Forex markets are generally known for their high liquidity and easy accessibility. Nevertheless, traders will still need to find a reliable broker to execute their plans.

This guide reviews the best forex brokers in the UAE for 2023. We will also explain how to set up an account and start trading forex in less than five minutes.

The 10 Best Forex Brokers in the UAE

The forex market in the UAE is saturated with different providers. After careful consideration, we have narrowed down our list to the top ten forex brokers in the UAE – which are listed below:

- eToro – Overall Best Forex Broker in the UAE

- Evest – Top Forex Broker Offering Tight Spreads

- Libertex – Popular CFD Broker with Zero Spreads

- AvaTrade – Heavily-Regulated FX Broker with MT4/MT5 Support

- Pepperstone – Forex Broker for Advanced Traders

- FOREX.com – Specialist Forex Broker for UAE Traders

- XM – Trade Forex with Leverage of Up to 1:1000

- HotForex – Leading Forex Broker in Dubai

- IG Markets – Access Over 80 Forex Pairs

- Interactive Brokers – Top Forex Broker for Tight Spreads and Deep Liquidity

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

We have included detailed reviews of each of these forex brokers in the next section.

Best Forex Brokers Dubai Reviewed

To help our readers choose the best forex broker in the UAE, we tested and compared the top providers in the market. We paid particular attention to the number of forex pairs available, fees, features, and security.

So, let’s explore the best forex trading platforms in the UAE.

1. eToro – Overall Best Forex Broker in the UAE

Furthermore, this broker is also one of the heavily regulated forex trading platforms out there – with licenses from the FCA, SEC, CySEC, and ASIC. Crucially, eToro features an Islamic account, which is an important factor for many UAE residents. It is also beginner-friendly, while, still providing all the standard brokerage features sought out by experienced traders.

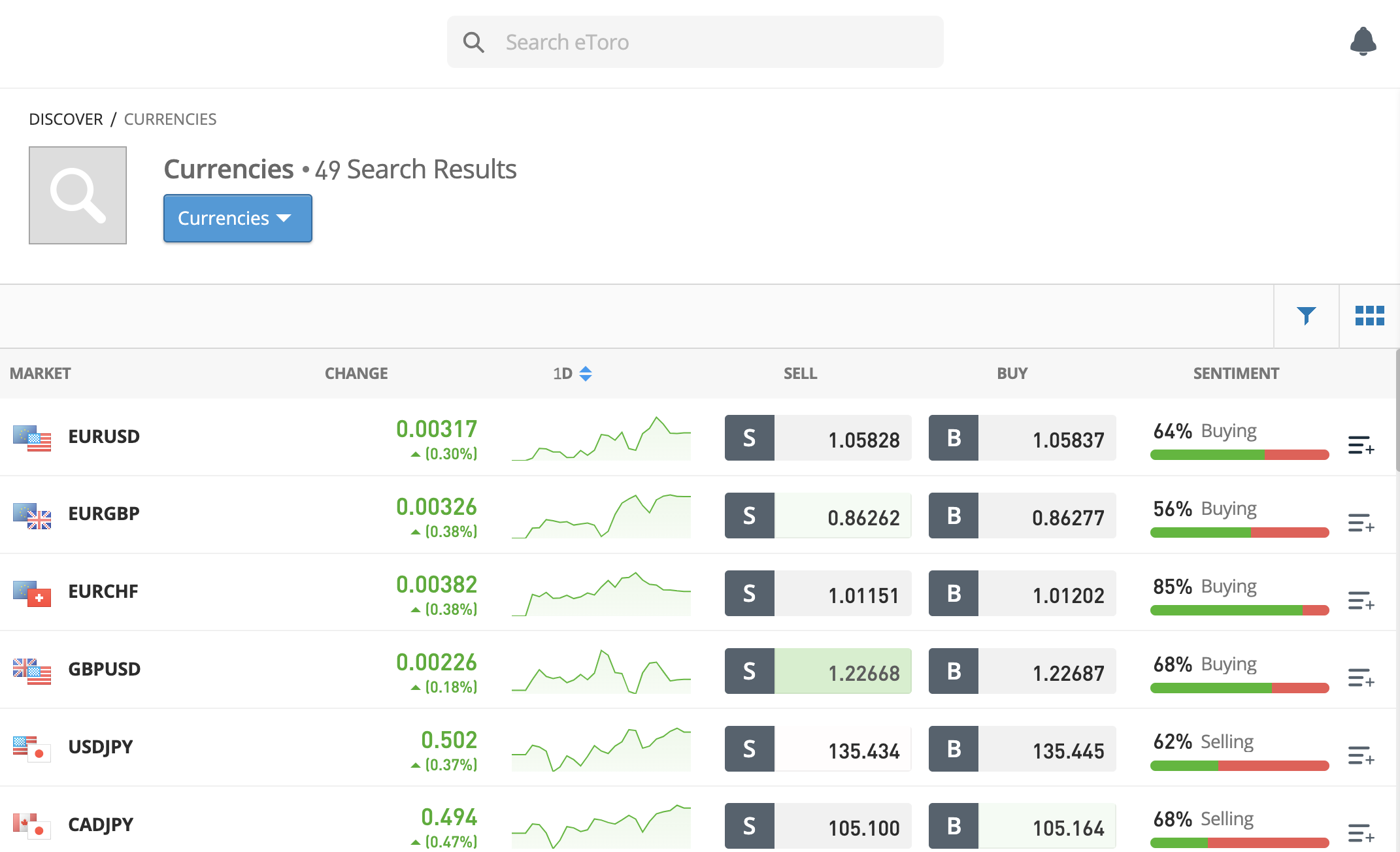

When it comes to forex trading, eToro lists close to 50 markets. And users will be able to access all of them on a spread-only basis – which starts from just 1 pip per slide. eToro also offers support for both major and minor forex pairs.

The eToro platform comes with a good selection of standard trading tools, like price alerts, news feeds, market updates, and customized charts. Moreover, retail clients can leverage their forex trades on major currency pairs by up to 1:30. For minors, however, the leverage is limited to 1:20.

The standout feature of this broker is its unique passive and automated trading tools. On eToro, users can duplicate the forex trading strategies of other leading investors, like-for-like, on their portfolios. eToro also has a premium portfolio management product that allows its customers to diversify into multiple stocks and cryptocurrencies with just one click.

eToro stipulates a minimum deposit of $50 from its users in the UAE – which comes to around 180 AED. Traders can fund their account with credit/debit card, e-wallets, or by making a bank transfer. The fees for processing the deposits come to 0.5% for UAE residents.

| Number of forex pairs | 49 |

| Commission | 0% commissions |

|

Spread for EUR/USD

|

From 1 pip |

| Min deposit | $50 (around 185 AED) |

| Top 3 features | Copy trading, access high leverage of 1:30, Islamic account |

What We Like

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

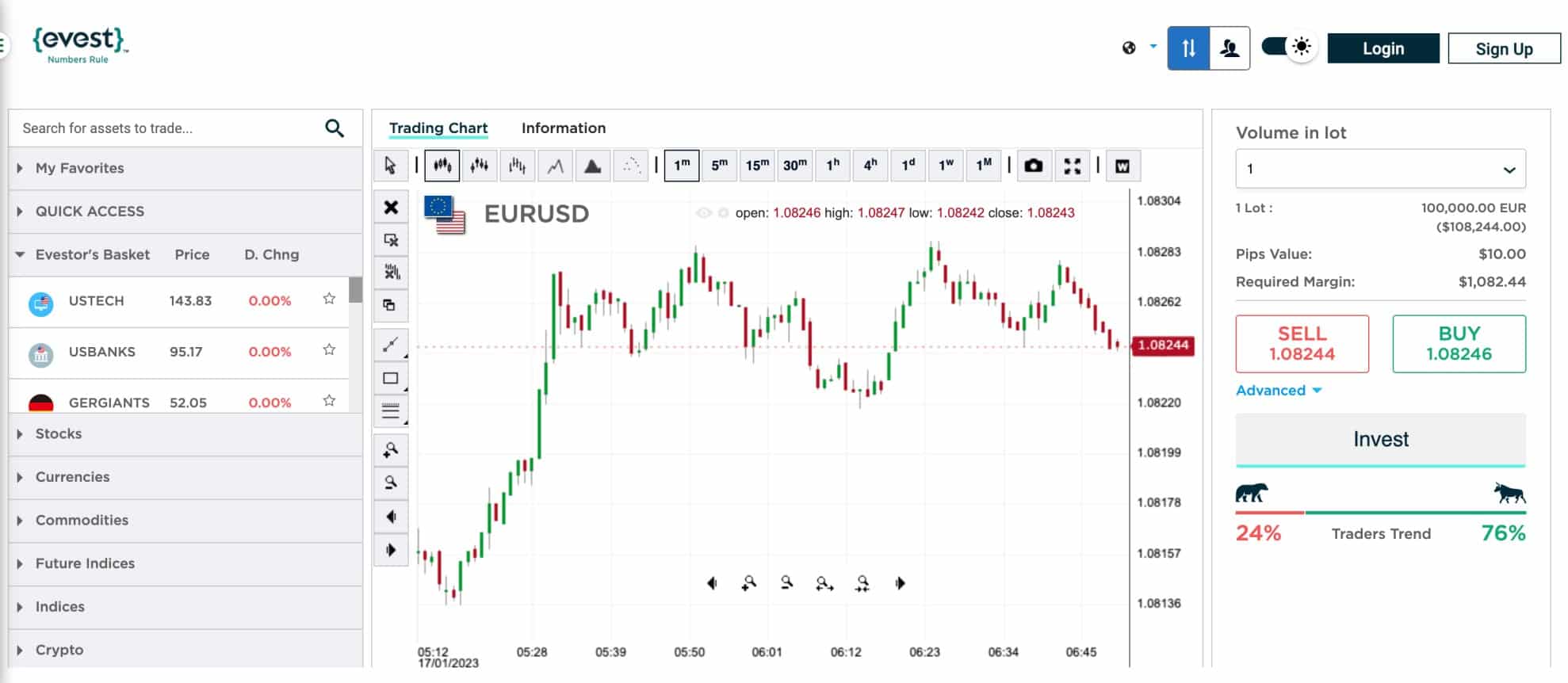

2. Evest – Top Forex Broker Offering Tight Spreads

After creating an account with Evest in just a few minutes, users can access over 100 financial markets. On Evest, users can trade FX pairs with low spreads, depending on the account type. There are four account types on Evest – Silver, Gold, Platinum, and Diamond.

On the Silver account, users can begin trading with only a $250 (918 AED) deposit, but the spreads start at 3 pips. The Diamond account can benefit advanced traders since it offers customized pips. However, the minimum deposit on this account type is $50,000 (183,647 AED). Supporting multiple payment options, Evest lets investors make payments with Credit cards such as VISA, Mastercard, and American Express. Members can also use wire transfers and e-wallets such as Skrill and Neteller.

Offering a fast execution speed of under 0.03 milliseconds, Evest ensures users can quickly trade Forex pairs and top global stocks. Regarding fees, Evest charges no commission on trades and offers free deposits. However, users must pay an 18 AED fee per withdrawal (minimum 91 AED).

Our Evest review found that beginners can benefit from Evest’s Trading Academy – which offers multiple courses on trading basics and terms. One can also practice FX trading with the Evest demo account, which comes pre-loaded with $25,000 worth of virtual funds. A safe trading platform to use, Evest uses SSL (Secure Sockets Layer) encryption technology to protect all the user’s deposits. Furthermore, this forex broker is regulated by the Vanuatu Financial Services Commission.

Evest can be accessed online through a desktop and is supported on Android and iOS mobile devices. The platform also gives users access to MetaTrader 5, the popular web-based forex trading platform.

| No. Forex Pairs | 29 |

| Commission | 0% commission |

| EUR/USD Spread | Starting at 0.8 pips |

| Min. Deposit | $250 (Silver Account) |

| Min Deposit | $250 (918 AED) |

| Top 3 Features | No commissions on forex trading / Trading academy for beginners to access / No deposit fees |

What We Like

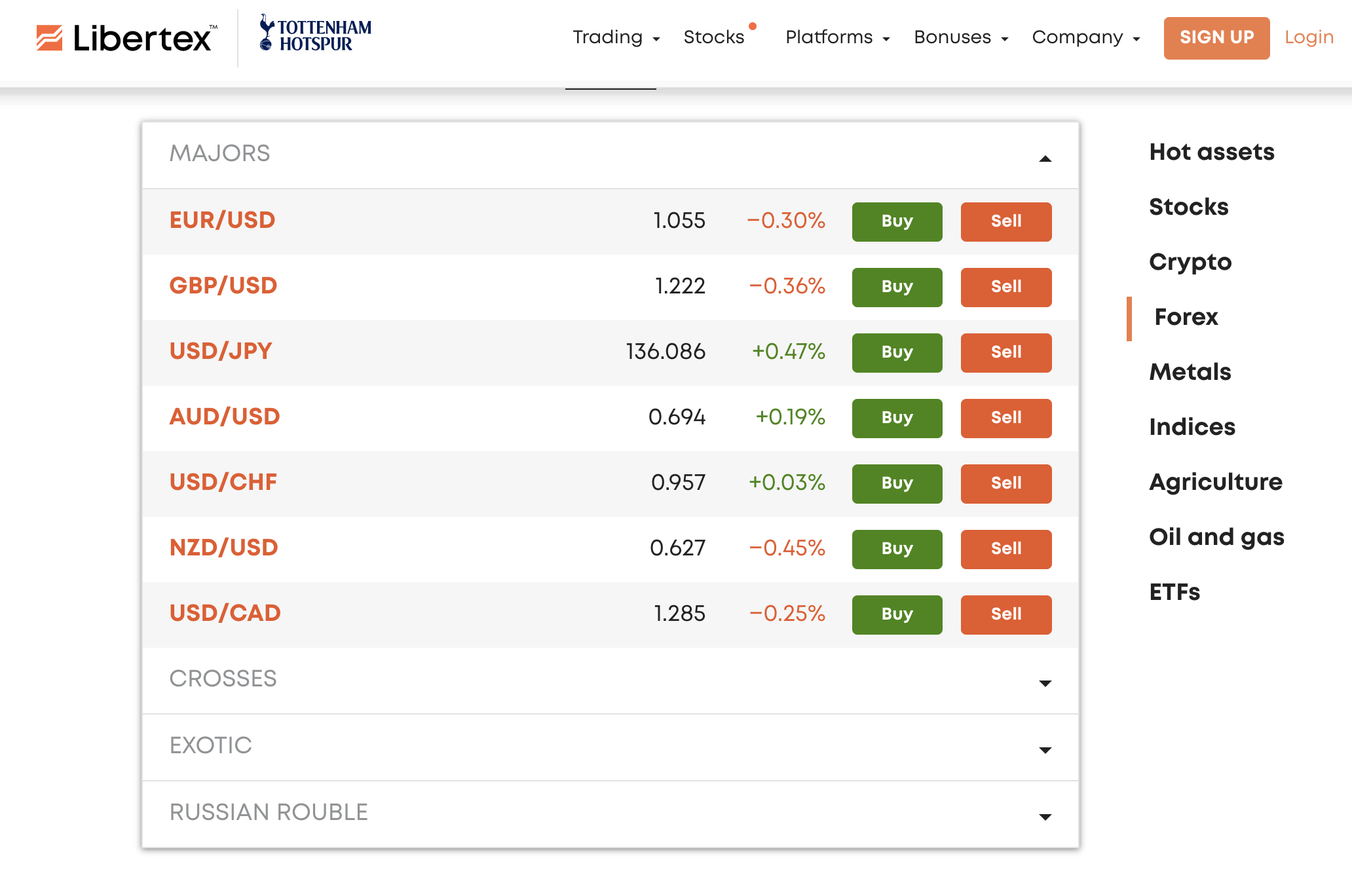

3. Libertex – Popular CFD Broker with Zero Spreads

The broker offers UAE residents access to a variety of major, cross, and exotic currency pairs. Customers of Libertex also have several tools at their disposal in order to devise their trading strategy. For instance, it provides trading ideas, forex signals, charting tools, market news, and more.

On top of this, Libertex is also a great MT5 forex broker accessible to UAE residents. Libertex customers will be able to add money to their account using a bank transfer for free – if they are willing to wait for two to five days for the deposit to process. The other instant deposit methods available include credit/debit card, Neteller, and Skrill.

In terms of trading fees, Libertex does not charge any spread at all. Instead, it charges a floating commission, that varies depending on market conditions. Moreover, Libertex also offers high leverage of up to 1:1000 on major forex pairs when trading via the MT4.

| Number of forex pairs | 50+ |

| Commission | From 0.03% per trade |

|

Spread for EUR/USD

|

0.0 pips |

| Min deposit | $20 (around 75 AED) |

| Top 3 features | Access to MT4 and MT5, over 50+ forex pairs, trading signals and ideas |

What We Like

Your capital is at risk. 70.8% of retail investor accounts lose money when trading CFDs with this provider.

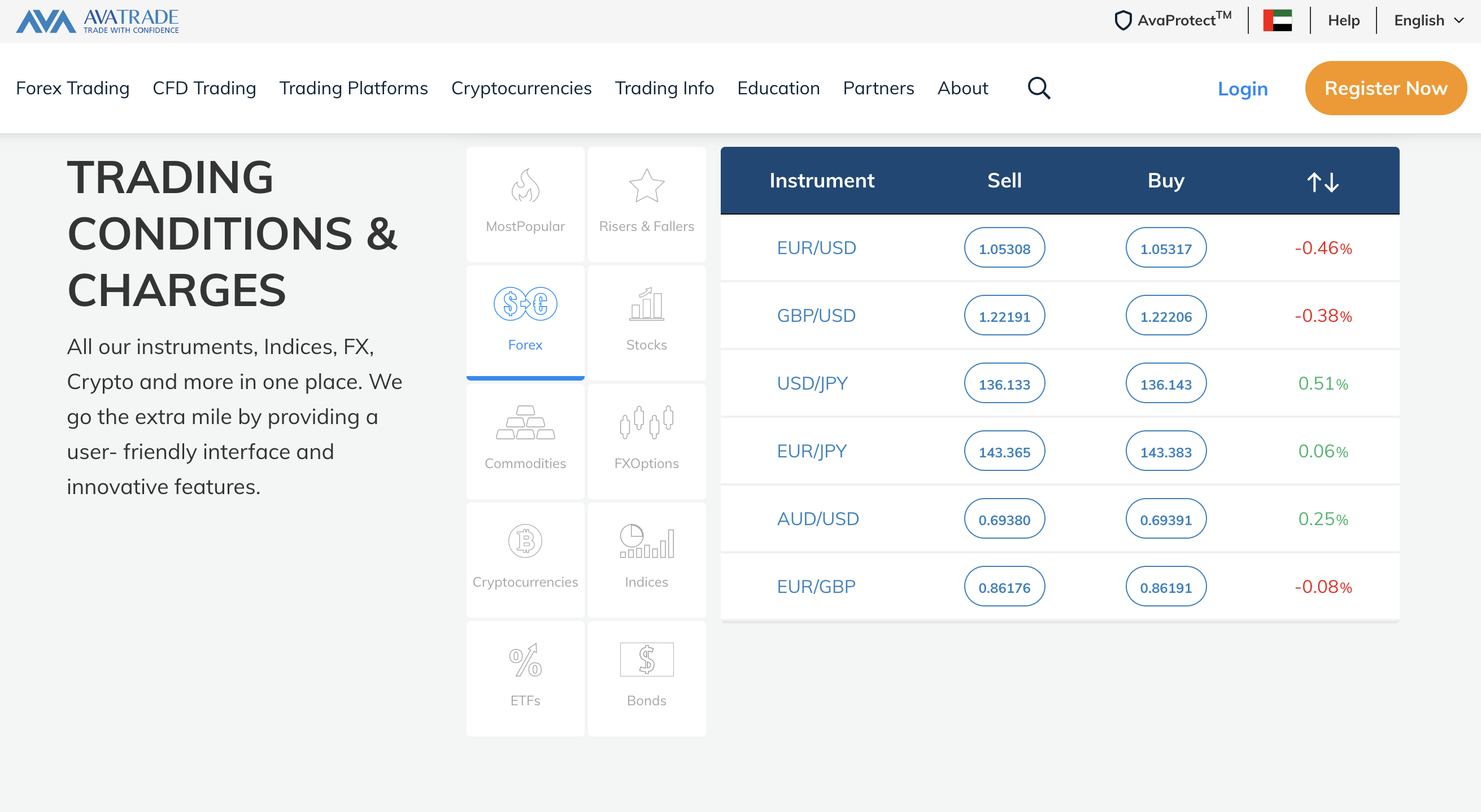

4. AvaTrade – Heavily-Regulated FX Broker with MT4/MT5 Support

This broker provides access to the forex market through CFDs and vanilla options. Users can trade over 50 currency pairs via AvaTrade without paying any commissions. Furthermore, AvaTrade is also highly preferred by advanced traders, as it integrates with both MT4 as well as MT5.

However, the spread for forex trading tends to be relatively high here, starting at 0.9 pips. Avatrade accepts payments via debit/credit card, wire transfer, and e-wallets such as Neteller, Skrill, and WebMoney. UAE residents will also be able to use AvaTrade to set up an Islamic account, which operates under Sharia Law.

| Number of forex pairs | 50+ |

| Commission | 0% commissions |

|

Spread for EUR/USD

|

From 0.9 pips |

| Min deposit | $100 (around 360 AED) |

| Top 3 features | Access to MT4 and MT5, Islamic account, supports vanilla options for forex |

What We Like

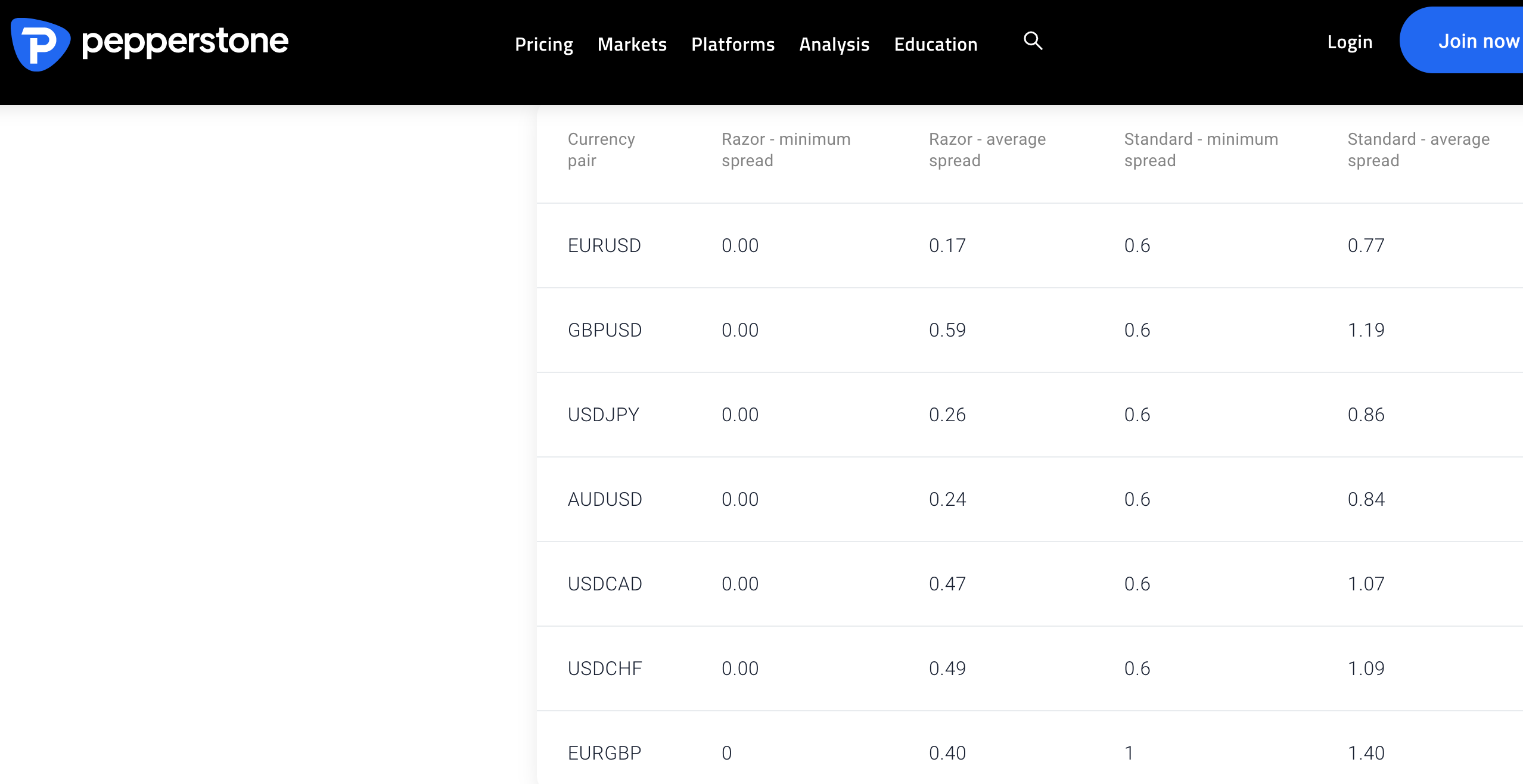

5. Pepperstone – Forex Broker for Advanced Traders

Pepperstone is a prominent forex broker that is regulated by the DFSA, ASIC, FCA, and SCB. It comes with support for multiple trading platforms – including the MT4, MT5, and CTrader. All these are advanced, meaning, Pepperstone might not be the most suitable broker out there for beginners.

The platform lists over 60 currency pairs, which includes 14 majors. Pepperstone also sends market analysis and insights regularly to its users. If needed, traders can subscribe to Daily Fix, to receive direct updates from Pepperstone’s research department.

When signing up, individuals can choose between a razor or a standard account. The former is spread-free, whereas the second provides support for 0%-commission forex trading. Pepperstone allows its customers to deposit funds to their account with Visa, Mastercard, or via bank transfer.

| Number of forex pairs | 60+ |

| Commission | From $0.04 per slide |

|

Spread for EUR/USD

|

0.0 pips for razor accounts, from 0.6 pips for standard accounts |

| Min deposit | Recommended minimum is around 500 AED |

| Top 3 features | Access to MT4, MT5, CTrader, direct market research updates, spread-free accounts |

What We Like

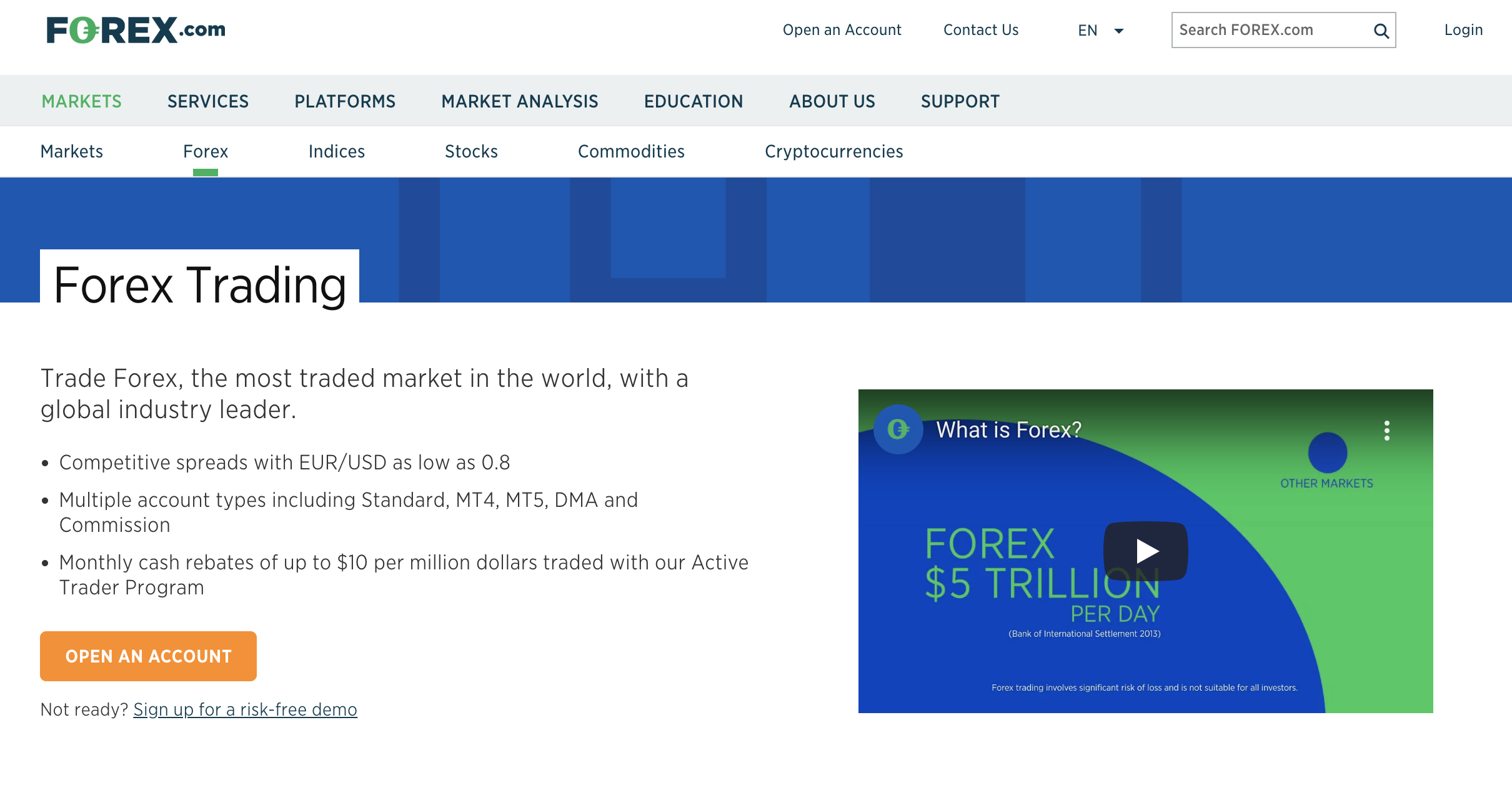

6. FOREX.com – Specialist Forex Broker for UAE Traders

FOREX.com is another established global online broker that caters to individuals seeking access to the FX and CFD markets. It comes with two different account types – the first for commission-based trading, and the second for DMAs.

With a commission account, users will be trading CFDs on low variable spreads plus a flat $5 fee per 100K lot. On the other hand, when using a DMA account, customers will not have to pay a spread.

Instead, FOREX.com charges a commission – and users will also benefit from volume discounts of up to 67%. Regardless of which account type is selected, FOREX.com gives access to over 80 currency pairs.

FOREX.com comes with sophisticated trading platforms with integrated charting tools, technical indicators, and market insights. Users will also be able to exchange currencies via MT4 and MT5 with a FOREX.com account.

Finally, FOREX.com is also considered the best trading app in the UAE – as it supports order alerts, TradingView tools, and lighting-fast execution.

| Number of forex pairs | 80+ |

| Commission | $5 flat |

|

Spread for EUR/USD

|

From 0.8 pips |

| Min deposit | $100 (around 360 AED) |

| Top 3 features | Access to MT4 and MT5, SMART trading signals, High liquidity via DMAs |

What We Like

7. XM – Trade Forex with Leverage of Up to 1:1000

With over 55+ currency pairs and leverage of up to 1:1000, XM is one of the best forex brokers in the UAE to consider right now. It gives users access to majors, minors, and exotics. The platform facilitates commission-free forex trading and offers competitive spreads.

XM lets its users open an Islamic account in order to receive swap-free status. In addition to this, individuals can also set up an ultra-low account, which offers swap-free trading for a wide selection of major currency pairs such as EUR/USD, USD/JPY, EUR/JPY, and GBP/USD. This account also comes with spreads as low as 0.6 pips.

Customers of XM are also offered free access to forex market research, daily webinars, and even trading signals. To get started, users need to make a minimum deposit of only $5. Those new to currency trading can also benefit from XM’s demo account, which comes pre-funded with $100,000 in paper money.

| Number of forex pairs | 55+ |

| Commission | 0% commissions |

|

Spread for EUR/USD

|

From 0.6 pips |

| Min deposit | $5 (around 20 AED) |

| Top 3 features | Islamic account, forex trading signals, leverage of 1:1000 |

What We Like

8. HotForex – Leading Forex Broker in Dubai

Put otherwise, security-wire, HotForex is a reputable platform to consider for currency trading in the UAE. At the time of writing, this platform lists over 50 forex pairs, which includes a handful of minors and exotics.

And what’s more, users will be able to access leverage of up to 1:1000 when trading currencies. The platform also offers an extremely competitive spread – which starts as low as 0.1 pip.

Not only that, HotForex supports over 15 payment methods and charges no deposit fees. The minimum requirement for the initial deposit is $200, but – the subsequent payment can be as low as $5.

HotForex also integrates seamlessly with MT4 and MT5 – through a web browser, iPad, mobile, and desktop software.

| Number of forex pairs | 50+ |

| Commission | 0% commissions |

|

Spread for EUR/USD

|

$0.03 per 1K lot |

| Min deposit | $200 (around 750 AED) opening deposit |

| Top 3 features | Access to MT4 and MT5, 15 deposit methods, low spread |

What We Like

9. IG Markets – Access Over 80 Forex Pairs

This means that users of IG Markets can access greater liquidity with DMAs – through primary exchanges, brokers, and MTF dark pools. No matter which approach is selected, IG Markets offer access to forex trading through its mobile app and advanced web platforms.

However, while forex CFDs are commission-free, trading with DMAs comes with variable charges. The spread, however, can be high and averages 1.04 pips. IG Markets also require an initial deposit of 20,000 AED from its users. Once set up, traders will have access to over 80 forex pairs via this broker, with leverage of up to 1:30.

| Number of forex pairs | 80+ |

| Commission | 0% commissions, variable fees for DMAs |

|

Spread for EUR/USD

|

Average 1.04 pips |

| Min deposit | 20,000 AED for first deposit, $300 (around 1,100 AED) |

| Top 3 features | Access DMAs, over 80 forex pairs, high liquidity |

What We Like

10. Interactive Brokers – Top Forex Broker for Tight Spreads and Deep Liquidity

Interactive Brokers, commonly known as IBKR, has a staggering range of tradable products. It is often deemed as one of the best forex trading platforms in the UAE, in terms of the number of markets listed.

Users of IBKR can trade over 100 currency pairs. The platform provides deep liquidity and real-time quotes from different FX dealers.

It also comes with professional tools that are specially designed for forex trading – such as up and down indicators, average price trends, multiple order types, and more.

Interactive Brokers also provides competitive fees and does not charge anything extra for processing deposits. The provider levies low commissions – ranging between 0.08 to 0.20 bps. Other than this, there are no hidden spreads or markups.

| Number of forex pairs | 100+ |

| Commission | 0% commissions |

|

Spread for EUR/USD

|

From 0.08 bps (basis points) |

| Min deposit | $100 (around 360 AED) |

| Top 3 features | High liquidity, no spread, advanced FXTrader platform |

What We Like

Top UAE Forex Trading Brokers Compared

Wondering how to choose the best forex broker in the UAE?

Refer to our comparison table below to make an informed decision.

| Forex brokers | Number of forex pairs | Commission | Spread for EUR/USD | Min deposit | Top 3 features |

| eToro | 49 | 0% commission | From 1 pip | $50 (around 185 AED) | Copy trading, access high leverage of 1:30, Islamic account |

| Libertex | 50+ | From 0.03% per trade | 0.0 pips | $20 (around 75 AED) | Access to MT4 and MT5, over 50+ forex pairs, trading signals, and ideas |

| Evest | 29 | 0% commission | From 0.8 pips | $250 (918 AED) | No commissions,Trading academy, No deposit fees |

| AvaTrade | 50+ | 0% commission | From 0.9 pips | $100 (around 360 AED) | Access to MT4 and MT5, Islamic account, supports vanilla options for forex |

| Pepperstone | 60+ | From $0.04 per slide | 0.0 pips for razor accounts, from 0.6 pips for standard accounts | $0, recommended minimum is around 500 AED | Access to MT4, MT5, CTrader, direct market research updates, spread-free accounts |

| Forex.com | 80+ | $5 flat | From 0.8 pips | $100 (around 360 AED) | Access to MT4 and MT5, SMART trading signals, High liquidity via DMAs |

| XM | 55+ | 0% commission | From 0.6 pips | $5 (around 20 AED) | Islamic account, forex trading signals, leverage of 1:1000 |

| HotForex | 50+ | 0% commission | $0.03 per 1K lot | $200 (around 750AED) opening deposit | Access to MT4 and MT5, 15 deposit methods, low spread |

| IG Markets | 80+ | 0% commission, variable fees for DMAs | Average 1.04 pips | 20,000 AED for first deposit, $300 (around 1,100 AED) | Access DMAs, over 80 forex pairs, high liquidity |

| Interactive Brokers | 100+ | 0% commission | From 0.08 bps (basis points) | $100 (around 360 AED) | High liquidity, no spread, advanced FXTrader platform |

How we Select the Best UAE Forex Brokers

Choosing the right forex broker is one of the most challenging decisions that a currency investor can make. With a long and growing list of available options, it can be daunting to find a platform that fits a trader's unique needs.

With this in mind, we thoroughly researched the online investment space to identify the best forex brokers in the UAE.

We compared and contrasted different features - which we list below. Our readers can also consider the same metrics when selecting a forex broker for themselves.

Regulation

When researching the best forex trading platforms in the UAE, we placed the greatest emphasis on security. All the brokers we listed here are regulated by top financial authorities.

A few platforms hold licenses from the DFSC in Dubai and the FSRA in Abu Dhabi - two of the esteemed governing bodies in the UAE.

Users will be able to easily find the regulatory status of a forex broker by visiting the website of the provider.

On top of this, brokers such as eToro have implemented the best data protection measures for the safety of users. The platform also holds clients' money in highly secure bank accounts in Europe and has them separated from its operational funds.

Range of pairs

When choosing the best forex broker in the UAE, special attention should be paid to the currency pairs offered by the provider. Some only provide the basic currency pairings and nothing more.

However, we made sure that all the forex brokers reviewed today list a decent mix of majors, minors, and exotics. This is crucial for a trader looking to diversify their portfolio.

In addition to this, the majority of the forex brokers on this page also offer access to other asset classes - such as stocks, commodities, and cryptocurrencies.

For instance, UAE residents can access eToro to buy Bitcoin, altcoins, commodities, stocks, and more.

Fees

Even the best forex broker in the UAE will charge some kind of fees - after all, the provider is in the business to make money.

When it comes to forex trading, there are two different types of fees that users need to be aware of - which are as follows.

Commissions

Commissions are charged by brokers for facilitating transactions. This is often calculated as a percentage against the size of the trade.

Take a look at this example:

- Suppose a broker charges a commission of 1% on forex trades.

- A user decides to stake $1,000 on the pair EUR/USD.

- When opening the trade, the user will have to pay $10 (which is 1% of $1,000).

- Then again, when closing the trade, the commission will be charged again.

- So, suppose at the time of closing, the position is worth $2,000.

- The commission will be 1% of $2,000 - which is $20.

- This means that the total commission on this trade comes to $30.

Those looking for low trading fees should consider a commission-free broker like eToro. In doing so, users only need to consider the spread.

Spreads

Most forex brokers in the UAE do not charge commissions. Instead, when executing trades, they deduct the cost of the spread.

- The spread is the difference between the buy and ask price of the chosen forex pair - quoted by the broker.

- Due to the market volatility, each broker will quote a slightly different price for the same currency pair.

- As such, the spread will also vary from one broker to another.

- Ideally, users should be looking for platforms that offer low spreads.

- That being said, there are also brokers that facilitate spread-free forex trading.

- However, in this case, users will be required to pay a commission.

Looking for the best app for forex trading with low fees? Below, we have included a summary of the spread and commission charged by the best forex brokers in the UAE.

| Forex Brokers | Commission | Spread for EUR/USD |

| eToro | 0% commission | From 1 pip |

| Libertex | From 0.03% per trade | 0.0 pips |

| AvaTrade | 0% commission | From 0.9 pips |

| Pepperstone | From $0.04 per slide | 0.0 pips for razor accounts, from 0.6 pips for standard accounts |

| Forex.com | $5 flat | From 0.8 pips |

| XM | 0% commission | From 0.6 pips |

| HotForex | 0% commission | $0.03 per 1K lot |

| IG Markets | 0% commission, variable fees for DMAs | Averages 1.04 pips |

| Interactive Brokers | 0% commission | From 0.08 bps (basis points) |

Non-Trading Fees

Aside from the spread and commission, some brokers might also charge fees for processing deposits, withdrawals, and for general account maintenance.

Crucially, if trading CFDs and buying stocks, individuals should also keep an eye out for overnight fees. Also known as 'swap fees', these charges are applicable if traders hold a CFD position open overnight.

Tools & Analysis

A good broker is not only a middleman to execute trades. Some of the best UAE forex trading platforms also offer a wide selection of tools to assist users with their decision-making process.

Moreover, they also integrate tools that can be immensely helpful for traders to conduct quality research.

Moreover, brokers such as eToro go one step further by providing an extensive library of educational materials. Users of this platform can access webinars, take courses, and learn to trade using its free demo account.

Minimum Deposit

We found that the best forex brokers in the UAE also have very low minimum deposit requirements.

In fact, on the majority of platforms, individuals can get started with as little as $10-$20.

That said, the minimum deposit requirement might vary depending on the chosen payment method.

Demo Account

Beginners searching for the best forex trading apps in the UAE might want to prioritize those that come with access to a demo account.

This is why we encourage our readers to consider the likes of eToro.

For first-time users, it might take a bit of time to get used to the many different features available and learn how to make the most of them. This is where a demo account comes in handy.

Additionally, as demo accounts come funded with virtual money, individuals can also practice trading in real-market conditions, without taking any risk. Users will also be able to switch between the demo and live accounts as needed.

Payment Methods

Individuals now have different options at their disposal when it comes to funding a brokerage account. The best forex brokers in the UAE accept payments through not only bank transfers, but also through Visa and MasterCard.

Some providers also allow users to move funds from e-wallets such as PayPal, Neteller, and Skrill. We have ensured that all the best brokers discussed today support multiple convenient payment methods.

Mobile App

We also considered which is the best trading app in the UAE in terms of swift execution, integration of features, and convenience of use. After all, a complicated interface can make it challenging to place orders through a mobile screen.

The majority of the top forex brokers in the UAE come with their own mobile apps.

After considering the different options in this market, eToro came across as the best app for forex trading in the UAE - for advanced traders and beginners, respectively.

Customer Service

It is also important to consider what level of customer support is provided by a broker. All the best forex trading apps in the UAE come with excellent customer support.

On eToro, users can contact a customer representative via live chat. It is also possible to send direct emails to the support team. Moreover, the platform also has a help center that caters to the most common FAQs.

Best Forex Signals UAE

Beginners entering the forex space might be confused about how to make the right trading decisions. For many newbies, it might not be feasible to spend hours researching the market before making a move.

However, forex signals can help investors make smart choices without having to do any groundwork. In simple terms, forex signals are trading suggestions curated by experts or algorithms.

A forex signal will include a currency pair and the specific price at which the trade has to be executed.

There are several forex signal providers that cater to investors in the UAE. Learn2Trade is a prominent platform that offers the best forex signals in the UAE.

It sends up to three forex signals for free per week - which includes information such as the currency pair, whether to go long/short and even a stop-loss and take-profit order suggestion.

With a premium account, users will receive up to three signals daily. Learn2Trade sends its signals via Telegram, and users from the UAE will be able to access them by connecting their devices to one of the best VPNs available in the country.

After receiving the signal, investors can review them and execute the order via their chosen forex broker.

Your capital is at risk. There is no guarantee that you will make money when using this signal provider.

How to Start Forex Trading in the UAE

Ready to get started with a forex trading account?

Below, we have included a detailed breakdown of how to set up an account and start trading with the best forex broker in the UAE - eToro.

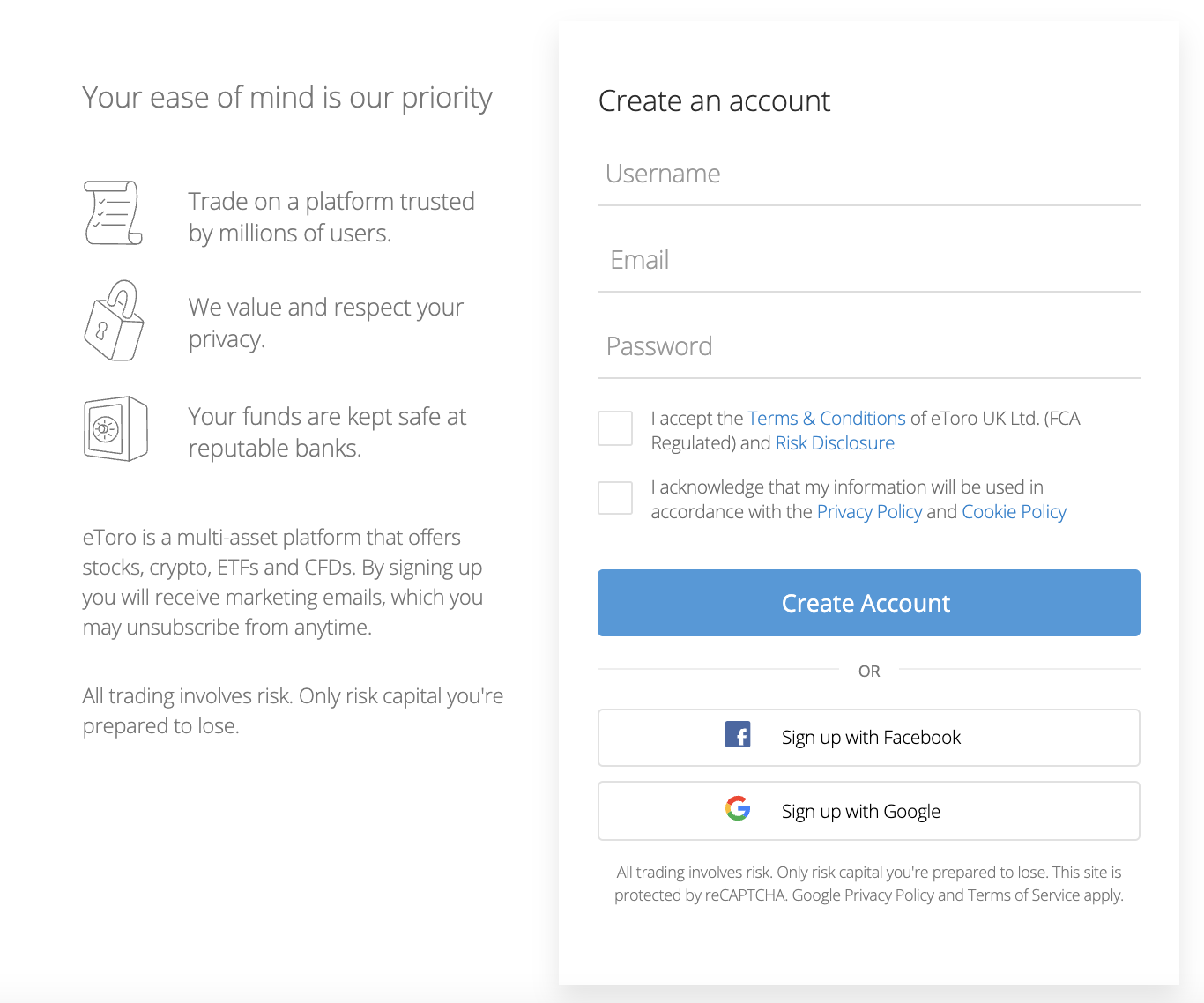

Step 1: Open an eToro Trading Account

To sign up for a new account, go to the eToro website and tap on 'Trade Now'. Next, fill out the email address and password fields before clicking on the 'Continue' button to proceed.

Then, new users will have to provide some personal information, such as a full name, date of birth, and address.

New users will then be prompted to upload their documents for identification purposes. For instance, eToro requires documents that can verify the identity and address of a user.

This can be a passport or a driver's license. Individuals will also need to upload a utility bill or a bank statement in order to verify the address they have submitted.

Step 2: Deposit Funds

Before trading forex, users will have to make a deposit into their account. They can do this with a debit/credit card or bank wire transfer.

Users can also use several methods to make instant deposits. The minimum deposit for debit/credit card and e-wallet payments is $10.

That said, customers of eToro do not need to deposit any money to get started with the demo account.

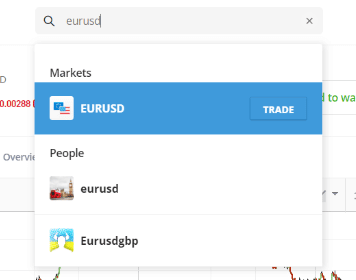

Step 3: Search Forex Pair

Next, users can look for the forex pair they want to trade in the 'Discover' tab of the trading platform.

Alternatively, simply enter the trading pair in the search bar to find it.

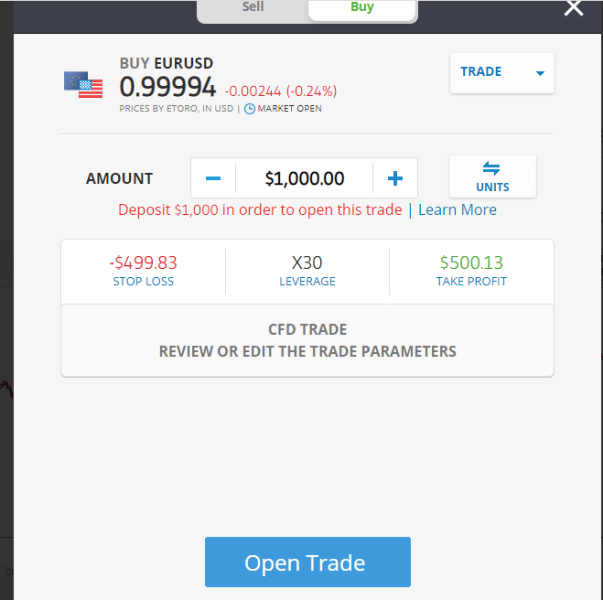

Step 4: Trade Forex

To start trading, click on the forex pair and choose the type of order that has to be placed. As eToro deals with CFDs, users can speculate in both directions.

To go long, individuals can open their position with a 'buy' order.

If going short, a 'sell' order needs to be placed.

To open a position, simply enter the stake amount and click on the 'Buy' or 'Sell' button based on the respective trading strategy.

The trade can be found in the 'Portfolio' section of the account.

Conclusion

From our research, we found that the UAE hosts a number of top-notch forex brokers. Most offer support for dozens of currency pairs and feature excellent trading platforms.

After considering factors such as security, fees, and functionality - we consider eToro as the best forex broker in the UAE.

It comes with a demo account and facilitates advanced trading through its feature-rich platform. Moreover, eToro is commission-free and does not charge any deposit fees.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider