Global spending on cybersecurity has skyrocketed due to the necessity of cloud computing and remote operations implemented by organizations and governments. As a result of the increased demand, investors are looking to buy cybersecurity companies’ stock.

In this guide, we discuss the best cybersecurity stocks to invest in by performance in 2023.

Below, we’ve ranked the best cybersecurity stocks to watch in 2023:Best Cybersecurity Stocks According to Performance 2023

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

A Closer Look at the Best Performing Cybersecurity Stocks

Below, investors will see our full analysis of the top cybersecurity stocks by performance. Read on to find out which cybersecurity stocks are being purchased by institutional investors.

1. Booz Allen Hamilton – Technology and Management Consulting Firm

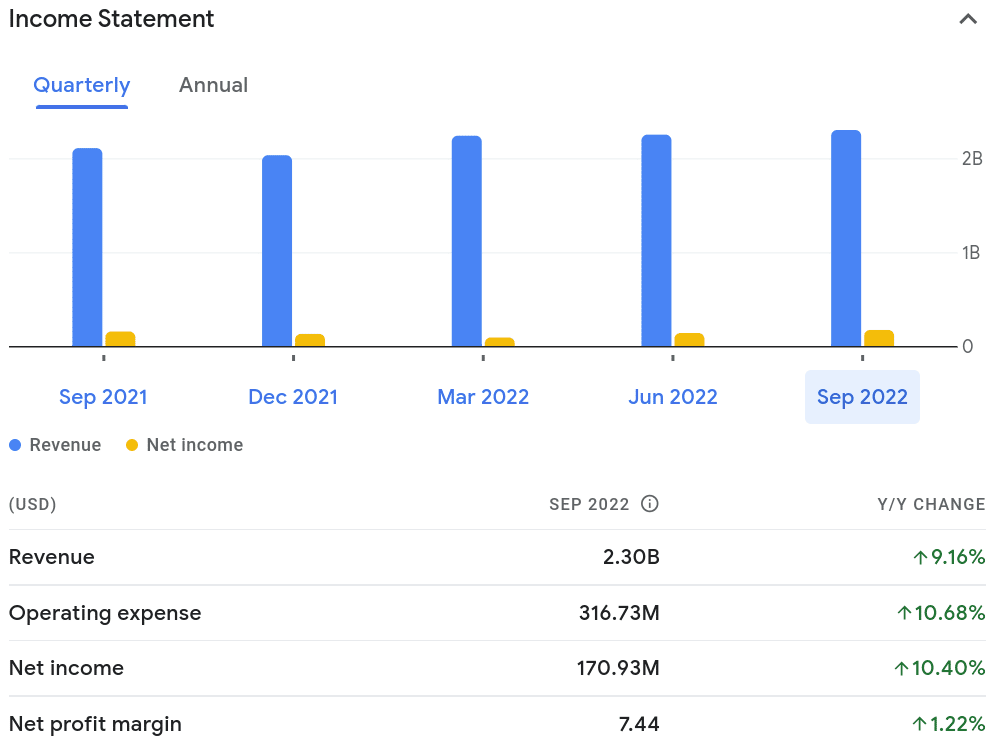

Booz Allen Hamilton is one of the top cybersecurity stocks by performance. The stock has increased by over 21.5% year to date (YTD). Through its subsidiaries, this holding firm offers management and technology consulting services.

The company provides support to the US government in the areas of civil markets, intelligence, and the military. It’s the largest IT contractor serving the government. Revenue growth slowed down in January 2022 due to the company hiring more staff.

However, in Q1 and Q2 2022 earnings and revenues reports, the company beat top estimates. As a result, Booz Allen Hamilton stock increased by 0.3% in July 2022, and 4.8% in October. According to the latest quarterly financial report, revenue increased to $2.3 billion.

This is an increase of 9.16% year on year (YoY). Meanwhile, net income went up by 10.4% and diluted EPS (earnings per share) was up by 12.28%. The net profit margin was up 1.22% compared with the previous year. In the Q2 2023 earnings call, EPS expectations were beaten by 18.86%. Revenue was a surprise of 1.77%.

According to Wall Street sell-side analysts over 90 days, Booz Allen Hamilton was rated 3.92 out of 5, so is a ‘buy’. At the time of writing, the market capitalization is over $14 billion.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

2. CACI International – Holding Company Offering Security Mission Services

One of the best cybersecurity stocks to invest in according to Wall Street sell-side analysts is CACI International, having given it a buy rating of 4.26 out of 5. CACI International stock is up 11.25% YTD.

CACI International is a holding corporation that provides services for national security missions through its subsidiaries. The firm assists the US government with internal and international issues. This also covers the fields of surveillance, intelligence, communications, reconnaissance, and more.

This cybersecurity company reported revenue of just over $1.6 billion in its latest quarterly financials – an increase of 7.7% YoY. Net income was up 1.15%, diluted EPS had increased by 1.62%. The company’s net profit margin was down 6% due, to higher expenses.

Q1 2023 ESP expectations were beaten by 2.48%, and revenue was a surprise of 1.28%. This cybersecurity stock went up almost 5.5% the day its most recent earnings report was released. As of writing, the market capitalization of CACI International stock is over $7.1 billion

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

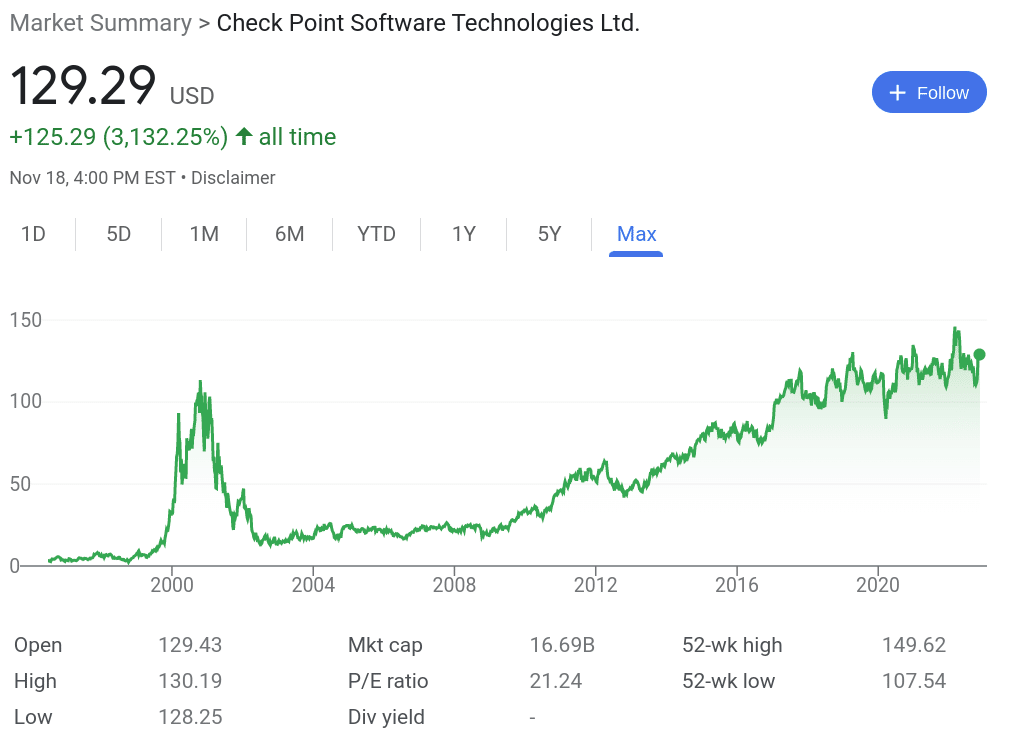

3. Check Point Software – American-Israeli Multinational Combined Hardware and Software Developer

Check Point Software is a renowned cybersecurity business. The founder and CEO of Check Point Software is credited with creating the first firewall. In addition to solutions for network, endpoint, cloud, and mobile security, the company offers security management services.

Checkpoint Software stock is up over 11.08% YTD. According to 8 of 30 Wall Street sell-side analysts over 90 days, this stock is a strong buy, while 14 say hold. According to the company’s latest quarterly financial report, revenue increased to $577.6 million, up 8.16% YoY.

Net income was down 1.6%, although diluted EPS increased by 5% YoY. Net profit margin fell by 9%. In the Q3 2022 earnings call, EPS was a surprise of 5.75% and expected revenue was beaten by 1.02%.

The company has been awarded a state of California Software License Program (SLP). This gives state and local government organizations an easy way to buy security tools and services to support the digital transformation of the sector.

All partners that have a Check Point SLP Agreement are top-tier resellers with the skills and experience necessary to meet customers’ demands in the areas of cybersecurity, cloud computing, and more. As of writing, Check Point Software carries a market capitalization of over $16.6 billion.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

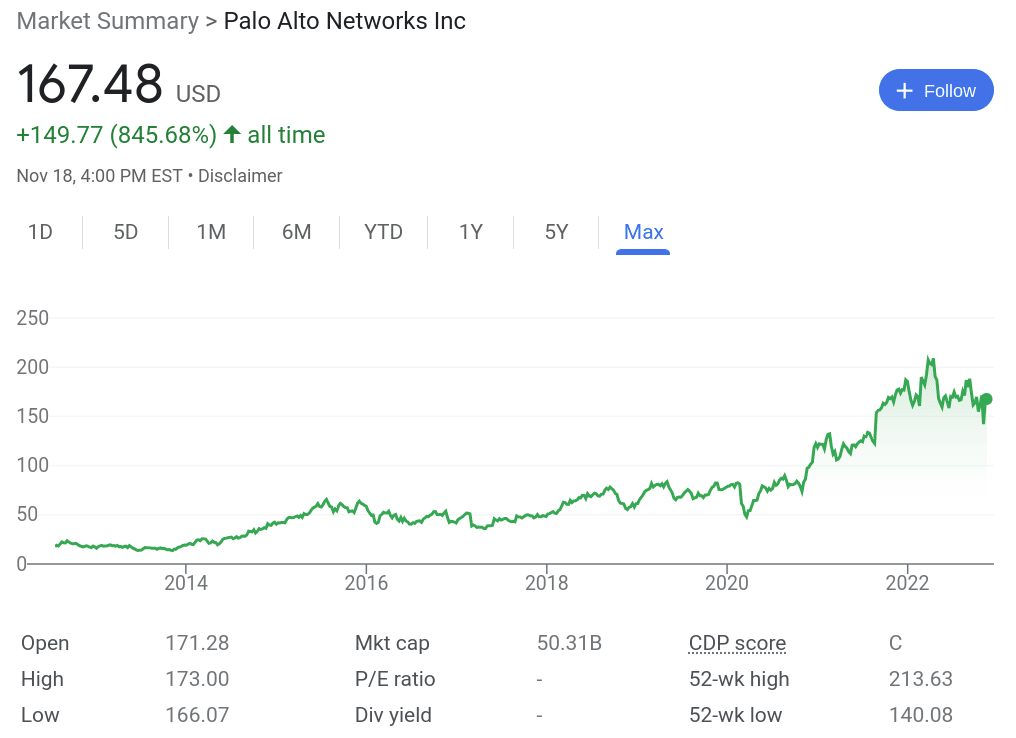

4. Palo Alto Networks – Independent Cybersecurity Specialist Based in the US

By revenue and market capitalization, Palo Alto Networks is the biggest pure-play cybersecurity company in the space. This company, now a top cloud security service, focussed on firewalls for many years.

Although there is still strong demand for its legacy services, cloud computing is where true development is. Furthermore, over three years, the company has acquired more than a dozen smaller cloud-native businesses.

Palo Alto Networks has thus completely revamped its security operation. Amid a broader stock market sell-off, Palo Alto Networks is down 7.67% YTD. That said, the company has beaten earnings and revenue expectations and full-year guidance has been increased.

In the company’s Q1 2023 earnings call, Palo Alto Networks’ EPS was beaten by 20.37%, while revenue was a surprise of 0.79%. The latest quarterly financials show a revenue increase of 25.33% YoY, net income was up 119.31%, and diluted EPS increased by 117.14%.

Net profit margin was up a huge 115.4% for the company. Palo Alto Networks carries a market capitalization of over $50.3 billion as of writing.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

5. Qualys – Compliance Management and IT Security Company

Qualys specializes in information security and compliance management. Customers in the US can use its solutions to manage vulnerability, scan online apps, find malware, and perform other activities.

According to sell-side analysts over 90 days, Qualys is a ‘buy’, with a score of 3.68 out of 5. Qualys stock is down over 9.2% YoY. In February 2022, Qualys stock lost over 14.3% in a single trading day after disappointing Q4 and full-year 2021 results.

In August 2022, earnings guidance topped all estimates, leading to an increase of 12% in one day. According to Qualys’ latest quarterly financials, revenue was up 19.66% YoY. Net income had fallen by 0.39%. Diluted EPS increased by 1.43%, and the net profit margin was down 16.74% YoY.

That said, in the Q3 2022 earnings call, Qualys beat EPS expectations by 8.83% and revenue by 0.77%. As of writing, the market capitalization of Qualys is over $4.7 billion.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

6. CyberArk – Identity Management Provider Across Multiple Sectors

The world’s leading organizations, including about half of the S&P 500 constituents trust CyberArk to help secure their assets. According to the CyberArk platform, the company had an ARR growth of 44% in 2021. Subscription revenue grew by 139% in the same year.

CyberArk is down 12.8% YTD. However, this is one of the best cybersecurity stocks to buy according to Wall Street sell-side analysts over 90 days. CyberArk is a ‘strong buy’, with a score of 4.70 out of 5. Out of 24 analysts, 18 rated this a strong buy.

In November 2022, CyberArk stock began to increase following reports it had beaten earnings estimates. According to CyberArk’s Q3 2022 earnings, EOS was beaten by 70.83%. Revenue was also a positive surprise, beating expectations by 1.13%.

The latest quarterly financials meanwhile state that revenue was up 25.55% YoY and net profit margin had increased by 10.44%. Net income, on the other hand, was down 12.43% and diluted EPS had fallen by 9.59% YoY.

The market capitalization of CyberArk as of writing is over $6 billion.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

7. Fortinet – Multinational Corporation Developing and Selling CyberSecurity Solutions

In terms of revenue and market capitalization, Fortinet is among the biggest cybersecurity firms in the world. It has sustained double-digit percentage growth and is very lucrative, much like its rival, Palo Alto.

The so-called ‘freeway’ on which data moves on the internet is maintained by CDNs, which constitute internet infrastructure. Akamai is a leader in this industry, it focuses on developing edge computing technology. This moves data out of centralized centers and closer to end consumers.

In terms of performance, Fortinet stock is down by 21.7% YTD. However, according to Fortinet’s latest quarterly financials, as of September 2022, revenue was $1.15 billion, up 32.55% YoY.

Net income saw an increase of an impressive 42% and diluted EPS was up by 52.63%. The net profit margin was 20.15%, an increase of 7.12% YoY. Its Q3 2022 earnings call showed that Fortinet beat revenue expectations by 2.28% and EPS by 20.57%.

The market capitalization of Fortinet as of writing is around $40.7 billion.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

8. Akamai – Internet Infrastructure Provider for Software and Media Delivery and Cloud Security

Akamai, a content delivery network (CDN), is one of the best cybersecurity stocks to watch according to sell-side analysts. The company ensures information safely reaches its intended location. This type of network is significant because the amount of data being transmitted over the internet is continually rising.

In order to improve its network security services and safeguard its clients from ransomware attacks, Akamai bought the Israeli company Guardicore in 2021. The company also acquired the cloud infrastructure provider Linode in the first half of 2022. Akamai stock is down 22.6% YTD, which isn’t to concerning considering it only underperformed the S&P 500 by around 5%.

Wall Street sell-side analysts have rated Akamai stock a buy in the last 90 days, giving it a score of 3.85 out of 5. We analyzed Akamai’s latest quarterly financials and found that while revenue was up 2.51% YoY, net income and diluted income were down 29.5% and 39.5% respectively.

Net profit margin fell 41.06% YoY. According to its Q3 2022 earnings call, it beat EPS expectations by 2.96% and revenue by 0.67%. The market capitalization of Akamai at this time is around $14.3 billion.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

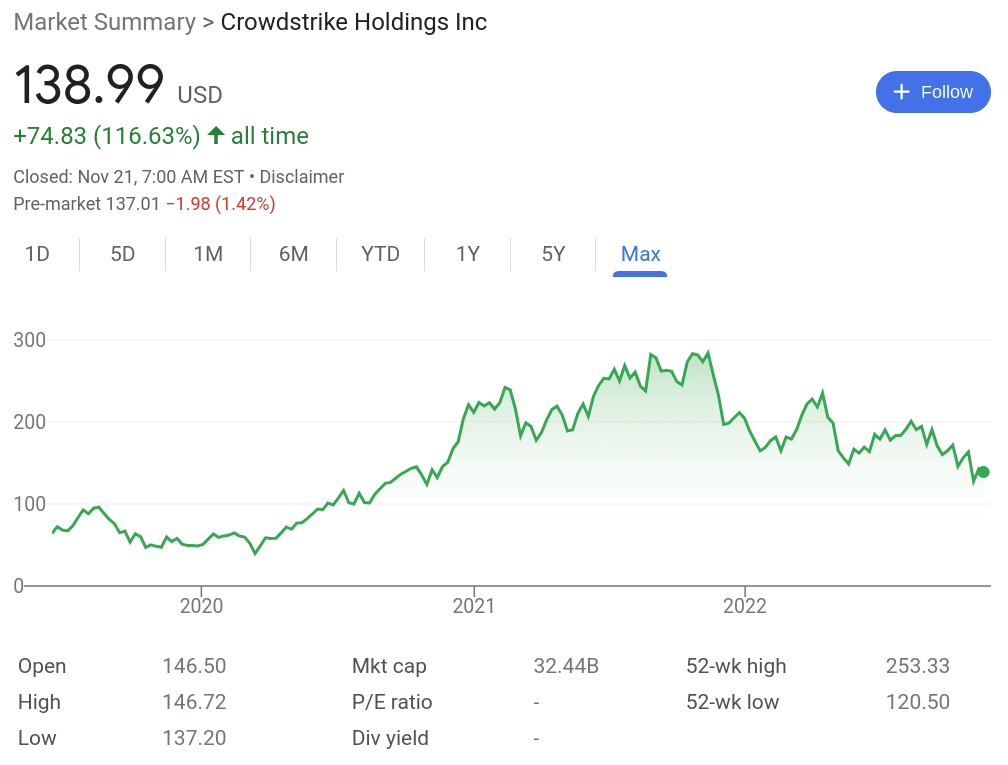

9. Crowdstrike – One of the Leaders in the Cybersecurity Space by Market Cap

Crowdstrike is one of the best cybersecurity stocks to buy according to Forrester Research and Gartner. The company has received high accolades from these analysts, who recognized Crowdstrike’s leadership in endpoint security. Crowdstrike has also been voted the top security business at the 2022 SC Awards.

The distinctive architecture of the company’s Falcon platform is a major contributor to its success. It consists of 22 distinct modules, ranging from identity protection and threat intelligence to endpoint and cloud security. All of these may be installed without necessitating a device reboot.

In terms of the stock’s performance, Russian cyber attack fears caused Crowdstrike to increase by 13.01% in one day in March 2022. The same happened in April when Crowdstrike was upgraded as one of the best cybersecurity stocks to invest in according to Goldman Sachs. The stock increased 7.32% in one trading day following the upgrade.

However, despite positive quarterly financials reported in July 2022, Crowdstrike is down over 29.9% YTD. The fast expansion of CrowdStrike and the robustness of its main performance measures suggest that the stock selloff is unjustified.

Revenue was up 58.4% YoY according to its latest quarterly financials, while net income has increased by 14.01%. Meanwhile, net profit margin was up 54.7% YoY. Furthermore, despite the difficult macroeconomic environment, it has strong scale-up growth.

Those who argue that Crowdstrike is one of the best cybersecurity stocks could buy it at a 55% discount. That’s when compared with its all-time high of $284 – which was achieved in November 2021. Crowdstrike has a market capitalization of around $32.4 billion as of writing.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

10. Splunk – Software Developer Powering Enterprize Observability

Splunk, an expert in data analytics, offers software that aids businesses in sorting through information logs, keeping track of online activity, and planning reactions to data breaches. The business has transferred clients to more recent cloud-based versions of its software.

Institutional investors own a significant amount of Splunk’s shares, which shows some credibility. Late in 2021, Splunk stock fell by 18% in one trading day after its CEO had stepped down. Year to date, Splunk stock has fallen by 33.9%.

This is still one of the cybersecurity stocks to watch according to numerous analysts nonetheless. Splunk stock has been rated a ‘buy’ by Wall Street sell-side analysts, over 90 days. 20 of the 41 analysts have rated Splunk a ‘strong buy’. 8 say ‘buy’, and 13 rate this cybersecurity stock a ‘hold’.

According to the latest quarterly financial report, revenue is up 31.8% YoY and net income has increased 45.3%. Net profit margin is also up, by 58.59%. The company’s earnings call is expected at the end of November 2022.

The market capitalization of Splunk as of writing is over $12.5 billion.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

Why do People Invest in Cybersecurity Stocks?

Because of the increase in big data, cloud computing, and remote workers, cyberattacks have been increasing in volume and complexity for many years.

Therefore, the challenge of protecting digital systems has risen dramatically.

- A larger amount of data is being accessed from more locations than ever before

- As a result, the market for security services is robust and expanding

- This may help cybersecurity companies’ stock rise over the coming years

- As such, some of the most appealing long-term investment prospects in technology right now are related to cybersecurity

Businesses, governments, and individuals need the assistance of cybersecurity firms to protect themselves from online fraudsters and bad actors.

According to Gartner, global spending on goods and services related to information security and risk management could increase 11.3% (compared with 2022) to $188.3 billion in 2023.

Things to Consider Before Investing in Cybersecurity Stocks

Below, we discuss a range of key considerations that investors should make when searching for the best cybersecurity stocks 2023 by performance.

Financial Health

It’s important to check the finances of each prospective company when analyzing the best cybersecurity stocks. The financial reports of all publicly listed companies are readily available and can be found with a quick search.

Investors could look at metrics like the quarterly results in terms of profit, EPS, and revenue.

Not only does this information offer a clear picture of how the company handles finances, but when a report is released, this can affect stock prices negatively or positively. When it comes to cybersecurity stock, investors could also consider comparing it to other companies in the same industry, or a benchmark.

A good benchmark to look at might be the First Trust Nasdaq Cybersecurity or the iShares Cybersecurity and Tech ETF. The First Trust Nasdaq Cybersecurity ETF has fallen by 22.9% YTD, while Booz Allen Hamilton has risen more than 21.5%.

Determine Personal and Company Goals

We’ve talked about a range of cybersecurity stocks to watch, some have similar cloud-based business models, and others are considered legacy software providers.

These services are utilized by many different businesses, including but not limited to healthcare, banking, finance, and retail. Additional users of cybersecurity services include individuals, companies, and governments.

See below:

- Cloud-based companies tend to be the best cybersecurity stocks to buy according to performance

- This is because they have a natural competitive edge with the newest software technology

- Legacy cybersecurity companies tend to produce large profits and have the funds to invest in modernization

- Businesses that handle web content and apps are also becoming more and more crucial to a company’s online security

- This is in addition to cybersecurity companies that keep an eye on cloud-based operations

For example:

- Booz Allen Hamilton offers a range of different resources, inclusive of cloud-based and beyond

- Akamai and Splunk monitor IT infrastructure and manage web content and apps

- Meanwhile, Palo Alto Networks, Fortinet, and Crowdstrike specialize in cloud computing

- Fortinet and Palo Alto benefit from being long-standing legacy security providers that have also entered the cloud market

Investors should, however, consider their own goals. For instance, some might only be looking to buy shares in companies that focus on cloud technology. Others might be keen to find a growth cybersecurity stock and thus – have less preference for where the firm fits into the industry.

Dividends

Dividend stocks typically pay out on a quarterly basis. This presents investors with a way to earn a passive income, and many use this to reinvest. Investors who research this subject should know that all annual dividend yields are based on the price of the stock at the time of writing.

One of the best cybersecurity stocks to invest in according to sell-side analysts – Booz Allen Hamilton, is one of the only firms in this space that pays dividends. It pays an annual dividend yield of 1.59% as of writing. The most recent quarterly dividend payment amounted to $0.43.

Where Can You Buy Cybersecurity Stocks?

After choosing the best cybersecurity stocks, investors need to place an order with a reputable online brokerage that provides access to the relevant marketplace.

Below, we’ve reviewed one of the most popular regulated trading platforms offering zero commission on stocks.

eToro – Cybersecurity Stock Broker With Zero Commission

eToro is a broker that has the regulatory approval of numerous bodies. This includes the SEC, the FCA, ASIC, and CySEC. The company is also registered with FINRA and other financial organizations. eToro lists a wide range of assets.

Each and every cybersecurity stock we’ve talked about today, such as Booz Allen Hamilton and CACI International is available at this brokerage. Furthermore, when investors buy stocks on eToro, they can do so on a commission-free basis. The broker also allows investors to buy stocks in fractional amounts of $10 or more.

Investors who don’t want to buy equities in fractional quantities will find some of the best cybersecurity penny stocks, including BIO-Key International and Blackberry. eToro also offers commission-free ETFs that track the top cybersecurity stocks by performance.

One such ETF is First Trust Nasdaq Cybersecurity. This ETF follows an index of businesses operating in the tech and industrial cybersecurity sector. Holdings include Palo Alto Networks, Fortinet, CrowdStrike, Check Point, CyberArk, and more. This exposes an investor’s portfolio to a basket of stocks simultaneously.

Investors can find a beginner’s guide on ETF trading here. Investors who want to try shortening the learning curve could opt to allocate $200 or more to Copy Trading. Choose a pro trader based on their preferred asset class, sector, and other metrics and every stock they buy or sell will be mirrored automatically.

eToro also offers a selection of Smart Portfolios that automatically track a basket of stocks. There is one called Cyber Tech Stocks, which offers access to over 30 related equities. eToro also offers access to indices, forex, commodities, and cryptocurrencies. The initial account balance required is just $20 for US investors, with no deposit fee.

78% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

That concludes our full analysis of the best cybersecurity stocks 2023 by performance. Booz Allen Hamilton had a strong financial performance, surpassing analysts’ expectations. Moreover, its stock increased by over 21.5% YTD.

The company has notable clients like the US government and military. This is in addition to commercial clients covering manufacturing, healthcare, energy, and financial services. Investors unsure of where to buy cybersecurity companies’ stock could consider eToro.

The platform lists everything from cybersecurity penny stocks, to the top performers we’ve talked about today. Investors only need to pay the spread when buying stocks at eToro – meaning the platform is commission-free.

78% of retail investor accounts lose money when trading CFDs with this provider.