Leverage allows investors to trade with more money than they have in their brokerage account. The higher the leverage on offer, the more trading capital the investor has access to.

In this guide, we explore the best high leverage brokers in the market today – not only in terms of limits, but fees, supported assets, account minimums, and more.

Best Forex Brokers with High Leverage

The list below covers many of the top high leverage forex brokers on the market right now:

- eToro – Overall Best High Leverage Forex Broker

- XTB – Up to 500:1 Leverage

- Vantage – High Leverage CFD Trading Forex Broker

- Pepperstone – Top Broker for Raw Spread Accounts

- AvaTrade – Leverage of up to 1:400 Depending on Client Location

- Skilling – Access Leverage of 1:500 on Major FX Pairs

- Forex.com – Best High Leverage Broker for US Clients

- Interactive Brokers – Access to Interbank Currency Quotes

- FBS – Highest Leverage in the Market at up to 1:3000

- HotForex – High Leverage Broker With Limits of up to 1:1000

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

Read on to explore reviews of the best forex brokers with high leverage in 2023.

Best High Leverage Brokers Reviewed

It is important to note that regulated forex brokers can only offer certain leverage limits to traders – which are based on the individual’s country of residence.

Limits are also determined based on whether the trader is a retail or professional client, as well as the respective asset class.

Nonetheless, in the sections below, we compare the 10 best high leverage brokers in the market right now.

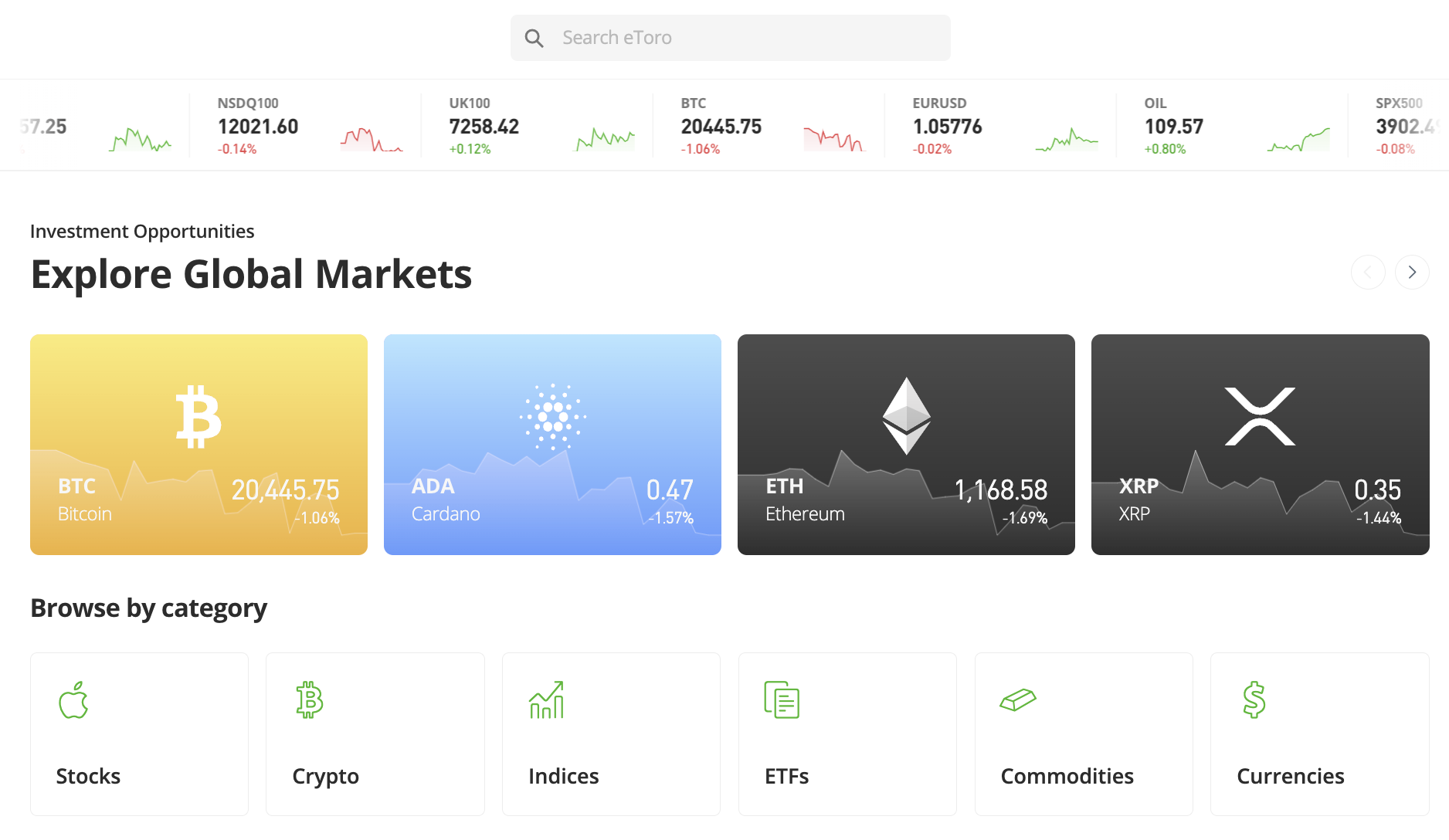

1. eToro – Overall Best High Leverage Forex Broker

We found that eToro came in at a close second when reviewing the best high leverage brokers. This low spread forex broker is used by over 25 million clients and it supports thousands of financial instruments. This is inclusive of more than 2,500 commission-free stocks and ETFs.

Those looking at where to buy stocks with leverage might consider trading CFDs at eToro. In doing so, leverage of up to 1:5 will be offered and both long and short positions are supported. Alternatively, eligible clients will also be able to buy cryptocurrency CFDs with leverage of up to 1:2.

The highest leverage limit available to retail clients is 1:30 – and this will be offered on major forex pairs. With that being said, eToro offers professional accounts that come with a maximum leverage ratio of 1:400. This will, however, require the trader to meet certain eligibility requirements – such as having a minimum investment portfolio of €500k.

What we really like about eToro is that the platform offers a Copy Trading tool that consists of thousands of verified traders. Once a trader has been selected, the user can elect to copy all future positions automatically. This leading forex copy trading platform also offers Smart Portfolios that offer passive access to dozens of investment strategies.

eToro is also one of the best social trading crypto platforms. This feature allows eToro traders to share investment ideas and even comment on and ‘Like’ posts. When it comes to safety, eToro is regulated not only by the SEC, FCA, ASIC, and CySEC, but it has been operational since 2007. Those wishing to try eToro for the first time might consider using the demo stock trading account.

Furthermore, for those looking for the best forex bonuses in 2023, eToro offers a $250 bonus after its users deposit $5k or more into their live trading accounts. Read our guide on the best forex bonus offers for more details.

| FX Pairs | 49 |

| Max Leverage | 1:30 for retail clients |

| Commission | 0% stocks and ETFs, spread-only on CFDs |

| EUR/USD Spread | From 0.6 pips |

| Other Assets | Stocks, ETFs, indices, commodities, cryptocurrencies |

| Platforms | Web trader, mobile app |

| US Clients | Yes – but for real stocks and cryptocurrencies only |

| Brokerage Type | Broker-dealer, CFD broker |

What We Like

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider

2. XTB – Up to 500:1 Leverage

XTB offer up to 500x leverage depending on the client’s location and tight spreads from 0.1 pips on dozens of FX trading pairs as well as 2100+ global markets and 1500+ CFD markets in total, covering a wide range of financial assets.

Beginners can use their free educational materials to get a comprehensive education on trading and the optimal use of leverage.

This award winning broker also offers active trader rewards such as cashback and customized trade alerts, including trade recommendations from major banks like Goldman Sachs.

Fast and highly qualified support staff are available for XTB traders 24 hours a day, five business days a week.

| FX Pairs | 48+ currency pairs |

| Max Leverage | 1:500, or 1:30 for retail clients |

| Commission | 0% |

| EUR/USD Spread | From 0.1 pips |

| Other Assets | Shares, indices, commodities, cryptocurrencies |

| Platforms | xStation, MT4 |

| US Clients | No |

| Brokerage Type | CFD broker |

What we like:

- 24 hour support

- 1500+ CFD markets: Forex, Indices, Commodities, Shares & Cryptocurrencies

- Tight spreads from 0.1 pips

Your capital is at risk. 81% of retail investor accounts lose money when trading CFDs with this provider.

3. Vantage – High Leverage CFD Trading Forex Broker

The standard STP account requires a minimum deposit of $200 – which can be made using a debit/credit card, bank transfer or via an e-wallet such as PayPal, Skrill, Neteller and more. With the STP account, clients can access commission-free FX trading. However, this account charges high spreads. For example, the popular EUR/USD pair charges a high spread of 1.1 pips.

The second account type is the Raw ECN account – which requires a minimum deposit of $500. With the ECN account, investors can access low-spread FX pairs. The EUR/USD pair offers low spreads, starting at 0.2 pips. However, a small commission is charged per lot.

One of the best high leverage brokers for forex, Vantage allows investors to access up to 1:100 leverage on trades. This means that for every $100 you are trading, you are able to access $10,000 worth of currency. The platform also allows leverage options up to 1:500 for certain approved accounts that are trading with higher amounts of equity.

Apart from Forex, traders can access CFD options for cryptos, shares, commodities and indices with Vantage. The platform is available with MT4 & MT5 traders, and also offers a mobile app on iOS and Android.

| FX Pairs | 44 FX pairs |

| Max Leverage | 1:100 (1:500 for certain accounts with higher equity) |

| Commission | No commission on STP accounts/average $3 commission on ECN accounts |

| EUR/USD Spread | 1.1 pips on STP/ 0.2 pips on ECN account |

| Other Assets | CFDs via stocks, indices, commodities, cryptocurrencies |

| Platforms | MT4, MT5, Mobile app |

| US Clients | No |

| Brokerage Type | CFD |

What We Like

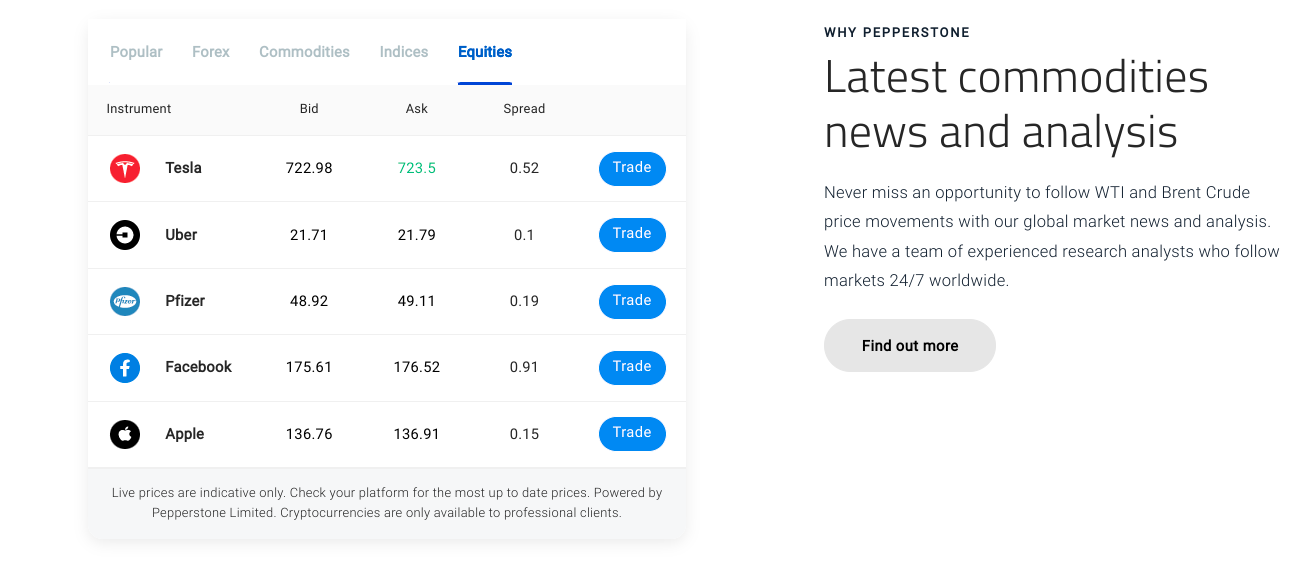

4. Pepperstone – Top Broker for Raw Spread Accounts

The next option to consider from our list of the best high leverage brokers is Pepperstone. This provider offers more than 1,200 trading instruments – all of which can be accessed via CFDs. This covers ETFs, stocks, cryptocurrencies, forex, and more.

In addition to fast execution speeds, we like that Pepperstone offers customer service on a 24/7 basis. Another reason that Pepperstone came out as one of the best high leverage brokers is that it offers raw spread accounts. This offers direct access to other market participants and thus – major instruments like EUR/USD can be traded on a zero-spread basis.

Commissions on raw spread accounts are super competitive too at just $3.50 for each currency lot traded. In terms of its leverage offering, Pepperstone is limited to 1:30 – should the retail client be based in the UK, Europe, or Australia. However, the platform does offer limits of up to 1:400 to retail clients in certain other jurisdictions. Professional clients can access up to 1:500.

| FX Pairs | Dozens of majors, minors, and exotics |

| Max Leverage | Up to 1:400 for retail clients |

| Commission | $3.50 for 1 lot traded on raw spread account |

| EUR/USD Spread | 0 pips on raw spread account |

| Other Assets | CFDs via stocks, indices, commodities, cryptocurrencies, currency indices |

| Platforms | MT4, MT5, cTrader, TradingView |

| US Clients | No |

| Brokerage Type | CFD |

What We Like

74-89% of retail investor accounts lose money when trading CFDs

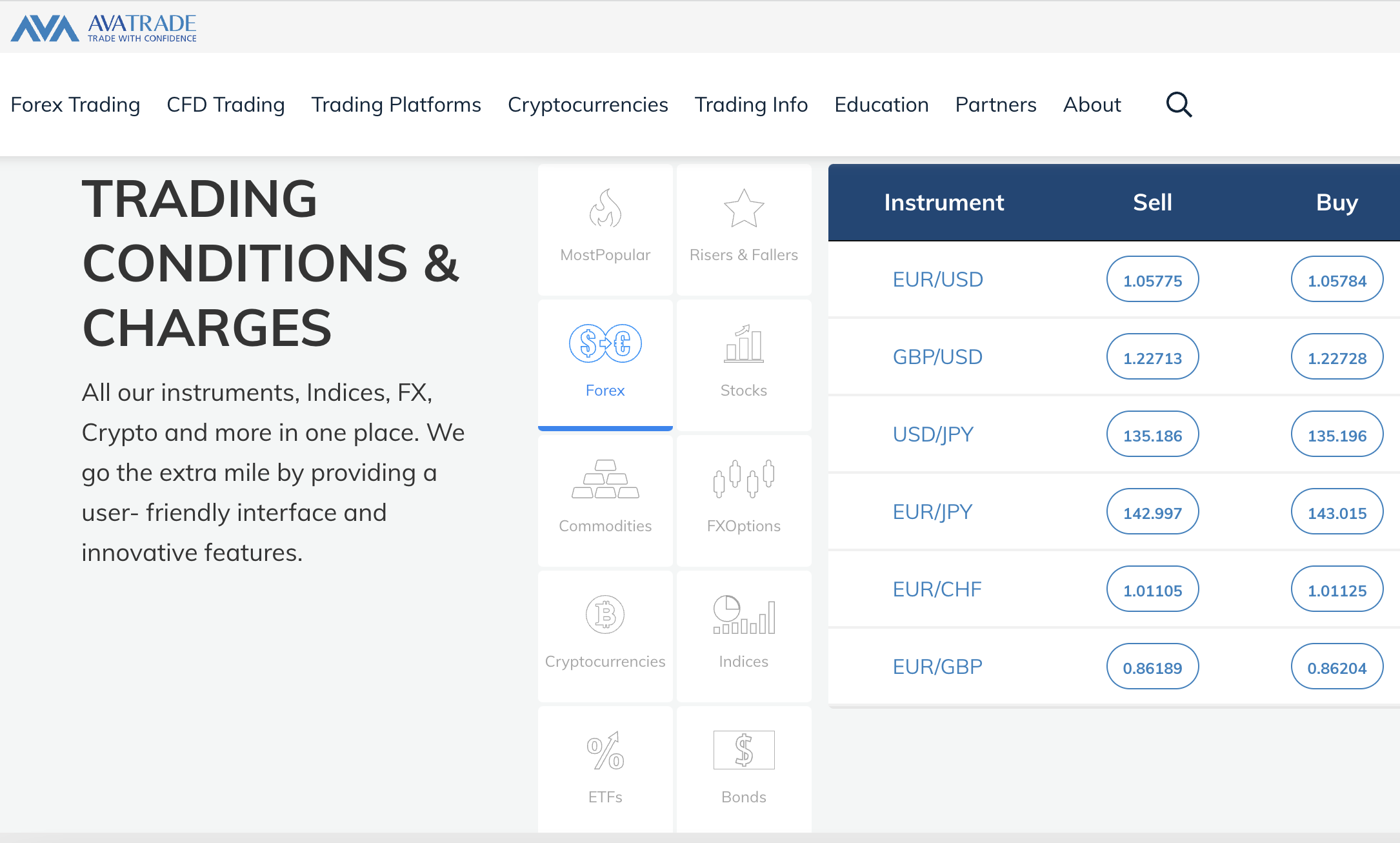

5. AvaTrade – Leverage of up to 1:400 Depending on Location

For instance, those based in locations such as the UK, Europe, or Australia will be capped to the standard 1:30 limit. However, traders in jurisdictions where leverage caps do not apply will likely be offered much higher limits. Professional clients are also catered to at AvaTrade, which will often attract triple-digit leverage ratios.

In terms of supported markets, AvaTrade is a CFD broker. Across over 1,200 financial instruments, account holders will be able to access stocks, indices, cryptocurrencies, commodities, and more. The minimum first-time deposit requirement at AvaTrade is set at an affordable $100 and free demo accounts are offered to all registered users.

| FX Pairs | 55 |

| Max Leverage | Up to 1:400 |

| Commission | 0% |

| EUR/USD Spread | From 0.9 pips |

| Other Assets | CFDs via stocks, indices, commodities, cryptocurrencies |

| Platforms | Web trader, mobile app, MT4, MT5, DupliTrade, ZuluTrade |

| US Clients | No |

| Brokerage Type | CFD (market maker) |

What We Like

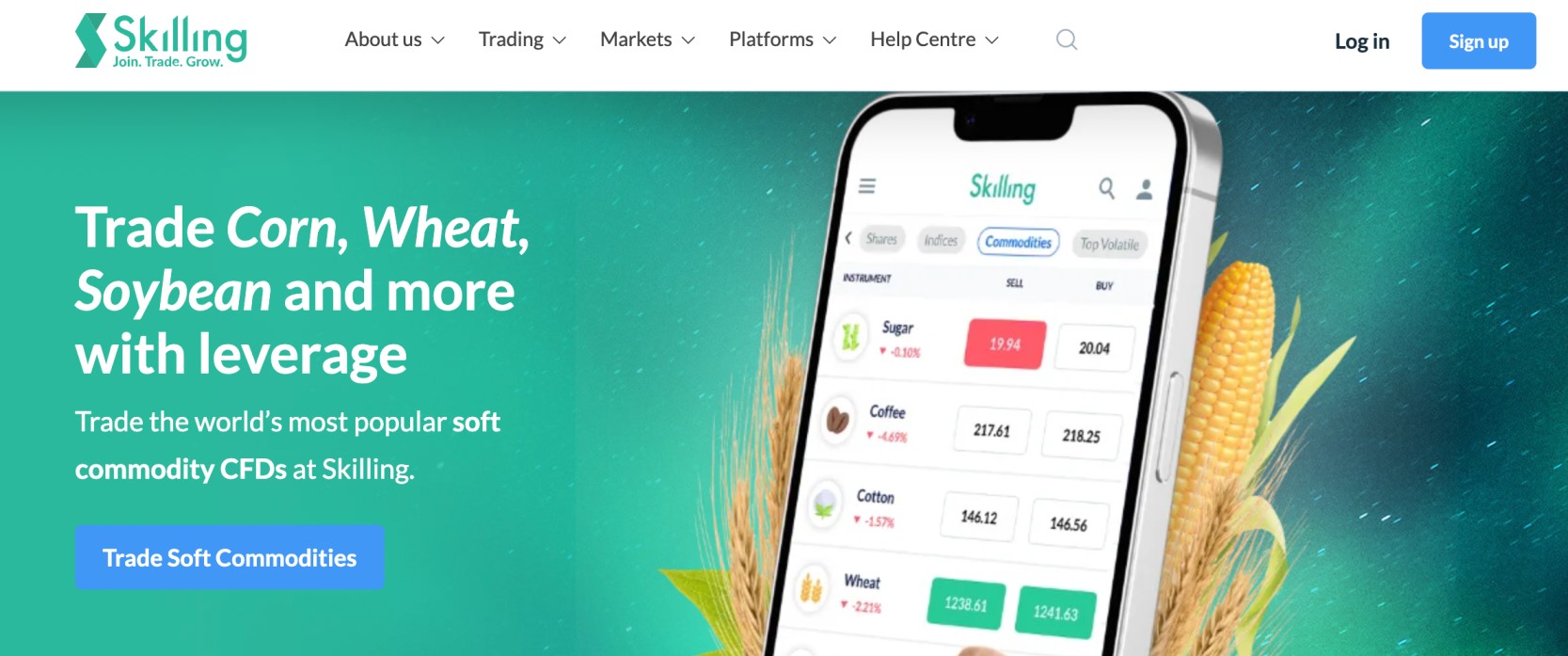

6. Skilling – Access Leverage of 1:500 on Major FX Pairs

Examples here include EUR/USD, GBP/USD, and AUD/USD. Minor FX pairs and gold can be accessed with a maximum leverage ratio of 1:200, while other commodities are capped at 1:100. Cryptocurrencies can be traded with leverage of up to 1:50, but only up to the first $1,000. After that, the leverage is capped at 1:5.

Skilling is a regulated trading platform, which means that certain restrictions will apply. For example, those in the UK and Europe will be capped by the usual 1:30 limit – unless they are a professional client. Supported trading platforms at Skilling include MT4 and cTrader, as well as its own native browser-based interface.

| FX Pairs | 74 |

| Max Leverage | Up to 1:500 |

| Commission | 0% |

| EUR/USD Spread | From 0.5 pips |

| Other Assets | CFDs via stocks, indices, commodities, cryptocurrencies |

| Platforms | Web trader, mobile app, MT4, cTrader |

| US Clients | No |

| Brokerage Type | CFD |

What We Like

7. Forex.com – Best High Leverage Broker for US Clients

Most trading platforms that offer leverage do so via CFD instruments, which US clients cannot access for legal reasons. Forex.com, however, offers direct access to the currency markets without needing to go through CFDs.

Therefore, we found that Forex.com is one of the best US forex brokers with high leverage.

As per domestic regulations, US clients can access leverage of up to 1:50 when trading certain major currency pairs. This is inclusive of EUR/USD, USD/JPY, and USD/CAD. Other forex pairs from the minors and exotics come with lower leverage limits.

We like that Forex.com offers several account types to choose from. Casual investors might consider the standard account, which comes with 0% commission and spreads that start at 1 pip.

There is also a commission account, which attracts a fee of $5 for every $100k traded, and spreads start at 0.2 pips. The STP Pro account offers spreads as low as 0.1 pips – see our guide to the best STP brokers.

| FX Pairs | 80+ |

| Max Leverage | Up to 1:50 for US clients |

| Commission | Depends on the account – from 0% commission |

| EUR/USD Spread | Depends on the account – from 0.1 pips |

| Other Assets | Gold, silver, futures, options |

| Platforms | Web trading, mobile apps, MT4, TradingView |

| US Clients | Yes |

| Brokerage Type | STP, DMA |

What We Like

8. Interactive Brokers – Access to Interbank Currency Quotes

Interactive Brokers is another trading platform that offers leverage to US clients. This platform will appeal to currency traders that wish to access the wholesale markets via interbank currency quotes. This means that Interactive Brokers offers some of the best rates in the market.

For example, spreads on major currency pairs can be accessed from just 1/10 of a pip. Moreover, those trading less than $1 million in a 30-day period will pay a competitive commission of 0.20 basis points. The best commission available is 0.08 basis points, but this requires a minimum monthly trade volume of over $5 million.

Interactive Brokers is able to offer leverage within US regulatory limits, which means 1:50 on major pairs and less on other currencies. We also like Interactive Brokers for its currency trading markets across futures and options. There is no minimum deposit at Interactive Brokers, but a margin requirement will come into play when trading with leverage.

| FX Pairs | 100+ |

| Max Leverage | Up to 1:50 for US clients |

| Commission | Between 0.08 and 0.2 bps |

| EUR/USD Spread | From 1/10 of a pip |

| Other Assets | Stocks, futures, options, mutual funds, ETFs, and more |

| Platforms | Client portal, trader workstation, IBKR mobile, IBKR globaltrader |

| US Clients | Yes |

| Brokerage Type | ECN broker with access to interbank quotes |

What We Like

9. FBS – Highest Leverage in the Market at up to 1:3000

We found that the best high leverage broker for those with an appetite for risk is FBS. The reason for this is that FBS offers leverage of up to 1:3000. This means that for every $100 staked, a trading position of up to $300,000 can be entered.

This is only available on standard and zero-spread accounts. Standard accounts require a minimum deposit of $100 and come without commission alongside spreads that start from 0.5 pips. Those opting for a zero-spread account will be able to trade from 0 pips alongside a commission of $20 per lot.

FBS also offers ECN accounts, which come with a maximum leverage limit of 1:500. This top-rated broker supports a wide selection of asset classes. This covers everything from forex, metals, indices, and energies to stocks and crypto. Trading platforms are inclusive of MT4 and MT5, as well as the native FBS web trader.

| FX Pairs | 28 |

| Max Leverage | Up to 1:3000 |

| Commission | Depends on the account – from 0% |

| EUR/USD Spread | Depends on the account – from 0 pips |

| Other Assets | Metals, indices, energies, stocks, crypto |

| Platforms | FBS web trader, MT4, MT5 |

| US Clients | No |

| Brokerage Type | ECN, DMA |

What We Like

10. HotForex – High Leverage Forex Broker With Limits of up to 1:1000

The final option to consider from our list of the best high leverage brokers is HotForex. As the name suggests, this trading platform specializes in currencies. The platform supports more than 50 pairs across majors, minors, and exotics.

There are multiple account types to choose from, so traders of all levels should find something that suits them. Absolute beginners might consider the micro account, which requires a minimum deposit of just $5 and this comes with a maximum leverage ratio of 1:1000.

This account offers spreads from 1 pip, albeit, no commissions apply. More experienced traders might consider the zero-spread account, which offers spreads from 0 pips on major forex pairs and a standard commission of $3 per lot traded. In addition to forex, this top-rated broker also offers CFDs via stocks, indices, commodities, and more.

| FX Pairs | 50 |

| Max Leverage | Up to 1:1000 |

| Commission | Depends on the account – from 0% |

| EUR/USD Spread | Depends on the account – from 0 pips |

| Other Assets | CFDs via crypto, stocks, indices, commodities, and more |

| Platforms | MT4, MT5 |

| US Clients | No |

| Brokerage Type | ECN, STP |

What We Like

Best High Leverage Forex Brokers Compared

Choosing the best high leverage broker requires in-depth research across a variety of important metrics.

The comparison table below summarizes the information that we provided in our brokerage reviews.

| High Leverage Brokers | FX Pairs | Max Leverage | Commission | EUR/USD Spread | Other Assets | Platforms | US Clients? | Brokerage Type |

| eToro | 49 | 1:30 for retail clients | 0% stocks and ETFs, spread-only on CFDs | 1 pip | Stocks, ETFs, indices, commodities, cryptocurrencies | Web trader, mobile app | Yes | Broker-dealer, CFD |

| AvaTrade | 55 | Up to 1:400 | 0% | 0.9 pips | CFDs via stocks, indices, commodities, cryptocurrencies | Web trader, mobile app, MT4, MT5, DupliTrade, ZuluTrade | No | CFD |

| Skilling | 74 | Up to 1:500 | 0% | 0.5 pips | CFDs via stocks, indices, commodities, cryptocurrencies | Web trader, mobile app, MT4, cTrader | No | CFD |

| Pepperstone | Dozens of pairs | Up to 1:200 | $3.50 for 1 lot traded on raw spread account | 0 pips on raw spread account | CFDs via stocks, indices, commodities, cryptocurrencies, currency indices | MT4, MT5, cTrader | No | CFD |

| Forex.com | 80 | Up to 1:50 for US clients | From 0% | From 0.1 pips | Gold, silver, futures, options | Web trading, mobile apps, MT4, TradingView | Yes | STP, DMA |

| Interactive Brokers | 100 | Up to 1:50 for US clients | Between 0.08 and 0.2 bps | From 1/10 of a pip | Stocks, futures, options, mutual funds, ETFs, and more | Client portal, trader workstation, IBKR mobile, IBKR globaltrader | Yes | ECN |

| FBS | 28 | Up to 1:3000 | From 0% | From 0 pips | Metals, indices, energies, stocks, crypto | FBS web trader, MT4, MT5 | No | ECN, DMA |

| HotForex | 50 | Up to 1:1000 | From 0% | From 0 pips | CFDs via crypto, stocks, indices, commodities, and more | MT4, MT5 | No | ECN, STP |

What is Leverage in Trading?

Leverage allows traders to enter positions with more money than they have in their brokerage account. Each broker will offer certain leverage limits, which are typically displayed as a ratio.

- For example, let’s say that the broker offers leverage of 1:10.

- If the trader stakes $50 at 1:10, this amplifies the value of the position to $500.

- As such, if the trader makes gains of 20% on this position, they will make $100 ($10 x 10) as opposed to just $10 (20% of $50 stake).

The main concept of leverage trading is that it allows investors to access a much higher level of capital.

This is especially important when trading forex, as price movements are often very small in percentage terms. Therefore, this can make it difficult to make an attractive amount of money with a small capital outlay.

Leverage limits are dependent on several factors, such as:

- The country of residence that the trader lives

- The asset class

- The broker

- Whether the trader is a retail or professional client

While leverage does offer the ability to amplify investment gains, it can do the same with losses. As such, beginners should tread carefully when applying leverage for the first time.

High Leverage Definition

Whether or not the amount of leverage available to a trader is deemed ‘high’ is subjective. With that said, if the trader is based in a country where clear limits exist, anything above this level might be considered high.

For example, traders in the UK, Europe, and Australia are capped to a maximum leverage ratio of 1:30 when trading major forex pairs, and less on other assets.

This is due to regulatory guidelines set by the ruling financial authority such as the UK’s FCA. Nonetheless, should the trader find a broker that offers higher limits than 1:30, this would be considered a high leverage platform.

It is important to note that when searching for the best forex brokers with high leverage, traders should ensure that the platform is adequately regulated.

That is to say, there are many offshore brokers that offer leverage limits above and beyond the 1:30 level, but whether or not the investment capital is safe remains to be seen.

Benefits of Trading with High Leverage

The main benefits of trading with high leverage are discussed below:

Ideal for Traders on a Budget

Leverage is highly suitable for skilled traders that wish to make a living from their investment endeavors but do not have a suitable amount of capital.

- For instance, let’s say that a trader is able to make average gains of 4% per month over the course of a year.

- While at first glance this is an impressive feat, an initial starting balance of just $500 would not make the process worthwhile.

- After all, in real terms, this amounts to a monthly profit of just $20.

However, let’s then say that the trader utilizes leverage of 1:30 on each and every trade. In the same scenario, this would boost the monthly profit to $600.

Suitable for Low Volatility Markets

Another benefit of trading with leverage is that it is highly suitable for low volatility markets. For instance, major forex pairs like EUR/USD rarely move by more than 1-2 in a single day of trading.

Unlike stocks, the aim isn’t for a currency pair to increase in value indefinitely. Instead, currencies typically go through trends and cycles which can be both bullish and bearish.

The key point here is that it can be difficult to make worthwhile profits from low-volatility markets. But, when implementing leverage, this can turn a small gain into a highly sizable profit.

Great for Low-Risk, High-Profit Trades

The best high leverage brokers offer negative balance protection. This means that when trading with leverage, the user can never lose more than they have in their brokerage account.

And therefore, this makes leverage ideal for targeting low-risk, high-profit trades.

- For example, let’s say that the trader stakes $100 with leverage of 1:1000.

- This turns the $100 position into trading capital of $100,000.

As per the above, only two things can happen. Either the trade results in a maximum loss of $100 or gains are multiplied by a factor of 1,000x.

Risks of Trading with High Leverage

The main risks of trading with high leverage are discussed below:

Liquidation

The most obvious risk of trading with leverage is that the position can be liquidated. This will happen when the position declines in value by a certain amount.

For example, let’s say that leverage of 1:20 is added to a stake of $100. This means that with a stake of just $100, the trader places a position worth $2,000. This amounts to just 5% of the trading position.

Therefore, if the trade declines by 5%, the broker will be forced to liquidate the position and the trader will lose their $100 stake.

Most Leverage Traders Lose Money

By visiting a high leverage trading platform that specializes in CFDs, a risk warning is typically displayed. This informs the user of the percentage of retail clients that end up losing money. More often than not, this figure is in the 70-80% region.

As such, a lot more traders lose money when accessing leveraged markets when compared to those that generate a consistent profit.

How to Trade with a High Leverage Broker

The guide below explains how to start trading assets right now with a high leverage broker.

For this tutorial, we explain the steps with eToro – which offers leverage on thousands of financial instruments.

Step 1: Open an eToro Account

First, visit the eToro website and create an account. This will require some personal information and contact details.

eToro will also ask for a copy of a passport or a driver’s license for verification purposes.

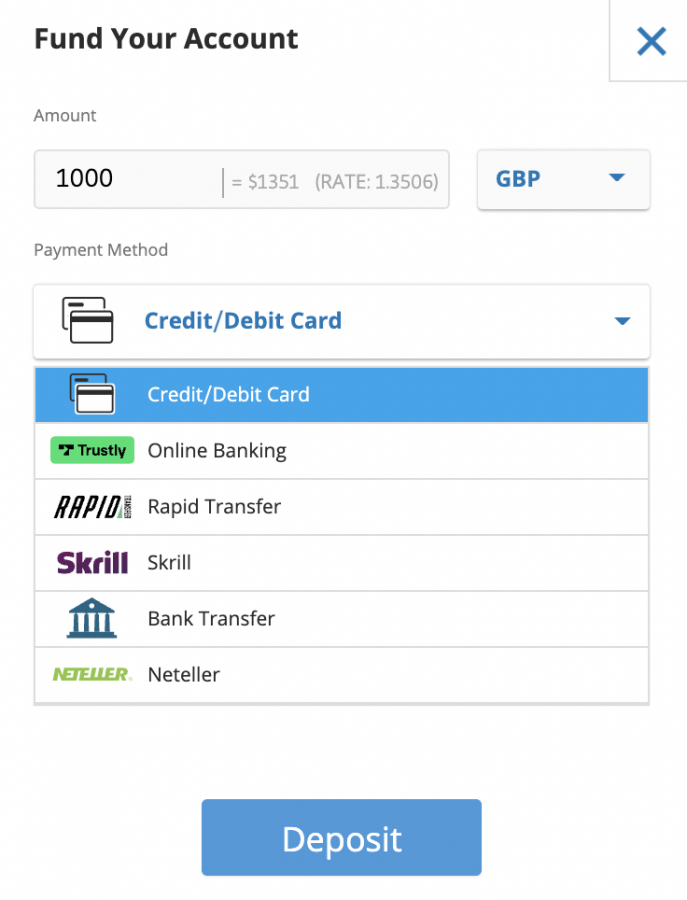

Step 2: Deposit Funds

Next, add some money to the newly created eToro account.

- A minimum of $10 is required when funding an account

No deposit fees are charged by eToro.

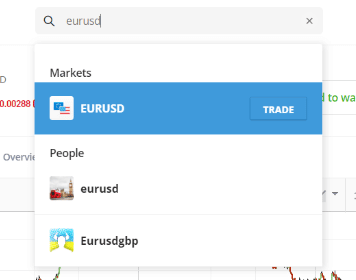

Step 3: Search for Asset

Next, use the search bar at the top of the page to find an asset to trade.

The above example highlights how to search for the forex pair EUR/USD.

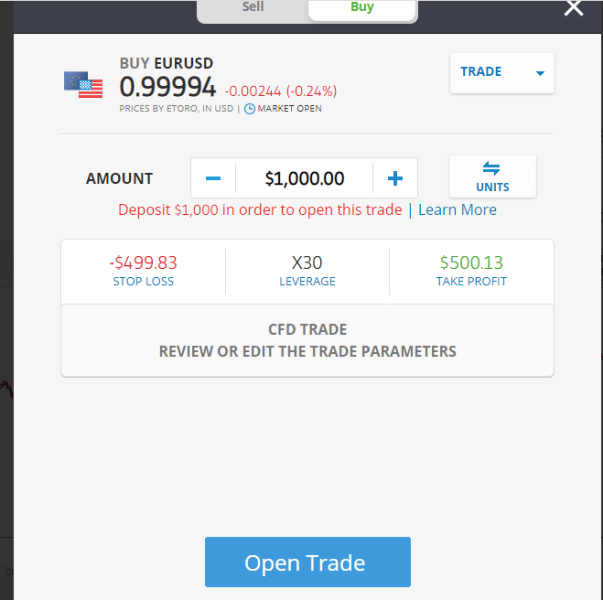

Step 4: Trade Forex

Finally, choose from a buy or sell order, depending on whether the trader thinks the asset will rise or fall in value.

Enter a stake and confirm the order.

Conclusion

This guide has compared the overall best high leverage brokers to consider today.

When choosing a suitable platform, it is important to focus on metrics other than just maximum leverage limits. On the contrary, the investor should explore fees, supported markets, customer service, regulation, and more.

To conclude, we found that the overall best high leverage broker is eToro. The platform not only offers tight spreads, but thousands of markets in a fully regulated trading environment.

79% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.