Decentralized crypto exchanges enable users to buy and sell cryptocurrency with no middleman, directly from other people who want to sell or buy the same tokens. Decentralized exchanges (DEXs) offer low fees, fast transaction speeds, anonymity, and more.

In this guide, we’ll review the best decentralized exchanges for 2023 and explain why traders and investors should try out a DEX for their next crypto purchase.

The Best Decentralized Crypto Exchanges List

We’ve tested out dozens of top DEXs to bring you the 11 best decentralized exchanges for 2023:

- OKX – Best Decentralized Crypto Exchange with 340+ Tokens

- Binance – Leading Global Exchange with P2P Crypto Trading

- Uniswap – Popular Decentralized Exchange for DeFi

- PancakeSwap – Top DEX for Discovering New Cryptocurrencies

- Huobi – Decentralized P2P Trading with No Fees

- KuCoin – 20+ Payment Methods for BTC, ETH, USDT, and USDC

- SushiSwap – Fast-growing DEX for Crypto Yield Farming

- dydx – Leading Decentralized Crypto Exchange for Day Trading

- Curve Finance – Top DEX for Staking DeFi Cryptocurrencies

- Kine Protocol – Advanced DEX for Crypto Trading and Staking

- ApolloX – Trade Decentralized Bitcoin Futures

The Top Decentralized Exchanges Reviewed

Want to know more about the best decentralized exchanges? We’ll take a closer look at what each of these DEXs has to offer for crypto traders and investors.

1. OKX – Best Decentralized Crypto Exchange with 340+ Tokens

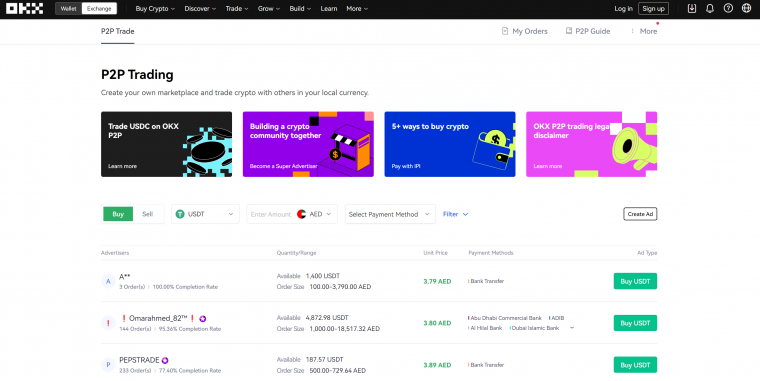

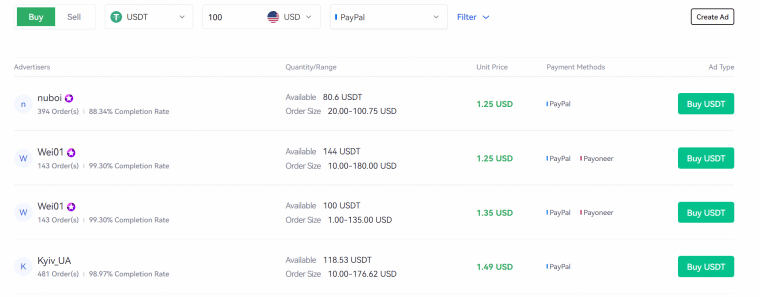

OKX also offers decentralized peer-to-peer (P2P) trading for the most popular tokens on the exchange, including Bitcoin, Ethereum, Tether, USD Coin, TrueUSD, and Maker. Traders can set their own prices on OKX’s decentralized exchange as well as choose from more than 900 available payment methods. It’s incredibly simple to get funds in whatever currency a seller desires.

Even better, OKX doesn’t charge any trading fees for its P2P exchange. The only time traders pay is if they want to create an advertisement for their trade, which can help other traders find what they’re offering to buy or sell on the DEX.

Creating a decentralized order on OKX is simple. Just choose a coin, the amount to buy or sell, and a payment method, and the trade will instantly be communicated to other traders on OKX. It’s also easy to follow traders on OKX’s decentralized exchange, which is handy if there are specific traders that often use the payment methods a buyer or seller works with.

OKX accepts deposits by credit card, debit card, bank transfer, or e-wallet. In addition, the exchange has its own custodial wallet app for iOS, Android, and web browsers. This makes it simple to securely store crypto tokens and access OKX’s P2P exchange to make swaps at any time. The wallet also has a growing library of decentralized apps (dApps).

Check out OKX today to get started with the best decentralized exchange for 2023!

2. Binance – Leading Global Exchange with P2P Crypto Trading

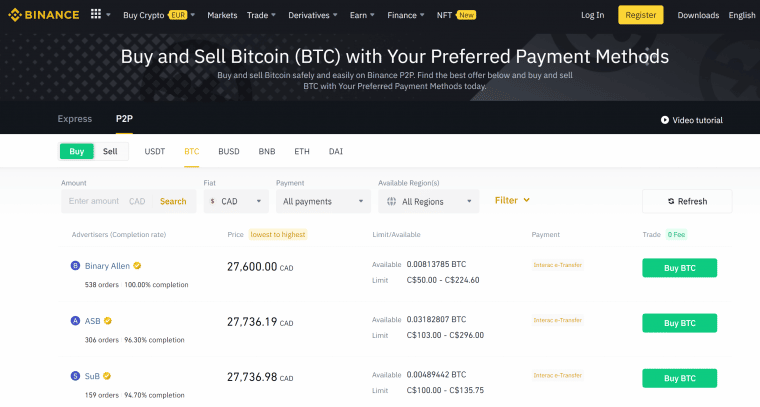

On the Binance DEX, traders can buy Ethereum, BTC, BNB, Maker, Tether, and Binance USD. There are more than 50 different currencies available for payments and dozens of payment methods for each currency. So, traders anywhere in the world can easily find traders in their region.

Binance’s P2P exchange is anonymous when buyers use cash, so privacy is a major selling point for this DEX. In addition, buyers and sellers who accept a listed order on the exchange don’t pay any fees. Makers – users who create buy or sell advertisements – are charged a very small (variable) transaction fee.

Another benefit to Binance’s P2P exchange is that it’s highly secure. The platform puts all funds into an escrow account while a transaction is taking place, so there’s no way for a buyer or seller to back out of a deal after money has been sent. This keeps both individuals in a transaction safer and ensures that every transaction proceeds smoothly.

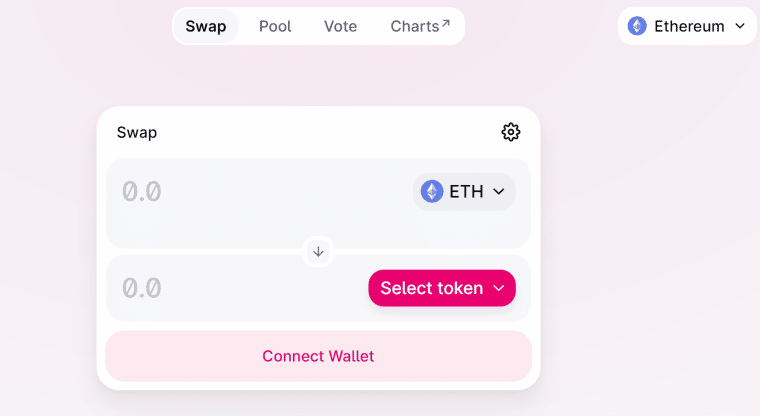

3. Uniswap – Best Decentralized Exchange for DeFi

There are hundreds of ERC-20 tokens available to buy and sell on Uniswap. That’s in part because this DEX makes it incredibly simple for new tokens to list. Holders of a unique token just need to add the coin to the exchange by funding an equivalent amount of Ethereum to create a new liquidity pool. This means that Uniswap is home to many new crypto tokens that can’t be found elsewhere.

Uniswap has some of the lowest transaction fees of any major decentralized exchange. On top of that, users can earn interest on their crypto holdings by staking tokens to a liquidity pool. This makes trading easier in that token and offers opportunities for crypto yield farming.

Notably, Uniswap also offers a governance token, UNI. UNI holders have a vote on open proposals on Uniswap, which help to reward the people that support this exchange and keep Uniswap competitive.

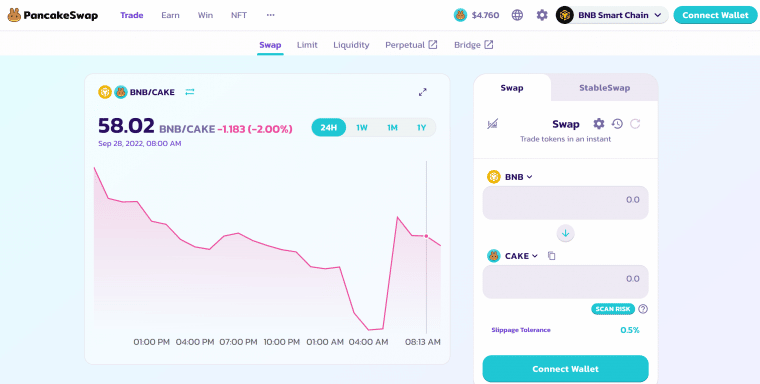

4. PancakeSwap – Top DEX for Discovering New Cryptocurrencies

PancakeSwap was originally built on the Binance Smart Chain, making it quite distinct from competitors like Uniswap and SushiSwap. Recently, it launched a new integration with the Ethereum blockchain. Now that PancakeSwap operates on both blockchains, users have access to thousands of tokens and more liquidity.

Swapping from one token to another on PancakeSwap is incredibly simple and takes only seconds. The platform also has a special swap for stablecoins that offers near-zero fees and reduced slippage.

PancakeSwap is also attractive as a DeFi crypto interest platform. This DEX offers numerous liquidity pools where investors can stake their tokens as well as yield farming offers that earn up to 778% APY interest. PancakeSwap’s own crypto token, CAKE, can be staked alongside stablecoins like BUSD and USDT to earn up to 50% APY.

5. Huobi – Decentralized P2P Trading with No Fees

Huobi’s P2P platform offers dozens of currencies and up to 59 local payment methods for each currency. The vast majority of decentralized trades are completely free, making Huobi a great option for traders who hate paying fees.

Tokens and payments are stored in escrow accounts while transactions are happening, keeping both parties secure automatically. Huobi also verifies advertisers on the platform and uses facial recognition software to ensure that transactions are legit. These measures reduce privacy on Huobi compared to the other best decentralized crypto apps, but offer users greater trust in the system.

Another benefit to Huobi is that the exchange offers 24/7 customer support. That’s a feature that traders won’t typically get when using a DEX, and it can be a big help for first-time users. Huobi also has a detailed explainer video to assist new users in trading on the decentralized exchange.

What is a Decentralized Crypto Exchange?

A decentralized crypto exchange is a crypto exchange where traders can buy and sell tokens directly from or to one another. There is no middleman involved to make trades happen. The trading process is fully automated to provide security and ease of use.

Decentralized crypto exchanges can be standalone platforms that are governed by a decentralized autonomous organization (DAO), like Uniswap or PancakeSwap. Alternatively, they can be part of a P2P trading platform within a centralized exchange, like at OKX, Binance, and Huobi.

How Do Decentralized Bitcoin Exchanges Work?

Decentralized exchanges don’t have a middleman to facilitate trades. Instead, they rely on automated processes to ensure that a buyer receives their tokens and a seller receives their payment.

When a transaction is initiated, the seller’s tokens are put into an escrow account. This is a secure account in which the tokens are under control of the smart contract or algorithm governing the DEX. When the buyer’s payment reaches the seller, tokens in the escrow account are automatically transferred to the buyer. If payment is not made, tokens in the escrow account can be returned to the seller.

There are two types of DEXs: swaps and orderbook exchanges.

Swaps, like Uniswap and PancakeSwap, are simply designed to enable traders to swap one token for another. They rely on liquidity pools that contain pairs of tokens, such as ETH/USDT.

If a trader wants to swap ETH for USDT or vice versa, the tokens for the trade simply come from this liquidity pool following the escrow process above. Users can stake tokens to a liquidity pool to provide liquidity, typically in exchange for interest on their staked tokens.

Orderbook exchanges like OKX, Binance, and Huobi enable traders to list tokens they want to buy or sell along with the prices and payment methods they’re willing to accept. In this case, traders are buying or selling directly from one another.

It’s up to traders to search the order book for trades that they’re interested in. The coins and payment methods available for trading can vary significantly over time.

Benefits of Decentralized Cryptocurrency Exchanges

Decentralized cryptocurrency exchanges have several benefits over centralized exchanges.

Coin Selection

One of the biggest advantages to using a decentralized crypto exchange is that the coin selection is often enormous. DEXs make it easy for new coins to list, so traders and investors can access emerging cryptocurrencies very early on. Many cryptocurrencies spike in price after launching on a DEX, so this could be a big advantage for traders in search of the next big token.

Privacy

Decentralized exchanges typically do not require identity verification or other Know Your Customer (KYC) measures. This means that traders can buy and sell crypto on an exchange in near-total anonymity.

Low Fees

Trading fees on decentralized crypto exchanges are often lower than those on centralized exchanges. That’s because there’s less work and risk involved for the exchange itself, since the exchange never holds tokens as a middleman.

DeFi Access

Many of the best decentralized exchanges are also DeFi platforms that offer crypto staking. Traders who use a DEX can stake their tokens to a liquidity pool to support the exchange’s operations and earn interest on their crypto.

Decentralized Exchanges vs Centralized Exchanges

Decentralized exchanges are fundamentally distinct from centralized exchanges, which serve as middlemen to match buy and sell orders for specific tokens.

Compared to decentralized exchanges, centralized exchanges typically charge higher fees and have smaller selections of cryptocurrencies. However, they also offer some benefits, such as greater customer support and simpler user interfaces. Many centralized exchanges also have custodial wallets for customers to store their crypto on the exchange, which some users may find easier than storing their tokens in a non-custodial wallet.

To some extent, centralized and decentralized exchanges serve different purposes in the crypto ecosystem. Centralized exchanges provide an easy on-ramp into crypto and offer experiences more similar to traditional finance. Decentralized exchanges serve as the backbone for DeFi and make it possible for more advanced crypto investors to swap tokens and earn yield.

It’s important to note that many centralized exchanges have decentralized exchange platforms within them. The P2P trading platforms at OKX, Binance, and Huobi are all decentralized exchanges within these larger centralized exchange platforms.

How to Use a Decentralized Crypto Exchange

Ready to buy crypto on a decentralized exchange? We’ll walk readers through the process to buy Tamadoge, one of the best new crypto tokens for 2023, from OKX, our top-rated DEX.

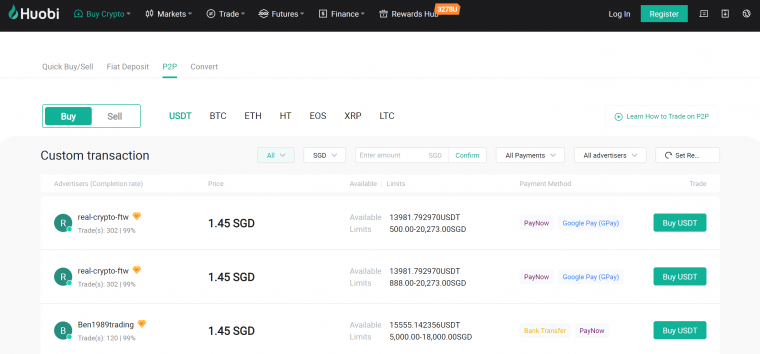

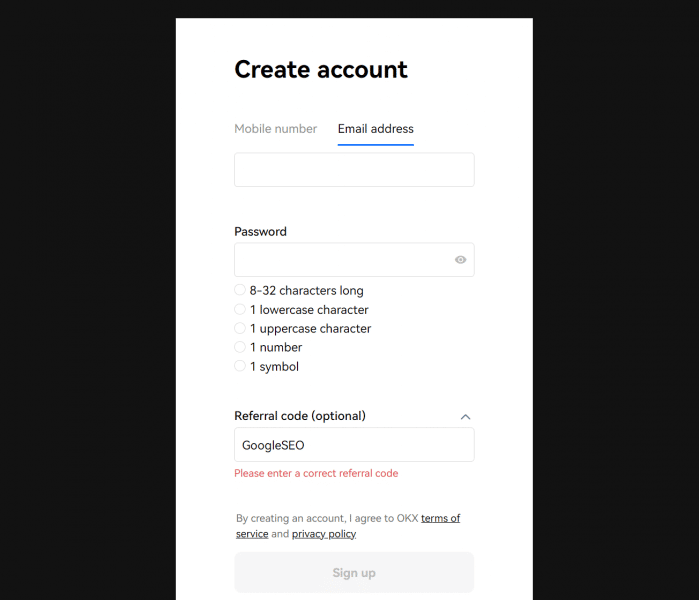

Step 1: Sign Up

To get started, head to the OKX website and click Sign Up. Enter an email address or phone number and a password, then click Sign Up.

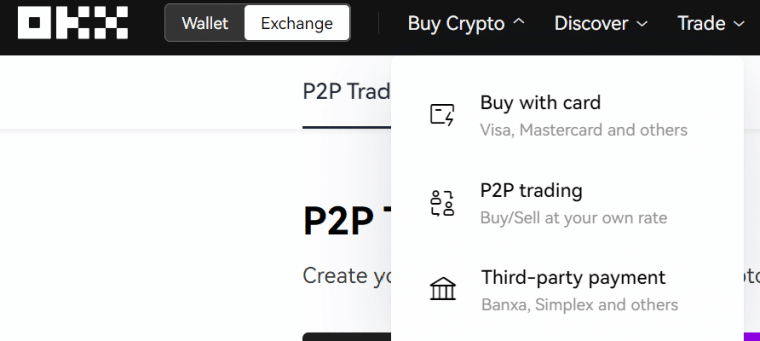

Step 2: Visit P2P Exchange

From the OKX dashboard, select Buy Crypto from the navigation menu and then select P2P Exchange.

Step 3: Buy Crypto

In the P2P exchange window, select Buy and choose a token to purchase. OKX offers decentralized trading on BTC, ETH, USDT, USDC, TUSD, and DAI. Enter a currency and payment method, then choose one of the available offers. Click Buy and make the payment to purchase the chosen tokens.

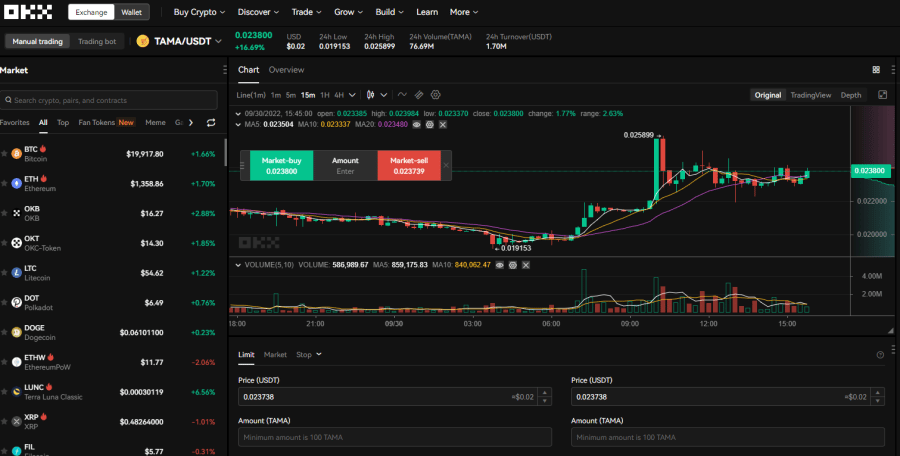

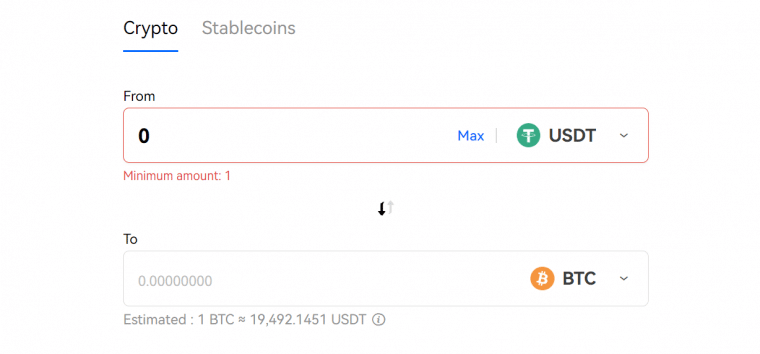

Step 4: Convert to TAMA

Now the purchased crypto tokens can be converted to Tamadoge. From the OKX navigation menu, select Trade and then Convert. Select the token purchased from the DEX and select TAMA as the token to convert to. Then click Convert to get TAMA.

Conclusion

The best decentralized exchanges enable traders to buy or sell crypto without using a middleman. They offer reduced trading fees, privacy, a greater coin selection, and access to yield-generating DeFi staking.

The best decentralized exchange in 2023 is OKX, which offers P2P trading with zero fees for several popular cryptocurrencies. Check out OKX today to buy crypto!