Looking for the best mutual funds by performance? Not only do mutual funds enable investors in the UK to diversify their capital, but the process is completely passive.

Read on to discover popular UK mutual funds from a variety of sectors and long-term objectives.

Best Performing Mutual Funds UK for 2023

Here’s a sneak peek of the 10 best mutual funds by performance according to industry analysts:

- Vanguard Value (VTV) – Exposure to 300+ Large-Cap Stocks That Could Offer Long-Term Value

- iShares MSCI India (INDA) – Invests in Over 100+ Leading Companies From India

- iShares FTSE 250 (MIDD) – Popular Fund Offering Exposure to Small UK Companies

- iShares Core High Dividend (HDV) – Established Fund Aimed at Dividend Income Seekers

- Fidelity MSCI Information Technology (FTEC) – Largest Fund Tracking High-Growth IT Companies

- Vanguard Real Estate (VNQ) – Actively Managed Real Estate Fund With Quarterly Dividends

- Vanguard FTSE Emerging Markets (VWO) – Indirect Exposure to Emerging Market Economies

- Vanguard Total Bond Market (BND) – Enables Access to Over 10,000 Actively Traded Bonds

- VanEck Gold Miners (GDX) – Five-Year Returns of Over 40%

- VanEck Oil Services (OIH) – High-Growth Fund Targeting Oil and Gas Service Providers

Read on to find out why some market analysts believe the above list represents the best mutual funds in the UK.

A Closer Look at Best UK Mutual Funds by Performance

When attempting to select the best mutual fund in the UK by performance, it is important to take a long-term time horizon. This means ignoring short-term pricing actions and instead assessing where the valuation of the mutual fund could be in 3-5 years.

It is also wise to consider the types of assets and markets that the mutual fund seeks to gain exposure to. This could be anything from leading FTSE 100 companies to stocks located in emerging markets.

Read on to explore the best-performing mutual funds in the UK.

1. Vanguard Value (VTV) – Exposure to 300+ Large-Cap Stocks That are Deemed to Offer Long-Term Value

Vanguard mutual funds are hugely popular with investors in the UK and further afield. This provider has a solid reputation in the investment space and is one of the largest providers of mutual funds globally. Vanguard Value (VTV) is a popular fund that offers exposure to over 300 large-cap companies that are listed in the US markets.

The overarching objective is to invest in companies that are deemed to be undervalued. The portfolio is well-diversified, with the largest holding of 3.13% allocated to Berkshire Hathaway. This company is in itself diversified, considering that Berkshire Hathaway has exposure to over 50 stocks.

Other holdings in the Vanguard Value are inclusive of UnitedHealth Group, Procter & Gamble, Johnson & Johnson, Chevron, and more. As such, the portfolio offers access to every industry and sector imaginable, whether that’s oil and gas, banking, healthcare, or telecommunications.

As of writing, the Vanguard Value has a price-to-book of 2.6x, which mirrors the benchmark level like-for-like. In terms of performance, the Vanguard Value has remained steady over the prior 12 months, with a slight decline of just over 1%. Over a five-year period, the fund is up 31%.

Since its inception in 2004, the Vanguard Value has offered average annualized returns of 8.41%. Many of the value stocks owned by this fund are dividend payers. As a result, Vanguard makes a dividend distribution every three months.

81% of retail investor accounts lose money when trading CFDs with this provider.

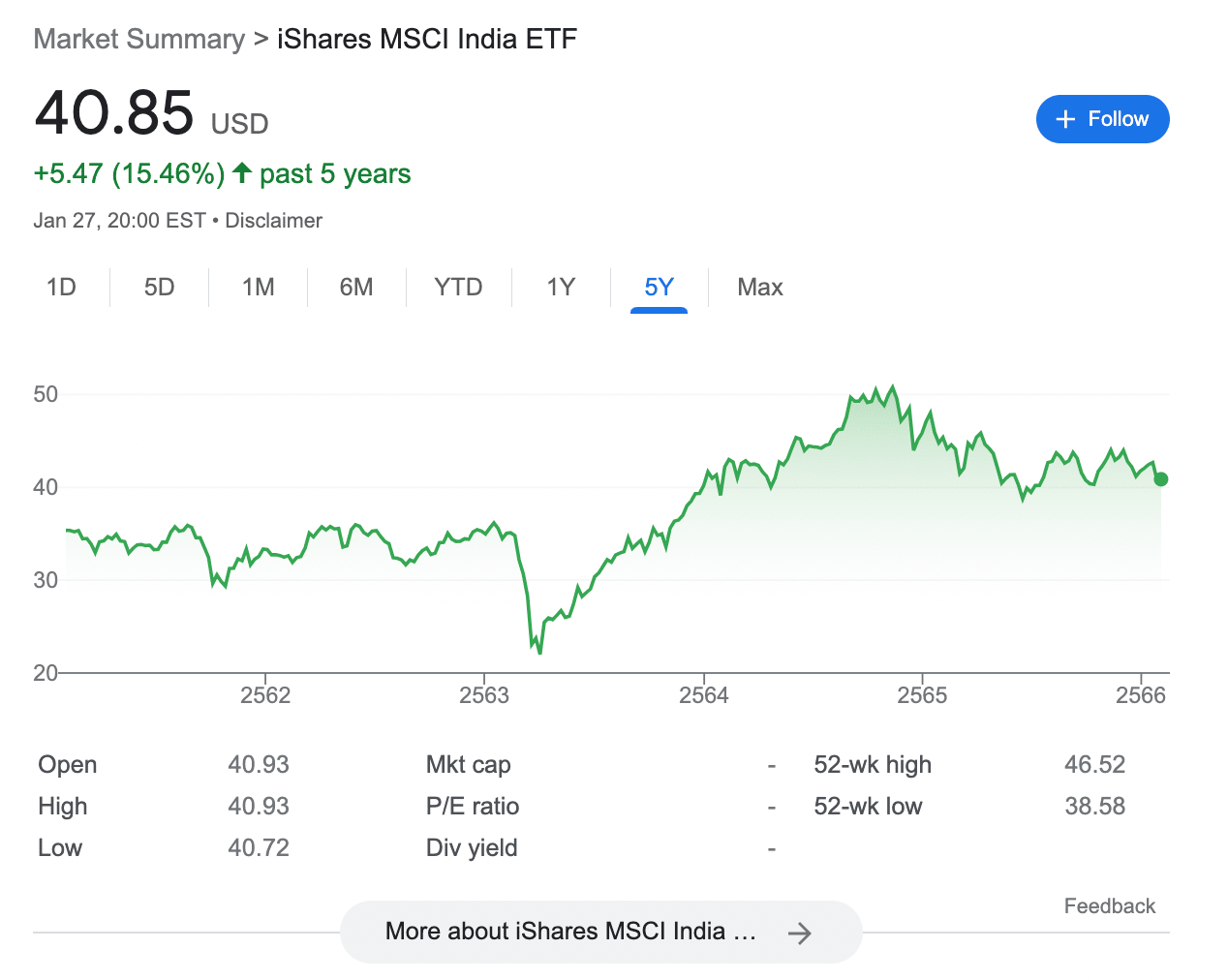

2. iShares MSCI India (INDA) – Invests in Over 100+ Leading Companies From India

India is one of the fastest-growing economies globally. As such, some investors in the UK may wish to gain exposure to the growth of the Indian stock exchange. According to many market commentators, the iShares MSCI India (INDA) is one of the best mutual funds by performance for this purpose.

The fund offers exposure to over 100 prominent stocks that are listed and traded in India. This includes a vast range of industries and sectors, such as energy, information technology, banking, consumer staples, and industrials. This ensures that the fund is well diversified – at least in a domestic sense.

Some of the largest stocks held by the iShares MSCI India (INDA) include Reliance Industries, Infosys, Housing Development Finance, ICICI Bank, and Tama Consultancy Services. All holdings are weighted to reflect the broader valuation of each stock. This fund comes with an annual expense ratio of 0.64% annually.

Although considered somewhat high, this is because the fund offers access to an emerging marketplace. The iShares MSCI India was incepted in 2012 and since then, has offered a respectable average annualized gain of nearly 6%. Over a three-year period, average annualized gains of 8.3% have been generated.

81% of retail investor accounts lose money when trading CFDs with this provider.

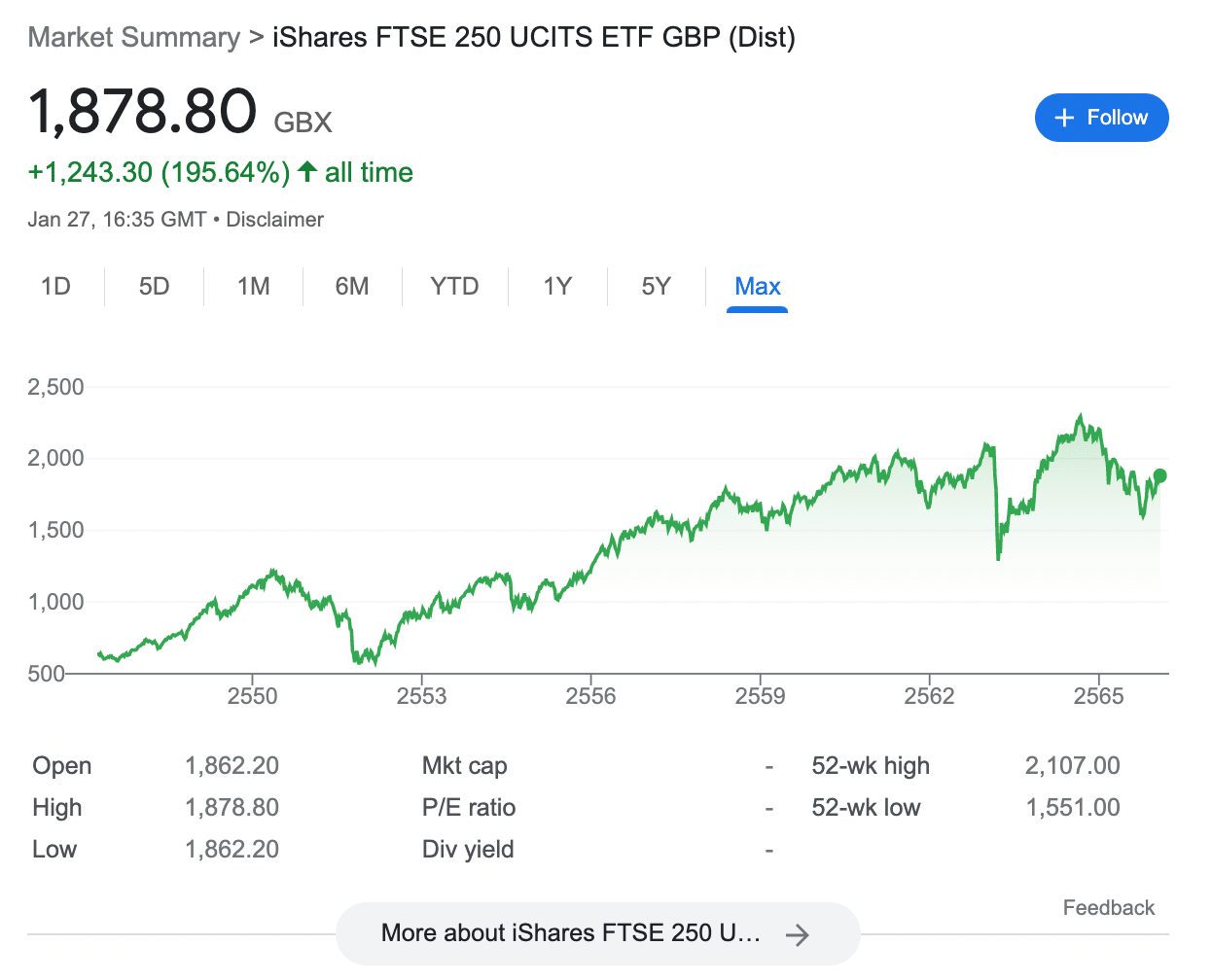

3. iShares FTSE 250 (MIDD) – Popular Fund Offering Exposure to Small UK Companies

Looking for the best mutual funds by performance from within the UK marketplace? If so, the iShares FTSE 250 (MIDD) is a popular fund that specifically targets UK companies that fall outside of the hallmark FTSE 100 index. In other words, the fund invests in smaller companies that carry a modest market capitalization.

235 stocks are held by this fund as of writing from more than a dozen sectors. With that said, nearly 40% of the fund is held in companies from within the financial and banking spaces. Other heavily weighted sectors include industrials and consumer services.

With that being said, the iShares FTSE 250 is very well-diversified, considering that the largest single holding represents just 1.14% of the broader portfolio. Some of the leading stocks held are inclusive of Intermediate Capital Group, Greencoat UK Win, IMI PLC, Howden Joinery Group, and Diploma.

This fund was incepted in 2004 and since then, has generated average annualized returns of 8.49%. Over a 10-year period, this stands at 6.56%. Over the prior five years, however, average annualized returns stand at just 0.14%. The total expense ratio of this fund amounts to 0.40% per year.

81% of retail investor accounts lose money when trading CFDs with this provider.

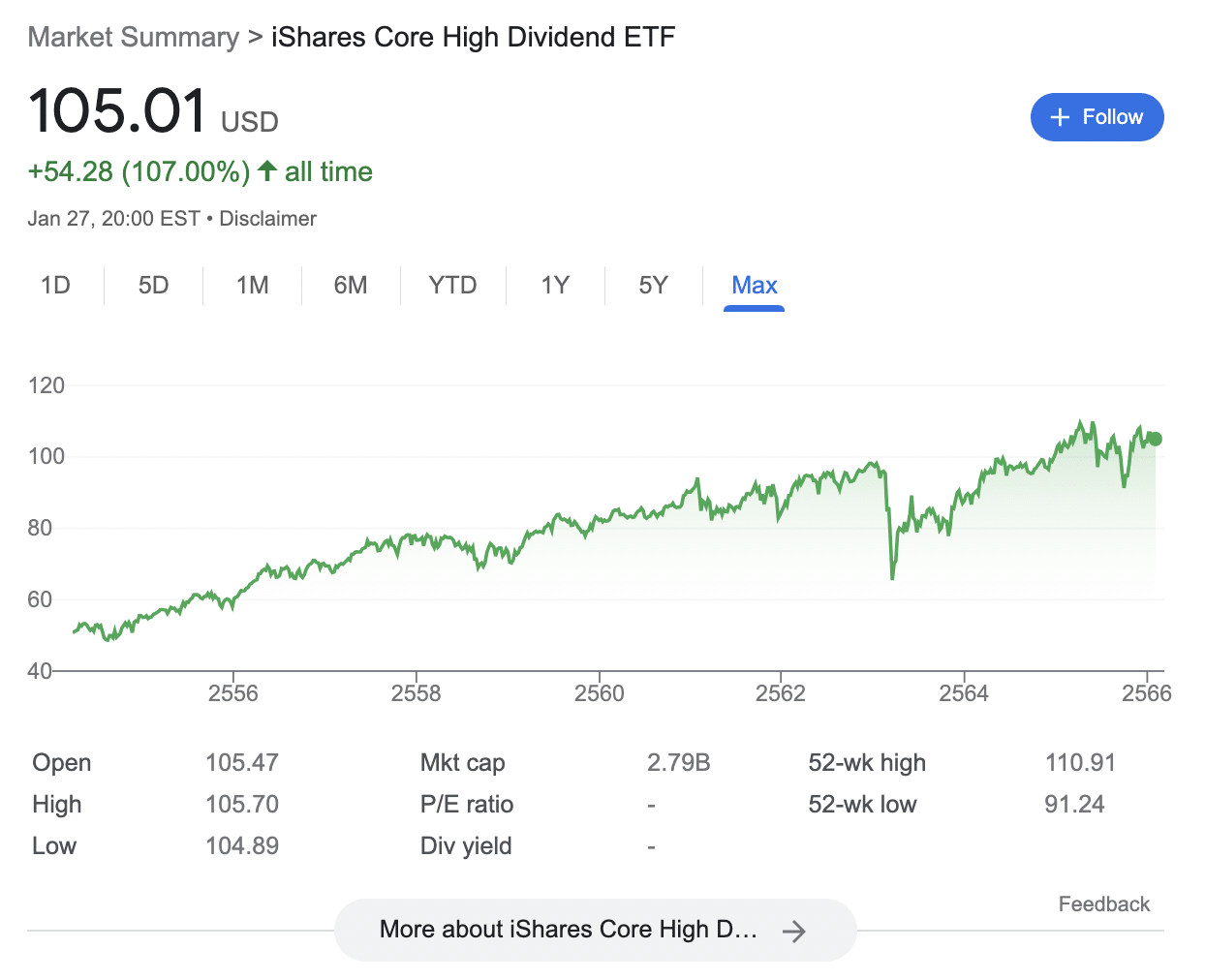

4. iShares Core High Dividend (HDV) – Established Fund Aimed at Dividend Income Seekers

Dividend mutual funds are favored by investors that seek predictable and regular income. In this regard, the iShares Core High Dividend (HDV) is a popular option. Although the portfolio is slightly lighter when compared to other funds at just 75 stocks, all respective companies are solid dividend payers.

Not only that, but the portfolio focuses exclusively on large-cap companies from a wide range of sectors. On the flip side, the largest stock held by the iShares Core High Dividend – Exxon Mobil, represents 9.65% of the total portfolio. Other larger holdings are inclusive of Verizon Communications, Chevron, Abbie, Philip Morris, and Coca-Cola.

Many of the companies held by this fund are dividend aristocrats. This means that the company has paid dividends for 25 consecutive years and increased the size of each annual payment. This is also one of the cheapest funds to own, considering that the annual expense ratio is just 0.008%.

When it comes to performance, The iShares Core High Dividend has generated average annualized gains of 10.19% since its inception in 2011. Over a 10-year period, average annualized gains of 9.78% have been achieved. On a three and five-year basis respectively, the fund has generated average annualized returns of 6.13% and 6.91%.

81% of retail investor accounts lose money when trading CFDs with this provider.

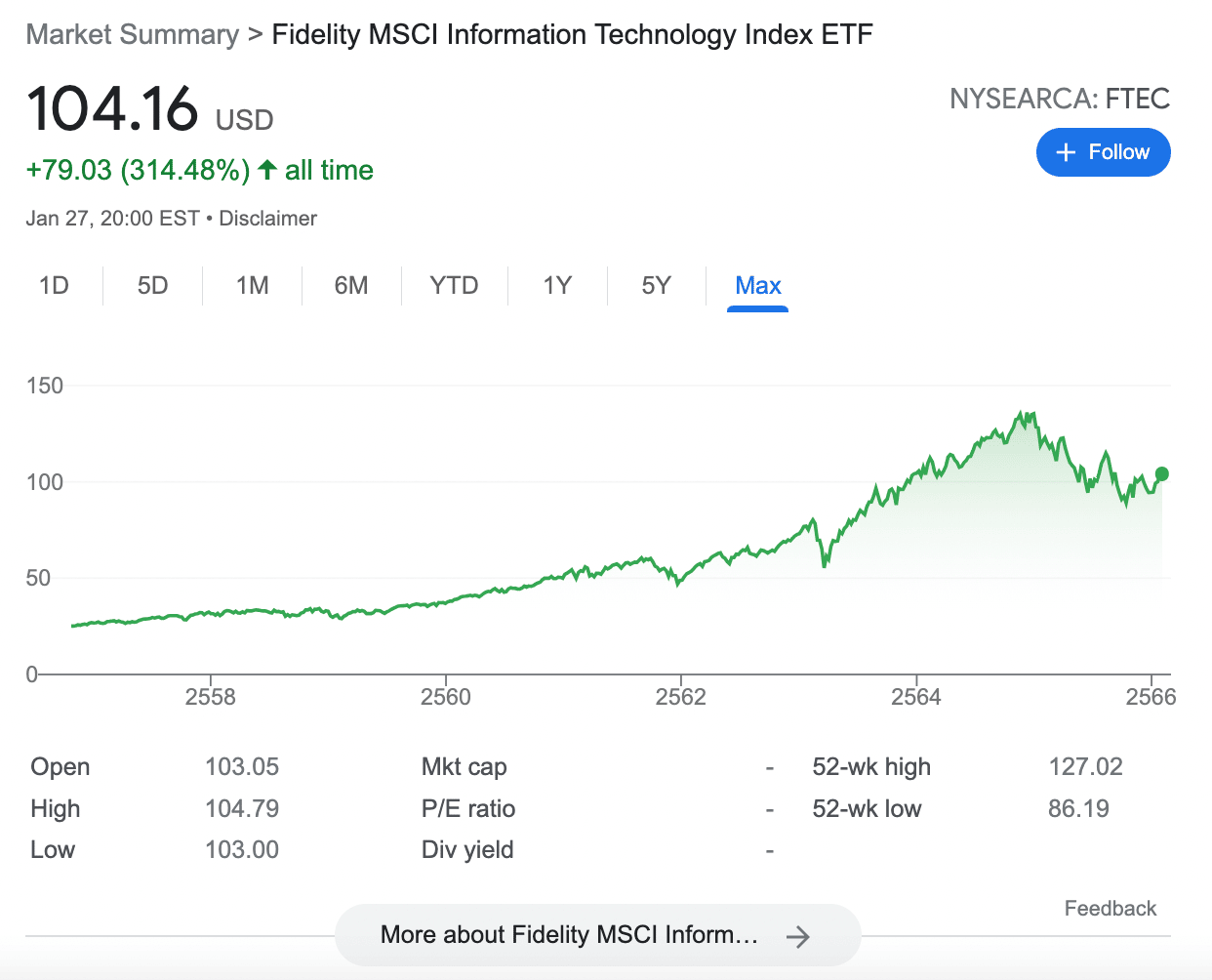

5. Fidelity MSCI Information Technology (FTEC) – One of the Largest Funds to Track High-Growth IT Companies

Fidelity mutual funds are also popular with UK investors. In the case of the Fidelity MSCI Information Technology (FTEC), this aims to capitalize on the ever-growing US tech space. Its portfolio holds more than 360 stocks, many of which are leaders in their respective niches.

However, we should note that over 20% of the portfolio is held in Apple stocks, and 18% in Microsoft. These two companies alone represent over 38% of the broader portfolio. Other leading stocks held by the Fidelity MSCI Information Technology include Visa, MasterCard, Broadcom, Cisco, and Adobe.

Those in the market seeking the best mutual funds by performance will be pleased to know that the Fidelity MSCI Information Technology has generated total growth of 314% since its inception in 2013. This translates into average annualized gains of more than 16%.

Naturally, however, the information technology sector is often the hardest hit when the wider economy is bearish. As such, investors should bear this in mind before proceeding. Nonetheless, this is also one of the best-priced funds in the market, with an annual expense ratio of just 0.08%.

81% of retail investor accounts lose money when trading CFDs with this provider.

6. Vanguard Real Estate (VNQ) – Actively Managed Real Estate Fund With Quarterly Dividends

Vanguard is also popular with investors that seek to gain exposure to the real estate market without actually owning any properties. This might be suitable for investors in the UK that wish to diversify or simply do not have the required capital to purchase a home outright.

The Vanguard Real Estate (VNQ), for example, offers exposure to more than 160 stakeholders from within the US property sector, each of which can have a portfolio of thousands of individual properties. This fund is also considered cost-effective, considering that the annual expense ratio amounts to just 0.12%.

Vanguard Real Estate is diversified across a wide range of property markets. Not only does this include residential units, but healthcare facilities, offices, shopping complexes, hotels, resorts, and more. Some of the largest holdings include Prologis, American Tower, Equinix, Realty Income, Public Storage, and Crown Castle International.

When it comes to performance, this fund has generated average annualized returns of 7.43% since its inception in 2004. Over a five-year period, annualized returns have been more modest at 3.66% per year. This fund may also appeal to investors that seek regular income, considering that properties generate rental payments.

81% of retail investor accounts lose money when trading CFDs with this provider.

7. Vanguard FTSE Emerging Markets (VWO) – Secure Indirect Exposure to Emerging Market Economies

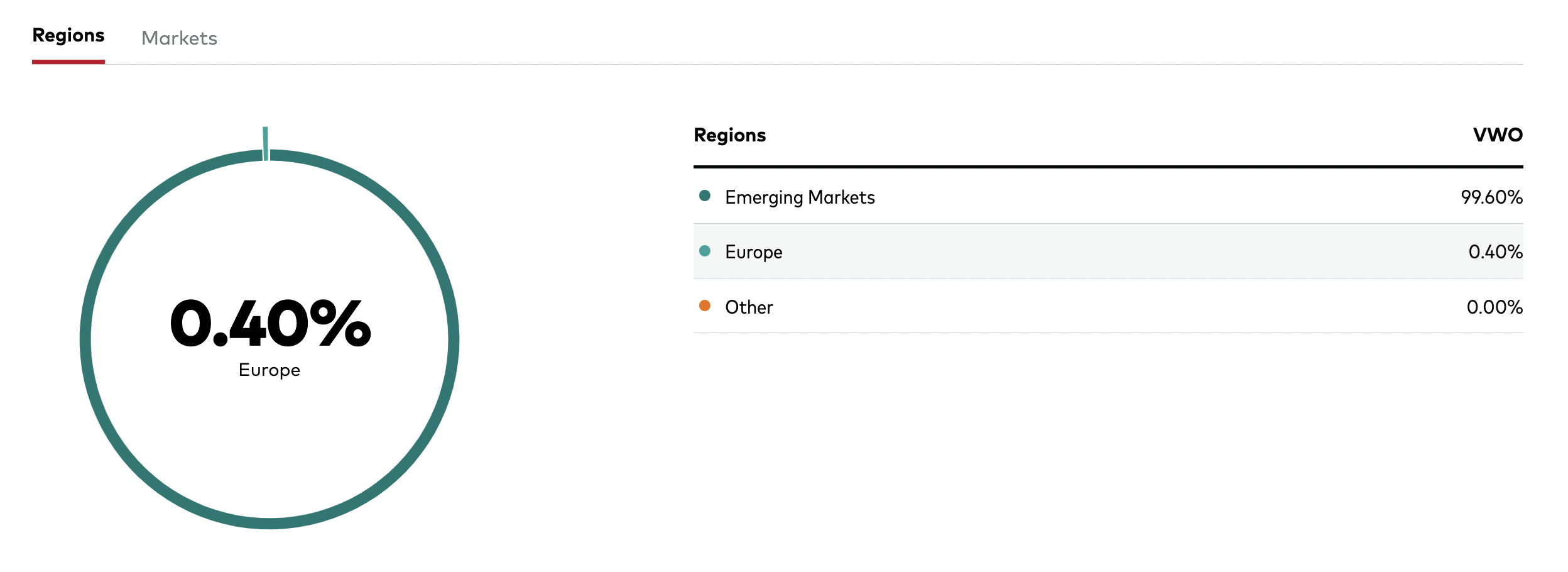

Some of the best mutual funds by performance in recent years are those that target the emerging market economies. The Vanguard FTSE Emerging Markets (VWO), for example, is tasked with offering access to fast-growing markets found in South Africa, Brazil, China, and more.

Although the fund targets stocks that would otherwise be challenging for retail clients to access, the expense ratio is competitive at just 0.08% annually. Some of the largest companies held by this fund include Taiwan Semiconductor Manufacturing, Tencent Holdings, Reliance Industries, Alibaba Group, Vale SA, JD.com, and China Construction Bank.

Naturally, the value of the Vanguard FTSE Emerging Markets is often volatile, considering the regions being targeted. Over the prior year, for example, the fund is down over 18%. Much of this is due to extended COVID-related lockdown measures in China. Nonetheless, since its inception in 2005, this fund has generated average annualized returns of 5.16%.

81% of retail investor accounts lose money when trading CFDs with this provider.

8. Vanguard Total Bond Market (BND) – Enables Access to Over 10,000 Actively Traded Bonds

Most of the funds discussed so far focus exclusively on stocks. With that said, some investors will be in the market for the best mutual funds by performance from within the bond trading arena. The Vanguard Total Bond Market (BND) is popular with income-seeking investors, considering that it offers exposure to more than 10,000 bonds.

The average bond maturity day is 8.9 years, which is slightly above the 8.5-year benchmark. The average yield-to-maturity is a respectable 4.6%. The Vanguard Total Bond Market has more than 67% of its portfolio in US government bonds. The balance comes from the corporate bond sector.

For instance, there are bonds issued by the likes of American Express, Amazon, and Broadcom. As is to be expected from a high-grade bond fund, the Vanguard Total Bond Market has generated modest returns since its inception in 2007 – with average annualized gains of 2.83%. The expense ratio is super-low at just 0.03% annually.

81% of retail investor accounts lose money when trading CFDs with this provider.

9. VanEck Gold Miners (GDX) – Five-Year Returns of Over 40%

Another area that is popular with mutual fund investments is gold. In the case of the VanEck Gold Miners (GDX), this fund offers exposure to mining companies rather than the commodity itself. With that said, this fund generally performs better when gold prices are high, albeit, there will always be a disparity between the two metrics.

Nonetheless, not only does the VanEck Gold Miners offer exposure to nearly 50 mining organizations, but the portfolio is diversified across many regions and continents. For example, 41% of the portfolio is held in Canadian mining firms, with 17% and 13% relevant to companies headquartered in the US and Australia respectively.

Other regions include Brazil, South Africa, China, Tanzania, and the UK. Naturally, most firms will have transnational mining operations in multiple countries. In terms of performance, the VanEck Gold Miners has generated cumulative returns of over 40% in the prior five years of trading.

81% of retail investor accounts lose money when trading CFDs with this provider.

10. VanEck Oil Services (OIH) – High-Growth Fund Targeting Oil and Gas Service Providers

Another popular area to research further when exploring mutual funds to invest in is oil and gas. Unlike traditional funds in this space, VanEck Oil Services (OIH) targets service providers. These are companies that serve conventional oil giants such as Exxon Mobil, BP, and ConocoPhillips.

In total, VanEck Oil Services has a rather modest portfolio of 25 stocks as of writing. Two of the largest holdings are inclusive of Schlumberger Nv and Halliburton, with a weighting of nearly 20% and 12% respectively. Other holdings include Baker Hughes, Tenaris Sa, Nov Inc, and Helmerich & Payne.

This is yet another VanEck that has generated notable returns in recent years. In fact, over the prior 12 months alone, the fund has grown by 44%. Although nearly 86% of the oil companies held by the fund are based in the US, VanEck also offers exposure to the Netherlands, Bermuda, and the UK.

81% of retail investor accounts lose money when trading CFDs with this provider.

What are Mutual Funds?

Mutual funds are a financial instrument that permits passive investing. Backed by some of the largest investment houses globally – such as iShares, Vanguard, and Fidelity, mutual funds are actively managed. This means that, unlike index funds, mutual funds will aim to outperform the broader market.

As such, mutual funds are not only judged by annualized returns, but how this compares to benchmark indexes. By opting for a mutual fund, there is no input required from the investor. On the contrary, each and every investment decision is determined by the fund manager.

Not only in terms of which securities to buy, but when to enter and exit positions. Due to the level of expertise required, mutual funds are typically more expensive than index funds. Therefore, investors seek higher returns when opting for a mutual fund over a conventional tracker market such as the S&P 500 or Dow Jones.

Mutual funds do not trade on traditional stock exchanges like index funds that are backed by ETFs. In turn, mutual funds are priced based on the net asset value (NAV) of their respective portfolios. This takes into account the value of each asset at the end of the trading day.

Another thing to take into account when searching for the best mutual funds by performance is that virtually any marketplace imageable can be targeted. For instance, some mutual funds will target large-cap stocks in the UK or the US, while others might seek to gain exposure to emerging market economies found in China, South Korea, or South Africa.

In other cases, mutual funds will target specific sectors, such as information technology, oil and gas, banking, or consumer staples. Dividend-centric mutual funds are also popular with investors – particularly those that seek predictable income. To invest in a mutual fund, retail clients will generally go through a regulated UK trading platform.

Things to Consider When Investing in Mutual Funds

Mutual funds are just one financial product available to UK investors.

As such, before exploring the best mutual fund by performance, investors should assess whether or not this asset class is suitable for their long-term goals and tolerance for risk.

Portfolio Management

Perhaps the most appealing aspect of mutual funds for UK investors is that the entire process of managing the portfolio is taken care of. More specifically, once the initial investment is made, there is no required input from the investor at all.

This means that the mutual funds will handpick which investments are added to the portfolio. The mutual fund will also determine the required weight of each investment.

This is the percentage given to each investment when compared to the broader exposure of the mutual fund. The mutual fund will actively maintain and rebalance the portfolio, too.

This is with the view of giving the mutual the best chance possible of outperforming the broader market.

Outperform, Rather than Just Tracking

As noted above, mutual funds will aim to outperform the broader markets, rather than tracking a specific benchmark as index funds do.

This does, of course, come with both benefits and drawbacks. On the one hand, if the mutual fund is successful in outperforming the market, then this will generate more attractive returns for investors – had they instead opted for a conventional index tracker.

On the other hand, there is no guarantee that the mutual fund will be successful in outperforming its benchmark targets. In fact, in recent years, index funds have generally performed better than their mutual fund counterparts.

Access to Non-Traditional Markets

One of the most popular aspects of mutual funds is that investors have access to non-traditional markets at fair pricing. For instance, we mentioned earlier that some mutual funds target emerging market economies, such as India, China, and Brazil.

For retail clients looking to inject modest amounts into these economies, access is often restricted. And even if the investor can buy stocks and bonds from emerging economies, fees are often very high.

Mutual funds, however, typically manage multi-billion pound portfolios, meaning that they access any market of their choosing and at competitive pricing.

Regular Income

Mutual funds not only offer the chance to outperform the broader market from the perspective of asset price growth, but they can also provide a steady flow of income.

This is because many mutual funds distribute dividends every three months. Some go one step further by doing this on a monthly basis. Do note, however, some mutual funds make a distribution bi-annually or even annually.

Either way, distributions represent the investor’s share of dividends received during the period.

Expense Ratios

Although some mutual funds offer competitive pricing, expense ratios will generally be a lot higher when compared to a traditional index fund.

After all, index funds are low maintenance, insofar as they are simply tasked with tracking a benchmark like the S&P 500. Mutual funds, on the other hand, are labor intensive, considering that the overarching objective is to generate returns above and beyond what tracker indexes offer.

As such, investors should expect higher annual fees when opting for a mutual fund. This is especially the case when targeting non-traditional markets, such as the emerging economies.

Redemption Clauses

Another thing to consider when searching for the best mutual funds by performance is that some providers have unfavorable redemption terms.

This refers to the length of time that the investor must wait until a withdrawal request can be made. In some instances, this could be several years from the time the investment is made.

Making a redemption from a mutual fund can also come with high withdrawal fees and even penalties. As such, investors should only consider mutual funds if they are prepared to lock the funds away for at least 3-5 years.

How to Invest in Mutual Funds UK

Wondering how to invest in the best performing mutual funds in the UK? Investing in a mutual fund is relatively straightforward. Although some fund managers accept direct investments, the most cost-effective way is to opt for a regulated broker that is aimed at casual investors.

Here’s a basic overview of the investment process when injecting money into a UK mutual fund.

Step 1: Choose a Regulated FCA Stock Broker

eToro is an FCA-regulated broker that is home to hundreds of funds from a wide range of target markets. When investing in a fund, the minimum requirement is just $10 and no commission fees are charged.

After choosing a suitable broker, proceed to open an account by providing some personal information and contact details. In most cases, the broker will request a copy of a passport or driver’s license.

81% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Deposit Funds

After opening a brokerage account, the next step is to make a deposit. This should cover the minimum requirement stipulated by the broker and the respective amount being invested in the mutual fund.

At eToro, the minimum deposit requirement is $10 or about £8. In comparison, when investing directly with a fund provider, the minimum can be £500 or more.

Deposit methods at eToro are inclusive of debit cards, e-wallets, and UK bank transfers.

Step 3: Research Suitable Mutual Funds

Now that a brokerage account has been opened and funded, the next step will require some in-depth research.

When creating a shortlist of the best UK mutual funds, it is important to make the following considerations:

- What is the target market, such as dividend mutual funds?

- How has the mutual fund performed in recent years in comparison to the broader market?

- Does the mutual fund pay regular income and if so, how often?

- How risky are the investments held by the mutual fund?

- Is there a minimum redemption period before a withdrawal can be made?

- How much does the mutual fund charge in annual expense ratios?

- What is the minimum investment stipulated?

Just remember, there are no guarantees that the chosen mutual fund will outperform its target benchmark, let alone make a profit. As such, investors should consider reducing their risk exposure through a diversification strategy.

Step 4: Complete Mutual Funds Investment

After a suitable mutual fund has been chosen, the final step is simply a case of completing the order with the chosen brokerage.

There should be a search box somewhere on the brokerage platform, so type in the name of the mutual fund.

Then enter the amount of money to be invested. After confirming the order, the stock broker will execute the mutual fund trade on behalf of the investor.

Note: Beginners that are still unsure whether mutual funds are right for their financial goals can read our guide on the best UK investments, according to experts.

Mutual Funds vs ETFs

Mutual funds are very similar in nature to ETFs for several reasons.

For example, both mutual funds and ETFs can either be actively or passively managed. Moreover, each mutual fund and ETF will have a specific target market in place, such as high-yield dividend stocks or bonds from the emerging markets.

Moreover, both mutual funds and ETFs are managed on behalf of investors and in most cases, dividends are distributed on a quarterly basis.

However, the key difference between mutual funds and ETFs is the way in which investments are facilitated. For example, ETFs trade on public stock exchanges, so the process is not too dissimilar from electing to buy shares in the UK.

Furthermore, the ETF will have a share price that moves up and down throughout the trading day.

In comparison, mutual funds do not trade on public stock exchanges. Moreover, the price of a mutual fund will only be updated at the end of each day and this is based on the NAV of the respective portfolio.

Mutual Funds vs Index Funds

In the vast majority of cases, index funds are tasked with tracking a particular marketplace like-for-like.

For instance, most index fund investments are made to track major stock benchmarks like the FTSE 100, Dow Jones, and S&P 500. This means that when the FTSE 100 rises, so will the index fund that is tracking it – and vice versa.

Mutual funds, in most cases, are actively managed. As noted throughout this guide, this means that mutual funds will aim to outperform traditional markets, such as index funds.

Another thing to note is that index funds are represented by ETFs. And as we covered above, ETFs trade on public stock exchanges for seamless entry and exit into and from the markets.

Mutual Funds vs Hedge Funds

Mutual funds and hedge funds carry many similarities. Both financial products enable investors to gain exposure to their chosen market in a passive manner. Moreover, neither mutual funds nor hedge funds trade on public exchanges.

However, the key difference is that while most mutual funds are available to retail clients, hedge funds are exclusively private. In fact, expect to be asked for at least £1 million when approaching a hedge fund in the UK.

Another thing to note is that hedge funds will typically target much more sophisticated strategies when compared to mutual funds. This includes short-selling – which aims to make a profit from declining asset prices.

Conclusion

This guide has explored some of the best mutual funds by performance and other core metrics, such as the target market, expense ratio, and asset class.

Mutual funds may appeal to investors that wish to have their money managed on their behalf and perhaps target markets that are not readily available to retail clients.

However, casual investors may also consider index funds and ETFs, considering that entry and exit into and from the market is more seamless, not to mention more cost-effective.