Many British investors say they want to invest in British companies in a diversified way, so they might search online for the best index fund UK. But what do we mean by ‘best’ when it comes to index funds?

Below we look at some of the best index funds to invest in from a number of key perspectives including investment return, cost and stock diversification. We outline the scope of index funds in the UK, taking in mutual funds as well as ETFs. And we ask, when it comes to growth potential, if investors should consider the best crypto presales instead – particularly with a couple of undiscovered crypto gems on our radar right now.

Best Index Funds UK to Watch in 2023

What makes the best index fund to invest in is down to the investor to decide – but below we scope out some common popular features, as well as feature some well-known index funds.

- Crypto Presales – Better Alternative to UK Index Funds

- Fidelity Index World Fund – One of the Leading Index Tracker Funds For Large-Cap Blend Stocks

- iShares Core FTSE 100 UCITS ETF (ISF) – Most Popular Index Funds UK for FTSE 100 Coverage

- Legal & General All Stocks Gilt Index Trust – Invests Exclusively in UK Government Bonds

- iShares Core £ Corp Bond UCITS ETF (SLXX) – Index ETF Tracking UK Corporate Bonds

- Vanguard Lifestrategy 100% Equity – Popular Index Funds UK According To Investors

- iShares MSCI UK Small Cap UCITS ETF (CUKS) – Broad Coverage of the UK Small Cap Sector

- FTSE 250 UCITS ETF (VMID) – Trending with Investors Looking for Mid-Cap UK Company Stocks

- HSBC FTSE 250 Index Fund – Tracks the influential UK Mid-Cap FTSE 250 Index

- FTSE Global All Cap Index Fund – Trusted Index Funds to Invest In For Global Equity Coverage

- iShares Emerging Markets Equity Index Fund (UK) – For Affluent UK Investors Seeking Emerging Markets Exposure

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof & CoinSniper Audited

- Strong Community of 70,000 Traders

Crypto Presales – A Better Alternative To UK Index Funds

UK index funds are held to be a low-cost way to benefit from rising markets. Investors can benefit from the easy accessibility of index funds in ETF format, as well as skip having to make stock selections themselves. But index funds are rarely numbered amongst the best short-term investments UK.

For investors wanting financial assets with immediate growth potential, the obvious answer is cryptocurrency presales.

With crypto presales, the investor can buy a new crypto before it gets listed for general trading on an exchange. Just as with pre-IPO stocks in the conventional stock market, this brings with it real opportunity to buy at bargain prices. Crypto presales are organized into stages. Critically, the price increases with each stage. So an investor who gets in early will earn a guaranteed paper profit. And, provided the crypto does not tank at its listing, this profit can then be realized; the crypto in question could, of course, rocket at listing too.

We have identified two exciting crypto presales on right now:

- Dash 2 Trade is a revolutionary new crypto analytics project backed by an established and successful team.

- IMPT is a crypto in the green space which makes it easy for consumers to offset their own carbon footprint using carbon credits.

1. Dash 2 Trade (D2T) – Pioneering Crypto Analytics and Signals Platform in Presale Now

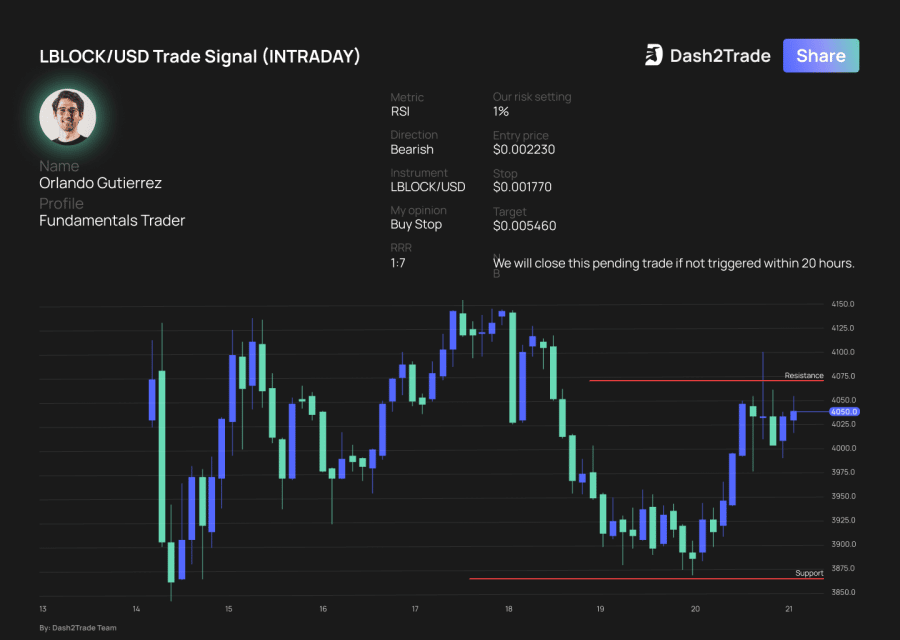

What makes Dash 2 Trade stand out straight away is its provenance. This project – which brings first-rate market intelligence to crypto investors with a suite of powerful analytics – is brought to market by the team behind established signals platform, Learn 2 Trade.

This means that there is already a global community of 70,000 users switched on to Dash 2 Trade’s potential. And, with a subscription to Dash 2 Trade services payable using its in-house token D2T, this sets the project’s tokenomics on a good footing.

With 21,000+ crypto out there, it is difficult for retail investors to pick a winner. With Dash 2 Trade, the investor can get stuck into crypto armed with data and insights – as well as refine their trading strategy and even get graded information on hot new crypto presales.

As well as delivering regular trading signals, the platform uses cutting-edge data analytics to analyse sentiment around crypto on social media and thus pinpoint emerging crypto. A demo mode is available too for investors to try out trading strategies without committing funds.

Excitement over Dash 2 Trade is mounting. The project is in stage 3 of its presale, with a D2T token on sale for just 0.0513 USDT. As soon as the project progresses to stage 3, the price will jump to 0.0533 USDT – so that’s a guaranteed profit for those investors who buy now. And, with 9 presale stages in all, the price will continue to rise.

- In stage 1 of its presale D2T was available for 0.0476.

- At stage 9, it will be available for 0.0662 USDT.

- That’s a locked-in price increase of 39% across the presale. It pays to get in early.

| Price Stage | Amount Raised In Stage | Token Allocation |

| $0.0476 | $1,666,000 | 35,000,000 |

| $0.0500 | $3,500,000 | 70,000,000 |

| $0.0513 | $3,591,000 | 70,000,000 |

| $0.0533 | $4,663,750 | 87,500,000 |

| $0.0556 | $4,865,000 | 87,500,000 |

| $0.0580 | $5,075,000 | 87,500,000 |

| $0.0606 | $5,302,500 | 87,500,000 |

| $0.0635 | $5,556,250 | 87,500,000 |

| $0.0662 | $5,792,500 | 87,500,000 |

A maximum supply of 1 billion tokens applies, with 70% available during the presale stages. No vesting period applies.

Investors can confirm the exciting potential of this project with the Dash 2 Trade whitepaper. To stay on top of breaking news, join the Dash 2 Trade Telegram group.

How to Buy D2T

Investors can buy D2T in just four steps:

- Set up a MetaMask crypto wallet.

- Connect the wallet to the Dash 2 Trade presale platform.

- Purchase D2T using Tether (USDT) or Ethereum (ETH).

- Receive D2T tokens when the presale phase completes.

| Min Investment | 1000 D2T |

| Max Investment | NA |

| Purchase Methods | ETH, USDT |

| Blockchain | Ethereum (ERC-20 token) |

2. IMPT – Revolutionary Crypto Carbon Offsetting Project in Presale Now

IMPT uses the power of the blockchain to make it easy for consumers to offset their carbon footprint. With climate change unlikely to leave the headlines, the green space is a marketplace with giant opportunities.

- IMPT users may buy carbon credits on the IMPT platform using in-house token IMPT. These carbon credits are minted into NFTs. They can then be traded on the IMPT marketplace. Alternatively, users can offset their own carbon footprint by burning their credits onsite.

- For extra convenience, users can earn IMPT tokens as they shop. IMPT has partnered with thousands of brands and deployed deep-linking to ensure that users’ IMPT balance is automatically topped up every time they engage with partner brands.

What makes IMPT stand out is the team’s clever use of the blockchain to make carbon credits a safe area for consumer investment.

As investors will find out who research how to buy carbon credits UK, carbon credit trading is largely the domain of institutions and corporations. The entire market is bedeviled by fraud and double-counting. With IMPT, users can be sure their carbon credits are authentic; not only because they originate from authorised issuers, but also because the blockchain ensures that fraud and double-counting cannot take place.

Investors looking for green cryptocurrency snapped up the IMPT token in stage 1 of its presale – it sold out four weeks ahead of schedule.

Right now, investors have already committed $12.5 million. The presale is at stage 2, with IMPT available at $0.023. Time is running out – stage 2 ends when its remaining tokens are sold out or by January 31st, 2023. And there are only 3 stages to the presale.

- At stage 3, IMPT will be available for $0.028 – a 55% price increase from stage 1’s price of $0.018. Investors who buy now are guaranteed to be holding coins that are later priced higher.

How to Buy IMPT

Investors can buy IMPT in four steps:

- Set up a MetaMask crypto wallet.

- Connect the wallet to the IMPT token presale platform.

- Purchase using Tether (USDT), Ethereum (ETH) or fiat currency with credit card.

- Receive IMPT tokens when the presale phase ends.

| Min Investment | $30 recommended |

| Max Investment | NA |

| Purchase Methods | ETH, USDT, fiat |

| Blockchain | Ethereum (ERC-20 token) |

Best UK Index Funds Reviewed

Below we outline the scope of the UK market in our search to pinpoint the best index fund to invest in.

- All featured funds are denominated in GBP and available in the UK.

- Some feature a UK perspective on domestic stocks, whilst others take a wider sweep.

2. Fidelity Index World Fund P Accumulation – One of the Best Index Tracker Funds For Large-Cap Blend Stocks

The fund is classified by Morningstar as a ‘large-cap blend’. This means that it holds shares in companies with mostly large market capitalizations with a ‘blend’ of value, core and growth stocks. Value stocks, broadly speaking, are established stalwarts of their sector; growth stocks are newer companies with good growth prospects; and core companies have features of both types. The top 3 holdings are Apple (5.01%), Microsoft (3.33%), and Amazon (1.88%).

69.52% of this fund’s stocks are US-based, with 7.86% based in the Eurozone, 6.01% Japanese, and 4.3% UK-based – with Australasia, Canada, and Asia covered too.

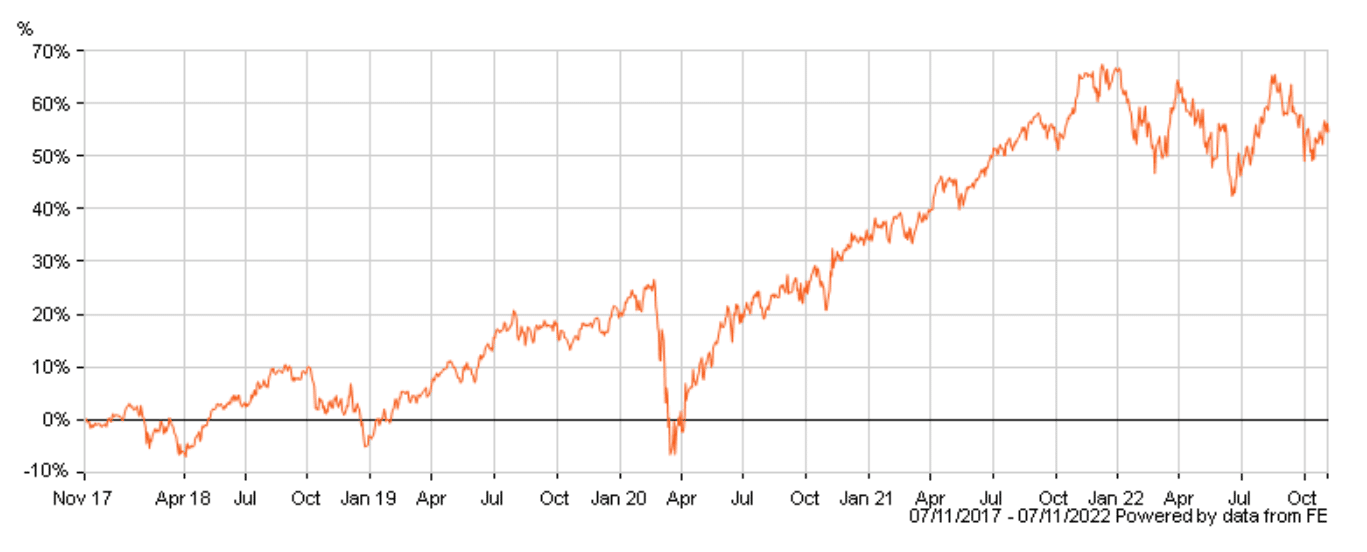

This fund is an accumulator – which means any dividends are automatically reinvested in the fund. With an ongoing charge of 0.12%, it is almost twice as cheap as its Vanguard global index fund counterpart featured below. The fund features a dividend yield of 2.56%.

3. iShares Core FTSE 100 UCITS ETF (ISF) – Amongst the Best Index Funds UK for FTSE 100 Coverage

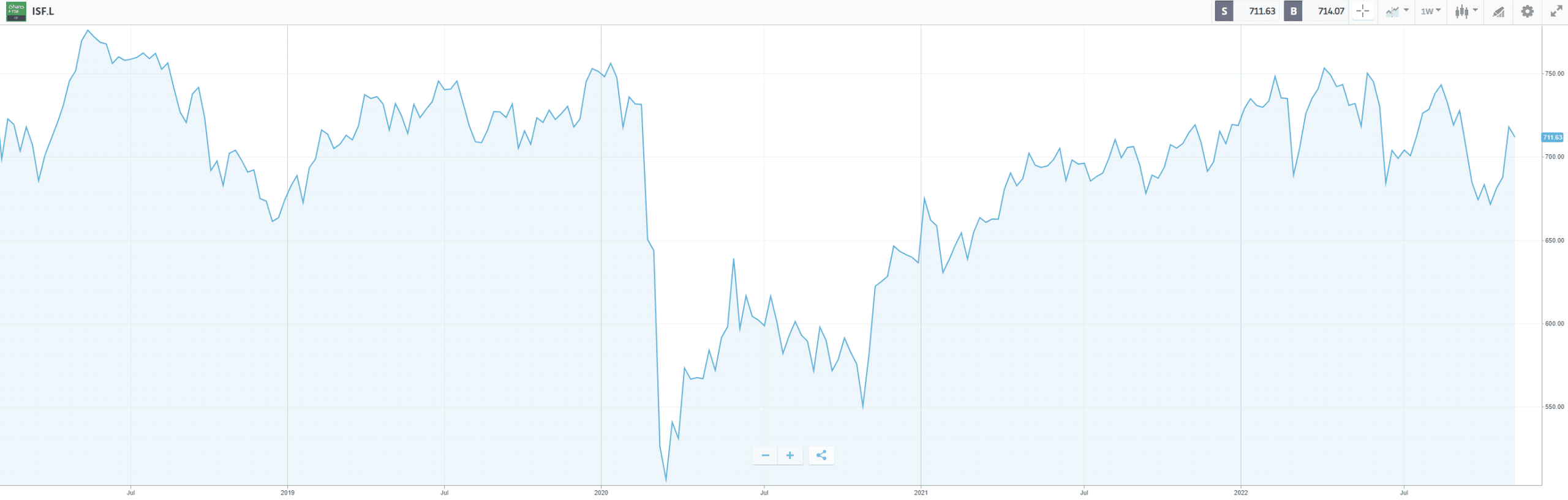

This £10.5 billion ETF has exactly 100 UK stock holdings. That is because it is one of the FTSE 100 index funds available. It tracks the FTSE 100 index, which covers the top 100 biggest companies in the UK. Launched in 2000, the fund is denominated in GBP. With a Total Expense Ratio of just 0.07%, the fund is the best index fund to invest in from the point of view of the running costs of those we review here.

ISF’s top 3 holdings are:

- UK oil giant Shell (SHEL), with 9.58% of the index fund portfolio.

- UK pharmaceuticals giant AstraZeneca (AZN): 8.23%.

- Consumer goods giant Unilever: 5.35%.

Consumer Staples is the biggest sector covered – with an allocation of 19.24%. Financials is second with 16.53%, and Energy is third with 14.60%.

ISF is one of the best sustainable investments UK from the point of view of MSCI ESG ratings – scoring AAA. It is listed on 7 international exchanges and is available in denominations of GBP, CHF, EUR, MXN and USD. The fund returned 18.3% in 2021, but suffered throughout 2020 with pandemic woes to the tune of -11.6%.

4. Legal & General All Stocks Gilt Index Trust – Invests Exclusively in UK Government Bonds

Bonds are issued with a variety of maturity dates. Bonds with short maturity are the dominant type in this index fund portfolio. 33.6% is allocated to bonds with a maturity of 0-5 years, 22.5% to 5-10 year bonds, and varying allocations of bonds with up to 40 years maturity.

From the table below, we can see that this fund registered a loss of almost 24% for 2022. Bonds issued by a sovereign authority are considered to be of the highest quality in terms of risk – as governments are expected to be in a position to honour their bonds. But 2022 has been recognised as a terrible year for bonds, and even broad based index funds have suffered.

| Year | Rolling 12-month Performance to Last Quarter End |

|---|---|

| 2018 | 0.64% |

| 2019 | 12.43% |

| 2020 | 3.82% |

| 2021 | -6.93% |

| 2020 | -23.34% |

The idea of bond index funds is to provide growth in the value of the fund as well as regular returns – or ‘distributions’ as they are known. Bond distributions are like stock dividends, in that they are paid on a regular basis. In the case of this accumulation fund, the 1.4% distribution yield is automatically re-invested. Dividends are paid twice a year, with the most recent paid out on 25th July 2022 at 0.87p to the share; each share is valued at £186.10.

5. iShares Core £ Corp Bond UCITS ETF (SLXX) – Index ETF Tracking UK Corporate Bonds

This index ETF gives investors exposure to the UK corporate bond market. Launched in 2004, the fund has 478 holdings worth £1.4 billion. It tracks the Markit iBoxx GBP Liquid Corporates Large Cap Index, which gives exposure to bonds issued in GBP by UK, European, and US banks and major corporations. In the table below, we can see the top five bond issuers:

| Issuer | Portfolio Weight |

|---|---|

| HSBC Holdings | 3.36% |

| Electricite de France | 2.69% |

| EON International Finance | 2.43% |

| AT&T Inc | 2.43% |

| Glaxosmithkline Capital Plc | 2.38% |

32.44% of SLXX bonds are issued by banks, 10.57% by communications companies, and 9.53% by firms working in the Consumer Non-Cyclical sector. 51.22% of its bonds are BBB rated, with only 1.83% AAA-rated.

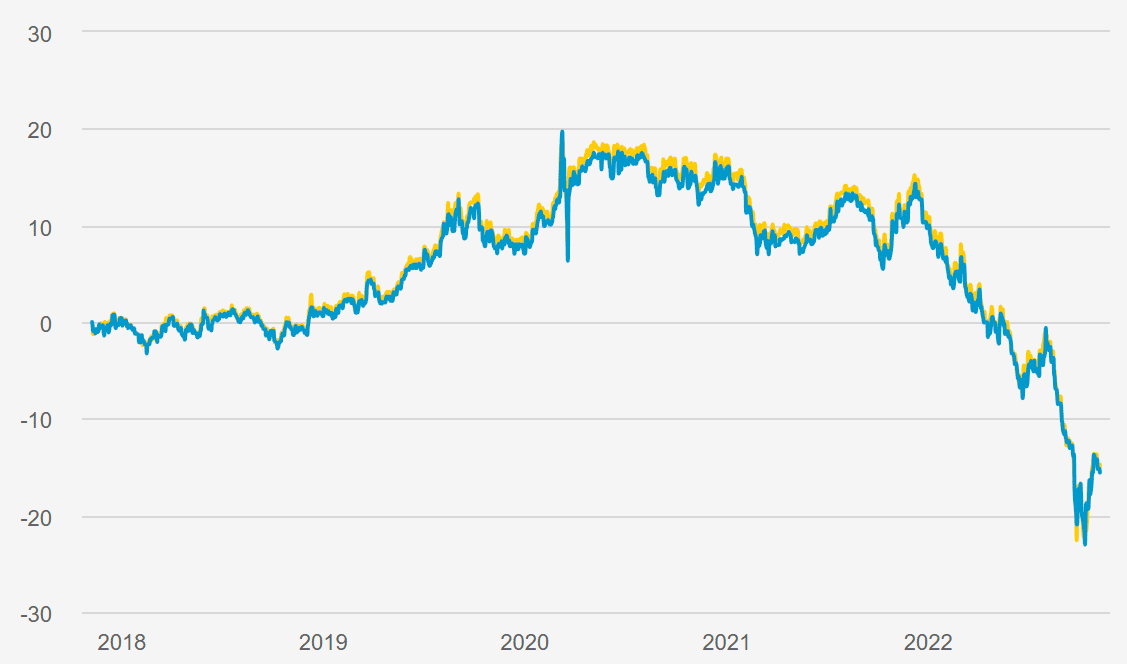

SLXX has a 12-month trailing yield of 2.63%. In terms of total return, it had good years in 2019 (11.2% return) and 2020 (8.9% return), but fell in value by 4.1% in 2021. SLXX is not one of the best index funds to invest in when it comes to ongoing fees, with a Total Expense Ratio of 0.20%.

This fund is a good example of why the convenience of ETFs has made them so popular amongst retail investors compared to mutual funds. Whereas the iShares Corporate Bond Index Fund (UK) – which gives access to the UK bond universe – stipulates a minimum investment of £1 million, this ETF has no minimum investment requirement.

6. Vanguard Lifestrategy 100% Equity – One of the Best Index Funds UK According To Investors

This fund invests in ten of the best Vanguard index funds in terms of gaining a broad coverage of global equity. For example:

- 19.7% of its £4.1 billion portfolio is allocated to the Vanguard FTSE UK All Share Index Unit Trust.

- 16.0% is devoted to what is colloquially known as the Vanguard 500 index fund – the Vanguard S&P 500 UCITS ETF. (As it is an ETF rather than a mutual fund, the latter is arguably the best S&P 500 index fund issued by Vanguard in terms of investor convenience.)

- Other funds tracked by this fund cover equities in emerging markets, developed Europe, Japan, and the Pacific.

(Strictly speaking, therefore, this fund is not an index fund – but rather a fund of index funds.)

Notably, this fund reinvests all distributions, and thus is called an ‘accumulation fund’. It is available via Vanguard directly and other fund providers. It features an ongoing fee of 0.22.%.

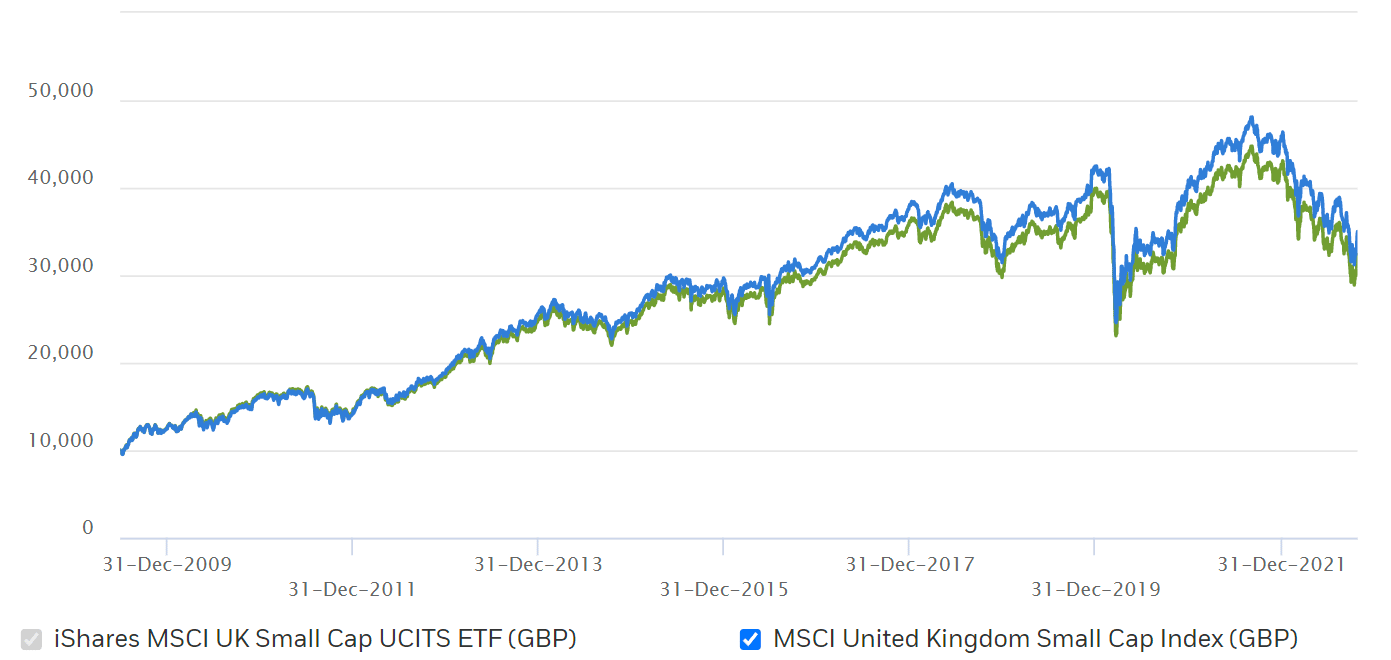

7. iShares MSCI UK Small Cap UCITS ETF (CUKS) – Broad Coverage of the UK Small Cap Sector

Launched in 2009, this £190m ETF tracks 270 stocks. It follows the MSCI United Kingdom Small Cap Index. This index (launched in 2001), accounts for roughly 14% of the market capitalisation of UK firms. The average market capitalisation of the firms it covers is £1.085 billion – though the smallest comes in at just £35 million.

From the table below we can see CUKS’s top five holdings by portfolio weight:

| Stock | Portfolio Weight |

|---|---|

| Weir Group Plc | 1.50% |

| Centrica Plc | 1.49% |

| Rightmove Plc | 1.39% |

| RS Group Plc | 1.38% |

| Smith (DS) Plc | 1.36% |

Industrials is the top sector covered, with 20.59% portfolio allocation. Second is Financials, with 16.64%. And third is the Consumer Discretionary sector, claiming 13.78% of the portfolio.

CUKS had a good year in 2021, rising in value by 13.9%.

With a Total Expense Ratio of 0.59%, this ETF is not one of the best index funds UK in terms of running costs.

8. FTSE 250 UCITS ETF (VMID) – For Investors Looking for Mid-Cap UK Company Stocks

Launched in 2014, VMID has total assets of £1.4 billion.

The FTSE 250 has an average market capitalisation per company featured of £1.6 billion. (By contrast, the average company featured in the large-cap FTSE 100 is worth £30 billion.) The top five companies in VMID by portfolio allocation are:

| Stock | Portfolio Weight |

|---|---|

| Weir Group Plc | 1.21% |

| Greencoat UK Wind Plc | 1.16% |

| Beazley Plc | 1.13% |

| Johnson Matthey Plc | 1.10% |

| Hicl Infrastructure Plc | 1.09% |

44% of VMID stocks are in the financial sector. The Industrial sector accounts for 15.8%, and the Consumer Discretionary sector accounts for 12.9%.

Stocks in VMID feature an average earnings on growth rate of 7.3%. This figure shows that, across the portfolio, companies have increased their annual earnings on average by 7.3% each year for the last five years.

9. HSBC FTSE 250 Index Fund – Tracks the UK Mid-Cap FTSE 250 Index

The fund has 168 equity holdings. And the dominant category is medium-cap core companies, accounting for 22.57% of the index fund portfolio.

From the table below, we can see that four of its five top five stocks are the same as those in the Vanguard FTSE 250 UCITS ETF, but differ marginally in proportion:

| Stock | Portfolio Weight |

|---|---|

| Weir Group Plc | 1.26% |

| Beazley Plc | 1.20% |

| Johnson Matthey Plc | 1.11% |

| abrdn Plc | 1.09% |

| Greencoat UK Wind | 1.08% |

This fund is structured as an Open Ended Investment Company (OEIC). It is accessible via Fidelity with a Stocks and Shares ISA, a Junior ISA, a SIPP, Junior SIPP or Investment Account.

Launched in 1997, the fund did particularly well during the market recovery from the Pandemic, realizing a gain of 37.72% between 2020 and 2021. Since the markets have fallen back over inflation fears, its performance slackened to lose 24.57% of its value between 2021 and 2022.

10. FTSE Global All Cap Index Fund – Amongst the Best Index Funds to Invest in For Global Equity Coverage

Available to UK investors, this accumulator fund invests in a total of 7,193 stocks with a portfolio worth £1.8 billion. Launched in 2016, the fund tracks the FTSE Global All Cap Index.

This one of Vanguard’s broad-based index funds. The scope of its portfolio includes companies of all sizes from both developed and emerging markets around the world.

63.7% of the portfolio is dedicated to North American stocks, 14.8% to European stocks and 10.7% to Pacific stocks. Technology stocks are the top sector covered, with 20% of the portfolio, followed by Financials with 14.5% and Consumer Discretionary with 14.2%.

The three top holdings are Apple (APPL) with 3.52% of the portfolio, Microsoft with 2.90% and Amazon with 1.68%.

The fund has an ongoing charge of 0.23%. Thanks to its 10.5% exposure to emerging markets, the fund has a relatively high risk rating of 5/7.

11. iShares Emerging Markets Equity Index Fund (UK) – For Affluent UK Investors Seeking Emerging Markets Coverage

This fund gives UK investors the chance to get index fund coverage of emerging markets – provided they can stump up the minimum investment required of $100,000. The fund, launched in 2019, tracks the FTSE Emerging Index. It has 1781 equity holdings with an average P/E ratio of 10.97.

The top 3 countries covered are:

- China: 29.18% of fund stocks.

- India: 19.34% of fund stocks.

- Taiwan: 14.70% of fund stocks.

Other emerging markets covered include Brazil, Saudi Arabia, South Africa, Mexico, Thailand and Indonesia.

The dominant sector is Financials, which accounts for 24.08% of the portfolio. Technology accounts for 19.61%, and Consumer Discretionary accounts for 11.85%. The top five holdings are:

| Stock | Portfolio Weight |

|---|---|

| Taiwan Semiconductor Manufacturing | 5.47% |

| Tencent Holdings Ltd | 2.96% |

| Alibaba Group Holdings Ltd | 2.21% |

| Reliance Industries Ltd | 1.94% |

| Infosys Ltd | 1.24% |

The fund charges an OCF of 0.20%. In 2021, the fund returned 0.4%, compared to 2020 growth of 11.3%.

- Gaining exposure to emerging markets is considered to be a riskier undertaking than engaging with US, UK and European markets, so caution is advised.

What are Index Funds?

The essential definition of an index fund is any mutual fund, Open Ended Investment Company (OEIC), or ETF which follows a stock market index of any kind.

Indices follow a basket of stocks on a national, regional, sector or thematic basis.

Index funds thus do not try and beat the market by clever stock selection. They aim to follow a particular take on the markets and benefit from their upwards trajectory in a broad-based way. This works well in times of rising markets – but in times of recession? Crypto presales look a better option for short-term investment return.

Why Invest in Index Funds?

There are four compelling reasons to consider index funds as a welcome addition to an investing portfolio:

1. Diversified For Good Risk Management

The whole point of any fund – including UK index funds – is that their stock basis is diversified. This protects the investor against catastrophes affecting single stocks. Because the fund has definitively not put all its eggs in one basket, it can weather such events.

2. Cheap Fees

With the advent of ETFs since the turn of the millennium, funds are a lot cheaper than they used to be.

- Look for the TER (Total Expense Ratio) or OCF (Ongoing Charge Figure) on a fund’s online profile to see how much you will be charged a year as a contribution to running costs.

- This charge will be automatically deducted from your investment account if it is a mutual fund, or directly from your transaction costs if you are trading ETFs.

3. Easy to Invest In

ETFs have ushered in a whole new era of accessibility for funds. Index fund investing in the UK can be achieved easily via standard online brokerage accounts by browsing through the available ETFs, and buying shares in them; just like tracking down the best shares to buy UK.

4. Dividends/Distributions

Index funds pay the dividends distributed by stocks they cover. These dividends are payable on either a quarterly, bi-annual, or annual basis. If the fund is an accumulation fund, these dividends are automatically re-invested in the fund.

How to Invest in Index Funds UK

Investors who have learnt how to buy shares online know how easy it is nowadays. And to invest in index funds in the UK is just as easy – particularly with ETFs (Exchange-Traded Funds).

Index funds investing involves:

- Finding an online broker that offers either index mutual funds or ETFs.

- Signing up with that broker and getting verified with ID.

- Depositing funds.

- To buy into mutual funds, opening an investment account will be necessary; ETFs, on the other hand, can be traded just like conventional shares.

Mutual funds may generally be held in an investment ISA, SIPP (Self-Invested Personal Pension) or investment account with the fund issuer/some brokers.

How to Pinpoint the Best Index Fund to Invest in

How do we rate the best index fund performance? The best index fund to invest in from one angle may be all wrong from another. Here are some common criteria used by investors when they buy index funds:

- Type: what type of stocks does an index fund include?

- Investment Return: By what percentage has the index fund grown?

- Risk: Does the index fund offer high potential returns at the cost of high risk?

- Running Cost: What Total Expense Ratio (TER) or OCF (Ongoing Charges Figure) does the fund have?

- Accessibility: Can investors gain exposure to the index fund via the markets, or must they subscribe with a special investment account?

1. Type

Ratings agency Morningstar categorises some funds according to the type of stocks they include. This helps the investor to decide what is the best index fund to invest in regarding their stock type preference.

Value stocks: index funds with value stocks contain companies which tend to be well-established with steady performance and often high dividend payments. Value stocks can be found in all sectors, but Utilities is known to be a key sector of choice in this regard. UK consumer goods giant Unilever, for example, would commonly considered to be a value stock.

Growth stocks: index funds with growth stocks contain companies with excellent, but often unproven, growth potential. Such companies tend to have future earnings priced into high P/E ratios. Often these companies are in the technology or biomedical sectors.

Blend: An index fund described as a ‘Blend’ contains both value and growth stocks.

Large-cap, mid-cap, low-cap: ‘cap’ stands for ‘capitalisation’, as in market capitalisation.

- Large cap companies in the UK are listed on the FTSE 100 (roughly £4 billion + market capitalisation).

- Mid-cap companies are listed on the FTSE 250 (£500 million to £4 billion).

- Small cap companies worth between £150 million and £500 million may be found on the FTSE Small Cap Index.

- Firms worth less than £150 million populate the Alternative Investment Market (AIM).

Below is an example illustration of the stock profile for the HSBC FTSE 250 Index Fund:

2. Investment Return

We might assume that there is nothing more complicated to stock index funds than their investment return. How much money, in other words, does that fund make?

- There are two issues here. First, investment returns vary over time. As fund giant Vanguard reminds us, ‘past performance is not a reliable indicator of future results.’ Hence UK index fund the iShares Core FTSE 100 UCITS ETF, for example, returned 17.2% in 2019 – but then tanked in 2020 with an -11.6% return.

Secondly, high returns from index funds investing can be a sign that an investor has a high risk appetite, and is investing in aggressive leveraged funds. High-risk, high-reward investing can work both ways for the investor.

- Hence the leveraged ProShares Ultra QQQ ETF, for example – which delivers 2x the daily price movement of the US NASDAQ tech index – is up 20% since its inception in 2006, but 56.10% down Year To Date.

- Even more dramatically, the MicroSectors U.S. Big Oil Index 3X Leveraged ETN, is up over 300% Year To Date, thanks to big oil companies making spectacular profits during the ongoing global energy crisis – but, if the natural gas issue resolves and petrol prices drop, this geared ETF is set up to punish the investor.

3. Risk

Many fund issuers make it easy for investors to assess risk by giving their fund a risk rating. Vanguard, for example, uses a scale of 0 to 7, where a rating of 7 is the riskiest.

Recognised as a rule of thumb is the idea of diversification for better risk management. The more diversified an index fund is in terms of the type and number of companies it covers, the less vulnerable it is to isolated falls in share price.

And when a national or even global slowdown in the markets happens – as in 2022 – diversification remains a sensible strategy for risk management. Although all shares tend to be adversely affected, vulnerable growth stocks are hit hardest. It makes sense therefore for an index fund to spread its investment as widely as possible.

4. Running Cost

Index tracking funds tend to offer low OCFs (Ongoing Charge Figures). This is because they track an index, which means stock selection is handled automatically – based on the stocks that the index tracks. This passive approach to investing is why index funds are generally associated with low cost: tracking an index is a lot less expensive than paying a fund manager to select the stocks.

5. Accessibility

The best index funds to invest in from the point of view of accessibility are ETFs. Shares in ETFs may be traded just like normal shares at any point when the market is open.

Investors, for example, will likely find shares of a popular ETF like the iShares Core FTSE 100 UCITS ETF available on many of the best stock trading apps UK – as well as accessible via a SIPP (Self-Invested Personal Pension) or ISA (Individual Savings Account).

Other funds may be traded once a day on the open market (if available) but are generally only accessible via subscription with the fund provider or accounts with specific brokers.

Index Funds vs ETFs

Many index tracking funds – both in the UK and abroad – are available in one of two formats: ETF (Exchange Traded Fund) or standard mutual fund/OEIC.

One example is the US Vanguard Total Stock Market Index Fund. As a US equity index fund – rather than a UK index fund – this tracks the CRSP US Total Market Index, and thus invests in 4066 US companies of all sizes across many sectors.

In its ETF form, this fund is available via brokers with an expense ratio of just 0.03% for a minimum investment of $1. If investors buy into it via fund manager Vanguard in its mutual fund format, its running cost is slightly higher – at 0.04% – and a minimum investment of $3,000 is required.

Offering easier accessibility and lower fees than mutual funds, ETFs have surged in popularity in the last 20 years.

Index Funds vs Mutual Funds

Because they track an index, many mutual funds can be categorized as index funds. But not all of the best mutual funds in the UK are index funds; some involve active stock selection by a fund manager, and therefore tend to offer higher running costs.

Index Funds vs Crypto Presales

Index funds are considered to be a suitable investment vehicle if the investor is looking for a low-risk way to generate unspectacular returns over the long-term. It has to be said though that, with the global economy heading down rather than up, index funds are not the sure-fire, slow-burn winner that they were.

The first index fund ever was the (aptly-named) First Index Investment Trust launched in 1975. This fund is nowadays called the Vanguard 500 Index Trust. Since its inception, a lot has changed in financial markets.

Investors looking for the best investments UK in terms of short-term growth potential can access crypto presales and plug into bargain asset prices with guaranteed price increase as the presale progresses.

Conclusion

Above we have reviewed the scope of index fund investing in the UK. And we conclude that superior short-term growth potential is available with crypto presales – which arguably number amongst the best investments UK in 2023.

Because the price of crypto goes up at each stage of a crypto presale, investors buying into brand-new cryptocurrencies stand to gain over the short-term – and can sell their crypto as soon as it is listed on one of the popular UK crypto exchanges.

Why buy Bitcoin – which has already made its long journey to ascendancy at the top of the crypto sector – when exciting new prospects are available at a bargain?

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof & CoinSniper Audited

- Strong Community of 70,000 Traders