In deciding to add a selection of popular dividend stocks to your portfolio, you will be investing in companies that distribute a portion of their profits to shareholders quarterly, bi-annually, or annually.

In this guide, we discuss 10 popular dividend stocks in 2023. We also explain the steps involved in investing in dividend stocks with an online broker that offers 0% commission.

10 Popular Dividend Stocks in 2023

Detailed below are some of the most popular dividend stocks in the market right now:

We analyze the 10 dividend stocks outlined above in the following sections of this guide. We also cover what is dividend investing in 2023?

A Closer Look at the Popular Dividend Stocks

In choosing the popular dividend stocks for an investment portfolio, there are many metrics that investors may want to look at. In addition to the size of the dividend yield on offer, investors may want to explore how long the company has been making distributions and whether or not it has a track record of increasing payments.

Moreover, investors can choose to look at the fundamentals dividend stocks, such as how their share price has increased in recent years compared to the broader market.

In the sections below, we take the aforementioned factors into account by comparing the 10 popular dividend stocks for 2023:

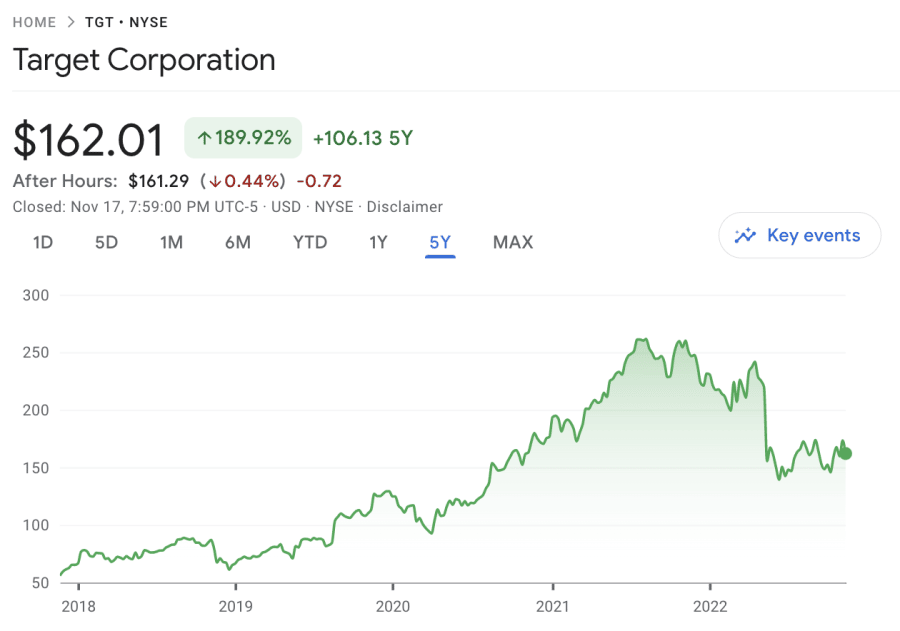

1. Target Corporation

According to financial experts, one of the best dividend stocks based in the US is Target. Target is a US-based department store ranked as one of the largest retailers in America. The company operates nearly 2,000 stores throughout the states and employs over 400,000 people.

Target makes our list of the top dividend stocks because the company has paid a quarterly dividend for over 25 years. Furthermore, Target consistently raises its dividend – even increasing it by 20% in June 2022. At the time of writing, Target’s dividend yield stands at an impressive 2.65%.

Although Target has undoubtedly been affected by inflation, the company’s gross margin and operating margin are still – with the latter currently sitting at around 4.40%. Moreover, Target has expanded from purely physical stores and branched into e-commerce, which has helped the company maintain a solid income level. These factors help ensure shareholders will continue receiving dividend payments for years to come.

2. Clearway Energy

Another of the most popular dividend stocks to be aware of is Clearway Energy. Whether an investor is looking to invest $1,000 (or more) in a dividend stock, they’d be wise to add CWEN shares to their watchlist – as they offer an impressive dividend yield of 4.26%.

Clearway Energy operates in the ever-growing renewables sector and can still be considered in its growth phase, which makes the company’s high yield even more remarkable. According to MarketBeat.com, the company also has a payout ratio of 29.88%. This means that Clearway Energy distributes over a quarter of its profits to shareholders.

Despite all the market turmoil, Clearway Energy’s management also opted to increase dividend payments by 2% in Q3 2022. Given the company’s substantial growth prospects, investing in CWEN shares could prove lucrative over the long term if dividend payments continue to increase year-over-year.

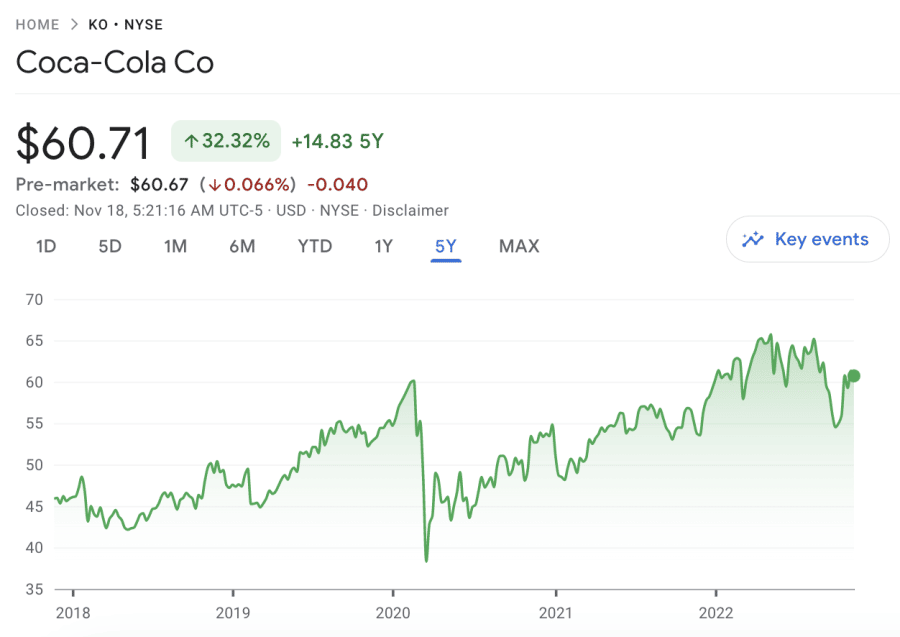

3. Coca-Cola

Another popular dividend stock to analyze is Coca-Cola. In February 2022, the board at Coca-Cola announced their 60th consecutive annual dividend increase. This means that for six decades, Coca-Cola has not only paid a dividend but increased the size of its annual contribution.

And as such, irrespective of how the broader economy has performed, Coca-Cola has stayed true to its word as being one of the popular dividend stocks to buy and hold for consistency and solidity. After all, its products – which also include Fanta, Dr. Pepper, Sprite, Costa Coffee, Schweppes, and Oasis, are sold in virtually every country globally.

As of writing, Coca-Cola is offering a running dividend yield of just over 2.88%. In terms of its recent share price performance, Coca-Cola shares are up 3% YTD. Over the prior five years, the stocks have increased by over 33%. In comparison, direct competitor PepsiCo has seen its shares increase by 10% and 56% over the prior one and five years, respectively.

As such, Coca-Cola has slightly underperformed PepsiCo over the past five years. With that being said, Coca-Cola has outperformed the NYSE Composite – which has grown by just 4% and 46% respectively over the same period.

4. Johnson & Johnson

In a similar nature to Coca-Cola, Johnson & Johnson is a solid dividend king that has increased the size of its annual distribution for no less than 60 consecutive years. For more than 130 years, Johnson & Johnson has been a market leader in various core divisions – which includes household and surgical products, over-the-counter drugs, and more recently – a vaccine for COVID-19.

In terms of its stock market performance, Johnson & Johnson shares have increased by over 8% in the prior year. Moreover, the shares have increased by nearly 27% over the past five years. As of writing, Johnson & Johnson is offering a running dividend yield of 2.57%.

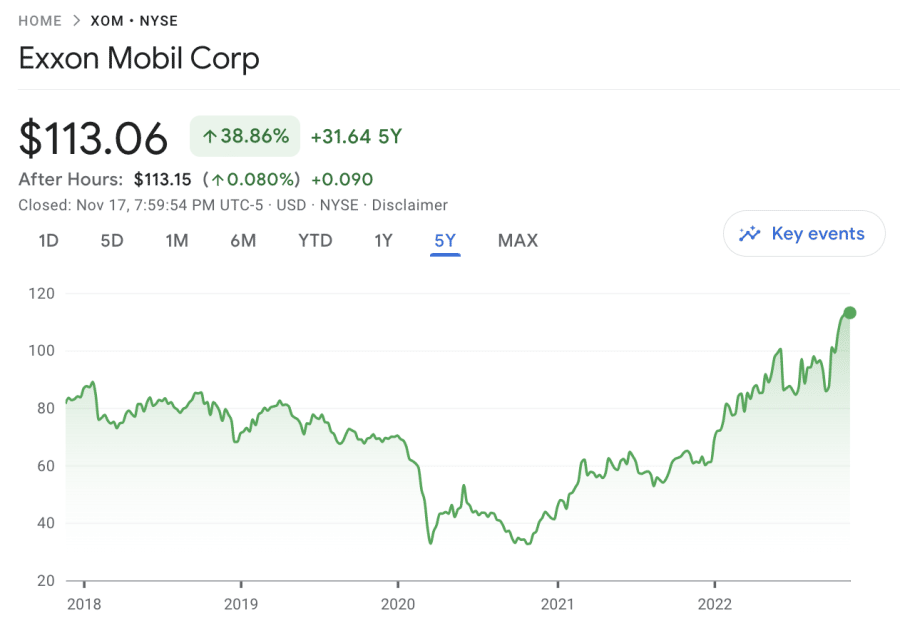

5. ExxonMobil

ExxonMobil is a US-based leader in global oil and gas exploration.

As of writing, ExxonMobil stocks are offering a running dividend yield of 3.26%. Even during the midst of the pandemic, ExxonMobil stocks were yielding a dividend yield of 7-8%. Moreover, it is also important to note that ExxonMobil stocks have generated significant gains in recent times.

This is largely due to the rise of global oil prices, which recently surpassed $100 per barrel. Over the prior 12 months, for instance, ExxonMobil stocks have increased by a whopping 75%. Over the past five years, the shares have performed less well – with gains of just 37%.

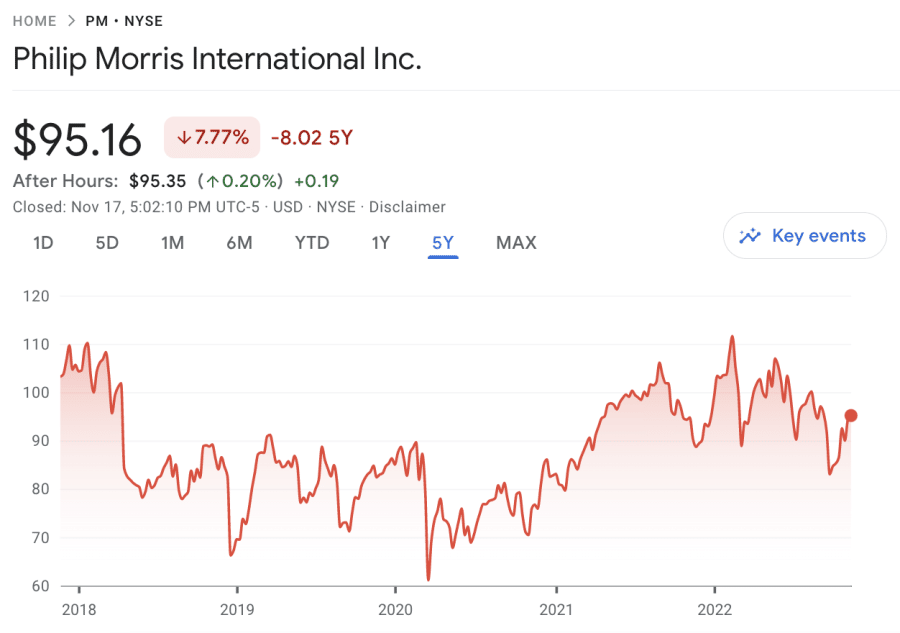

6. Philip Morris International

Philip Morris International is a global tobacco manufacturer with operations in over 180 countries. This stock is offering a running yield of 5.28% at the time of writing.

The firm sells multiple products – which includes leading cigarette brand Marlboro.

When it comes to its share price performance, Philip Morris International stocks are only up 1% over the prior year. Although this is slightly below the market average, users will be entitled to a running yield of over 5% based on current prices.

7. Verizon Communications

Verizon Communications is not a dividend aristocrat – which requires an annual distribution increase for 25 years, the firm has still been making quarterly payments for 15 years.

Moreover, each payment within the prior 15 years has increased in value. As such, Verizon Communications is a solid dividend stock for consistency. As of writing, Verizon Communications is offering a running dividend yield of nearly 6.75%. The P/E ratio stands at 7.17, at the time of writing.

In terms of key projects, Verizon Communications is making progress with its 5G rollout. On the other hand, we should note that this dividend stock is down 24% over the past 12 months, and down 17% in the past five years.

8. Chevron

Another energy company to analyze from our list of the popular dividend stocks is Chevron. This US-based oil and gas producer is in prime position to benefit from the ongoing sanctions implemented on Russian exports. In fact, over the prior 12 months alone, Chevron stocks are up nearly 60%.

Furthermore, Chevron is a solid dividend aristocrat, not least because the firm has increased the size of its distribution for 36 consecutive years. In buying this dividend stock, investors will get a running yield of over 3.12%. The firm also has a strong balance sheet.

This includes significant levels of free cash flow – which will enable Chevron to continue its aggressive global exploration ventures. Another thing to note about Chevron is that the firm plans to increase its share buyback program in the coming months.

9. Bank of America

Another popular dividend stock to analyze for your portfolio today is the Bank of America. Not only is this one of the popular dividend stocks for consistency, but the Bank of America continues to outperform its peers in terms of share price value. For instance, over the prior fives years, the Bank of America has seen its share price increase by 40%.

In comparison, the Invesco KBW Bank ETF – which tracks the performance of leading US-based financial institutions, has decreased by 31% over the same period. In terms of its dividend program, this banking firm has made a distribution since 2013. With that said, there was no dividend increase in 2020 – due to the impact of the pandemic.

Nonetheless, in buying Bank of America stocks today, you will obtain a running yield of over 2.3% – as of writing. This firm is carrying a P/E ratio of 11.77.

10. Walgreens Boots Alliance

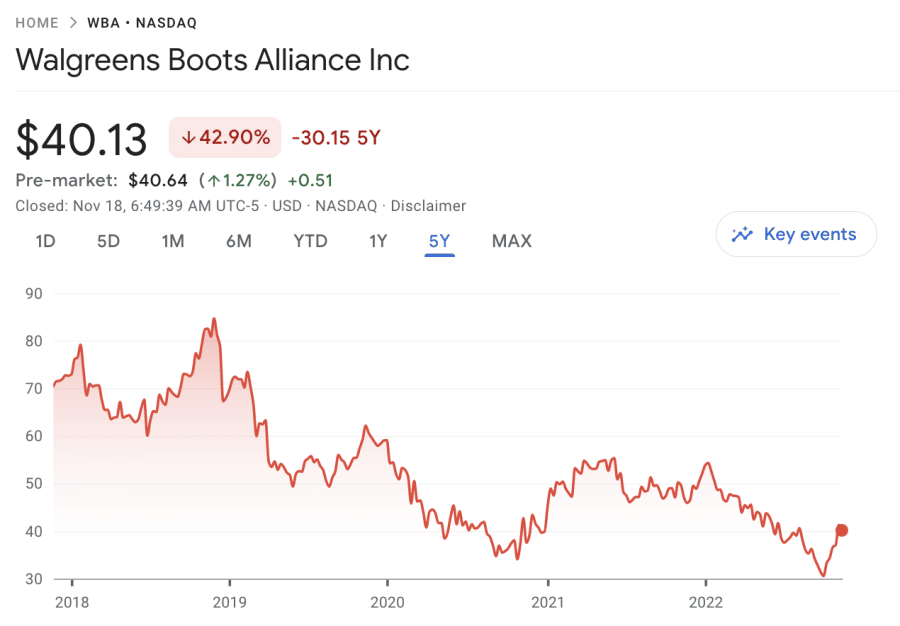

Walgreens Boots Alliance is a large-cap holding company with more than 4,000 pharmacy and healthcare locations in the US. Over the prior year, the stocks are down 15%.

Over the prior five years, the stocks have lost over 42% in value. At the forefront of this is the robust balance sheet that Walgreens Boots Alliance is holding. This will facilitate future store expansion with ease. Moreover, Walgreens Boots Alliance is a solid dividend aristocrat.

In fact, for 45 consecutive years, this firm has increased the size of its annual payment. Based on prices at the time of writing, Walgreens Boots Alliance stocks are paying a running dividend yield of 4.78%.

What are Dividend Stocks?

Put simply, dividend stocks are companies that distribute retained profits to those holding shares. In most cases, the popular dividend-paying stocks will make a distribution every three months.

In rarer cases, the firm might make a payment bi-annually or annually. Either way, the amount of money that shareholders receive will depend on two key metrics:

- The size of the dividend per share announced by the company

- The number of shares owned

For instance, we noted earlier that in February 2022, Coca-Cola raised its annual dividend for the 60th consecutive year. The payment increased from $0.42 per share to $0.44.

This means if an investor owned 1,000 Coca-Cola shares, they would have received a total dividend of $440 for the quarter. As such, owning a collection of popular dividend stocks in your portfolio can provide a regular stream of passive income.

With that said, it is important to remember that just because a stock pays a dividend, this isn’t to say that the value of the investment portfolio will grow. For instance, if a firm pays a dividend yield of 6%, but its shares dropped by 10%, then that will equate to a loss.

Features to Analyze Popular Dividend Stocks

There are thousands of US-listed stocks that pay dividends – and even more when venturing into the international markets.

With that said, not all dividend stocks are worth adding to a portfolio – so it’s important that users conduct their own research to analyze stocks. In the section below, we discuss some of the factors to look for when searching for the most popular dividend stocks in 2023:

Dividend Yield

If the main investment strategy is to maximize returns from quarterly dividends, then investors might want to focus on the yield. Put simply, the yield refers to the size of the dividend payment that shareholders will receive over the course of the year, in relation to the firm’s stock price.

- For example, we mentioned earlier that the most recent distribution made by Coca-Cola was $0.44 per share.

- As of writing, Coca-Cola stocks are trading at $63.83.

- Investors need to multiply the quarterly payment of $0.44 by four to get the annual dividend amount.

- Then, divide this into the stock price to get a percentage yield. In this case, this amounts to a dividend yield of 2.75%.

Now, it goes without saying that the higher the yield, the better it is. However, as we cover in more detail shortly, a higher dividend yield could be the result of falling share prices.

As we noted earlier, oil stocks like ExxonMobil often yield 4% or more. Tobacco is another sector that offers a high dividend yield. For instance, as of writing, Phillip Morris International and British American Tobacco are yielding 5% and 6.5% respectively.

Dividend Consistency

Crucially, long-term growth investors may favor consistency over yields. By this, we mean the number of years that the firm has paid a quarterly dividend.

Moreover, during this period, there should be no dividend cut or suspension. And, perhaps most importantly, you should assess how long, if at all, the stock has increased the size of its annual dividend.

For example, many of the firms discussed today fall into the category of a ‘dividend aristocrat’ or ‘king’. This means that the company has increased the size of its annual dividend payment for 25 or 50 consecutive years, respectively.

In choosing such dividend stocks, investors can be sure they are investing in solid companies that remain consistent even when the broader markets are not performing well.

Financial Strength

Companies are able to make dividend payments when they have sufficient levels of free cash flow. As such, in order to find popular dividend stocks, investors may want to explore the firm’s balance sheet before proceeding.

An example of companies with a robust balance sheet and plenty of surplus cash are Coca-Cola, Johnson & Johnson, and Phillip Morris International. Even if the aforementioned firms experience a quarter that is below market expectations, there should be no reason why a dividend payment cannot be met. As such, these firms offer a consistent dividend program regardless of performance.

- However, there are also firms like AT&T – whereby the telecommunications giant was a dividend aristocrat until 2021.

- It lost this status because its 2021 dividend payment did not increase from 2020.

- The overarching reason for this is that AT&T has a less than favorable balance sheet.

- This sentiment was further supported in early 2022 when it was announced that AT&T would be cutting its dividend.

Share Price Performance vs Broader Markets

Focusing exclusively on dividends when buying stocks can be a costly exercise. After all, if the value of the shares decreases by a greater amount than the size of the dividend, investors will make a loss on their investment.

Moreover, investors may also want to analyze opportunity costs. This means that by choosing dividend stocks that underperform the broader markets, they are not making as much money as they could be elsewhere.

- For instance, we mentioned earlier that Apple is yielding an average dividend yield of just 0.50%.

- Although this is a much lower yield when compared to other dividend stocks that we have discussed today, it is important to take into account the share price increase that Apple has generated in recent years.

- Over the prior five years, for example, Apple stocks have increased by 380%.

- This is significantly more than you can make from any dividend policy available in the US stock markets.

Dividend Penny Stocks

Penny stocks are not only defined as companies with a share price of below $5 but those that have a small market capitalization. As such, very few penny stocks will have a dividend program in place.

Moreover, penny stocks will typically trade on the OTC (Over-the-Counter) markets, which means that retail investors might find it difficult to gain access. However, here are two popular examples:

- Gold Resource Corporation – As the name suggests, this penny stock is involved in the exploration and production of gold. Gold Resource Corporation, as of writing, is trading with a market capitalization of just over $147 million and it pays a running dividend yield of 2.40%.

- Nordic American Tanker – As of writing, this penny stock is valued at just over $774 million and year-to-date, has returned gains of nearly 92%. Based on prices as of writing, Nordic American Tanker is offering a running yield of 3.23%.

Where to Buy Dividend Stocks

If users are interested in purchasing dividend stocks, the next step is to look at the available brokerages from where to buy these stocks. The section below reviews a popular stock brokerage that supports the trade of dividend stocks:

1. eToro

Crucially, many supported payment methods are offered – which include debit and credit cards, e-wallets like PayPal, and traditional bank transfers. This is on the provision that deposits are made in US dollars. Once a user’s eToro account is ready to go, they will then have access to thousands of stocks – many of which pay quarterly dividends.

In fact, all of the companies from our list of the 10 popular dividend stocks of 2023 are available to buy and sell at eToro. And, regardless of which dividend stocks investors buy, they will not be charged any trading commission at this broker. This is the case even if they decide to buy dividend stocks from overseas – with eToro supporting markets in Europe, Canada, Asia, and more.

eToro also supports fractional shares. This means that investors can buy any dividend-paying stock from just $10. As such, should an investor wish to deposit $100 into their eToro account, you will have the opportunity to diversify across 10 different dividend stocks. Furthermore, they’ll also have access to a wide range of markets, including popular penny stocks as well as popular oil stocks.

We should also mention that eToro provides access to a number of popular dividend stock ETFs. This includes the previously discussed SPDR S&P US Dividend Aristocrat ETF – which can be invested in commission-free from a minimum of $10. In addition to ETFs, eToro also allows users to buy cryptocurrency, meaning they can invest in Bitcoin, Ethereum, and dozens more.

Another popular feature offered on the eToro website is the copy trading tool. In its most basic form, this enables users to copy the trades of a skilled investor that has a verifiable track record at eToro. Once a user has selected a trader to copy and decided how much to invest (minimum $200), all future positions will be mirrored in the account.

This means investors can actively buy and sell stocks without putting in any of the legwork. This is also the case when investing in smart portfolios – of which there are dozens to choose from. These are professionally managed by eToro and cover a wide spectrum of strategies – including that of dividend stocks.

eToro also offers a popular stock app – which connects to the main trading account. This means that users can buy, sell, and track dividend stock prices in real-time – and keep tabs on any quarterly payments. Finally, eToro is a heavily regulated broker, approved by licensing bodies in the US, UK, Europe, and Australia.

If investors are still on the fence, we have an eToro vs Webull review to see how this leading social trading platform performs when pinned against another popular broker.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

In summary, undervalued dividend stocks can provide an investment portfolio with both stability and consistency.

When investing in some of the most popular dividend stocks discussed today, such as Target and Coca-Cola, investors will be buying shares in companies that have increased the size of their annual payment for many decades.