Crypto ETFs offer exposure to digital currencies via traditional investment vehicles. The vast majority of ETFs in this space are backed by futures contracts, albeit, several funds outside of the US can be physically backed by Bitcoin and other cryptocurrencies.

In this comparison guide, we explore the 10 best crypto ETFs for low fees, minimum capital outlay, performance, and more.

The list below offers insight into the 10 best crypto ETFs in the market today. Read on to find out more about the above funds found on the above cryptocurrency ETF list.10 Best Crypto ETFs to Invest in 2023 – Crypto ETF List

Check Out the Dash 2 Trade Presale Launch

A Closer Look at the Best Crypto ETFs

Crypto ETFs enable investors to gain exposure to Bitcoin and other digital assets through a traditional brokerage account. This means that investors do not need to utilize a conventional crypto exchange to speculate on the future value of crypto assets.

Below, we review and analyze the 10 best crypto ETF providers in the space right now.

1. Dash 2 Trade Crypto Presale – Better Alternative to Crypto ETFs

Think along the lines of a stock IPO, but instead of equities – crypto tokens. Moreover, due to regulatory restrictions, crypto presales do not accept fiat currency from investors. Instead, presales typically collect major cryptocurrencies as a means to invest – such as Bitcoin, Ethereum, Tether, or BNB.

Now, presales are especially attractive to investors due to the upside potential on offer. After all, Bitcoin is already a multi-billion dollar asset class, so gains hereon will be limited when compared to what presales can provide. One of the most successful presales of all time is Ethereum.

When the world’s now second-largest cryptocurrency initiated its presale in 2014, early investors paid an unprecedented $0.31 per ETH token. As we now know, Ethereum has since reached heights of over $4,900 – translating into growth of 1.5 million percent. In more recent times, the Lucky Block presale in January 2022 was priced at $0.00015 per LBLOCK token.

Just a month after the presale had concluded, LBLOCk breached a price of $0.009 – representing growth of 6,000%. Then we had Tamadoge, which raised $19 million in presale funding in late 2022 to then generate growth of 2,000%. As is evident, presales offer a superb alternative for those searching for the best crypto ETF.

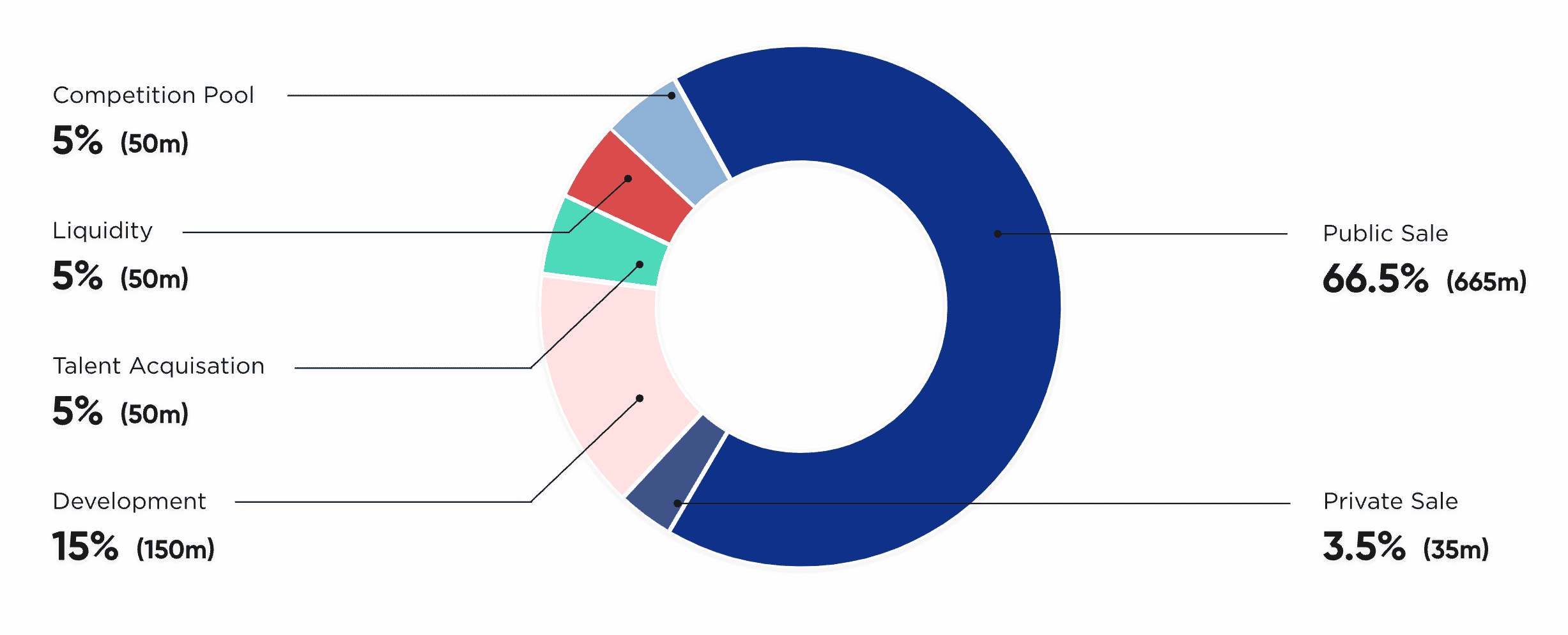

As of writing, there are a select number of ongoing crypto presales that could represent an attractive opportunity for investors in the market for above-average gains. Dash 2 Trade, for example, is offering its D2T token via a presale launch at $0.05. The presale has raised more than $3.6 million in just over a week.

The Dash 2 Trade presale offers early investors the best price possible. Across nine phases, the price of D2T tokens increases as each tranche of sells out. Those getting in at stage one will already have a 40% upside once the presale concludes. The rapid success of the Dash 2 Trade presale is largely due to its underlying product.

The project is building an advanced analytics dashboard that offers a wealth of data, features, and tools that will aid crypto investors in finding profitable opportunities. This includes exclusive access to on-chain data and whale movements, social media metrics, ICO ratings, new exchange listings, and a fully-fledged backtesting facility for strategy buildings.

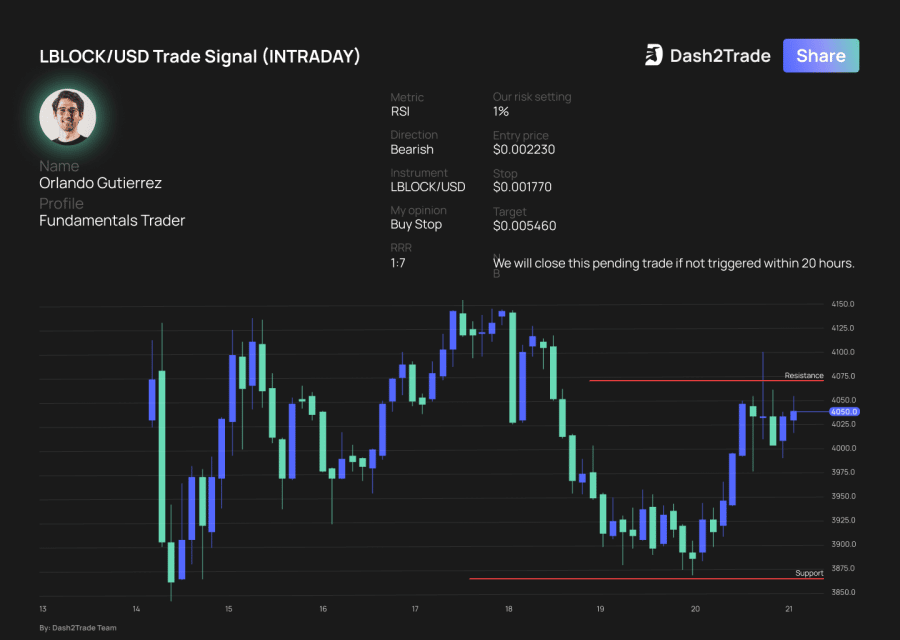

Moreover, Dash 2 Trade will also provide its members with ongoing crypto signals. This highlights which coin is likely to rise or fall in the coming hours, alongside the most suitable risk management orders. Crucially, members will pay a monthly subscription fee in D2T tokens to access the full functionality of Dash 2 Trade, which ensures the crypto asset has utility.

Read our guide on how to buy D2T tokens via the Dash 2 Trade presale.

IMPT – Another Top Crypto Presale

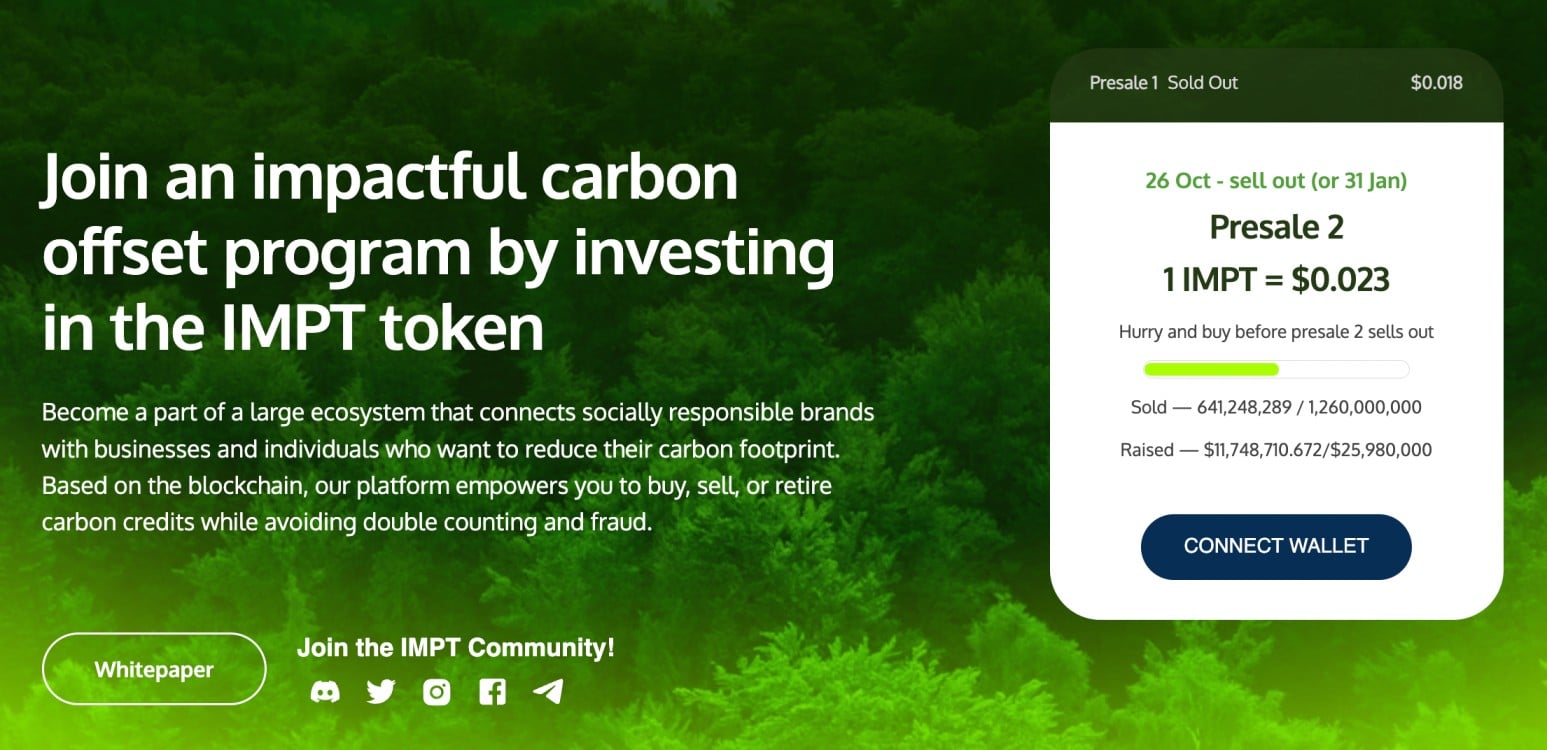

Next, IMPT is also worth considering in the presale space. Investors are bullish on the underlying product – which will facilitate carbon credit trading for both individuals and businesses. Investors can look to profit from the rise of carbon credit prices and businesses can obtain additional emission allowances for the year.

It is even possible to retire carbon credits at IMPT, simply by burning the respective digital asset. The IMPT token can now be purchased at a presale price of $0.023. Having already raised nearly $12 million, IMPT is currently in presale phase two. Just like Dash 2 Trade, the IMPT presale rewards early investors through a progressive pricing model.

Calvaria – Top Gaming Crypto Token Presale

The third presale to consider today as a great alternative to crypto ETFs is Calvaria. This project is building a play-to-earn crypto gaming platform that will incorporate gameplay with NFTs and the metaverse. The game is focused on traditional battle cards that enable players to win rewards for defeating other users.

Considering the exponential growth of the play-to-earn concept, Calvaria could be one to keep an eye on. In the meantime, The Calvaria presale is already in phase three, having raised more than $1 million. As of writing, 1 USDT equates to 50 RAI tokens – the native crypto asset of the Calvaria ecosystem.

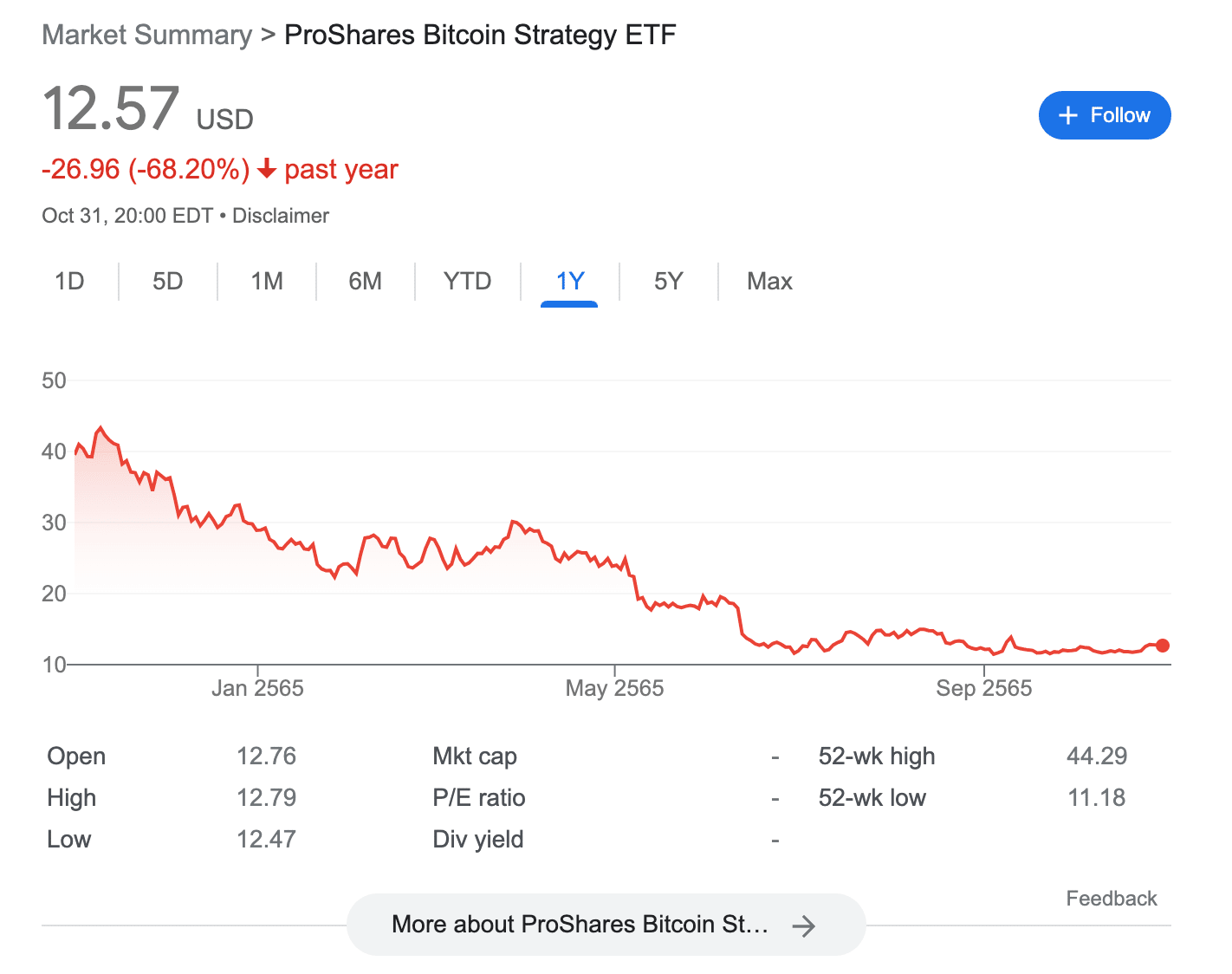

2. ProShares Bitcoin Strategy ETF (BITO) – Overall Best Crypto ETF

Those in the market purely for the best crypto ETF might consider the ProShares Bitcoin Strategy. As the name suggests, this ETF offers direct exposure to the rise and fall of Bitcoin. The ProShares Bitcoin Strategy ETF was actually the first fund of its kind to be approved in the US marketplace.

It is, however, important to note that like all of the crypto ETFs that we will discuss today, the fund is not physically backed by digital currencies. On the contrary, ProShares actively buys and sells Bitcoin futures to track the performance of the digital asset as closely as possible.

The ETF has achieved this goal since its inception in October 2021. For instance, over a 12-month period, the ProShares Bitcoin Strategy ETF is down 68%. In comparison, Bitcoin spot prices have declined by 66%. In terms of fees, this crypto ETF charges an expense ratio of 0.95%. The ETF trades on the NYSE, so investors can enter and exit the market with ease.

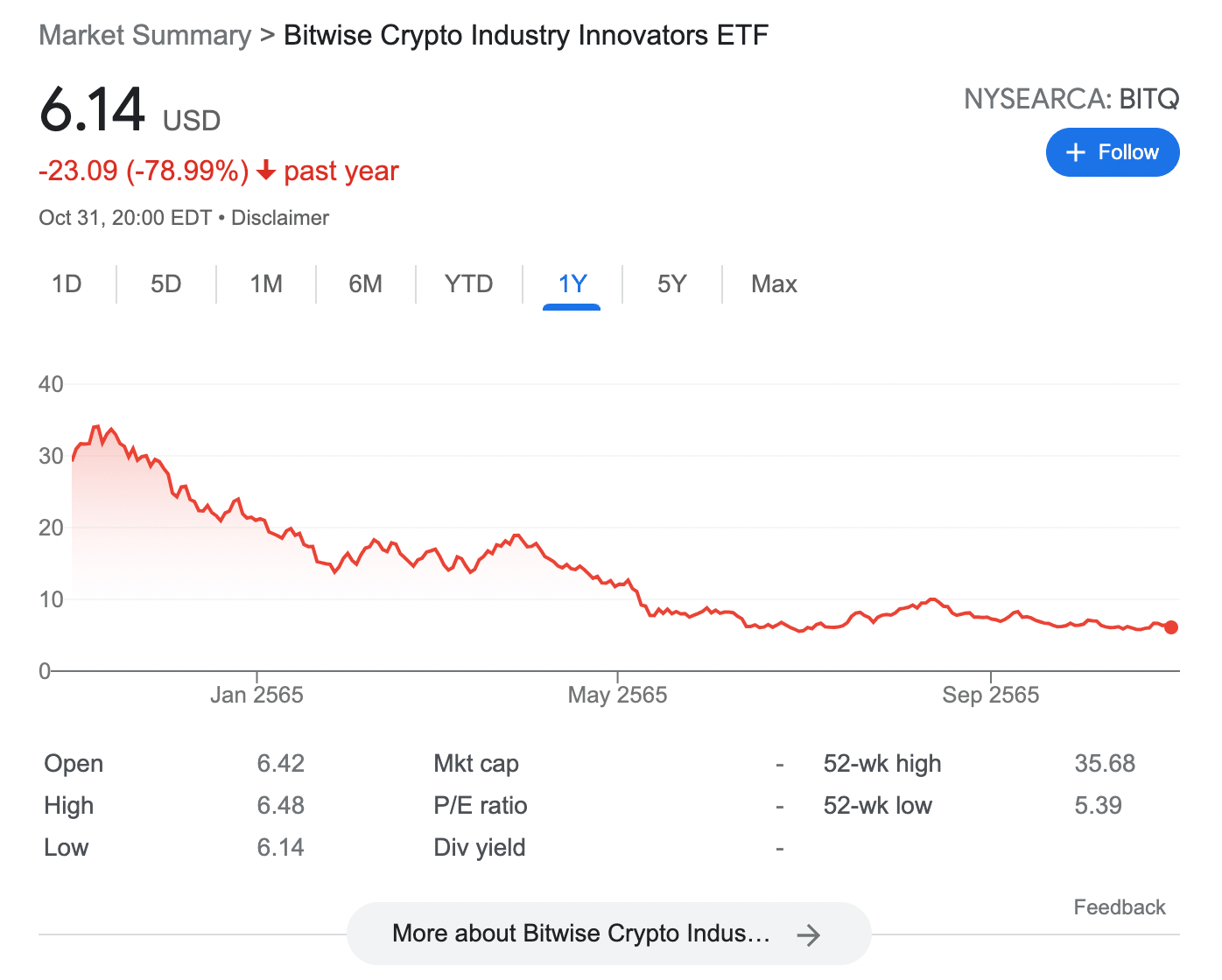

3. Bitwise Crypto Industry Innovators ETF (BITQ) – Gain Exposure to Crypto-Centric Stocks

Investors seeking a traditional fund that offers exposure to crypto-centric stocks might consider the Bitwise Crypto Industry Innovators ETF. As the name implies, this ETF invests in public companies that are directly involved in the growth of cryptocurrencies and/or blockchain technology.

In total, the ETF holds 29 stocks and the expense ratio is somewhat pricey at 0.85%. Some of the largest holdings of the Bitwise Crypto Industry Innovators ETF include Microstrategy and Coinbase, representing 14.28% and 12.28%, respectively. There are also holdings in Silvergate Capital, Hut 8 Mining, Marathon Digital, Riot Blockchain, and Galaxy Digital Holdings.

It is important to remember that while the aforementioned companies are actively involved in the cryptocurrency industry, this ETF does not offer direct exposure to digital asset prices. After all, the value of each stock will also be reflected in the business fundamentals – such as revenues, operating income, and price-to-earnings.

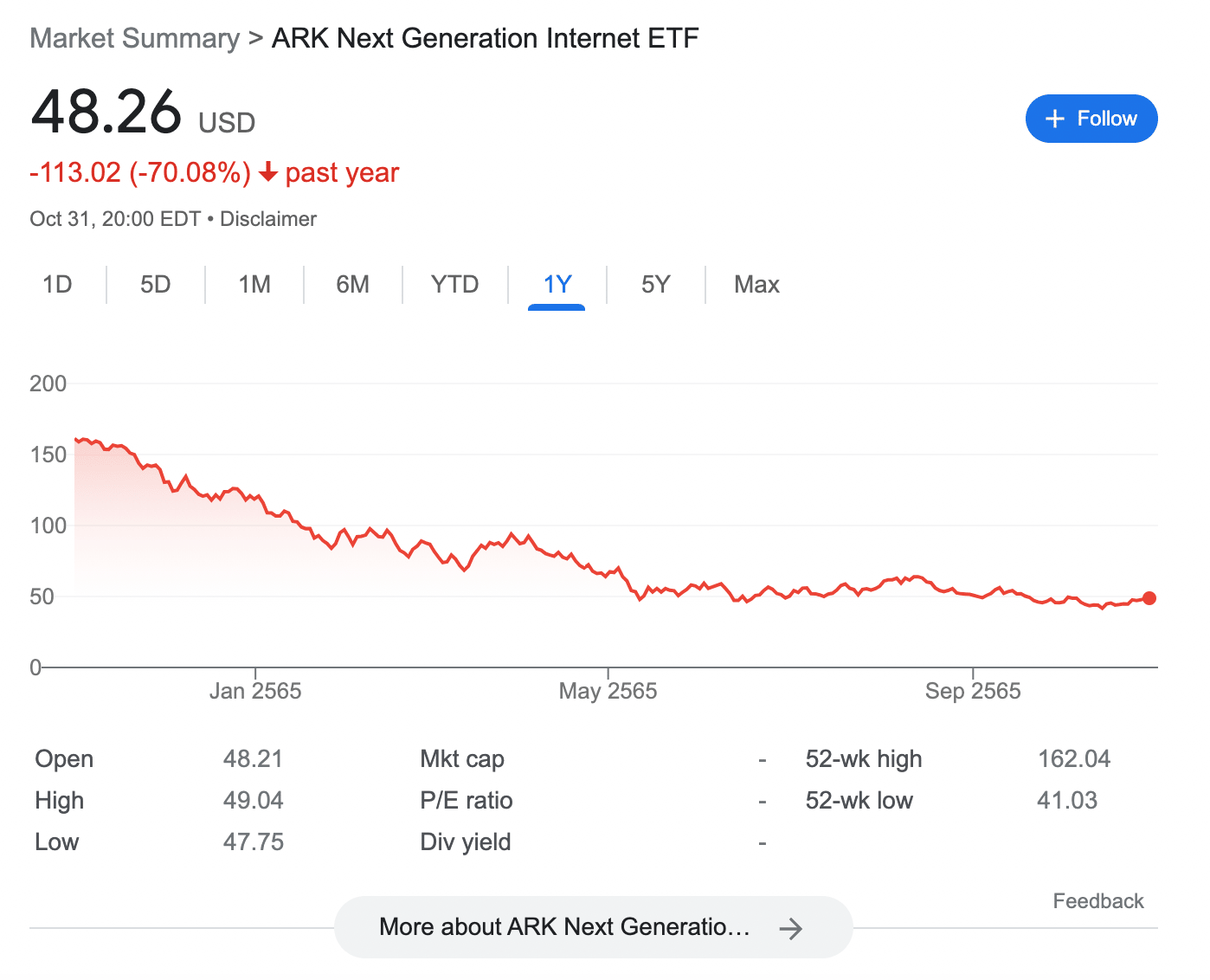

4. ARK Next Generation Internet ETF (ARKW) – Diversified Access to Bitcoin and Other Emerging Assets

The next option to consider when searching for the best cryptocurrency ETF is the ARK Next Generation Internet. The ARK crypto ETF is focused on assets that have the potential to revolutionize future society. Managed by Cathie Wood, the ARK Next Generation Internet ETF trades on the NYSE and it carries an expense ratio of 0.83%.

Breaking down the portfolio, the largest holdings of this ETF are Tesla and Zoom Video Communications, at just over 8% each. Coinbase contributes 7% to the portfolio in addition to Block at 6%. The ARK Next Generation Internet ETF also holds a 5.6% position in the Greyscale Bitcoin Trust. Other ETF constituents include Roku, Shopify, and Twilio.

Naturally, considering that the broader technology stock space has been hammered throughout 2022, this cryptocurrency ETF has followed suit. 12-month losses as of writing stand at over 66%. On the flip side, since its inception in 2014, this ETF has generated gains of 180%.

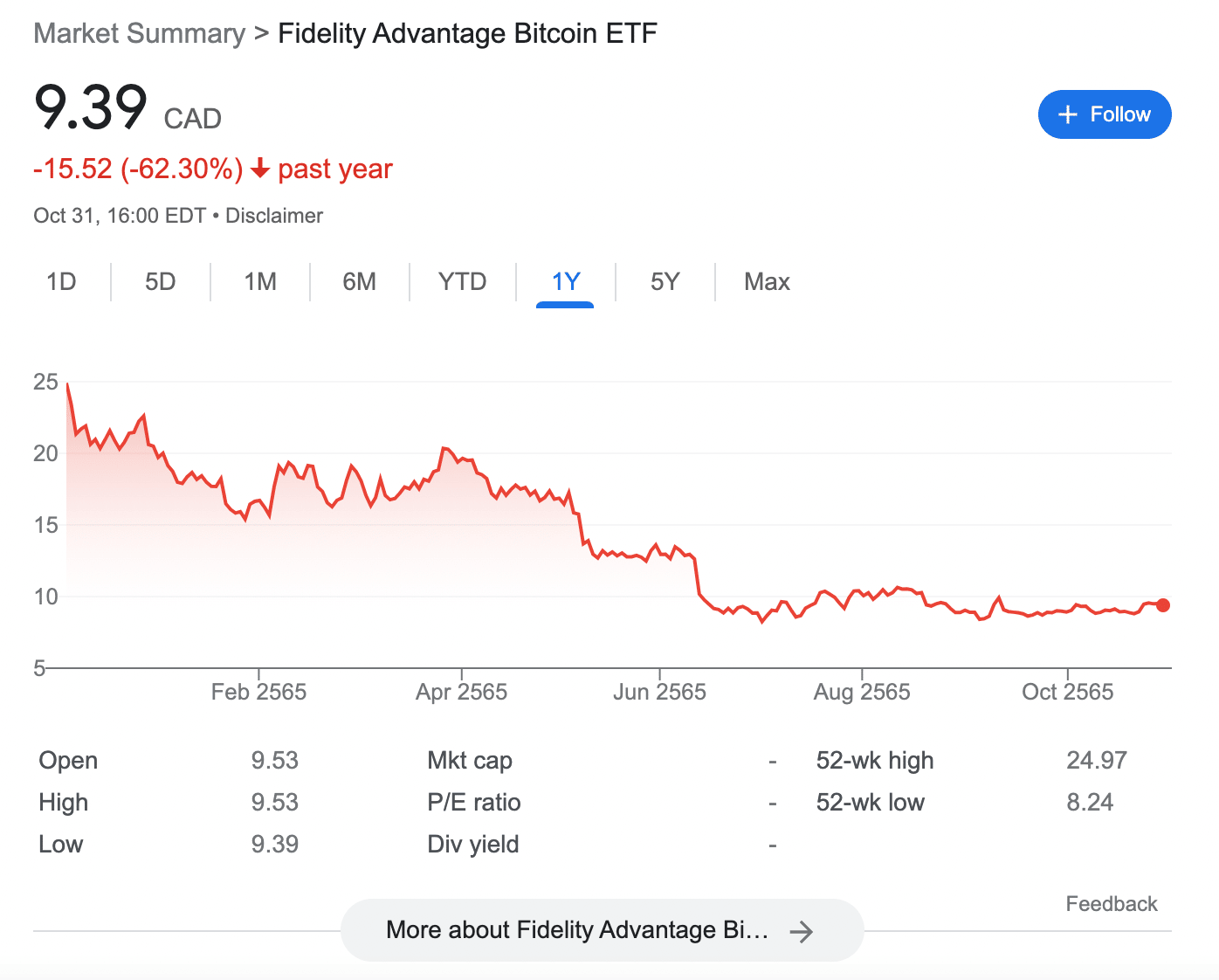

5. Fidelity Advantage Bitcoin ETF (FBTC) – Alternative Mutual Fund Investing Directly in Bitcoin

Aimed at accredited and institutional investors, the Fidelity Advantage Bitcoin ETF – which has the crypto ETF ticker FBTC, invests directly in BTC tokens. In fact, 99.8% of the ETF is held in Bitcoin, so its value directly correlates to global spot prices. This Fidelity crypto ETF is, however, somewhat small-fry, with just $23.5 million worth of assets under management.

Moreover, the expense ratio of this Fidelity cryptocurrency ETF is high at 0.96%. Nonetheless, those looking to invest in Bitcoin in the long run without dealing with exchanges might find this ETF suitable. Fund distributions are made on an annual basis and the ETF trades on the Toronto Stock Exchange. As a result, the Fidelity Advantage Bitcoin ETF is priced in Canadian dollars.

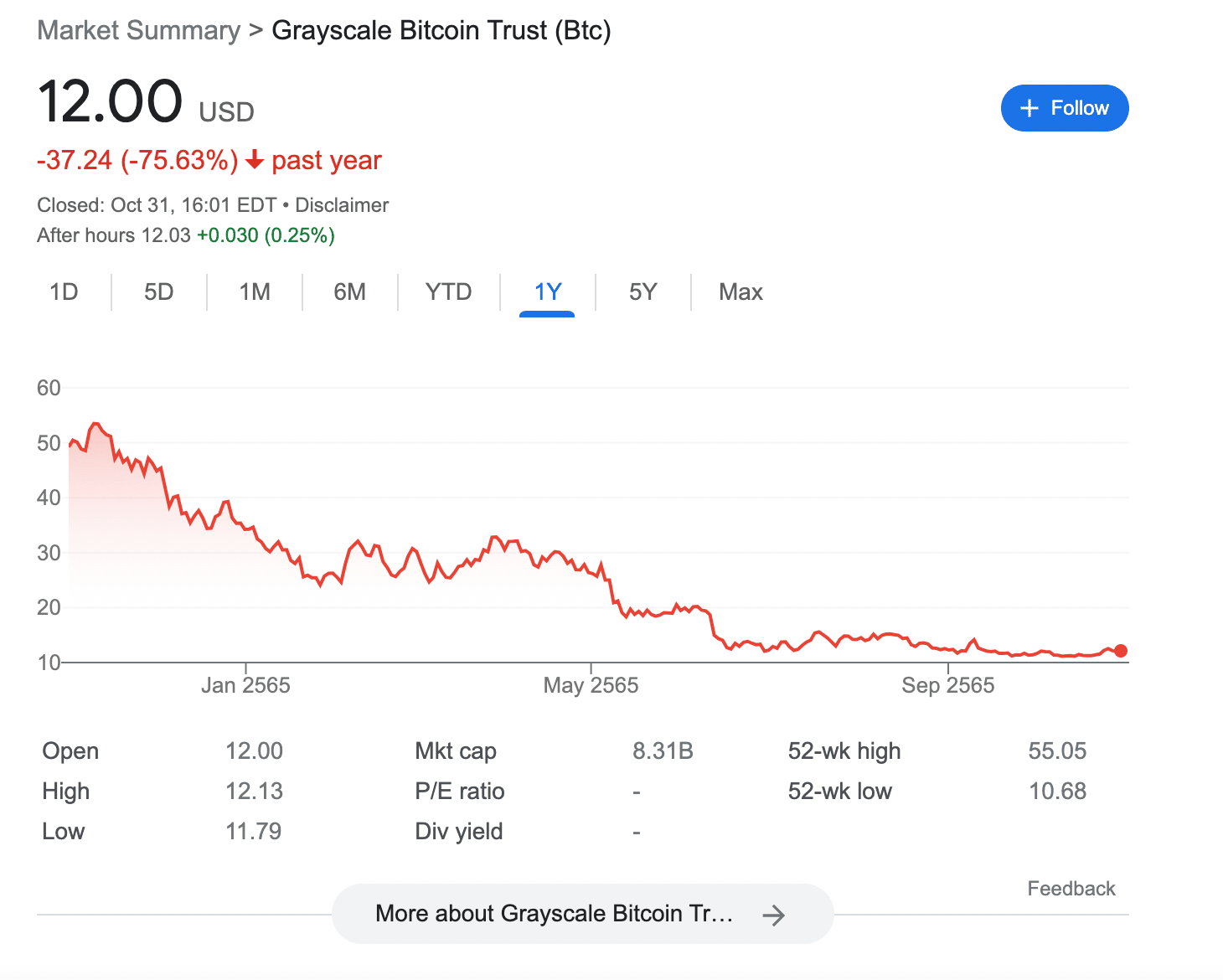

6. Grayscale Bitcoin Trust (BTC) – Established Bitcoin ETF Aimed at Large-Scale Investors

Launched in 2013, the Grayscale Bitcoin Trust is the longest-standing crypto ETF in this space. Since its inception, the ETF has generated represented returns of over 13,000%. On a 12-month basis, however, the fund is down 75%. This is, of course, indicative of the broader crypto winter.

Although the Grayscale Bitcoin Trust is considered one of the best crypto ETFs, there are two key caveats that must be considered. First, this ETF comes with a huge annual expense ratio of 2%. Second, the minimum investment in this crypto ETF is $50,000.

As a result, those looking to invest casual amounts into the crypto industry will likely find the Grayscale Bitcoin Trust out of reach. Another factor to consider is that the Grayscale Bitcoin Trust trades on the OTC (Over-the-Counter) markets. Once again, this makes the ETF inaccessible for the average trader.

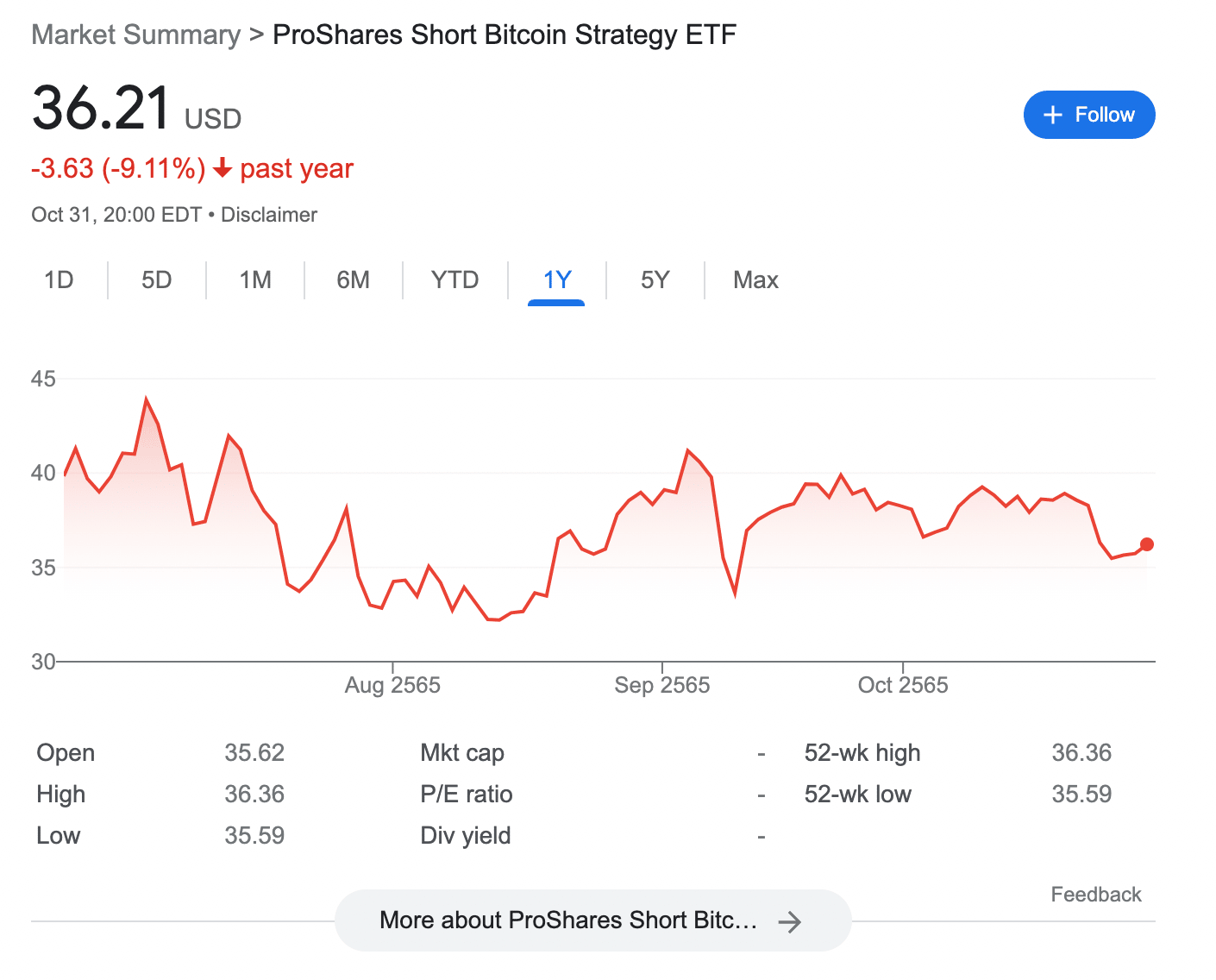

7. ProShares Short Bitcoin Strategy ETF (BITI) – ETF for Cryptocurrency Short-Selling

Those bearish on the short-term direction of digital assets might consider the ProShares Short Bitcoin Strategy as the best crypto ETF for this purpose. In a nutshell, this ETF enables investors to profit in the event that the price of Bitcoin declines. ProShares achieves this goal through Bitcoin futures that trade on the CME.

Crucially, this new crypto ETF facilitates a more seamless and cost-effective way to short-sell Bitcoin without needing to handle conventional financial derivatives. Furthermore, unlike short-selling Bitcoin futures directly, this crypto ETF ensures that investors cannot lose more than they invested.

It should, however, be noted that the ProShares Short Bitcoin Strategy ETF is not suitable for longer-term short-selling strategies. On the contrary, this ETF is aimed at traders that wish to enter and exit a position in the short-term. This is reflected in the price of the ETF, which has declined by 9% on a 12-month basis even though the Bitcoin spot market is down 66% over the same period.

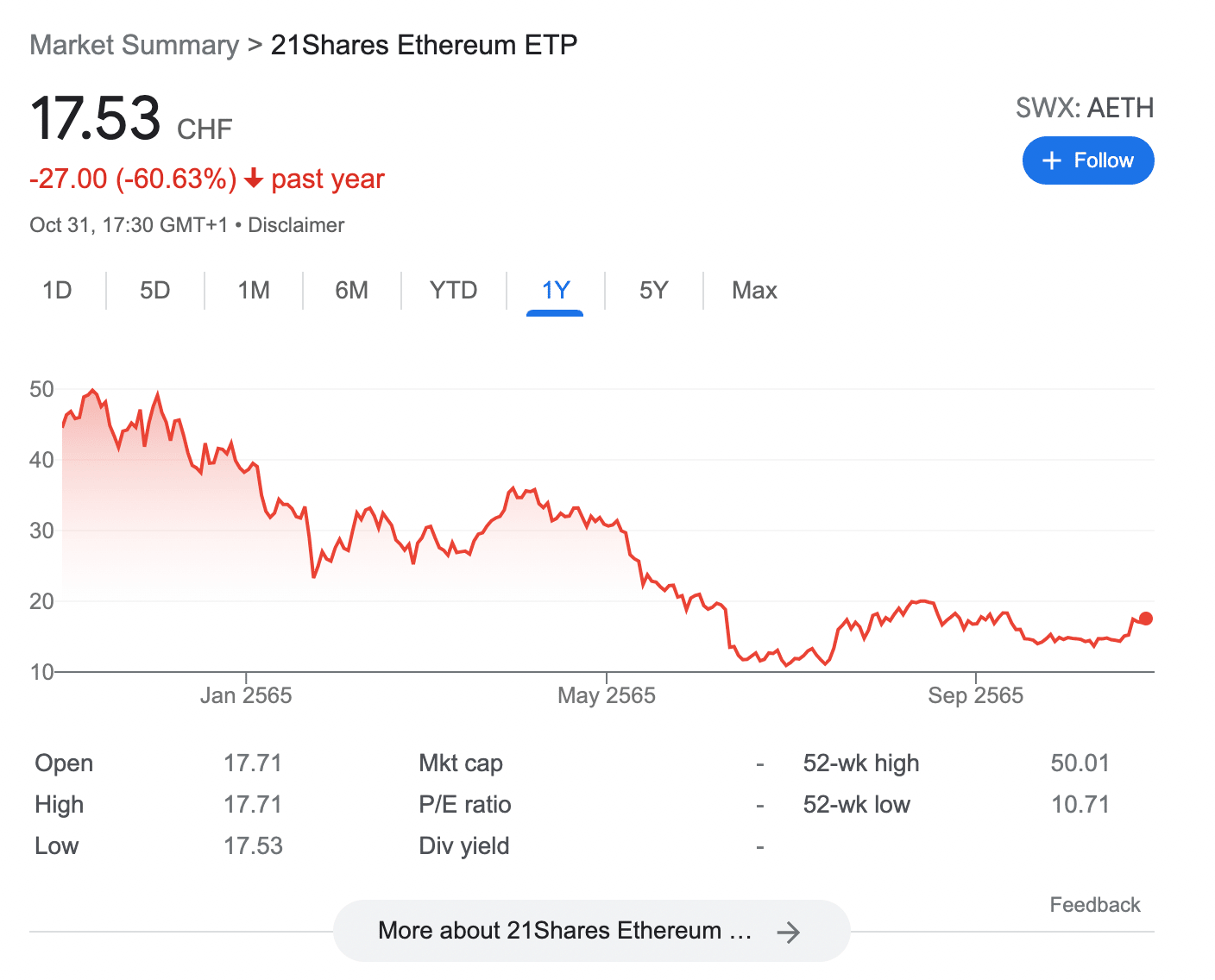

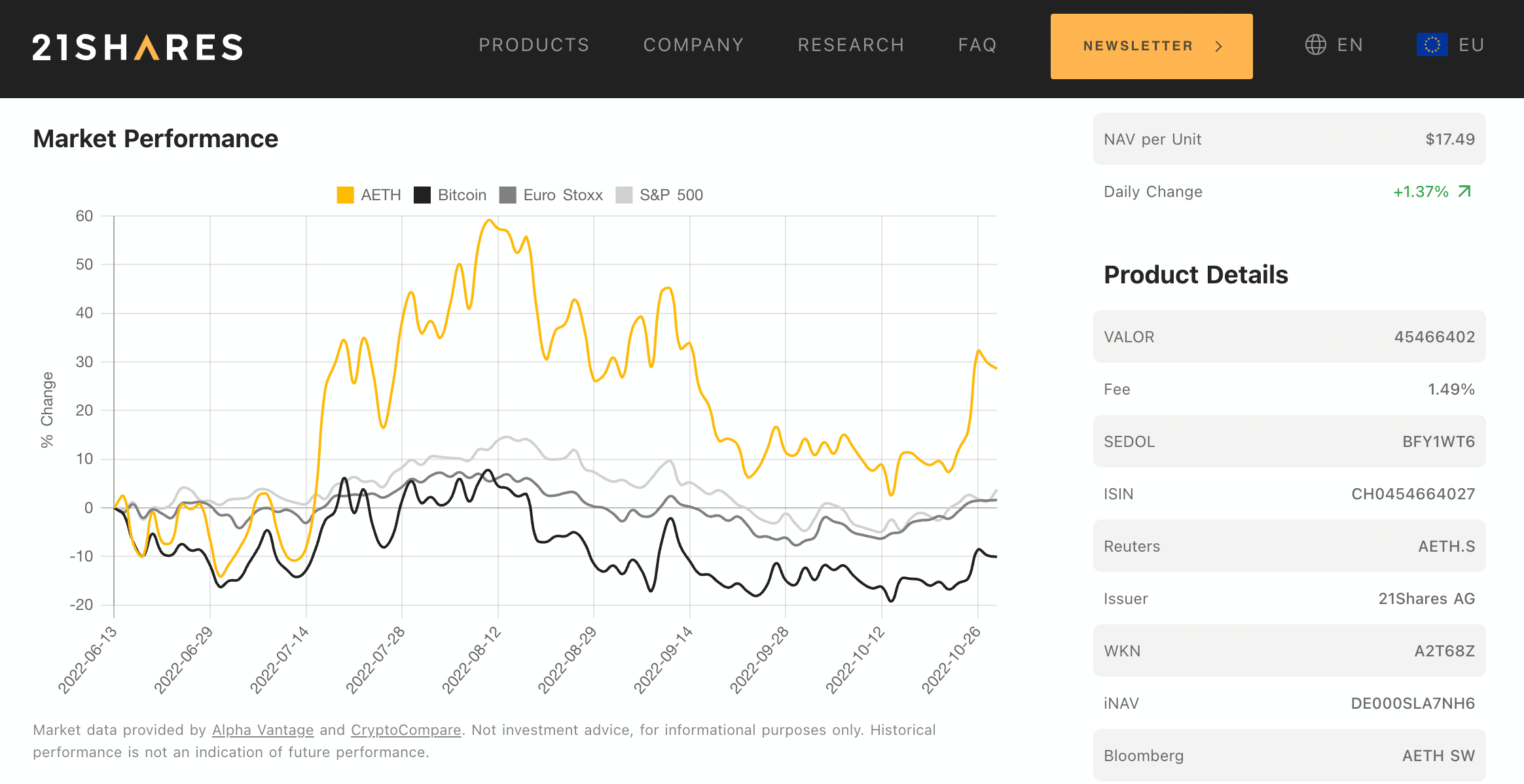

8. 21Shares Ethereum ETP (AETH) – Best Crypto ETF for Investing in Ethereum

While all of the crypto ETFs discussed thus far focus exclusively on Bitcoin, there is also the possibility to invest in Ethereum. In this regard, the 21Shares Ethereum ETP is perhaps the best cryptocurrency ETF for this purpose. The ETP (Exchange-Traded Product) is listed in Europe and most pertinently – physically backed by Ethereum.

This means that the value of the fund will be closely aligned with global Ethereum spot prices. The ETP provider states that 100% of value notes are held in ETH tokens and subsequently stored in cold storage. The expense ratio on the 1Shares Ethereum ETP is 1.49% – which again is expensive.

Nonetheless, the fund has over $213 million in assets under management at this moment in time. In terms of performance, this Ethereum fund is down 65% in the first 10 months of 2022. However, in 2020 and 2021, the fund increased in value by 442% and 397%, respectively.

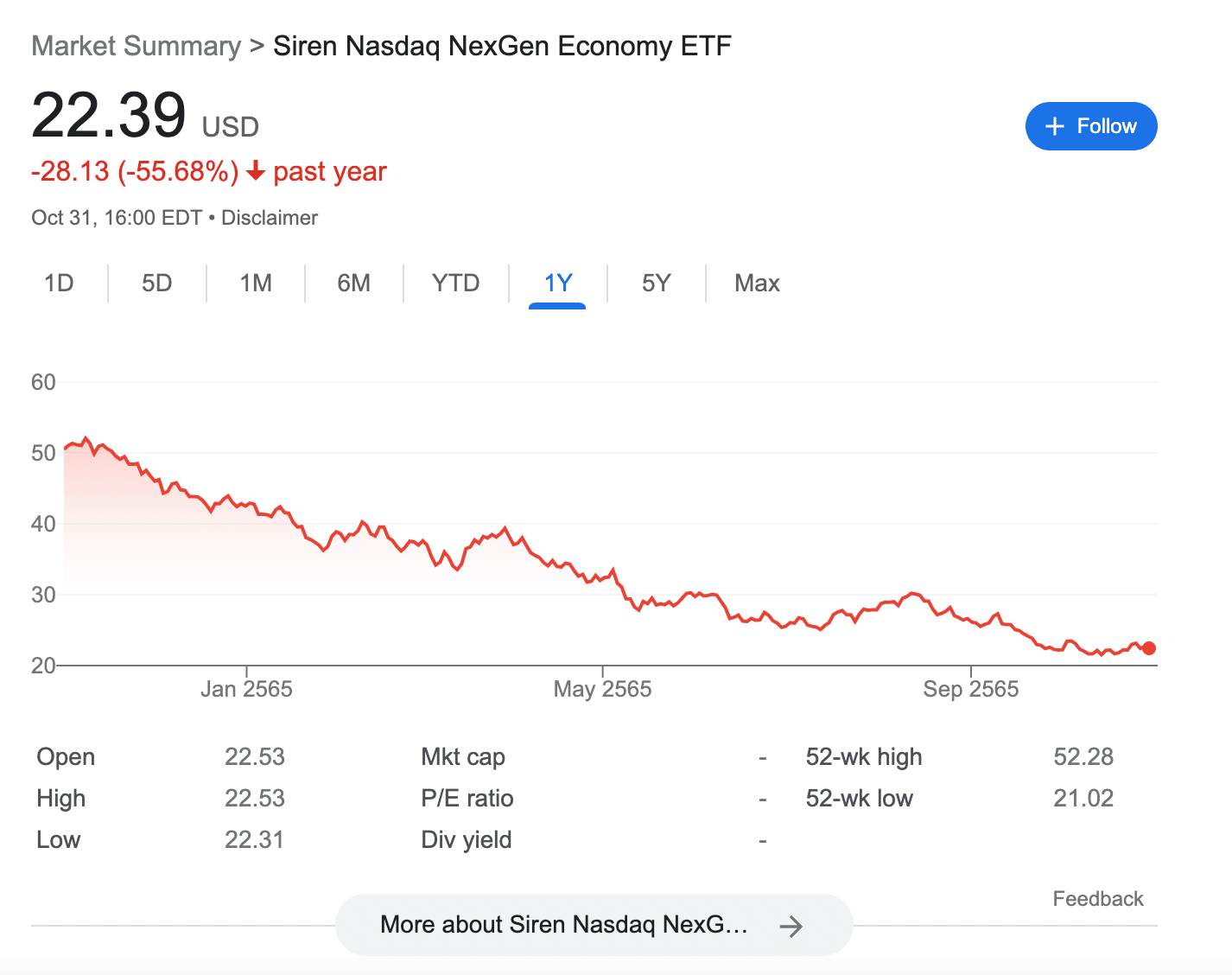

9. Siren Nasdaq NexGen Economy ETF (BLCN) – Long-Term Fund to Track the NASDAQ Blockchain Economy Index

The next option to consider on our list of the best crypto ETFs is the Siren Nasdaq NexGen Economy. The overarching purpose of this ETF is to track the performance of the NASDAQ Blockchain Economy Index. This means that its portfolio contains a range of crypto ETF stocks that are either directly or loosely involved in the growth of blockchain and crypto assets.

As of writing, the largest holdings in this ETF are inclusive of JPMorgan Chase, GMO Internet Group, SAP, IBM, Oracle, MasterCard, and Paypal. With this in mind, this crypto index ETF is likely suitable for more conservative investors that do not wish to have too much exposure to crypto-centric pure plays.

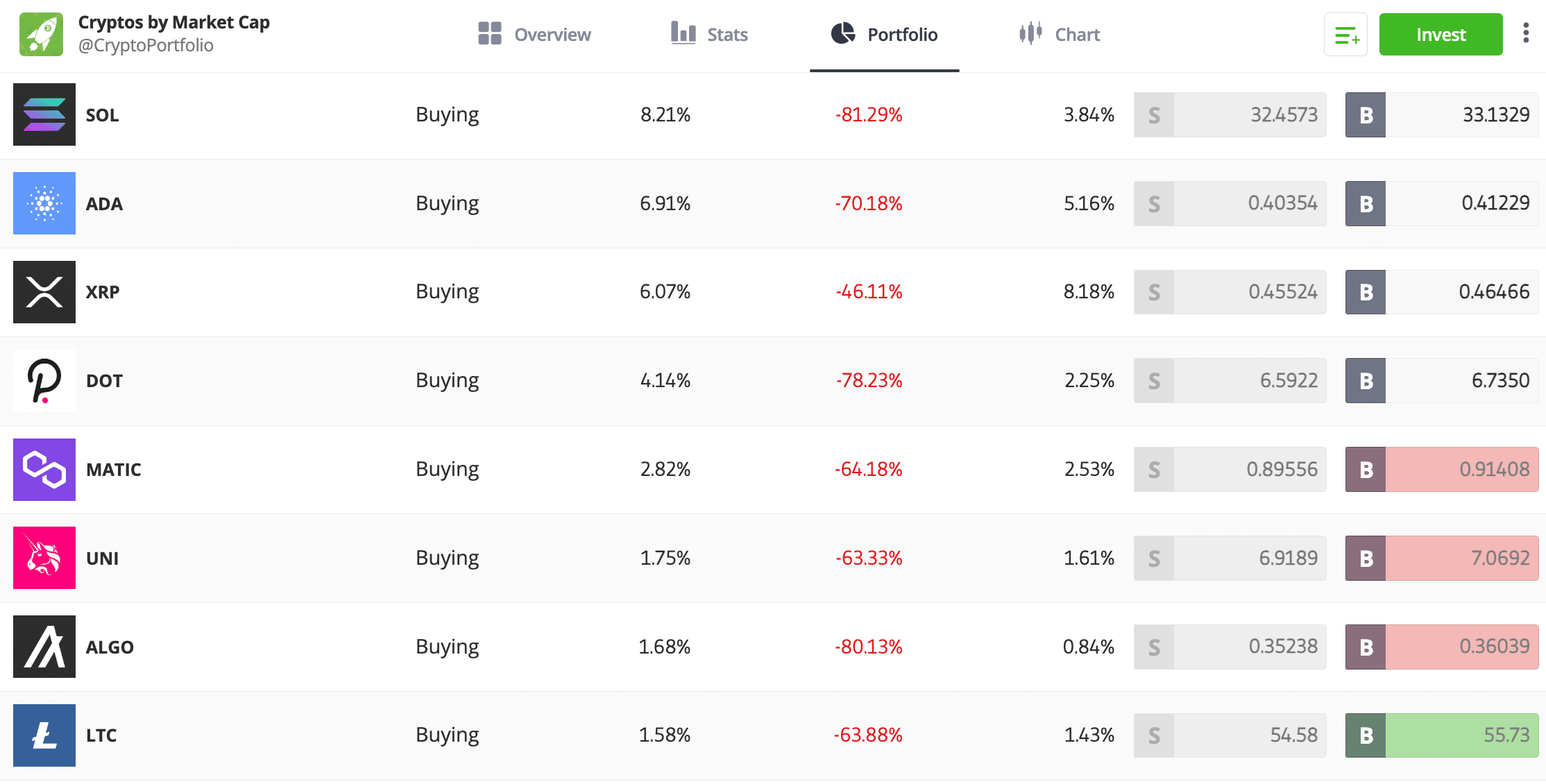

10. Cryptos by Market Cap Smart Portfolio – Invest in 20 Cryptocurrencies Weighted by Market Valuation

The final option to consider is the ‘Cryptos by Market Cap’ Smart Portfolio offered by eToro. While this isn’t an ETF per se, it does follow many of the same characteristics. This is because, through a single investment, investors will gain exposure to 20 different cryptocurrencies. Moreover, this Smart Portfolio is weighted based on market capitalization.

This means that the portfolio contribution of each cryptocurrency is based on its valuation and thus – this offers an avenue to speculate on the broader industry. As a managed basket of assets, eToro will regularly rebalance and reweight the Cryptos by Market Cap Smart Portfolio on behalf of investors.

Casual traders will appreciate that the minimum investment to access this Smart Portfolio is just $500. Moreover, eToro does not charge additional fees, which means that investors will indirectly pay a buy-and-sell commission of 1% on any trades executed via the Smart Portfolio.

What is a Crypto ETF?

ETFs for cryptocurrency are designed to give investors exposure to the digital currency markets via a more traditional investment vehicle. This means that investors can speculate on the future value of cryptocurrencies without needing to buy Bitcoin and altcoins via an exchange.

More pertinently, many seasoned investors do not feel comfortable using crypto exchanges for the purpose of buying and selling assets. Instead, preference is made for ETFs that are managed by established, regulated providers – such as ProShares, ARK, and Fidelity.

- In terms of the fundamentals, crypto ETFs come in various shapes and sizes.

- For example, the vast majority of crypto ETFs focus exclusively on Bitcoin.

- Moreover, Bitcoin ETFs accessible in the US markets are not physically backed.

- On the contrary, the ETF provider will buy and sell Bitcoin futures on behalf of investors.

- This is problematic from a tracking perspective, as there will always be a disparity between the value of Bitcoin spot markets and the respective ETF.

Outside of the US markets, there are a number of ETFs that are physically backed by cryptocurrency. While most are backed by Bitcoin, there are also ETFs that directly invest in Ethereum.

Perhaps the main benefit offered by the best crypto ETFs is that exposure to the industry can be made via a conventional brokerage account. Crypto ETFs generally trade on public equity exchanges, meaning that entry and exit into the market is no different from using a traditional stock trading platform.

Crypto ETFs also offer a greater level of security for some investors. This is because there is no requirement for the investor to trust an unregulated exchange for the purpose of storing their cryptocurrencies. Instead, custodianship is the sole responsibility of the ETF provider, which will operate in a heavily regulated space.

How do Cryptocurrency ETFs Work?

It is wise to understand how cryptocurrency ETFs work before injecting any capital.

In this section, we break down the fundamentals in much greater detail.

Crypto ETFs Trade on Exchanges

First and foremost, crypto ETFs trade on public stock exchanges. This makes them attractive to investors due to the ease with which crypto ETFs can be bought and sold. After all, investing in a crypto ETF is often much the same as buying and selling stocks.

The value of the crypto ETF will also rise and fall like conventional equities. This is based on the net asset value (NAV) of the ETF at the end of each trading day. This essentially takes into account the total assets held by the crypto ETF, based on current market prices.

Physically-Backed Crypto ETFs

The best cryptocurrency ETFs are those that are actually backed by digital assets. This is similar to a traditional gold ETF that is backed by physical bullion bars. In turn, the value of the ETF will very closely align with the global spot price of the cryptocurrency it seeks to track.

Unfortunately, in the US market at least, there is no physically-backed cryptocurrency ETF that has been approved by the SEC. Instead, most US-listed cryptocurrency ETFs are backed and settled by financial derivatives like Bitcoin futures. Outside of the US, however, there is a growing number of ETFs that are in fact backed by cryptocurrencies.

A prime example of this is the 21Shares Ethereum ETP, which is backed by ETH tokens on a like-for-like basis. This gives the ETF the best chance possible of tracking the price of Ethereum, without needing to rely on complex and expensive crypto derivatives.

Futures Crypto ETFs

As noted above, the vast majority of cryptocurrency ETFs – at least in the US markets, are backed by futures contracts. This greatly limits the ability to diversify, not least because the only regulated crypto futures market in the US is Bitcoin.

Moreover, investors never actually have a firm stake in the value of Bitcoin when investing in an ETF that is involved in futures and other derivatives.

The reason for this is that there will always be a disparity in pricing between the spot price of Bitcoin with that of the respective ETF.

Cryptocurrency ETF Stock

Another option available to investors is to invest in an ETF that is backed by crypto-centric stocks. The previously discussed Bitwise Crypto Industry Innovators ETF offers access to a variety of cryptocurrency pureplays, including Coinbase, Marathon Digital, and Riot Blockchain.

For more risk-averse investors, The Siren Nasdaq NexGen Economy ETF offers access to established stocks that are loosely involved in cryptocurrency. This includes Paypal, IBM, Oracle, and even JPMorgan Chase.

Nonetheless, opting for a top crypto ETF that is backed by stocks as opposed to digital assets or futures offers one core benefit – dividends. After all, if any of the dividend stocks held by the crypto ETF make a distribution, investors will be entitled to their share.

Are Crypto ETFs a Good Investment?

There is often a divide in opinion when it comes to the best way to invest in cryptocurrency. While the vast majority of investors utilize conventional crypto exchanges, others feel more comfortable dealing with established ETF providers.

With this in mind, we will now discuss some of the core factors to consider before gaining exposure to a crypto ETF.

Avoid Crypto Exchanges

One of the overarching reasons why some investors seek top crypto ETFs for the purpose of investing in digital assets is that it enables them to avoid exchanges.

After all, cryptocurrency is trading differently from the traditional stock market – which utilizes centralized exchanges such as the NYSE and NASDAQ. This means that there is a centralized pricing system that enables investors from all over the world to view the real-time performance of their chosen stocks – in a regulated manner.

In contrast, cryptocurrency prices are determined by the exchange that they trade on. Consider that there is often a huge disparity in the price of Bitcoin depending on the country that the crypto exchange operates in. As a result, by investing in a crypto ETF, this enables investors to gain exposure to Bitcoin without needing to risk capital on a shady exchange.

Custodianship

Perhaps an even greater benefit of opting for a crypto ETF is that custodianship is taken care of. Traditionally, when buying cryptocurrency online, the investor will have two options.

- First, they can leave the tokens in the wallet that is controlled and secured by their chosen crypto exchange.

- However, if the exchange is hacked, the investor could lose all of their tokens.

- The second option is to withdraw the tokens to a private wallet.

- While this option means that the investor has full control over their cryptocurrency, again, if a hacking attempt takes place this can result in a loss of funds.

In comparison, by opting for a crypto ETF, there is virtually no custodianship risk for the investor. The reason for this is that the ETF will be backed by a regulated, established provider like Fidelity or ProShares.

The ETF provider will have insurance and institutional-grade security controls in place, all of which is taken care of on behalf of investors.

All in all, this means that investors can gain exposure to cryptocurrency without needing to have any knowledge of how wallet security works.

Liquidity

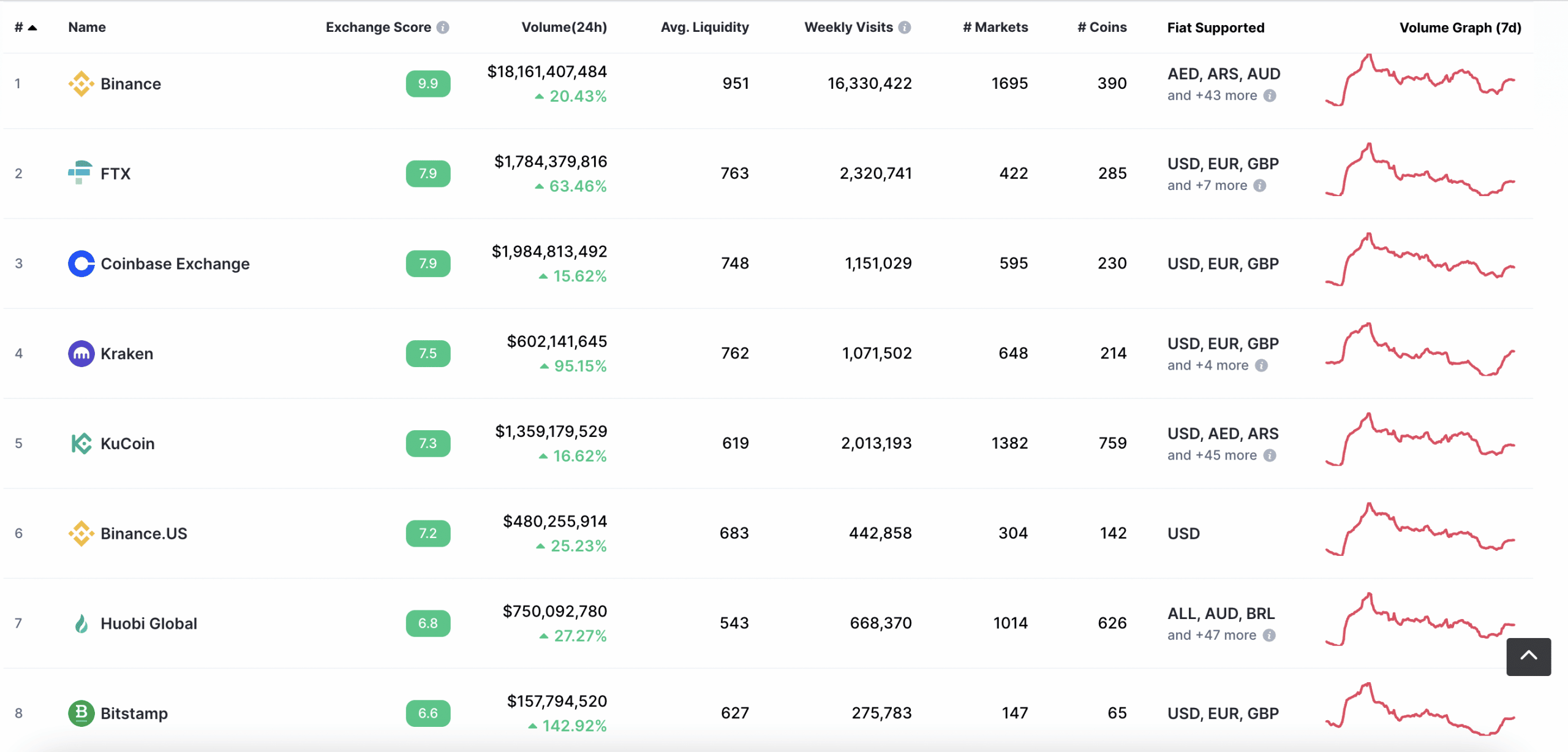

Interestingly, although crypto ETFs were created to amplify liquidity levels in the market, this isn’t the case at this moment in time. On the contrary, there is significantly more liquidity on major crypto exchanges such as Binance.

For instance, in the prior 24 hours of trading, more than $18 billion worth of cryptocurrencies changed hands on the Binance exchange – which is far and beyond anything that ETFs rival.

In fact, during bullish cycles, Binance often hosts over $70 billion in daily volume.

Short-Selling

Another benefit that cryptocurrency fund ETFs offer is that they enable investors to short-sell Bitcoin with ease. Ordinarily, the investor would need to engage with complex financial derivatives for this purpose – such as crypto futures or options. Alternatively, the investor would be required to use an unregulated crypto derivatives exchange like Bitmex.

Instead, the ProShares Short Bitcoin Strategy ETF is directly crafted for short-selling positions. The investor simply needs to buy the ETF – which trades on the NYSE, to profit from the decline in Bitcoin’s price.

With that being said, the ProShares Short Bitcoin Strategy ETF is only suitable for very short-term positions, considering that it is backed by futures. As such, looking at the ETF’s chart, there is a huge disparity in the correlation between its price with that of Bitcoin spot markets.

Why Crypto Presales are Better Than Crypto ETF?

Earlier in this comparison guide, we explained that there are much better alternatives to crypto ETFs – at least in their current form. We noted that at the forefront of this are crypto presales.

Crucially, presales are suited to investors that not only wish to gain exposure to digital currencies – but to outperform the broader markets. This is because presales offer the very best price available before the cryptocurrency is listed on a public exchange for trading.

Therefore, in the sections below, we offer insight into three of the best presales to keep an eye on right now.

Dash 2 Trade – Overall Best Crypto Presale to Invest in Right Now

Dash 2 Trade is building a crypto analytics platform that will be jam-packed with features. Having had the opportunity to test its alpha-stage terminal, we found that Dash 2 Trade will provide investors with intimate access to the most profitable trading opportunities that the cryptocurrency markets have to offer.

For example, the Dash 2 Trade terminal will offer trading signals throughout the day. The signal might, for instance, suggest buying XRP at $0.45, and entering a stop-loss and take-profit at $0.40 and $1.10, respectively. This enables traders to access the crypto markets without needing to perform any research.

Other core features include a strategy building that can be tested in a risk-free, live virtual environment. Members of the dashboard – which pay monthly fees in the project’s native currency – D2T, will also have access to ICO reviews and ratings, new exchange listings, professional-grade data, social metrics, on-chain analysis, and much more.

Investors can buy D2T tokens via the presale campaign right now at just $0.05 per token. The price of the token will increase by approximately 5% once the presale enters the next stage. This will continue for nine consecutive stages.

IMPT – Gain Exposure to the Growing Carbon Credits Market

Carbon credits represent one of the hottest emerging asset classes right now. However, the industry is still fragmented and thus, access can be challenging – especially for retail clients and small businesses. This is why IMPT is building a revolutionary ecosystem that will facilitate carbon credit trading for investors and companies of all shapes and sizes.

The IMPT presale is accessible right now at a price of $0.023 per token. Those buying IMPT tokens right now will have an immediate upside once it is listed on an exchange. Alternatively, the IMPT tokens can be converted to carbon credit NFTs. This offers a speculative way to invest in the future price of carbon credits without needing to be an institutional investor.

Calvaria – Innovative Play-To-Earn Gaming Network

Traditional gaming products are both centralized and controlled by a small number of leading developers. Calvaria aims to revolutionize this space through its play-to-earn concept. In a nutshell, this means that players can earn rewards in the form of digital tokens, simply for progressing through the Calvaria universe.

Not only that, but any in-game assets earned or purchased by players are 100% owned by the respective user. This is because in-game items are backed by NFTs that are stored and traded on the blockchain. The Calvaria presale is ongoing and currently in stage three – meaning that RAI tokens can be purchased at just $0.02.

Conclusion

This guide has analyzed and ranked the best crypto ETFs in the market today.

While crypto ETFs were designed to facilitate seamless and safe investments into the Bitcoin market, the majority of funds are actually backed by futures contracts – rather than actual digital assets.

Therefore, a much better alternative to consider today is crypto presales. IMPT is a notable option in this regard, considering its revolutionary carbon credit trading ecosystem.

Dash 2 Trade is also a presale worth checking out, with its advanced crypto analytics dashboard packed with unique and innovative features.

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members