If you’re on the hunt for the best crypto exchange in Australia – this guide compares the top eight providers to consider in 2023.

We examine core metrics of each crypto exchange – such as regulation, supported coins, fees and commissions, customer service, trading tools, and more.

Read on to get started with the best Australian crypto exchange in under five minutes.

The Best Australian Crypto Exchanges in 2023

The eight best crypto exchanges in the Australian market right now are those listed below.

- eToro – Overall Best Crypto Exchange Australia-based investors can use

- Crypto.com – Beginner-Friendly Crypto Exchange with Numerous Useful Features

- Plus500 – Highly Trusted and User-Friendly Exchange and Trading Platform

- Coinbase – Top Australian Bitcoin Exchange for Beginners

- Binance – Cheapest Crypto Exchange for Spot Trading

- Digital Surge – Affordable Crypto Investing Platform

- Swyftx – Trade 310+ Cryptos with TradingView Charts

- CoinSpot – Simplest Australian Exchange to Instant Buy Crypto

Cryptoassets are a highly volatile unregulated investment product.

To select the best crypto exchange in Australia for you – read our in-depth reviews in the following sections.

Top Crypto Apps in Australia Reviewed

The only way to choose the best crypto app and Bitcoin exchange in Australia for you is to consider your main priorities.

For example, in addition to selecting a regulated exchange that offers a safe investment environment – is your main focus obtaining the lowest fees possible, or accessing highly advanced trading tools?

Similarly, consider if you want to invest in cryptocurrency with leverage, and which markets the respective exchange supports.

To help you with your decision-making process, reviews of the eight best crypto exchanges in Australia can be found below.

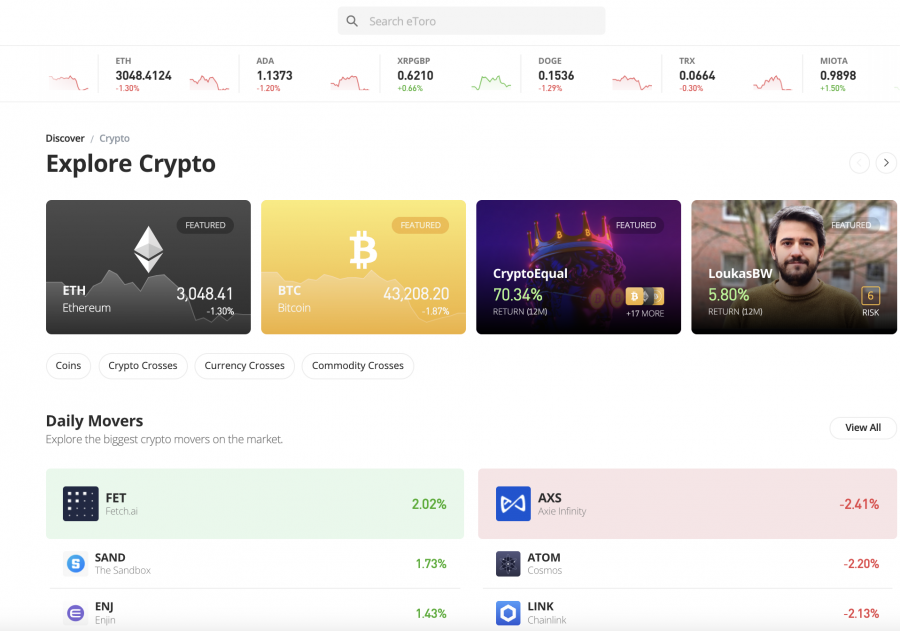

1. eToro – Overall Best Crypto Exchange Australia for 2023

This means that you can buy, sell, and trade crypto assets without needing to worry about the legitimacy of the platform. To get started with an eToro crypto account, you simply need to register some personal details and upload some ID. After that, you can instantly deposit funds with an Australian debit/credit card, or an e-wallet like Paypal.

You can also deposit funds via a bank transfer. All supported deposit methods attract a small fee of just 0.5% and the minimum funding requirement stands at $50. In terms of supported markets, eToro is home to dozens of crypto assets – which covers everything from Bitcoin, AAVE, Dogecoin, and Ethereum to XRP, Litecoin, Cardano, and Shiba Inu.

Moreover, you can also access leveraged CFDs, which are inclusive of crypto-cross pairs like BTC/ETH. To diversify even further, you might even consider the 3,000+ commission-free stocks and ETFs hosted by eToro. When it comes to crypto trading fees, this stands at just 1% per trade, plus the market spread.

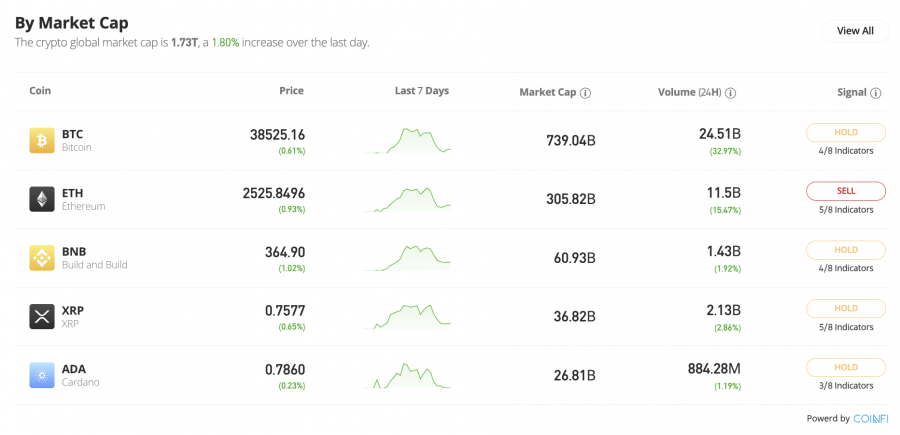

We also like the eToro copy trading feature. This enables you to choose from thousands of experienced crypto investors that use the eToro trading platform, and then elect to copy their trades like-for-like. The minimum investment requirement when engaging with the copy trading tool is just $200. You can also invest in smart portfolios, which are professionally managed by the eToro team.

This includes a number of crypto-centric portfolios, which promotes a passive way of gaining exposure to the digital asset industry. We also like the free virtual portfolio offered by eToro, which allows you to trade in live market conditions but in a risk-free manner. The eToro app is also worth downloading, as this connects to your main brokerage account.

For a more detailed analysis, see our eToro review AU.

| Number of Cryptos | 50+ |

| Trading Commission | 1% plus market spread |

| Debit Card Fee | 0.5% |

| Minimum Deposit | $50 |

Pros

- Regulated by ASIC

- Super low trading fees

- Offers one of the best crypto wallets in Australia

- Web and mobile app platform

- Supports dozens of coins

- Deposit funds with a debit/credit card, e-wallet, or bank transfer

- Copy Trading tools

Cons

- Advanced traders might find the platform a bit basic

Cryptoassets are a highly volatile unregulated investment product. 68% of retail investor accounts lose money when trading CFDs with this provider

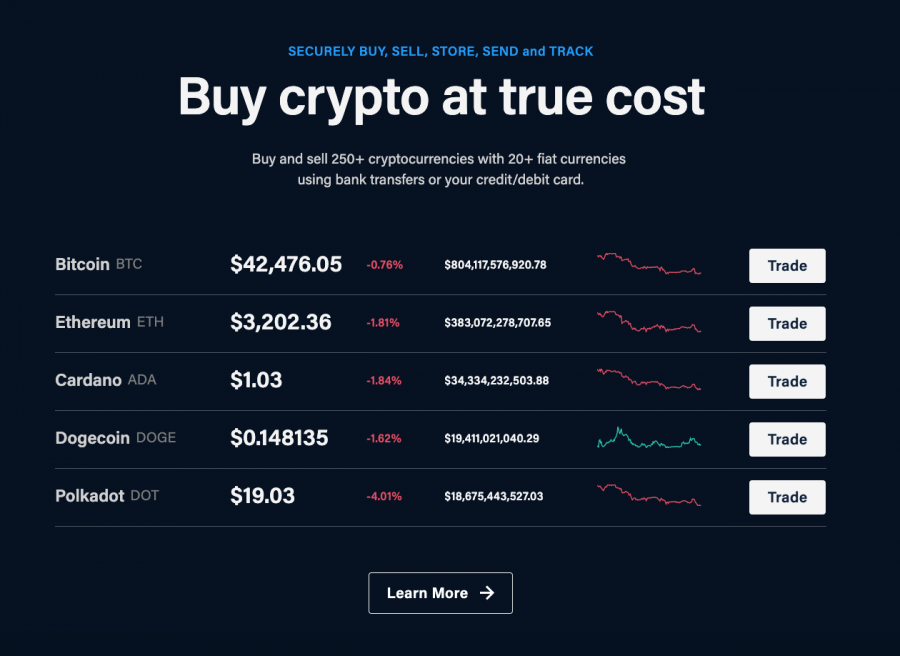

2. Crypto.com – Beginner-Friendly Crypto Exchange with Numerous Useful Features

Clients can opt to trade on the Crypto.com exchange or through the mobile app. The former is more suited to advanced traders and features a maker/taker pricing structure, equating to 0.4% on either side of the trade. Notably, users who own CRO (Crypto.com’s native token) can choose to pay these charges using this digital currency, resulting in a 10% discount on trading fees.

Beginner users may feel more comfortable using the dedicated Crypto.com app, available on iOS and Android. The app acts as the central hub for the Crypto.com trading experience and allows users to buy cryptocurrency instantly using a credit or debit card. This approach is usually accompanied by a fee of up to 4%; however, this fee is waived for the first 30 days of trading.

If you’re into crypto staking then you’ll be pleased to learn that Crypto.com is one of the best crypto staking platforms in Australia.

Users can also make free AUD deposits on the app and use the funds to purchase crypto. The app also has simple price charts and real-time data, making it easy to keep tabs on price movements. Finally, Crypto.com even offers a handy crypto debit card, allowing users to spend their trading balance online or in-store as if it was AUD!

| Number of Cryptos | 250+ |

| Trading Commission | 0.4% maker/taker fee |

| Debit Card Fee | Up to 4% (free for first 30 days) |

| Minimum Deposit | $20 |

Pros

- Can purchase crypto instantly using a credit or debit card

- Useful crypto debit card offered

- Option to trade on the exchange or mobile app

- Card fees waived for the first 30 days of trading

- Over 250 crypto assets to trade

- Free AUD deposits

Cons

- Limited educational resources

Cryptoassets are a highly volatile unregulated investment product.

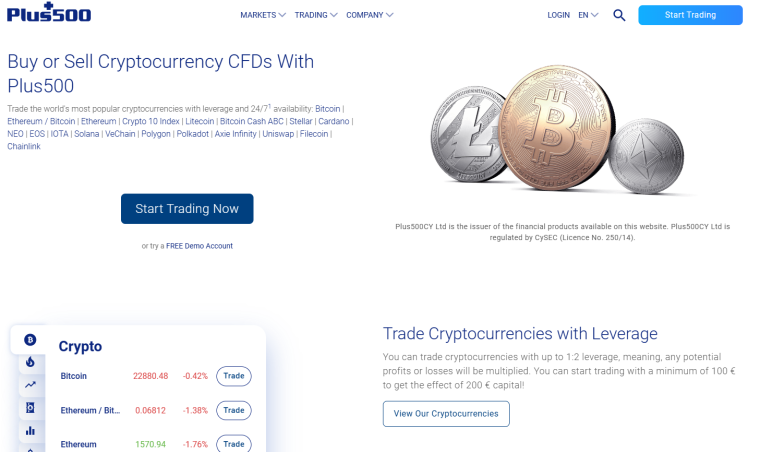

3. Plus500 – Highly Trusted and User-Friendly Exchange and Trading Platform

Regulated by various institutions globally, including ASIC, Plus500 is also listed on the London Stock Exchange and is a member of the FTSE250 Index.

The platform offers a wide variety of more than 2,000 financial instruments to trade including currencies, commodities, indices, options, ETFs and more.

That includes a number of leading crypto CFDs, including Bitcoin, Ethereum, Solana, Polygon and Polkadot, but the range is much smaller than others.

Users can also trade the Crypto 10 Index – which represents the top 10 tokens – and also trade with up to 1:2 leverage.

Plus500, which also features one of the best apps around, does not charge any deposit or withdrawal fees and instead fees are built into the price.

There is a $100 minimum deposit, which is higher than some other platforms on this list.

| Number of Cryptos | 20 |

| Trading Commission | None |

| Debit Card Fee | None |

| Minimum Deposit | $100 |

Pros

- Highly trusted and regulated by ASIC

- User-friendly app

- No fees

- Leverage trading

- Wide range of other investment options

Cons

- Limited number of cryptos

Cryptoassets are a highly volatile unregulated investment product. 79% of retail investor accounts lose money when trading CFDs with this provider

4. Coinbase – Top Australian Bitcoin Exchange for Beginners

Beginners will appreciate the simple investment process at Coinbase, which typically requires just three steps. First, you need to open an account by providing some personal information. Second, you need to verify your identity by uploading some ID. Finally, after entering your credit or debit card details – you can then buy Bitcoin instantly.

When using a credit or debit card at this platform, fees of 3.99% apply. You can alternatively deposit funds by transferring money from your Australian bank account – which is fee-free. When the funds are credited – which can take a few business days, you will then need to pay a commission of 1.49% on your chosen crypto market.

Supported markets on the Coinbase exchange cover over 50 popular cryptocurrencies – all of which can be traded from just $2. Coinbase also offers a mobile app that doubles up as a secure wallet. This can be downloaded free of charge to your Android or iOS phone. Finally, Coinbase offers crypto staking services for those wishing to earn a yield of their digital funds.

| Number of Cryptos | 50+ |

| Trading Commission | 1.49% per trade |

| Debit Card Fee | 3.99% |

| Minimum Deposit | $50 |

Pros

- Regluated in the US and listed on the NASDAQ

- Supports 50+ coins

- Accepts debit/credit cards and bank transfers

- Great security features

- Perfect for beginners

Cons

- High payment and commission fees

- Limited trading tools and features

Cryptoassets are a highly volatile unregulated investment product.

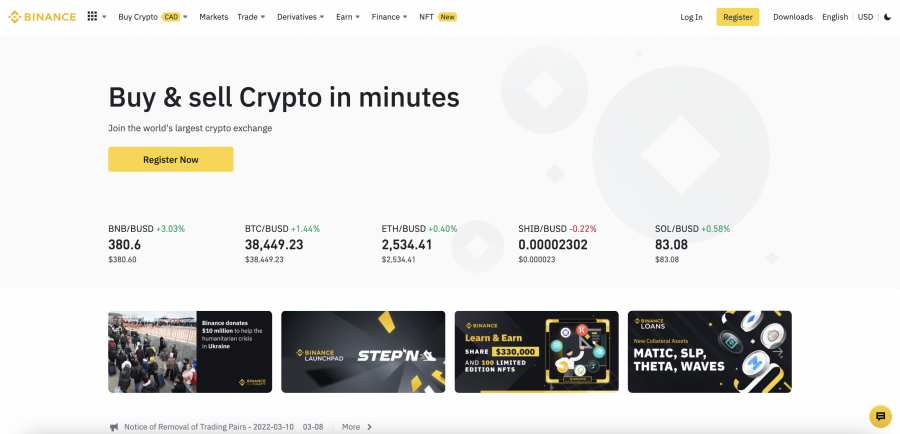

5. Binance – Cheapest Crypto Exchange for Spot Trading

If you’re looking to actively engage in spot trading, Binance could be the best crypto exchange in Australia for you. You won’t be short of trading opportunities at this exchange, with Binance supporting over 1,000 markets. This is inclusive of both fiat-crypto and crypto-cross pairs.

Spot trading fees on this platform cost up to 0.10%, which makes Binance one of the best crypto exchanges in the market. By trading larger volumes, Binance will offer you discounted commissions. This is also the case if you hold the platform’s native token – BNB. We also like Binance for the amount of trading volume it attracts, which ensures that liquidity levels are sufficient at all times.

To fund your Binance account, opt for a fee-free PayID transfer to have the deposit processed super-fast. Crypto deposits are also an option. In addition to low fees and a huge suite of tradable markets, Binance offers crypto savings accounts. This enables you to generate interest on any digital assets that you deposit. Various yields and lock-up terms are available.

You can also engage in yield farming which again, allows you to earn interest on your idle tokens. In terms of safety, two-factor authentication is mandatory on all account login attempts. Finally, Binance offers a mobile app that not only allows you to trade on the move – but store your crypto assets.

| Number of Cryptos | 1,000+ markets |

| Trading Commission | Up to 0.10% |

| Debit Card Fee | Depends on third-party processor |

| Minimum Deposit | Varies by payment method |

Pros

- Hundreds of coins across 1,000+ markets

- Low commissions of just 0.10% per trade

- Supports fiat money deposits and withdrawals

- Great tools for advanced traders

- One of the largest crypto exchanges for liquidity

Cons

- Not regulated by any licensing body

- Has previously been hacked

Cryptoassets are a highly volatile unregulated investment product.

6. Digital Surge – Affordable Crypto Investing Platform

The platform offers trading on more than 300 cryptocurrencies and offers several key features for long-term investors, including recurring buy orders. You can easily dollar-cost average into any cryptocurrency you like, while price alerts and limit orders help you get the best possible price during periods of volatility.

Importantly, Digital Surge also has a mobile app so you can take advantage of buying opportunities on the go.

You can open a new account with Digital Surge in less than 2 minutes. The platform is regulated by ASIC and AUSTRAC and offers live chat support 7 days a week. Plus, Digital Surge offers its own crypto wallet to help you start buying and selling as quickly as possible.

| Number of Cryptos | 300+ |

| Trading Commission | 0.5% plus spread |

| Debit Card Fee | FREE |

| Minimum Deposit | $2 |

Pros

- Rates from 0.1% per trade

- Trade 300+ cryptocurrencies

- Supports recurring buy orders

- Regulated by ASIC and AUSTRAC

- Integrated crypto wallet

Cons

- Limited technical trading tools

- Doesn’t support staking

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

7. Swyftx – Trade 310+ Cryptos with TradingView Charts

Instead of developing its own charting interface, Swyftx simply integrated with the best charting platform currently available: TradingView. You get access to hundreds of technical indicators and unbeatable customization options.

Another reason to use Swyftx for trading cryptocurrency is its pricing structure. This platform charges a fixed trading fee of 0.6%, which on its own is competitive but not outstanding. But, Swyftx offers crypto spreads as low as 0.41% for highly liquid assets like Bitcoin. While many exchanges don’t publicize their spreads, Swyftx’s spreads are among the lowest we’ve seen in Australia.

Swyftx is registered with AUSTRAC and is widely trusted in Australia. The platform offers 24/7 live chat support for customers and you can start investing with as little as $1. There are no deposit or withdrawal fees for fiat currency at Swyftx.

See our full comparison of Swyftx vs CoinSpot, another popular crypto exchange Australia based traders are accepted at.

| Number of Cryptos | 310+ |

| Trading Commission | 0.6% plus spread |

| Debit Card Fee | FREE |

| Minimum Deposit | $30 |

Pros

- Extremely competitive crypto spreads

- Integrated TradingView charts

- API for automated trading

- 24/7 live chat customer support

- Regulated by AUSTRAC

Cons

- No instant buy option

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

8. CoinSpot – Simplest Australian Exchange to Instant Buy Crypto

CoinSpot charges 1% for instant buy and sell transactions, which is fairly competitive. What’s even better is that if you use CoinSpot’s spot trading platform, the fee drops to just 0.1% per trade. The spot trading market is essentially an OTC market between CoinSpot members, so just keep in mind that spreads can be somewhat high relative to other Australian crypto exchanges.

CoinSpot offers several other enticing features, including a free crypto wallet app and portfolio tracking tools. The platform also has 24/7 live chat support and doesn’t charge for POLi, PayID, or direct deposits.

CoinSpot is regulated by AUSTRAC and is one of only a few Australian exchanges certified to the ISO 27001 security standard. It isn’t yet regulated by ASIC like eToro though – see our ‘is Coinspot safe‘ review.

| Number of Cryptos | 350+ |

| Trading Commission | 0.1% plus spread |

| Debit Card Fee | FREE |

| Minimum Deposit | $1 |

Pros

- Extremely easy to use

- Trade 350+ cryptocurrencies

- Offers instant buy or OTC trading

- Regulated by AUSTRAC

- 24/7 live chat support

Cons

- Moderately above-average trading fees

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

The Best Crypto Exchanges Australia Compared

The crypto exchange ranking comparison table below summarizes our reviews of the top eight providers discussed above.

| Crypto Exchange | Number of Coins | Trading Fee | Payment Methods | Minimum Deposit |

| eToro | 50+ | 1% + market spread | Debit/credit cards, e-wallets, bank transfer | $50 |

| Crypto.com | 250+ | 0.4% maker/taker fee | Debit/credit cards, e-wallets, bank transfer | $20 |

| Coinbase | 50+ | 1.49% per trade | Debit/credit cards, bank transfer | $50 |

| Binance | 1,000+ markets | Up to 0.1% per trade | Debit/credit cards (third-party) and PayID | Depends on the payment processor |

| Digital Surge | 300+ | 0.5% plus spread | Debit cards (third-party) and PayID | $2 |

| Swyftx | 310+ | 0.6% plus spread | Debit/credit cards (third-party) and PayID | $30 |

| CoinSpot | 350+ | 1% plus spread | Debit/credit cards (third-party), POLi, PayID | $1 |

How do Cryptocurrency Exchanges Work?

Top crypto exchanges in Australia enable you to access the digital currency markets. Initially, you will need to open an account and – assuming that you are using a regulated provider, upload some ID. After that, you can buy and sell your chosen cryptocurrencies from the comfort of home.

When you place an order at your chosen crypto exchange, you typically need to pay a commission. This is how the crypto exchanges generate revenue. Depending on your chosen exchange, you might be matched with other market participants when you enter and exit positions. This is why it’s important to choose a crypto exchange with sufficient levels of liquidity.

With that said, platforms like eToro and Coinbase double up as a broker, meaning that you can buy cryptocurrency directly from the platform itself. You then have platforms like AvaTrade – which offer crypto CFDs. Although you won’t own the underlying digital tokens when trading CFDs, this marketplace allows you to access leverage and short-selling facilities.

Ultimately, if you want to buy or sell crypto in Australia, you need to have an account with a platform that meets your requirements. Core metrics to consider for this purpose – which we cover in more detail shortly, include supported markets, fees, minimum account balances, trading tools, customer service, and of course – regulation.

Cryptoassets are a highly volatile unregulated investment product. 68% of retail investor accounts lose money when trading CFDs with this provider

How to Choose the Best Cryptocurrency Exchange for You

Choosing the best crypto exchange in Australia for your personal requirements is a simple process when you know what to look for.

As such, when researching the many exchanges in this marketplace, consider the key metrics discussed below.

Regulation

As noted earlier, it is imperative that you only open an account with a crypto exchange that is adequately regulated. Coinbase, for instance, is regulated in the US.

You then have eToro, which is not only regulated by the Australian licensing body ASIC – but with the FCA, SEC, and CySEC. Choosing a regulated exchange will ultimately ensure that you can buy, sell, and trade crypto in safety.

On the other hand, you will likely come across a large number of platforms that hold no regulatory license.

Although these platforms might offer huge leverage facilities, super-low fees, and an abundance of sign-up offers – you should avoid using a crypto exchange that is not licensed.

Tradable Cryptos

If you checked out our comparison table of the eight best crypto exchanges in Australia, you will have noticed that there is a vast disparity in the number of supported markets.

For instance, although AvaTrade is a great platform for seasoned pros that seek leverage and high-level trading tools, it only supported 13 crypto markets.

Many of these pairs can be traded against the Australian dollar – such as BTC/AUD and ETH/AUD. eToro is also good for asset diversification, as the platform supports dozens of crypto markets.

Sign-up Offers

Some Australian crypto exchanges will offer a sign-up bonus to customers that are yet to open an account. This could, for example, include a free allocation of Bitcoin when you deposit or trade a certain amount.

However, these offers typically come with unfavorable terms and conditions. As such, we would suggest that you avoid choosing a crypto exchange based on a sign-up offer alone. Instead, consider more important metrics – such as regulation and fees.

Trading Fees

Trading fees typically center on two key factors – commissions and the spread. The former is often charged as a variable fee against your stake.

- For instance, for trades above $200, Coinbase charges a commission of 1.49%.

- As such, a $1,000 trade would cost you a commission of $14.90.

- You would again need to pay this commission when closing your position.

- CFD platforms like AvaTrade do not charge commissions, so you only need to cover the spread.

The spread is a fee that is rarely advertised by crypto exchanges. This is because it refers to the gap – or spread, between the bid and ask price of the crypto you are looking to buy or sell. The wider that this spread is, the more that you pay in fees.

Non-Trading Fees

You also need to consider non-trading fees in your search for the best crypto exchange in Australia. For instance, you might need to pay a deposit fee when funding your account – especially if opting for a debit or credit card.

Coinbase charges 3.99% on debit/credit card payments, while at eToro, this will cost you just 0.5%. AvaTrade charges no fees at all on debit/credit card deposits – or any supported payment method for that matter.

You also need to check what withdrawal fees apply to your chosen payment type. Moreover, if you’re planning to trade crypto with leverage, you also need to consider daily funding rates.

Tools & Features

Another factor to consider in your search for the best Bitcoin exchange in Australia is what tools and features you will have access to.

This might include advanced trading tools like technical indicators and short-selling facilities, alongside leveraged and crypto-centric derivatives.

Or, if you’re looking to trade passively, you might want to consider the copy trading tool offered by eToro. As noted earlier, this allows you to copy a seasoned trader at an investment amount you feel comfortable with.

Other core features to look for include managed portfolios. Again, this is something offered by eToro via its smart portfolio service. This is inclusive of a managed crypto portfolio that covers more than a dozen digital tokens.

Payment Methods

Unless you already have some crypto tokens to hand, you will need to fund your exchange account with fiat money – e.g. Australian dollars. All of the platforms that we reviewed today support a number of fast and convenient payment methods.

For example, at eToro, you can take your pick from a debit/credit card, e-wallet, or bank transfer. Over at Binance, you transfer funds via PayID.

Customer Service

The best Bitcoin exchanges in Australia that we came across during the research process offer excellent customer service. This often includes a live chat service that operates 24/7.

Take note, if your chosen exchange only offers support via email. this means that receiving assistance on your account will be a cumbersome process. After all, you won’t be able to speak with an agent in real-time.

How to Use a Crypto Trading Platform Australia

If you’re ready to start buying and selling digital currencies at the best crypto exchange in Australia – eToro, follow the step-by-step walkthrough below.

In just five minutes, you’ll have a verified eToro account that gives you access to dozens of crypto markets at industry-leading fees.

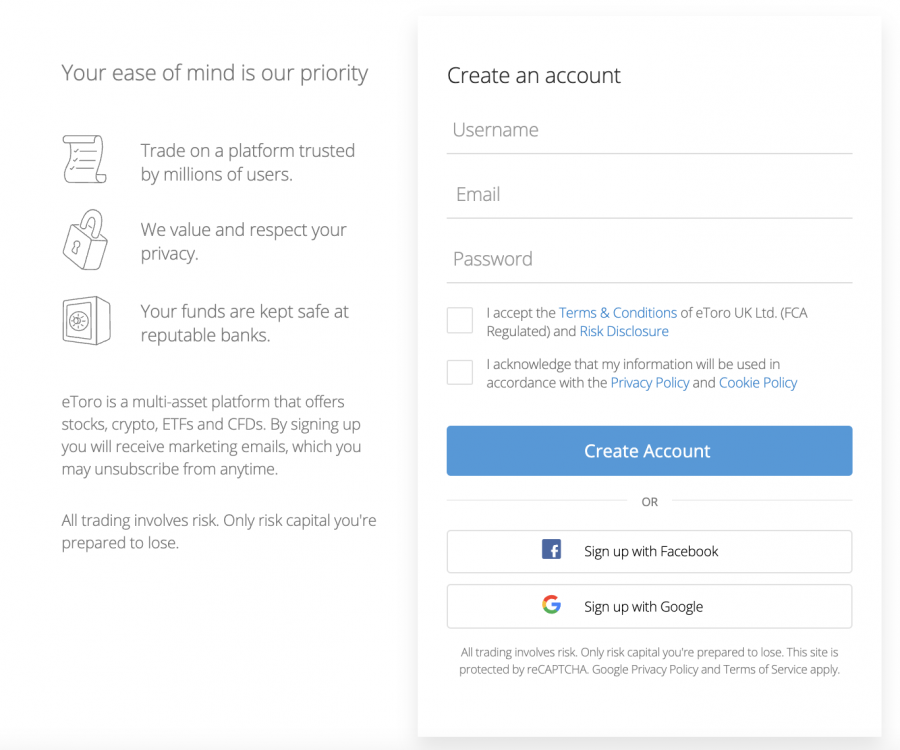

Step 1: Open an eToro Crypto Account

You will first need to register an account at eToro – which you can do by clicking on the ‘Join Now‘ button. A registration form will then populate, which initially will ask you to enter your name, email address, cell phone number, and a preferred username.

Once you click on ‘Create Account’, you will be asked for some additional information – such as your date of birth, national tax number, and residential address.

Step 2: Verify Account

The best thing about using eToro to trade crypto is that the platform is authorized and regulated by ASIC. This does, however, mean that you will need to verify your account before you can start trading.

First, to verify your identity, upload a copy of your passport or driver’s license. To verify your residential status, upload a recently issued document with your name and address on it. A bank statement or utility bill will suffice.

Step 3: Deposit Funds

Chose your preferred deposit method from a debit/credit card, bank transfer, Paypal, Skrill, and more. All deposit types attract a small fee of just 0.5%.

And, the minimum deposit amounts to just $50 for Australian traders.

Step 4: Search for Crypto

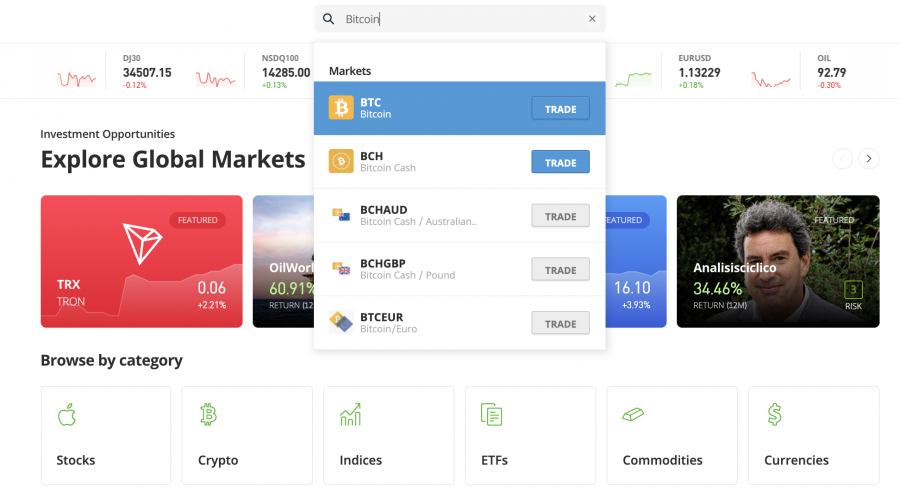

You can search for the crypto that you wish to trade – should you know which marketplace interests you. As you can see in the image below, we are searching for Bitcoin.

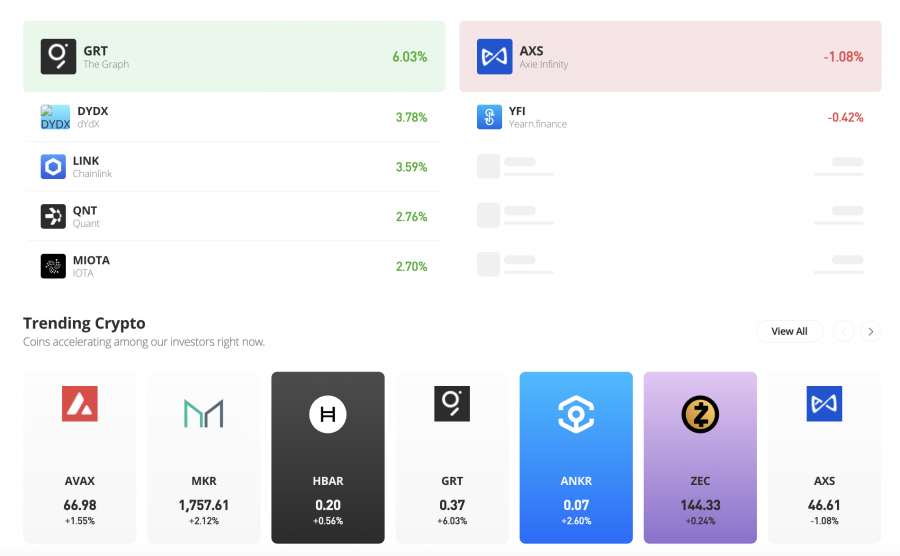

You can also click on the ‘Discover’ button. After clicking on ‘Crypto’, to can view each and every digital asset market supporter by this platform.

Step 5: Buy Bitcoin

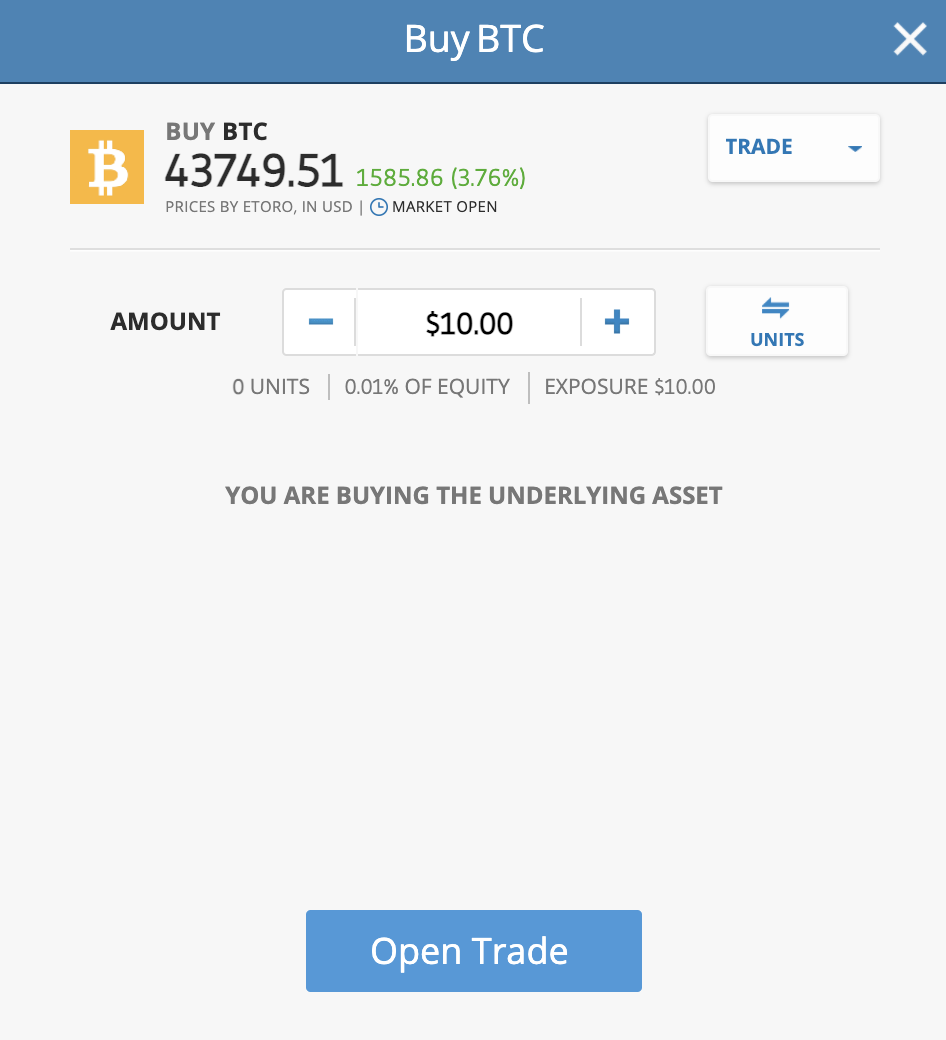

When you see the crypto that you want to trade, click on the ‘Trade’ button. This will then present you with an order box – like in the image below.

In the ‘Amount’ box, enter your stake from $10 upwards. Click on the ‘Open Trade’ button to confirm your first crypto trade.

Latest Crypto Exchange News Australia

Before rounding off this guide, let’s take a quick look at some pressing news stories related to crypto exchanges:

- In an exciting move, social media giant Twitter has expanded its ‘$Cashtags’ feature to support another 30 cryptos. This feature allows users to search for coins/tokens on the platform and receive real-time data and price charts.

- Leading crypto exchange Huobi has partnered with Solaris to launch a crypto debit card. This card will allow Huobi’s users to pay for goods and services throughout Europe using their crypto holdings.

- Finally, the Swedish Financial Supervisory Authority has permitted Binance to begin operating in the country. This now means Sweden-based traders and investors can buy and sell cryptos using Binance.

Conclusion

Choosing the best crypto exchange in Australia for fees, security, supported coins, customer service, and more, is a crucial stage of investing in digital currencies. Especially with the crypto markets beginning to show signs of recovery.

To get started with a trading account right now – eToro came out as the overall best Bitcoin exchange in Australia for 2023.

At this platform, you can trade dozens of digital currencies at industry-leading fees and, most importantly, the exchange is licensed by ASIC.

Cryptoassets are a highly volatile unregulated investment product. 68% of retail investor accounts lose money when trading CFDs with this provider

FAQs on Crypto Exchanges in Australia

What is a crypto exchange?

What crypto exchanges can I use in Australia?

What is the best cryptocurrency exchange in Australia?

Which crypto exchange has the lowest fees in Australia?

What is the safest crypto exchange in Australia?

Read more: Commonwealth Bank of Australia will No Longer Debut Crypto Trading App