Beginners that are looking to enter the forex trading arena for the very first time might consider opening a cent account.

This account type is aimed at causal traders that wish to stake small amounts – not least because balances are represented in cents as opposed to dollars.

In this comparison guide, we rank and review the best forex cent account brokers for fees, supported pairs, spreads, customer service, and more.

The 4 Best Cent Account Forex Brokers in 2023

The best cent account forex brokers offer small minimum deposit requirements and support for low trading stakes.

Below, we offer an overview of the best providers in the forex industry that currently meet this criterion.

- eToro – Best Cent Account Forex Broker with 0% Commission and a Minimum Deposit of $10

- FXTM – Cent Accounts From $10 for New Customers

- FBS – $1 Minimum Deposit and Leverage of up to 1:1000 on Cent Accounts

- Instaforex – Two Different Cent Account Types to Choose From

Do note that not all low-stake forex brokers offer a cent account in name. Instead, they offer standard trading accounts that come with small minimums and affordable trading conditions.

78% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Best Cent Forex Accounts Reviewed

Not only do the best cent forex accounts facilitate small balances and stakes, but they should offer low trading fees, tight spreads, and a strong commitment to safety.

With this in mind, below we offer comprehensive reviews of the overall best forex cent accounts in the market today.

1. eToro – Best Cent Account Forex Broker with 0% Commission and a Minimum Deposit of $10

eToro is one of the best forex brokers in the online space, with more than 25 million traders actively using the platform. There are several reasons why eToro continues to experience a strong wave of new customer account applications. First and foremost, the minimum deposit at eToro starts at just $10.

There are no deposit or withdrawal fees when funding an account in US dollars and this is applicable to debit/credit cards, multiple e-wallets, and bank wires. Other currencies are supported at eToro albeit they attract a deposit fee of 0.5%. eToro is also popular with those on a trading budget as it supports a minimum lot size of 0.01.

As we noted just a moment ago, this means that the minimum trade size is 1,000 units of the base currency. However, as eToro supports leverage of up 1:30 on major pairs, this drops the minimum stake requirement to just $33.33. In total, eToro offers access to 49 forex pairs. Those trading minors and exotics will need to meet a minimum margin of 5%.

eToro offers real-time pricing charts that can be customized, alongside economic indicators and drawing tools. There are also market insights, webinars, and educational tools available on the eToro website. The eToro Academy, in particular, will appeal to beginners that wish to improve their forex trading knowledge.

In terms of fees, majors, minors, and exotics can be traded on a spread-only basis, which is also the case with precious metals, energies, indices, and agricultural products. Crypto assets can be traded at a fee of 1%, while stocks and ETFs are commission-free. Overnight financing charges will apply to CFD positions albeit we like that eToro displays this when setting up an order.

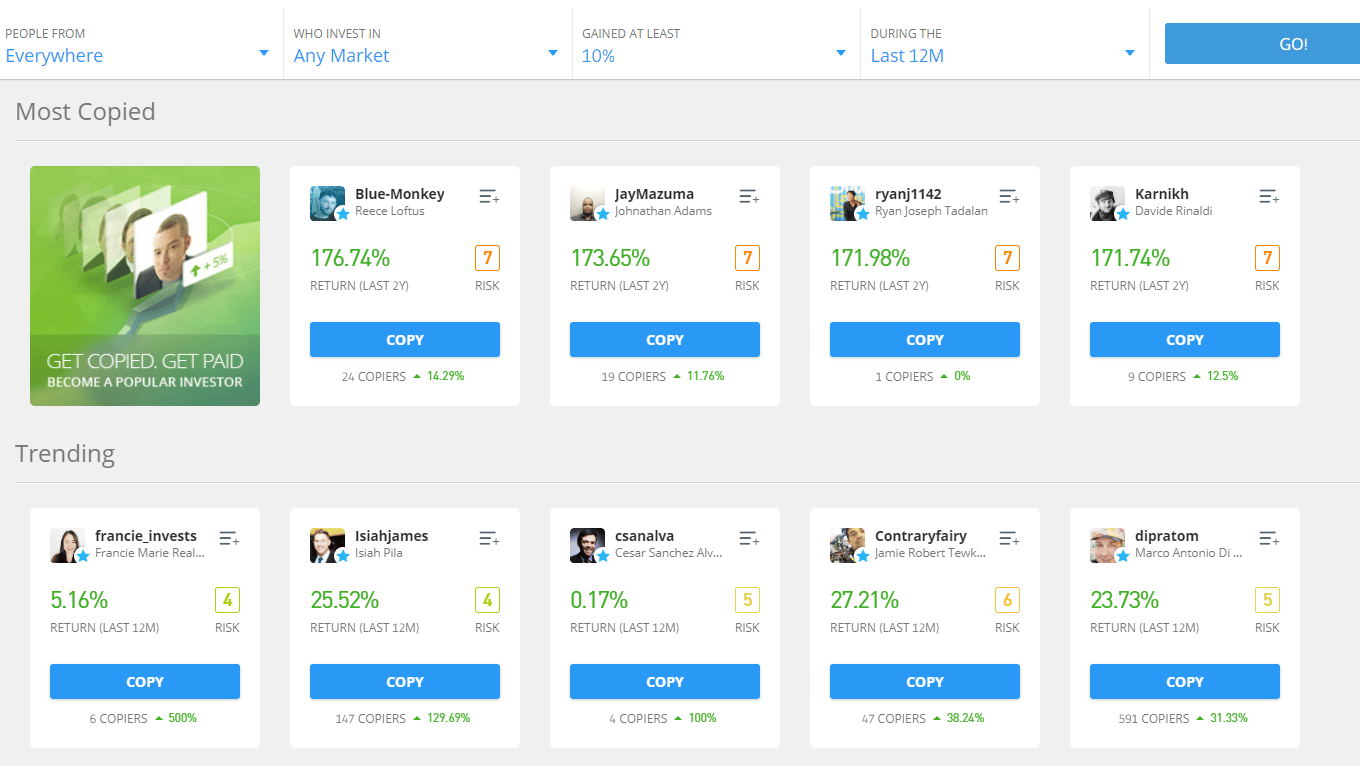

Perhaps the most attractive aspect of eToro is that the broker supports Copy Trading. This means the beginners can choose a forex trader that they like the look of and elect to automatically copy all future positions. This is carried over to the eToro portfolio at a proportionate amount to the investment.

For instance, if $200 is invested in a trader and they risk 10% of their portfolio on a EUR/USD trade, this position will be copied at a stake of just $20. This means that Copy Trading is even more budget-friendly than opening and closing positions on a DIY basis, as the minimum lot size does not come into force.

Finally, we like that eToro offers a top-rated demo account facility. Unlike other forex brokers with cent accounts, the eToro demo facility does not come with any time limits. It also comes pre-loaded with $100k in paper trading funds, which is more than enough to get to grips with the eToro forex suite.

| Forex pairs | 49 |

| Other assets | Stocks, ETFs, commodities, crypto, indices |

| Pricing system | Spread-only on forex markets. 0% commission on stocks and ETFs. 1% on crypto. |

| Deposit fee | $0 on USD payments. 0.5% on other currencies. |

| EUR/USD spread | 1 pip |

| Account fees | $10 inactivity fee, $5 withdrawal fee on non-USD payments |

| Trading Platforms | Proprietary eToro platform for web browsers and mobile devices |

| Min Deposit | $10 for UK/US traders, $50 elsewhere |

Pros

Cons

78% of retail investor accounts lose money when trading CFDs with this provider.

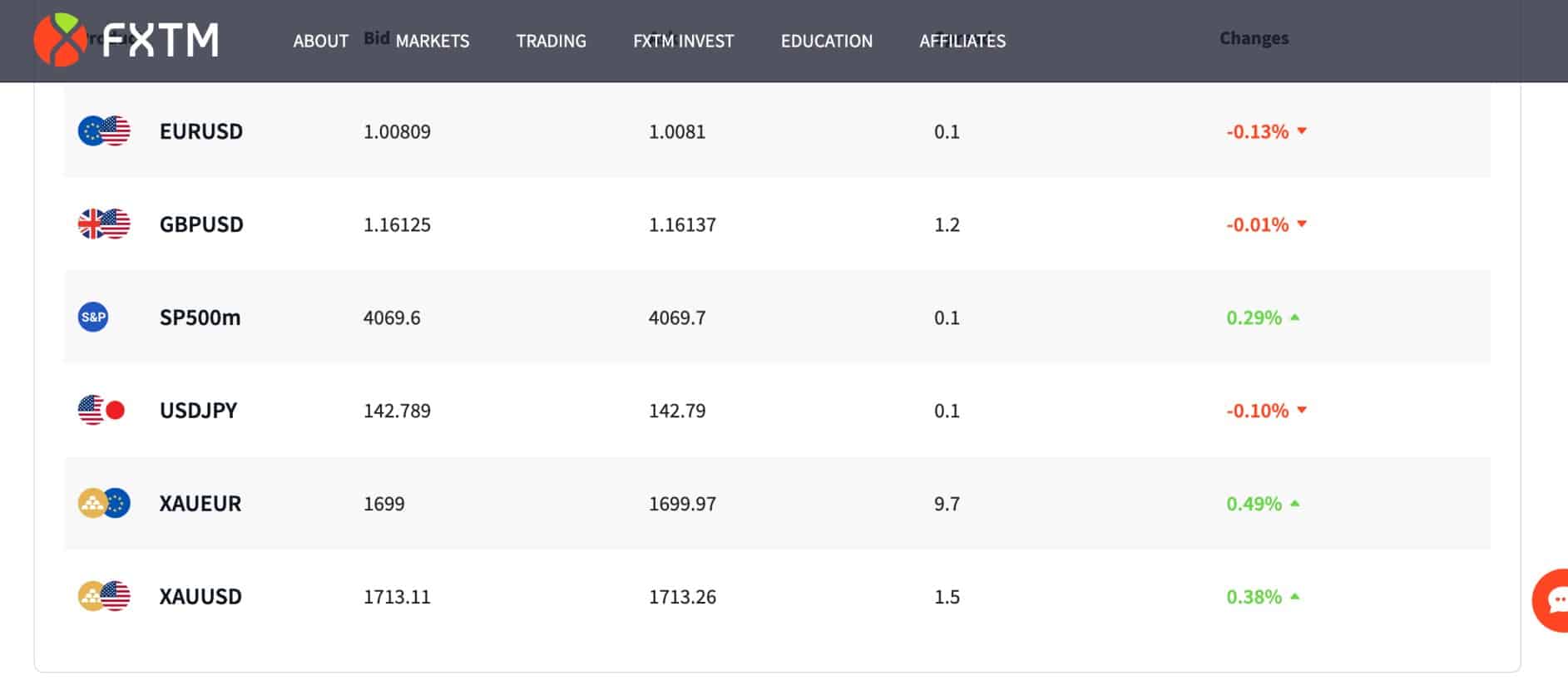

2. FXTM – Cent Accounts From $10 for New Customers

This will perhaps be more appealing to experienced traders considering that MT4 is jam-packed with advanced analysis tools and features. Nevertheless, the cent account comes with a maximum leverage limit of 1:1000. This is location dependent, meaning that European traders, for instance, will still be capped to 1:30 unless they are defined as professional clients.

In terms of fees, the FXTM cent account for forex comes without trading commissions, albeit, spreads start from a rather hefty 1.5 pips on EUR/USD. This is why more seasoned traders will opt for the likes of eToro, as trading fees are a lot more competitive.

FXTM also offers CFD instruments outside of the forex space. This is inclusive of stocks, spot metals, energies, indices, and more. Those using FXTM for the first time might consider its demo trading account. This offers a risk-free way of testing FXTM out before needing to make a real money deposit.

| Forex pairs | 60+ |

| Other assets | Stocks, spot metals, energies, indices |

| Pricing system | 0% commission on cent accounts |

| Deposit fee | None |

| EUR/USD spread | 1.5 pips on cent accounts |

| Account fees | $5 inactivity fee |

| Trading Platforms | MT4, MT5, FXTM Trader |

| Min Deposit | $10 on cent accounts |

Pros

Cons

3. FBS – $1 Minimum Deposit and Leverage of up to 1:1000 on Cent Accounts

FBS is perhaps the best cent forex account broker for those looking to deposit super-small stakes. The cent account at FBS requires a minimum initial deposit of just $1. By meeting the minimum, this will result in a starting balance of 100 cents.

With this account type, there are no trading commissions charged by FBS. Moreover, floating spreads on EUR/USD start at 1 pip. The maximum leverage offered on the FBS cent account is 1:1000. Once again, do remember that leverage limits will depend on the location of the trader.

FBS cent accounts come with execution speeds of 0.3 seconds and positions are executed via an STP model. When it comes to supported markets, FBS offers just 28 forex pairs – which is on the low side. Therefore, those in the market for less common pairs – such as exotics, might wish to consider eToro instead.

On top of forex, FBS supports several other asset classes. This is inclusive of metals, indices, energies, crypto, and stocks. FBS offers its own native trading platform for smartphone users via an iOS and Andoird app. However, those wishing to trade via a desktop device will need to choose from MT4 or MT5.

| Forex pairs | 28 |

| Other assets | Metals, indices, energies, crypto, stocks |

| Pricing system | 0% commission on cent accounts |

| Deposit fee | None |

| EUR/USD spread | 1 pip on cent accounts |

| Account fees | None |

| Trading Platforms | FBS mobile app, MT4, MT5 |

| Min Deposit | $1 on cent accounts |

Pros

Cons

4. Instaforex – Two Different Cent Account Types to Choose From

Instaforex is the next broker that we will discuss from our list of the best forex cent accounts. In fact, this provider offers two different cent accounts to choose from. First, there is the cent.standard account, which offers commission-free forex trading.

However, the spreads on this account are huge – not least because they start from 3 pips. The cent.eurica account offers spreads that start from 0.0 pips. However, a commission of between 0.03-0.07% will be applied to each order. Both cent account types come with a minimum deposit of just $1. With that said, the maximum deposit is very low at $1,000.

Another drawback of Instaforex is that both desktop and mobile platforms are somewhat clunky. Information on its website looks somewhat dated and moreover – just 300 markets are supported. This does, however, include over 100+currency pairs with a wide variety of exotic markets. Additional assets include stocks, commodities, crypto, indices, and futures.

| Forex pairs | 100+ |

| Other assets | stocks, commodities, crypto, indices, futures |

| Pricing system | 0% commission on cent.standard account, Up to 0.07% on cent.eurica |

| Deposit fee | None |

| EUR/USD spread | From 3 pips on cent.standard account, From 0.0 pips on cent.eurica |

| Account fees | $5 inactivity fee, bank withdrawal fee of 2% + 0.3 EUR |

| Trading Platforms | WebTrader, MT4, InstaTick Trader |

| Min Deposit | $1 on cent accounts |

Pros

Cons

Top Cent Account Forex Trading Platforms Compared

The table below compares the five brokers that we reviewed in the sections above:

| Brokers | Total FX Pairs | Other Assets | Pricing System | EUR/USD Spread (From) | Deposit Fee | Min. Deposit (From) | Trading Platforms |

| eToro | 49 | Stocks, ETFs, commodities, crypto, indices | Spread-only on forex markets. 0% commission on stocks and ETFs. 1% on crypto. | 1 pip | $0 on USD payments. 0.5% on other currencies. | $10 | Proprietary eToro platform for web browsers and mobile devices |

| FXTM | 60+ | Stocks, spot metals, energies, indices | 0% commission on cent accounts | 1.5 pips on cent accounts | None | $10 | MT4, MT5, FXTM Trader |

| FBS | 28 | Metals, indices, energies, crypto, stocks | 0% commission on cent accounts | 1 pip on cent accounts | None | $1 | FBS mobile app, MT4, MT5 |

| Instaforex | 100+ | Stocks, commodities, crypto, indices, futures | 0% commission on cent.standard account, Up to 0.07% on cent.eurica | From 3 pips on cent.standard account, From 0.0 pips on cent.eurica | None | $1 | WebTrader, MT4, InstaTick Trader |

What is a Forex Cent Account?

A cent account is offered by forex brokers that wish to target traders on a budget. In most cases, the account will be denominated in cents as opposed to dollars. For example, if the trader deposits $10 into their account, this will be displayed as 1,000 cents.

Crucially, cent accounts are ideal for those that wish to trade with small amounts because they are entering the forex space for the very first time. Some of the best forex cent accounts that we came across require a minimum deposit of just $1.

This is an inconsequential amount and in many ways, a better first-time strategy than relying on demo accounts. After all, demo accounts do not offer exposure to the emotional side effects of losing money.

It should be noted, however, that in many cases, cent accounts come with unfavorable fees. For example, the cent account offered by Instaforex – while supporting a $1 minimum deposit, come with a huge minimum spread of 3 pips.

This is why it is often better to open a standard trading account with a micro lot forex broker.

eToro, for example, requires a minimum trade size of 0.01 lots which amounts to a margin of just 3.33% when utilizing leverage. Moreover, no commissions are charged by eToro and spreads start from just 0.6 pips.

Benefits of Cent Forex Trading

The main benefit of opening a cent forex account is that it supports super-small stakes. As noted, the minimum first-time deposit often amounts to just $1. Moreover, traders can enter forex positions in cents, rather than dollars.

This means that even the most inexperienced of traders can speculate on the forex markets without needing to risk substantial sums. However, once again, just be sure to assess what spreads the cent account comes with – as this is often unfavorable.

How we Select the Best Cent Account Forex Brokers

Below we offer some insight into how we rank and rate the best forex cent accounts that the market has to offer.

Regulation and Safety

The primary factor that we look for in brokers offering forex trading cent accounts is their regulatory status. Be sure to only choose a provider that is licensed by a reputable financial body.

Supported Forex Pairs

The best forex cent accounts offer lots of choice when it comes to selecting a suitable currency pair. eToro offers 49 pairs across all majors and minors, and dozens of exotics.

Fees

We found that traditional cent accounts often come with higher fees. This is especially the case when it comes to spreads.

The table below offers a recap of the fees and spreads charged by the best forex cent accounts that we reviewed:

| Brokers | Pricing System | EUR/USD Spread (From) | Deposit Fee | Account Fees |

| eToro | Spread-only on forex markets. 0% commission on stocks and ETFs. 1% on crypto. | 1 pip | $0 on USD payments. 0.5% on other currencies |

0.5% on non-USD deposits, $10 inactivity fee, $5 withdrawal fee

|

| FXTM | 0% commission on cent accounts | 1.5 pips on cent accounts | None | $5 inactivity fee |

| FBS | 0% commission on cent accounts | 1 pip on cent accounts | None | None |

| Instaforex | 0% commission on cent.standard account, Up to 0.07% on cent.eurica | From 3 pips on cent.standard account, From 0.0 pips on cent.eurica | None |

$5 inactivity fee, bank withdrawal fee of 2% + 0.3 EUR

|

Tools and Analysis

The best forex cent accounts should come packed with trading tools. This should include the likes of custom order types and charts, economic and technical indicators, and financial news.

We also like the Copy Trading platform offered by eToro, which offers a passive forex experience.

Minimum Deposit

Some cent accounts come with a minimum deposit of just $1. This will appeal to first-time forex traders on a small budget.

Demo Account

Before risking real capital, it is wise to start off with a demo account. One of the best demo accounts in this marketplace is offered by eToro – which mirrors live forex conditions and comes with a paper trading balance of $100,000.

Mobile App

Most cent account brokers offer a mobile app for iOS and Android. If a native app isn’t supported, then mobile trading is often available via MT4 or MT5.

Payment Methods

Be sure to check what payment methods the broker charges. The best forex cent account brokers support e-wallets, bank wires, and Visa/MasterCard.

Customer Service

The best trading platforms offering cent accounts should operate their customer service department on a 24/7 basis. This will ensure that help is available irrespective of the trader’s timezone.

Conclusion

This guide has analyzed the best forex cent accounts in the market today. Although cent accounts come with low account minimums and small stake requirements, we found that spreads and commissions can be on the high side.

Instead, we found the standard account offered by eToro an alternative worth considering. The platform offers 0% commissions – and the minimum deposit amounts to just $10.

78% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.