The best forex brokers in the online marketplace offer a wide range of currency pairs, low trading fees, and tight spreads.

Due to the fast-paced nature of the currency investment scene, top-rated forex brokers also offer notable trading and analysis tools, alongside a fully-fledged mobile app.

In this guide, we compare the overall best forex brokers in Australia to consider joining today.

The 11 Best Forex Brokers in Australia

The 11 best forex brokers in Australia are summarized in the list below:

- eToro – Overall Best Forex Broker in Australia With Copy Trading Tool

- Plus500 – Top Forex Broker in Australia Offering 60+ Pairs and 0% Commission

- Vantage – Trading 44 Forex Pairs with MT4 and MT5

- Pepperstone – Best Forex Broker in Australia for Raw Spread Accounts

- AvaTrade – Regulated Forex Broker That Supports MT4 and MT5

- Forex.com – Established Forex Broker With Competitive Fees

- Oanda – Trade 70+ Forex Pairs with No Minimum Deposit

- XM – Multiple Forex Trading Accounts and Minimum Deposit Just $5

- HotForex – High Leverage Forex Broker Located Offshore

- IG Markets – Trusted Forex Broker With ASIC Regulation

- Interactive Brokers – Access to Interbank Currency Quotes

79% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

To ensure our readers select the best forex broker in Australia for their trading requirements, we offer comprehensive reviews of the above providers in the following sections of this comparison guide.

Best Australian Forex Brokers Reviewed

The reviews below compare the best forex brokers in Australia for:

- Supported markets

- Commissions and spreads

- Regulation

- Trading tools

- Payment methods

- Minimum account balance

- And more

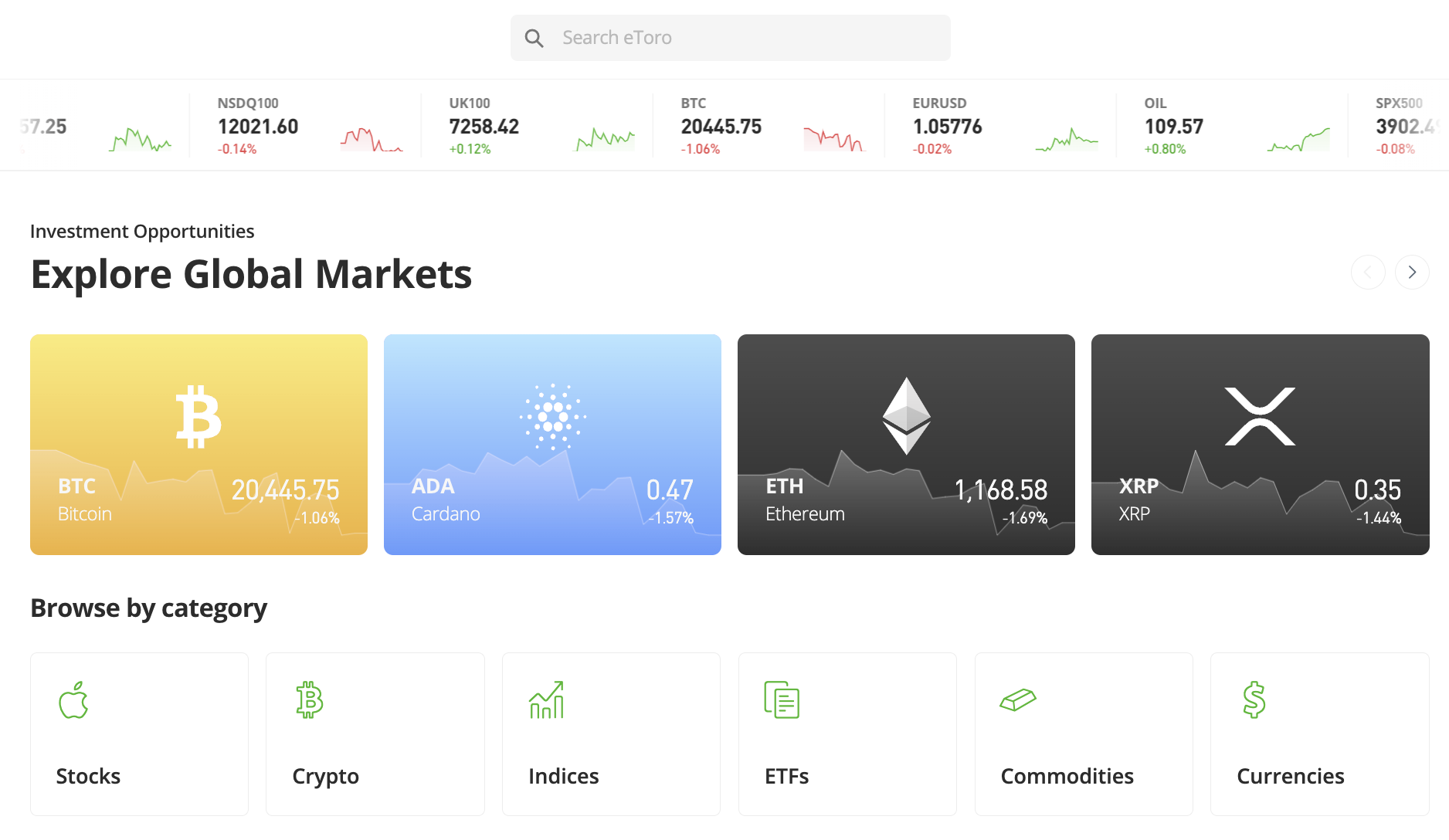

1. eToro – Overall Best Forex Broker in Australia With Copy Trading Tool

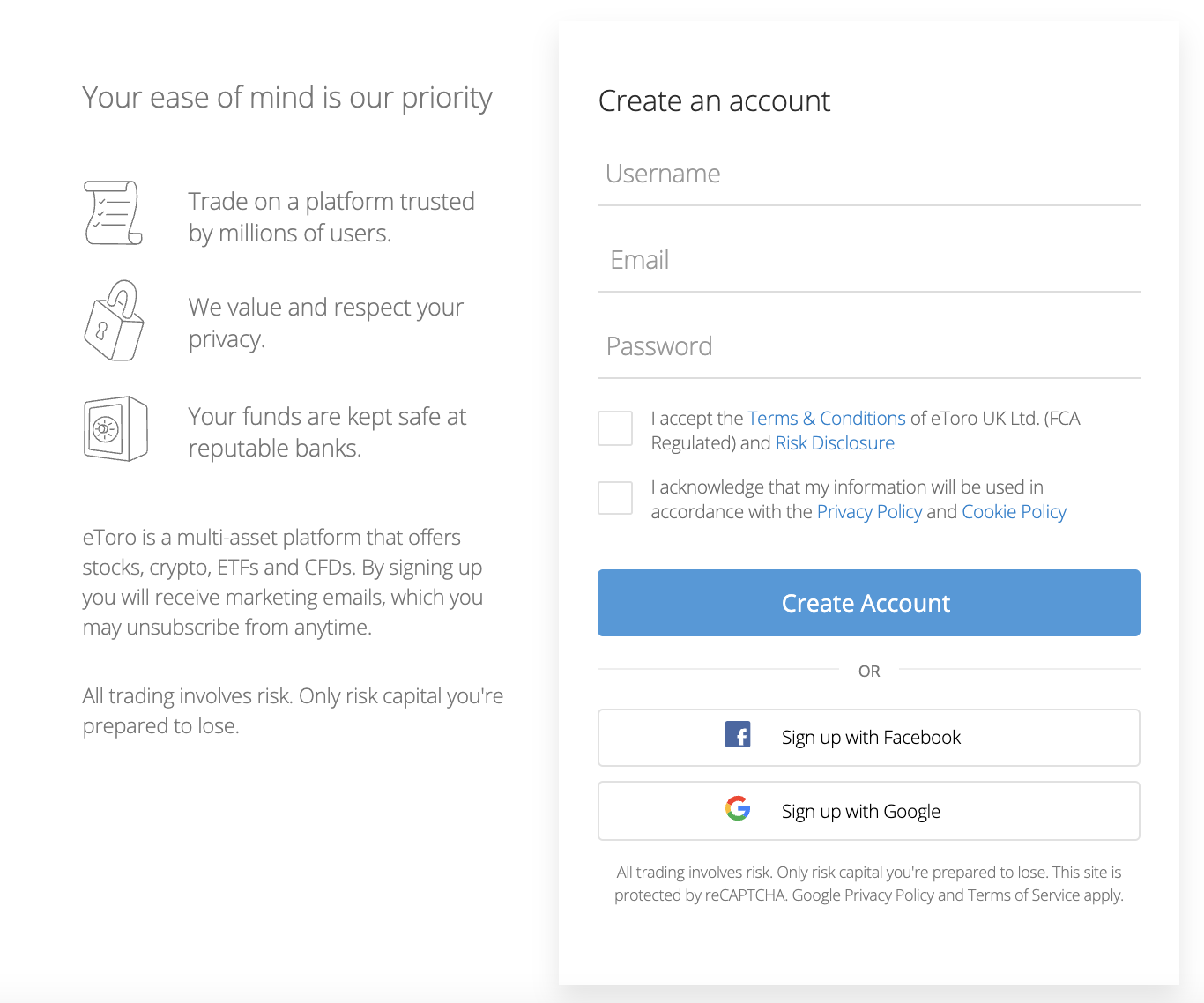

The next platform to consider from our list of the best forex brokers in Australia is eToro. This platform is heavily regulated. This includes licenses with ASIC, CySEC, SEC, and the FCA. The eToro platform has been operational since 2007 and is now utilized by more than 25 million clients.

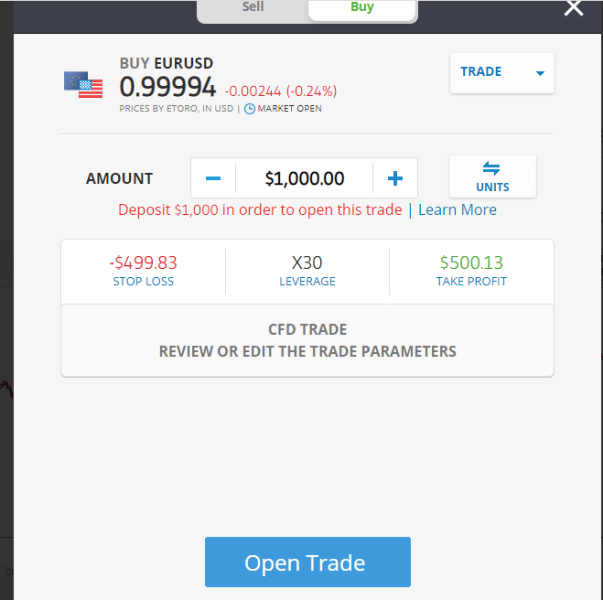

We like that eToro offers a carefully selected range of major, minor, and exotic currency pairs. The forex trading suite offered by eToro operates on a spread-only pricing structure. This starts at 1 pip on major pairs like EUR/USD and USD/JPY.

As the forex trading department at eToro is offered via CFDs, Australian residents will have access to leverage. eToro is undeniably the best forex broker in Australia for passive trading. This is because the platform offers a Copy Trading tool, which enables users to mirror the positions of an experienced forex trader.

For instance, let’s suppose that an eToro user decides to invest $1,000 into a forex trader with a solid history on the platform. The trader decides to risk 10% of their balance going short on EUR/USD. Automatically, the eToro user will replicate the same position at a stake of $100 – which is 10% of their $1,000 investment.

Crucially, the eToro Copy Trading tool is ideal for both inexperienced forex investors and those without the required time to research the markets. On top of forex, eToro also offers CFDs in the form of indices and commodities. However, where eToro really stands out is that it allows users to buy shares in Australia at 0% commission – from just $10 per trade.

Moreover, eToro is also a superb option for those looking to invest in cryptocurrency in Australia with low fees. Nonetheless, to start trading on the eToro platform, users can open an account in minutes and the minimum deposit is just $50. eToro supports payments via debit/credit cards, e-wallets, and bank transfers.

| FX Pairs | 49 |

| Commission | Spread-only |

| EUR/USD Spread | From 1 pip |

| Min Deposit | $50 |

| Top 3 Features | One of the best forex brokers for social trading, very competitive fees, user-friendly trading platform |

What We Like

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider

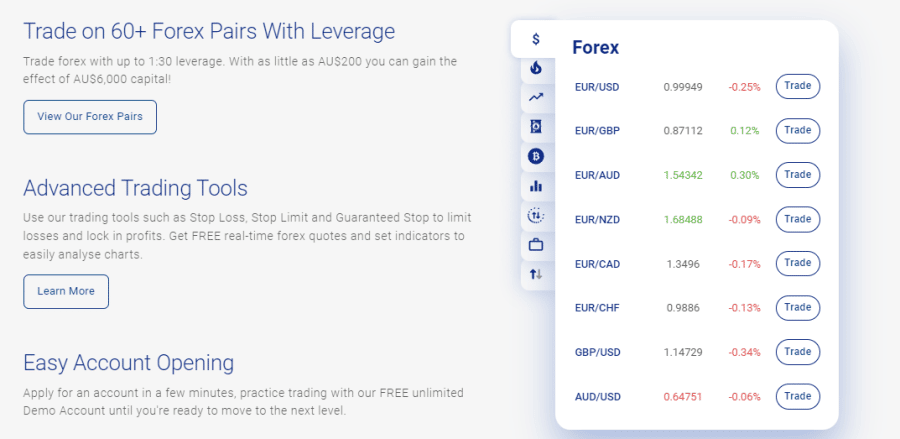

2. Plus500 – Top Forex Broker in Australia Offering 60+ Pairs and 0% Commission

Besides the web platform, traders can also opt for the mobile app or test out the platform by downloading the demo account.

Traders can incorporate advanced indicators and fundamental data in their analysis because Plus500 provides news and key market insight.

The platform provides price alerts to let traders know when currencies have reached certain exchange rates, while traders can use the guaranteed stop order feature to minimize losses and lock in profits.

Plus500 provides free educational content and FAQ sections that provide key information traders want to know and its support centre is available 24/7 to answer queries traders may have.

Regarding trading, Plus500 enables traders to improve their skills by enrolling in the trading academy.

To get started, traders need to deposit a minimum of AU$ 200 – payment options include bank wire, cards, Paypal, and Apple Pay.

Plus500 enables traders to fund their accounts without incurring any fees. Traders won’t incur a commission for trading and will receive tight spreads for certain currency pairs.

The only other fees traders need to be aware of are the guaranteed stop order, if implemented, currency conversion, and overnight fees.

Plus500 also charges $10 monthly to inactive traders are 3 months of consecutive inactivity.

| FX Pairs | 60 |

| Commission | Spread-only |

| EUR/USD Spread | From 0.8 pips |

| Min Deposit | $200 |

| Top 3 Features | Guaranteed stop loss, market insights, trading academy |

What We Like

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Plus500UK Ltd authorized & regulated by the FCA Plus500CY Ltd authorized & regulated by CySEC.

3.Vantage – Trading 44 Forex Pairs with MT4 and MT5

The standard STP account requires a $200 minimum deposit and offers commission-free trading to investors. However, the spread on popular pairs like EUR/USD begin at 1.1 pips. With the Raw ECN account, investors can access the EUR/USD pair from 0.1 pips onwards. On average, this account may require a small commission of $3 per lot. The Raw ECN account requires a minimum deposit of $500.

Approved accounts can access up to 1:100 leverage, while limited professional accounts can apply up to 1:500 leverage when trading with Vantage. The platform can be accessed with MetaTrader 4 and MetaTrader 5, which allows investors to access several customization options, various advanced charts and technical indicators to assist them in their trades. Retail clients can also begin trading with the Vantage app: which is available to download on iOS and Android.

Apart from FX trading, Vantage offers stock CFDs, index CFDs, commodities CFDs and cryptocurrency CFDs. After creating a new account in under 5 minutes, investors can fund their accounts with a credit/debit card, bank transfer or e-wallets such as PayPal, Skrill, Neteller and others. Notably, Vantage does not charge any inactivity fees or deposit fees.

Vantage is regulated by some of the top global regulatory bodies, including ASIC, FCA and the VFSC.

| FX Pairs | 44 FX Pairs |

| Commission | No commission on STP account, small commission (average of $3) on Raw ECN account |

| EUR/USD Spread | 0.2 pips on ECN account/1.1 pips on STP account |

| Min Deposit | $200 – STP Account/ $500 Raw ECN Account |

| Top 3 Features | No commission on STP account, MT4 & MT5 compatible, Multi-asset CFD trading |

What We Like

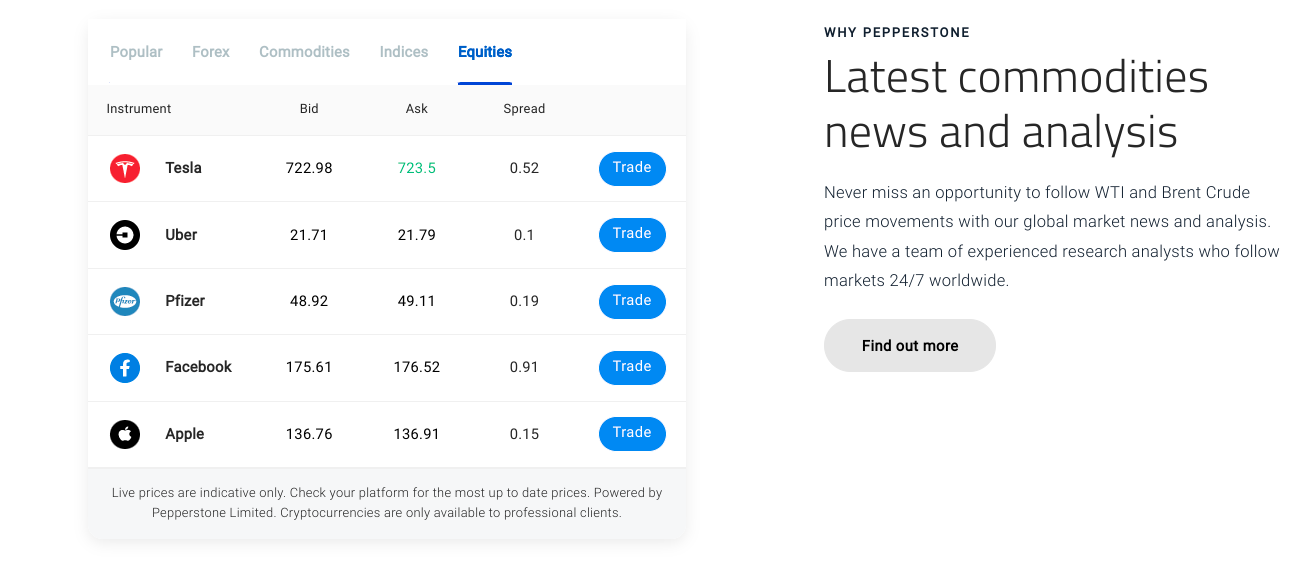

4. Pepperstone – Best Forex Broker in Australia for Raw Spread Accounts

Pepperstone is the best Australian forex broker for those wishing to open a raw spread account. This particular account type allows Australian traders to buy and sell forex pairs with spreads that start from 0 pips.

This is achieved by trading directly with other market participants. In return for accessing zero spreads, Pepperstone users on this account type will pay a very competitive commission of $3.50 for every 1 currency lot traded. On the other hand, Pepperstone also offers standard forex trading accounts that come with commission-free trading.

This account type will subsequently require the trader to cover a spread, which starts at 0.6 pips. Either way, both accounts give Australian traders access to a wide variety of platforms. This is inclusive of MT4, MT5, cTrader, and TradingView. Pepperstone offers dozens of major, minor, and exotic pairs and the maximum leverage limit for retail clients in Australia is 1:30.

When it comes to funding, Pepperstone supports debit and credit card deposits, as well as BPay, POLi, bank transfers, and a variety of e-wallets. In addition to forex, Pepperstone offers a wide selection of other CFD markets, which is inclusive of commodities, shares, cryptocurrencies, and indices.

| FX Pairs | Dozens of majors, minors, and exotics |

| Commission | $3.50 for 1 lot traded on raw spread account |

| EUR/USD Spread | 0 pips on raw spread account |

| Min Deposit | No minimum stated |

| Top 3 Features | Raw accounts offer spreads from 0 pips, great reputation in Australia, multiple trading platforms |

What We Like

74% of retail investor accounts lose money when trading CFDs with this provider.

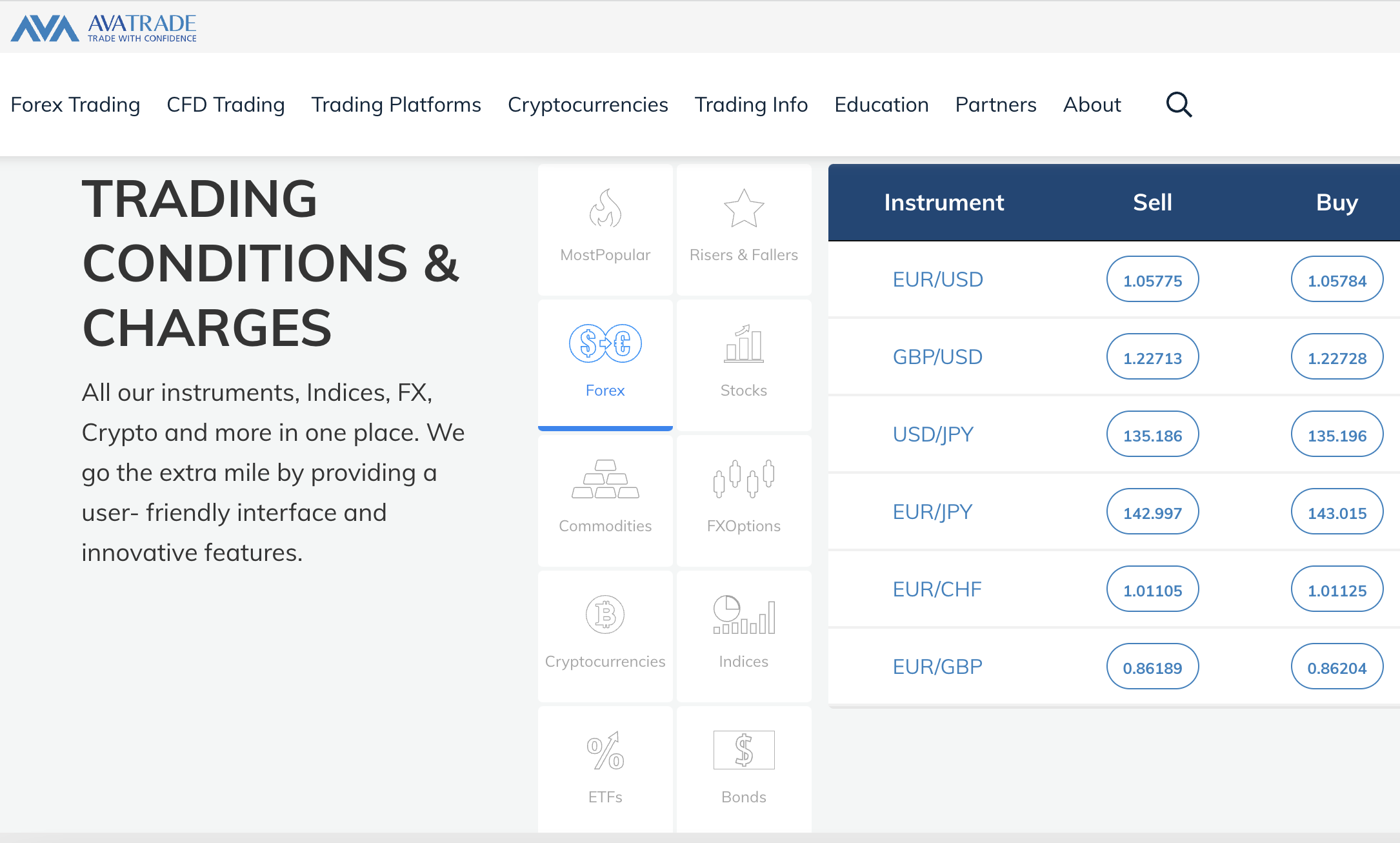

5. AvaTrade – Regulated Forex Broker That Supports MT4 and MT5

Supported payment methods at this platform include debit/credit cards and bank wires. AvaTrade is a CFD trading platform and thus – it offers Australian residents leverage of 1:30 and 1:20 on majors and minors/exotics respectively. In terms of its forex offering, AvaTrade is home to dozens of currency markets.

Each and every trading pair can be accessed on a commission-free basis and spreads start at 0.9 pips. Those with prior forex trading experience might consider AvaTrade for its compatibility with MT4 and MT5. Both of these platforms are favored by traders that seek high-level tools and features.

Less experienced traders might consider using the AvaTrade web trading platform – which can be accessed via a standard web browser. There is also an AvaTrade mobile app for iOS and Android. AvaTrade also offers CFDs in the form of stocks, indices, cryptocurrencies, and commodities.

| FX Pairs | 55 |

| Commission | 0% |

| EUR/USD Spread | 0.9 pips |

| Min Deposit | $100 |

| Top 3 Features | Support for MT4/5, advanced trading suite, 8 regulatory licenses |

What We Like

71% of retail investor accounts lose money when trading CFDs with this provider.

6. Forex.com – Established Forex Broker With Competitive Fees

Forex.com is perhaps the best forex broker in Australia for reputational purposes. This is because the platform has been operational since 2001 and it is regulated by several tier-one financial bodies.

We also like that Forex.com offers a huge trading library that consists of over 80 currency pairs. Forex trading markets on this platform are open on a 24/5 basis. When it comes to fees, Australian traders will not pay any commissions when speculating on forex. Spreads are very competitive here too, with the likes of EUR/USD starting at 0.5 pips.

Forex.com also offers a highly comprehensive news and analysis department. This is inclusive of forex trading ideas that have been compiled by experienced currency investors. We also like the ‘Week Ahead’ section that considers the most important economic developments to keep an eye on in the coming trading sessions.

Another reason to choose Forex.com is that it offers a top-rated educational academy. This allows complete beginners to learn the ropes of forex trading via interactive courses, platform tutorials, and self-assessment quizzes. Finally, Forex.com is also known for its quality customer service team that operates around the clock during standard currency trading hours.

| FX Pairs | 80+ |

| Commission | 0% on standard account |

| EUR/USD Spread | From 0.5 pips on standard account |

| Min Deposit | $100 |

| Top 3 Features | Specialist forex broker, no

commissions charged on forex, top educational department |

What We Like

7. Oanda – Trade 70+ Forex Pairs with No Minimum Deposit

Oanda offers multiple trading platform, including it’s own proprietary platform for web, desktop, and mobile. More experienced traders can also use MetaTrader 4, which supports automated trading strategies, and TradingView, which offers custom technical indicators. Oanda provides all traders with a forex news feed, economic calendar, forex webinars, and daily technical analysis.

For a limited time, new traders at Oanda can earn a welcome bonus when they open an account and make a deposit. The bonus is worth $5,000 for traders who deposit $50,000 or more and $500 for traders who deposit $500 or more. Oanda accepts credit and debit cards, bank transfers, and several popular e-wallets.

| FX Pairs | 70 |

| Commission | 0% |

| EUR/USD Spread | From 1.2 pips |

| Min Deposit | None |

| Top 3 Features | Offers MT4 and TradingView, welcome bonus up to $5,000, 70+ forex pairs to trade |

What We Like

8. XM – Multiple Forex Trading Accounts and Minimum Deposit Just $5

The next platform to consider from our list of the best forex brokers in Australia is XM. This platform offers three core trading accounts – with all budgets and financial goals catered for. The cent account, for instance, is suitable for those that are just starting out in the world of forex.

This is because it allows traders to speculate on currency pairs from just 0.01 lots. This account comes with a minimum spread of 1 pip on major pairs. The XM ultra-low account also comes with a minimum trade requirement of 0.01 lots and spreads start from 0.6 pips.

Either way, all forex trading accounts at XM require a minimum deposit of just $5. Furthermore, all accounts offer commission-free trading. In total, XM offers more than 1,000 financial instruments – which is inclusive of 55 forex pairs. Other markets here include CFDs on indices, stocks, commodities, metals, and energies.

XM is also popular for its wide selection of supported trading platforms. This includes MT4 and MT5, as well as the native XM platform for both desktop browsers and iOS/Android smartphones. XM also offers a huge suite of educational and analysis tools, with the latter including market insights and trading ideas.

| FX Pairs | 55 |

| Commission | 0% |

| EUR/USD Spread | From 0.6 pips |

| Min Deposit | $5 |

| Top 3 Features | 16 platforms supported, minimum deposit just $5, 1,000+ financial instruments |

What We Like

9. HotForex – High Leverage Forex Broker Located Offshore

HotForex is the best forex trading platform in Australia for those seeking high leverage limits. The reason for this is that HotForex is located offshore and thus – it offers limits above the standard 1:30 threshold. In fact, the platform notes that leverage of up to 1:1000 is on offer.

This means that for every $100 staked, a trading platform of up to $100,000 can be entered. Do note that utilizing high leverage limits is extremely risky and can result in the entire stake being lost. Nonetheless, HotForex offers five trading accounts for registered users to choose from.

The micro account, which is designed for beginners and those on a budget, requires a minimum deposit of just $5. This offers spreads from 1 pip on major pairs. Alternatively, those depositing a minimum of $200 can open a zero spread account. While this comes with a lower maximum leverage limit of 1:500, no spreads are charged on major pairs like EUR/USD.

We also like that HotForex offers a fully-fledged demo account, which mirrors live market conditions. In total, the platform supports over 50 forex pairs, alongside a variety of other CFD markets. This includes metals, energies, indices, shares, bonds, and more. There are plenty of premium trading tools offered by this platform – which will suit experienced currency investors.

| FX Pairs | 50 |

| Commission | 0% |

| EUR/USD Spread | From 0 pips on the raw account |

| Min Deposit | From $5 |

| Top 3 Features | Zero spread accounts offered, premium trading tools, high leverage limits |

What We Like

10. IG Markets – Trusted Forex Broker With ASIC Regulation

IG Markets is a trusted online broker that supports over 80 forex pairs. This covers a good blend of majors, minors, and exotics. Customer support is offered on a near 24/7 basis and accounts can be opened in a matter of minutes.

Those opting for a DMA forex account will pay a commission of just $10 for every $1 million traded. The minimum spread payable on EUR/USD is 0.6 pips. But, this can surpass 1 pip outside of core trading hours. Margin accounts at IG Markets come with a maximum leverage limit of 1:30 for retail clients in Australia.

Those with a professional-client status will be offered much higher limits. We also like that IG Markets gives its users access to multiple trading platforms. In addition to its own native web-based platform, this also includes support for MT4 and ProRealTime. The IG app for iOS and Android is also worth considering, which offers full account functionality.

IG Markets is also great when it comes to financial analysis, with the platform offering real-time news, trading ideas, and economic insights. It is also possible to keep tabs on core financial events via its economic calendar. The main drawback with IG Markets is that new customers are required to meet a minimum deposit threshold of $250.

| FX Pairs | 80+ |

| Commission | $10 for every $1 million traded |

| EUR/USD Spread | From 0.6 pips |

| Min Deposit | $250 |

| Top 3 Features | Established in 1974, mobile app with full functionality, near-24/7 customer support |

What We Like

11. Interactive Brokers – Access to Interbank Currency Quotes

The final provider to consider from our list of the best Australia forex trading platforms is Interactive Brokers. Although this platform is primarily headquartered in the US, it has exposure in multiple countries – including Australia.

Put simply, Interactive Brokers is best suited for serious forex traders. The reason for this is that the provider offers direct access to interbank currency rates. This means that traders will be able to speculate on currency markets with super tight spreads – which start from 1/10 of a pip.

This also means that Interactive Brokers offers some of the deepest liquidity in this marketplace. There is an abundance of professional trading tools offered via this platform, which is inclusive of economic indicators and customizable charts. In total, Interactive Brokers supports more than 100 currency pairs.

Commissions are charged at between 0.08 and 0.2 bps, depending on the market. Interactive Brokers is also perhaps the best forex broker in Australia for those that wish to diversify into other asset classes. The platform supports more than 10,000 financial instruments across stocks, ETFs, options, futures, bonds, mutual funds, and more.

| FX Pairs | 100+ |

| Commission | Between 0.08 and 0.2 bps |

| EUR/USD Spread | From 1/10 of a pip |

| Min Deposit | Not stated |

| Top 3 Features | Access to interbank FX rates, deep liquidity, heavily regulated |

What We Like

Top Australian Forex Trading Platforms Compared

For a comparison of the top Australian forex brokers, check out the table below.

| Forex Brokers | FX Pairs | Commission | EUR/USD Spread | Min Deposit | Non-Trading Fees | Min Lot Size | Top 3 Features |

| eToro | 49 | Spread-only | 1 pip | $50 | 0.5% on non-USD deposits, $10 inactivity fee | 0.01 | Copy trading tool, very competitive fees, user-friendly trading platform |

| Plus500 | 60 | Spread-only | 0.8 pips | $200 | Currency conversion, $10 monthly inactivity fee | 0.01 | Guaranteed stop order, trading academy, market insights |

| AvaTrade | 55 | 0% | 0.9 pips | $100 | $50 inactivity fee | $100 min |

Support for MT4/5, advanced trading suite, 8 regulatory licenses

|

| Pepperstone | Dozens of majors, minors, and exotics | $3.50 for 1 lot traded on raw spread account | 0 pips on raw spread account | No minimum stated | None | 0.01 |

Raw accounts offer spreads from 0 pips, great reputation in Australia, multiple trading platforms

|

| Forex.com | 80 | 0% | From 0.1 pips | $100 | $40 on bank wire withdrawals, $15 inactivity fee | 0.01 |

Specialist forex broker, no commissions charged on forex, top educational department

|

| Oanda | 70 | From 0% | From 1.2 pips | None | None | 0.01 | Offers MT4 and TradingView, welcome bonus up to $5,000, 70+ forex pairs to trade |

| XM | 55 | 0% | From 0.6 pips | From $5 | $5 inactivity fee | 0.01 |

16 platforms supported, minimum deposit just $5, 1,000+ financial instruments

|

| HotForex | 50 | 0% | From 0 pips on the raw account | From $5 | None | 0.01 |

Zero spread accounts offered, premium trading tools, high leverage limits

|

| IG Markets | 80 | $10 for every $1 million traded | From 0.6 pips | $250 | 1% on Visa, 0.5% on MasterCard, $18 inactivity fee | $1 per point |

Established in 1974, mobile app with full functionality, near-24/7 customer support

|

| Interactive Brokers | 100 | Between 0.08 and 0.2 bps | From 1/10 of a pip | No minimum stated | 1% on physical currency deposits | $25,000 min |

Access to interbank FX rates, deep liquidity, heavily regulated

|

79% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

When considering which forex broker is the best in Australia, be sure to check the above figures before proceeding.

How we Select the Best Australian Forex Brokers

Choosing the best forex broker in Australia can be a time-consuming and stressful task.

To fast-track the process, below we explain the main criteria to look for when researching forex brokers.

Regulation

The most important thing to consider when choosing the best forex broker in Australia is whether or not the provider is regulated.

To offer some insight, eToro are both authorized and regulated by ASIC, alongside a number of other tier-one financial bodies.

This means that Australian traders can speculate on the future direction of forex pairs in a safe ecosystem. ASIC regulation also ensures that Australian retail clients do not have access to leverage limits above 1:30.

Range of Pairs

As the comparison table above highlighted, the best forex brokers in Australia will offer a large number of trading pairs. Virtually all of the platforms that we reviewed cover all major and minor currencies.

Then it’s just a case of exploring what exotic currency pairs the platform supports, should more volatility be required. It is also worth seeing whether or not the broker offers more sophisticated financial instruments – such as CFDs, futures, and options.

For example, in our GO Markets Australia review we found that this popular CFD broker offers 50+ forex pairs.

Fees

Fees are charged by all forex brokers. Otherwise, they wouldn’t be in the business of offering currency trading services.

The main fees to check when searching for the best forex brokers in Australia are as follows:

Commissions

Many of the forex brokers discussed today do not charge trading commissions. Instead, they operate a spread-only model – which we discuss shortly. Nonetheless, those that do charge commissions often do so on a per-lot basis.

For example, Pepperstone charges $3.50 for every 1 currency lot traded – which consists of 100,000 units. IG Markets, on the other hand, charges $10 for every $1 million traded.

Spreads

Two of the best forex brokers in Australia that we came across – eToro and Plus500, do not charge any trading commissions. Instead, users simply need to cover the spread when placing a buy and sell order.

This simply refers to the gap between the bid and ask price of the respective currency pair. Crucially, the best forex brokers in Australia offer tight spreads alongside a commission-free pricing model.

Leverage Fees

Those in the market for leverage will need to remember that this will attract a daily funding charge.

The exact rate will not only vary from one broker to another, but on the pair, account type, stake, and the amount of leverage being utilized.

Funding

Before trading, users will be required to make a deposit into their respective forex broker accounts. At Plus500, Australian traders can deposit and withdraw funds across all supported payment methods without incurring any fees.

However, some of the forex brokers that we came across charge fees on certain payment methods, or to convert AUD into a major currency like USD or EUR.

Trading and Analysis Tools

Forex pairs rise and fall in value on a 24/7 basis, second by second. This means that traders will need to have access to certain tools so that they can make informed investment decisions.

Those looking for historical pricing trends will likely want to choose a forex broker that offers technical indicators and customizable charts. In addition to this, fundamental tools are important too.

For example, at eToro, the platform offers financial news, market insights, and even an economic calendar.

Another top-rated feature to consider is the eToro Copy Trading facility. In a nutshell, this allows Australian investors to mirror the positions of an experienced forex trader, like-for-like.

For example:

- Let’s say that the user decides to invest $5,000 into a seasoned swing trader on eToro

- The trader risks 5% of their capital going long on AUD/USD

- This means that the eToro user copies the trade automatically, at a stake of $250 (5% of $5,000)

- A few days later, the trader closes the position at a profit of 10%

- The eToro user automatically closes the trade and also makes a 10% profit – or $25.

Ultimately, Copy Trading will suit newbie forex traders that have little to no experience in buying and selling currencies.

Minimum Deposit

At one end of the scale, we came across forex brokers like IG Markets, which require a high minimum deposit of $250 to get started with an account.

On the other hand, there are also platforms like eToro, which require a minimum first-time deposit of just $50 when funding an account with an e-wallet or debit/credit card.

Beginners are advised to select a forex broker that has a minimum deposit requirement that meets their trading skills and investment budget.

Demo Account

Anyone without a solid background in forex trading should consider opening an account with a broker that offers a demo facility. This will allow the user to trade currency pairs in a 100% risk-free environment.

Not only that, but the best demo accounts in this space will mirror actual market conditions. This will allow the trader to practice different strategies and ultimately – get to grips with how the forex market works.

At eToro, for example, all registered users get access to a $100,000 demo trading facility.

Mobile App

Another core feature offered by the best forex brokers in Australia is a fully optimized mobile app for iOS and Android.

This should offer all of the same features as available on the main desktop platform – such as being able to place buy and sell orders, perform market research, request a deposit or withdrawal, and more.

The best forex broker apps in this space are super user-friendly and will not hinder the trading experience just because a smaller screen is being utilized.

Customer Service

Traders of all skill sets should look for a forex broker that offers top-rated customer service. Many of the best brokers for forex that we reviewed today offer support on at least a 24/6 basis to mirror the global currency trading market.

If live chat is available, this is an added bonus.

Best Forex Signals in Australia

We mentioned earlier that those searching for the best forex broker for beginners in Australia might consider using the eToro Copy Trading feature – should they wish to speculate on currency pairs without any prior experience.

With that said, another option available in this marketplace is forex signals. In a nutshell, signals are trading suggestions sent by experienced currency investors to their members.

Each forex signal will inform the member which currency pair should be traded and whether a long or short position should be entered. Popular signal providers like Learn2Trade will also offer a suggested limit, stop-loss, and take-profit order price.

In doing so, this allows inexperienced investors to actively trade forex but without needing to do any technical or fundamental analysis – which can take many years to truly master.

Those wishing to give forex signals a go might consider the 30-day moneyback guarantee offered by Learn2Trade on its premium plans.

This comes with up to three forex signals per day at a reported win rate of 76% since Learn2Trade began its operations more than a decade ago. Learn2Trade also offers the best indicators for forex scalping.

Your capital is at risk.

How to Start Forex Trading in Australia

The currency trading market is by far the largest investment scene globally, with an estimated daily volume of over $5 trillion. However, those that are new to this marketplace might require a bit of guidance in getting started.

If so, the guide below explains how to open an account with eToro in under five minutes, before making an instant deposit and placing a forex trading order.

Step 1: Open an eToro Forex Broker Account

First, new customers will need to open an eToro trading account.

This requires some personal information surrounding the user’s name, nationality, residential address, date of birth, and contact details.

Step 2: Upload ID

eToro requires newly registered users to upload a form of ID. This can either be a driver’s license or a passport.

Step 3: Deposit Funds

Next, the user will need to make a deposit into their eToro account. Bank wires are worth avoiding here, as the minimum deposit is high at $50 and the funds can take several days to arrive.

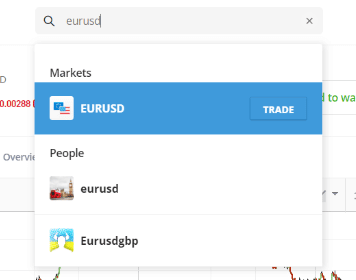

Step 4: Search for Forex Pair

eToro is home to 49 forex pairs. As such, rather than scrolling through many pages of available markets, it is best to use the search bar at the top of the page.

In our example above, we are searching for EUR/AUD. This means that we are looking to trade the euro against the Australian dollar.

Step 5: Trade Forex

The final part of this walkthrough will require the user to place a forex trading order.

- A ‘buy’ order should be selected if the user believes that the value of the pair will rise

- A ‘sell’ order should be selected if the user believes that the value of the pair will fall

Next, enter an investment stake into the relevant box. The user can also enter the price that they wish the trade to be executed at via a limit order. Otherwise, the order will be executed instantly at the next best available price.

Conclusion

This beginner’s guide has compared and ranked the best forex brokers in Australia right now. The core metrics that our review team focused on include fees and commissions, supported pairs, regulation, and the availability of trading tools.

To start trading currencies today with a leading forex broker – consider eToro. This ASIC-regulated platform offers 49 currency pairs – all of which can be traded at 0% commission and tight spreads.

79% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.