crypto, indices, bonds, options | 1,000+ | 0% commission on all markets | None | 0.9 pips | 0.14% spread | $100 |

WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, DupliTrade, ZuluTrade

|

| Pepperstone | Stocks, ETFs, forex, commodities, crypto, indices | 1,200+ | $3.50 commission per lot on razor account, 0% commission on standard account | None | From 0.0 pips on razor account, 0.6 pips on standard account | $0.02 per share | $0 | MT4, MT5, cTrader, TradingView |

| IG | Stocks, ETFs, forex, commodities, crypto, indices, options, futures, bonds, interest rates | 18,000 | 0% commission on all CFD markets other than stocks | 1% on Visa, 0.5% on MasterCard | 0.6 pips | $0.02 per share | $250 | Native platform for web and mobile trading, MT4 |

| Skilling | Stocks, forex, commodities, crypto, indices | 900+ | 0% on standard accounts | Debit/credit cards are free, e-wallets range from 0-2.9% | 0.7 pips | $0.53 spread | €100 | Native platform for web and mobile trading, MT4, cTrader |

| CMC Markets | Stocks, ETFs, forex, commodities, crypto, indices, treasuries, | 12,000+ | 0% on all markets apart from stocks and ETFs | None | 0.7 pips | $0.02 per share | $0 | Native NGEN platform for web and mobile trading, MT4 |

| Plus500 | Stocks, ETFs, forex, commodities, crypto, indices, options | 2,800+ | 0% commission on all markets | None | 0.8 pips | 0.74% spread | $100 | Native platform for web and mobile trading |

How We Select the Best CFD Brokers

The best CFD brokers that we discussed today each offer something different from the next – whether that’s in terms of supported asset classes, fees, or trading tools.

Below, we explain the fundamentals of how we selected the best CFD brokers for our top 10 list.

Regulation

CFDs operate in a heavily regulated industry. Therefore, we only select CFD brokers that are licensed. Not only that, but we prefer platforms that hold tier-one licenses, issued by the likes of the FCA or ASIC.

Supported CFD Markets

There is often a huge disparity in the number and type of markets supported by CFD brokers.

For instance, Capital.com supports more than 6,000 financial instruments across stocks, ETFs, crypto, indices, commodities, and more. Libertex, however, supports just 250.

Fees

When reviewing the best CFD brokers, we spent a considerable amount of time exploring the fee structure for each provider.

To recap, check out the fee table below, which covers the 10 CFD trading platform providers that we reviewed today:

| CFD Brokers | Pricing System | EUR/USD Spread (From) | Cost to Trade Amazon Stock | Account Fees |

| Capital.com | 0% commission on all markets | 0.6 pips | $0.33 spread | None |

| eToro | 0% commission on stocks and ETFs. 1% on crypto. Spread-only on CFD markets. | 1 pip | $0.15 spread |

0.5% on non-USD deposits, $10 inactivity fee, $5 withdrawal fee

|

| XTB | 0% commission on all markets | 0.1 pip | $0.50 spread | $10 inactivity fee |

| XM | From 0% commission | 1 pip on standard account | 5.85 pips spread | $5 inactivity fee |

| Avatrade | 0% commission on all markets | 0.9 pips | 0.14% spread | $50 inactivity fee |

| Pepperstone | $3.50 commission per lot on razor account, 0% commission on standard account | From 0.0 pips on razor account, 0.6 pips on standard account | $0.02 per share | None |

| IG | 0% commission on all CFD markets other than stocks | 0.6 pips | $0.02 per share |

1% on Visa, 0.5% on MasterCard, $18 inactivity fee

|

| Skilling | 0% on standard accounts | 0.7 pips | $0.53 spread | None |

| CMC Markets | 0% on all markets apart from stocks and ETFs | 0.7 pips | $0.02 per share | $10 inactivity fee |

| Plus500 | 0% commission on all markets | 0.8 pips | 0.74% spread | $10 inactivity fee |

Tools and Analysis

Top CFD brokers will offer a range of trading tools, such as:

- Copy Trading (eToro)

- Technical indicators and chart drawing tools

- Support for third-party platforms like MT4 (Capital.com)

- Financial news and market insights

- Pricing alerts and watchlist

- Leverage

Minimum Deposit

Be sure to consider the minimum deposit requirement. As per the 10 providers that made our list of the best CFD brokers, this ranges from $0 to $250.

Demo Account

Beginners should consider choosing a CFD broker that offers a risk-free demo facility. At Capital.com, the platform offers $10,000 in paper trading funds. At eToro, this figure stands at $100,000. Both accounts mirror live market conditions.

Mobile App

The best CFD brokers offer a native web trading platform in addition to a mobile app for both iOS and Android. This enables the trader to enter and exit positions at the click of a button, as well as set up real-time pricing alerts.

Payment Methods

The easiest way to deposit funds into a CFD brokerage account is via a debit/credit card or e-wallet – as these payment types are processed instantly. Some CFD platforms, however, only support traditional bank wires – which can take 1-7 working days to arrive.

Customer Service

When choosing the best broker for CFDs, look for providers that offer real-time customer support via live chat.

Conclusion

This comparison guide has ranked and reviewed the 10 best CFD brokers for 2023. Our comparison was based on a wide range of important factors, such as regulations, spreads, and supported markets.

We like eToro as the overall best CFD broker, not least because this regulated provider offers thousands of instruments at 0% commission and offers the best copy trading tools on the market.

78% of retail investor accounts lose money when trading CFDs with this provider.