Over the past decade, forex trading has become more accessible to traders worldwide – especially those who abide by Sharia law. Since Sharia law forbids the accrual of interest, certain brokers now offer ‘Islamic Accounts’ that do not charge swap fees, ensuring they can be considered halal.

This guide discusses a selection of the best Islamic brokers on the market, highlighting what they are and how they work, before providing an in-depth walkthrough of how investors can begin trading with one of these accounts today.

The Best Islamic Forex Broker Accounts

Below is a list of our top 10 Islamic forex brokers, derived from extensive research and testing. In the following section, we’ll review each of these brokers in turn, discussing elements like fee structure, asset selection, trading tools, and payment methods.

- Capital.com – Overall Best Islamic Broker for 2023

- eToro – Islamic Forex Trading Broker with 0% Commissions

- XTB – Popular Swap-Free Broker for Certain Assets

- Vantage – CFD Trading Platform with No Commission on FX

- Pepperstone – Popular Forex Platform with Social Trading Features

- AvaTrade – Leading FX Broker with MT4/MT5 Support

- Skilling – Best Swap Free Forex Account for Micro Lot Trading

- Forex.com – Top Islamic Forex Trading Account for Low Spreads

- FXTM – One of the Best Swap Free Forex Brokers for ECN Trading

- FBS – Excellent Islamic FX Broker with User-Friendly App

- FP Markets – Respected FX Broker with Free Islamic Demo Account

- IC Markets – Great Swap-Free Broker with Extensive Regulation

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

Best Islamic Trading Accounts Reviewed

Due to the popularity of FX trading, many of the best forex brokers now offer dedicated Islamic trading accounts that allow traders to abide by Sharia law whilst still gaining access to the same features as a regular account. However, since there are so many to choose from, it can be challenging to narrow down the selection when making a broker choice.

Not to worry – we’ve completed all of the necessary research and testing, with our top 10 Islamic forex brokers reviewed in-depth below:

1. Capital.com – Overall Best Islamic Broker for 2023

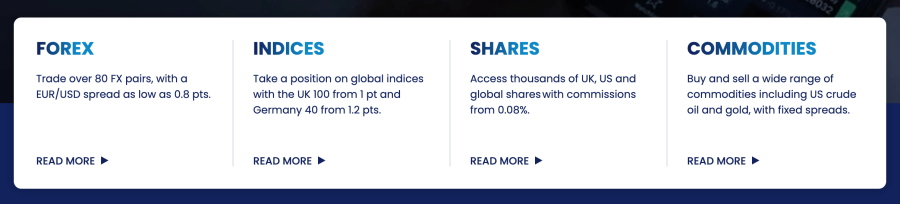

Users can trade over 130 currency pairs with Capital.com, including a selection of minors and exotics. As a CFD broker, all of Capital.com’s fees are incorporated into the spread, meaning no hefty commissions are charged. Moreover, the bid/ask spread tends to be relatively tight – averaging at just 0.6 pips for highly-traded pairs like EUR/USD.

This ensures that Capital.com is one of the best low spread forex brokers on the market, bolstered by the fact that no deposit, withdrawal, or inactivity fees are charged. In terms of halal trading, unfortunately Capital.com does not currently offer a swap-free trading account. However, the broker does provide scope for day trading, which is considered a halal activity – if certain conditions are followed.

Capital.com accepts deposits from only $20, with support for credit/debit cards, bank transfers, Apple Pay, and PayPal. Users can trade on Capital.com’s web-based platform or mobile app – although MT4 is also offered. Using MT4 can be particularly useful for advanced FX traders, as it allows for custom trading strategies to be employed.

Finally, Capital.com will also appeal to beginner traders due to the enormous educational library it offers. This library includes tutorial videos, articles, and webinars designed to streamline the learning process. There’s even a free demo account with $10,000 in virtual money, allowing traders to experience the markets risk-free.

| Number of Currency Pairs | 138 |

| Other Tradable Assets | Stocks, ETFs, commodities, indices, crypto |

| Pricing Structure | 0% Commission + Variable spread |

| Spread for EUR/USD | Average of 0.6 pips |

| Platforms Offered | Web-based platform + mobile app + MT4 |

| Accepts US Clients? | No |

| Max Leverage | 30:1 |

| Broker Type | CFD |

What we like:

- 0% commission FX broker

- Spreads can be as low as 0.6 pips

- Huge range of educational resources

- Full support for MT4

- Accepts deposits via Apple Pay and PayPal

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

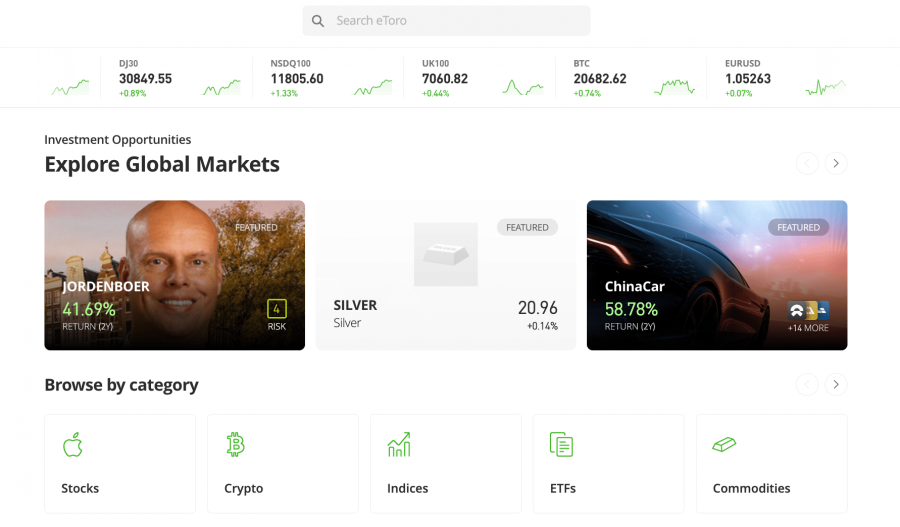

2. eToro – Islamic Forex Trading Broker with 0% Commissions

eToro offers one of the best swap-free forex accounts on the market, which charges no interest and doesn’t take any additional commissions. This account also provides interest-free leverage and can be opened online. All that’s required is a $1,000 deposit and proof that the user is a member of the Muslim faith.

Regarding account specifics, eToro offers 49 currency pairs to trade, all with 0% commissions. Spreads are clearly quoted on eToro’s fee page, starting at just one pip for EUR/USD. As a CFD broker, eToro offers up to 30:1 leverage and allows positions to be opened from as little as $10.

eToro’s minimum deposit amount is only $10, which can be made via credit/debit card, bank transfer, or e-wallet. Notably, eToro also offers a valuable ‘CopyTrader’ feature, which offers many of the same benefits as the best forex signals. This feature allows users to copy the trades placed by other eToro users, thereby automating the investment process.

| Number of Currency Pairs | 49 |

| Other Tradable Assets | Stocks, ETFs, commodities, indices, crypto |

| Pricing Structure | 0% Commission + Spread |

| Spread for EUR/USD | 1 pip |

| Platforms Offered | Web-based platform + mobile app |

| Accepts US Clients? | Yes (forex trading is currently unavailable) |

| Max Leverage | 30:1 |

| Broker Type | CFD (Market maker/STP) |

What we like:

- Dedicated Islamic account offered

- Accepts PayPal deposits

- Innovative ‘CopyTrader’ feature

- Heavily regulated worldwide

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

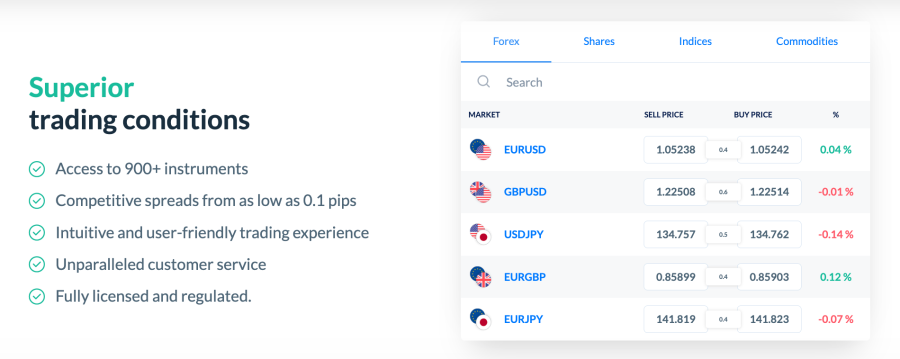

3. XTB – Popular Swap-Free Broker for Certain Assets

The best part is that these platforms cater to beginner and advanced traders. But beginners who struggle can access free educational content about trading forex and using the platform. A demo account is available to practise before going live.

Analyzing the fundamentals is crucial, so XTB provides market news consisting of the latest developments globally and even an analysis.

If forex traders want to dabble in other markets, they have access to more than 2100 global markets and exposure to cryptocurrencies, commodities, indices, stocks and ETFs. To make trading more convenient, traders can use the trader’s calculator, advanced tools and the market sentiment provided.

| Number of Currency Pairs | 48 |

| Other Tradable Assets | Stocks, ETFs, commodities, indices, crypto |

| Pricing Structure | Spreads |

| Spread for EUR/USD | Average of 0.1 pips |

| Platforms Offered | xStation 5 and xStation mobile |

| Accepts US Clients? | No |

| Max Leverage | 1:30 |

| Broker Type | CFD |

What we like:

- Offers 48 currency pairs

- Low spreads for major pairs

- Fast deposits and withdrawals

Your capital is at risk. 81% of retail investor accounts lose money when trading CFDs with this provider.

4. Vantage – CFD Trading Platform with No Commission on FX

A STP/ECN broker, Vantage allows investors to choose their preferred account type. The standard STP account requires a minimum deposit of $200 – offering no commissions on CFD trading. However, the spreads are often higher on this account. For example, the popular AUD/USD pair takes a spread of 1.6 pips per lot.

On the other hand, the Raw ECN account can allow investors to trade FX pairs with minimum spreads. The AUD/USD pair take a spread of 0.3 pips along with a small commission per lot traded. This account type requires a minimum deposit of $500. Vantage allows retail clients to access leverage of up to 1:100, while professional trades can access up to 1:500 leverage.

The brokerage is available to use via the web-based platform, which is compatible with the MT4 & MT5 trader. Vantage also offers a mobile trading app – offering exciting features such as Social Trading. This allows investors to copy the trades of other investors who may be more experienced or skilled. Other features on the platform include market analysis & insight columns, education resources such as webinars & guides.

A secure platform, Vantage is regulated by the FCA, ASIC and the VFSC.

| Number of Currency Pairs | 44 |

| Other Tradable Assets | CFDs for crypto, indices, shares, commodities |

| Pricing Structure | No commission + high spread on STP account, low commission + low spread on ECN account |

| Spread for EUR/USD | 1.2 pips on STP, 0.2 pips on ECN account |

| Platforms Offered | MT4 + MT5 + mobile app |

| Accepts US Clients? | No |

| Max Leverage | 100:1 (500:1 for professional traders) |

| Broker Type | STP and ECN |

What we like:

- Offers STP and ECN accounts

- Supports MT4, and MT5

- No commission on STP accounts

- Social Trading features

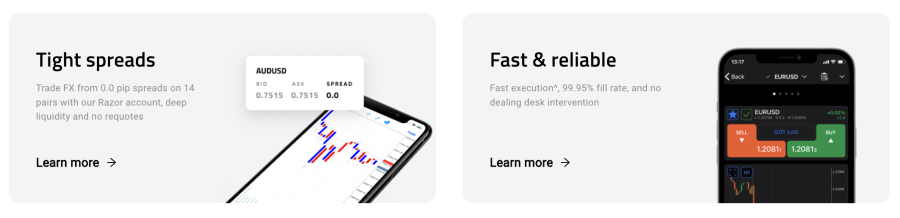

5. Pepperstone – Popular Forex Platform with Social Trading Features

Pepperstone offers over 60 currency pairs to trade, all via CFDs. Spreads are relatively low with Pepperstone, averaging at 0.75 pips for EUR/USD. However, investors who opt for the ‘Razor’ account will gain access to ‘raw’ spreads, which can be as low as 0.0 pips in some instances.

However, this account will come with a commission, meaning it’s generally targeted at experienced traders. Pepperstone also offers a swap-free account, making it one of the best Islamic brokers for Sharia-compliant trading. Finally, Pepperstone has also partnered with several social trading platforms (such as DupliTrade), which provides trade ideas and signals in an automated manner.

| Number of Currency Pairs | 60+ |

| Other Tradable Assets | Stocks, commodities, indices, crypto |

| Pricing Structure | Variable spread on Standard account; commission on Razor account |

| Spread for EUR/USD | Average of 0.77 pips on Standard account; as low as 0.0 pips on Razor account |

| Platforms Offered | Web trader + mobile app + cTrader app + MT4 + MT5 + TradingView |

| Accepts US Clients? | No |

| Max Leverage | 30:1 (500:1 for professional traders) |

| Broker Type | STP and ECN |

What we like:

- Spreads as low as 0.0 pips on Razor account

- Offers STP and ECN accounts

- Supports cTrader, MT4, MT5, and TradingView

Trading CFDs and FX is risky and if you are a professional client, losses can exceed deposits. Pepperstone Financial Services (DIFC) Limited is regulated by the DFSA

6. AvaTrade – Leading FX Broker with MT4/MT5 Support

AvaTrade also offers a dedicated Islamic account with no swap fees. Instead, fees are transferred within MT4 to daily administration fees across all tradable currency pairs. In terms of asset selection, AvaTrade provides 55 pairs to trade with no commissions.

As a CFD broker, AvaTrade’s fees are built into the spread – which averages around 0.9 pips for EUR/USD and GBP/USD. The minimum deposit threshold for new traders is set at $100, with no deposit fees attached. AvaTrade even has an ‘AvaOptions’ platform, which offers seamless options trading with professional risk management tools – although options are not considered halal by most religious scholars.

| Number of Currency Pairs | 55 |

| Other Tradable Assets | Stocks, ETFs, commodities, indices, crypto, bonds |

| Pricing Structure | 0% Commission + Spread |

| Spread for EUR/USD | Average of 0.9 pips |

| Platforms Offered | Web-based platform + mobile app + MT4 + MT5 |

| Accepts US Clients? | Yes |

| Max Leverage | 30:1 |

| Broker Type | CFD (Market maker) |

What we like:

- Supports MT4 and MT5

- Dedicated options trading platform

- No commissions when placing trades

7. Skilling – Best Swap Free Forex Account for Micro Lot Trading

Skilling charges no transaction fees, instead opting to take their cut through the spread. This spread fluctuates throughout the day and can be slightly higher for Standard account users, averaging at just over one pip for EUR/USD. However, Skilling also offers a ‘Premium’ account that provides deep liquidity, meaning spreads can be as low as 0.1 pips.

However, although spreads are low, Skilling charges a volume-based commission on this account. Notably, micro lot trading is available on all Skilling accounts, which is helpful for beginner traders. Finally, Skilling offers a wide range of deposit methods, such as Trustly, Klarna, and Neteller, which can facilitate instant funding.

| Number of Currency Pairs | 73 |

| Other Tradable Assets | Stocks, ETFs, commodities, indices, crypto, bonds |

| Pricing Structure | 0% Commission + Spread |

| Spread for EUR/USD | Average of 1.2 pips (from 0.1 pips for Premium account) |

| Platforms Offered | Web trader + cTrader app + MT4 |

| Accepts US Clients? | No |

| Max Leverage | 30:1 |

| Broker Type | STP |

What we like:

- Premium account offers spreads from 0.1 pips

- Supports MT4 and cTrader

- Over 70 FX pairs to trade

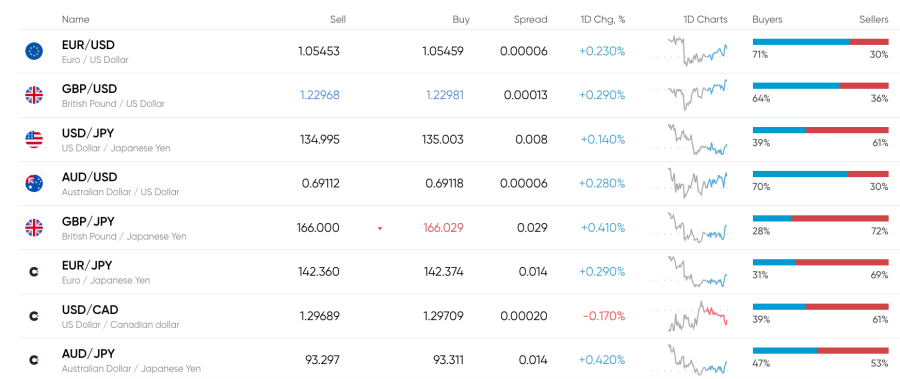

8. Forex.com – Top Islamic Forex Trading Account for Low Spreads

Forex.com offers 91 currency pairs to trade and an array of other asset classes. Notably, investors looking to buy cryptocurrency can trade six digital currencies – all with low trading fees. FX trading fees are also relatively low, with spreads averaging just above one pip for EUR/USD.

However, users can opt for the ‘STP Pro’ account, which means spreads can be as low as 0.1 pips. Forex.com also offers a swap-free account, making it one of the best Islamic brokers on the market. Finally, Forex.com can also integrate with TradingView, providing a way to conduct in-depth technical analysis.

| Number of Currency Pairs | 91 |

| Other Tradable Assets | Stocks, ETFs, commodities, indices, crypto, bonds |

| Pricing Structure | 0% Commission + Spread (commission on STP Pro account) |

| Spread for EUR/USD | Average of 1 pip (as low as 0.1 pips for STP Pro) |

| Platforms Offered | Web trader + mobile app + MT4 |

| Accepts US Clients? | Yes |

| Max Leverage | 50:1 |

| Broker Type | Offers DMA and STP accounts |

What we like:

- Offers DMA and STP accounts

- Spreads as low as 0.1 pips on STP Pro

- Intergrates with TradingView

9. FXTM – One of the Best Swap Free Forex Brokers for ECN Trading

One of FXTM’s most compelling features is its ECN accounts. These accounts operate through MT4 and provide spreads from as low as 0.0 pips. However, the ECN account does come with a commission of $2 per lot – which can add up for high-volume traders.

FXTM does offer a ‘swap-free’ option on its accounts, making it one of the top Islamic brokers for Sharia compliance. The account opening process is fully digital, with a minimum deposit requirement of $50. Finally, FXTM shines when it comes to educational resources, as users can view tutorial videos and try out a demo account for free.

| Number of Currency Pairs | 60+ |

| Other Tradable Assets | Stocks, indices, commodities, crypto |

| Pricing Structure | 0% Commission + Spread (volume-based commission on ECN account) |

| Spread for EUR/USD | As low as 0.0 pips on ECN account |

| Platforms Offered | Web trader + mobile app + MT4 + MT5 |

| Accepts US Clients? | No |

| Max Leverage | 30:1 |

| Broker Type | Standard + ECN |

What we like:

- ECN account offered

- Supports MT4 and MT5

- Swap-free structure available through this broker

10. FBS – Excellent Islamic FX Broker with User-Friendly App

The minimum deposit for a standard account is $100, with full support for micro lot trading. Leverage of up to 30:1 is offered on all accounts, although professional traders can obtain up to 500:1 leverage. Regarding deposit methods, FBS accepts credit/debit cards, Neteller, Skrill, and Rapid.

FBS doesn’t charge any deposit or withdrawal fees, making this broker extremely cost-effective to partner with. It can also be considered an option for the best Islamic trading platform, as FBS offers a swap-free account which is easy to set up. Finally, the mobile app provided by FBS is one of the best in the business, featuring a two-step login process and advanced order types.

| Number of Currency Pairs | 100 |

| Other Tradable Assets | Stocks, indices, commodities, crypto |

| Pricing Structure | 0% Commission + Spread |

| Spread for EUR/USD | Average of 0.7 pips |

| Platforms Offered | Web trader + mobile app + MT4 + MT5 |

| Accepts US Clients? | No |

| Max Leverage | 30:1 (500:1 for professional traders) |

| Broker Type | NDD, STP, and ECN offered |

What we like:

- Islamic account is easy to set up

- NDD, STP, and ECN accounts offered

- Supports MT4 and MT5

11. FP Markets – Respected FX Broker with Free Islamic Demo Account

FP Markets also provides a free Islamic demo account, making it the only broker on our list to offer this feature. In terms of asset selection, FP Markets provides over 60 currency pairs to trade, all with zero commissions. However, advanced users can opt for the ECN account, which does charge a commission – yet allows transactions from as low as 0.0 pips.

The minimum deposit at FP Markets is $100, which can be facilitated in ten different base currencies via credit/debit card, bank transfer, or an array of e-wallets. Finally, FP Markets charges no deposit, withdrawal, or inactivity fees for using their service.

| Number of Currency Pairs | 60+ |

| Other Tradable Assets | Stocks, indices, commodities, crypto |

| Pricing Structure | 0% Commission + Spread (Commissions on ECN account) |

| Spread for EUR/USD | As low as 0.0 pips on ECN |

| Platforms Offered | Web-based platform + mobile app + MT4 + MT5 + CTrader |

| Accepts US Clients? | No |

| Max Leverage | 30:1 (500:1 for professional traders) |

| Broker Type | DMA and ECN |

What we like:

- ECN account offered

- No deposit, withdrawal, or inactivity fees

- Free Islamic demo account

12. IC Markets – Great Swap-Free Broker with Extensive Regulation

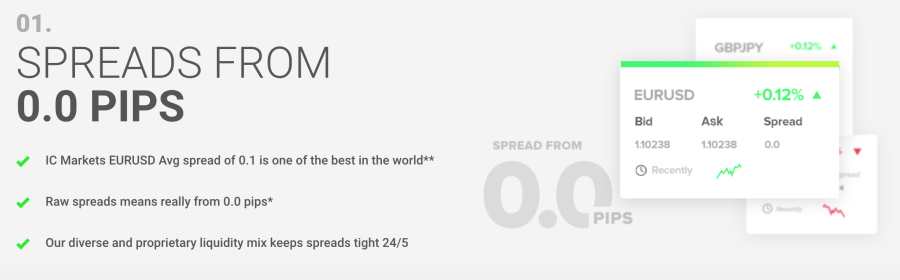

This broker offers over 60 currency pairs to trade, with an account that offers raw spreads from as little as 0.0 pips. IC Markets also offers micro lot trading, which is ideal for beginner investors. Furthermore, IC Markets’ execution speeds average under 40ms, helping avoid slippage.

With over 180,000 clients worldwide, IC Markets helps simplify the trading process by offering integrations with MT4, MT5, and cTrader. An Islamic account is also provided, with no interest fees and raw pricing. Although the minimum deposit threshold is slightly higher at $200, users can deposit for free via PayPal, Skrill, or Neteller.

| Number of Currency Pairs | 60+ |

| Other Tradable Assets | Stocks, ETFs, commodities, indices, crypto, bonds |

| Pricing Structure | 0% Commission + Spread (commission on Raw account) |

| Spread for EUR/USD | From 0.0 pips on the Raw account |

| Platforms Offered | Web-based platform + mobile app + MT4 + MT5 + CTrader |

| Accepts US Clients? | No |

| Max Leverage | Up to 500:1 for professional traders |

| Broker Type | CFD (ECN account offered) |

What we like:

- Integrates with MT4, MT5, and cTrader

- Spreads as low as 0.0 pips on Raw account

- Accepts PayPal, Skrill, and Neteller deposits

Best Islamic Forex Accounts Compared

The section above has reviewed ten of the best Islamic trading accounts on the market, focusing on key characteristics such as fee structure, trading features, and asset selection. To help smooth the decision-making process even further, the table below compares all of these halal brokers together, providing an overview of which platforms perform best in specific areas:

| Broker Name | Number of Currency Pairs | Other Tradable Assets | Pricing Structure | Spread for EUR/USD | Platforms Offered | Accepts US Clients? | Max Leverage | Broker Type |

| Capital.com | 138 | Stocks. ETFs, commodities, indices, crypto | 0% Commission + Variable spread | Average of 0.6 pips | Web-trader platform + mobile app + MT4 | No | 30:1 | CFD |

| eToro | 49 | Stocks. ETFs, commodities, indices, crypto | 0% Commission + Spread | 1 pip | Web-trader platform + mobile app | Yes (forex trading unavailable) | 30:1 | CFD (Market maker/STP) |

| AvaTrade | 55 | Stocks. ETFs, commodities, indices, crypto, bonds | 0% Commission + Variable spread | Average of 0.9 pips | Web-trader platform + mobile app + MT4 + MT5 | Yes | 30:1 | CFD (Market maker) |

| Skilling | 73 | Stocks. ETFs, commodities, indices, crypto, bonds | 0% Commission + Variable spread | Average of 1.2 pips (from 0.1 pips for Premium account) | Web trader + cTrader app + MT4 | No | 30:1 | STP |

| Pepperstone | 60+ | Stocks, commodities, indices, crypto | Variable spread on Standard account; commission on Razor account | Average of 0.75 pips on Standard account; as low as 0.0 pips on Razor account | Web trader + mobile app + cTrader + MT4 + MT5 | No | 30:1 (500:1 for professional clients) | STP and ECN |

| Forex.com | 91 | Stocks. ETFs, commodities, indices, crypto, bonds | 0% Commission + Spread (commission on STP Pro account) | Average of 1 pip (as low as 0.1 pips for STP Pro) | Web trader + mobile app + MT4 | Yes | 50:1 | Offers DMA and STP accounts |

| FXTM | 60+ | Stocks, indices, commodities, crypto | 0% Commission + Spread (volume-based commission on ECN account) | As low as 0.0 pips on ECN account | Web trader + mobile app + MT4 + MT5 | No | 30:1 | Standard + ECN |

| FBS | 100 | Stocks, indices, commodities, crypto | 0% Commission + Spread | Average of 0.7 pips | Web trader + mobile app + MT4 + MT5 | No | 30:1 (500:1 for professional traders) | NDD, STP, and ECN offered |

| FP Markets | 60+ | Stocks, indices, commodities, crypto | 0% Commission + Spread (Commissions on ECN account) | As low as 0.0 pips on ECN | Web-based platform + mobile app + MT4 + MT5 + CTrader | No | 30:1 (500:1 for professional traders) | DMA and ECN |

| IC Markets | 60+ | Stocks, indices, commodities, crypto, bonds | 0% Commission + Spread (commission on Raw account) | From 0.0 pips on the Raw account | Web-based platform + mobile app + MT4 + MT5 + CTrader | No | 30:1 (500:1 for professional traders) | CFD (ECN account offered) |

What is an Islamic Trading Account?

Now that we’ve discussed the best trading platforms with Islamic trading accounts, let’s look at what these accounts are and how they work. An Islamic trading account is a halal trading account that abides by the principles established in Sharia law. Sharia law prohibits interest payments, which presents an issue when it comes to FX trading.

This is because trades held overnight are subject to ‘swap fees’, which work much like interest payments. As such, regular FX accounts are considered haram and unusable by Muslim traders.

Fortunately, many of the best Islamic brokers offer ‘swap-free’ accounts, meaning no interest is charged on overnight positions. Moreover, these accounts also charge no interest on leveraged positions and enable currencies to be transferred immediately.

The best Islamic forex brokers that accept USA traders (and those that don’t) make it easy to open a swap-free account. Usually, all that’s required is for the trader to contact customer service, where they will ask for proof of religion. However, it’s essential to remember that many platforms will charge a separate fee to make up for the money lost through swap fees – this is sometimes expressed as a daily administration charge.

How we Select the Best Islamic Trading Platforms

Choosing which of the best Islamic brokers to partner with can be challenging; however, much like the process to invest in stocks, certain factors must be kept in mind while making a decision. A selection of the most critical factors are discussed below:

Regulation

Naturally, regulation is an important consideration when choosing a broker. Regulation from top-tier entities provides a high degree of investor protection, which helps increase the safety of FX trading. Make sure to look out for brokers with oversight from leading institutions like the FCA, ASIC, or CySEC.

Range of Currency Pairs

The best Islamic brokers tend to have a vast selection of currency pairs to choose from. Although all FX brokers will offer majors, many will also provide minors and exotics to trade. However, the latter two types best suit experienced traders, as they can be volatile and feature higher spreads.

Fee Structure

Our reviews of the best Islamic brokers earlier all touched on the spreads and commissions that each broker charges. However, some platforms will charge additional fees, such as deposit, withdrawal, or inactivity fees. Finally, although relatively rare, some brokers may even charge a monthly account fee for using the service.

| Broker Name | Account Fees |

| Capital.com | No |

| eToro | No |

| AvaTrade | No |

| Skilling | No |

| Pepperstone | No |

| Forex.com | No |

| FXTM | No |

| FBS | No |

| FP Markets | No |

| IC Markets | No |

Tools & Analysis

Technical analysis is a crucial part of FX trading, so partnering with a broker that offers real-time price charts and technical indicators can be beneficial. Furthermore, certain brokers (like eToro) offer unique trading features, with ‘CopyTrader’ being one of the most widely used by FX traders.

Minimum Deposit

The best brokers with Islamic accounts will have a low (or non-existent) minimum deposit threshold. Many brokers will also waive any deposit fees if the user deposits in one of the supported base currencies.

Demo Account

Demo accounts can benefit beginner traders, as they offer the same experience as a live account, except without real money. FP Markets even provides a dedicated Islamic demo account, which mirrors the real account.

Mobile App

The fast-moving nature of the FX market means that brokers offering a mobile app are considered the best. All of the brokers on our list provide a mobile app for on-the-go trading, ensuring that users never miss an opportunity.

Supported Payment Methods

Customer Service

Finally, choosing an Islamic broker with a solid customer service offering can be hugely beneficial in the longer term. Look out for brokers with live chat or telephone support features, as these can provide targeted assistance in a speedy manner.

How to Open an Islamic Trading Account

Before rounding off this guide on the best swap-free forex accounts, let’s take an in-depth look at the investment process. Our recommended platform to partner with is Capital.com due to its low fees and vast selection of currency pairs.

As noted in our Capital.com review earlier, this broker doesn’t technically have a dedicated Islamic account, meaning positions cannot be held overnight. However, Capital.com does provide scope to conduct day trading – which is considered halal by many religious scholars.

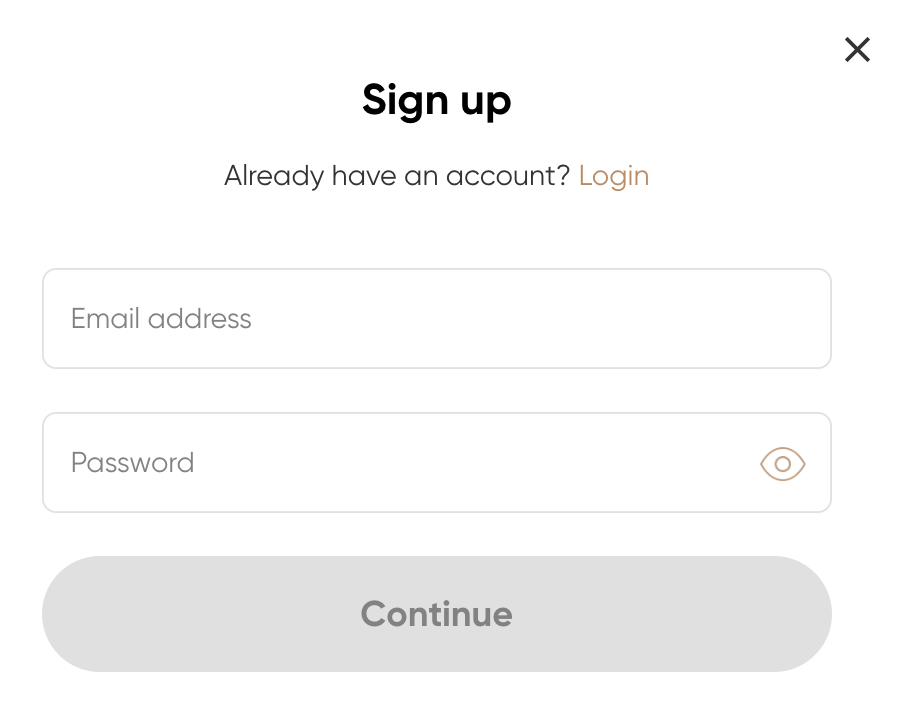

Step 1 – Sign Up for a Capital.com Account

Head to Capital.com’s website and click the ‘Trade Now’ icon on the homepage. On the page that appears, enter a valid email address and choose a password for the account. Capital.com will then send an email to this address with a link for verification purposes.

Step 2 – Verify Account

Click the ‘Complete Registration’ icon on Capital.com’s trading dashboard to begin the verification process. Capital.com will ask for some personal details for KYC checks, after which you’ll need to upload proof of ID (e.g. passport) and proof of address (e.g. bank statement). Once uploaded, Capital.com will verify these documents and send an email once complete.

Step 3 – Make a Deposit

Click ‘Deposit’ on Capital.com’s dashboard and enter how much you’d like to fund your account with – the minimum deposit threshold is just $20. In terms of payment methods, Capital.com accepts the following:

- Credit card

- Debit card

- Bank transfer

- Apple Pay

- PayPal

Step 4 – Search for Currency Pair

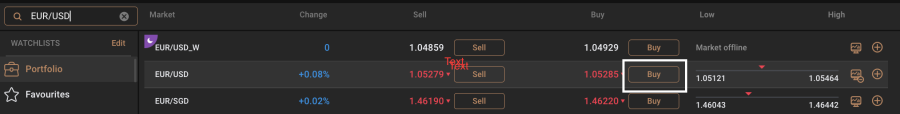

Type the ticker symbol of the currency pair you’d like to trade into the search bar – in this example, we’ll be looking to trade EUR/USD. Once the pair appears in the listing section, click ‘Buy’.

Step 5 – Trade Forex

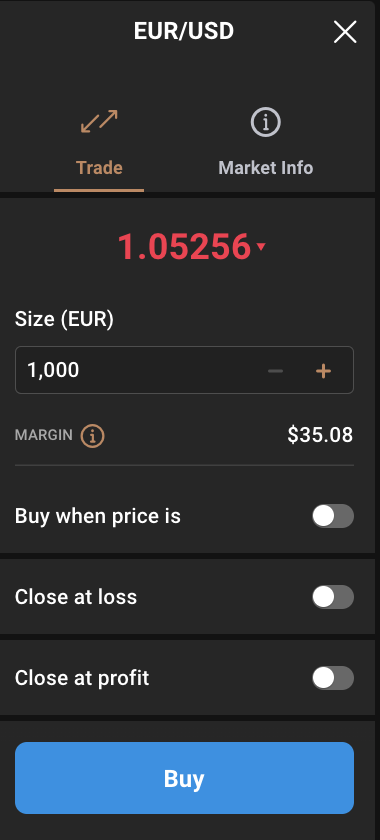

An order box will appear on the right side of the screen, much like the one below. In this box, enter your position size, opt for a stop-loss or take-profit level (if you wish), and click ‘Buy’ again.

Best Islamic Brokers – Conclusion

To conclude, this guide has taken an in-depth look at the best Islamic brokers on the market, highlighting their fees, features, and trading tools. More brokers than ever now offer an Islamic account that complies with Sharia law – ensuring Muslim traders can obtain the same trading experience whilst abiding by their faith.

For those interested in halal trading, we recommend partnering with Capital.com. Although Capital.com doesn’t yet offer a dedicated Islamic account, it does provide day trading services that are halal if certain conditions are followed. What’s more, Capital.com charges no commissions and allows positions to be opened from as little as $1.

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.