Canadians wishing to trade forex online can do so at a regulated trading platform. Typically, the best forex brokers in this space will offer dozens of currency pairs, tight spreads, low commissions, and plenty of trading tools.

In this guide, we compare the 9 best forex brokers in Canada for 2023.

The 9 Best Forex Brokers in Canada

For a quick overview of the best forex brokers in Canada – consider the 10 platforms outlined below:

- AvaTrade – Overall Best Forex Broker in Canada

- Vantage – Trade EUR/USD from 0.2 Pips

- CMC Markets – Access Over 330+ Forex Pairs via a Single Trading Platform

- Oanda – Trade 70+ Forex Pairs & Get a $5,000 Welcome Bonus

- Saxo Bank – Trade EUR/USD From 0.9 Pips

- Forex.com – Specialist Forex Broker With 80+ Pairs

- XM – Open a Zero Spread Forex Account From Just $5

- Eightcap – 40+ Forex Pairs and Access to Raw Spreads

- Interactive Brokers – Trade Forex With Access to Interbank Quotes

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Best Canadian Forex Brokers Reviewed

The process of choosing the best forex broker in Canada is no easy feat. There are dozens of trading platforms in this space – many of which offer low fees and support for a wide range of currencies. Traders should, however, also consider what trading tools the forex broker offers, alongside its regulatory standing.

Below, we offer comprehensive reviews of the 10 best forex brokers in Canada for 2023.

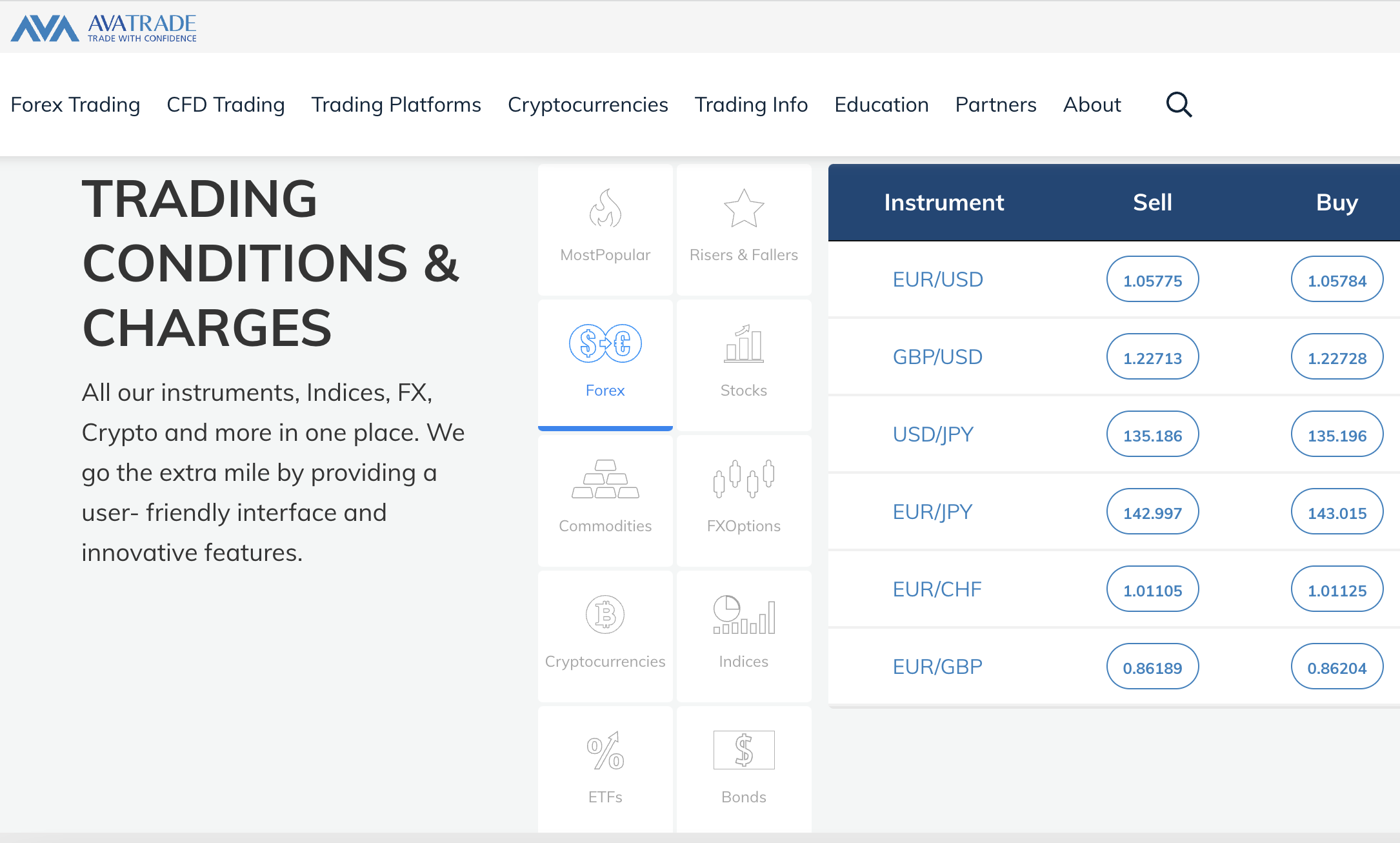

1. AvaTrade – Overall Best Forex Broker in Canada

When entering buy and sell positions at AvaTrade, no trading commissions are charged. Spreads here are reasonable, with EUR/USD starting at 0.9 pips. Canadians can trade via the AvaTrade website, or download the mobile app for iOS and Android.

Alternatively, AvaTrade also supports MT4 and MT5, which can be accessed online or via desktop software – which includes Mac devices. All trading platforms supported by AvaTrade come packed with advanced tools, such as technical indicators. Canadian traders have access to leverage at AvaTrade, with limits going up to 1:50 on major forex pairs.

AvaTrade supports hundreds of other CFD markets too – which include US-listed stocks, hard metals, energies, indices, and cryptocurrencies. To open a forex trading account with AvaTrade, the minimum first-time deposit is $100. Accounts can be funded with a variety of convenient payment methods, which include debit/credit cards.

| Forex Pairs | 55 |

| Pricing System | 0% commission on all markets |

| EUR/USD Spread | From 0.9 pips |

| Min Deposit | $100 |

| Top 3 Features | Partnered with Friedberg Direct, lots of trading platforms to choose from, leverage of up to 1:50 |

What We Like

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. Vantage – Trade EUR/USD from 0.2 Pips

Investors can choose between two account types – the standard STP account and the Raw ECN account. The STP account offers commission-free FX trading but charges a high spread. For example, the EUR/USD pair takes a spread of 1.1 pips or higher. This account type requires a minimum deposit of $200.

On the other hand, the Raw ECN account provides low spread trading + a commission fee. For example, EUR/USD can be traded at a low spread of 0.2 pips with an average of $3 commission per lot. However, clients must make a minimum deposit of $500 to access this platform. Vantage can be accessed through the MT4 & MT5 trading platforms, which offer multiple customization tools and charting options.

Retail clients can access various educational materials such as webinars, market guides and articles on how to begin trading with MT4 & MT5. Vantage also provides a mobile app, which is accessible via iOS and Android. To get a more detailed idea about the global markets, Vantage offers daily market updates and economic calendars to get the latest information.

Vantage is regulated by multiple global regulatory bodies, including the FCA, ASIC and VFSC.

| Forex Pairs | 44 |

| Pricing System | No commission + high spread on STP Account/ Commission per lot + Low spread with ECN Account |

| EUR/USD Spread | From 1.2 pips on STP Account/0.2 Pips on ECN Account |

| Min Deposit | $250 – STP Account/$500 – ECN Account |

| Top 3 Features | MT4 & MT5 Trading platform, education resources & CFD Trading |

What We Like

4. Oanda – Trade 70+ Forex Pairs & Get a $5,000 Welcome Bonus

For a limited time, new traders at Oanda can take advantage of the broker’s $5,000 welcome bonus offer. Qualifying for the full bonus requires making a $50,000 deposit, but traders can get a $500 welcome bonus with a $500 deposit. Oanda offers fee-free deposits by credit card, debit card, and bank transfer.

Traders at Oanda can choose between the broker’s proprietary web, desktop, and mobile platform, MetaTrader 4, or TradingView. While MT4 is undoubtedly the most advanced platform for experienced traders and automation, Oanda’s trading platform offers a wide range of technical analysis tools and charting features. The broker also offers a forex news feed and daily technical analysis to help traders stay on top of a fast-moving market.

| Forex Pairs | 70+ |

| Pricing System | 0% commission on forex |

| EUR/USD Spread | From 1.2 pips |

| Min Deposit | None |

| Top 3 Features | No minimum deposit, welcome bonus up to $5,000, MT4 |

What We Like

5. CMC Markets – Access Over 330+ Forex Pairs via a Single Trading Platform

CMC Markets is one of the best forex brokers in Canada when it comes to supported markets. By opening an account with this platform, Canadians will have access to more than 330+ forex pairs. This means that in addition to majors and minors, CMC Markets covers a sizable number of exotic currencies.

This will perhaps suit traders that wish to speculate on volatile markets. CMC Markets is perhaps the cheapest forex broker in Canada too, with no commissions charged on forex and EUR/USD spreads that start from 0.7 pips. There is no minimum deposit to get started with an account here, which will suit those on a budget.

In addition to forex, CMC Markets offers thousands of alternative CFD instruments. This covers everything from stocks and ETFs to precious metals and energies. CMC Markets can be accessed online or via an iOS and Android app for both smartphones and tablets. Traders will also have access to morning market updates and weekly insights.

CMC also enables traders access to Bitcoin.

| Forex Pairs | 330+ |

| Pricing System | 0% commission on forex |

| EUR/USD Spread | From 0.7 pips |

| Min Deposit | No minimum stated |

| Top 3 Features | Lists more FX pairs than any other broker, 18,000+ financial markets, Competitive spreads |

What We Like

6. Saxo Bank – Trade EUR/USD From 0.9 Pips

When it comes to fees, Saxo Bank operates a spread-only pricing structure on forex. Spreads will, however, vary depending on the account type. For example, the classic account offers a minimum spread of 0.9 pips on EUR/USD, and 1.1 pips on GBP/USD.

The minimum deposit on the Canadian account is 2,000 EUR (approx 2,600 CAD). Therefore, Saxo Bank will not be suitable for those wishing to trade forex with a small amount of capital. The platinum and VIP accounts require an even higher minimum deposit, albeit, these options come with lower fees.

| Forex Pairs | 190+ |

| Pricing System | 0% commission on forex |

| EUR/USD Spread | 0.9 pips on the classic account |

| Min Deposit | Approx 2,600 CAD |

| Top 3 Features | 190+ forex pairs, regulated investment bank, huge selection of alternative markets |

What We Like

7. FOREX.com – Specialist Forex Broker With 80+ Pairs

Forex.com is an established trading platform that offers access to more than 80 forex pairs, alongside 3,000 CFD instruments. The latter is inclusive of stocks, commodities, and indices. The forex trading suite at this platform is only on a 24/5 basis and no commissions are charged.

Spreads will vary throughout the day depending on broader market conditions, albeit, EUR/USD starts at 0.8 pips. The most competitively priced pair on Forex.com is GBP/USD, which comes with a minimum spread of 0.6 pips. Canadians will have access to leverage of up to 1:50 on this platform when trading major forex pairs.

Most account holders at Forex.com will use the web trading platform, which can be accessed via a standard web browser. This offers a seamless trading experience, 50+ drawing tools, 70+ economic indicators, and more. There is also a Forex.com app for Andoird and iOS phones. Advanced traders will appreciate that Forex.com has also integrated TradingView, which provides charts also for cryptocurrencies such as Dogecoin.

When it comes to opening an account with Forex.com, the process rarely takes more than 10 minutes from start to finish. There is no minimum deposit on bank wire payments, but debit/credit cards and Paypal require at least $100.

| Forex Pairs | 80+ |

| Pricing System | 0% commission on all markets apart from stocks |

| EUR/USD Spread | From 0.8 pips |

| Min Deposit | $0 on bank transfers, $100 on debit/credit cards, and Paypal |

| Top 3 Features | 50+ drawing tools, custom charts, economic indicators |

What We Like

8. XM – Open a Zero Spread Forex Account From Just $5

The next platform to consider on our list of the best forex brokers in Canada is XM. This trading platform is regulated by multiple financial bodies and offers a variety of account types to choose from. In particular, we like that the zero spread account at XM requires a minimum deposit of just $5.

Do note, that zero spreads are typically only available on major pairs like EUR/USD and during busy market conditions. Moreover, there is a commission to pay on this account type. Alternatively, XM also offers a commission-free account that comes with minimum spreads of 1 pip. The minimum trade size across all account types is 0.01 lots.

In total, XM offers access to more than 55 forex pairs alongside over 1,000 alternative CFD markets. This includes commodities, indices, stocks, and futures. Leverage is offered on all account types. Supported trading platforms include both MT4 and MT5, both of which can be accessed via web browsers, desktop devices, and smartphones.

| Forex Pairs | 55+ |

| Pricing System | From 0% commission |

| EUR/USD Spread | From 0.0 pips |

| Min Deposit | $5 |

| Top 3 Features | Open a zero spread account from $5, commission-free accounts also available, 55+ forex pairs |

What We Like

9. Eightcap – 40+ Forex Pairs and Access to Raw Spreads

Eightcap is another option to consider on our list of the best forex brokers in Canada. This popular trading platform – which is regulated by ASIC, offers two account types. First, the standard account offers commission-free trading, with spreads that range from 0.5 to 1.8 pips.

Alternatively, the raw account offers access to 0.0 pip spreads, alongside a trading commission of $3.50 per lot. Both account types come with a minimum trade size of 0.01 lots, an 80% margin call level, and support for scalping and EAs (expert advisors). Once an account type has been chosen, the trader will need to meet a minimum deposit of $100.

This can be funded with a wide variety of convenient payment methods, which include everything from Paypal and Neteller to Visa and MasterCard. In total, Eightcap offers access to over 40+ forex pairs. The platform also supports plenty of other CFD asset classes, such as commodities, indices, cryptocurrencies, and stocks.

| Forex Pairs | 40+ |

| Pricing System | From 0% commission |

| EUR/USD Spread | From 0.0 pips |

| Min Deposit | $100 |

| Top 3 Features | Raw spread and commission-free accounts, user-friendly interface, 80% margin call level |

What We Like

10. Interactive Brokers – Trade Forex With Access to Interbank Quotes

The final option to consider on our list of the best forex brokers in Canada is Interactive Brokers. This US-based platform has a solid reputation in the brokerage space and it accepts clients from multiple regions – including Canada.

Interactive Brokers is perhaps best suited for forex traders that have proven experience in this space. This is because the platform offers access to interbank quotes, which means that traders will be buying and selling pairs with other market participants. Some of the best spreads in the market are on offer here, some of which are as narrow as 1/10 of a pip.

Moreover, commissions are very competitive, ranging from 0.08 to 0.2 bps with no mark-ups. Another reason why we found that Interactive Brokers is a top option for seasoned forex traders is that it offers deep liquidity levels. There are more than 100+ forex pairs supported by the broker.

| Forex Pairs | 100+ |

| Pricing System | From 0.08 bps |

| EUR/USD Spread | From 1/10 of a pip |

| Min Deposit | No minimum stated |

| Top 3 Features | Access interbank quotes, deep liquidity levels, competitive spreads |

What We Like

Top Canadian Forex Trading Platforms Compared

Still searching for the best broker for forex trading in Canada?

If so, refer to the comparison table below – which summarizes the 10 best forex brokers for Canadian traders which were reviewed in the sections above.

| Broker | FX Pairs | Commission | Min Deposit | Non-Trading Fees | Min Lot Size | Top 3 Features |

| AvaTrade | 55 | 0% | $100 | $50 inactivity fee | $100 |

Partnered with Friedberg Direct, lots of trading platforms to choose from, leverage of up to 1:50

|

| Oanda | 70 | From 0% | None | None | 0.01 | No minimum deposit, welcome bonus up to $5,000, MT4 |

| CMC Markets | 330 | 0% | No minimum stated | $10 inactivity fee | 0.01 | Lists more FX pairs than any other broker, 18,000+ financial markets, Competitive spreads |

| Saxo Bank | 190 | 0% | Approx 2,600 CAD | $100 inactivity fee | 0.01 | 190+ forex pairs, regulated investment bank, huge selection of alternative markets |

| Forex.com | 80 | 0% | $0 on bank wires | $40 on bank wire withdrawals, $15 inactivity fee | 0.01 | 50+ drawing tools, custom charts, economic indicators |

| XM | 55 | From 0% | $5 | $5 inactivity fee | 0.01 |

Open a zero spread account from $5, commission-free accounts are also available, 55+ forex pairs

|

| Eightcap | 40 | From 0% | $100 | None | 0.01 | Raw spread and commission-free accounts, user-friendly interface, 80% margin call level |

| Interactive Brokers | 100 | From 0.08 bps | No minimum stated | 1% fee on physical cash deposits | $25,000 CAD | Access interbank quotes, deep liquidity levels, competitive spreads |

How We Select the Best Canadian Forex Brokers

Investors are strongly advised to do their own research when searching for the best Canadian forex trading platform.

To offer some insight into how we rank top forex brokers in Canada, consider the factors outlined below:

Regulation

Make no mistake about it – we never discuss forex brokers that are not adequately regulated. When choosing a forex broker that is physically located in Canada, then it should be authorized and licensed by the Regulatory Organization of Canada (IIROC).

With that said, some of the best forex brokers that we discussed today are international platforms and thus – are regulated by other tier-one bodies.

Ultimately, regulated forex brokers in Canada ensure that traders can speculate on the currency markets in a safe and secure environment.

Range of Forex Pairs

Some of the best forex brokers in Canada that we discussed today offer access to more than 100 currency pairs. For example, AvaTrade offers 55 pairs across the majors, minors, and exotics.

On the other hand, the likes of Eightcap offer just 40 pairs, meaning that those seeking access to exotic currencies will be disappointed.

Trading Fees

When searching for the best forex brokers in Canada, traders are advised to spend some time assessing the fee structure of the platform.

Direct trading fees will consist of a commission and spread. Many brokers in Canada offer commission-free forex trading, with spreads of under 1 pip on major pairs like EUR/USD.

Raw spread accounts operate in a different manner. For example, some brokers offer 0.0 pips on major pairs alongside a small commission that averages $3-4 for every currency lot traded.

Non-Trading Fees

Be sure to check what non-trading fees are charged by the forex broker. In addition to deposits and withdrawals, assess whether a fee is charged on non-active accounts.

| Broker | Commission | EUR/USD Spread (From) | Non-Trading Fees |

| AvaTrade | 0% | 0.9 pips | $50 inactivity fee |

| Oanda | From 0% | 1.2 pips | None |

| CMC Markets | 0% | 0.7 pips | $10 inactivity fee |

| Saxo Bank | 0% | 0.9 pips | $100 inactivity fee |

| Forex.com | 0% | 0.8 pips | $40 on bank wire withdrawals, $15 inactivity fee |

| XM | From 0% | 0.0 pips | $5 inactivity fee |

| Eightcap | From 0% | 0.0 pips | None |

| Interactive Brokers | From 0.08 bps | 1/10 of a pip | 1% fee on physical cash deposits |

Tools and Analysis

The only way to make money from the forex trading arena is to have access to tools that support research and charting analysis. At a minimum, all of the forex brokers discussed today offer a range of technical indicators and chart drawing tools.

When support for MT4 or TradingView is offered, this enables the trader to access high-level analysis features.

The best forex brokers in Canada also offer market insights, which enables the trader to assess the viewpoints of seasoned investors in this space.

Minimum Deposit

Don’t forget to check what the minimum deposit requirement is before opening an account with a broker.

AvaTrade which we found to be the overall best forex broker in Canada, requires a minimum deposit of just $100 (debit/credit cards and e-wallets, not bank wires).

On the other hand, Saxo Bank requires the equivalent of approximately $2,600 to open an account for the first time.

Demo Account

Those in the market for the best forex broker for beginners in Canada should check whether the provider offers a free demo account.

In doing so, this enables beginners to practice their forex trading strategies before risking real money. Traders can use a demo account to test out various assets such as Bitcoin.

Mobile App

Top forex trading platforms will also offer a mobile app that has been fully optimized for both Android and iOS devices.

This will enable traders to access the forex markets around the clock, no matter where they are. Trading apps also enable users to set up pricing alerts, which are sent directly to the phone in real-time.

Payment Methods

The best forex brokers in Canada accept instant payment methods – such as a debit/credit card or e-wallet. If the broker only supports traditional bank wires, it might take several days for the money to arrive.

Customer Service

Don’t forget to check what customer service channels the forex broker offers, and how long the average wait time is when sending a request via live chat or email.

Best Forex Signals in Canada

Another option to consider when learning how to trade forex is to sign up with a leading signals provider like Learn2Trade. By joining Learn2Trade, the member will receive up to five signals each and every day. Each signal will inform the member which forex pair should be traded and whether a long or short position should be entered. Furthermore, Learn2Trade provides signals that contain the suggested entry, stop-loss, and take-profit profits.

Ultimately, this enables traders in Canada to avoid the need to spend countless hours researching the forex markets. Instead, it’s just a case of joining Learn2Trade and entering the trading positions that each forex signal suggests.

Head over to Learn2Trade to learn more about its free and premium signals.

How to Start Forex Trading in Canada

To get started with a forex trading account in less than 10 minutes, follow the step-by-step walkthrough below:

Step 1: Open an AvaTrade Forex Broker Account

We found that AvaTrade is the best forex broker in Canada, so we’ll explain how to complete the process with this provider.

First, visit the AvaTrade website and elect to register an account.

This will initially require some personal information and contact details. After that, upload a copy of a government-issued ID to get the newly created account verified.

Step 2: Deposit Funds

The minimum deposit required to start trading forex at AvaTrade is $100, but this is on the proviso that the user adds funds with a debit/credit card or e-wallet.

Step 3: Search for Forex Pair

Now that the account is funded, the user can type in the forex pair that they wish to trade at AvaTrade.

Below, we are searching for EUR/USD.

Step 4: Trade Forex

The final step is to choose from a long or short position, alongside the desired stake (min 0.01 lots).

Confirm the order and AvaTrade will execute it instantly. To close the position, users can do this manually or by setting up a stop-loss and take-profit order.

Conclusion

First-time currency traders should choose wisely when selecting a forex broker or crypto exchange. Key factors to consider during the decision-making process include regulation, fees, the minimum account balance, supported pairs, and user-friendliness.

Overall, we found that AvaTrade is the best forex broker in Canada. By opening an account with this provider, Canadians are only required to meet a $100 minimum deposit.

After that, Canadians can trade forex without paying any commission, alongside competitive spreads that start at 0.6 pips.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.