Forex brokers allow you to speculate on the future value of currency pairs like USD/GBP or EUR/JPY.

You’ll want to choose a forex broker that offers plenty of tradable markets with low fees – alongside access to leverage, charting tools, and research materials.

This guide compares the 10 best forex brokers in the US and explains how to get started with a currency trading account in under five minutes.

The Best Forex Brokers for 2023 Ranked

The 10 best forex brokers in the market right now are those listed below:

- eToro – Overall Best Forex Trading Platform

- Capital.com – Leading Forex Platform with 0% Commissions

- XTB – Best Forex Broker Trading Platform

- GO Markets – Respected Forex Broker with Spreads from 0.0 Pips

- AvaTrade – Heavily-Regulated FX Broker with MT4/MT5 Support

- Skilling – Top FX Platform with Spreads From Only 0.1 Pips

- Interactive Brokers – Top Forex Broker for Tight Spreads and Deep Liquidity

- TD Ameritrade – Top-Rated Stock Broker for Seasoned Traders

- Forex.com – Specialist Forex Broker for US Traders

- E*TRADE – Good Forex Broker for Currency Futures

We review the above forex brokers in great detail in the following sections. This will help you choose the best forex broker in the USA for your skillset and trading goals.

Best Forex Trading Platforms Reviewed

There are dozens of forex brokers that allow US clients to buy and sell currency pairs with the best MT4 brokers offering full access to the MetaTrader suite.

No two forex brokers are the same though, so you’ll want to do some research surrounding supported markets, commissions, account types, minimum deposits, trading tools, and other important factors.

The overall 10 best forex brokers in the market right for are discussed below:

1. eToro – Overall Best Forex Trading Platform for 2023

This covers a good blend of majors, minors, and exotics. When you trade forex on the eToro platform, you won’t be charged any conventional commissions. Instead, you will pay a competitive spread that starts at just 1 pip per slide. This makes eToro one of the cheapest places to trade forex in the online space. For those unfamiliar with Pips our article on ‘what is a Pip in forex?‘ covers all the basics.

Moreover, after you have opened an account, you won’t pay any transaction fees if you are funding your account in US dollars. When it comes to leverage, eToro offers retail clients up to 1:30 on major forex pairs. Minors and exotics come with leverage of up to 1:20. This means that you can amplify your positions by a considerable amount.

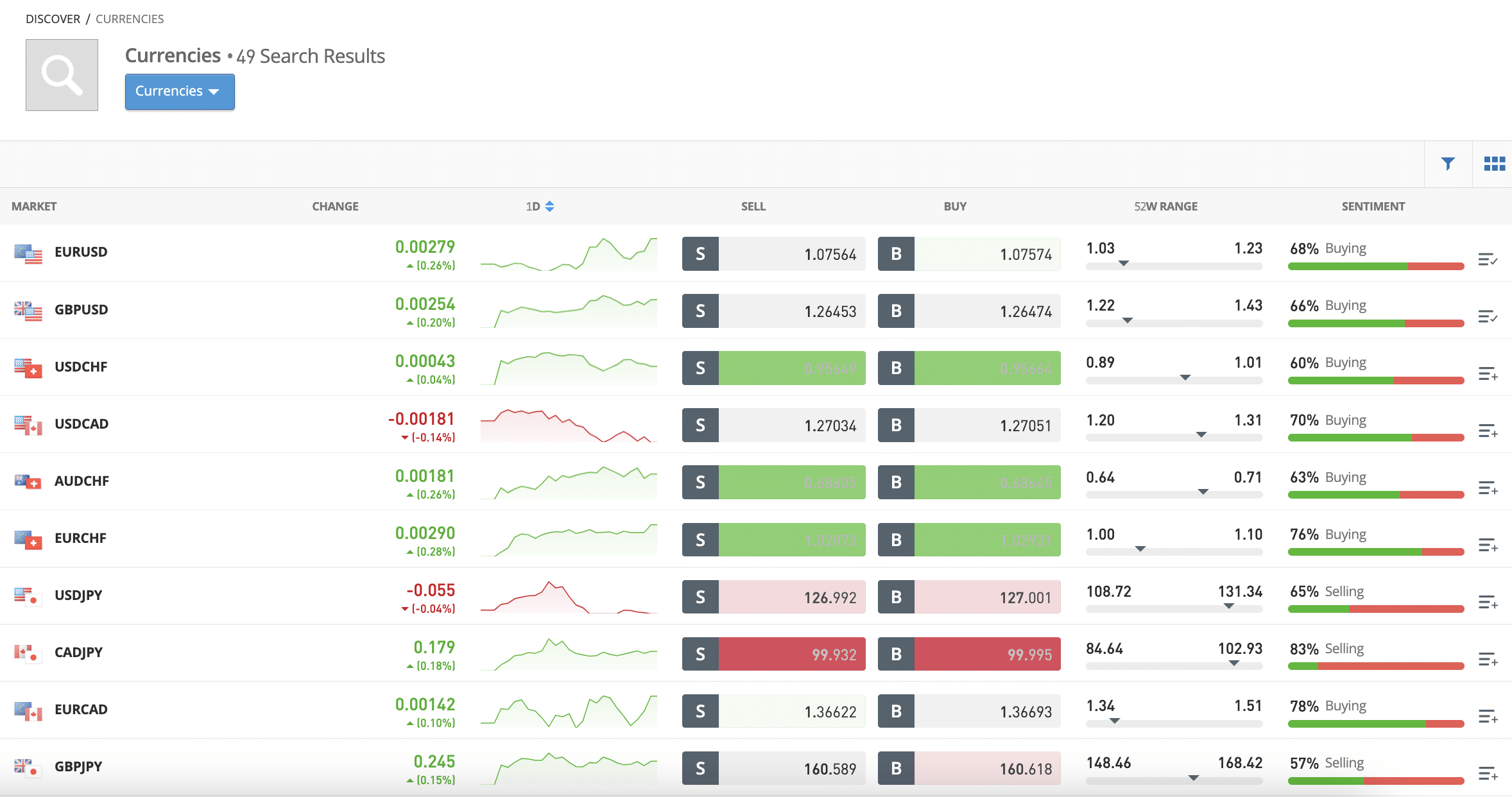

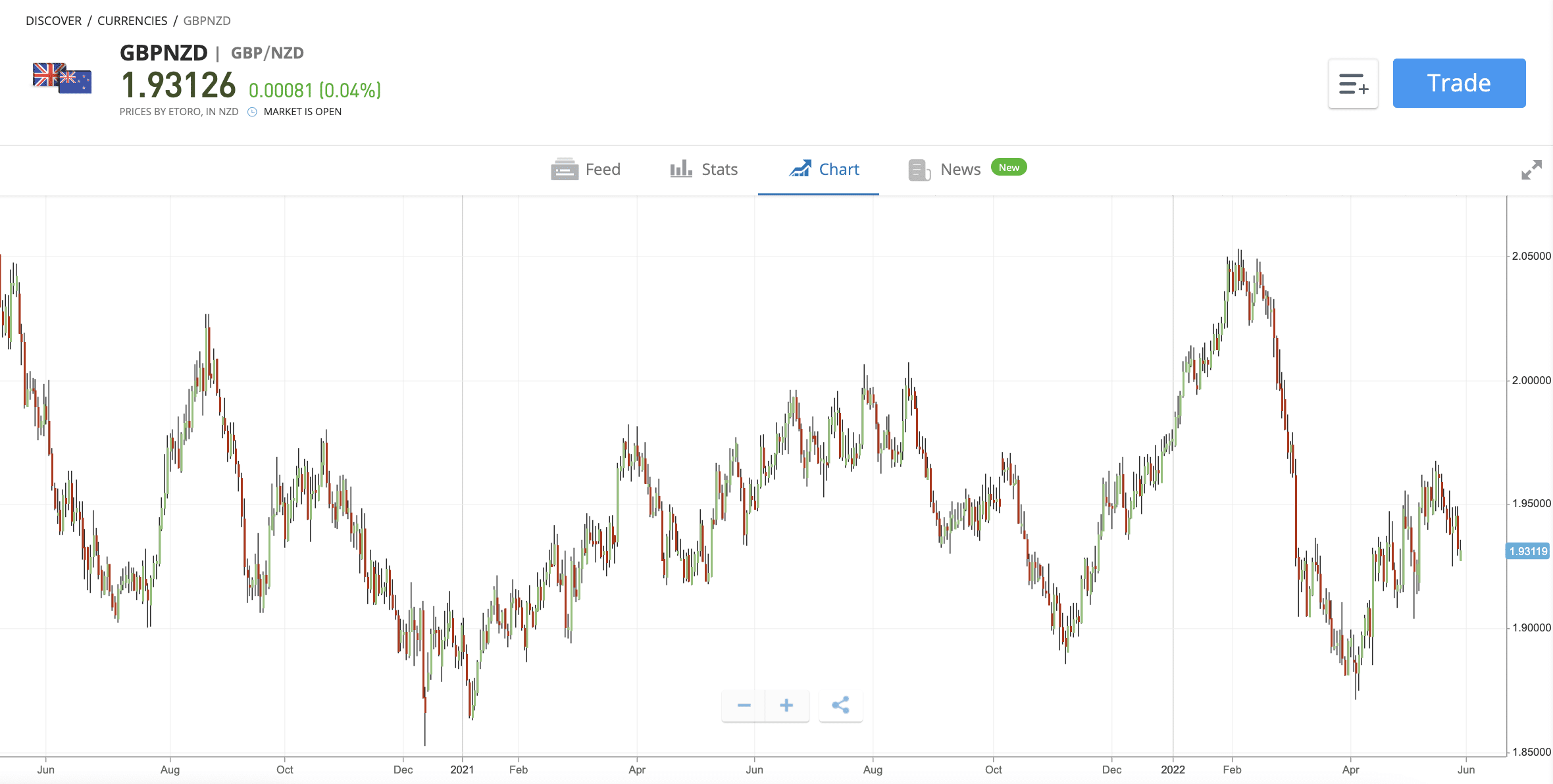

Another benefit of choosing this low spread forex broker is that its platform is very user-friendly. You can find your chosen forex pair via the search box or browse the full list of supported markets through the ‘Discover’ section. In terms of placing a trader, it’s just a case of entering your stake and confirming the order. You can also apply limits, stop-losses, and take-profits.

If you are completely new to the forex markets, then you might also like the eToro Copy Trading tool as a potential alternative to managed forex accounts. This enables you to copy a seasoned forex trader like-for-like via one of the best automated forex trading softwares. For instance, if your chosen trader allocates 5% of their portfolio on a EUR/GBP long position and you invested $2,000 into the respective individual, you will copy the trade at a value of $100. In addition to copy trading tools, forex traders might be interested in the best forex signals, which are essentially tips and signals sent by market analysts telling users when to enter and exit a position.

Another popular feature offered by eToro is its mobile app for iOS and Android. This allows you to deposit/withdraw funds, open and close forex trader, check the value of your portfolio, and access any other tools offered by the main eToro website. There is also a free forex demo account at eToro – which comes with $100,000 in paper trading funds. Additionally, eToro offers one of the best forex cent accounts with a minimum Lot size of 0.01. As one of the best Skrill forex brokers with an array of deposit methods you can fund your live trading account with popular options including Skrill and Neteller.

If you are the type of trader that likes to diversify, you will appreciate that this best forex copy trading platform offers plenty of other asset classes. Not only can you invest in cryptocurrency products, but thousands of commission-free stocks and ETFs.

If you’re concerned about safety or if you’re wondering if forex trading is legit then you’ll be pleased to learn that eToro is authorized and regulated by the SEC, FCA, CySEC, and ASIC.

eToro also offers one of the best forex bonus offers on the market. This includes receiving a $250 bonus when you deposit at least $5,000 into your trading account.

To open an eToro account today, you simply need to register some personal details and upload a copy of your government-issued ID. You can then make an instant deposit via Visa, MasterCard, Maestro, Paypal, Neteller, or Skrill. ACH and domestic bank wires are also supported. The minimum first-timed deposit for US clients is just $10. Did you know that eToro is one of the best Neteller forex brokers?

| Minimum Deposit | $10 |

| Forex Pairs | 49 |

| Trading Commission | 0% |

| Spread | From 1 pip |

| Platform | Web-based platform + mobile app |

| Max Leverage | 30:1 |

| Account Types Offered | Standard lots |

| Islamic Accounts? | Yes |

| Swap Rate | 1% markup |

| Broker Type | Market maker/STP |

Pros

Cons

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

2. Capital.com – Leading Forex Platform with 0% Commissions

Since these currencies are traded via CFDs, Capital.com builds all fees into the spread. Spreads can vary depending on the pair, although they are as low as 0.6 pips for EUR/USD during peak trading hours. Capital.com charges no commissions when opening an FX trade and no deposit, withdrawal, or inactivity fees. Capital.com has over 100 different currency pairs to choose from including the most volatile forex pairs on the market.

Capital.com also offers real stocks as well as CFD stocks on a 0% commission basis. For those trying to decide between stock trading and forex trading we have a useful article that explores the ins and outs of both financial markets.

Users can make deposits in five different base currencies via credit/debit card, bank transfer, Apple Pay, and PayPal. Did you know that Capital.com is also one of the best Western Union forex brokers? The minimum deposit threshold is only $20, and the account opening process is entirely digital. Finally, those who wish to trade FX using Capital.com can do so via the web platform or MT4 – ensuring an option for all experience levels.

In terms of regulations and security, Capital.com is one of the best ASIC regulated forex brokers on the market and also has licensing from CySEC, the FCA, the FSA, and NBRB.

| Minimum Deposit | $20 |

| Forex Pairs | 138 |

| Trading Commission | 0% commissions |

| Spread | From 0.6 pips |

| Platform | Web-based platform + mobile app + MT4 |

| Max Leverage | 30:1 |

| Account Types Offered | Standard lots |

| Islamic Accounts? | No |

| Swap Rate | 3% +/- LIBOR |

| Broker Type | CFD |

Pros

Cons

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

3. XTB – Best Forex Broker Trading Platform

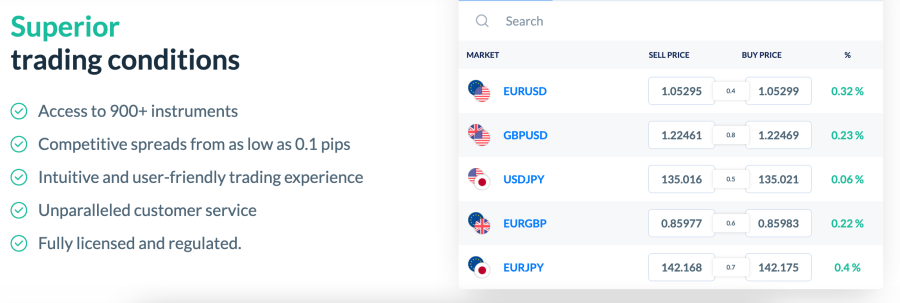

XTB offers trading on 48 forex pairs with spreads as low as 0.1 pips. There’s no minimum deposit required to open a new trading account and traders can access leverage up to 500:1 for major forex pairs.

This forex broker offers a market news feed and economic calendar, but not much else in terms of supplementary analysis tools. Traders can test out XTB with a free demo account with no deposit required.

| Minimum Deposit | None |

| Forex Pairs | 48 |

| Trading Commission | None |

| Spread | From 0.1 pips |

| Platform | Web-based platform + mobile app |

| Max Leverage | 500:1 |

| Account Types Offered | Micro lots |

| Islamic Accounts? | Yes |

| Swap Rate | Varies depending on the pair |

| Broker Type | CFD |

Pros

Cons

Your capital is at risk. 76% of retail investor accounts lose money when trading CFDs with this provider.

4. GO Markets – Respected Forex Broker with Spreads from 0.0 Pips

Another of the best forex brokers to consider is GO Markets. GO Markets is an Australia-based CFD broker that offers over 50 FX pairs to trade. The platform has been in operation for over 16 years and boasts regulation from ASIC and CySEC – ensuring a solid level of credibility and safety.

GO Markets offers two account types – a Standard account and a GO Plus+ account. The former is well-suited to casual traders and allows trades to be opened with no commissions. The latter is targeted towards active traders and does charge a €2 commission per transaction – yet spreads can be as low as 0.0 pips.

Moreover, GO Markets offers leverage of up to 500:1 in certain jurisdictions. Regarding the trading experience, GO Markets caters to all users by providing access to the markets via a browser-based platform, dedicated mobile app, or even MetaTrader 4. Interestingly, GO Markets also offers ‘MT4 Genesis’, which adds a full suite of valuable tools to the MetaTrader client.

Due to GO Trader’s exceptional features, the platform has won numerous industry awards – including the ‘Best Forex Fintech Broker’ at the Global Forex Awards in 2022. Finally, Go Markets even has a fully-fledged ‘Education Hub’, complete with free articles, podcasts, and webinars designed to smooth the trading process.

| Minimum Deposit | $99 |

| Forex Pairs | 50+ |

| Trading Commission | 0% commissions on Standard account; €2 per trade on GO Plus+ account |

| Spread | From 0.0 pips on the GO Plus+ account |

| Platform | Web trader + mobile app + MT4 |

| Max Leverage | 500:1 |

| Account Types Offered | Standard lots + Micro lots |

| Islamic Accounts? | No |

| Swap Rate | Between 0.3% and 2.5% |

| Broker Type | CFD |

Pros

Cons

64% of retail investor accounts lose money when trading CFDs with this provider.

5. AvaTrade – Heavily-Regulated FX Broker with MT4/MT5 Support

As AvaTrade’s pairs are offered through CFDs, the platform charges no commissions when opening or closing a trade. Spreads also tend to be relatively tight, reaching as low as 0.9 pips for highly-liquid pairs like EUR/USD. AvaTrade even offers a free demo account for beginner traders and a selection of FX-based Vanilla Options. Additionally, AvaTrade is also considered to be one of the best PAMM account forex brokers of 2023.

Although AvaTrade’s minimum deposit threshold is slightly higher, set at $100, account funding is entirely free to complete, with six base currencies supported. Withdrawals are also free to facilitate and can take as little as three business days to arrive. Finally, AvaTrade also offers a wide array of educational materials, including tutorial videos, articles, and webinars.

| Minimum Deposit | $100 |

| Forex Pairs | 55 |

| Trading Commission | 0% commissions |

| Spread | From 0.9 pips |

| Platform | Web trader + mobile app + MT4 + MT5 |

| Max Leverage | 30:1 |

| Account Types Offered | Standard lots |

| Islamic Accounts? | Yes |

| Swap Rate | Between 0.4% and 2.8% |

| Broker Type | CFD (Market maker) |

Pros

Cons

71% of retail investor accounts lose money when trading CFDs with this provider.

6. Skilling – Top FX Platform with Spreads From Only 0.1 Pips

There are also no hidden charges, as Skilling incorporates its fee into the bid/ask spread. Spreads start from only 0.7 pips, although Skilling also offers a ‘Premium’ account which offers spreads from as little as 0.1 pips. The maximum leverage on each account is 30:1, offering both negative balance protection and scalping services.

Notably, Skilling offers micro lot trading, meaning users can open positions from as little as 0.1 lots. But what is a Lot in forex trading? Read our guide to find out more.

Regarding account funding, Skilling accepts bank transfers, credit/debit cards, and numerous e-wallets, such as Neteller and Skrill. The minimum deposit at Skilling is set at $100 – although clients who open a Premium account need to meet a $5,000 minimum deposit threshold.

| Minimum Deposit | $100 ($5,000 for a premium account) |

| Forex Pairs | 70+ |

| Trading Commission | 0% commission |

| Spread | From 0.7 pips (from 0.1 pips on Premium account) |

| Platform | Web trader + cTrader app + MT4 |

| Max Leverage | 30:1 |

| Account Types Offered | Standard lots + micro lots |

| Islamic Accounts? | No |

| Swap Rate | Varies depending on the account type |

| Broker Type | STP |

Pros

Cons

7. Interactive Brokers – Top Forex Broker for Tight Spreads and Deep Liquidity

Interactive Brokers is perhaps known for its highly extensive library of stocks, ETFs, and mutual funds. However, this top-rated platform also offers one of the best places to trade forex in the US. In opening an account here, you will have access to over 100+ forex pairs.

This includes all major and minor pairs, and dozens of exotic currencies. Due to the size of Interactive Brokers and the markets it has access to, forex traders enjoy deep liquidity levels here. Moreover, you will also find that Interactive Brokers offers very competitive fees. Put simply, you will pay a commission of between 0.08 and 0.20 BPS (basis points).

There are no additional spreads or markups added to the fees that you see when setting up an order, Another plus point of using Interactive Brokers is that you will have access to a highly advanced platform – FXTrader. This offers a wealth of useful features – such as real-time streaming quotes, custom order types, up and down indicators, and risk-management tools.

| Minimum Deposit | $0 |

| Forex Pairs | 100+ |

| Trading Commission | From 0.08 BPS |

| Spread | No hidden spreads |

| Platform | FXTrader web-based platform |

| Max Leverage | 50:1 |

| Account Types Offered | Standard lots |

| Islamic Accounts? | No |

| Swap Rate | Average 1% |

| Broker Type | ECN and STP execution offered |

Pros

Cons

8. TD Ameritrade – Buy and Sell Forex Pairs at 0% Commission

If you’re looking for the best forex trading platform for low fees – it might be worth considering TD Ameritrade. In a nutshell, this forex broker allows you to trade currencies on a commission-free basis with no hidden spreads. Instead, your fees are simply built in to the bid/ask price.

At TD Ameritrade, you will find over 50+ forex trading pairs across the majors, minors, and exotics. Although TD Ameritrade offers highly competitive fees, we should note that its native trading platform – thinkorswim, is perhaps better suited for seasoned investors. With that said, if you know your way around a trading suite – thinkorswim offers everything you need.

For example, you will find real-time economic news and forex market developments, technical indicators, customizable charting screens, currency trading maps, and much more. You can access thinkorswim via desktop software or your main web browser. It also comes in the shape of a mobile app for iOS and Android.

| Minimum Deposit | $0 |

| Forex Pairs | 50+ |

| Trading Commission | 0% |

| Spread | Built into bid/ask price |

| Platform | Web trader (thinkorswim) |

| Max Leverage | 50:1 |

| Account Types Offered | Standard lots |

| Islamic Accounts? | No |

| Swap Rate | 1.25% |

| Broker Type | Standard FX account |

Pros

Cons

9. Forex.com – Specialist Forex Broker for US Traders

Launched in 2001, Forex.com is an established currency trading platform that offers US clients over 80+ pairs at competitive fees. You will not pay any trading commissions when buying and selling forex pairs and spreads start at just 0.5 pips per slide on major markets.

The forex trading facility at this platform operates on a 24/5 basis. We also like that Forex.com supports a variety of platforms across multiple devices. This includes integration with MetaTrader5 – which will suit those of you that seek access to high-level trading tools. There is also the Forex.com web trader alongside a mobile app for iOS and Android.

Forex.com is also popular for its academy, which comes with a wealth of educational guides and courses. This provider is also one of the best forex trading platforms for real-time news. You will find market insights and updates on key developments throughout the day – which can be invaluable for predicting market movements.

| Minimum Deposit | $100 |

| Forex Pairs | 80+ |

| Trading Commission | 0% |

| Spread | From 0.5 pips |

| Platform | Web trader + mobile app + MT4 |

| Max Leverage | 50:1 |

| Account Types Offered | Standard lots + Micro lots |

| Islamic Accounts? | Yes |

| Swap Rate | 0.0 pips |

| Broker Type | Offers DMA and STP accounts |

Pros

Cons

10. E*TRADE – Good Forex Broker for Currency Futures

If you’re an experienced derivatives investor that wishes to trade currency futures, E*TRADE is one of the best forex brokers for this purpose. E*TRADE supports a variety of currency futures that covers everything from EUR and CAD to GBP and NZD.

Minimums and tick values will depend on the futures contract that you opt for. We like that E*TRADE offers its futures marketplace from just $1.50 per contract and orders can be placed on a 24/6 basis. Another benefit for those on a budget is that pattern day trading rules do not apply at this broker.

You will also have access to margin here, but do remember that this requires a minimum deposit of $2,000 as per SEC regulations. In addition to currency futures, E*TRADE is worth considering if you are wondering where to buy stocks with low fees. This is because the platform allows you to invest in US-listed equities at 0% commission.

| Minimum Deposit | $0 |

| Forex Pairs | 9 currency futures markets |

| Trading Commission | From $1.50 per contract |

| Spread | Built into bid/ask price |

| Platform | Web trader + mobile app |

| Max Leverage | Margin of up to 50% |

| Account Types Offered | N/A (just currency futures markets) |

| Islamic Accounts? | No |

| Swap Rate | N/A |

| Broker Type | Securities broker |

Pros

Cons

Top Forex Trading Platforms Compared

If you’re still not sure which provider from our list of the best forex brokers is right for you – check out our comparison table below:

| Minimum Deposit | Forex Pairs | Commission | Spread | Platform | Max Leverage | Account Types Offered | Islamic Accounts? | Swap Rate | Broker Type | |

| eToro | $10 | 49 | 0% | From 1 pip | Web-based platform + mobile app | 30:1 | Standard lots | Yes | 1% markup | CFD (Market maker/STP) |

| Capital.com | $20 | 138 | 0% commissions | From 0.6 pips | Web-based platform + mobile app + MT4 | 30:1 | Standard lots | No | 3% +/- LIBOR | CFD |

| XTB | None | 48 | 0% commissions | From 0.1 pips | Web-based platform + mobile app | 500:1 | Micro lots | Yes | Varies depending on pair | CFD |

| GO Markets | $99 | 50+ | 0% commissions on Standard account; €2 per trade on GO Plus+ account | From 0.0 pips on GO Plus+ account | Web trader + mobile app + MT4 | 500:1 | Standard lots + micro lots | No | Between 0.3% and 2.5% | CFD |

| AvaTrade | $100 | 55 | 0% commissions | From 0.9 pips | Web-based platform + mobile app + MT4 + MT5 | 30:1 | Standard lots | Yes | Between 0.4% and 2.8% | CFD (Market maker) |

| Skilling | $100 ($5,000 for Premium account) | 70+ | 0% commissions | From 0.7 pips (from 0.1 pips for Premium account) | Web trader + cTrader app + MT4 | 30:1 | Standard lots + micro lots | No | Varies depending on account type | STP |

| Interactive Brokers | $0 | 100+ | From 0.08 BPS | No hidden spreads | FXTrader web-based platform | 50:1 | Standard lots | No | Average 1% | ECN and STP execution offered |

| TD Ameritrade | $0 | 50+ | 0% | Built into bid/ask price | Web trade (thinkorswim) | 50:1 | Standard lots | No | 1.25% | Standard FX account |

| Forex.com | $100 | 80+ | 0% | From 0.5 pips | Web trader + mobile app + MT4 | 50:1 | Standard lots + micro lots | Yes | 0.0 pips | Offers DMA and STP accounts |

| E*TRADE | $0 | 9 currency future markets | From $1.50 per contract | Built into bid-ask price | Web trader + mobile app | Margin of up to 50% | N/A (just currency future markets) | No | N/A | Securities broker |

Just remember that some forex brokers offer different fees and minimums depending on the account that you open. As a result, be sure to check the specifics of your chosen account type before proceeding.

How we Select the Best Forex Brokers

If you’ve ever asked yourself the question ‘what is forex trading?’ then you’re in the right place. Choosing the best forex broker for you is an important decision to make before risking any capital.

Not only should you focus on factors surrounding fees and supported markets, but account types and minimums, regulation, leverage, trading tools, and more.

In the sections below, we discuss the main considerations to make when searching for the best forex brokers for your financial goals and investor profile.

Regulation and Safety

The first step to take when selecting the best forex broker for you is to check whether the platform is regulated and by whom.

In the US, both the Commodities Futures Trade Commission (CFTC) and the National Futures Association (NFA) are tasked with regulating the forex industry.

As such, it’s a smart idea to see whether your chosen forex broker has been authorized by at least one of these bodies. In doing so, you can be sure that you are trading forex in fair market conditions.

Forex Pairs

The forex trading industry is split between three pair categories – majors, minors, and exotics. We found that the vast bulk of forex brokers will cover all available major and minor pairs.

On the other hand, if you are looking to target higher gains and you favor volatile market conditions – you might want to focus on exotics. With that said, not all forex brokers offer access to exotic currencies like the Turkish lira or South African rand.

As such, if you’re looking for the best pairs to trade in forex – make sure the broker in question supports it before you sign up.

Financial Instrument

You should also explore what type of financial instrument the forex trading platform gives you access to. For instance, when using eToro – you will be trading forex spot prices.

This means that the prices you see on your screen are reflective of live market conditions.

However, other platforms – such as E*TRADE and Fidelity, only offer access to currency derivatives. This means that you will be speculating on the future price of a currency.

Fees

Forex trading fees will typically center on two core metrics – commissions and spreads.

Commissions

If you are required to pay a commission, your chosen forex broker will deduct a fee based on the size of your trade.

- For example, let’s suppose that the broker charges a commission of 0.2% per slide

- You decide to stake $2,000 on EUR/GBP

- To enter this position, you will be charged a commission of $4

- Let’s then say that you close the position when it is worth $2,200

- In this scenario, you will pay a commission of $4.40 to close the trade

With that being said, you then have brokers like OANDA, which will charge a flat commission on its premium account. This stands at $50 for every $1 million traded – which is very competitive.

Spreads

It is important to note that many of the providers that made our list of the best forex trading platforms do not charge commissions. Instead, they operate a spread-only pricing model.

For example, at eToro, you can buy and sell forex pairs on a commission-free basis and pay a minimum spread of just 1 pip per slide. For those unaware, a pip – or percentage in point, amounts to one-hundredth of a basis point.

For those asking if forex trading is profitable, it goes without saying that the lower the spread, the better it is for your trading profits. This is because the spread is the gap between the bid and ask price that your chosen forex broker offers. As such, you want the spread to be as tight as possible.

Non-Trading Fees

It is also a good idea to assess what non-trading fees are charged when searching for the best forex broker for you. This might, for example, consist of a fee charged when you deposit and/or withdraw funds.

Access to Margin

Major and even minor currency pairs will oftentimes move up and down throughout the day in a non-volatile manner. This means that without risking huge sums of capital, you might find that forex trading is not viable for your budget. For more details refer to our guide on risk management in forex.

This is where margin comes in. In a nutshell, by using a forex broker that gives you access to margin, you can trade with far more than you have in your account.

In the US, retail clients can trade major forex pairs with leverage of up to 1:50. On minor and exotic currencies, leverage is capped to 1:20.

Trading Platforms

You should also think about the type of platform that is suitable for your forex trading goals and skillset.

For instance, we found that eToro is one of the best forex brokers for beginners, as its web trading platform is simple to navigate. Placing an order is just a case of specifying your stake and determining whether the currency pair will rise or fall in value.

At the other end of the spectrum, if you’re an advanced trader, then you might want to choose a forex broker that is compatible with either MetaTrader 4 or 5. These are third-party platforms that come with highly advanced charting tools and indicators.

eToro is also a crypto trading platform as well as a forex platform – we ranked it highly on our list of Bitcoin forex brokers, i.e. FX brokers that also support BTC and other major crypto assets.

Tools and Features

The best forex brokers will offer tools and features that can enhance your trading abilities. For instance, we like that eToro offers real-time pricing charts alongside technical indicators.

The aforementioned broker also offers relevant news and market updates throughout the day. With that said, perhaps the best feature available on the eToro platform is its copy trading tool.

As we mentioned earlier, this allows you to ‘copy’ the forex positions of an experienced trader of your choosing. Therefore, you will be able to trade forex passively.

Minimum Deposit

It is also wise to check what the minimum deposit is at your chosen forex broker before you go through the account opening process.

Many of the forex brokers that we reviewed today allow you to get started without meeting an account minimum. However, you then have platforms like Saxo Bank and IG, which require a minimum of $2,000 and $250 respectively.

Ultimately, if the minimum deposit is too high for your budget, you might be trading with more than you can afford to lose.

Demo Account

Another feature that we found at some of the best forex brokers that we reviewed is the availability of a demo account. Put simply, this will allow you to trade forex without risking any money.

Instead, although the demo account will mirror live market conditions, you will be trading with paper funds. This can be great for beginners that are learning how to trade forex for the first time.

Mobile App

The forex markets can change momentum at a fast pace – so it’s also wise to choose a forex broker that offers a top-rated mobile app for your smartphone.

The best forex apps give you the opportunity to enter or exit a position no matter where you are located. Just make sure that the mobile app is user-friendly.

Payment Methods

You will need to deposit funds before you will be able to start trading forex at your chosen broker. Therefore, the best forex brokers in this industry will support a wide variety of payment methods.

At eToro, for instance, not only does the broker accept ACH and bank wire deposits – but also debit/credit cards and e-wallets like Neteller and Paypal.

Customer Service

If you need assistance on your forex brokerage account, you will want access to first-class customer support. The best forex trading platforms in this space typically offer support on a 24/5 basis.

In terms of contact methods, both live chat and telephone support will give you access to help in real-time. However, if you can only contact support via email, you will need to wait several hours or even days to receive a reply.

How to Start Forex Trading

If you’re looking to start buying and selling forex pairs today – the guide below will help you get set up with eToro in under five minutes.

We found that eToro is the best forex broker for its low fees and account minimums, regulation, and support for dozens of majors, minors, and exotics.

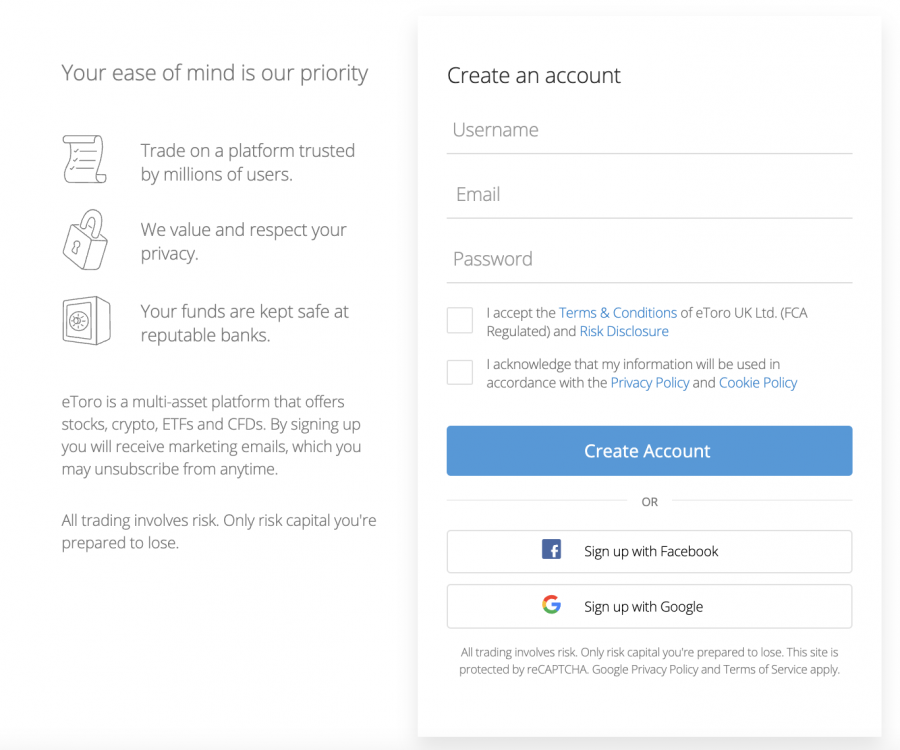

Step 1: Open an eToro Forex Broker Account

Head over to the eToro website and open an account. You will need to provide some personal information and contact details.

Choose a username and password and verify your email address to proceed to the next step.

Step 2: Upload ID

You will need to get your eToro account verified before you can start trading forex. You can do this by uploading a copy of your government-issued ID and a proof of address (e.g. bank statement or utility bill).

Step 3: Deposit Funds

Once your account has been verified, you will then be asked to meet a minimum deposit of $10. US clients pay no deposit fees.

Supported payment types on the eToro platform include debit/credit cards, ACH, bank wires, and e-wallets like Neteller and Paypal

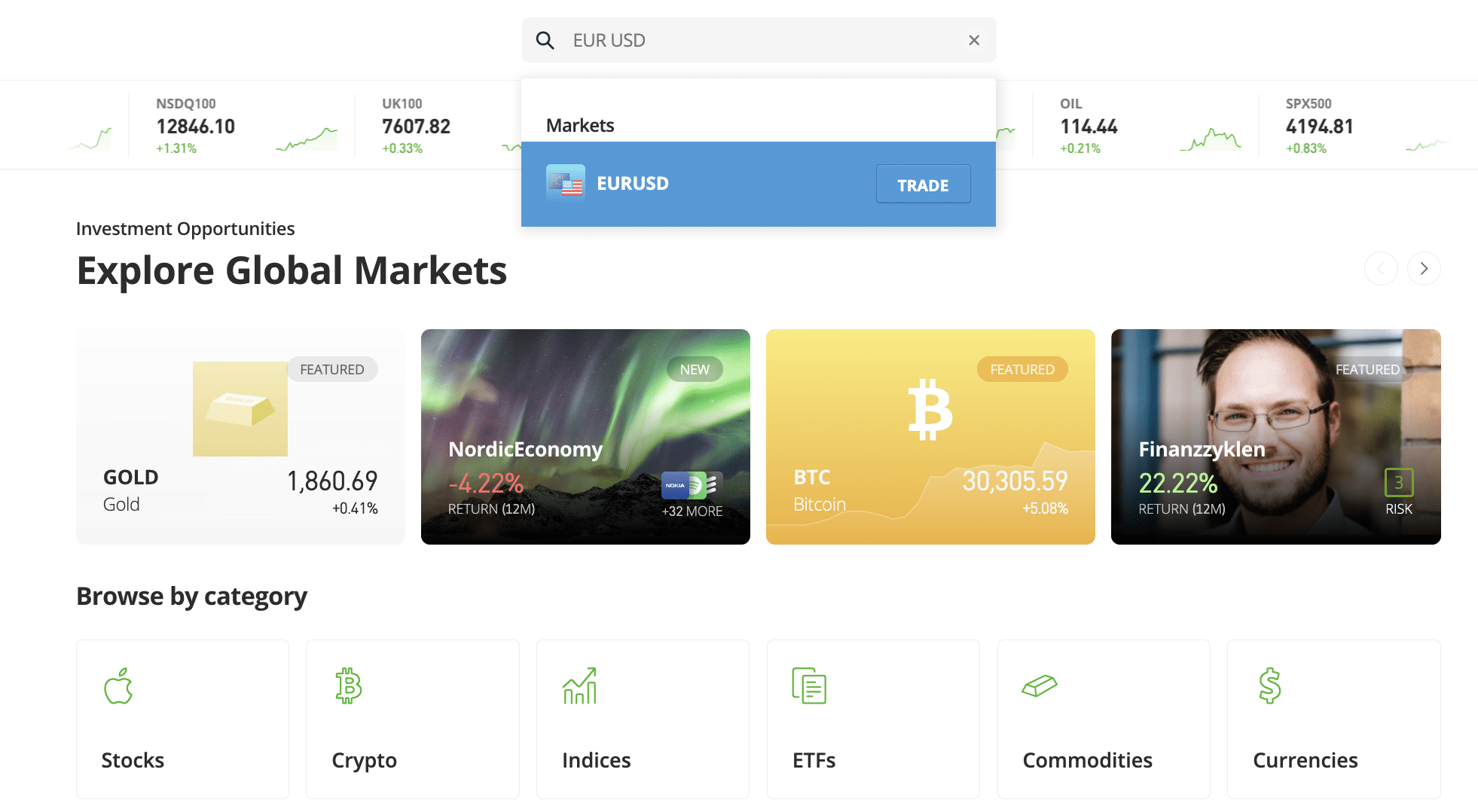

Step 4: Search for Forex Pair

You can find your chosen forex pair by using the search box. For instance, you will see that in the image below, we are searching for EUR/USD.

This means that we are looking to trade the euro against the US dollar – which is one of the best forex pairs to trade.

The other option here is to click on ‘Discover’ followed by ‘Currencies’. This will allow you to browse which forex pairs are supported by eToro.

Either way, you will need to click on the ‘Trade’ button next to your chosen pair to populate an order form.

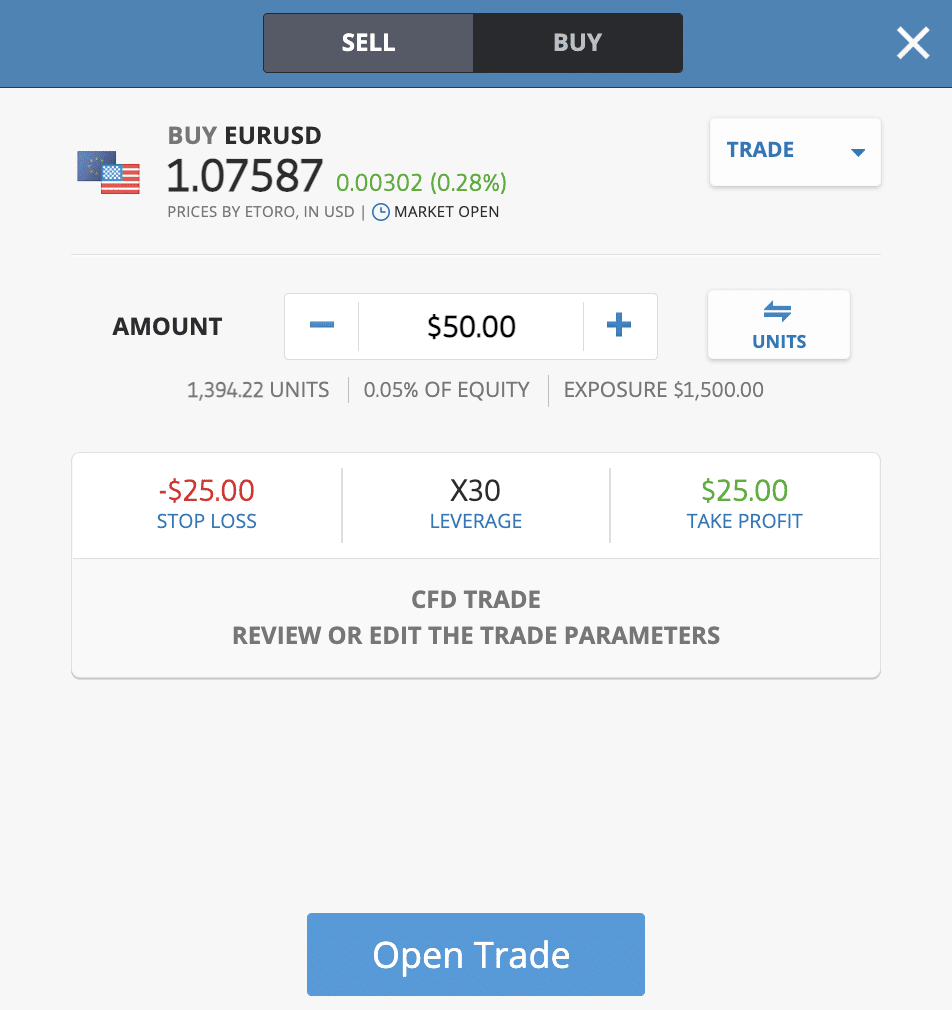

Step 5: Trade Forex

Once the order box appears on your screen, you will need to specify your stake. In our example below, we are staking $50 at leverage of 1:30. This means that the total value of our trade is $1,500 – when you factor in the impact of leverage.

If you don’t feel comfortable trading with leverage, you can adjust this by clicking on the relevant button. eToro also gives you the option of setting up a limit, stop-loss, and/or take-profit order.

In our example, however, we are opting for a standard market order – which means that our position will be executed by eToro instantly at the next best available price.

To place your order, click on ‘Open Trade’.

Conclusion

Forex is the largest trading market globally – so it makes sense that you will have plenty of different brokers to choose from. The best forex brokers that we identified offer dozens of pairs at competitive commissions and spreads.

If you’re looking to start trading currencies today, we found that eToro is the overall best broker for forex. You can buy and sell forex pairs from just 1 pip in a safe and user-friendly environment.

Moreover, eToro requires a minimum deposit of just $10 if you’re a US client and it takes just five minutes to set up an account.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.