Decentralized autonomous organizations – DAOs – are one of the most exciting concepts that have been borne out of the cryptocurrency market. These organizations are not controlled by a centralized authority and are instead governed by community members – allowing investors to have a say in the project’s direction.

This article will discuss several of the best DAO crypto projects in operation right now before highlighting how these projects work and why investors are often interested to get involved with them.

The Best Crypto DAO Projects for 2023

Listed below are ten of the best DAO crypto projects this year, derived through extensive research and analysis. Later in this article, we’ll explore each of these projects in great detail:

- RobotEra – Overall Best DAO Project to Invest in 2023

- Calvaria – P2E and F2P GameFi Project with DAO Governance

- Tamadoge – Meme Token DAO project

- Battle Infinity – New Crypto DAO Project for 2023

- Lucky Block (LBLOCK) – Exciting Competitions and Prizes Project

- Uniswap (UNI) – Leading DeFi Protocol With Over $5.5 billion in TVL

- Compound (COMP) – Popular Crypto Lending DAO Trading at a Discount

- Aave (AAVE) – One of the Best DAO Crypto Projects for Long-Term Potential

- DeFi Coin (DEFC) – New DAO Project with Passive Income Potential

- Curve (CRV) – Ethereum-based DeFi Protocol for Stablecoins

- ApeCoin (APE) – Best ‘Meme Coin’ DAO

- Illuvium (ILV) – Upcoming NFT Gaming Project with DAO Governance

- Dash (DASH) – Innovative ‘Privacy Coin’ Set for a Rebound

- SushiSwap (SUSHI) – Beginner-Friendly DEX Set to Transition to a DAO

A Closer Look at the Top Crypto DAO Projects

Many of the most undervalued cryptos fall into the category of DAO projects, as these entities are still not fully understood by a large percentage of investors. With that in mind, let’s dive in and explore the crypto DAO entities listed above:

1. RobotEra – Overall Best DAO Project to Invest in 2023

Aiming to be a Sandbox-like metaverse gaming project, RobotEra leverages TARO as its native cryptocurrency, with the ERC-20 token allowing investors to access the RobotEra DAO and various other resources on the metaverse.

TARO is currently available to purchase during the first round of a three-stage presale and, built on the Ethereum blockchain, is an ERC-20 token with a fixed supply of 1.8 billion.

The token can be used on the RobotEra marketplace to purchase Robot NFTs, which makes it our top pick for best NFT games.

Robot NFTs are users’ in-game 3D avatars that exist on the ‘Taro Planet’ – RobotEra’s virtual metaverse world. Players can also buy Land on 7 continents within the Taro Planet, which are also minted as NFTs.

The RobotEra whitepaper states that the platform will eventually launch its decentralized autonomous organization – which can be accessed by staking TARO tokens.

The DAO will grant voting and decision-making rights to control various aspects of the Taro Planet. Since Robots in the game are divided into various factions – DAO members can vote and suggest implementation strategies for their particular factions.

Players are also able to stake their TARO and use it to buy metaverse plots of land, which can be built upon and monetized in a variety of ways, including by mining for resources, charging admission to events and concerts and selling billboard space to advertisers.

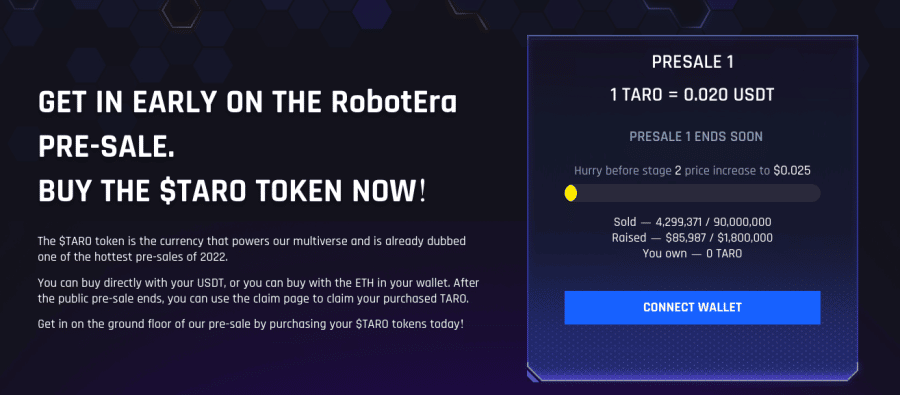

To join this new DAO project, investors can buy TARO on presale now – the ongoing first presale stage is allocating 90 million tokens for $0.02.

The price of TARO will increase as the stages progress, with stage 2 tokens to sell for $0.025 and the third and final stage for $0.032 – a 60% increase.

There will be a hard cap of $6.93 million for the 270 million presale tokens (which is 15% of the max supply) and no vesting period.

Interested readers can join the RobotEra Telegram Channel to keep track of the project’s developments.

| Presale Started | Q4 2022 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | 1,000 TARO |

| Max Investment | N/A |

2. Calvaria – P2E and F2P GameFi Project with DAO Governance

The project is now in stage 4 of its presale with nearly $2 million of investment is secured and RIA tokens selling for $0.025 – by the tenth and final stage, RIA will be on sale for $0.055, a 120% increase from the current price.

Calvaria wants to drive the adoption of casual and traditional gamers to the blockchain by solving two major issues with Duels of Eternity – prohibitive costs and lack of knowledge of the blockchain.

It will do that by offering a completely free version of the game, where players are not rewarded with tokens for their wins and do not own the NFTs, like in the P2E version.

However, Calvaria believes the game itself will be enough to entice players over. The F2P version will feature a visible tracker to show much much players could have earned in the P2E version, as well as gamified quests to teach players about the blockchain.

Duels of Eternity is a card-battle strategy game set in the afterlife which sees players align with one of three factions that have different traits and strengths.

They then stack their decks and use knowledge, skill and other in-game assets, such as upgrades or boosters, to win one vs one matches.

Unlike its closest rivals the game is in 3D and available on mobile and also features a single-player campaign mode.

Calvaria, which has a doxxed and KYC-verified team, is set to adopt a seasonal approach – like Fortnite or Apex Legends – to ensure the long-term growth of the game.

During the presale, investors can buy the RIA token to stake and also be part of the DAO. Another token, eRIA, will be used to distribute rewards for individual matches and larger tournaments.

For more information read the Calvaria whitepaper or join the Telegram group.

Calvaria Presale Overview

There will be 300M tokens available for the presale (30% of the supply). Here is a full breakdown of the Calvaria presale stages:

Total Supply: 1 Billion RIA

Presale: 300 Million RIA

| Stage 1 | 1 USDT = 100 RIA | Price: $0.01 |

| Stage 2 | 1 USDT = 66.67 RIA | Price: $0.015 |

| Stage 3 | 1 USDT = 50 RIA | Price: $0.02 |

| Stage 4 | 1 USDT = 40 RIA | Price: $0.025 |

| Stage 5 | 1 USDT = 33.33 RIA | Price: $0.03 |

| Stage 6 | 1 USDT = 28.57 RIA | Price: $0.035 |

| Stage 7 | 1 USDT = 25 RIA | Price: $0.04 |

| Stage 8 | 1 USDT = 22.22 RIA | Price: $0.045 |

| Stage 9 | 1 USDT = 20 RIA | Price: $0.05 |

| Stage 10 | 1 USDT = 18.18 RIA | Price: $0.055 |

3. Tamadoge – Upcoming Meme Token DAO project

Tamadoge, the native cryptocurrency of the Tamaverse, is a project that launched earlier this year to huge hype as the latest high-potential ‘Doge’ themed meme coin.

However, while cryptos like Dogecoin gained popularity due to their social media backing via influential celebrities, Tamadoge is providing a multi-utility token and play-to-earn (P2E) platform on the blockchain.

Players compete on this P2E platform for potential earnings from a prize pool – which are rewarded as TAMA tokens. Users are meant to create, breed and trade pet dogs, known as Tamadoge pets.

Each pet is minted as an NFT via smart contracts and offers their unique characteristics, advantages and weaknesses. The goal is to build up these Doge pets and make them competitive to earn points on a monthly leaderboard.

The Tamadoge pets are purchased from the Tama Store, where users can also buy tokenized items such as pet foods to use in the ecosystem.

Unlike many of the top meme coins, Tamadoge is a deflationary asset with a max supply of 2 billion tokens – TAMA does this by burning 5% of all tokens that are spent on transactions.

Thus, this can potentially make TAMA more valuable in the long term, as users are bidding on limited assets with multiple use-cases.

TAMA completed a successful presale campaign – raising $19 million. After the presale ended, the token was listed on OKX with the token reaching an all-time high (ATH) of over $0.19.

CoinSniper has verified this Metaverse project, and Solid Proof has completed an audit.

While the price of the coin has retraced, it now offers a low entry point for a high-potential project that should recover when market conditions improve.

4. Battle Infinity – Overall Best Crypto DAO Project for 2023

We recommend Battle Infinity as another of the best crypto DAO projects for 2023. Battle Infinity looks to combine Play-to-Earn (P2E) gaming with Web 3.0 technology by developing a metaverse-based game (Battle Arena) using blockchain technology. Battle Infinity provides users with a decentralized platform that provide users with a gaming ecosystem that can be used to play, earn and create items in a virtual environment.

With the Battle Infinity Battle Arena, users can participate in 6 P2E gaming environments. Among the available protocols are the IBAT Battle Games feature – which lets participants access multiple NFT games and play to earn rewards.

The IBAT coin functions as the utility token of this metaverse platform. Users need to stake an amount of IBAT to take part in the Battle Stake, with the potential to earn, build and create more NFTs, which can be converted into IBAT rewards.

In order to promote liquidity on the platform, 10% of staked tokens are used as transaction fees, out of which 50% are transferred into a global liquidity pool. This pool of assets can also be accessed to deploy rewards to gaming participants, transfer IBAT with other cryptos and earn interest by locking up digital assets for a certain period.

IBAT tokens are created on the Binance Smart Chain and are gearing up for a smart contract mainnet deployment as part of phase 3 of the platform’s roadmap. Users can follow the Battle Infinity Telegram Group to stay up to date with all the new developments and updates on this new metaverse project.

The presale for IBAT tokens sold out early, less than a month into the 90 day presale, however investors will be able to buy IBAT when its listed on PancakeSwap.

5. Lucky Block (LBLOCK) – Exciting Competitions and Prizes Project

Lucky Block is built on the Binance Smart Chain (BSC), ensuring that the platform is entirely decentralized. Prizes are distributed in LBLOCK, Lucky Block’s native token, meaning winners can instantly receive their winnings. Furthermore, since prize draw tickets are also denominated in LBLOCK, there’s no need for FIAT currency whatsoever.

Although Lucky Block does have a designated development team, the platform has many similarities to crypto DAO entities, such as allowing community members to become part of the project. This is achieved through Lucky Block’s Telegram group, which now contains over 47,000 members. There’s also a dedicated Lucky Block subreddit where members of the dev team remain active.

Lucky Block’s inaugural prize draws are set to commence on May 31st 2022, with the jackpot pool totalling $2 million. Half of that will be awarded in the main draw, $1 million, and investors who purchased Lucky Block NFTs will be entered into a separate prize draw for the chance to also win $1 million.

As Lucky Block acts in a decentralized manner, winners will be chosen through Chainlink’s VRF service and will be fully transparent to other community members.

Finally, the launch of Lucky Block’s games will also mark the beginning of regular income payments to LBLOCK holders. This is achieved since 10% of each jackpot pool is distributed to investors who hold LBLOCK in their connected crypto wallet. All in all, these characteristics mean that Lucky Block tops our DAO crypto list for 2023.

Cryptoassets are a highly volatile unregulated investment product.

6. Uniswap (UNI) – Leading DeFi Protocol With Over $5.5 billion in TVL

Uniswap uses ‘liquidity pools’, which remove the traditional order book from the equation. Anyone can place their idle ERC-20 tokens into Uniswap’s liquidity pools and generate a yield in return. Returns will vary depending on the token, although they tend to be far higher than those offered in traditional savings accounts.

Due to its popularity, Uniswap has become one of the most widely-used DeFi protocols globally. Many investors opt to invest in UNI, the protocol’s native token, simply to gain exposure to its growth. Due to this, Uniswap retains the second spot on our DAO crypto list.

Cryptoassets are a highly volatile unregulated investment product.

7. Compound (COMP) – Popular Crypto Lending DAO Trading at a Discount

For example, if you were to deposit USD Coin (USDC), you would receive regular income payments in that currency. On the other hand, Compound also lets people borrow crypto, too. Since the entire process is decentralized, Compound requires no credit checks from borrowers, and the whole process is anonymous.

Compound’s native token is COMP, with tokens given to all members of the ecosystem every day. Each token represents one vote, which is essential when debating governance proposals. Finally, this DAO crypto price is now down 93% from all-time highs – with many believing that it is trading well below its intrinsic value.

Cryptoassets are a highly volatile unregulated investment product.

8. Aave (AAVE) – One of the Best DAO Crypto Projects for Long-Term Potential

Many investors tout Aave as one of the best DeFi coins on the market, as the token surged by over 2,300% in early 2021. Although AAVE is now trading around 84% below May 2021’s all-time highs, much of this has been down to the overall bearish sentiment within the market.

As with other DAOs, holders of the AAVE token can have a real say in the protocol’s governance. These include how Treasury funds are used and potential upgrades to the system. Furthermore, AAVE can be used as collateral within the ecosystem, significantly reducing fees.

Cryptoassets are a highly volatile unregulated investment product.

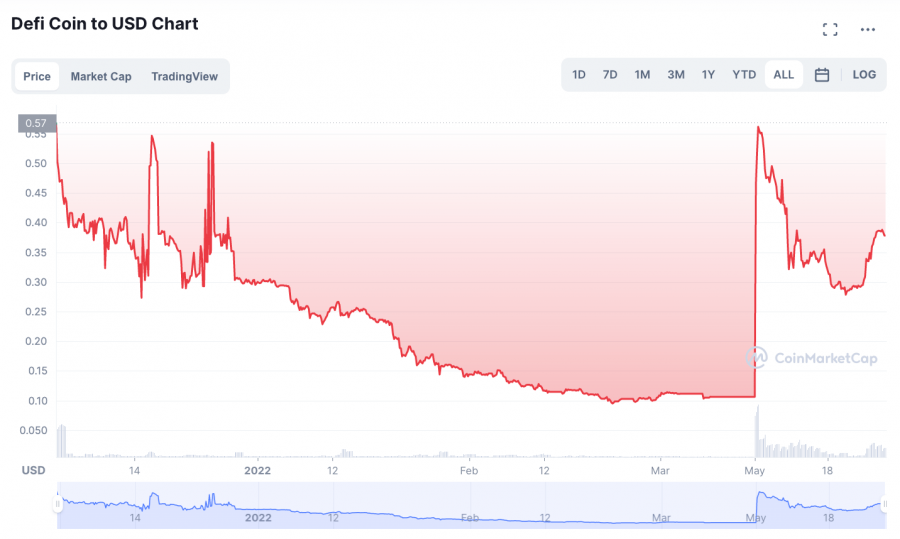

9. DeFi Coin (DEFC) – New DAO Project with Passive Income Potential

DEFC plays a crucial role in the DeFi Swap ecosystem and can be used as a medium of exchange when token swapping. Since DeFi Swap operates much like a DAO, investors can stake DEFC and receive interest – with yields reaching as high as 75% per year for 365-day lock-up periods. However, there are also additional ‘tiers’ for investors who seek more flexibility, although yields remain higher than average.

Another reason DeFi Coin has emerged as one of the best DEX coins is that token holders will be able to generate a passive income stream through the project’s ‘static rewards’ mechanism. These rewards are funded through a 10% tax levied whenever an investor buys or sells DeFi Coin. Ultimately, the combination of passive income and high yields ensures that DeFi Coin is one of the best DAO projects to launch this year.

Cryptoassets are a highly volatile unregulated investment product.

10. Curve (CRV) – Ethereum-based DeFi Protocol for Stablecoins

According to the Curve.fi website, over 70 liquidity pools are available where users can deposit their idle holdings and generate a yield. Yields tend to be based on supply and demand, although certain pools offer APYs of over 30%.

The Curve protocol is governed by CurveDAO, which helps organize the smooth facilitation of the protocol’s services. Curve’s governance token, CRV, is distributed to liquidity providers regularly as a sort of ‘thank you’ for contributing to the system. As such, those investors who have a stake in the system are the ones who can ultimately influence governance.

Cryptoassets are a highly volatile unregulated investment product.

11. ApeCoin (APE) – Best ‘Meme Coin’ DAO

Although ApeCoin wasn’t actually created by Yuga Labs, the team behind BAYC, it has become intrinsically linked with the collection as NFT holders were given tokens for free via an airdrop. What’s more, ApeCoin has become the native token of ‘The Otherside’, which is Yuga Labs’ upcoming metaverse project.

Interestingly, the ApeCoin community governs itself as a DAO, which means that the community decides how Treasury funds are spent. Everyone who holds APE is automatically part of the DAO, with the ApeCoin website having a dedicated ‘Proposals’ section where people can vote on various ideas. In addition, as noted in our ApeCoin price prediction, the token also has exceptional speculative potential due to its backing on social media.

Cryptoassets are a highly volatile unregulated investment product.

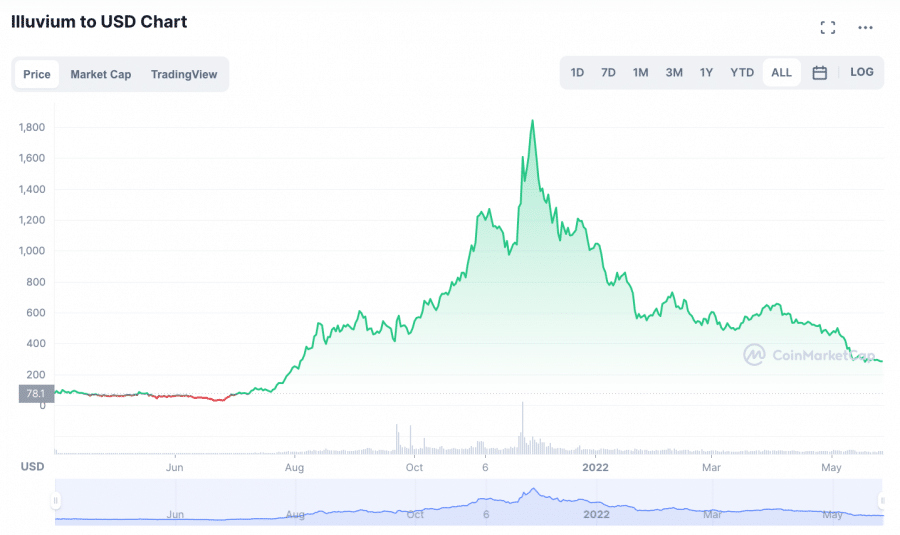

12. Illuvium (ILV) – Upcoming NFT Gaming Project with DAO Governance

Players can capture in-game monsters called ‘Illuvials’, which are structured as NFTs. These Illuvials can be used in player-vs-player (PvP) combat to earn ETH or traded on the game’s native marketplace. As such, Illuvial taps into the burgeoning play-to-earn (P2E) gaming space.

ILV is Illuvial’s native ERC-20 token, which is used to govern the DAO. Interestingly, Illuvial’s DAO has an ‘Illuvinati Council’, which is a designated management team that is voted on by community members. As such, Illuvium uses an exciting combination of centralized and decentralized mechanisms to ensure the game runs smoothly for all players.

Cryptoassets are a highly volatile unregulated investment product.

13. Dash (DASH) – Innovative ‘Privacy Coin’ Set for a Rebound

Dash works similarly to Bitcoin, except it has a built-in ‘InstantSend’ feature that means transactions can be confirmed in under two seconds. This is in stark contrast to Bitcoin, which can take around 10 minutes to confirm a transaction. Furthermore, Dash also employs a valuable mechanism whereby transactions are mixed in with others, making it nearly impossible to link a specific transaction to a particular wallet.

The DASH DAO crypto price has been pretty volatile over the past year and is trading around 86% below all-time highs. However, this is a trend that we see with many other altcoins, mainly due to the ‘risk-off’ sentiment within the market at present. That being said, Dash still has valuable real-world use cases which could help it bounce back in the future.

Cryptoassets are a highly volatile unregulated investment product.

14. SushiSwap (SUSHI) – Beginner-Friendly DEX Set to Transition to a DAO

SushiSwap has had a chequered history, most notably because the platform’s creator sold a tremendous amount of SUSHI, SushiSwap’s native token, which spooked investors and caused the price to sink. However, the platform has regained a solid following since then and offers a beginner-friendly way to enter the DeFi sector.

Users can swap tokens and participate in yield farming, which is the process of pledging your tokens to the platform and receiving a portion of accumulated transaction fees in return. SushiSwap also enables users to stake SUSHI for appealing yields. Notably, SushiSwap isn’t entirely a DAO yet, although a proposal has been put forward to make this transition – which could happen in the coming months.

Cryptoassets are a highly volatile unregulated investment product.

What is a DAO in Crypto?

The meaning of DAO in crypto is ‘decentralized autonomous organization’ – a blockchain-based entity where control is spread out across community members rather than one specific person or team. These organizations are in stark contrast to corporate entities, which are typically governed by a CEO and a management team.

Since control is spread out, the network’s community members have a real say in how the organization works. Governance is usually handled through voting mechanisms since DAOs will have a native token that essentially gives the owner a ‘stake’ in the organization. Elements that are voted on tend to include allocation of funds, upgrades to the network, and marketing decisions.

There are many advantages to operating as a DAO, with transparency being one of the main ones. Those who invest in cryptocurrency will know that transparency is hugely important since many crypto projects have sprung up with shady intentions. However, everything that happens within a DAO is publicly viewable, and no one entity can influence decisions.

Furthermore, DAOs help create thriving communities of like-minded people who can come together to reach a common goal. They also remove geographical barriers to entry, meaning anyone can purchase tokens and participate in governance. As such, many of the best DeFi apps are now being structured as DAOs to take advantage of these benefits.

How do Crypto DAO Projects Work?

So, how do these organizations actually work? As touched on above, since the project’s direction is decided on by the entire community, rather than one person, voting plays a crucial role in moving a DAO forward. DAOs tend to be built using smart contracts, ensuring that the organization remains decentralized.

The specific way that a DAO will function can vary, although most will allow token holders to vote on proposals put forward by community members. Certain DAOs will place greater emphasis on votes made by investors who hold vast amounts of tokens, which can be seen as both a positive and a negative. Given that everyone has a chance to participate, the process of making changes within the organization can be lengthy.

In terms of funding, this usually comes through making the DAOs native token available to purchase by the broader investment community. For example, although many people opt to buy Aave to become part of the community, some may wish to invest in the token for speculative purposes. Either way, the DAO will receive income through selling these tokens, helping fill up the Treasury and enabling changes to be made.

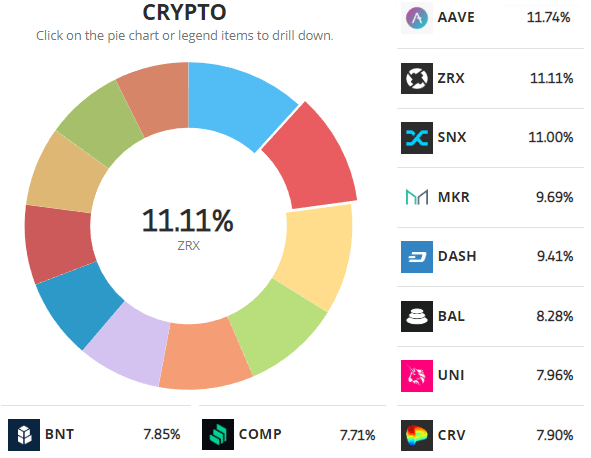

Update – eToro launched a DAO portfolio June 1st 2022, covering many of the DeFi coins we listed above and others such as 0x (ZRX).

Cryptoassets are a highly volatile unregulated investment product.

Why Invest in DAO Crypto Projects?

DAO projects have garnered a great deal of attention from the mainstream media, with high-profile outlets such as The New York Times even running articles on these entities. Given their dramatic rise in popularity, DAOs have naturally become a target for speculative investors.

With that in mind, presented below are three of the main reasons why people opt to invest in the best DAO crypto projects:

Impact on Governance

As expected, the main reason people invest in these projects is to have a tangible impact on a project’s governance. This cannot be achieved with centralized projects, as a specified development team governs these. Although the community can still offer feedback, there’s no guarantee the feedback will be acted on.

This isn’t the case with DAOs, as community members can make proposals at any time and put these proposals to a vote. If a submission is voted down, it’s usually viewed as a good thing since it highlights that most community members do not want the mooted change.

Fully Decentralized

Much like the best DeFi exchanges, DAOs are fully decentralized and tend to be run through the use of smart contracts. These smart contracts remove the need for a middleman and allow tasks to be completed automatically.

There are numerous benefits to decentralization, such as transparency which dramatically reduces (or removes) the chance that fraud could occur. DAOs are not influenced by governments either, thereby maintaining their integrity. It’s a lot like open source crypto.

Access to the DeFi Sector

Finally, a large percentage of DAOs operate within the scope of the DeFi sector, which provides a realm of opportunities for yield generation. According to Yahoo Finance, the DeFi market surpassed a $100 billion valuation in February 2022, which equated to 47% growth from the previous year.

This trend shows no signs of stopping, as more and more investors are growing tired of the low-yield options offered by traditional banking institutions. Token swapping, staking, and liquidity pools are just some of the services provided by DAOs that operate within the DeFi sector, with more being added regularly. Due to this, we’ll likely see a more significant number of investors move their capital to this area of the market – making DAOs an appealing investment opportunity.

Best DAO Crypto Projects – Conclusion

In summary, this article has taken a detailed look at the best DAO crypto projects currently available, exploring why they are so popular and how they could shape various industries in the months and years ahead.

We included some brand-new crypto projects including RobotEra, which is an upcoming metaverse game that leverages the TARO token to control the in-game economy.

With TARO, users can access the decentralized autonomous organization of RobotEra, earn passive income and earn rewards – TARO is currently available to buy during the first stage of its presale for $0.02.

RobotEra - Next Big Metaverse Game

- Backed by LBank Labs

- Buy, Trade and Develop NFT Land

- Doxxed Professional Team

- TARO Token on Presale Now - robotera.io