Futures trading is a popular way to speculate on the price of various asset classes, including commodities, equities, and even interest rates. A key consideration when beginning futures trading is finding a suitable broker to partner with – preferably one that offers low fees, advanced tools, and acceptable margin requirements.

This guide helps traders find the best futures trading platform by presenting 11 brokers that meet the criteria mentioned above. We’ll also explore the key factors to consider when choosing a broker before showing a quick walkthrough on how to begin futures trading today.

The Best Futures Brokers in 2023

The list of futures brokers below contains 11 of the best platforms for traders looking to get involved in the futures market. We’ll review each of these platforms in the following section, covering elements including fees, trading tools, and regulatory oversight.

- eToro – Overall Best Futures Broker for Copy Trading

- Plus500 – Top-Rated Broker Offering 0% Commission and Tight Spreads

- XTB – Advanced Futures Trading Platform with Low Spreads

- Interactive Brokers – Best Futures Broker for Experienced Traders

- TD Ameritrade – Best Futures Broker for Beginners

- CMC Markets – Leading Trading Platform with Huge Asset Selection

- Forex.com – Popular Futures Broker with Array of Trading Tools

- E*TRADE – Top Futures Platform for E-Mini Contracts

- Fidelity – Established Broker with 75+ Years of Industry Experience

- Saxo Bank – Best Futures Broker for High-Net-Worth Traders

- AvaTrade – Widely-Used Broker with Quick Account Opening Process

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

Best Futures Trading Platforms Reviewed

Since futures contracts are a highly speculative asset class, it’s vital to partner with a safe and well-intentioned broker. In addition, many brokers for futures trading also provide a low-fee environment, which can help retain a more significant share of any accrued profits.

To help streamline the decision-making process, we’ll discuss the best discount futures brokers below, presenting all the information needed to make an effective choice.

1. eToro – Overall Best Futures Broker for Copy Trading

eToro has developed a reputation as one of the world’s best copy trading platforms due to its innovative ‘CopyTrader’ feature. This feature enables traders to automatically copy the trades placed by others with no additional fees. eToro even has a ‘Smart Portfolios’ service where traders can invest in pre-made portfolios whilst avoiding hefty management fees.

Those wondering how to trade futures can use eToro’s CFD selection to speculate on various asset classes. Clients can open positions for just $10, and eToro offers up to 30:1 leverage on specific financial instruments. There are no commissions when trading with eToro, as all fees are incorporated in the spread.

eToro’s trading experience is streamlined, as users can trade through their browsers or smartphones. Both platforms offer real-time price charts, an abundance of technical indicators, and even a social media ‘newsfeed’ where traders can present their opinions on certain assets.

The minimum deposit threshold with eToro is only $10, making this platform ideal for beginners looking to start small and build their way up. Finally, eToro even has a free ‘eToro Academy’ feature that provides numerous guides and tutorials to streamline the trading process.

For traders looking to learn more about this leading copy trading platform, our eToro review covers all the key metrics from payment methods to tradable assets and regulations.

| Number of Futures Contracts | N/A (2,300+ financial instruments to trade) |

| Pricing Structure | 0% commission + variable spread |

| Minimum Deposit | $10 |

| Key Features | Innovative CopyTrader feature

Wide range of Smart Portfolios Built-in social newsfeed |

What we like:

- 0% commissions when placing trades

- Minimum position size is just $10

- Leverage of up to 30:1 on certain assets

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

2. Plus500 – Top-Rated Broker Offering 0% Commission and Tight Spreads

Trading on this platform is conducted in a safe environment as Plus500 is regulated by various financial authorities globally such as the FCA, CySEC, ASIC, FSP, and MAS.

Besides offering low spreads and 0% commission trading, Plus500 doesn’t charge a fee for deposits, opening/closing trades, rolling a position, live share CFD prices, and real-time forex quotes.

Traders should note, however, that this broker can implement a currency conversion fee, an inactivity fee of up to $10 per month for not logging into an account for three consecutive months, and a fee for a guaranteed stop order.

Traders can test out the platform by downloading the demo account and if anything regarding the platform is unclear, support is available 24/7.

To help traders optimize their positions, Plus500 provides news and market insights, as well as risk management tools – traders can also improve their knowledge by enrolling in the Plus500 trading academy or opting for alerts to receive trading setups.

Plus500 has simplified opening positions for traders on the go by offering an app containing key features found on the web platform.

Getting started on this platform is convenient as Plus500 has enabled traders to open accounts quickly and fund them with various payment options such as bank wire, Paypal, cards, Skrill, and Apple Pay, to name a few.

| Number of Futures Contracts | N/A (Various markets and more than 2,000 CFDs available) |

| Pricing Structure | 0% commission + variable spread |

| Minimum Deposit | $100 |

| Key Features | Offering trading academy

News and Market insights provided Advanced analytics tools |

What we like:

- 24/7 support

- 0% commissions

- Forex leverage 1:30

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Plus500UK Ltd authorized & regulated by the FCA Plus500CY Ltd authorized & regulated by CySEC

3. XTB – Advanced Futures Trading Platform with Low Spreads

XTB has some of the lowest spreads we’ve seen from a futures broker. Spreads start at just 3 pips for gold trading and 4 pips for the US’s S&P 500 stock index future. On top of that, traders at XTB can apply leverage up to 500:1 to their trades, so they don’t need a huge amount of capital to make significant trades.

Another standout feature of XTB is its proprietary trading platform, xStation 5. This is an advanced trading platform that mimics much of the functionality of MetaTrader 5 but in a much more user-friendly layout. xStation 5 is packed with technical indicators and risk management tools, making it one of the top trading software platforms for futures trading. The platform is available for web and mobile devices.

This broker offers both standard and swap-free trading accounts, neither of which require a minimum deposit to open. There are no account setup or management fees and XTB accepts deposits by credit card, debit card, bank transfer, or e-wallet.

| Number of Futures Contracts | 63 futures markets |

| Pricing Structure | Variable spread |

| Minimum Deposit | None |

| Key Features | Custom xStation 5 trading platform

No minimum deposit Swap-free accounts available |

What we like:

- Low spreads for global futures markets

- Customizable trading platform for web and mobile

- Leverage up to 500:1 for futures trading

Your capital is at risk. 76% of retail investor accounts lose money when trading CFDs with this provider.

4. Interactive Brokers – Best Futures Broker for Experienced Traders

This is the widest selection of markets on our list and includes futures, futures options, and stock futures. Futures contracts can be traded on agriculture, currencies, energy, fixed income, and even volatility. What’s more, Interactive Brokers futures fees equate to just $0.85 per contract (plus exchange, regulatory, and clearing fees) – although there’s also a volume-based structure if traders prefer.

Interactive Brokers also offers several trading options, including the ‘GlobalTrader’ web-based platform, a user-friendly mobile app, and even a desktop platform for advanced traders. The minimum deposit to begin trading is $100, which can be facilitated via ACH transfer or check.

| Number of Futures Contracts | 35+ futures markets available to trade |

| Pricing Structure | Varies ($0.85 per contract for USD-denominated futures) |

| Minimum Deposit | $100 |

| Key Features | Several advanced trading platforms

24 base currencies supported Low margin rates |

What we like:

- Offers interest on uninvested cash

- Accounts provided for both beginners and professionals

- Over 100 order types to employ

5. TD Ameritrade – Best Futures Broker for Beginners

TD Ameritrade allows clients to trade futures through the industry-leading ‘Thinkorswim’ platform, featuring a bid/ask price ladder, one-click orders, and customizable charts. Furthermore, TD Ameritrade is the ideal place for those wondering how to invest $1,000 since there are futures specialists on hand at all times to answer clients’ questions.

This platform’s fee structure is uncomplicated, set at just $2.25 per contract. This includes exchange and regulatory fees, meaning traders know exactly how much they are charged. Finally, TD Ameritrade also offers an abundance of free futures-related articles and tutorial videos to help beginners get up to speed.

| Number of Futures Contracts | 70+ |

| Pricing Structure | $2.25 fee per contract (plus exchange & regulatory fees) |

| Minimum Deposit | N/A |

| Key Features | Leading ‘Thinkorswim’ platform

Transparent fee structure Massive library of educational resources |

What we like:

- Dedicated futures specialists to deal with queries

- Over 70 futures contracts to trade

- ‘Micro futures’ offered with lower barriers to entry

6. CMC Markets – Leading Trading Platform with Huge Asset Selection

The asset selection is huge since CMC Markets offers access to an array of international exchanges. Leverage on these assets is set at 30:1, and CMC Markets charges no commissions to open a trade on most purchases. However, stock trades have a commission set at $0.02 per share on US-based equities.

There is no minimum deposit threshold with CMC Markets, and users can fund their accounts via credit/debit card, bank transfer, or PayPal. Deposits and withdrawals are free unless the withdrawal is via bank transfer, which comes with a fee. Finally, CMC Markets is one of the best MT4 brokers as it integrates seamlessly with MetaTrader 4.

| Number of Futures Contracts | N/A (11,500+ financial instruments to trade) |

| Pricing Structure | 0% commission + variable spread |

| Minimum Deposit | N/A |

| Key Features | No minimum deposit threshold

Supports PayPal deposits Integrates with MT4 |

What we like:

- Offers over 11,500 financial instruments to trade

- Up to 30:1 leverage on offer

- Free deposits and withdrawals using credit/debit card and e-wallet

7. Forex.com – Popular Futures Broker with Array of Trading Tools

There are various contracts to trade, including the US Dollar index, the precious metals index, and the global oil index. Those wondering how to trade futures options can do so with commissions as low as $1.29 per contract.

Furthermore, since Forex.com is regulated by the FCA, CFTC, and NFA, traders are afforded a high level of capital protection. Forex.com also provides a vast range of research tools, including trading ideas, technical indicators, newsfeeds, and even a detailed economic calendar.

| Number of Futures Contracts | Five markets available to trade |

| Pricing Structure | $1.29 commission (per side & contract) |

| Minimum Deposit | $100 |

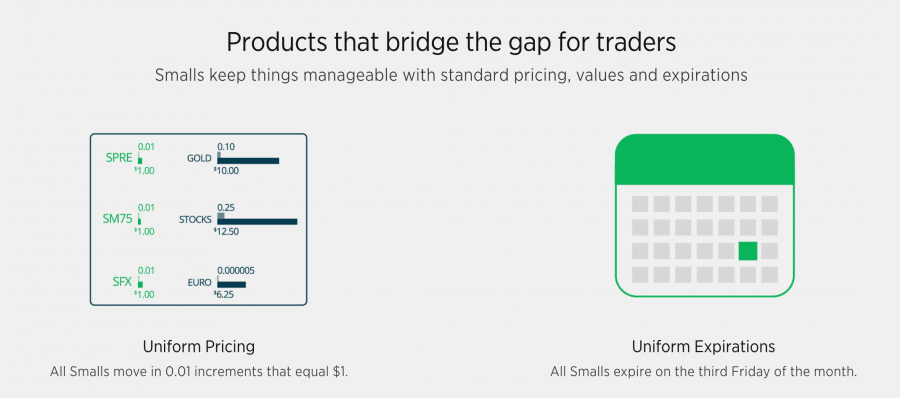

| Key Features | Offers ‘smalls market’ futures

Wide range of trading tools Regulated worldwide |

What we like:

- Flat fee per futures contract

- Regulated by the NFA

- All contracts are standardized

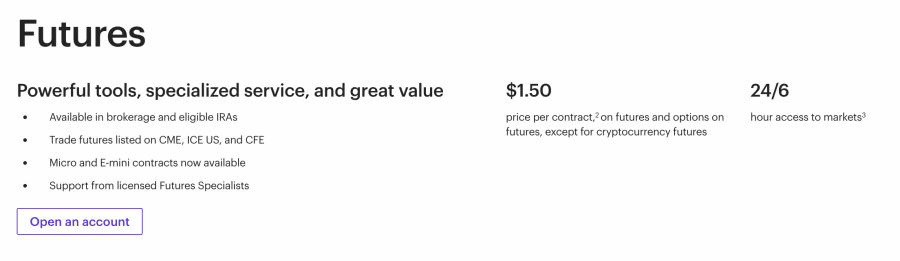

8. E*TRADE – Top Futures Platform for E-Mini Contracts

E*TRADE offers 24/6 access to the futures markets and even has dedicated futures specialists to deal with relevant queries. In addition, E*TRADE is one of the best micro e-mini futures brokers, as traders can gain exposure to the S&P 500 and NASDAQ’s price movements with a low tick value.

The trading experience is seamless, as trading can be conducted on the ‘Power E*TRADE’ web or mobile app. Both showcase real-time contract prices and offer numerous drawing tools that simplify analysis.

| Number of Futures Contracts | Three markets available to trade |

| Pricing Structure | $1.50 per contract |

| Minimum Deposit | N/A |

| Key Features | Offers several E-mini contracts

Drawing tools for analysis Flat-fee of $1.50 per contract |

What we like:

- Offers futures from the CME, ICE US, and CFE

- Can trade futures through the web-based or mobile app

- 24/6 access to the market

9. Fidelity – Established Broker with 75+ Years of Industry Experience

These include stocks, ETFs, funds, bonds, and options – with full access to a suite of international markets. What’s more, Fidelity also offers a ‘Fidelity-Go’ account that works as a Robo-advisory service, offering low-cost money management.

Fidelity clients can trade US-based stocks and ETFs free of charge, although there is a variable commission for international assets. However, Fidelity has no deposit, withdrawal, or inactivity fees to be aware of, making it a cost-effective broker to partner with.

| Number of Futures Contracts | N/A (2,500+ financial instruments to trade) |

| Pricing Structure | 0% commission on US-based equities; flat fee on funds |

| Minimum Deposit | N/A |

| Key Features | Over 75 years of industry experience

No deposit or withdrawal fees Provides access to international markets |

What we like:

- Robo-advisory account offered

- Free US stock and ETF trading

- No minimum deposit threshold

10. Saxo Bank – Best Futures Broker for High-Net-Worth Traders

Saxo Bank employs a volume-based structure, meaning clients can trade futures for as little as $1 per lot. However, Classic account holders will pay $4 per contract for USD-denominated futures – although this does decrease for users who are more active in the market.

Several advanced features are on offer at Saxo Bank, including futures spread trading, Level 2 order book data, and real-time futures prices. What’s more, Saxo Bank even provides 24-hour personalized customer support and a range of educational courses.

| Number of Futures Contracts | 300+ |

| Pricing Structure | $4 per contract for USD-denominated futures |

| Minimum Deposit | $500 |

| Key Features | Fees start at just $1 per lot

24-hour customer support Wide range of advanced trading tools |

What we like:

- More than 300 futures contracts to trade

- Various account types on offer

- Free educational courses

11. AvaTrade – Widely-Used Broker with Quick Account Opening Process

Those researching how to trade commodities can invest in 18 CFDs commission-free, along with various currencies, equities, ETFs, bonds, and cryptocurrencies. AvaTrade’s fees are built into the quoted spread, with deposits and withdrawals free to make.

One of AvaTrade’s top features is its seamless account opening process, which takes less than 10 minutes to complete and requires no physical paperwork. AvaTrade also offers an abundance of trading tools, including interactive charts, fundamental data, and MT4/MT5 integration.

| Number of Futures Contracts | N/A (700+ financial instruments to trade) |

| Pricing Structure | 0% commission + variable spread |

| Minimum Deposit | $100 |

| Key Features | Integrates with MT4 and MT5

Zero-commission approach Regulated by the Central Bank of Ireland |

What we like:

- Over 15 years of industry experience

- Wide range of asset classes to trade

- No deposit or withdrawal fees

Top Futures Trading Platforms Compared

Traders looking to find the best futures trading platform will need to consider each platform’s asset selection, pricing structure, and minimum deposit threshold – as these three features can make all of the difference over the long term.

To help streamline the decision-making process, the table below presents these criteria for the 10 best futures brokers reviewed in the previous section:

| Platform | Number of Futures Contracts | Pricing Structure | Minimum Deposit | Key Features |

| eToro | N/A (2,300+ financial instruments to trade) | 0% commission + variable spread | $10 | Innovative CopyTrader feature

Wide range of Smart Portfolios Built-in social newsfeed |

| Plus500 | N/A (Various markets and more than 2,000 CFDs available) | 0% commission + variable spread | $100 | Offering trading academy

News and Market insights provided Advanced analytics tools |

| XTB | 63 futures markets | 0% commission + variable spread | None | Custom xStation 5 trading platform

No minimum deposit Swap-free accounts available |

| Interactive Brokers | 35+ futures markets available to trade | Varies ($0.85 per contract for USD-denominated futures) | $100 | Several advanced trading platforms

24 base currencies supported Low margin rates |

| TD Ameritrade | 70+ | $2.25 fee per contract (plus exchange & regulatory fees) | N/A | Leading ‘Thinkorswim’ platform

Transparent fee structure Huge library of educational resources |

| CMC Markets | N/A (11,500+ financial instruments to trade) | 0% commission + variable spread | N/A | No minimum deposit threshold

Supports PayPal deposits Integrates with MT4 |

| Forex.com | Five markets available to trade | $1.29 commission (per side & contract) | $100 | Offers ‘smalls market’ futures

Wide range of trading tools Regulated worldwide |

| E*TRADE | Three markets available to trade | $1.50 per contract | N/A | Offers several E-mini contracts

Drawing tools for analysis Flat-fee of $1.50 per contract |

| Fidelity | N/A (2,500+ financial instruments to trade) | 0% commission on US-based equities; flat fee on funds | N/A | Over 75 years of industry experience

No deposit or withdrawal fees Provides access to international markets |

| Saxo Bank | 300+ | $4 per contract for USD-denominated futures | $500 | Fees start at just $1 per lot

24-hour customer support Wide range of advanced trading tools |

| AvaTrade | N/A (700+ financial instruments to trade) | 0% commission + variable spread | $100 | Integrates with MT4 and MT5

Zero-commission approach Regulated by the Central Bank of Ireland |

How We Select the Best Futures Brokers

Much like when researching the best forex brokers, identifying where to trade futures can be challenging – especially given how many platforms now offer futures trading. However, by being aware of the elements below, prospective traders can separate the effective platforms from the ineffective, making the entire process quicker and easier:

Regulation

Selection of Futures Contracts

Those looking to employ the best futures trading strategy may also wish to partner with a broker that offers a vast asset selection. This ensures an abundance of opportunities whilst providing options for investors with varying risk tolerance levels.

Fee Structure

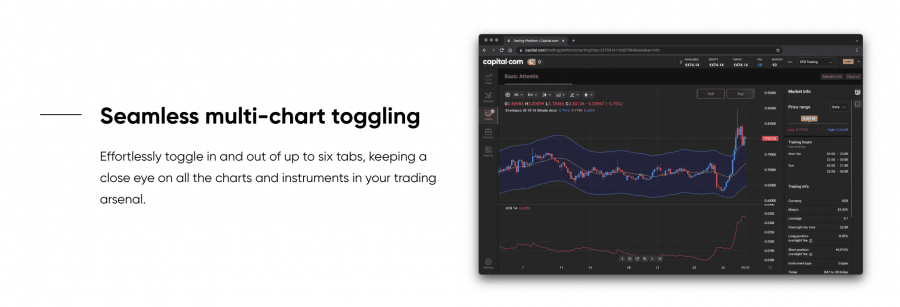

Trading the best futures stocks (and other asset classes) can be more profitable by partnering with a broker that offers a low-fee environment. Capital.com is one of these brokers – although it doesn’t offer futures contracts directly, it does provide a range of CFDs that can be traded commission-free.

Those wondering how to invest during inflation may also wish to use a broker that eliminates non-trading fees. These include deposit, withdrawal, inactivity, and monthly account fees, all of which can add up over time.

| Platform | Monthly Account Fee? |

| eToro | No |

| Plus500 | No |

| XTB | No |

| Interactive Brokers | No |

| TD Ameritrade | No |

| CMC Markets | Pro platform costs $49 per month |

| Forex.com | No |

| E*TRADE | No |

| Fidelity | Service fee of up to 0.35% per month (dependent on account balance) |

| Saxo Bank | No |

| AvaTrade | No |

Trading Tools

Trading tools can also be beneficial – especially interactive price charts that feature an array of technical indicators. Moreover, some brokers (like eToro) offer features that help automate the trading process, providing a similar service to the best trading robots.

Minimum Deposit

Beginners may find it easier to partner with a broker that has a low minimum deposit threshold, as this allows them to gain experience with small amounts. Capital.com and eToro have minimum deposit thresholds of just $20 and $10, respectively, meaning the barriers to entry for these brokers are extremely low.

Demo Account

The best paper trading platforms can be beneficial for newcomers to the futures market, as they enable traders to practice with virtual money. Most of the brokers reviewed in this guide offer a free demo account that mirrors the full trading experience – making the transition to live trading much more straightforward.

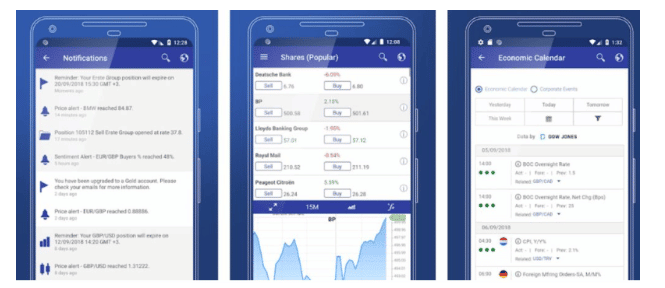

Mobile App

Looking for the best investing apps? Capital.com and eToro both offer leading and convenient trading apps so you can invest in futures anywhere at any time. The futures market can be inherently volatile, meaning the ability to trade on the go is a must. Brokers like Capital.com and eToro offer dedicated mobile apps that provide a condensed version of the services offered through their web-based platforms. This allows traders to buy and sell assets in just a few taps.

Payment Methods

Most futures brokers accept credit/debit cards and bank transfers as payment methods, although many also accept certain e-wallets. Credit/debit card and e-wallet deposits tend to arrive instantly, whilst bank transfers usually take several business days to arrive.

Customer Service

Finally, it’s vital to partner with a futures broker with a dedicated customer support team. Futures trading can be challenging, so opting for a platform with 24/5 (or 24/7) support can make all the difference. The best brokers also offer live chat support, which makes it easy to receive tailored help.

How to Start Trading Futures with a Regulated Broker

Before rounding off our guide on the best futures brokers for beginners, it’s essential to present an overview of the investment process. As mentioned earlier, eToro is our recommended option for prospective futures traders, as this broker offers thousands of CFDs that provide similar benefits to futures contracts – without high margin requirements.

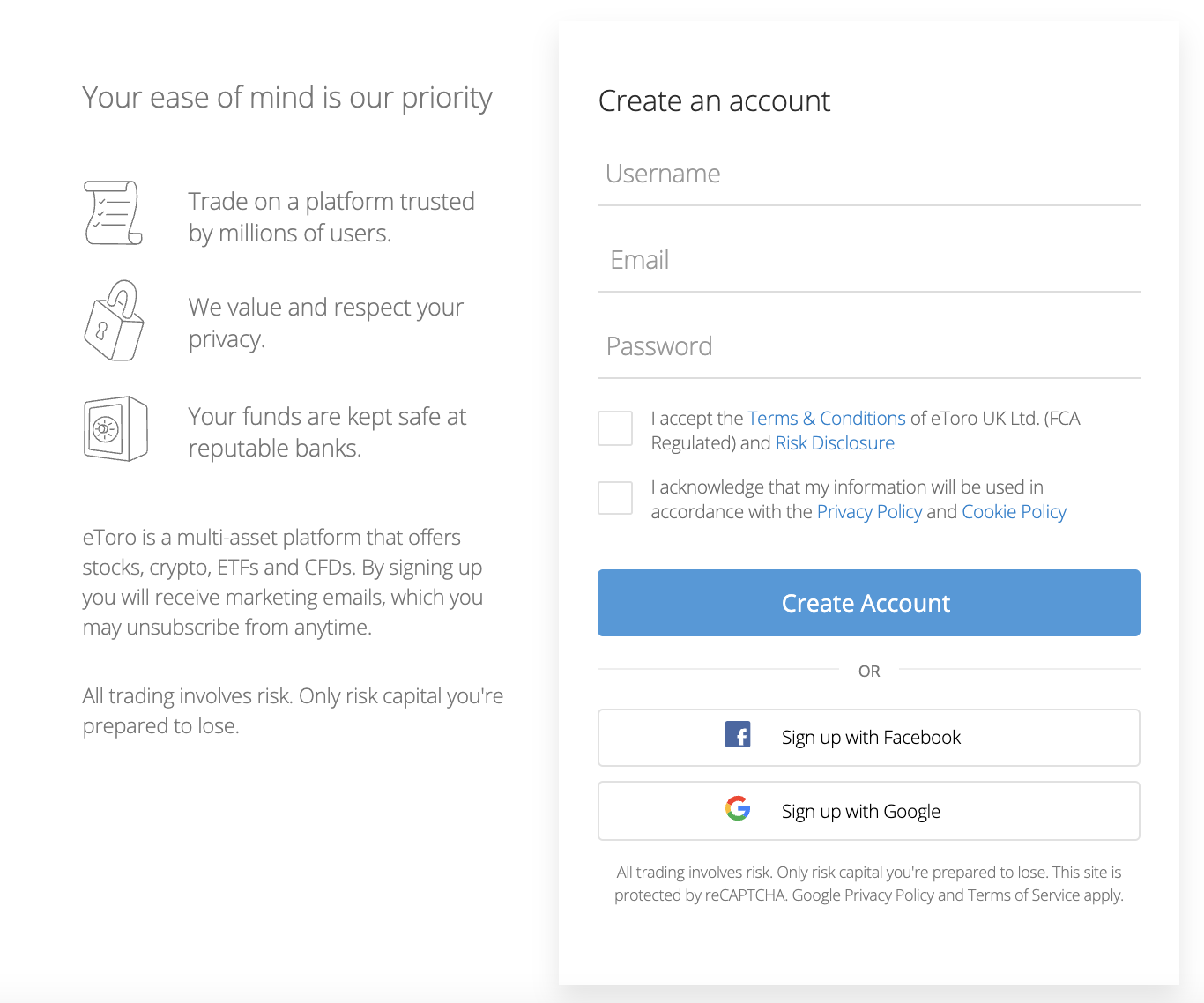

Step 1 – Open an eToro Trading Account

Go to eToro’s website and click ‘Trade Now’. On the following page, provide a valid email address and choose a password for the account. eToro will then send a verification email to confirm the account opening process.

Step 2 – Verify Account

Click’ Complete Verification’ on eToro’s trading dashboard and provide the personal information needed for the broker’s KYC checks. Traders will then be asked to upload proof of ID (e.g. passport) and proof of address (e.g. bank statement).

Step 3 – Make a Deposit

Once verification is complete, click ‘Deposit’ on eToro’s dashboard and enter the appropriate funding amount (minimum $10).

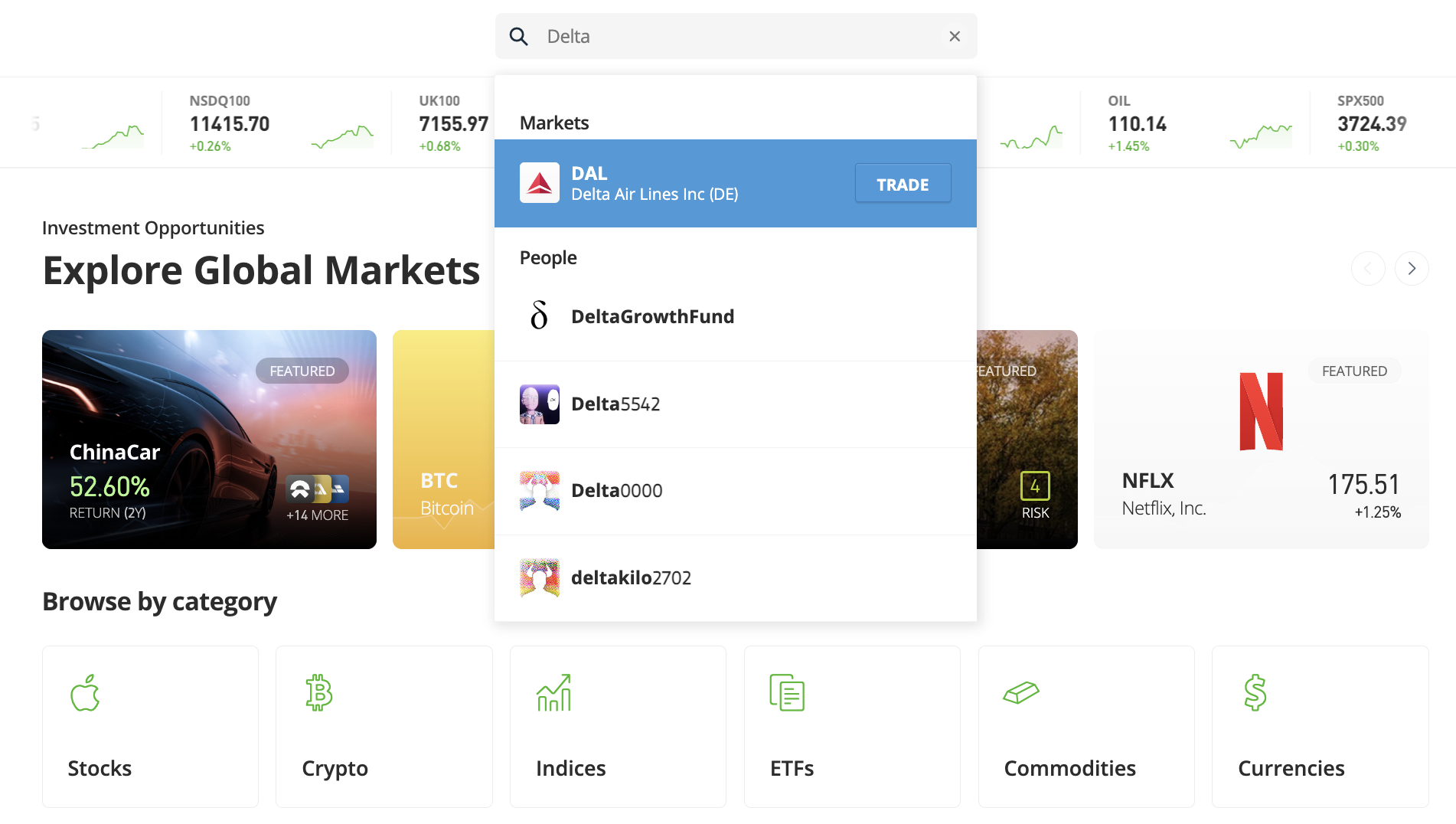

Step 4 – Search for an Asset to Trade

Type in the name of the asset to be traded in the search bar of eToro’s trading platform and click on it when it appears.

Step 5 – Begin Trading

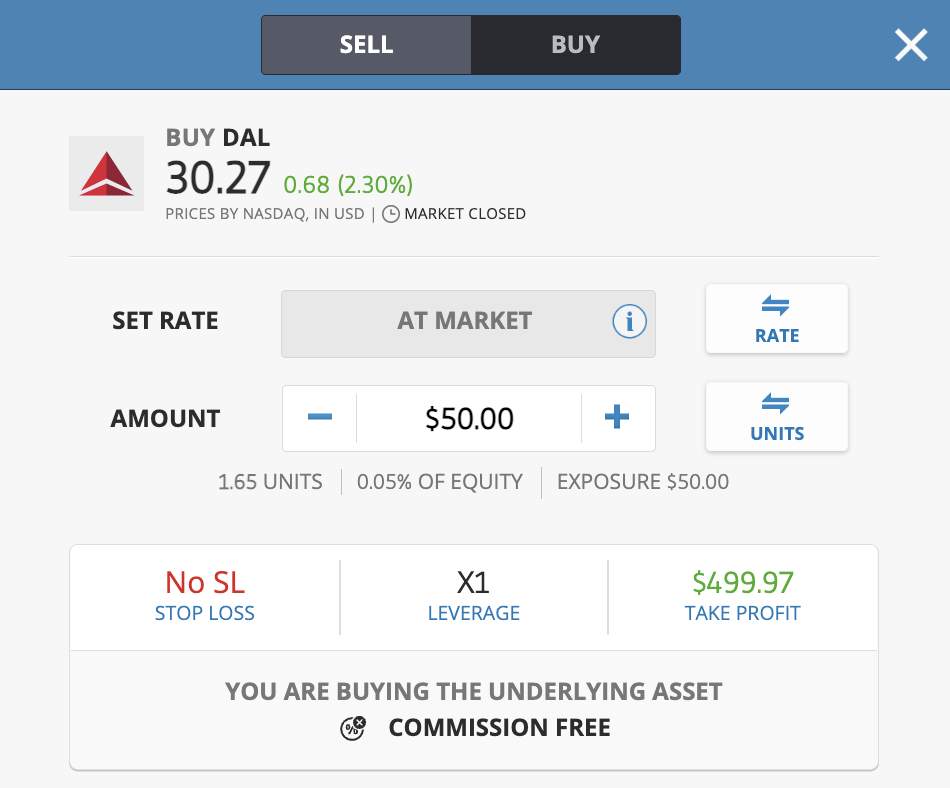

Traders must simply click the ‘Buy’ or ‘Sell’ button again to open the trade.

Best Futures Trading Platform – Conclusion

Through futures contracts, traders can speculate on the price of an asset at a later date – making them a popular asset class for those who have an opinion on the direction an asset’s price may go. This guide has discussed the best futures trading platform in detail, presenting several brokers that offer low fees and a safe environment for beginners and experienced pros.

Although it doesn’t offer futures contracts directly, eToro is an excellent option for those looking to receive the same exposure that futures contracts can offer in 2023.

eToro offers thousands of financial instruments to trade, all of which have a lower barrier to entry than futures. Trading these assets is commission-free, and eToro allows users to open an account with a minimum deposit of just $10.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.