Looking for the best crypto index funds? With the $1 trillion cryptocurrency sector having stabilized since June, 2022, investors are looking for ways to invest in crypto without having to own a crypto wallet or use a crypto exchange. For many, a crypto index fund is the answer.

Below we review the fast-growing market for crypto index funds. We shine the spotlight on 10 opportunities as well as outline some popular reasons to invest. We begin by highlighting the clear advantage that individual crypto presales offer over crypto funds when it comes to exciting growth potential.

10 Best Crypto Index Funds to Invest in 2023

With the market for crypto index funds at an early state of maturity, investors looking to make returns fast might do better to focus on the best emerging cryptos individually with crypto presales:

- Dash 2 Trade Crypto Presale – Better and Cheaper Alternative to Crypto Index Funds

- IMPT Crypto Presale – Innovative Crypto Carbon Credit Platform in Presale Now

- Bitwise 10 Crypto Index Fund (BITW) – Best Crypto Index Fund in Terms of Size

- Bitwise DeFi Crypto Index Fund – Best Crypto Index Fund for DeFi Assets

- Grayscale Digital Large Cap Fund (GDLC) – Digital Fund Giant Offering Top 6 Large Cap Cryptos

- Grayscale DeFi Fund – Best Cryptocurrency Index Fund For Top 5 DeFi Cryptos

- Osprey Bitcoin Trust (OBTC) – Bitcoin Offered for Physical Ownership Without Need for Crypto Wallet

- Bitwise Crypto Industry Innovators ETF (BITQ) – 29 of the Top Companies Supporting the Crypto Sector

- Purpose Bitcoin ETF (BTCC) – Index Fund for Crypto Centered on Physically-Settled Bitcoin

- CI Galaxy Ethereum ETF (ETHX) – Galaxy Crypto Index Fund Focused on Ethereum

- Hashdex Nasdaq Crypto Index ETF (HDEX) – Crypto Fund That Tracks the Nasdaq Crypto Index

A Closer Look at the Best Crypto Index Funds

Crypto index funds make up a fast-growing market divided into trusts and ETFs (Exchange-Traded Funds). But they are still thin on the ground.

With the crypto sector still evolving, the US Securities and Exchange Commission (SEC) is sparing with its regulatory approval.

- Indeed, digital fund giant Grayscale announced in October 2022 that it was suing the SEC for failing to approve the conversion of the Grayscale Bitcoin Trust (GBTC) from Bitcoin futures to spot Bitcoin.

What’s more, some of the fund giants are steering clear of crypto for the moment. There is in Q4 2022 no Vanguard crypto index fund, for example.

- But there is a Fidelity Cryptocurrency index fund centered on the Fidelity Crypto Industry and Digital Payments Index, called the Fidelity Crypto Industry and Digital Payments ETF.

So is crypto still one of the best sectors to invest in right now? Below we review the best crypto index funds available.

Crypto Presales – A Better Alternative To Crypto Index Funds

With even the best crypto index funds, a question mark remains. The best crypto presales – where investors can get in on the ground floor with a single project – offer low entry prices and far more explosive growth potential. For investors looking to find diamonds in the rough, crypto presales are the way forward.

It is vital that investors do their research and due diligence to get the full picture. We feature two top trending cryptos in presale below.

1. Dash 2 Trade (D2T) – World-Class Crypto Analytics Platform in Presale Now

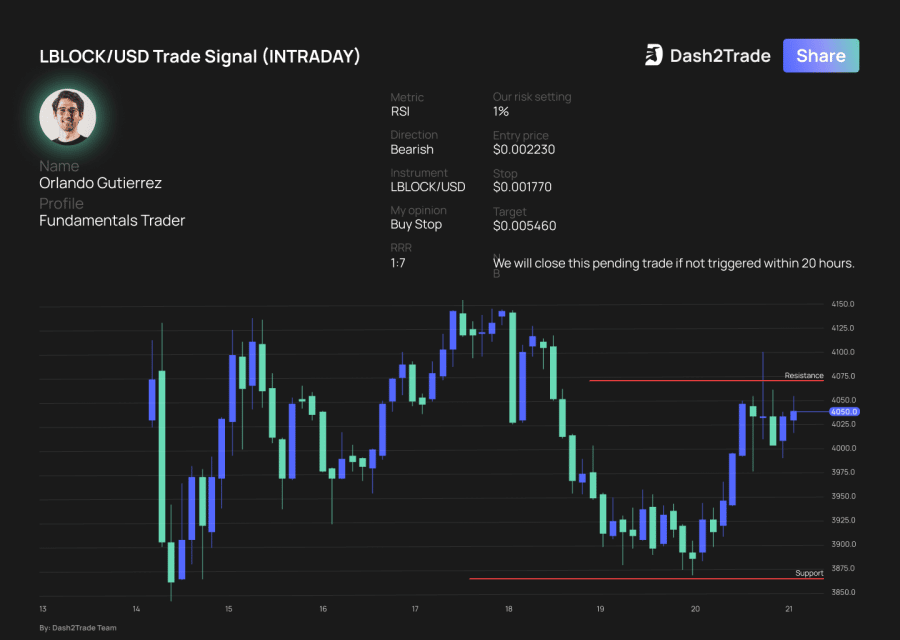

Brought to market by the team behind established trading signal brand Learn 2 Trade, which has 70,000 global users, Dash 2 Trade is currently in the second phase of its presale having sold out phase 1 in just three days and now raised $3.5 million in just a week.

A crypto signals, intelligence, and analytics platform, Dash 2 Trade makes it easier for investors looking for the best emerging cryptos, as well as hone their trading/investment strategy and maximize profit-taking potential by making more well-informed decisions on their holdings.

Dash 2 Trade will utilize a range of data points, insights, and tools to help its users.

There will be trading signals to highlight potential buying and selling opportunities, while on-chain data will be analyzed and social sentiment on websites such as Reddit and Twitter tracked to spot and take advantage of trends early.

For traders, there will be a range of tools to access, including automated trading APIs and a back-tester that allows strategies to be optimized and tested in real-time without risking capital.

There will also be social trading tools and members-only groups to discuss strategies and insights, as well as trading competitions.

Dash 2 Trade is also developing a bespoke scoring system to track and rank the best new crypto presales on the market, providing a range of insights to ensure investor confidence in new projects.

They will be scored out of 100 on categories such as tokenomics, roadmap, and the credentials of the developers.

The platform will also send out alerts to highlight new coin listings and exchange offerings so users can position themselves before coins pump.

Dash 2 Trade is available through a three-tier monthly subscription – Free, Starter, and Premium – that gives subscribers access to different levels of tools and data.

The native D2T token – which is needed to pay for the subscription – is currently in stage 2 of its 9-stage presale.

On sale at $0.05, each new stage sees an increase in the price of the token. By the final stage, tokens will sell at $0.0662, a 39% increase from stage 1.

That means that while a $100 investment landed 2,100 tokens in stage 1, it returns just 1,510 in stage 9.

Dash 2 Trade, which has a fully doxxed and KYC-verified team, has a max supply of just 1 billion tokens, with 700 million (70%) of them available during the presale stage, with no vesting period.

The remaining tokens will be split between the development of the protocol (15%), talent acquisition (5%), liquidity (5%) and the competition pool (5%).

Read through the Dash 2 Trade whitepaper or join the Telegram group for more information.

| Price Stage | Amount Raised In Stage | Token Allocation |

| $0.0476 | $1,666,000 | 35,000,000 |

| $0.0500 | $3,500,000 | 70,000,000 |

| $0.0513 | $3,591,000 | 70,000,000 |

| $0.0533 | $4,663,750 | 87,500,000 |

| $0.0556 | $4,865,000 | 87,500,000 |

| $0.0580 | $5,075,000 | 87,500,000 |

| $0.0606 | $5,302,500 | 87,500,000 |

| $0.0635 | $5,556,250 | 87,500,000 |

| $0.0662 | $5,792,500 | 87,500,000 |

How to Buy D2T

Investors can buy D2T in just four simple steps:

- Set up a MetaMask crypto wallet.

- Connect the wallet to the Dash 2 Trade presale platform.

- Purchase using Tether (USDT) or Ethereum (ETH).

- Receive D2T tokens when presale phase finishes.

For a comprehensive tutorial, read our guide on how to buy Dash 2 Trade tokens in 2023.

| Min Investment | 1000 D2T |

| Max Investment | NA |

| Purchase Methods | ETH, USDT |

| Blockchain | Ethereum (ERC-20 token) |

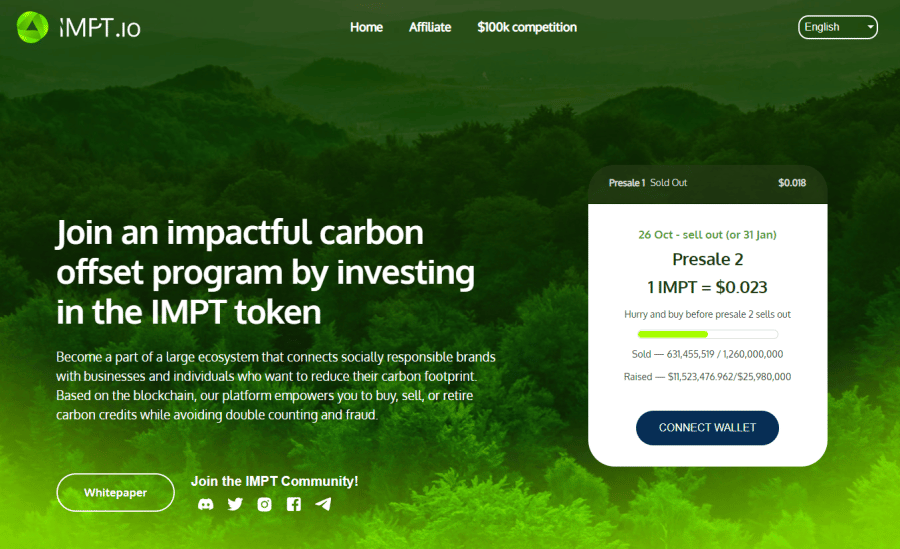

2. IMPT – Innovative Crypto Carbon Credit Platform in Presale Now

Phase 1 of the IMPT presale raised $11 million in just three weeks to sell out four weeks ahead of schedule as investors raced to buy into the green crypto project.

Many consumers nowadays are investigating how to buy carbon credits. But, with carbon credit trading limited to institutions, it is often difficult for retail investors to get involved.

With its convenient and progressive blockchain format, IMPT ranks as one of the best carbon offset programs online.

With IMPT, consumers can do their bit for the environment without working too hard. IMPT owners can buy carbon credits in NFT format, or acquire carbon credits automatically as they do their regular shopping, with the project having partnered with over 10,000 retail brands via deep-linking.

Leading brands such as Microsoft, Amazon, and LEGO are already among the partners.

Investors hungry for eco-friendly cryptos with a bright future can get hold of IMPT right now in its second phase of its three-phase presale.

- Presale 1 sold out with the IMPT token valued at $0.018.

- In Presale 2 – available now – IMPT is going for $0.023.

- Presale 2 will see coins sell for $0.028 – a 55% increase on phase 1.

Time is running out for smart investors wanting to buy one of the hottest cryptos right now before the price goes up again in the next presale phase or general listing.

- Presale 2 ends on January 31st, 2023 or when the IMPT allocation runs out.

- And 613m of the 1.26bn IMPT tokens have already been sold.

How to Buy IMPT

Investors can buy IMPT in just four simple steps:

- Set up a MetaMask crypto wallet.

- Connect the wallet to the IMPT token presale platform.

- Purchase using Tether (USDT) or Ethereum (ETH).

- Receive tokens when the presale phase finishes.

| Min Investment | $30 recommended |

| Max Investment | NA |

| Purchase Methods | ETH, USDT |

| Blockchain | Ethereum (ERC-20 token) |

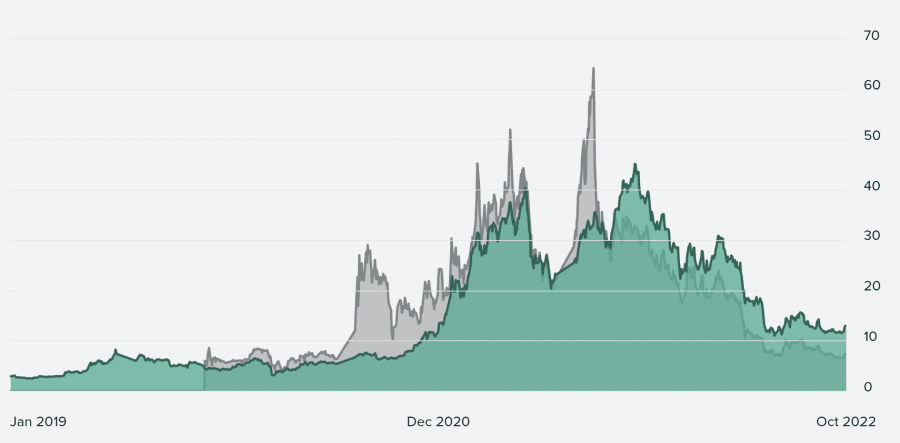

3. Bitwise 10 Crypto Index Fund (BITW) – Best Crypto Index Fund in Terms of Size

Launched in 2017, this crypto index fund is managed by San Francisco-based asset managers Bitwise.

With $409m Assets Under Management (AUM), this is the largest crypto index fund in the world – and was also the first. It tracks the Bitwise 10 Large Cap Crypto Index.

BITW holds the ten ‘most highly valued cryptocurrencies’ weighted by market capitalization. Thus, this fund devotes over 90% of its portfolio to the two big crypto: Bitcoin (BTC) and Ethereum (ETH). Less than 10% is dedicated to big blockchain players Cosmos (ATOM), Cardano (ADA) and Solana (SOL) as well as a handful of DeFi tokens.

| Crypto | Portfolio Weight |

|---|---|

| Bitcoin | 61.5% |

| Ethereum | 29.3% |

| Cardano | 2.1% |

| Solana | 1.8% |

| Polygon | 1.3% |

| Polkadot | 1.2% |

| Avalanche | 0.8% |

| Uniswap | 0.8% |

| Cosmos | 0.6% |

| Chainlink | 0.5% |

BITW charges a fee (Expense Ratio) of 2.5%. When it comes to how to invest in crypto, smart investors might wonder why they should not skip the fee, buy Bitcoin and a selection of other crypto, and construct their own crypto fund?

The answer in this case is that the fund managers stay on top of the market, so private investors do not have to: BITW assets are rebalanced monthly, and 24/7 monitoring is in place for ‘sudden events’ ie. crypto meltdowns.

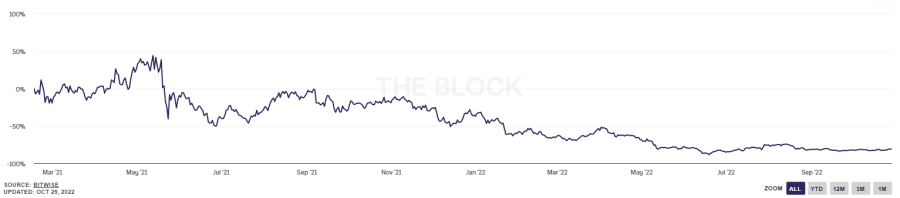

4. Bitwise DeFi Crypto Index Fund – Best Crypto Index Fund for DeFi Assets

Launched in early 2021, this fund is not available as shares on the open market like its fellow Bitwise fund reviewed above. This is why it does not feature a ticker symbol.

Rather, the Bitwise Defi Crypto Index Fund is currently available only to institutions and accredited investors: that means US citizens with an earned income exceeding $200,000 or a net worth over $1m.

Investors can get involved as an individual or through a Trust, IRA or company – provided they can cover the hefty minimum investment of $25,000. A running Expense Ratio of 2.5% applies.

This fund tracks the Bitwise Decentralized Finance Crypto Index – which centers on the 10 largest DeFi assets. It is down 77% in the last 12 months.

DeFi Decentralized Exchange Uniswap (UNI) takes just over half the portfolio allocation. DeFi blockchain Aave (AAVE) is next with just over 12%. And in third place is DAI stablecoin producer Maker (MKR) with 8%.

| Crypto | Portfolio Weight |

|---|---|

| Uniswap | 52.8% |

| Aave | 12.0% |

| Maker | 8.2% |

| Lido DAO | 5.3% |

| Curve | 5.1% |

| Convex Finance | 3.9% |

| Compound | 3.8% |

| Loopring | 3.5% |

| yearn.finance | 3.1% |

| Ox | 2.2% |

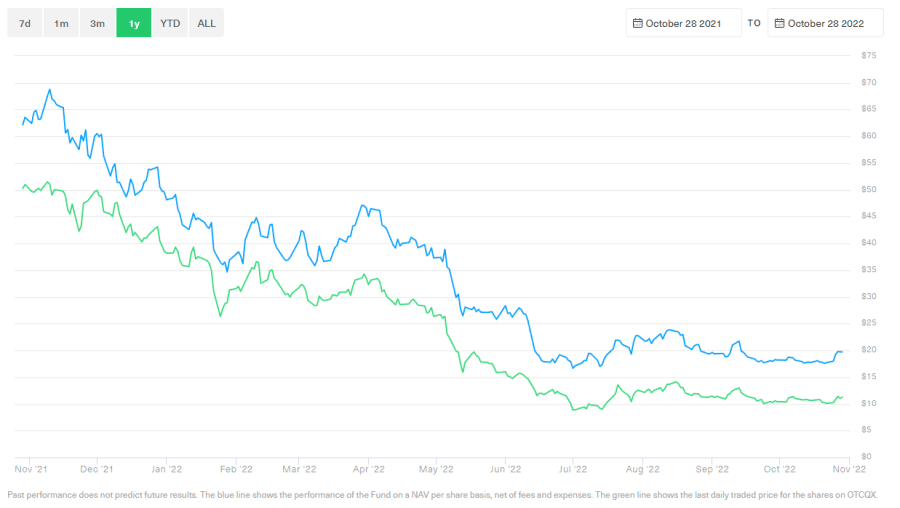

5. Grayscale Digital Large Cap Fund (GDLC) – Digital Fund Giant Offering Top 6 Large Cap Crypto Assets

Grayscale is a digital assets fund provider with $7bn under management. It offers 14 trusts focussed on a single crypto asset each, as well as three diversified index funds.

Launched in 2018 as a private fund, shares in Grayscale’s GDLC fund are now available on the OTCQX, the premier tier of the OTC (Over-The-Counter) market in the US.

GDLC tracks a composite index based on individual Coindesk indices for each of its crypto assets.

In all, this fund holds $204m of crypto. In June 2022, Grayscale cut Bitcoin Cash, Litecoin, Polkadot and Uniswap from this portfolio. Now therefore the fund takes a narrower scope than the Bitwise 10 Crypto Fund by focussing on the top 6 largest crypto instead of the top 10:

| Crypto | Portfolio Weight |

|---|---|

| Bitcoin | 63.27% |

| Ethereum | 30.53% |

| Cardano | 2.21% |

| Polygon | 1.32% |

| Avalanche | 0.86% |

| Solana | 1.81% |

Crypto assets are held securely in ‘cold’ (ie. offline) storage via Coinbase, the world’s third-biggest cryptocurrency exchange based in the US.

Year-to-date, this fund is down by 70% – thanks to the crypto winter which set in as a result of rising inflation and the Ukraine crisis.

With private placements, investment is limited to accredited investors with a minimum investment of $50,000. A 2.5% expense fee applies.

- Retail investors may struggle to find GDLC shares on all of the best investment apps, but can find them with Interactive Brokers, Ameritrade and Charles Schwab online brokers.

- Private US investors can subscribe to the fund via their IRAs (Individual Retirement Accounts) with Pacific Premier Trust, Millennium Trust and the Entrust Group.

6. Grayscale DeFi Fund – Best Cryptocurrency Index Fund For The Top 5 DeFi Crypto

This is a small fund with just $3.9m AUM. It has 233k shares outstanding, and tracks the Coindesk DeFi Index. That means that – like the Bitwise DeFi Crypto Index Fund reviewed above – this fund focuses on the best DeFi coins rather than the crypto sector as a whole.

Grayscale says that this fund aims to derive value from, ‘a basket of decentralized finance in the form of a security whilst avoiding the challenges of buying, storing, and safekeeping DeFi directly.’ Grayscale stores its crypto with leading US exchange Coinbase.

| Crypto | Portfolio Weight |

|---|---|

| Uniswap | 64.13% |

| Maker | 10.73% |

| Compound | 4.57% |

| Aave | 14.45% |

| Curve | 6.12% |

Like its fellow Grayscale GDLC fund, this crypto index fund offers a stiff expense ratio of 2.5% and has suffered during the crypto winter, with a trailing 12 month loss of 75%.

Investors can get involved with this fund if they are accredited investors and are prepared to make a minimum investment of $50,000. IRA subscriptions are available.

7. Osprey Bitcoin Trust (OBTC) – Bitcoin Offered For Physical Ownership Without Need For a Crypto Wallet

Launched in 2019 as a private investment vehicle, the Osprey Bitcoin Trust provides investors with exposure to the Bitcoin price without actually having to buy Bitcoin. As Osprey explain, this is ‘crypto, but no wallet or keys required.’

OBTC tracks the CMBI Bitcoin Index. It holds $57m of Bitcoin which is held in cold storage by exchange Coinbase (just as with the Grayscale Digital Large Cap Fund reviewed above).

A management fee of just 0.49% applies. As with all management fees, this is automatically deducted from brokerage accounts.

- This fund is available via IRA accounts (for US citizens) as well as with online brokers Fidelity Investments, Ameritrade and Charles Schwab.

- For taxation purposes, the fund is structured as a Delaware Grantor Trust.

Osprey founder Greg King said in an interview with US news outlet CNBC in 2021 that the two key features of this fund are its custodianship of Bitcoin with Coinbase and its low management fee of 0.49%.

The fund is down 72% year-to-date as a result of the decline in Bitcoin’s price due to macro economic factors.

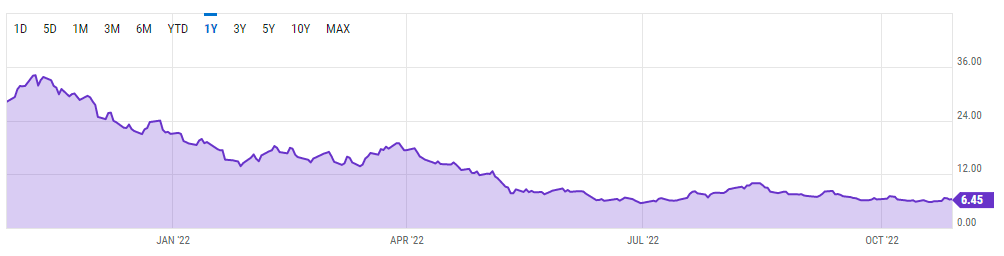

8. Bitwise Crypto Industry Innovators ETF (BITQ) – 29 of the Top Companies Supporting the Crypto Sector

Launched in 2021, this crypto index fund follows crypto-related companies rather than the best cryptocurrency coins and tokens.

Rather than being an index fund for cryptocurrency, BKCH tracks the Bitwise Crypto Innovators 30 Index. This index focusses on 29 pure-play crypto companies that create crypto infrastructure rather than crypto itself. Thus crypto exchanges, crypto mining firms and mining equipment providers and other service providers are included.

BITQ’s top 3 holdings by portfolio allocation are:

| Company | Portfolio Allocation | Description |

|---|---|---|

| Microstrategy (MSTR) | 14.02% | US analytics and cloud giant |

| Coinbase Global Inc (COIN) | 12.55% | Biggest US cryptocurrency exchange |

| Silvergate Capital (SI) | 7.54% | Financial services provider for cryptocurrency firms |

The fund, says Bitwise, ‘offers investors a ‘picks and shovels’ approach to investing in this dynamic space’. Rather than investing in the product that is being mined (crypto), the fund invests in companies which produce mining equipment.

BITQ holds $65m AUM and features an expense ratio of 0.85%.

9. Purpose Bitcoin ETF (BTCC) – Index Fund for Cryptocurrency Centered on Physically-Settled Bitcoin

This ETF is based in Canada. Outside of SEC jurisdiction, it is thus able to invest directly in crypto. This ETF was the first to offer physically-settled Bitcoin, launching in February 2021. It is now available in three versions:

- BTTC: FX hedged.

- BTCC.B: non-FX hedged.

- BTCC.I: Carbon-offset, non FX-hedged.

As of October, 2022, BTCC holds $659m of Bitcoin (BTC). That equates to 23,460 coins. 100% of BTCC’s Bitcoin is held in cold storage (ie. offline, safe from potential theft) and the custodian Gemini is insured up to $200m.

Purpose Investments distinguish this ETF from other Bitcoin funds by stressing that, ‘this isn’t just a claim to paper like Bitcoin futures, it’s the real deal. When you buy the ETF, we buy real Bitcoin with your money.’

The ETF tracks the TradeBlock XBX Index which, in turn, tracks the price of Bitcoin globally.

- A management fee of 1.00% applies (capped at 1.50%).

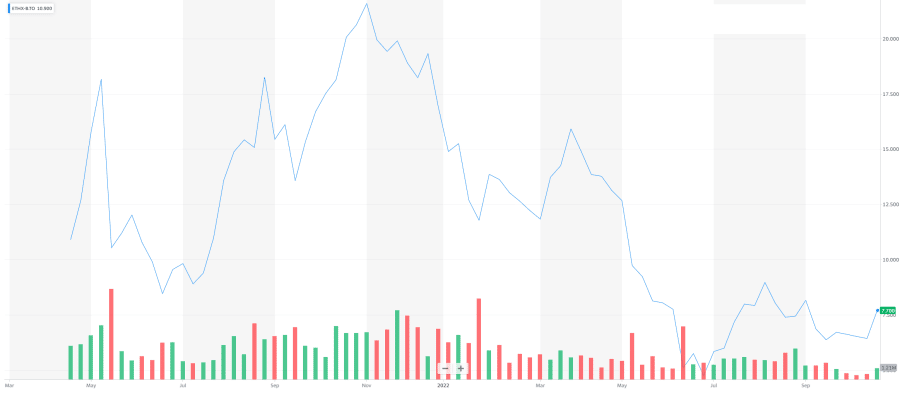

10. CI Galaxy Ethereum ETF (ETHX) – Galaxy Crypto Index Fund Focused on Ethereum

ETHX tracks the Bloomberg Galaxy Ethereum Index. As the name suggests, this ETF gives investors exposure to the price of Ethereum. The fund owns $387m of Ethereum.

Year-to-date, the fund is down 63% – with the crypto winter having taken its toll on Ethereum, despite the crypto’s promising transition to ETH 2.0 this year.

A management fee of 0.73% applies, which compares favourably with the Bitwise fees reviewed above.

Investors will note generally that Canada hosts a clutch of crypto funds – thanks to it being free of restrictive SEC regulation. Although some online brokers may provide access, US investors may face problems in accessing Canadian products like ETHX.

11. Hashdex Nasdaq Crypto Index ETF (HDEX) – Crypto Fund That Tracks the Nasdaq Crypto Index

This ETF might loosely be called a Nasdaq crypto index fund because it tracks the Nasdaq Crypto Index (NCI). Launched in 2018 by Brazilian fund managers Hashdex on the Bermudan stock exchange, HDEX is composed of ‘market weighted large-capitalization crypto assets.’

Thus, like the Bitwise 10 Crypto Index Fund, HDEX focuses on some of the biggest crypto coins:

| Crypto | Portfolio Weight |

|---|---|

| Bitcoin | 64.6% |

| Ethereum | 31.8% |

| Litecoin | 0.8% |

| Chainlink | 0.7% |

| Polkadot | 0.5% |

| Uniswap | 0.5% |

| Stellar | 0.4% |

| Bitcoin Cash | 0.3% |

| Axie Infinity | 0.1% |

| Filecoin | 0.2% |

| Sandbox | 0.2% |

Eagle-eyed investors will see that this is the only crypto index fund we have reviewed to feature one of the best gaming crypto coins of yesteryear – Axie Infinity (AXS) – as well as Sandbox (SAND), which is a metaverse crypto.

Otherwise, as is standard with market-weighted crypto index funds, HDEX devotes over 90% of its portfolio to the two big crypto coins Bitcoin (BTC) and Ethereum (ETH).

A management fee of 1.0% applies. HDEX crypto is stored by three custodians: Fidelity Digital Assets, Bitgo Trust, and Coinbase.

Thanks to the roller-coaster crypto sector, the fund is down a staggering 487% since its inception.

What is a Crypto Index Fund?

‘Crypto index fund’ has become something of a catch-all term for any fund that gives investors exposure to crypto. Strictly speaking, a fund is only an index fund if it focuses on an index; hence the name.

Most crypto funds do track an index. That index can center on:

- One crypto – like the Bloomberg Galaxy Ethereum Index tracked by the CI Galaxy Ethereum ETF (ETHX).

- Many crypto – like the Coindesk DeFi Index tracked by the Grayscale DeFi Fund.

- A selection of crypto-related companies – like the Bitwise Crypto Innovators 30 Index tracked by the Bitwise Crypto Industry Innovators ETF (BITQ).

Crypto funds which are not index-orientated include the ProShares Bitcoin Strategy ETF (BITO) and the Global X Blockchain & Bitcoin Strategy ETF (BITS), which track Bitcoin futures. For the best crypto ETFs read our comprehensive guide now.

Whether they track an index or not, funds can take the form of trusts or Exchange-Traded Funds (ETFs). Investors who have learnt how to invest in ETFs can confirm that ETFs offer many advantages to retail investors – not least that shares in ETFs can be traded as easily as conventional shares.

Are Crypto Index Funds a Good Investment?

Crypto index funds offer five main advantages:

1. No Need For a Crypto Wallet

Investors wanting to buy Ethereum, for example, may wonder why they would buy ETH via a fund. The answer is that buying into a crypto index fund takes away the need to use any of the free crypto wallets on offer.

Whilst it is true that setting up and using a crypto wallet is getting easier as the crypto sector matures, the technical requirements can be off-putting to some investors. With a fund, investors can generally use their regular online brokerage account to get involved, or open an account with a fund provider.

2. No Need to Use a Crypto Exchange

Using a crypto exchange is – just like using a crypto wallet – getting easier as time goes on. Exchanges are trying to appeal to the mass market. And consequently the technology is becoming simpler, including the automatic verification procedures that investors used to complain about.

Crypto index funds mean that crypto investors can get exposure to crypto without facing the hassle of signing up with an exchange.

3. No Need to Risk Own Crypto to Theft

Both individual crypto wallets and crypto exchanges remain vulnerable to hacks and thefts.

- For example, the biggest exchange in the world, Binance, had $570m stolen from its proprietary blockchain the BNB Smart Chain in October, 2022. $100m remains unrecovered. (Generally, though, Binance is considered to offer one of the best crypto apps).

Using a crypto index fund means that investors can avoid the risk of their own crypto being stolen. Crypto funds are quick to advertise that 100% of crypto is held in ‘cold storage’. This means that coins and tokens are stored offline other than when they are transferred.

4. 24/7 Monitoring of the Market

We know that crypto is the most volatile of all assets. And often this volatility can strike very suddenly.

One advantage of investing with a crypto index fund is that the fund managers often have software in place which monitors the markets for sudden catastrophes and acts accordingly to minimize any damage to the portfolio.

5. Institutional Involvement

Critics of the crypto sector point out that cryptocurrency generally is a speculative investment. Unlike stocks, crypto coins are not generators of revenue per se. Some retail investors are thus hesitant to get involved in crypto on their own.

The advent of crypto index funds means that institutions are viewing the crypto sector with increasing confidence – and this will be interpreted as a reassuring sign by some investors.

- This institutional confidence is reflected elsewhere in the crypto world, with the Norwegian tax department for example having just announced plans to set up an office in the Decentraland metaverse.

Crypto Index Funds – The Downside

A downside of crypto index funds is their lack of diversification compared to regular mutual funds and ETFs. Another drawback is that they tend to offer high Expense Ratios compared to funds dealing with regular stocks. And, when it comes to growth potential, even the best Cryptocurrency index fund cannot match a crypto presale.

Why Crypto Presales are Better than Crypto Index Funds

Investors wanting to find out how to invest in crypto know that two main options are to buy crypto individually, or to buy them in basket via a crypto fund of some sort.

The key advantage of buying crypto individually is that the investor can take part in crypto presales. These are the equivalent of pre-IPO sales in the conventional stock market (read our guide here on how to invest in pre-IPOs.)

Crypto investors who get in early get the best deals before the price of a new token increases during its presale phases and then usually spikes when it is listed on a centralized or decentralized exchange.

A main advantage of buying groups of crypto (as with a crypto index fund) is to spread risk. Indeed, investors who have researched how to invest in mutual funds will know that the advantage of funds in general is diversification. Conventional funds invest in big baskets of stocks, which spreads risk.

But with even the best cryptocurrency index funds, the maximum basket size tops out at 11 assets. The advantage of diversification does not therefore come into play significantly.

And crypto index funds miss out on opportunities. Fund managers confine their investments to the crypto with the largest market capitalizations. These, by definition, have less growth potential than new coins. Thus many crypto index funds account for 70-80% of the crypto sector by market capitalization – but miss out on over 22,000 of the best altcoins in terms of growth potential.

This means that not only is the basket of assets offered by a crypto index fund limited in terms of diversity, but also that the real crypto gems in presale phase are entirely overlooked.

Conclusion

Above we have outlined the scope of the crypto index fund sector. We have noted that funds generally focus on one crypto asset, with a maximum asset basket of just 11 crypto. Even the best crypto index funds do not therefore currently offer much in the way of diversification.

In their defense, of course, crypto index funds do save the investor the trouble of getting a crypto wallet and dealing with one of the crypto exchanges (although the best crypto exchanges are becoming increasingly user-friendly in 2023).

Canny crypto investors might do well to consider the two presale gems we have identified in our search for the best crypto deals:

The D2T token is the in-house crypto for the new analytics and social trading platform Dash 2 Trade, brought to market by the experienced team behind successful trading signals venture Learn 2 Trade. Investors can buy Dash 2 Trade now.

IMPT is a revolutionary carbon offsetting platform using the security of NFTs to offer genuine carbon offsets to regular consumers. Investors can buy IMPT now direct.

Dash 2 Trade - New Gate.io Listing