Decentralized finance (DeFi) apps give you access to a range of crypto-centric services in the palm of your hand. This includes everything from crypto loans and interest accounts to yield farming and staking.

In this guide, we compare the best DeFi apps to use right now to maximize your potential crypto gains.

The Best DeFi Apps for 2023 List

We found that the providers listed below offer the overall best DeFi apps for 2023.

- DeFi Swap – Overall Best DeFi App for 2023

- Aqru – Popular DeFi App with No Fees on Buying Crypto

- Crypto.com DeFi Wallet – Various DeFi Lending Accounts to Choose From

- Binance – Trade DeFi Coins and Earn Interest

- Coinbase – Access the Decentralized Web via iOS and Android

- Nexo – Leading DeFi Lending Marketplace

- YouHodler – Top DeFi App for Diversified Portfolio

- Trust Wallet – Decentralized App to Access BSc Network

Each of the above DeFi apps differs in terms of its services offered, fees, minimum deposits, and more.

As such, it’s a good idea to read through our best DApps reviews before choosing a provider.

Top DApps Reviewed

In order to select the best DeFi app for your requirements, you will first need to assess what services you seek.

For instance, are you looking to earn interest on your idle digital currencies or are you looking for a safe place to store your tokens?

You will also need to research the DeFi app provider in terms of safety, fees, supported tokens, and more.

To help clear the mist, below you will find reviews of the best DeFi apps in the market right now.

1. DeFi Swap – Overall Best DeFi App for 2023

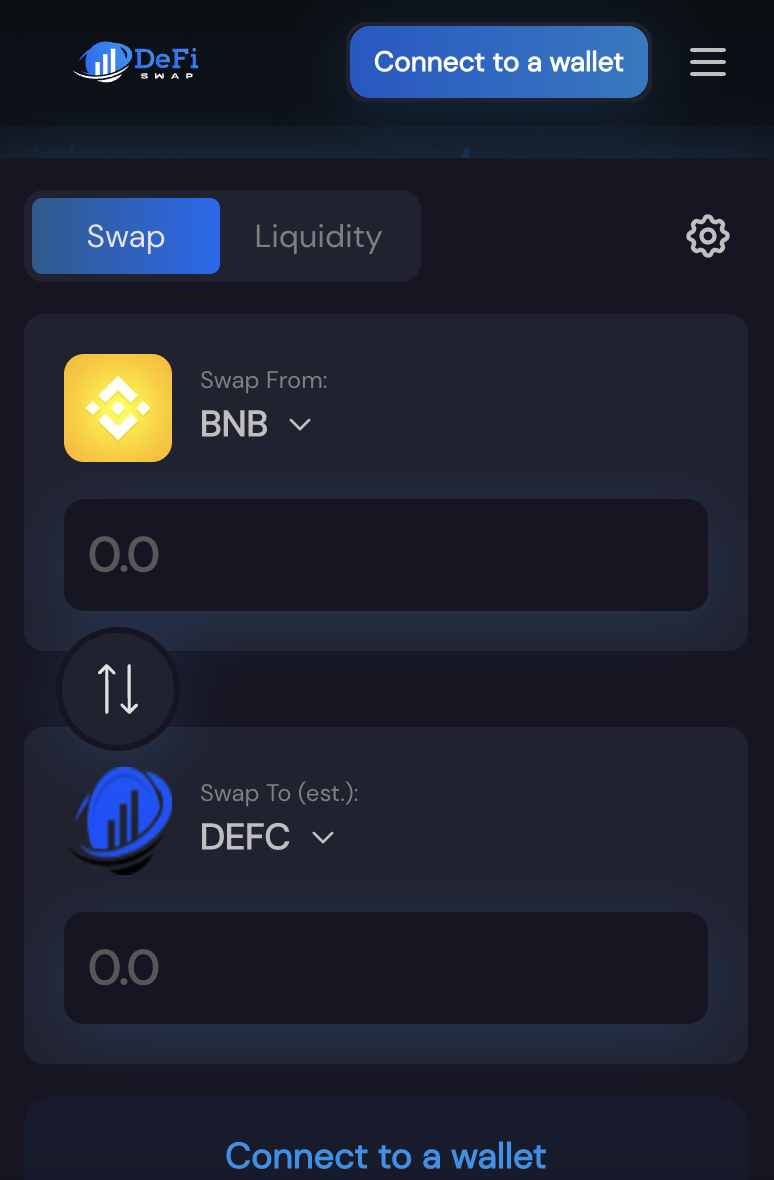

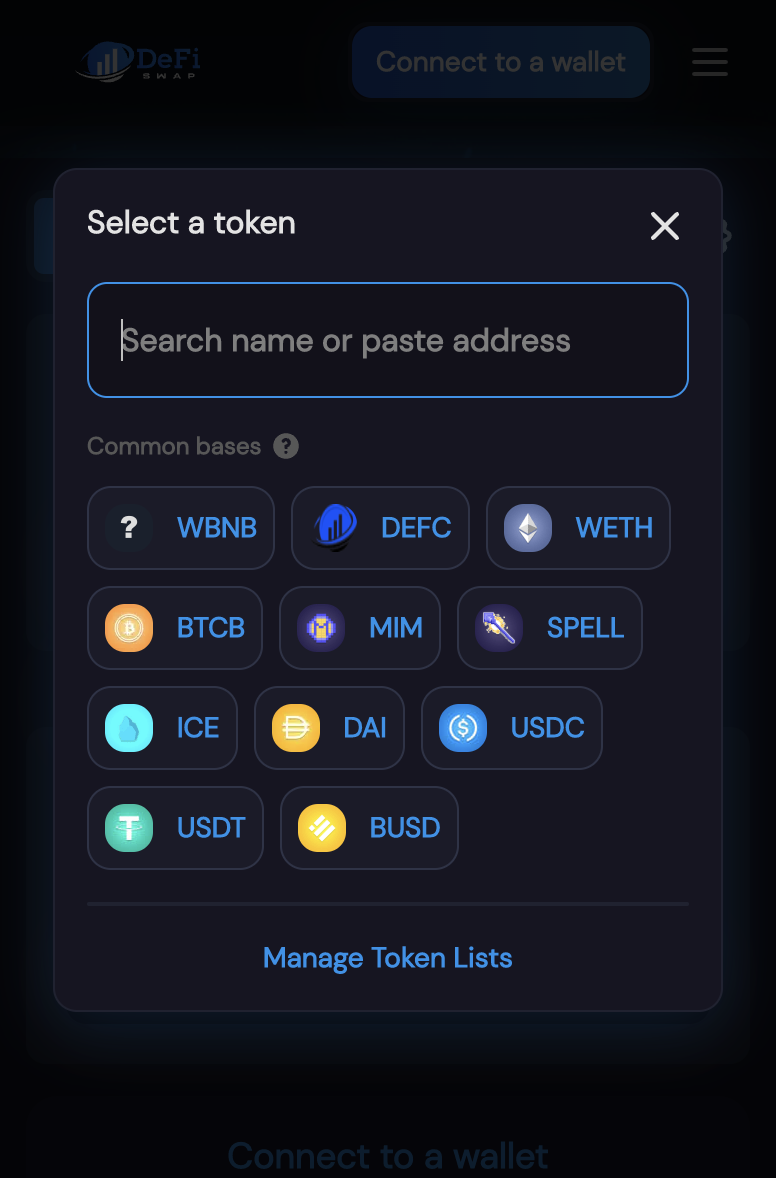

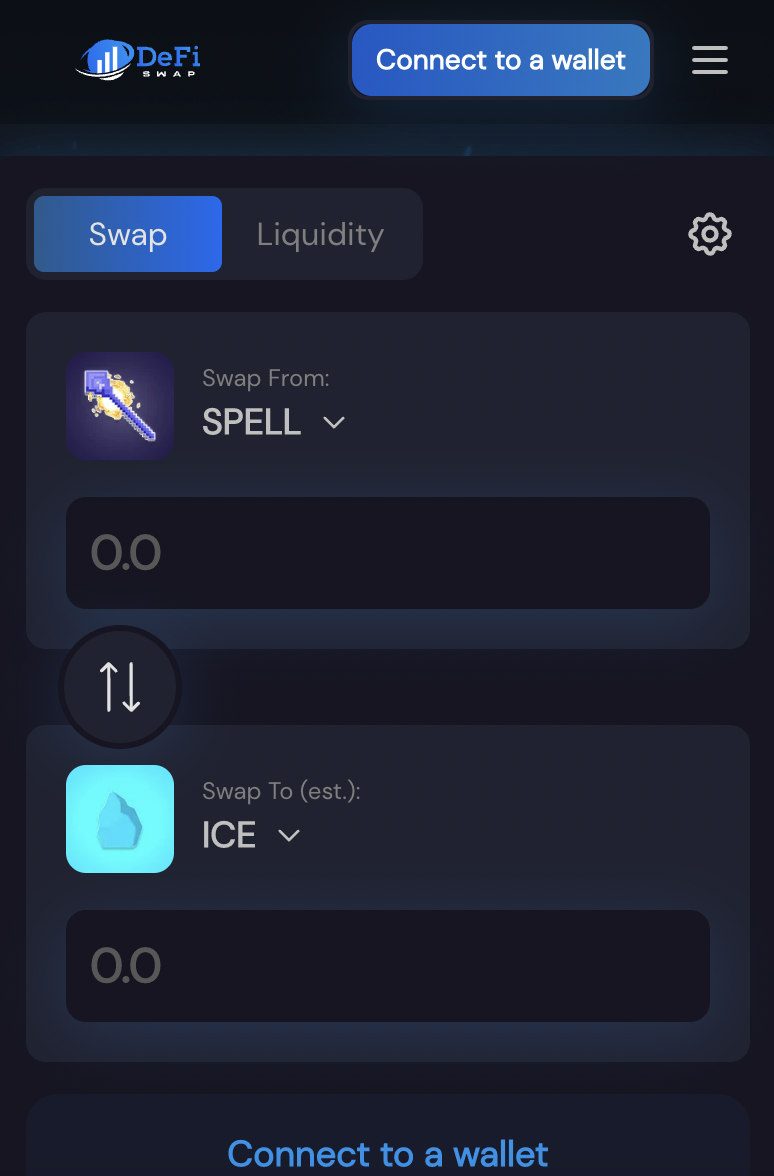

We found that DeFi Swap came out on top of the overall best DeFi apps to try in 2023 because it also provides access to some of the best DEX coins out there. First and foremost, DeFi Swap is a newly launched decentralized exchange that offers a wide variety of services. This includes a fully-fledged DEX that supports a huge selection of BSc tokens.

This means that you can use DeFi Swap to buy and sell digital currencies without needing to use a centralized platform. And as such, not only can you trade anonymously, but there is no requirement to even register an account. Instead, you simply need to connect your crypto wallet to the DeFi Swap platform and you are good to go.

Moreover, DeFi Swap also offers several tools that allow you to earn interest on your idle tokens making it one of the best DeFi staking platforms in 2023. First, there is the liquidity provision tool. This allows you to lend your crypto assets to the DeFi Swap exchange via a secure and transparent smart contract. In return for providing liquidity, you will earn a share of the trading fees collection.

This can really start to add up as a nice source of passive income as the DeFi Swap exchange begins to attract more volume. After all, the more volume that people trade, the more fees that will be collected, and thus – this translates into higher earnings for you. There is no lock-up requirement when providing liquidity on the DeFi Swap platform.

The next passive investment tool this top-rated platform offers is crypto yield farming. This allows you to stake your chosen digital token and in turn, you will generate an attractive APY. For example, if you were to stake DeFi Coin – which is their native token backing the DeFi Swap ecosystem, you can earn up to 75% per year in interest.

Your DeFi interest rate will, however, depend on how long you wish to lock away your tokens. For instance, if you opt for a 30-day period, the APY is reduced to 30%, albeit, this is still very competitive. In the coming months, DeFi Swap will be extending its services to NFTs. In a nutshell, this will enable you to trade NFTs in a decentralized way – meaning no third parties.

In terms of its DeFi app, this is scheduled for release in early Q3 2022 at the latest. Management at DeFi Swap notes that the app will be compatible with both iOS and Android devices. In the meantime, you can access all of the aforementioned decentralized finance services directly on the DeFi Swap website via your mobile browser.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

2. Aqru – Popular DeFi App with No Fees on Fiat Withdrawals

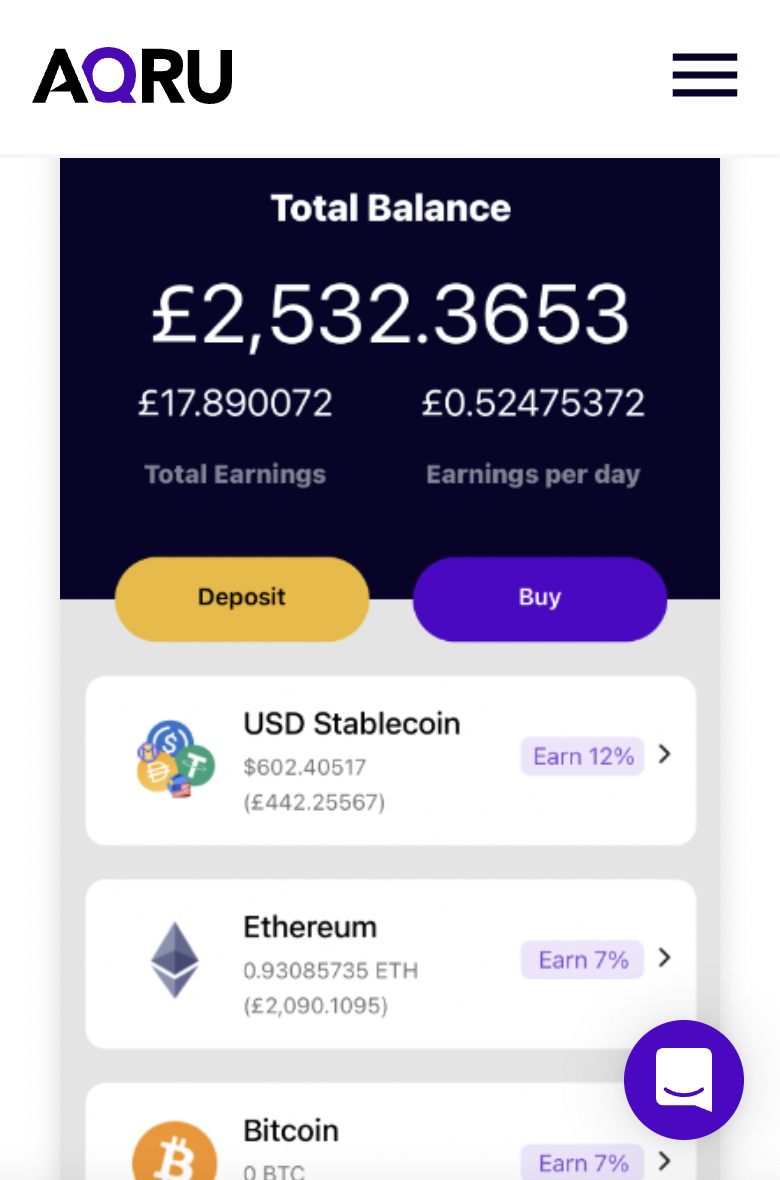

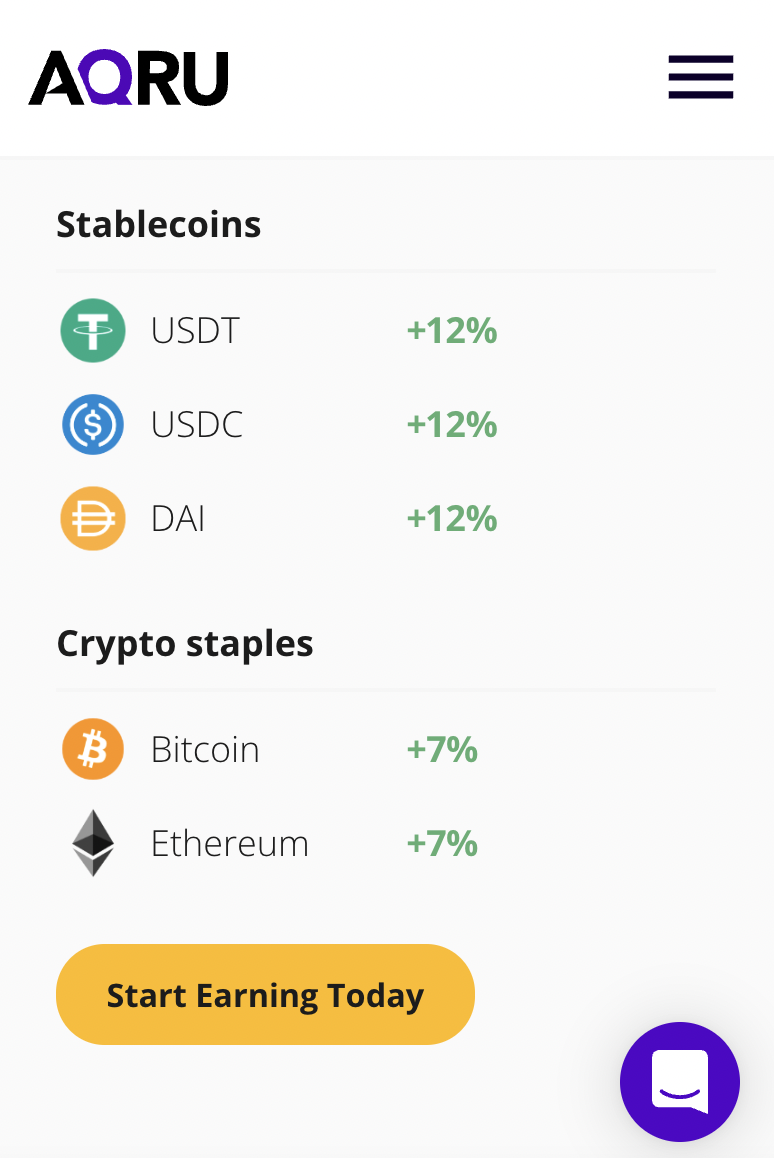

If you’re looking for the best DeFi yield app in terms of earning interest on major crypto assets like Bitcoin, then look no further than Aqru. In a nutshell, Aqru allows you to earn interest when you deposit Bitcoin into its crypto savings account. This is also the case with Ethereum.

Best of all, unlike many other crypto interest accounts in this industry, there are no caps in place. This means that you can deposit as much Bitcoin and Ethereum into your Aqru account and still maximize your interest per year. Moreover, you will not need to lock your tokens away for a minimum period of time at Aqru.

On the contrary, all crypto interest plans here are offered on a flexible basis. As such, withdrawals are honored whenever you wish to cash your tokens out. Take note, although fiat currency withdrawals are free here, you will be charged $20 when transferring crypto out of Aqru.

While we are on the subject of fiat money, Aqru is one of the few providers in this space that allows you to deposit funds in dollars, euros, and pounds. You can achieve this with a debit or credit card instantly, or a bank wire. Either way, this allows you to buy cryptocurrency and then automatically swap the tokens over to a savings account of your choosing.

When it comes to the Aqru DeFi app, this is available to download for free on both iOS and Android devices. When we tested the app out ourselves, we found it very user-friendly. Therefore, if this is your first time using a DeFi yield app for the purpose of generating interest on your crypto assets, Aqru is a great option to consider.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

3. Crypto.com DeFi Wallet – Various DeFi Lending Accounts to Choose From

Crypto.com also offers one of the best DeFi apps in the market. This decentralized mobile app triples up as a wallet, DeFi exchange, and crypto staking tool. Starting with its storage offering, Crypto.com offers a non-custodial wallet. Put simply, this means that you will be the only person to have access to your private keys.

This means that not even Crypto.com can access your DeFi coins. And therefore, you do need to be careful to ensure that you do not lose your backup passphrase. Available on both iOS and Android, the Crypto.com DeFi wallet app also allows you to swap tokens in a decentralized manner.

Once again, this means that there is no requirement to go through a third party. The app offers a wide selection of crypto tokens, so you will have plenty of options when it comes to finding DeFi investment opportunities. If you’re also looking to generate some passive income, the Crypto.com app also offers staking.

Crypto.com does not require you to lock your tokens away when staking digital tokens, which offers great flexibility. You will also find that Crypto.com offers superb APYs on many of its supported tokens. iI terms of security, the Crypto.com DeFi wallet app will store your private keys directly on your smartphone device. This is further supported by two-factor authentication.

Pros

Cons

4. Binance – Trade DeFi Coins and Earn Interest

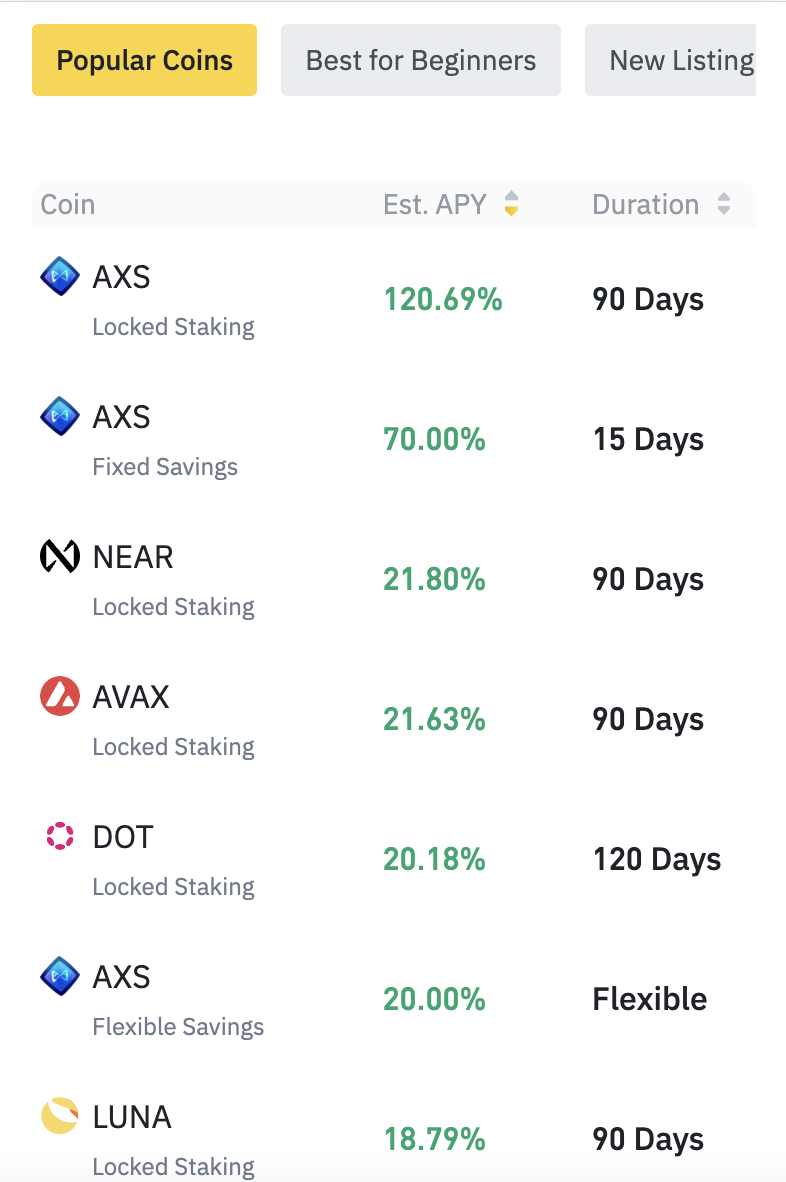

Binance – the world’s largest crypto exchange for trading volume, is looking to become the go-to hub for all things DeFi. First and foremost, once you have created an account with this provider, you can then proceed to download its mobile app for iOS and Android.

Then, you can start earning interest on your idle digital currencies straightaway. All you need to do is choose a suitable plan and you are good to go. Binance offers DeFI interest accounts on dozens of tokens, and APYs will depend on your chosen lock-up terms. Nonetheless, some tokens attract an APY of well over 100%.

In addition to savings accounts, you can also generate interest through staking. Moreover, if you are looking to build a diverse portfolio of DeFi tokens, Binance has you covered. After all, its global exchange – which excludes the US, offers over 600 different crypto assets. US traders, however, have access to just over 100+ tokens.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

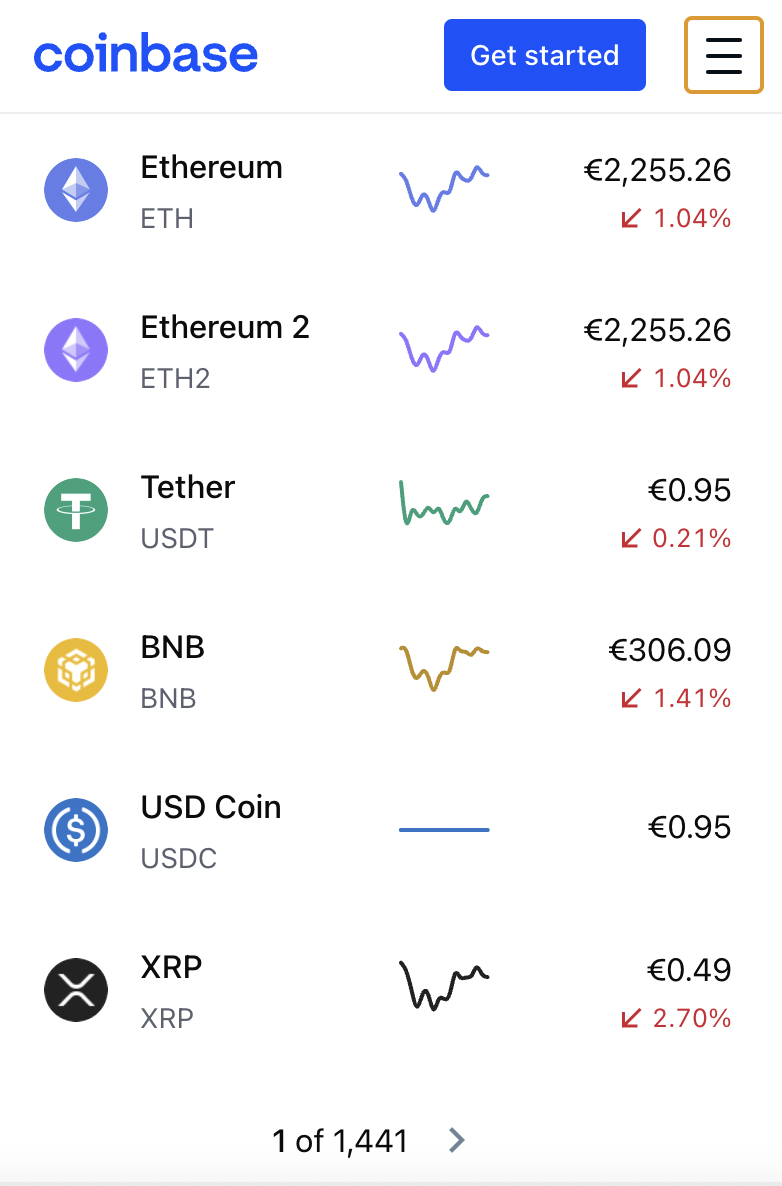

5. Coinbase – Access the Decentralized Web via iOS and Android

This DeFi app offers a decentralized wallet that gives you full control over your private keys and backup passphrase. Don’t forget, this also means that it is your responsibility to keep your private keys away from the wrong hands. In addition to offering solid wallet services, this DeFi app also gives you access to an NFT marketplace.

This was recently launched by Coinbase and it covers a wide variety of ERC-721 compatible tokens. If you wish to buy and sell DeFi tokens, the Coinbase app supports hundreds of markets. You simply need to choose which tokens you want to swap and the exchange will happen instantly.

Pros

Cons

[/su_list]

Cryptoassets are a highly volatile unregulated investment product.

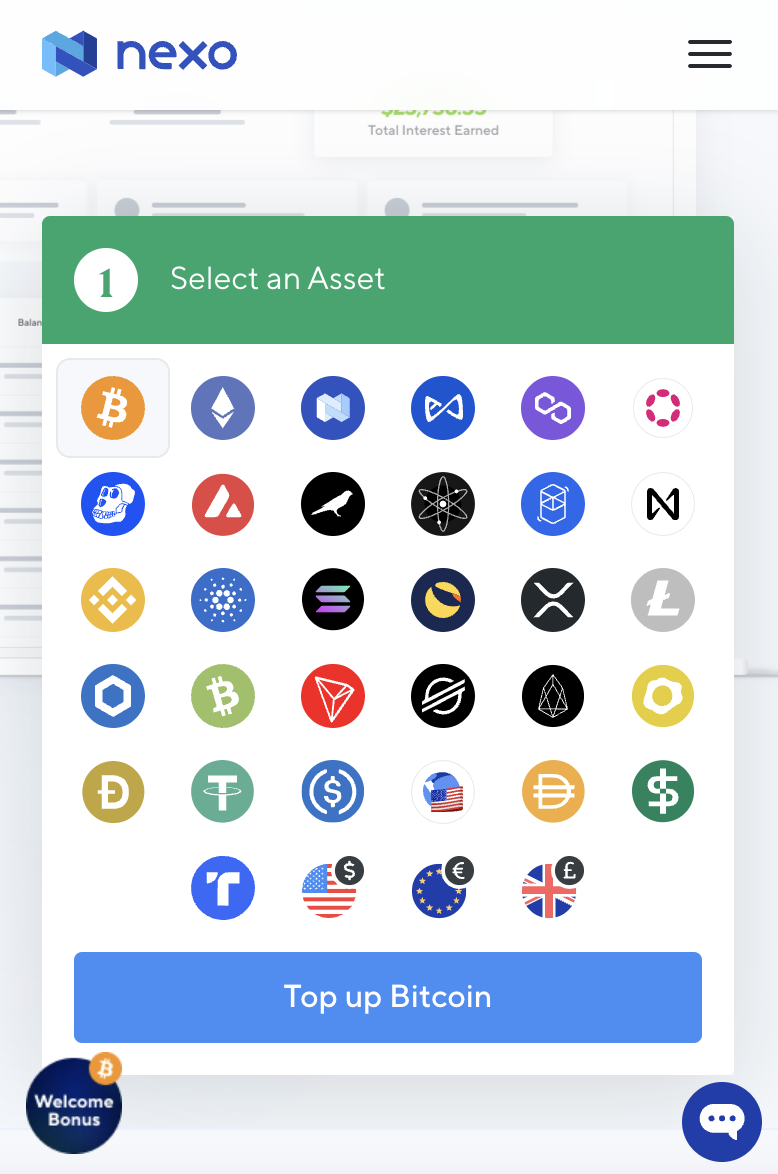

6. Nexo – Leading DeFi Lending Marketplace

This means that a $5,000 security deposit in Bitcoin tokens would give you access to $2,500 in liquidity. Moreover, as no credit checks are carried out, your loan will be approved instantly. Lending rates are very competitive too and you can create your own repayment plan.

If you want to earn interest on your crypto assets, Nexo offers up to 17% on stablecoins. You can also earn up to 36% on DeFi tokens like Axie Infinity. All of the aforementioned DeFi services can be accessed on the Nexo app for iOS and Android. Finally, Nexo also offers a pre-paid credit card that allows you to spend your crypto tokens in the real world.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

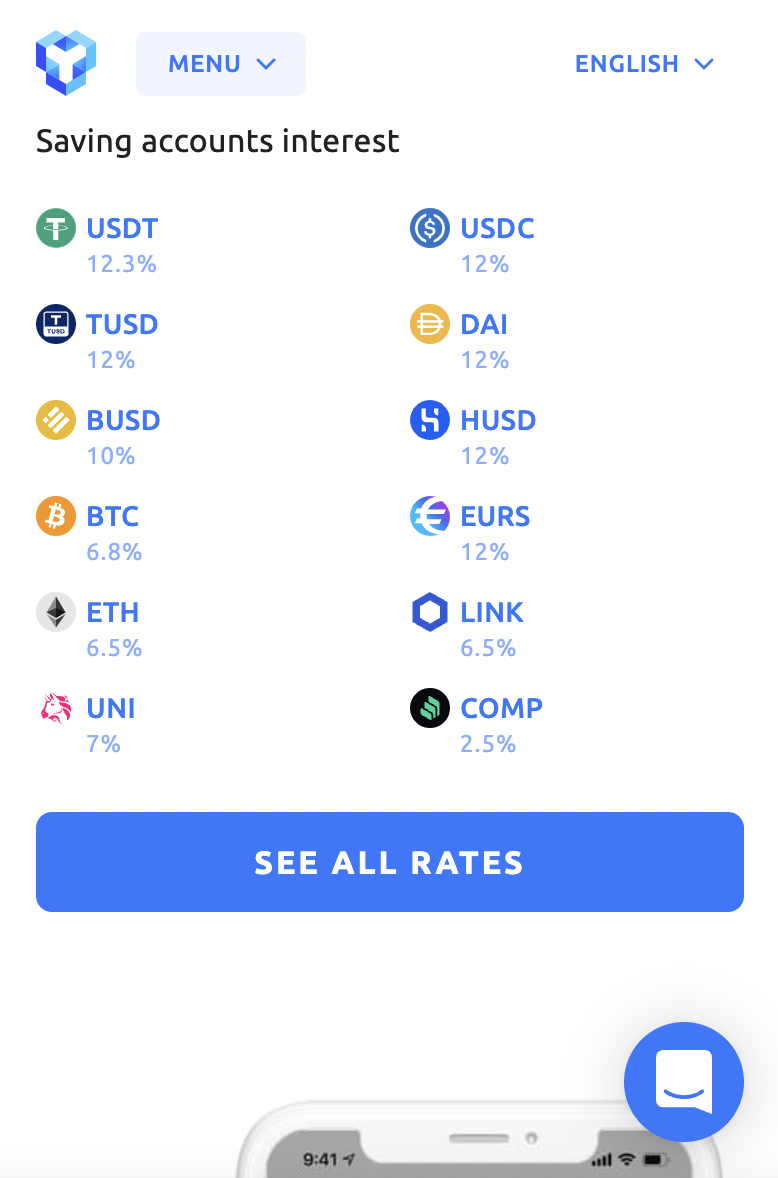

7. YouHodler – Top DeFi App for Diversified Portfolio

YouHodler is another leading DeFi app that allows you to earn interest on your crypto tokens. In fact, the YouHodler app supports dozens of digital currencies of various yields and risk levels. For example, Bitcoin attracts an interest rate of up to 6.8% annually, while Litecoin offers an APY of up to 7%.

You then have stablecoins like HUSD and TUSD – both of which yield 12% per year. Either way, you only need to meet a minimum deposit of $100 on this popular DeFi app. As such, you can easily diversify across multiple DeFi tokens without needing to risk large volumes.

Another thing to note about YouHodler is that you can keep your tokens in one of its crypto interests for as long as you wish. This means that if you are looking to generate a yield long-term, you don’t have to keep logging into your account every time a term concludes. The YouHodler DeFi app is available on both iOS and Android phones.

Pros

Cons

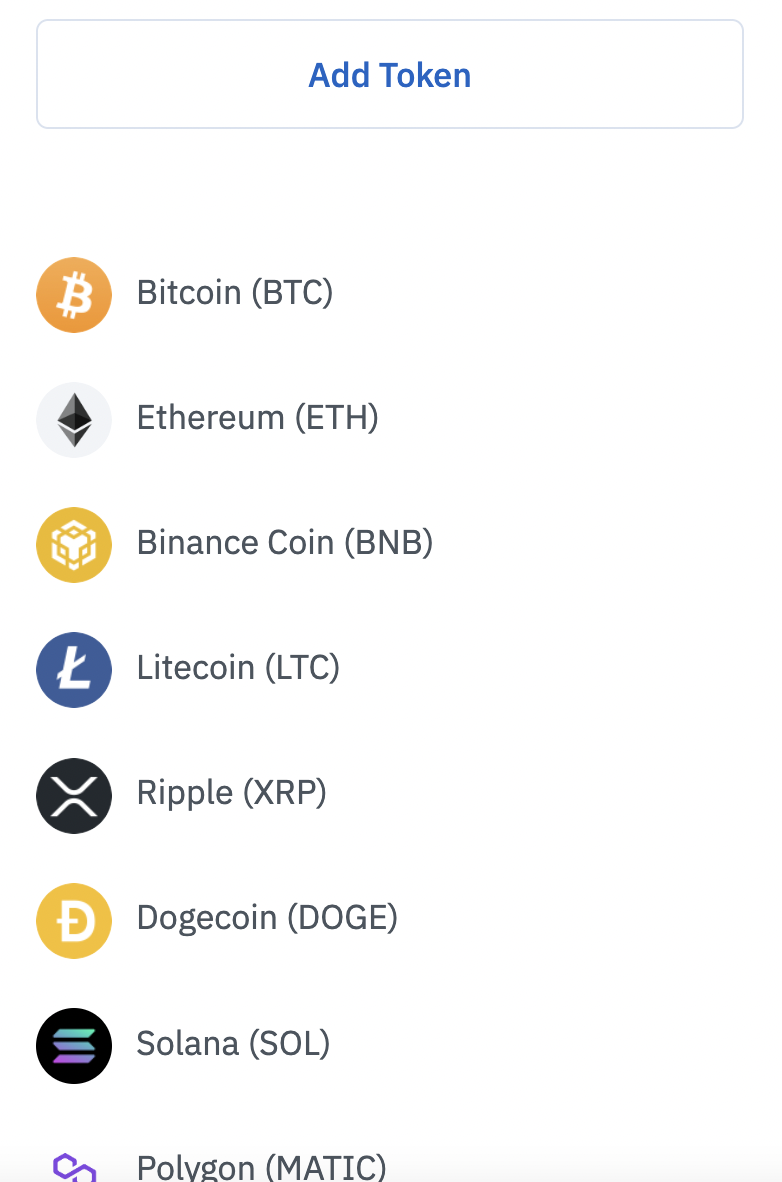

8. Trust Wallet – Decentralized App to Access BSc Network

The final option to consider is Trust Wallet. This hugely popular DeFi app offers more than just wallet services. In addition to supporting more than 56 different blockchains, Trust Wallet gives you direct access to the Binance Smart Chain.

This means that you can easily buy leading BSc tokens like DeFi Coin at the click of a button. You can achieve this by linking Trust Wallet to WalletConnect via the DeFi Swap website. Or, you can connect to Pancakeswap via the ‘DApps’ button. Either way, if there is a BSc token that you are interested in, you are sure to find it on Trust Wallet.

Pros

Cons

What Are DeFi Apps?

DeFi apps give you access to decentralized finance services directly on your smartphone. This means that you can facilitate all of your DeFi requirements no matter where you are – as long as you have an internet connection.

In terms of the services offered, this will vary from one DeFi app to the next. This might, for example, include the ability to earn interest in your digital currency investments.

At DeFi Swap, you can do this via a staking tool that covers a huge variety of tokens that operate on the Binance Smart Chain. You can also generate a yield on DeFi Swap by loaning your tokens to its decentralized exchange.

In doing so, you will earn a share of any transaction fees collected. You then have providers like Crypto.com, which allow you to borrow funds in return for depositing crypto tokens as collateral.

Additionally, the top DeFi apps in the market also offer exchange services. This means that you can swap one digital token for another without needing to use a centralized platform.

What Can You Do on DeFi Apps??

As noted above, the best Defi apps will offer a variety of decentralized finance services.

We explore each service in more detail in the sections below:

Instant and Decentralized Swaps

Many of the top DeFi apps that we came across offer a swapping tool. Put simply, this means that you can swap one token for another. For instance, let’s suppose that you hold BNB tokens in your wallet and you want to swap them for DeFi Coin.

- Ordinarily, you would need to transfer the BNB tokens to a third-party exchange.

- Then, you would need to swap BNB for DeFi Coin.

- And finally, you would need to transfer the DeF Coins back into your wallet.

- This can be both a slow and cumbersome process.

In comparison, the best DeFi apps allow you to swap tokens instantly without leaving your wallet interface. Moreover, when using a low-cost DEX like DeFi Swap, you will find that fees are ultra-competitive.

Wallet Storage

Next up, you should look for DeFi apps that also double as a wallet. This will allow you to store your digital token investments securely. Unlike traditional wallets, DeFi apps offer a non-custodial service.

As we briefly touched on earlier, this means that you will be the only person that has access to your private keys. This isn’t the case when you use a centralized exchange, as the platform will be responsible for safekeeping your tokens on your behalf.

Interest Accounts

The best DeFi apps in the market will also offer interest accounts. Aqru, for example, offers Bitcoin and Ethereum interest accounts.

Staking

Staking also allows you to earn interest on your idle crypto tokens. As a prime example, DeFi Swap offers a huge APY of up to 75% when you stake its native DeFi Coin.

In most cases, you will need to lock your tokens away for a certain period of time when staking. And, the longer the term, the higher the interest rate.

Liquidity Pools

You can also make money via liquidity pools when using a top-rated DeFi app. This will see you loan tokens to a decentralized exchange like DeFi Swap, which is used to provide liquidity to traders.

You will then be paid a commission on any trading fees collected. There are usually no lock-up requirements when utilizing liquidity pools.

How to Choose the Best Defi App for You?

If you are still not sure which is the best DeFi app for you, consider the following points in your search for the right provider.

DeFi Services

You will first need to determine what it is you are looking to achieve from a DeFi app. For instance, if you want to generate regular income on your crypto tokens, then choose a DeFi app that offers staking, yield farming, or liquidity pools.

Alternatively, if you want to borrow funds in a decentralized manner, you will need to focus on DeFi apps that offer instant loans without the need to go through credit checks. With the decentralization of the internet on the rise, you can also expect more DeFi apps on web3 to emerge in the upcoming years, which can give you access to additional services and functionalities.

Reputation

More and more DeFi apps are entering the market, which is great for consumer choice. However, many DeFi apps in this space have little to no track record. As such, you might be taking a big risk by depositing tokens into the app.

With this in mind, you should research the DeFi app provider extensively before proceeding.

Supported Coins

In addition to checking whether or not your chosen DeFi app offers your preferred services, you also need to consider what coins are supported.

For example, while the provider might offer interest accounts, you need to ensure that this covers coins that you currently own.

Fees

DeFi apps, regardless of what their marketing materials tell you, are in the business of making money. Therefore, you should spend some time exploring what fees are applicable for the DeFi services that interest you.

User Experience

The decentralized finance space can be a complex battleground for newbies. As such, if you are somewhat new to DeFi, make sure that the app is easy to use. It should be simple to connect your wallet and browse through the services offered.

The DeFi app should also be fully optimized for your mobile operating system.

Conclusion

Although the DeFi space is still in its infancy, it is already a multi-billion dollar industry. The best DeFi apps in this market allow you to generate interest on idle tokens and even borrow funds via an instant loan.

You can also swap crypto assets in a decentralized manner and provider liquidity to earn an attractive yield. To get started with the best DeFi platform for 2023 right now – consider DeFi Swap.

You’ll find super-high yields on this platform – alongside instant swap services. Plus, DeFi Swap is suitable for investors of all skillsets.

Cryptoassets are a highly volatile unregulated investment product.