Over the past few years, the growth of decentralized finance (DeFi) has been remarkable, providing scope for new and exciting alternatives to traditional finance systems. DeFi exchanges are just one of these alternative systems, offering a way for traders to exchange cryptocurrencies without the need for a centralized authority.

In this guide, we discuss the best DeFi exchange for 2023, highlighting the features you need to be aware of before showing you how to get started with one of the top decentralized exchanges today – all in a matter of minutes.

The Best DeFi Exchanges for 2023

If you’re looking to buy one of the best DeFi coins without going through a centralized intermediary, then DeFi exchanges can help you do so. With that in mind, listed below are five of the best DeFi exchanges on the market, all offering a way to trade cryptocurrencies quickly and cost-effectively:

- DeFi Swap – Overall Best DeFi Exchange

- PancakeSwap – Best Decentralized Exchange for Low Fees

- Uniswap – Leading Decentralized Crypto Exchange for Anonymity

- 1inch – One of the Top DEX Exchanges for Cost-Effective Swaps

- Curve – Best DeFi Crypto Exchange for Stablecoin Trading

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

The Top Decentralized Exchanges Reviewed

DeFi crypto exchanges, albeit relatively new to the trading scene, have completely revolutionized how many traders obtain cryptocurrencies and generate yields. Let’s dive in and explore the best decentralized exchanges, touching on their fees, features, and asset selection.

1. DeFi Swap – Overall Best DeFi Exchange

Through extensive research and testing, we’ve determined that DeFi Swap is the best DeFi exchange as well as the best DeFi staking platform on the market right now, not least because it is also considered one of the best DeFi apps on the market, but also because it supports the best DEX coins. DeFi Swap is a community-driven decentralized exchange (DEX) that offers various services, including token swaps, staking, and yield farming. The platform is made operational by using DeFi Coin (DEFC), which acts as its native token.

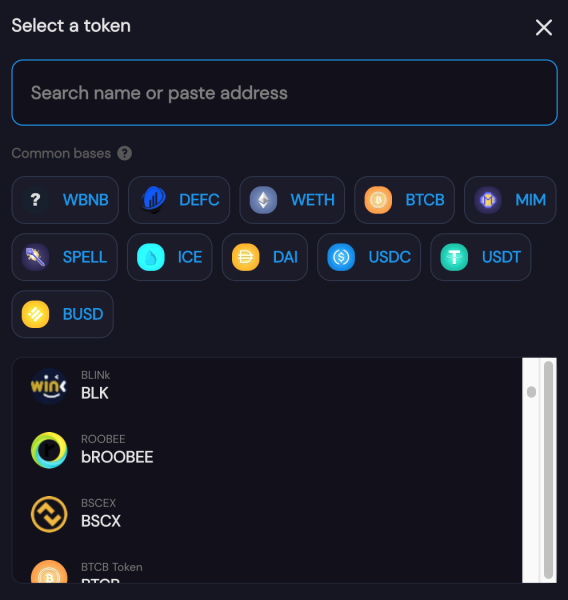

DeFi Swap’s online portal can be accessed through your browser, making it quick and easy to begin using this DeFi platform. The platform is built on the Binance Smart Chain (BSC) network, meaning that you can buy Binance Coin and then exchange it for one of DeFi Swap’s supported tokens. At present, DeFi Swap supports over 50 well-known tokens, such as DAI, USDC, USDT, and ANKR.

You can also generate returns through the exchange’s liquidity pools. These liquidity pools are made functional through smart contracts and allow you to earn a fixed rate of interest on your digital currency holdings. The best DeFi interest rates on offer tend to be far higher than what you’d receive with a traditional bank account, meaning this ‘yield farming’ approach can be lucrative over the longer term.

DeFi Swap also offers a staking service, where users can ‘lock-up’ their tokens for a specified period and generate interest payments for doing so. This process works in much the same way as liquidity pools, yet you will not be able to access your holdings until the lock-up period has expired.

Finally, investors who hold DEFC, DeFi Swap’s native token, can also generate a passive income stream through the token’s innovative taxation process. A 10% fee is levied whenever someone buys or sells DEFC, with half of the collected amount being distributed back to other holders as a ‘dividend’. Due to this and the features noted above, DeFi Swap is our pick for the best DeFi exchange this year.

| Number of DeFi Tokens | 50+ |

| Pricing Structure | N/A |

| Key Features |

|

| Minimum Deposit | N/A |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

2. PancakeSwap – Best Decentralized Exchange for Low Fees

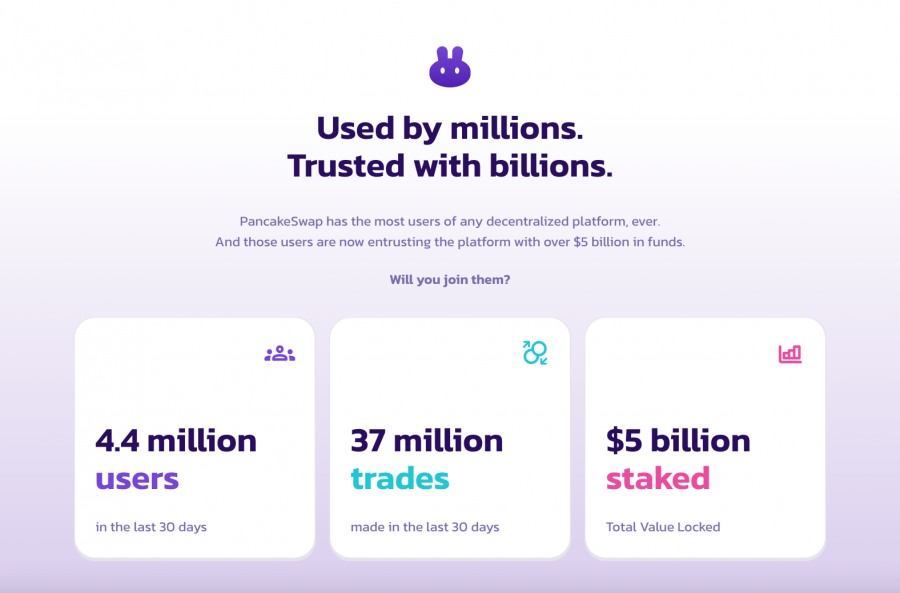

Another decentralized crypto exchange to consider if you’re looking to buy cryptocurrency is PancakeSwap. PancakeSwap is one of the best P2P crypto exchanges for beginners, offering a user-friendly web platform where you can swap tokens in seconds. Like DeFi Swap, PancakeSwap is hosted on the Binance Smart Chain and has been in operation since September 2020.

PancakeSwap supports an abundance of crypto tokens, which you can either search for or add manually using the contract address. You can exchange BNB for these tokens by connecting your crypto wallet to the platform, with PancakeSwap currently supporting ten different wallet providers, including MetaMask and Binance Wallet.

In terms of fees, PancakeSwap charges a 0.25% commission on all trades, which is divided between liquidity pools and the exchange’s treasury, with a portion used to buy back CAKE (the exchange’s native token) and burn it. Aside from token swaps, PancakeSwap also offers ‘Syrup Pools’ that allow you to stake CAKE and earn a return in the same token or a different token.

This decentralized crypto exchange also offers other niche services, such as a ‘PancakeSwap Lottery’. This makes it one of the best crypto lottery sites since users can buy tickets and win jackpots that can often exceed $90,000 in value. Although there’s always the chance for impermanent loss through PancakeSwap’s liquidity pools, there’s no doubt this is one of the best DeFi exchanges on the market.

| Number of DeFi Tokens | 50+ |

| Pricing Structure | 0.25% commission per trade |

| Key Features |

|

| Minimum Deposit | N/A |

Pros

Cons

3. Uniswap – Leading Decentralized Crypto Exchange for Anonymity

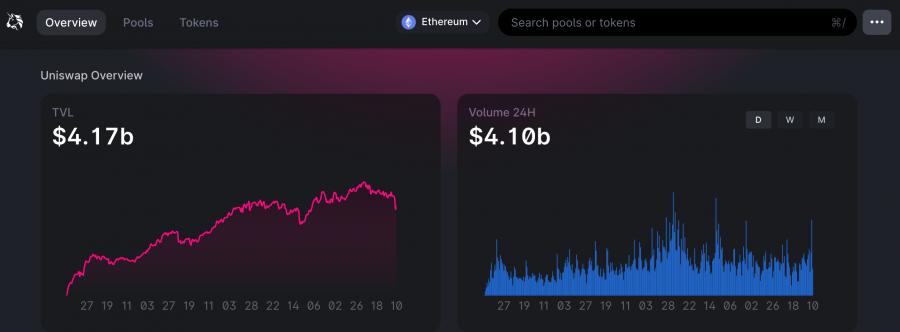

If you’re looking for the best DeFi exchange with the highest trading volume, then Uniswap is worth considering. According to CoinMarketCap, Uniswap regularly handles over $4 billion in trading volume each day, giving it the largest market share when it comes to DEXs.

Uniswap is what’s known as an ‘automated market maker’ (AMM), which means that it is entirely decentralized and facilitates trades and yield generation through smart contracts. With Uniswap, users can swap tokens or stake their holdings in liquidity pools, with the latter option providing yields that are similar (or better) than the best dividend stocks.

Since Uniswap is hosted on the Ethereum blockchain, there is a vast number of supported tokens. The great thing is that users do not need to create an account or provide any personal information, meaning that their entire process is essentially anonymous. In addition, users can also buy Uniswap and use their tokens to vote on governance proposals.

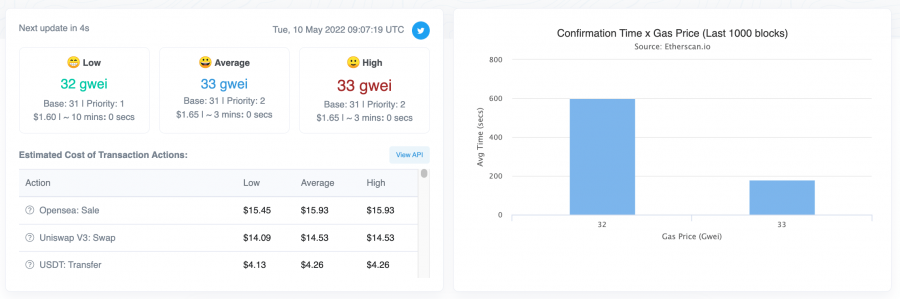

Uniswap charges a 0.3% fee on all transactions, which is distributed back to the platform’s liquidity pools. However, users also have to contend with GAS fees, which can be pretty high when the network is congested. Having said that, Uniswap makes up for this by being one of the safest and most well-respected DEXs in the space, making it a great DeFi platform to partner with.

| Number of DeFi Tokens | 400+ |

| Pricing Structure | 0.3% commission per trade |

| Key Features |

|

| Minimum Deposit | N/A |

Pros

Cons

4. 1inch – One of the Top DEX Exchanges for Cost-Effective Swaps

Another of the best DeFi platforms to consider is 1inch. 1inch is slightly different from the other options on our list because it is defined as a DEX aggregator. This means that it automatically shops around other decentralized exchanges and finds you the cheapest way to make a specific swap.

Sometimes this involves swapping your token multiple times across various platforms to ensure that you get the best rate. The great thing is that 1inch doesn’t charge any fees for this process, although there may be fees charged by the exchange that 1inch partners with to make your swap.

1inch is also one of the best altcoin exchanges for multi-chain support, as you can access tokens hosted on Ethereum, Avalanche, BNB Chain, Polygon, and more. 1inch even offers a proprietary DeFi wallet, enabling you to buy crypto with your bank card and store your holdings safely.

You can even buy 1inch and stake your holdings in the platform’s liquidity pools, generating a return in 1inch or another supported coin. There is also a ‘1inch Earn’ feature that offers an optimized version of liquidity pools, allowing for a more stable yield. Finally, the entire trading process with 1inch is incredibly streamlined, making it easy for beginners to trade in a decentralized manner.

| Number of DeFi Tokens | 400+ |

| Pricing Structure | No fees (end exchange may charge its own fees) |

| Key Features |

|

| Minimum Deposit | N/A |

Pros

Cons

5. Curve – Best DeFi Crypto Exchange for Stablecoin Trading

Rounding off our list of the best DeFi crypto exchanges is Curve. Those who invest in cryptocurrency regularly will likely have heard of Curve, as it is one of the largest DEXs on the market. The Curve protocol is built on the Ethereum blockchain and focuses primarily on stablecoin trading and yield generation through liquidity pools.

Curve’s aesthetic has a distinct ‘retro’ feel, although it is still straightforward to make the exchanges you’re looking to complete. Swaps on the Curve platform will come with a fee of only 0.04%, which is distributed amongst liquidity providers and members of the Curve DAO. In terms of asset selection, Curve currently supports over 45 tokens, including USDC, DAI, USDT, and more.

Curve is the best DeFi exchange for generating a yield on your stablecoin holdings, with a massive selection of liquidity pools available to use. Some of the rates on offer reach double-digits, offering a viable alternative to traditional bank accounts. In addition, Curve also supports several of the best crypto wallets, including WalletConnect, Trezor, and Ledger.

You can also buy Curve and stake it to earn veCRV, which allows you to vote on governance proposals and earn passive income through a share of the accumulated trading fees. Finally, now that Curve has partnered with Polygon, associated GAS fees are much lower than before – making Curve one of the best DeFi platforms for low-fee trading.

| Number of DeFi Tokens | 45+ |

| Pricing Structure | 0.04% commission per trade |

| Key Features |

|

| Minimum Deposit | N/A |

Pros

Cons

The Best DeFi Platforms Compared

Now that you have a clear understanding of what the top decentralized exchanges are, presented below is a table that compares and contrasts the asset selection, pricing structure, features, and minimum deposits of all five platforms:

| Exchange | Number of DeFi Tokens | Pricing Structure | Key Features | Minimum Deposit |

| DeFi Swap | 50+ | N/A | Automatic liquidity pools

User-friendly staking mechanism |

N/A |

| PancakeSwap | 50+ | 0.25% per trade | ‘Syrup Pools’ for staking

Exciting crypto lottery feature |

N/A |

| Uniswap | 400+ | 0.3% per trade | A huge number of ERC-20 tokens supported

No registration or personal details required |

N/A |

| 1inch | 400+ | No fees | Over 400 tokens supported

Finds the best rates for decentralized swaps |

N/A |

| Curve | 45+ | 0.04% per trade | Supports over 45 stablecoins

Links to the Polygon network to reduce GAS Fees |

N/A |

How to Choose the Best DeFi Exchange for You

Choosing which of the decentralized exchanges to partner with can be tricky, especially if this is your first time using one of these platforms. To help streamline the decision-making process, we’ve covered all of the factors that are worth keeping in mind whilst researching which DEX to choose:

Regulation

When looking to make money with crypto through decentralized exchanges, regulation is one of the most important things to keep in mind. Although these exchanges do not rely on a centralized authority, they are still subject to regulatory oversight, much like centralized exchanges. As such, opting for a regulated DEX can help improve the safety of your trading activities.

However, the laws can become a bit murky regarding cryptocurrencies and decentralized platforms, as they must deal in ‘securities’ and operate as an exchange. Since defining a ‘security’ can be tricky, lawmakers have found it challenging to regulate DEXs, so many are not given direct oversight. Thus, it’s essential to do your research beforehand and dive into the platform’s safety levels before beginning to trade.

Tradable DeFi Tokens

The number of DeFi tokens that the best DEX exchanges offer is also important to consider. A great example of this is DeFi Swap, which offers over 50 crypto tokens to work with. These include popular assets such as USDT and DAI and lesser-known assets like ALPHA and SPELL.

It’s also good to partner with a DEX that offers the type of token you’re interested in. For example, DEXs built on the Binance Smart Chain (BSC) will work with BEP-20 tokens, whilst DEXs hosted on Ethereum will work with ERC-20 tokens.

Sign-up Offers

The nature of DEXs means that signing up is not necessary. All you have to do is link your crypto wallet to the platform to begin trading, completely removing the need to complete any KYC checks. As such, sign-up offers don’t tend to be offered by decentralized exchanges, although it’s still worth keeping an eye on the platforms reviewed earlier to see if any promotional deals are presented.

Fees

Like the best crypto apps, DeFi exchanges will often charge a fee when making a token swap. However, the critical distinction is that the accumulated fees tend to be distributed back to the community somehow. This could be by depositing the funds into liquidity pools or sharing them with investors who hold the DEX’s native token.

Aside from fees charged directly by the DEX, it’s also essential to keep an eye out for network fees. For example, DEXs that operate on the Ethereum network are subject to GAS fees, which occur when a token is sent from one wallet to another. These fees can vary wildly depending on the level of network congestion – and can often be pretty excessive relative to the underlying trade size.

Tools & Features

Many decentralized exchanges offer a selection of services rather than just offering the ability to swap one token for another. Our pick for the best DeFi exchange, DeFi Swap, offers liquidity pools and a staking mechanism. The former service works similarly to the best crypto interest accounts by allowing you to deposit your digital currencies and earn a return.

Staking also allows you to earn a return, although this will involve ‘locking up’ your tokens for a set period. Aside from liquidity pools and staking, some platforms also offer niche services. A prime example of this is the crypto lottery service offered by PancakeSwap, which allows users to buy tickets for the chance to win a lucrative jackpot.

Payment Methods

Given that decentralized exchanges do not rely on centralized entities, the payment methods accepted by these platforms tend to just be via your crypto wallet. All you have to do is set up a crypto wallet compatible with the blockchain that the DEX is hosted on, enabling you to instantly swap the tokens you hold for an alternative asset.

However, this does mean that you must own some crypto beforehand, as DeFi exchanges don’t allow you to directly purchase digital currencies using a credit/debit card or bank transfer. Fortunately, it’s easier than ever to create an account with a crypto exchange, buy some coins, and transfer them to an external wallet, which you can then link to the DEX of your choice.

Customer Service

Finally, when choosing the best DeFi exchange for your needs, you may be interested in the level of customer service on offer. Unfortunately, customer service tends to be non-existent for decentralized exchanges since there is no ‘team’ that runs the platform.

These platforms are often structured as decentralized autonomous organizations (DAOs), meaning that the platform’s token holders are in charge. Thus, there will not be any live chat features or telephone support – although some DEXs do have FAQs sections or help centres that present information on how the exchange works and the processes you must follow.

Also see our guide on how to invest in DeFi.

How to Use a DEX Exchange

Now that you understand what the best decentralized crypto exchange is and the features to look out for when making your decision, let’s turn our attention to the investment process. As touched on earlier, we recommend partnering with DeFi Swap, as the platform is beginner-friendly and allows you to make swaps in seconds.

With that in mind, the four steps below will walk you through how to make your first token swap on DeFi Swap – all from the comfort of your own home.

Step 1 – Set Up a Crypto Wallet

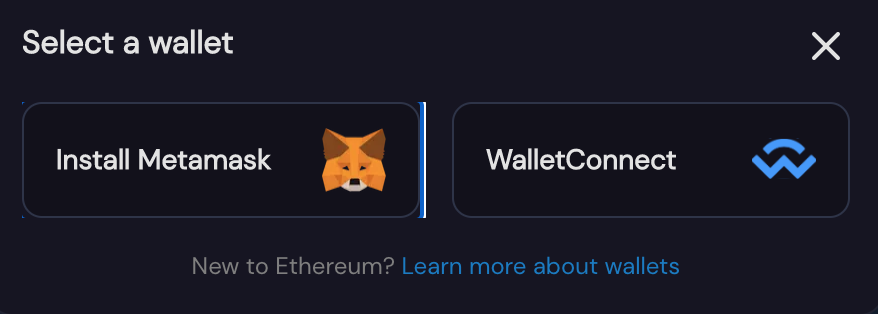

DeFi Swap is hosted on the Binance Smart Chain (BSC), so it’s a good idea to set up a crypto wallet that is compatible with this blockchain network. Many wallet providers offer this functionality, although we recommend MetaMask since it is user-friendly and free to use.

Step 2 – Purchase some Binance Coin (BNB)

Once you’ve set up a crypto wallet, you can purchase some Binance Coin (BNB) to make your token swap. BNB can be purchased from many of the best crypto exchanges, so feel free to partner with a platform that suits your needs. After your purchase is complete, transfer your BNB holdings to the crypto wallet you set up in the previous step.

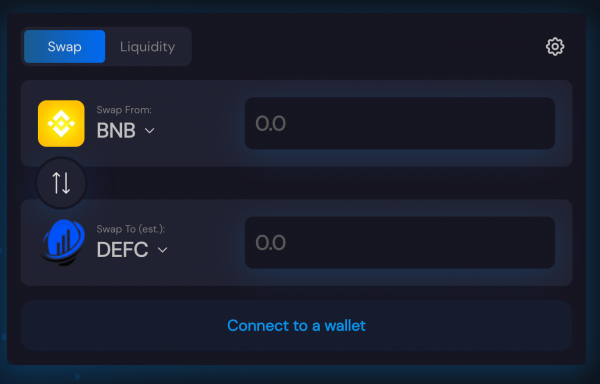

Step 3 – Connect Wallet to DeFi Swap

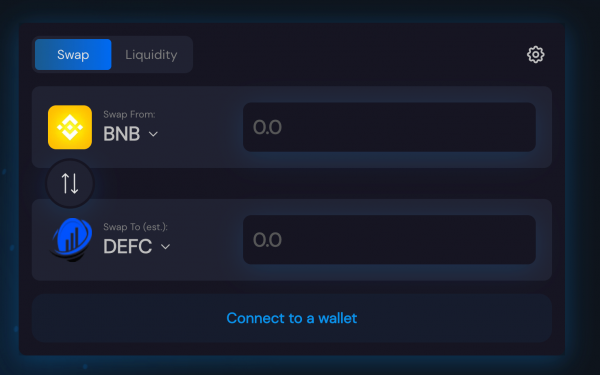

Next, head over to the DeFi Swap homepage and click the ‘Connect to a Wallet’ button. Select the wallet you use, and follow the on-screen instructions to link your wallet to the DeFi Swap exchange.

Step 4 – Make your Token Swap

You’re now ready to make your token swap. Make sure you’re on the ‘Swap’ section of the exchange, and then choose which token you’d like to obtain. For the purposes of this guide, we’ll be looking to swap BNB for DeFi Coin (DEFC).

Once the exchange is set up, enter the amount of BNB you’d like to swap in the order box. You can also click the cog icon and alter the slippage tolerance and transaction deadline if you wish to do so. When you are happy with everything, confirm the transaction, and your new tokens will be transferred to your wallet once the trade goes through.

Best DeFi Exchange – Conclusion

In conclusion, this guide has discussed the best DeFi exchange on the market, reviewing the top platforms and highlighting how you can begin trading in a decentralized manner today.

As touched on earlier, our recommendation for the best decentralized crypto exchange is DeFi Swap due to its user-friendly online portal and selection of valuable trading services. Not only can you swap and stake using DeFi Swap, but you can also invest in DEFC and generate a passive return – simply for holding the token.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.