Although the Chinese government has historically taken a hardline stance on cryptocurrency, especially with regard to ICOs and mining, the country is still home to some of the largest trading volumes globally.

In this guide, we discuss the best China crypto projects in the market right now to offer some insight into where the region sits within the broader blockchain asset arena.

The 10 Best China Cryptocurrency to Invest in 2023

The list below highlights the 10 best China crypto projects to consider today:

- Tamadoge – Care for and Battle Virtual Pets to Earn Rewards

- Battle Infinity – P2E Metaverse Gaming Platform With Crypto Rewards and NFTs

- Lucky Block – NFT Competition Ecosystem With Huge Prize Draws

- BNB – Ecosystem Token Backing the Largest Cryptocurrency Globally

- Bitcoin – Most Traded Cryptocurrency in China

- NEO – Established Smart Contract Project Created in China

- Huobi Token – Token Backing Asia’s Large Cryptocurrency Exchange

- Ethereum – Large-Cap Project With Sizable Trading Volumes in China

- OKB – Digital Asset Backed by the OKX Exchange

- Dogecoin – Greener Alternative for Chinese Miners

A Closer Look at the Best Chinese Crypto Coins

Some of the best China crypto projects have since left the country to position their headquarters in a more blockchain-friendly region. Nonetheless, the country still generates significant cryptocurrency trading volumes.

In the sections below, we discuss some of the best China crypto projects. This includes a blend of projects that are either popular in China or originated in the country itself.

1. Tamadoge – Care for and Battle Virtual Pets to Earn Rewards

A project gaining attention worldwide and expected to become popular with Chinese investors is Tamadoge (TAMA). While at first glance it appears that Tamadoge is a meme coin that is not too dissimilar to Dogecoin or Shiba Inu, this project is building an immersive ecosystem that focuses on a play-to-earn game and pet-themed NFTs.

The project is already among our 10 hottest new cryptocurrencies of 2023 after selling out its initial $2 million beta presale in just two weeks. As well as offering a meme coin with the potential for big gains, holders of TAMA will be able to mint a virtual pet NFT.

Each pet will have a variety of characteristics and will possess a specific rarity score. The user will be responsible for taking care of their virtual pet and ensuring that it is well fed – the pet will grow and once big enough, players will be able to battle other pets in a fun play-to-earn game that will reward the top players with prizes.

Further down the line, the team at Tamadoge will introduce augmented reality into its game, enabling users to bring their Tamadoge pet into the real world and hunt for TAMA tokens and other prizes.

In addition to a fully-fledged mobile app, plenty of other innovative developments are in the pipeline – in the meantime, Tamadoge can be purchased in the next tranche of the presale now.

2. Battle Infinity – P2E Metaverse Gaming Platform With Crypto Rewards and NFTs

Battle Infinity is another project to consider, a newly launched crypto ecosystem that is building a metaverse world. Within the Battle Field metaverse – or ‘multiverse’ as the project refers to it, there will be an abundance of games – all of which incentivize players through rewards.

One of the first games to launch is the IBAT Premier League, which is a fantasy sports tournament accessible by users globally. After choosing a sport – such as cricket or soccer, the next step is to create a team of individual players. After compiling a team, players compete against other Battle Infinity users.

Players will earn points based on how each player from within the team performs – such as scoring a goal in soccer or a century in cricket. The better the team performs, the more rewards that the player will earn. The underlying digital token backing the Battle Infinity ecosystem is IBAT. This is the token used to reward players when competing in games.

Within the metaverse, Battle Infinity users will have access to an immersive set of experiences and even have the opportunity to earn NFTs. The Battle Infinity whitepaper also explains that the project is building a decentralized exchange, where users will be able to buy and sell IBAT tokens, alongside other digital assets.

This will require no personal information or KYC documents from the user, as per the exchange’s decentralized framework. IBAT holders can increase their position passively through the Battle Infinity staking platform. This will suit those that wish to hold their IBAT tokens in the long run.

The IBAT presale sold out in just 24 days, raising 16,500 BNB or around $5 million at the time of writing. Investors in China and beyond that wish to gain exposure to the long-term goals of Battle Infinity still have a chance to buy IBAT early on PancakeSwap where its IDO takes place August 17.

Visit the Battle Infinity Telegram channel for real-time updates on the project.

3. Lucky Block – NFT Competition Ecosystem With Huge Prize Draws

The next project that we found could be a big hit in China is Lucky Block. This Lucky Block project is an NFT competition and rewards platform. To be more specific, Lucky Block is offering some of the most lucrative prizes in the global competitions space – some of which include a $1 million house and a Lamborghini, alongside a VIP package to the FIFA world cup.

In terms of how to enter a Lucky Block competition, the process is as follows. First and foremost, the user will need to decide which competition they wish to enter. Then, the user will be required to purchase an NFT that was created specifically for the purpose of a chosen competition.

This can be completed on the NFT LaunchPad platform. By holding the NFT in a private wallet, the user will automatically be entitled to ongoing rewards. This is paid in LBLOCK tokens, which are native to the Lucky Block platform. Once the specific NFT collection sells out, the competition will be conducted via a random draw.

It is important to note that each prize draw is 100% random and transparent, not least because it is executed by blockchain technology and smart contracts. After the draw has been made, those holding the NFT competition will still be entitled to a share of the rewards pool, paid in LBLOCK.

Unlike the previously discussed Tamadoge and Battle Infinity, LBLOCK has already concluded its presale launch. Investors in China can, however, buy the LBLOCK token at a major discount when compared to the previous high it achieved prior to the crypto winter.

LBLOCK is available on decentralized and centralized crypto exchanges.

4. BNB – Ecosystem Token Backing the Largest Cryptocurrency Globally

Binance is one of the best China crypto projects of all time. Launched in 2017 alongside its native cryptocurrency – BNB, Binance facilitates billions of dollars worth of daily trading volume. For instance, over the prior 24 hours of writing, more than $14 billion worth of cryptocurrency changed hands on Binance.

Behind Binance, its nearest competitor was FTX, at just $2 billion. Binance has also since gone on to create and launch a full host of other products and services. This includes leverage markets and derivatives, crypto savings accounts and loans, staking, yield farming, and more. Binance has even gone on to create its own blockchain network – BSc.

With thousands of tokens launched on top of the BSc network, many believe that Binance could one day compete with Ethereum and its ERC-20 marketplace. At the forefront of the aforementioned products and services is the BNB token. This digital asset has real-world use cases, not least because BNB is required to trade BSc tokens or access reduced commissions on Binance.

When BNB peaked in late 2021 – before the crypto winter came into force, it surpassed a market capitalization of $100 billion. Compared to its launch valuation in late 2017, this represents a growth of more than 600,000%. BNB can be added to an investment today at a discount of nearly 58%, when compared to its previous high of $670.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

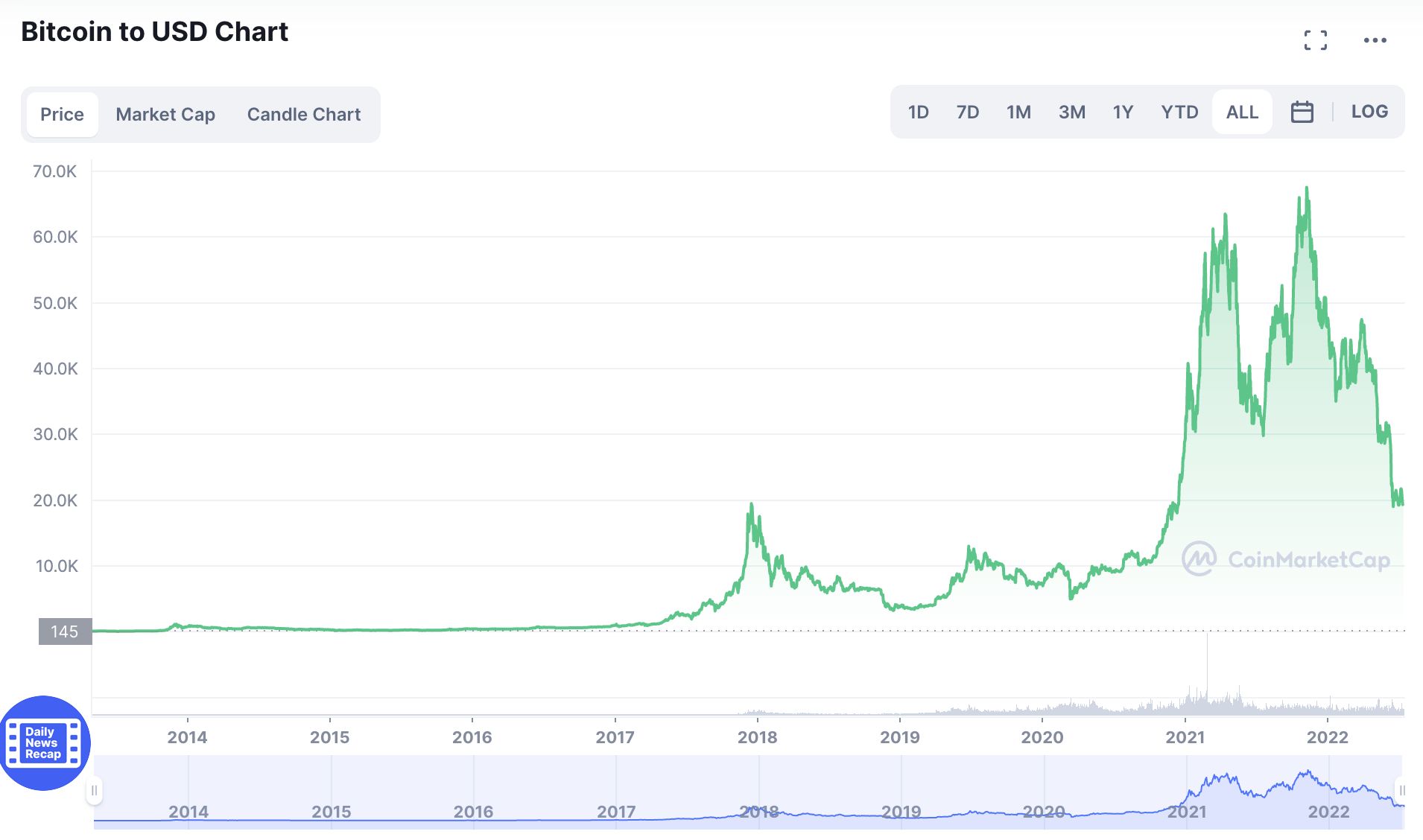

5. Bitcoin – Most Traded Cryptocurrency in China

Although cryptocurrency trading has officially been banned in China since 2019, the country is still home to huge volumes. At the forefront of this is Bitcoin – which is by far the most demanded digital asset in China. Bitcoin was first launched in 2009 as a means to compete with the global payments infrastructure.

It enables users from all corners of the world to send and receive funds without going through a third party, and no single person or authority owns or controls the network. Moreover, Bitcoin is also viewed as a store of value by many in China. There is a finite total supply of just 21 million BTC, and no more tokens will ever be created once this hard cap is met.

This makes the cryptocurrency attractive as an investment product in a similar nature to precious metals – hence the nickname that Bitcoin often carries – digital gold. However, unlike gold, Bitcoin can easily be fractionated into tiny units and transferred from one person to the next in just 10 minutes.

Bitcoin is also one of the best China crypto coins to consider in terms of its historical performance to date. For example, it wasn’t until 2011 that Bitcoin hit $1. Those risking just $100 back then would, as of writing, now be looking at a portfolio value worth more than $2 million.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

6. NEO – Established Smart Contract Project Created in China

Founded in 2014, NEO is a Chinese cryptocurrency project that supports smart contract agreements. This enables developers to create decentralized apps and programs, whereby transactions are executed in a trustless and autonomous manner. Often described as an ‘Ethereum Killer’, NEO is reportedly able to handle up to 10,000 transactions per second.

Fees are competitive too, with an average transaction charge of $0.10 – irrespective of the amount being transferred. This is in stark contrast to the current Ethereum framework, which often charges several dollars per transaction. Nonetheless, fees are paid in the project’s secondary currency – GAS.

However, the primary token backing the project is simply known as NEO. When it comes to the performance of the NEO token, the project initially produced gains of more than 47,000% during its first couple of years in the market. However, after peaking in 2018, the NEO token is yet to regain its prior all-time highs.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

7. Huobi Token – Token Backing Asia’s Large Cryptocurrency Exchange

Huobi is one of the largest cryptocurrency exchanges globally – and one of the biggest to serve Asian clients. This exchange was first founded and operated in China, before moving its offices overseas. This was largely in response to the Chinese government’s ban on cryptocurrency trading activities.

Nevertheless, the Huobi Token, which backs the exchange of the same name, is still one of the best Chinese crypto to invest in. It offers a wide range of use cases for token holders, including reduced trading fees on the Huobi exchange. Those wishing to access crypto derivatives – such as futures and options, can also do so via the Huobi Token.

This is because the exchange offers its derivatives markets in Huobi-backed pairs – which makes them more accessible to users on a global scale. The Huobi Token is listed on dozens of exchanges – many of which are either based in or service Asian traders. As of writing, the Huobi Token is trading at a huge discount of 75% when compared to its 52-week highs.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

8. Ethereum – Large-Cap Project With Sizable Trading Volumes in China

Although NEO is a smart contract platform that was created in China, Ethereum still dominates this space – even domestically. In fact, behind Bitcoin, Ethereum is the most traded cryptocurrency in China. This speaks volumes for Ethereum’s status as the de-facto smart contract blockchain of choice.

This is fully supported by the numbers – Ethereum is home to thousands of ERC-20 tokens, many of which have since reached a market capitalization of over a billion dollars. Some of the largest and most-recognized projects opting to build their framework on top of the Ethereum blockchain include Decentraland, Shiba Inu, AAVE, Uniswap, and the Sandbox.

The ETH token is backed by the Ethereum blockchain and it is the second largest cryptocurrency globally in terms of valuation. Each and every ERC-20 token utilizing Ethereum must have its transaction fees paid in ETH, which ensures that the digital asset continues to remain in demand.

Ethereum is also in the process of upgrading to a new consensus mechanism – proof-of-stake. This will make its blockchain ecosystem a lot more efficient, not only in terms of energy consumption – but more scalable transactions and lower fees. Although the proof-of-stake migration has been in development for some years, completion is expected to take place at some point in 2022.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

9. OKB – Digital Asset Backed by the OKX Exchange

OKX is a crypto exchange that formally went under the name OKEx. The exchange was first launched in China, but it has since moved its operations overseas like most other domestic platforms in this space. OKX is a top-20 exchange in terms of trading volume and the vast bulk of its client base comes from Asia.

In addition to spot markets, OKX also offers crypto derivatives, such as perpetual swaps and futures contracts. OKX also has a cryptocurrency token – OKB, and it is a top-50 digital asset for market capitalization, as of writing. The OKB token initially launched in 2019 at a price of just over $1.60.

As of writing, OKB is trading at more than 1,000% higher than its original listing price. However, when compared to its all-time high of $42 – which was achieved in 2021, OKB is trading at a discount of 57%.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

10. Dogecoin – Greener Alternative for Chinese Miners

Although cryptocurrency mining is still prohibited in China, the country still has a major foothold in this space. However, many miners have since left Bitcoin and instead migrated to a greener alternative – Dogecoin. After all, this meme coin can be mined with less sophisticated hardware and with more conservative energy consumption levels.

With that being said, Dogecoin is also popular in China for speculative reasons. In addition to being endorsed by Elon Musk and Tesla, Dogecoin has a huge online following – especially from within the Reddit forum. As such, many argue that Dogecoin has every chance to recover from its prior all-time of $0.74 once the bear market concludes.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

History of China Crypto

The story of China’s relationship with cryptocurrency and blockchain technology has been somewhat of a rollercoaster ride, to say the least. During the initial years of this industry, China – at least in terms of its consumers, largely embraced cryptocurrency.

- For instance, one of the first crypto exchanges in this space was based in the country – BTC China.

- After that, the likes of OKX, Huobi, and subsequently Binance launched their own operations.

- China was also dominant in the cryptocurrency mining scene – especially in the case of Bitcoin. Moreover, back in 2013,

- China’s leading search engine provider – Baidu, even began accepting payment in Bitcoin.

However, it was in 2017 that the Chinese government decided it was time to step in.

First, the government officially banned initial coin offerings (ICOs) in late 2017, in response to the many billions of dollars being raised by new and up-and-coming projects.

Then, in 2021, the Chinese government stepped up its efforts to ban domestic cryptocurrency mining operations. With that being said, even with the government’s anti-cryptocurrency stance, China is still home to some of the largest trading volumes globally.

Moreover, as this guide has discussed, some of the best China crypto projects are still going strong – even if they have been forced to move their operations overseas. This includes the likes of Binance, OKX, Huobi, and NEO.

China Crypto Regulation News

In recent news Chinese crypto firms are increasingly setting up operations in Singapore where the regulatory climate is more positive and Mandarin is widely spoken.

The city-state’s central bank the Monetary Authority of Singapore (MAS) has stated Singapore aims to become the leading tech-driven financial center in Asia, and welcomes Chinese companies.

See our guide to buying Bitcoin in Singapore.

Is Chinese Cryptocurrency a Good Investment?

Those wondering whether or not to invest in the best China cryptocurrency to buy discussed today should remember that in-depth research is crucial.

Nonetheless, below we discuss some of the main benefits of choosing to invest in Chinese crypto coins.

Huge Consumer Market

Perhaps the most obvious benefit of building a portfolio of the best China crypto projects is that the country is home to a huge consumer marketplace of more than 1.4 billion people.

This means that should a particular project become endorsed by the government, this could open up significant revenues for the digital asset in question.

Digital Yuan

On the flip side, since the launch of the Digital Yuan – which is backed by the Chinese central bank, the opportunity for domestic cryptocurrency projects to succeed is now somewhat limited.

The Digital Yuan is essentially a tokenized version of its domestic currency and permits cashless payments. Trials across several Chinese cities have been conducted, with billions of dollars worth of tokens changing hands.

International Crypto Still Dominates

Another thing to remember is that the Chinese consumer market is still more interested in non-domestic projects. For example, the two most traded digital assets in Chiba are Bitcoin and Ethereum – and by considerable amounts.

This offers the domestic market to hedge against the ever-fluctuating yuan.

Consider Presales

Rather than investing in the best China crypto projects discussed today, it might be worth exploring whether any notable presales are available. This offers the opportunity to buy a newly launched cryptocurrency before it is listed on a public exchange.

And, by investing early, presales offer a lower price point when compared to the main launch. Battle Infinity is one such option, with the 90-day presale already campaign already selling more than 50% of its token.

Tamadoge is already proving popular and is also running a $100,000 TAMA token giveaway that promises to be one of the biggest and best airdrops of the year.

How to Buy Crypto in China

This section of our guide will explain how to buy crypto in China.

For this walkthrough, we will explain the process involved to invest in the Tamadoge (TAMA) presale.

How to Buy Tamadoge Crypto Tutorial

Here we go through every step on how to set up a wallet and then buy Tamadoge with Ethereum:

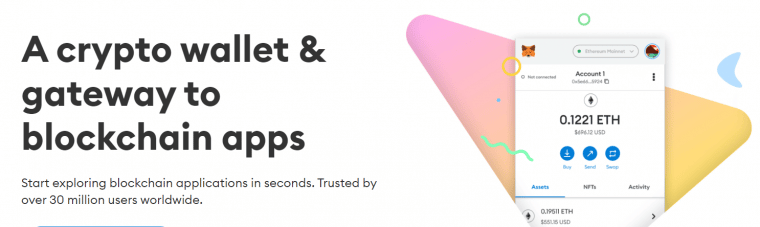

Step 1 – Set Up your Crypto Wallet

Those looking to buy Tamadoge crypto must first set up a crypto wallet. Many of the best crypto wallets are free and easy to use, although we recommend using MetaMask, due to its multi-chain support.

Head to the MetaMask website, click ‘Download’, and follow the on-screen instructions to set up the wallet.

Step 2 – Acquire ETH or USDT

It is also possible to buy Ethereum or USDT using a respected crypto exchange or broker such as eToro, although you will then have to transfer from that platform to your metamask wallet.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

Step 3 – Link Wallet to Tamadoge Presale Platform

Head over to Tamadoge’s website and click ‘Buy’, then on the following page, click ‘Connect Wallet’, choose your wallet provider – in this case MetaMask – and follow the instructions to complete the connection.

Step 4 – Buy Tamadoge

Enter the amount of Tamadoge tokens you’d like to purchase (minimum 1,000) and click ‘Convert ETH’ or ‘Convert USDT’, depending on which currency you hold in your wallet.

A pop-up will then appear asking you to confirm the transaction.

Step 5 – Claim Tamadoge Tokens

The final step is to claim your TAMA coins. You can do this once the presale has concluded by clicking ‘Claim’ on the Tamadoge website’s homepage.

Conclusion

Although China has banned many crypto-centric activities in its domestic market, the country still plays a major role in the space.

As this guide has discussed, some of the best China cryptocurrency to invest in are BNB, NEO, and Huobi Token, which are still going strong, albeit, in an overseas capacity.

The Chinese government has since launched its own crypto asset – the Digital Yuan. This will likely cripple many blockchain startups based in China.

Nonetheless, Chinese investors have an alternative in the form of crypto presales. Both Tamadoge and Battle Infinity are currently building exciting ecosystems that include token and NFT ownership and P2E gaming.

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption

Battle Infinity - New Metaverse Game

- Listed on PancakeSwap and LBank - battleinfinity.io

- Fantasy Sports Themed Games

- Play to Earn Utility - IBAT Rewards Token

- Powered By Unreal Engine

- Solid Proof Audited, CoinSniper Verified