Active forex traders will typically have access to both a web and mobile trading platform. The latter ensures that the trader is never more than a click away from the forex markets.

In this comparison guide, we review the 9 best forex trading apps for supported pairs, fees, regulation, trading tools, user-friendliness, and more.

The Best Forex Trading Apps to Use in 2023

We found that the 9 best forex trading apps in the market are those listed below.

- eToro – Overall Best Forex Trading App

- XTB – Trade Forex From Just 0.1 Pips

- AvaTrade – Trade Forex CFDs at 0% Commission

- Pepperstone – Zero Spread Forex Accounts

- IG US – Top Forex App for US Clients

- OANDA – Popular Forex App for US Traders

- Forex.com – Specialist Forex Broker With Low Fees

- FXTM – Various Forex Accounts to Suit Most Traders

- SuperForex – Forex App with $1 Minimum Deposit and 2000:1 Leverage

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider

Best Forex Apps Reviewed

The best forex trading apps that we reviewed offer a broad selection of major, minor, and exotic pairs, alongside competitive commissions and spreads.

When choosing a suitable app, traders should also ensure that the provider offers a user-friendly experience on standard smartphone devices.

Below, readers will find our analysis upon reviewing the best forex trading apps in the market, we’ll also explore the question ‘what is forex trading?’

1. eToro – Overall Best Forex App with Copy Trading Tools

eToro lists nearly 50 forex pairs across the majors, minors, and exotics. Eligible traders will be able to buy and sell forex pairs with leverage. Typically, limits on majors amount to 1:30 and 1:20 on minors and exotics. eToro does not charge commissions when trading forex and spreads on EUR/USD start at 1 pip.

Furthermore, traders can open an account at eToro with a minimum starting balance of just $10. Traders can deposit funds with a debit/credit card, e-wallet, ACH, or bank wire. eToro does not charge fees on USD payments across both deposits and withdrawals. Other currencies attract a deposit/withdrawal FX charge of 0.5%.

In terms of automated forex trading tools, eToro offers real-time forex charts alongside technical analysis tools. There is also an eToro demo account that comes with a paper trading balance of $100k. Passive investors might consider the eToro Copy Trading tool as an alternative to managed forex accounts. This allows users to copy the forex trades of an experienced investor.

eToro enables users to choose a suitable trader to copy through comprehensive data – such as the average trade duration and historical returns. In addition to forex, traders can access commodities and indices, alongside thousands of commission-free stocks and ETFs. Moreover, eToro is also offering one of the best forex bonus offers in 2023. By depositing a minimum of $5,000 users can get a $250 bonus.

eToro also enables clients to invest in cryptocurrency products. It is possible to buy Bitcoin, Ethereum, and more than 90 other digital assets at a commission of 1%.

Learn More: Read our full eToro review.

| FX Pairs | 49 |

| EUR/USD Spread | 1 pip |

| Max Leverage | 1:30 for retail clients |

| Broker Type | CFD |

| Platforms | Proprietary |

| Min Deposit | $10 |

| US Clients? | No |

What We Like

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider

2. XTB – Trade Forex From Just 0.1 Pips

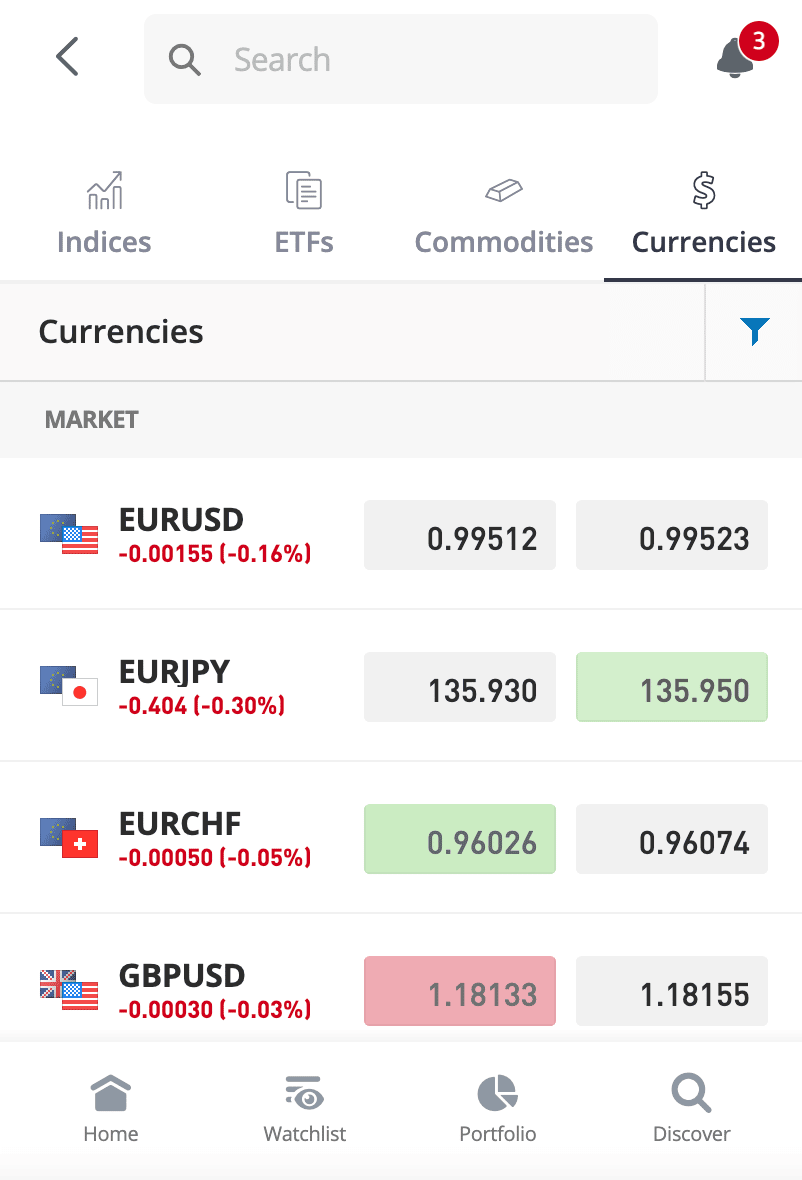

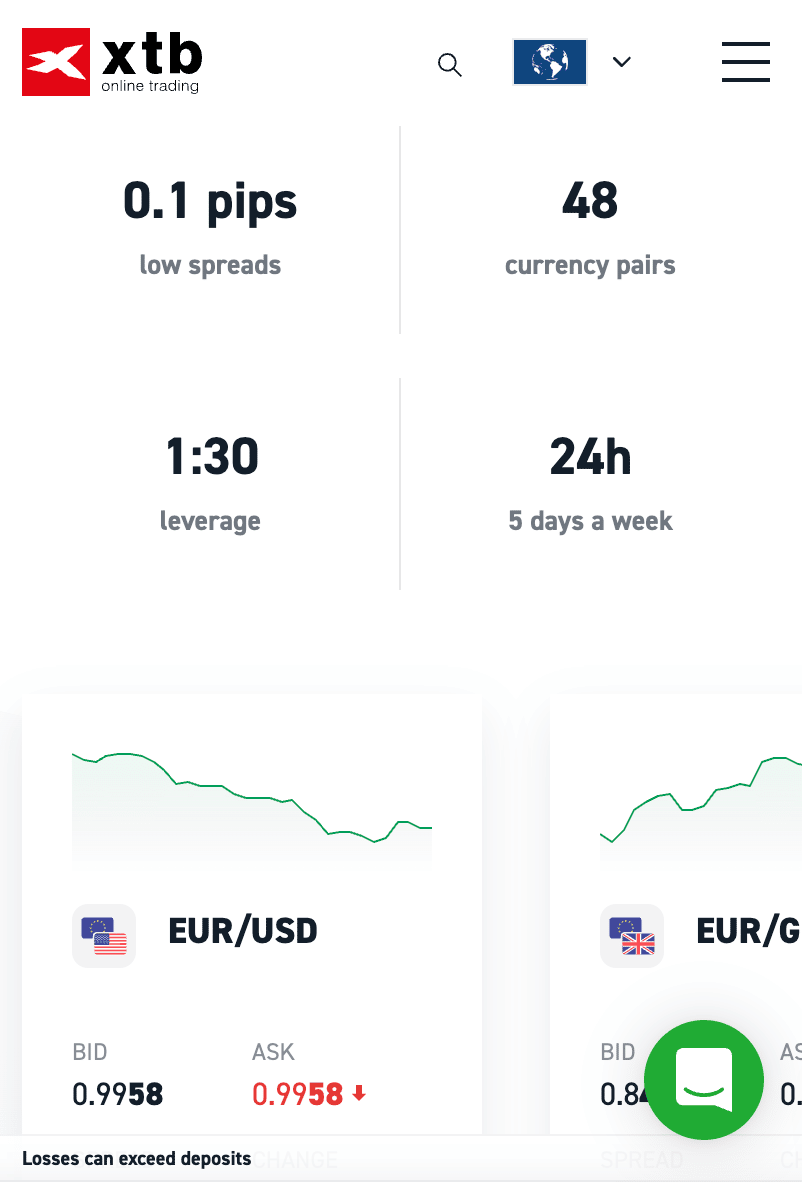

XTB is another CFD broker that offers support for multiple asset classes. In addition to forex, this includes stocks, ETFs, indices, and commodities. The XTB ‘xStation’ mobile app is free to download and compatible with iOS and Android.

It offers instant access to the forex markets and requires a minimum trade size of just 0.1 lots. Advanced traders will appreciate the customized charts and technical indicators offered by the app, in addition to fast execution times. The XTB app supports 48 forex pairs and no commissions are charged by this broker.

When trading EUR/USD, spreads start at 0.1 pips. Those on a budget will appreciate that XTB does not have a minimum deposit policy in place. Moreover, deposits are processed fee-free. Both a standard and swap-free account are offered by XTB. While both accounts offer commission-free trading, the former comes with tighter forex spreads.

Learn More: Read our full XTB review.

| FX Pairs | 48 |

| EUR/USD Spread | 0.1 pips |

| Max Leverage | 1:30 for retail clients |

| Broker Type | CFD |

| Platforms | Proprietary |

| Min Deposit | No minimum |

| US Clients? | No |

What We Like

3. AvaTrade – Trade Forex CFDs at 0% Commission

When it comes to spreads, traders will pay from 0.9 pips on EUR/USD. AvaTradeGO is the native mobile app offered by this provider. Compatible with both iOS and Android smartphones, AvaTradeGO offers an intuitive mobile interface that makes it seamless to trade forex. It also serves as one of the best PAMM account forex trading brokers.

Advanced tools are supported for those that seek to perform technical analysis as well as those looking for the best forex VPS. AvaTrade offers a free demo account too, alongside market data and research materials. Deposits can be made via the AvaTrade app at a minimum of $100. Debit and credit cards are supported for those that wish to deposit funds instantly.

| FX Pairs | 55 |

| EUR/USD Spread | 0.9 pips |

| Max Leverage | 1:400 for eligible clients |

| Broker Type | CFD |

| Platforms | Proprietary, MT4, MT5, DupliTrade, ZuluTrade |

| Min Deposit | $100 |

| US Clients? | No |

What We Like

71% of retail investor accounts lose money when trading CFDs with this provider.

4. Pepperstone – Zero Spread Forex Accounts

Those in the market for the best forex trading app for low spreads might consider Pepperstone. This online broker offers a Razor account that comes with ECN-like pricing. In other words, Razor account holders will have access to the best spreads in the forex market.

For instance, EUR/USD comes with an average spread of 0.0 pips. This account type comes with a commission of $3.50 for every lot traded – across all supported markets. The standard account offered by Pepperstone offers an average spread of 0.6 pips, but no commissions are payable when trading forex.

Ever wondered what the best MT5 broker is? Pepperstone account holders can access the platform via third-party providers like MT4 and MT5. Both of these providers offer a mobile app for iOS and Android, alongside advanced technical analysis tools. Leverage of up to 1:500 is offered by Pepperstone to eligible clients. Pepperstone also supports stocks, ETFs, indices, commodities, and crypto – all via CFDs.

| FX Pairs | 60 |

| EUR/USD Spread | 0.0 pips on Razor account |

| Max Leverage | 1:500 for eligible clients |

| Broker Type | CFD |

| Platforms | MT4, MT5, cTrader |

| Min Deposit | No minimum |

| US Clients? | No |

What We Like

5. IG US – Top Forex App for US Clients

The minimum deposit at IG is somewhat high at $250, albeit, payments are processed instantly via debit/credit cards. The IG native mobile app is available to download for free across iOS and Android smartphones, as well as tablets. All versions offer full functionality in terms of trading tools, real-time pricing, market data, and order placements.

Charts on the IG app are user-friendly and can be customized. The app also enables users to set up custom price alerts, which can be notified via a push notification, SMS, or email. IG was founded back in 1974 and is heavily regulated. Therefore, traders can buy and sell forex pairs on the IG app in safety.

| FX Pairs | 80 |

| EUR/USD Spread | 0.8 pips |

| Max Leverage | 1:50 for US clients |

| Broker Type | DMA (Forex Direct) |

| Platforms | Proprietary, MT4, ProRealTime |

| Min Deposit | $250 |

| US Clients? | Yes |

What We Like

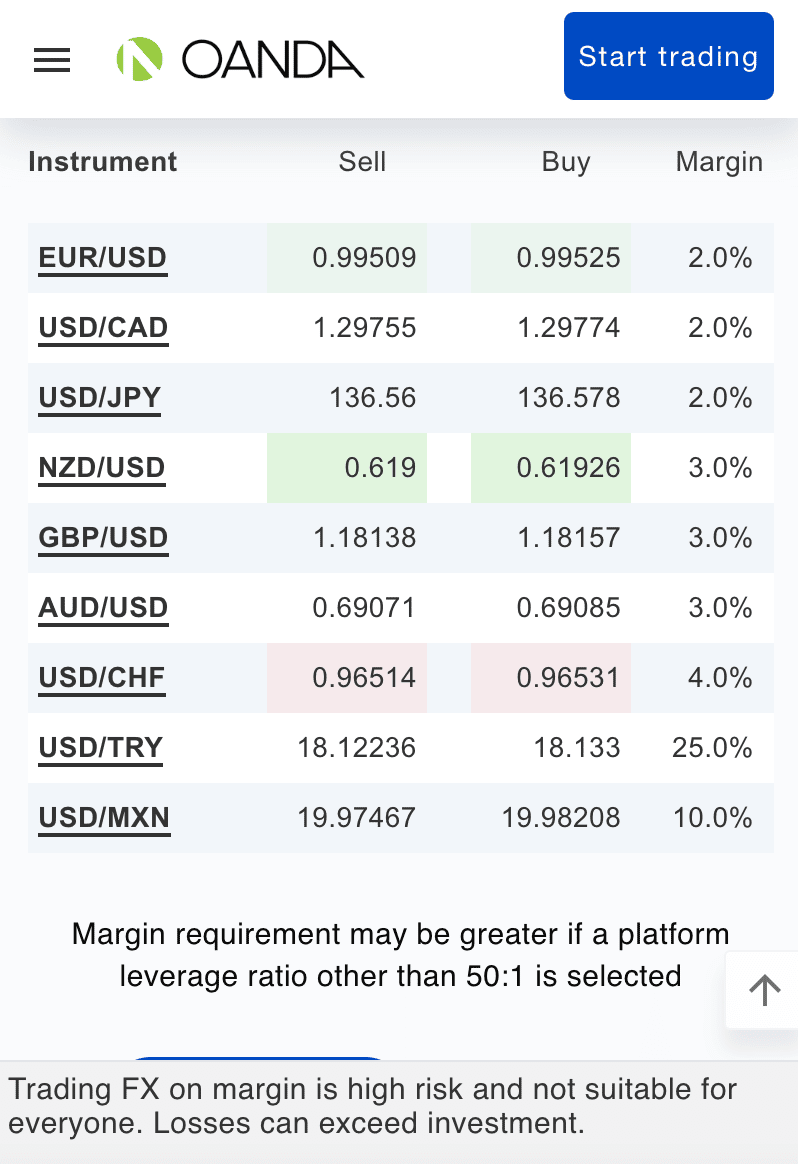

6. Oanda – Popular Forex App for US Traders

Oanda offers a safe and regulated trading environment for US clients. The platform – which has been operational for over two decades, is home to more than 70 forex pairs across the majors, minors, and exotics. US clients will have access to leverage on this platform.

As per domestic regulations, US clients can trade major pairs with leverage of up to 1:50, and 1:20 on minors and exotics. The OANDA forex app can be accessed on iOS and Android devices and it comes alongside 82 indicators, 11 drawing tools, and real-time charts. When it comes this depends on the selected account.

Most casual traders opt for the spread-only model. This means that traders will pay a spread as opposed to a commission. The core pricing account comes with a commission of $50 per $1 million traded, but much more competitive spreads. To offer some insight, EUR/USD can be traded from 0.4 pips on the core pricing account.

| FX Pairs | 70 |

| EUR/USD Spread | 0.4 pips on core pricing account |

| Max Leverage | 1:50 for US clients |

| Broker Type | Market maker |

| Platforms | Proprietary, MT4 |

| Min Deposit | No minimum |

| US Clients? | Yes |

What We Like

7. Forex.com – Specialist Forex Broker With Low Fees

The next provider to consider on our list of the best forex trading apps is Forex.com. This provider specializes in high-level forex trading and is particularly popular with those that wish to access advanced tools. For example, the app is integrated with TradingView.

This is one of the most utilized charting platforms for seasoned forex traders, not least because it comes backed with advanced technical and economic indicators, alongside drawing tools. The Forex.com app for iOS and Android comes with a clear interface and enables traders to set up custom watchlists.

It is also possible to deploy pricing alerts that appear as mobile notifications when triggered. In terms of trading fees, Forex.com offers a minimum spread of 0.8 pips on EUR/USD. No commissions are charged on forex, which is also the case for other supported markets apart from stocks.

| FX Pairs | 80 |

| EUR/USD Spread | 0.8 pips |

| Max Leverage | 1:50 for US clients |

| Broker Type | DMA, STP, CFD |

| Platforms | Proprietary, MT5 |

| Min Deposit | $0 (bank wire) $100 (debit/credit cards) |

| US Clients? | Yes |

What We Like

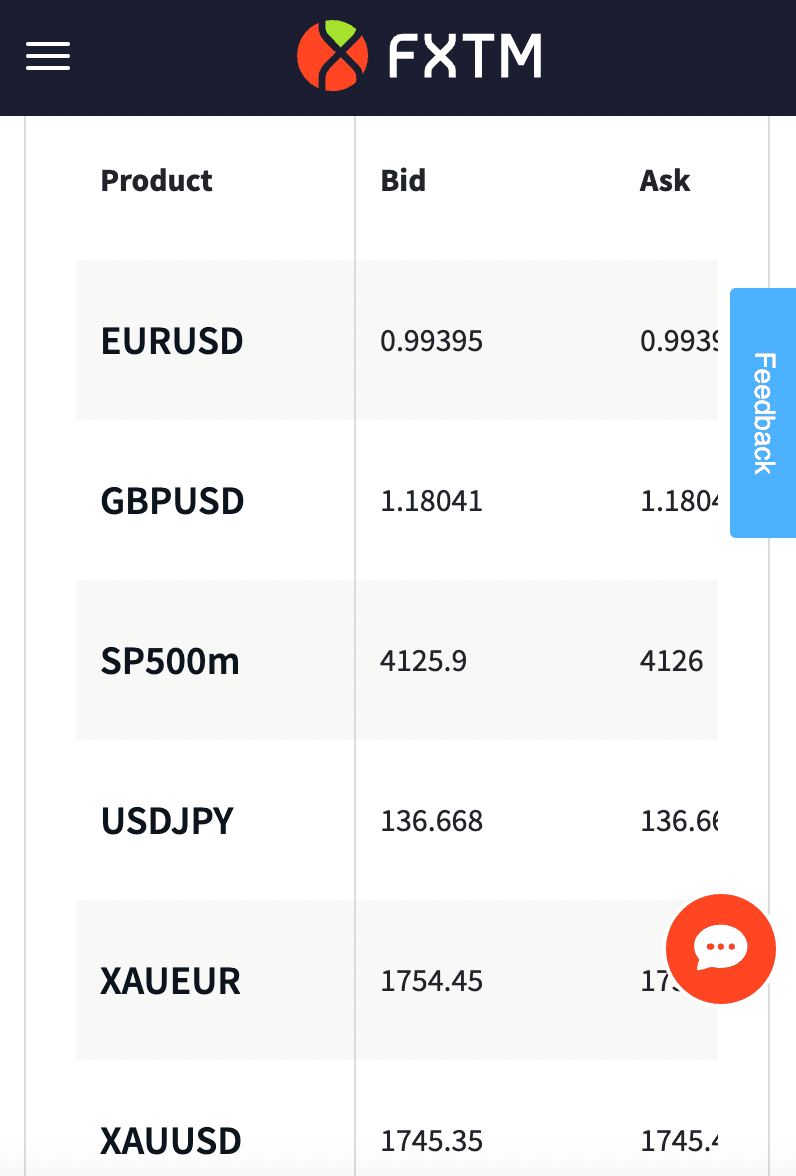

8. FXTM – Various Forex Accounts to Suit Most Traders

The final option to consider from our list of the best forex trading apps is FXTM. This platform specializes in CFDs, so won’t be suitable for US clients. Nonetheless, traders from other regions will have access to a wide variety of forex pairs. FXTM supports several account types to suit most requirements.

The Micro account requires a minimum deposit of just $10 and comes without any trading commissions. The advantage account will perhaps suit more active traders, not least because it offers a minimum spread of 0.0 pips on EUR/USD. This account requires a higher minimum deposit of $500 and comes alongside an average commission of $0.4.

FXTM offers its own native app for iOS and Android, which offers full functionality. This includes the ability to place trades on the move with fast execution speeds. With that said, FXTM users can also access their accounts via the MT4 and MT5 apps. FXTM also supports spot metals, stocks, and FX indices.

| FX Pairs | Not stated |

| EUR/USD Spread | 0.0 pips on advantage account |

| Max Leverage | 1:2000 for eligible clients |

| Broker Type | CFD |

| Platforms | Proprietary, MT4, MT5 |

| Min Deposit | $10 on micro account |

| US Clients? | No |

What We Like

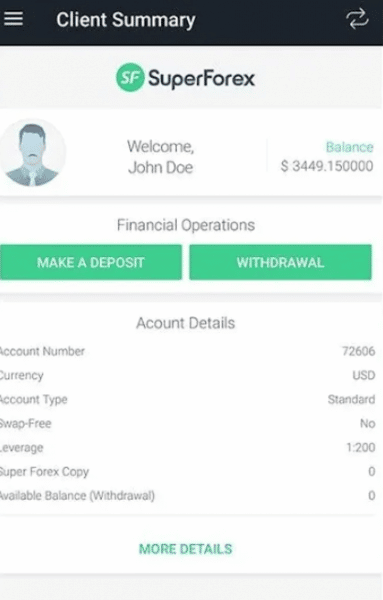

9. SuperForex – Forex App with $1 Minimum Deposit and 2000:1 Leverage

SuperForex has a variety of trading accounts, too. Straight-through processing accounts offer fast execution and zero commissions, while ECN accounts reduce spreads as low as 0.0 pips in exchange for a commission. There are also swap-free accounts and spread-free STP accounts.

Traders at SuperForex have access to the brokerage’s custom app for iOS and Android devices. It offers basic charting and analysis capabailities, but isn’t the most in-depth app we’ve tested. It’s ideal for quick trading on the go and keeping an eye on positions while away from the desk. For more advanced analysis on mobile, SuperForex also offers the MetaTrader 4 app.

| FX Pairs | 50 |

| EUR/USD Spread | 2.0 pips on standard account |

| Max Leverage | 1:2000 for eligible clients |

| Broker Type | CFD |

| Platforms | Proprietary, MT4 |

| Min Deposit | $1 |

| US Clients? | No |

What We Like

Top Forex Trading Apps for Beginners Compared

The table below highlights our key findings when reviewing the best forex trading apps discussed above.

| Forex Brokers | FX Pairs | Min. EUR/USD Spread | Max Leverage | Broker Type | Platforms | Min Deposit | US Clients? |

| eToro | 49 | 1 pip | 1:30 for retail clients | CFD | Proprietary | $10 | No |

| Capital.com | 138 | 0.6 pips | 1:30 for retail clients | CFD | Proprietary, MT4 | $20 | No |

| XTB | 48 | 0.1 pips | 1:30 for retail clients | CFD | Proprietary, MT4 | $0 | No |

| Avatrade | 55 | 0.9 pips | 1:400 for eligible clients | CFD | Proprietary, MT4, MT5, DupliTrade, ZuluTrade | $100 | No |

| Pepperstone | 60 | 0.0 pips on Razor account | 1:500 for eligible clients | CFD | MT4, MT5, cTrader | $0 | No |

| IG US | 80 | 0.8 pips | 1:50 for US clients | DMA | Proprietary, MT4, ProRealTime | $250 | Yes |

| OANDA | 70 | 0.4 pips on core pricing account | 1:50 for US clients | Market maker | Proprietary, MT4 | $0 | Yes |

| Forex.com | 80 | 0.5 pips | 1:50 for US clients | DMA, STP, CFD | Proprietary, MT5 | $0 | Yes |

| FXTM | Not stated | 0.0 pips on advantage account | 1:2000 for eligible clients | CFD | Proprietary, MT4, MT5 | $10 | No |

| SuperForex | 50 | 2.0 pips | 1:2000 for eligible clients | CFD | Proprietary, MT4 | $1 | No |

How we Select the Best Forex Apps

There are dozens of forex platforms and apps in this market. Therefore, narrowing our list of the best forex trading apps down to just 10 providers was no easy feat.

As such, in the sections below, we explain the core factors we look for when selecting forex apps.

Regulation

All of the forex apps discussed on this page are regulated and authorized to offer trading services in the countries that they operate.

This should be a bare minimum when searching for the best forex trading app, as regulation ensures that traders have a safe and secure platform to access the markets.

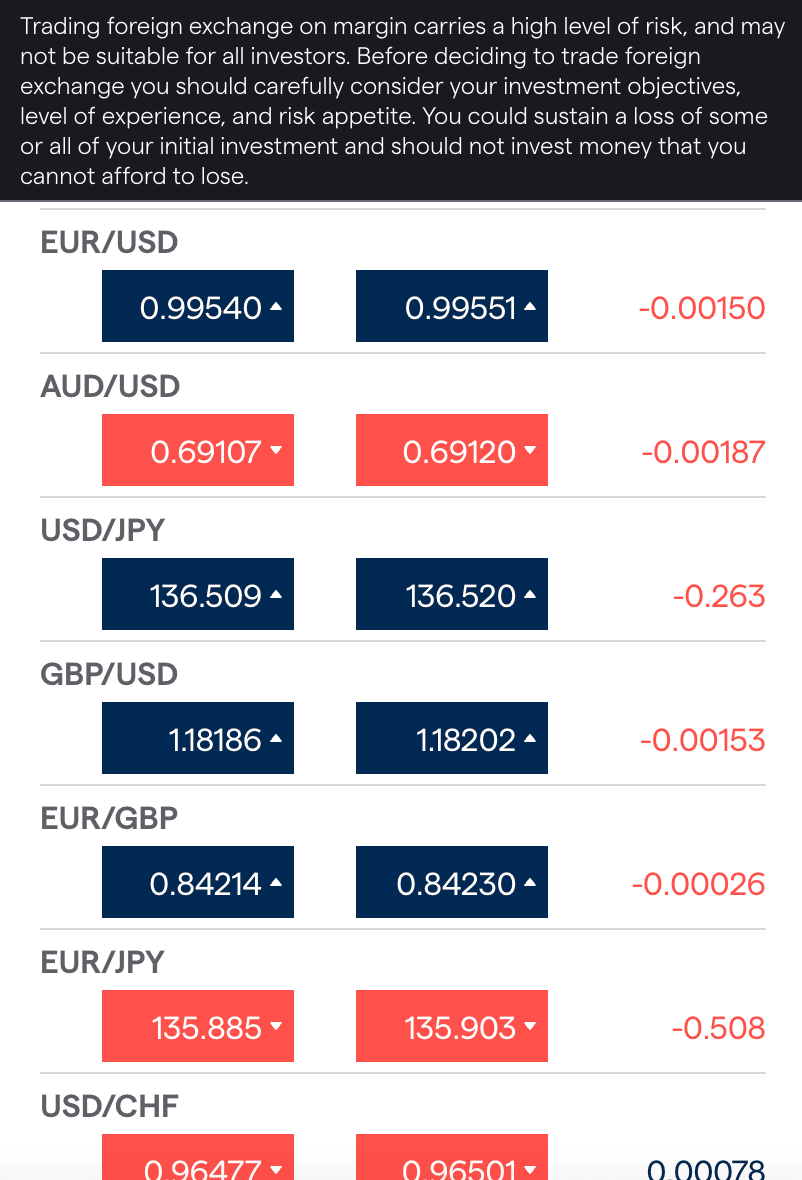

Range of FX Pairs

We found that majors and minors are supported by all of the forex providers that we discussed today. When it comes to support for exotic currencies like the Turkish lira or South African rand, this will vary from one trading app to the next.

Nonetheless, we made sure that all of the forex apps reviewed on this page offer a broad range of the best pairs to trade in forex.

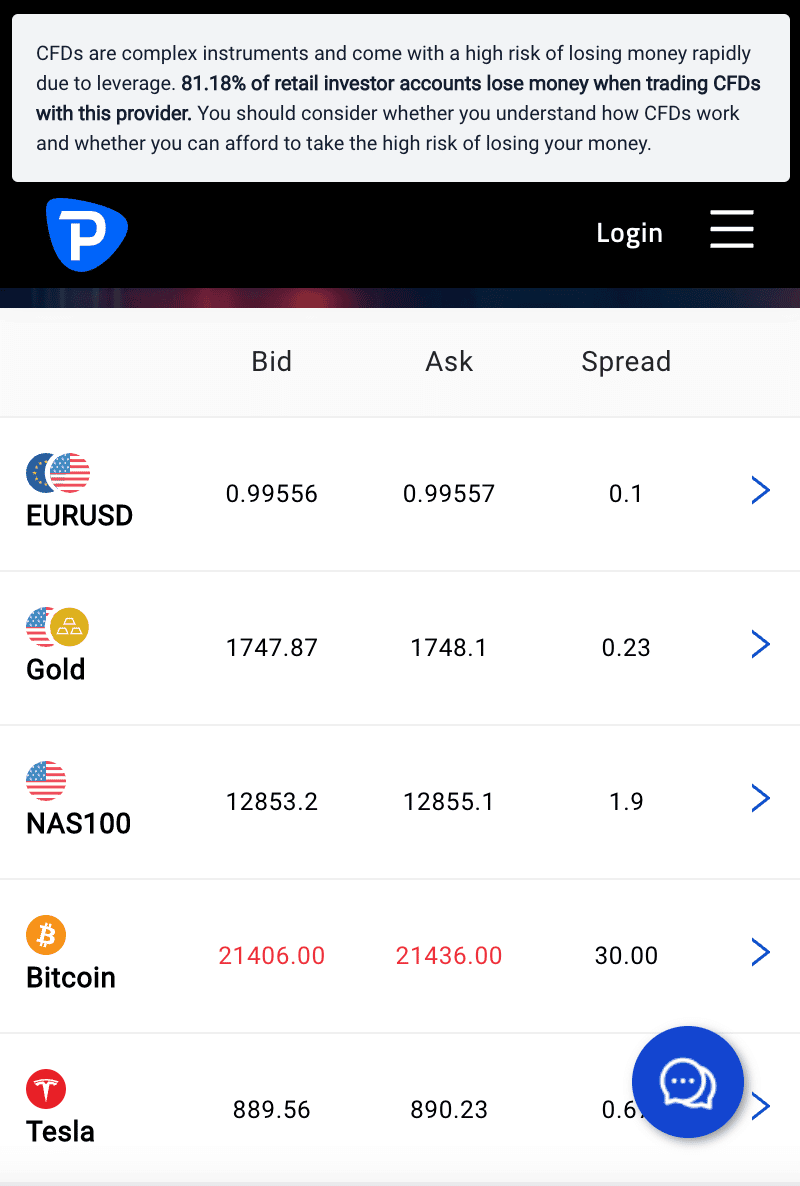

Trading Fees

Trading fees will be charged when buying and selling forex pairs. Some forex apps charge both a commission and a spread. In other cases, the provider will offer multiple accounts with various pricing models.

For example, one account might offer access to zero spreads but a flat commission will need to be paid. Other accounts might come with commission-free trading, but a less competitive spread.

Non-Trading Fees

Fees might also apply when conducting non-trading-related tasks – such as making a deposit.

| Min. EUR/USD Spread | Non-Trading Fees | |

| eToro | 1 pip | 0.5% on non-USD deposits, $10 inactivity fee, $5 withdrawal fee |

| XTB | 0.1 pips | $10 inactivity fee, 2% on Skrill deposits |

| AvaTrade | 0.9 pips | $50 inactivity fee |

| Pepperstone | 0.0 pips on Razor account | None |

| IG US | 0.8 pips | 1% on Visa, 0.5% on MasterCard, $18 inactivity fee |

| OANDA | 0.4 pips on core pricing account | $20 on bank wire withdrawals, inactivity fee after 12 months ($ not stated) |

| Forex.com | 0.5 pips | $40 on bank wire withdrawals, $15 inactivity fee |

| FXTM | 0.0 pips on advantage account | $5 inactivity fee |

| SuperForex | 2.0 pips | None |

Tools and Analysis

Although trading forex on an app is a lot less convenient when compared to a desktop device, seasoned investors will need access to analysis tools.

The best forex trading apps that we reviewed today offer a range of technical indicators and chart drawing tools, alongside market insights and research materials.

We also found that eToro offers a Copy Trading tool – which is also accessible via its native mobile app. This enables users to copy the buy and sell positions of an experienced forex trader.

Minimum Deposit

The 10 providers that made our list of the best forex apps require a minimum deposit that ranges from $0 to $250. This should be checked before opening an account, to ensure that the forex app aligns with the trader’s budget.

Demo Account

The best forex trading apps offer a free demo account that comes pre-loaded with paper funds. This will particularly suit beginners that wish to practice their forex strategies before risking real capital.

Mobile Experience

As noted above, it is all good and well offering advanced features and tools. But, if the forex app is difficult to use, then this will result in an unfavorable user experience.

eToro, which we found to be the overall best forex trading app for beginners, offers a user-friendly interface – even though the platform is feature-rich.

Payment Methods

Ever wondered what the best Neteller forex broker is? Traders should check what deposit methods are supported when searching for the best forex app. At eToro, for example, the app supports real-time payments via Paypal, Visa, MasterCard, Neteller, and more.

Customer Service

We prefer forex trading providers that offer in-app customer service via live chat. Some of the apps that we came across only offer email support – so this is another metric to check before choosing a provider.

Best Forex Signals Apps

Attempting to predict the future direction of a forex pair is no easy feat – even for seasoned traders. As a result, traders of all skill sets will often join a forex signal service.

Learn2Trade, for example, perhaps offers the best app for forex signals. It has a team of in-house analysts that research the forex markets around the clock. After finding a trading entry point, Learn2Trade will send a ‘signal’ to its members.

This is essentially a trading suggestion that covers the relevant pair, whether a buy or sell order should be placed, and what stop-loss and take-profit positions to enter.

Through its 30-day moneyback guarantee plans, Learn2Trade offers up to five premium forex signals each and every day, with prices starting from £40. Learn2Trade also offers free forex signals for those that wish to try the provider out first.

Your capital is at risk.

How to Use a Mobile Forex App

The step-by-step below explains how to get started with the eToro forex app in under five minutes.

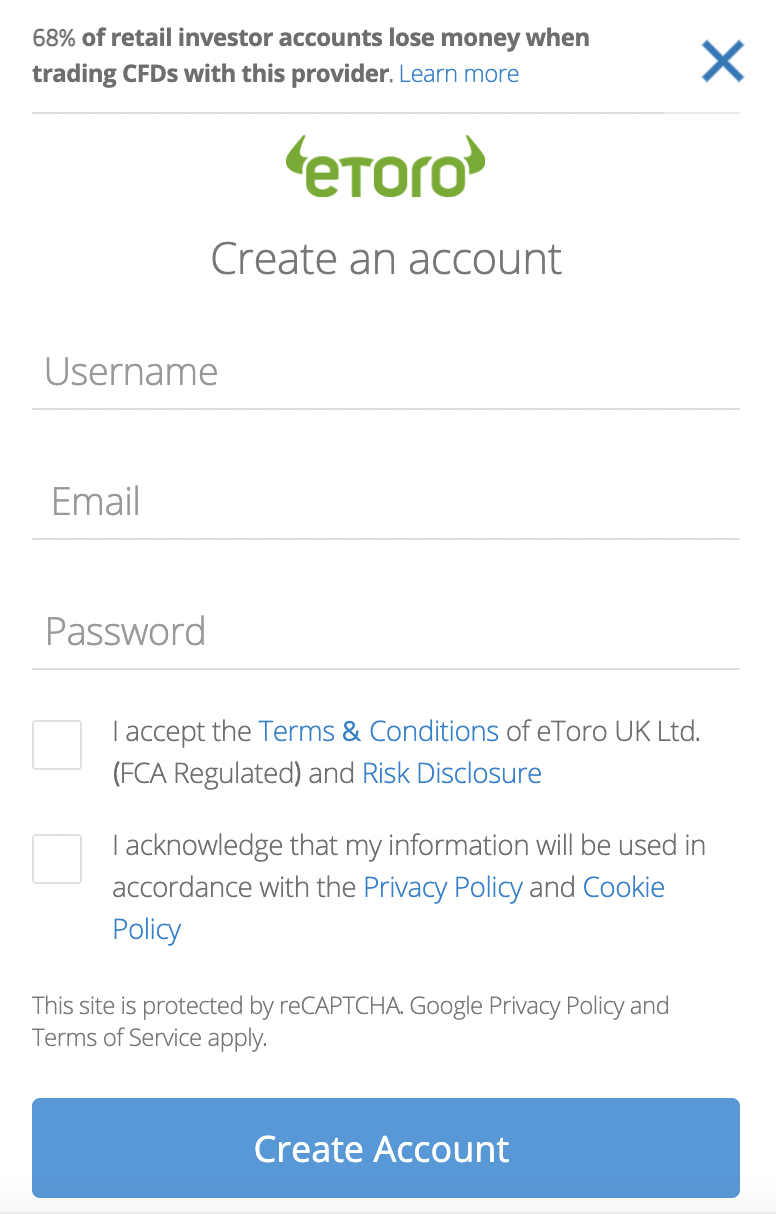

Step 1: Open eToro Forex Account

Step 1 is to visit the eToro website to open a forex trading account.

The broker will ask for the following information from the trader:

- First and last name

- Date of birth

- Email address

- Cell phone number

- Preferred username and password

- Nationality

- Residential address

To verify the account, eToro will ask for a copy of a passport, state ID, or driver’s license.

Step 2: Download eToro Forex App

Via the eToro website, the trader can now download the eToro app to their iOS or Android device.

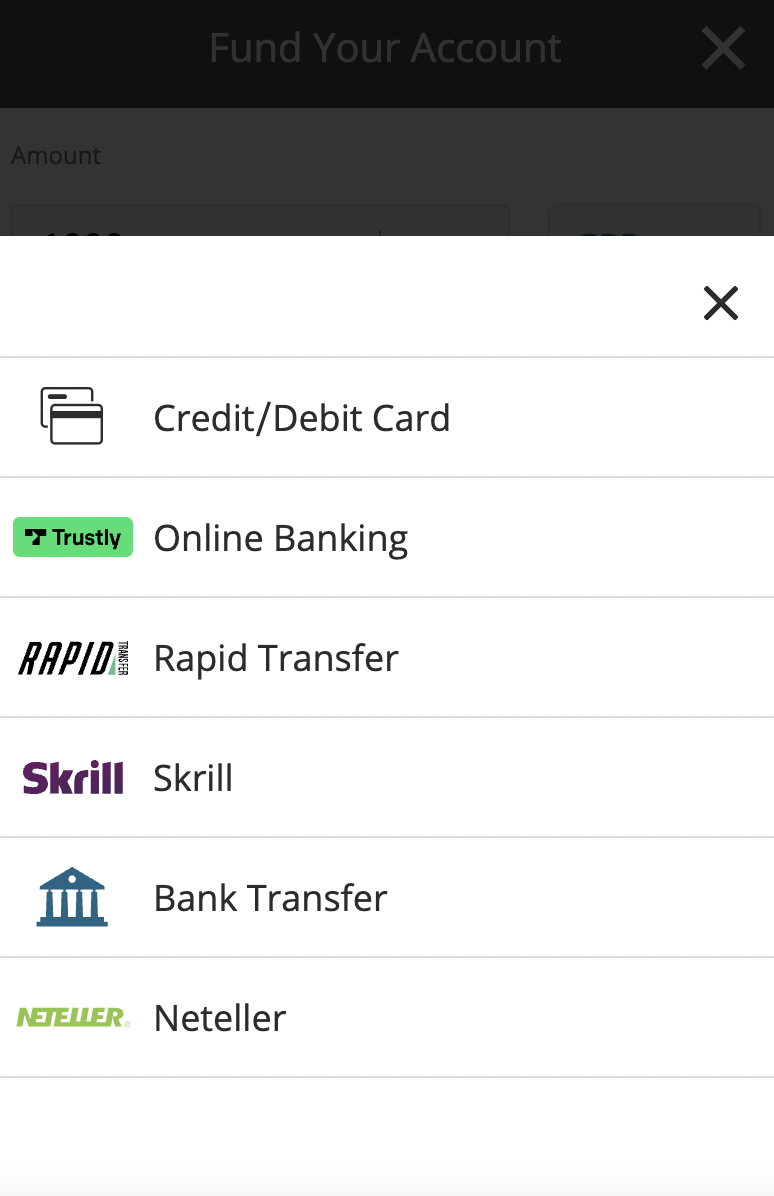

Step 3: Deposit Funds

After logging into the eToro app, the trader can deposit some funds. UK and US traders will need to meet a minimum deposit of $10. The vast majority of other nationalities will need to deposit $50 or more.

Non-USD deposits are charged 0.5%. Payments made in US dollars are fee-free. Instant payments can be made via the eToro with a debit/credit card or e-wallet.

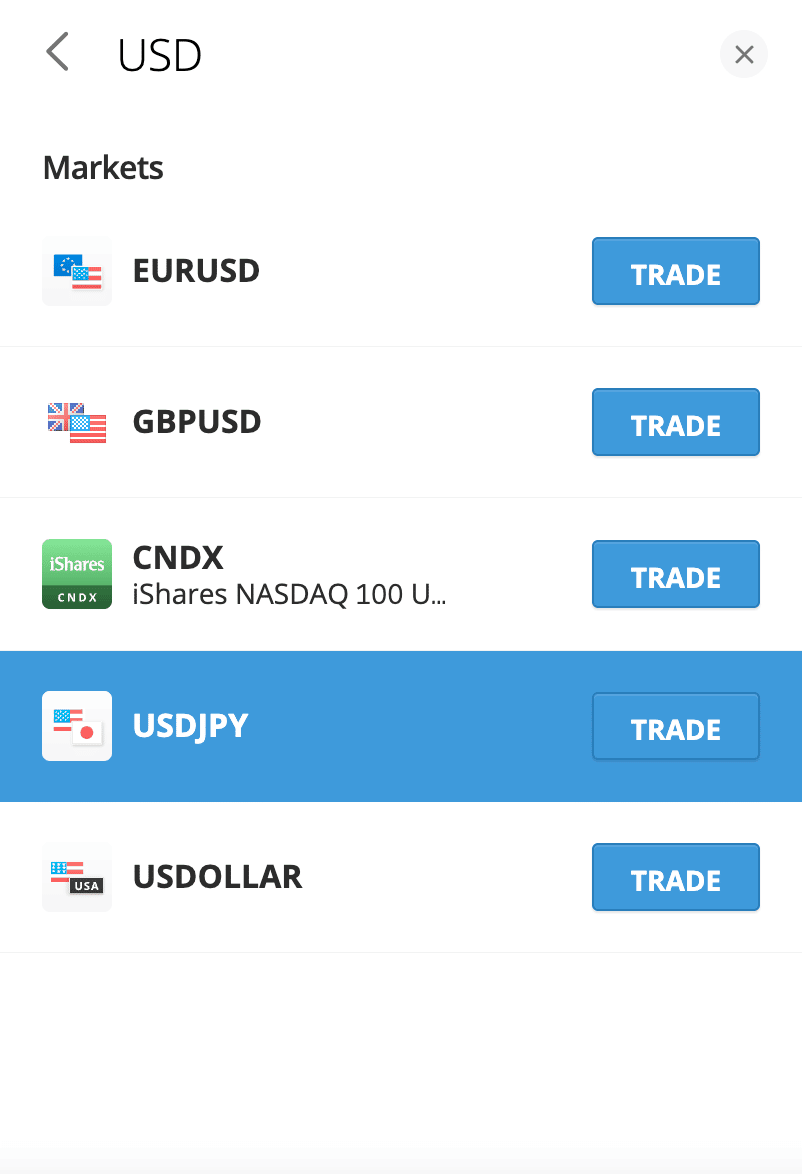

Step 4: Search for Forex Market

The eToro account should now be verified with a funded balance. The next step is to decide which forex pair to trade.

The eToro app comes with a search bar, so the trader can begin typing their preferred pair.

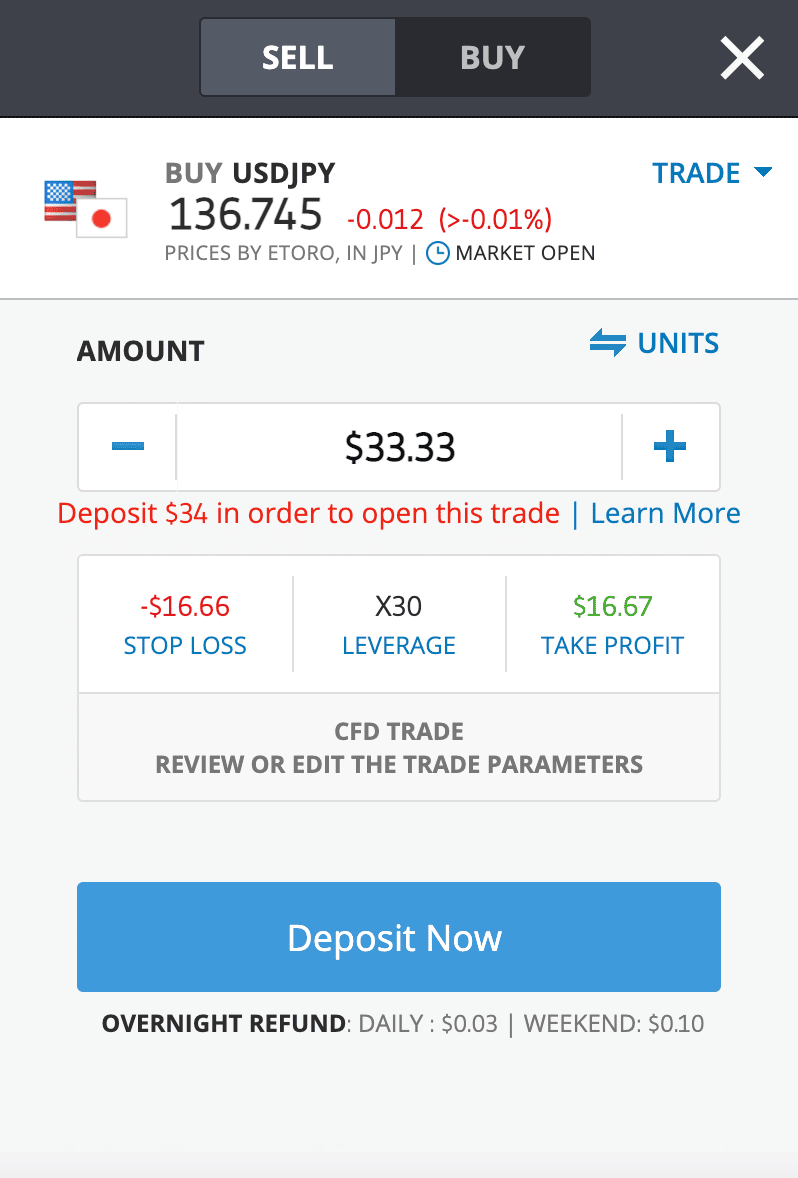

In the example above, we are searching for USD/JPY.

Step 5: Trade Forex

Next to the relevant pair, click ‘Trade’. eToro will then populate an order form for the forex position.

Choose from a buy (long) or sell (short) position and enter a stake.

Leverage can also be applied. Traders can select their preferred leverage limits from the relevant box.

To confirm the trading order, click on ‘Open Trade’.

Conclusion

Selecting the best forex trading app is no easy task considering how many providers are active in this space. Typically, the best forex trading apps for beginners offer low fees and tight spreads across a varied range of majors, minors, and exotics.

Our findings point in the direction of eToro in terms of the overall best forex app. We like that the app is regulated by several tier-one financial bodies, offers a user-friendly experience, and supports low-fee trading.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider