Coinbase is one of the largest crypto exchanges for buying, selling and trading digital assets. However, users can access the best Coinbase alternatives by comparing the other options based on their tradable assets, price structure and regulations.

This guide reviews and compares the best alternatives to Coinbase in 2023.

The 7 Best Coinbase Alternatives for 2023

In the table below, we have listed some of the best Coinbase alternatives to use in 2023.

- eToro – Best Coinbase Alternative

- Crypto.com – Stake Cryptos to Earn Interest

- Bitstamp – Advanced Trading Platform

- Binance – Invest in More than 600 Cryptocurrencies

- Kraken – Crypto Trading for Beginners & Advanced Traders

- Gemini – Store Crypto Safely

- CEX.io – CFD Broker to Invest in Cryptos

Cryptoassets are a highly volatile unregulated investment product.

The Best Coinbase Alternatives Reviewed

Before choosing the best Coinbase alternative, users may want to review the different crypto exchanges to find a suitable platform to begin trading cryptocurrencies with.

In the sections below, we review the best alternatives to Coinbase.

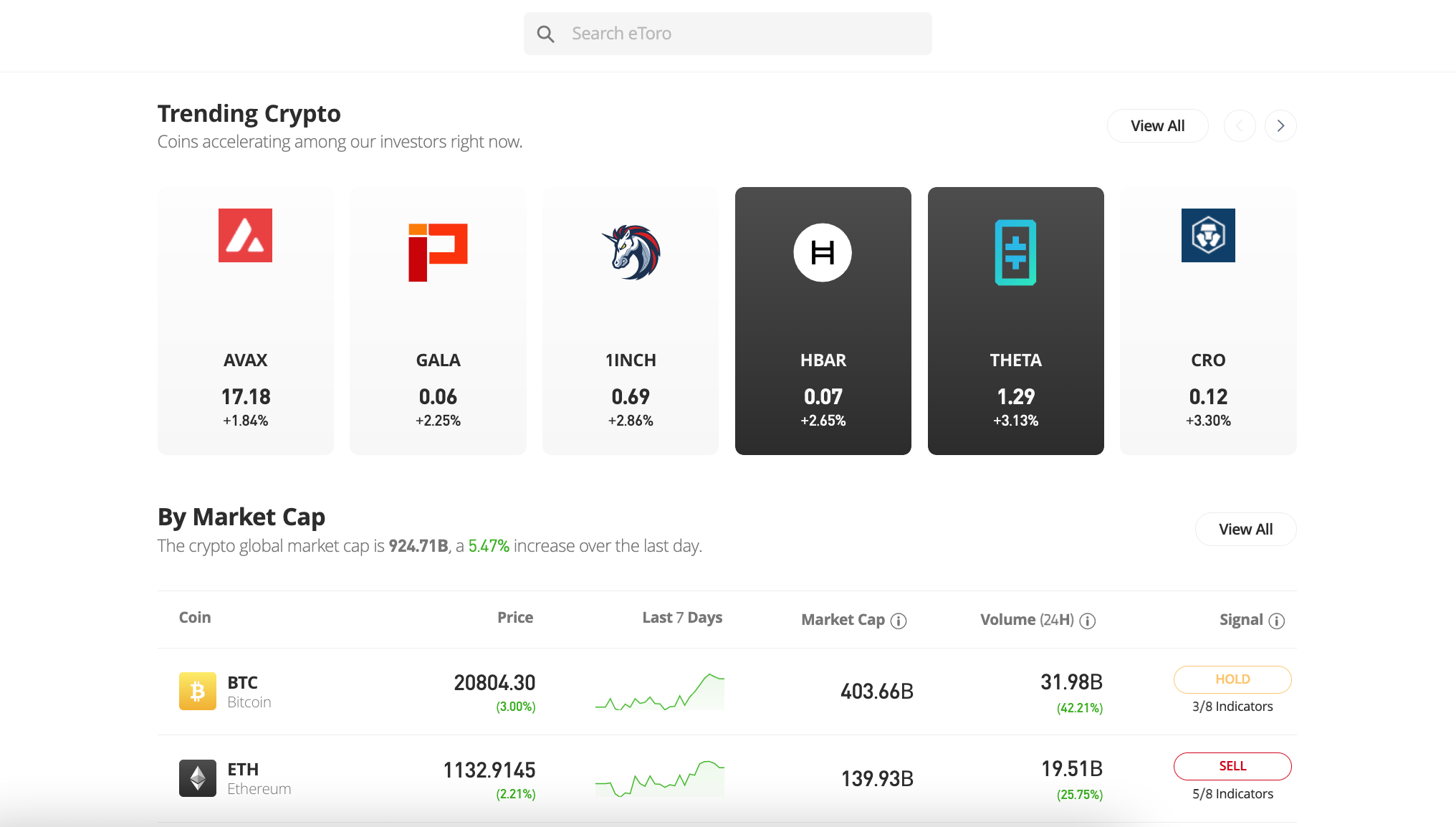

1. eToro – Best alternative to Coinbase

With over 27 million users from over 140 countries, eToro is the best alternative to Coinbase. This crypto trading platform

Users can invest in the best meme coins and buy Dogecoin and other popular assets in this field. Furthermore, investors can diversify their portfolios by investing in DeFi assets and Metaverse-based digital currencies.

To get started, users must make a minimum deposit of only $10 (U.S and UK). Additionally, eToro supports multiple payment options, including debit/credit cards, bank transfers and e-wallets like PayPal, Neteller and Skrill.

As a social trading platform, eToro provides users with multiple tools and features to help support crypto trades. One such feature is the copy trading Crypto Portfolio – a bundle of various cryptos that cater to a particular field within the digital assets category.

For example, Big Crypto is a crypto portfolio containing the largest cryptocurrencies per market cap. With the CopyTrading feature, users can copy the exact trades of skilled and advanced traders on the platform.

eToro provides a “Crypto Focused” option, letting users discover various crypto traders to copy.

Regarding fees, eToro charges a commission of 1% per transaction along with a bid/ask spread fee. Users can access all the eToro web services via the eToro mobile app as well – available on Android and iOS.

Furthermore, eToro provides a digital wallet, allowing users to store all digital assets with a private key safely. A global brokerage, eToro is registered with top-tier regulatory bodies like the FCA, FINRA, CySEC and ASIC.

What We Like

- Multiple investment opportunities

- Good user-interface

- CopyTrading tools for beginners

- Well-regulated crypto exchange

- Low minimum deposit of $20 (In U.S and UK)

| Crypto Exchange | eToro | Coinbase |

| Cryptos Available | 73 | 100 + |

| Pricing Structure | Commission fee + bid/ask spread | Commission fee + maker/taker fee |

| Price for Buying BTC | 1% + bid/ask | 1.49% + 0.50% |

| Digital Wallet | Yes | Yes |

| Top 3 Features |

|

|

| Regulated? | Yes | Yes |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Crypto.com – Stake Cryptos to Earn Interest

Another Coinbase alternative for 2023 is Crypto.com. This crypto exchange provides multiple earning opportunities through its mobile-friendly application. With Crypto.com, users can invest in 250 + tradable assets instantly. Additionally, Crypto.com supports the staking of cryptos.

The Crypto.com earn feature lets users lock up their crypto holdings for a minimum of 3-months to earn interest in return. Depending on the user’s holdings, up to 12.5%, APY can be made by staking crypto assets.

Crypto.com lets users invest in CRO – the platform’s native token.

Users with a certain number of CRO holdings can earn 2% additional interest on stakings. When purchasing cryptocurrencies, Crypto.com charges a simple maker/taker fee – beginning at 0.40% per transaction.

However, payment options may lift the transaction costs. For example, buying crypto with credit cards adds a 2.99% transaction cost per transaction. Alternatively, users can take out a Crypto.com VISA card. This provides 5% to 8% cashback when purchasing digital assets on Crypto.com.

Crypto.com also provides credit and loans on cryptocurrencies, a feature that not all crypto exchanges possess. Furthermore, users can buy and sell NFTs with the Crypto.com NFT marketplace, accessible through the app. Users can read our how to invest in NFT tokens guide, to find out more about this diversification opportunity.

What We Like

- Stake Crypto assets

- 250 + tradable assets

- Hold CRO tokens to increase returns

- Earn cashback with Crypto.com VISA card

| Crypto Exchange | Crypto.com | Coinbase |

| Cryptos Available | 250+ | 100 + |

| Pricing Structure | Maker/taker fee | Commission fee + maker/taker fee |

| Price for Buying BTC | 0.40% | 1.49% + 0.50% |

| Digital Wallet | Yes | Yes |

| Top 3 Features |

|

|

| Regulation | Regulated globally | Regulated globally |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

3. BitStamp – Advanced Trading Platform

BitStamp is a popular cryptocurrency exchange that traders can choose as an alternative to Coinbase.

This platform caters to skilled traders looking for a more advanced platform to practice multiple charting options and trading strategies. The platform gives traders access to TradingView – an advanced screener that lets users apply hundreds of technical indicators to assist their trades.

By providing multiple API capabilities, BitStamp allows users to customise their suitable programmes and tailor them to an individual’s unique workflow. BitStamp has also installed a robust data encryption policy to ensure users’ assets are safely stored online.

Over 4 million users currently access 70 + cryptos with BitStamp. The crypto exchange charges a trading fee beginning at only 0.50% – when the 30-day trading volume is below $10,000.

However, payment methods are slightly hefty on BitStamp. A credit card fee of 8% is applied on small transactions, which reduces to 5% with an increase in trading volume.

What We Like

- Suitable for skilled traders

- Multiple technical indicators to assist day-trading

- Strong data encryption policies

- Low maker/taker fee (0.50%)

| Crypto Exchange | BitStamp | Coinbase |

| Cryptos Available | 70+ | 100 + |

| Pricing Structure | Maker/taker fee | Commission fee + maker/taker fee |

| Price for Buying BTC | Beginning at 0.50% | 1.49% + 0.50% |

| Digital Wallet | No | Yes |

| Top 3 Features |

|

|

| Regulation | Registered with the CSSF for AML supervision | Regulated globally |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

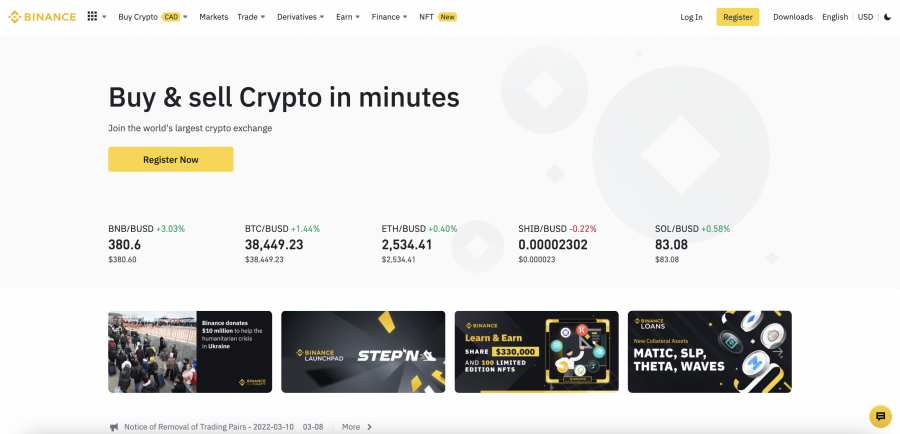

4. Binance – Invest in More Than 600 Cryptocurrencies

Binance is one of the best Coinbase alternatives in 2023 for users to look at. Read our Binance vs Coinbase review to find out more. In terms of daily trading volume, Binance attracts the most number of users among any crypto exchange.

Binance provides over 600 cryptocurrencies to trade – allowing users to buy Cardano and multiple other assets. Apart from trading, Binance lets users stake assets in exchange for interest. This crypto platform charges some of the lowest fees – taking a 0.1% maker/taker fee per transaction.

Users can decrease transaction costs by 25% if they hold a certain number of BNB – the platform’s native token. Binance is one of the few crypto exchanges that lets users apply leverage on trades. With leverage trading, investors can increase the value of their trade and stand a chance to earn more profits.

However, the chances of earning losses also increase when trading with leverage. Binance attracts users by providing referral programmes – letting current users earn commission by getting new users onto the exchange.

Finally, users can buy cryptos with credit cards or wire transfers. However, credit card purchases attract a further 4.5% fee per transaction.

What We Like

- High number of cryptos available

- Users can apply leverage on cryptos

- Users can earn income by staking and referring new users

- Low trading fee beginning at 0.1%

| Crypto Exchange | Binance | Coinbase |

| Cryptos Available | 600 + | 100 + |

| Pricing Structure | Maker/taker fee per transaction | Commission fee + maker/taker fee |

| Price for Buying BTC | Beginning at 0.1% | 1.49% + 0.50% |

| Digital Wallet | Yes | Yes |

| Top 3 Features |

|

|

| Regulation | Listed as a registered digital asset provider in some countries | Regulated globally |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. Kraken – Crypto Trading for Beginners & Advanced Traders

Kraken is yet another Coinbase alternative for users to review. The Kraken crypto exchange gives users 120 + crypto assets.

While the regular Kraken trading account will charge users a standard 1.5% trading fee for crypto assets and a 0.9% fee for stablecoins. The cheapest payment method is a bank transfer, which only costs 0.50% per transaction.

However, users may be charged an additional 3.75% when investing in cryptos with credit/debit cards or e-wallets.

With Kraken Pro, advanced traders can access active charts and advanced open order options on the mobile app and web interface. The Kraken Pro platform charges users a simple maker/taker fee per transaction.

If the 30-day trading volume is below $50,000 – users must pay a maker/taker fee of 0.16%/0.26% per transaction.

What We Like

- Two trading platforms for beginners and advanced traders

- Leverage & margin trading features

- Cheaper fees with Kraken Pro

- Multiple cryptos to invest in

| Crypto Exchange | Kraken | Coinbase |

| Cryptos Available | 120+ | 100 + |

| Pricing Structure | Trading fee for standard platform/ Maker/Taker model for Kraken Pro | Commission fee + maker/taker fee |

| Price for Buying BTC | 1.5% trading/ 0.16% and 0.26% maker/taker fee | 1.49% + 0.50% |

| Digital Wallet | Yes | Yes |

| Top 3 Features |

|

|

| Regulation | Regulated by FinCEN | Regulated globally |

6. Gemini – Store Crypto Safely

Gemini crypto exchange is one of the best Coinbase alternatives for users looking to begin trading in digital assets.

With the Gemini digital wallet, users can store all cryptos offline – which is only accessible by a private key that the user holds. Gemini keeps most of its assets in cold storage and prevents digital assets from hacking online. Furthermore, the platform prides itself on being one of the few platforms that have never been successfully hacked.

Gemini offers an active trader platform – which supports complex charts and technical indicators to assist day-traders and skilled investors. These tools can be accessed on the web and through the Gemini mobile app.

In terms of fees, Gemini offers a complex pricing structure. Trades under $200 are subject to a fixed fee. For example, users must pay between $0.99 to $2.99 on transactions under $200.

All transactions over this threshold are met with a 1.49% trading fee. Buying cryptos with debit cards is met with a high trading fee of 3.49% on Gemini.

What We Like

- Low fee under $200

- Offers 21 trading pairs to users

- Active Trader Platform to support complex trading charts

- Secure digital wallet

| Crypto Exchange | Gemini | Coinbase |

| Cryptos Available | 50 + | 100 + |

| Pricing Structure | Fixed cash fee under $200/ Trading fee over the $200 mark | Commission fee + maker/taker fee |

| Price for Buying BTC | $0.99 – $2.99 under $200 transactions/ 1.49% trading fee over $200 | 1.49% + 0.50% |

| Digital Wallet | Yes | Yes |

| Top 3 Features |

|

|

| Regulation | Regulated by NYDFS | Regulated globally |

7. CEX.io – CFD Broker to Invest in Cryptos

CEX.io is a cryptocurrency exchange platform based out of London, with over 4 million users.

Thus, users can access fiat-to-crypto transactions, purchasing cryptocurrency directly with GBP and USD. The platform also gives users access to CEX.io Broker – a more advanced marketplace to access advanced charts and carry out more trading types.

For example, users can apply up to 2x leverage on crypto transactions with CEX.io Broker. Since the CEX.io Broker platform is a CFD (contracts for Differences) brokerage, users can long and short crypto trades.

CEX.io charges a maker/taker model beginning at 0.15% and 0.25% simultaneously. When purchasing with VISA and MasterCard, a fee of 2.99% and a minimum deposit of $20 are applicable. However, users can deposit fiat currencies with a bank transfer and not pay any fees.

CEX.io is currently on the Financial Conduct Authority’s (FCA) temporary registration scheme, making it legally unauthorised to operate in the UK.

What We Like

- CFD broker that allows leverage trading

- Lets users buy crypto directly with fiat currency

- Regulated by the FCA

- Over 200 trading pairs

| Crypto Exchange | CEX.io | Coinbase |

| Cryptos Available | 110 + cryptos | 100 + |

| Pricing Structure | Maker/taker model | Commission fee + maker/taker fee |

| Price for Buying BTC | Beginning at 0.15%/0.25% per transaction | 1.49% + 0.50% |

| Digital Wallet | Yes | Yes |

| Top 3 Features |

|

|

| Regulation | Regulated by FCA | Regulated globally |

Best Coinbase Alternatives Compared

In the table below, we have compared the best Coinbase alternatives based on various factors including fees, pricing structure and more.

| Exchange | Cryptos | Pricing Structure | BTC Trading Fee | Digital Wallet | Top 3 Features | Regulation |

| Coinbase | 100+ | Commission fee + maker/taker fee | 1.49% + 0.50% | Yes |

|

Regulated globally |

| eToro | 73 | Commission fee +bid/ask spread | 1% + bid/ask spread | Yes |

|

Regulated globally |

| Crypto.com | 250+ | Maker/Taker fee | 0.40% | Yes |

|

Regulated globally |

| BitStamp | 70+ | Maker/Taker fee | O.50% | No |

|

Registered with the CSSF for AML supervision |

| Binance | 600+ | Maker/Taker fee | 0.1% | Yes |

|

Listed as a registered digital asset provider in some countries |

| Kraken | 120+ | Trading fee for standard account/ Maker/taker for PRO | 1.5%/ 0.16% + 0.26% maker-taker | Yes |

|

Regulated by FinCEN |

| Gemini | 50+ | Fixed fee/ trading fee over $200 | $0.99 - $2.99/ 1.49% | Yes |

|

Regulated by NYDFS |

| CEX.io | 110+ | Maker/Taker model | 0.15%/ 0.25% | Yes |

|

Regulated by FCA |

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Why Use a Coinbase Alternative? Coinbase Limitations

Despite being one of the biggest crypto exchanges, Coinbase does have certain limitations that may affect investors' trades. In the sections below, we discuss some factors that affect a user’s investing strategy, which is not the case with cryptocurrencies on Uniswap.

High Card Transaction Fees

When trading with Coinbase, users may be required to pay a fee of 3.99% per transaction with credit or debit cards. This cost significantly increases the transaction costs when purchasing cryptocurrencies.

On the other hand, eToro does not charge any deposit fees when using credit cards. Users may only be required to pay a fee to their local banks or third-party payment system. Thus, eToro is one of the best Coinbase alternatives which users can look at.

Tradable Assets

Coinbase offers over 100 cryptocurrencies to trade, which can increase to more than 250 with their Pro platform. However, users may need to pay higher platform fees with the Pro version.

On the other hand, Binance may be a suitable opportunity for users looking to diversify their portfolios. The platform offers over 600+ tradable assets, the most assets offered among the top crypto exchanges we have listed.

Complex Trading Fee

With Coinbase, crypto users is required to pay a trading fee, a maker/taker fee and a fee on payment methods when applied. For example, users must pay a 1.49% trading fee and maker/taker fee beginning at 0.5% per transaction. A credit card payment will cost a further 3.99%.

On the other hand, platforms like Crypto.com charge a simple maker/taker fee beginning at 0.4% per transaction. Furthermore, with the Crypto.com VISA card, users can earn cashback while purchasing crypto.

Few Tools & Features for Beginners

While Coinbase provides a mobile app and digital wallet, the platform does not directly offer any special tools for beginners to take advantage of. On the other hand, platforms like eToro provide ready-made portfolios that bundle together various cryptos.

With the CopyTrading tool, users can even copy the exact trades of crypto traders on eToro. This can be a suitable option for investors looking for external help when building a portfolio.

Cryptoassets are a highly volatile unregulated investment product.

Staking Fees

While users can stake crypto assets to earn interest with Coinbase, this attracts very high fees. There is a 25% staking fee on cryptos with Coinbase, which may detract some users from using this service.

A popular Coinbase alternative for staking is Binance since it does not charge any staking fees.

Conclusion

This article has reviewed some of the best alternatives to Coinbase in 2023. While Coinbase is a top-quality crypto exchange, high fees on credit cards and a lack of multiple trading tools for beginners may prevent users from accessing certain features.

We recommend eToro as the best alternative to Coinbase in 2023. This crypto exchange provides low fees when trading cryptos and even offers debit card deposits free of charge. Use the link below to access multiple crypto bundles and tools to begin trading cryptocurrencies quickly.

Cryptoassets are a highly volatile unregulated investment product.