Many forex traders looking for more competitive rates look to No Dealing Desk brokers. However, finding the best NDD forex broker will require research into different platforms and features.

Luckily, we’ve got it covered. In our Best NDD Forex Brokers review, we’ll be sharing the top brokers that do not fully use dealing desks. Some of the things we’ll be taking a look at are the pricing models, spreads, leverage, and trading platforms for you to compare. Let’s get started.

Here’s a list of our picks for the best NDD forex brokers based on research. The 10 Best NDD Forex Brokers in 2023 List

81% of retail investor accounts lose money when trading CFDs with this provider.

Best NDD Forex Brokers Reviewed

Offering competitive prices through a network of liquidity providers isn’t the only thing to consider when looking into NDD forex brokers. The best trading platforms offer an excellent trading experience through product design, user-interface, and low overall costs. Here’s a closer look at the best NDD forex brokers today.

1. XTB – Overall Best NDD Trading App

With close to 20 years of market experience, XTB is our overall best non dealing desk broker. It’s well regulated, offers an innovative proprietary platform called xStation, and offers over 2,100 financial instruments including 48 forex pairs. The broker is considered to be a global leader in forex and CFD trading.

XTB also lets its users trade on the go with xStation mobile, their mobile application available for Android and iOS devices. Many forex brokers rely on the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms for their users to trade, but they both require a desktop to run. xStation mobile provides trading of over 1,500 instruments that users can trade wherever they are.

Beginner traders will benefit from the broker’s weekly live webinars and educational trading courses while experienced traders can find value in the advanced trading tools of xStation and the range of markets offered. This makes XTB a very well-rounded broker and our choice for overall best NDD forex broker.

The standard account in XTB includes 24/5 customer support, a personal account manager, and 0% commission on trades. More features of the broker can be found in our XTB review and in the below.

Forex Pairs

48 pairs

Max Leverage

1:30 leverage for retail clients

Other Instruments

Stocks, Commodities, Indices, ETFs, Crypto

Pricing

0% commission

Spread for USD/EUR

From 0.1 pips

Trading Platforms

Proprietary platform

Accepts US Clients

No

What We Like

81% of retail investor accounts lose money when trading CFDs with this provider.

2. Pepperstone – Top Australia-based NDD Forex Broker

The next best NDD forex broker is Pepperstone, a highly-rated platform headquartered in Sydney. The regulated online broker is a particularly good option for those looking for tight forex spreads as it draws from a network of top-tier liquidity providers.

These competitive spreads can be accessed through Pepperstone’s raw accounts and clients are allowed scalping, trading bots in expert advisors (EA), and hedging. Additionally, clients can have diverse portfolios and open positions in stocks commodities, and even cryptocurrencies.

The base currencies available for Pepperstone accounts include USD, AUD, JPY, EUR, GBP, CHF, NZD, SGD, and HKD. A minimum lot size of 0.01 is required to open a trade and the maximum leverage for retail users is 1:200. Check out the details below or our Pepperstone review for more broker features.

Forex Pairs

Over 60 pairs

Max Leverage

1:200 for retail clients

Other Instruments

Stocks, Commodities, Indices, ETFs, Crypto

Pricing

$3.5 per lot for raw accounts, 0% for standard account

Spread for USD/EUR

From 0 pips

Trading Platforms

TradingView, cTrader, MT4, MT5

Accepts US Clients

No

What We Like

74% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

3. SuperForex – Established NDD Forex Broker With Proprietary App

SuperForex also stands out for traders who want to lean heavily on margin. The broker offers retail traders the ability to apply leverage up to 2,000:1 to major forex pairs like EUR/USD. Traders can approach the market using MetaTrader 4 or SuperForex’s own proprietary mobile app, but the broker doesn’t offer professional market research of its own.

This NDD forex broker only requires a minimum deposit of $1 to get started, but traders who make a deposit can take advantage of several forex bonus offers. SuperForex has a 50% deposit match welcome bonus along with additional matching offers for large deposits. Traders can make deposits with a credit card, debit card, bank transfer, or Skrill, all with no deposit fees.

Forex Pairs

50 pairs

Max Leverage

1:2000 for certain account types

Other Instruments

Stocks, Commodities, Indices, Crypto

Pricing

0% commission for Standard account

Spread for USD/EUR

From 2.0 pips

Trading Platforms

Proprietary app, MT4

Accepts US Clients

No

What We Like

4. FBS – A-Book NDD Forex Broker With High Leverage

In recent years, FBS has gained a lot of traction not only as a forex broker but as a multi-asset platform as well. As an A-book broker, FBS directly routes its clients’ trade orders to liquidity providers instead of keeping the orders internally. This makes FBS more trustworthy as a whole much like the best NDD forex brokers.

The main highlight to FBS is a huge leverage of 1:3000 that is provided in some accounts. This unique offering is backed by negative balance protection to make trading safer with the leverage given.

FBS is also regulated with licenses from the top regulatory bodies such as ASIC, and even FSCA in South Africa. The online broker provides some of the best user experiences thanks to running educational seminars and trading materials that it provides to clients. More of the broker’s trading details can be found below.

Forex Pairs

43 pairs

Max Leverage

1:3000 for certain account types

Other Instruments

Stocks, Commodities, Indices, Crypto

Pricing

$6 commission for ECN account, 0% commission for Standard account

Spread for USD/EUR

From 0 pips

Trading Platforms

Proprietary app, MT4, MT5

Accepts US Clients

No

What We Like

5. Eightcap – Award-winning NDD Forex Broker With Over 1000 Markets

The last platform we’ll go through among the best NDD forex brokers is Eightcap, an online broker known for being a low spreads forex broker. It also offers easy deposit methods, personal customer service, and multi-award winner. Eightcap offers over 40 major and minor currency pairs as well as other trading instruments across 1000+ markets.

With Eightcap, users can open a raw account which has spreads starting from 0 pips for major pairs. Raw accounts have a $3.5 commission while standard accounts have 0% commission and spreads starting from 1 pip. Additionally, clients will enjoy the wide variety of payment methods offered by this leading Neteller forex broker such as bank cards, PayPal, Neteller, and even crypto deposits.

Opening an account with Eightcap will require a $100 minimum deposit for both standard and raw accounts. USD, GBP, EUR, AUD, NZD, SGD, and CAD are all support base currencies with the forex broker. View more features and details of the regulated broker in the table below.

Forex Pairs

Over 40 pairs

Max Leverage

1:30 for Australian clients, 1:500 for non-Australian clients

Other Instruments

Stocks, Commodities, Indices, Crypto

Pricing

$3.5 commission for Raw account, 0% commission for Standard account

Spread for USD/EUR

From 0 pips for Raw account; From 1 pip for Standard account

Trading Platforms

WebTrader, TradingView, MT4, MT5

Accepts US Clients

No

What We Like

Best NDD Forex Brokers Compared

Below is a table summary to help you compare the best NDD Forex Brokers.

Forex Brokers

Forex Pairs

Max Leverage

Other Instruments

Pricing

EUR/USD Spread

Trading Platforms

Accepts US Clients

XTB

48 pairs

1:500 leverage

Stocks, Commodities, Indices, ETFs, Crypto

0% commission

From 0.1 pips

Proprietary platform

No

Pepperstone

Over 60 pairs

1:200 for retail clients

Stocks, Commodities, Indices, ETFs, Crypto

$3.5 per lot for raw accounts, 0% for standard account

From 0 pips

TradingView, cTrader, MT4, MT5

No

SuperForex

50 pairs

1:2000 for retail clients

Stocks, Commodities, Indices, ETFs, Crypto

0% commission for Standard account

From 2.0 pips

Proprietary, MT4

No

FBS

43 pairs

1:3000 for certain accounts

Stocks, Commodities, Indices, Crypto

$6 commission for ECN account, 0% commission for Standard account

From 0 pips

Proprietary app, MT4, MT5

No

Eightcap

Over 40 pairs

1:30 for Australian clients, 1:500 for non-Australian clients

Stocks, Commodities, Indices, Crypto

$3.5 commission for Raw account, 0% commission for Standard account

From 0 pips for Raw account; From 1 pip for Standard account

WebTrader, TradingView, MT4, MT5

No

Vantage

Over 40 pairs

1:500 leverage

Stocks, Commodities, Indices

$3 per lot per side for Raw ECN account, 0% commission for Standard STP account

From 0 pips for Raw ECN account

Proprietary app, ProTrader, WebTrader, MT4, MT5

No

FXCM

10 pairs

1:400 leverage

Stocks, Commodities, Indices, Crypto

0% commission

From 1 pip

Trading Station, MT4, ZuluTrader, NinjaTrader, Capitalise AI

No

IC Markets

Over 61 pairs

Up to 1:500 leverage

Stocks, Commodities, Indices, Crypto, Bonds, Futures

$3.5 per lot per side for Raw Spread account, 0% commission for Standard account

From 0 pips for Raw Spread account;From 0.6 pips for Standard account

WebTrader, MT4, MT5, cTrader. ZuluTrade

No

FXPro

70 pairs

1:200 for retail clients

Stocks, Commodities, Indices, Crypto,Futures

0% commission on MT4, MT5, and FxPro Edge accounts

1 pip

Proprietary platform, MT4, MT5, cTrader

No

FP Markets

63 pairs

Up to 1:500 leverage

Stocks, Commodities, Indices, ETFs, Crypto, Bonds, Futures,

$3 commission per side on Raw ECN account, 0% commission for Standard account

From 1.2 pips for Standard account;From 0 pips for Raw ECN account

Proprietary mobile app, MT4, MT5, WebTrader

No

What is an NDD Forex Broker?

Some of the best forex brokers use both Dealing Desk (DD) and NDD systems for trade execution. No Dealing Desk forex brokers incorporate the currency prices from a network of banks and other liquidity providers. At an NDD broker, the forex rates that clients see are the best available prices across the network.

This is in contrast to DD brokers wherein trades are kept internally. These types of brokers are also known as market makers who buy and sell financial instruments on a regular basis and take the other side of their clients’ positions. With this system, the broker earns through the equivalent losses of its clients.

If you’d like to learn more about the forex markets you can read our guide on what is forex trading.

Benefits of Using an NDD Forex Broker

After defining both DD and NDD forex brokers, the advantages of using the latter are easier to identify. For one, NDD brokers let its clients trade directly with the prices given by multiple liquidity providers. With this method, it’s often the case that forex rates are razor sharp with low spreads that benefit the traders.

Another benefit to using NDD forex brokers is that there is no conflict of interest when clients open a position. Since DD brokers need to take an opposing position to clients’ trades, there is an inherent discord between both parties. This means that DD brokers or market makers can potentially alter the prices given.

NDD brokers act more of a facilitator for its clients since positions are determined by outside sources (liquidity providers and banks) so the broker won’t be able to manipulate rates.

How to Trade with an NDD Forex Broker

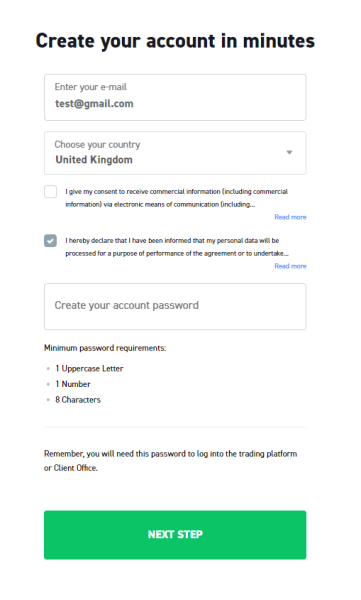

Although it might take more time to find the best NDD forex broker for you, it’s important that we discuss how to trade with one using XTB as an example.

Step 1: Open an Account

Head to the XTB website and click on the ‘create account’ button at the right side of the navbar. Then, you’ll have to input your email, country of residence, a secure password, and other details associated with account registration. Opening an account takes just minutes.

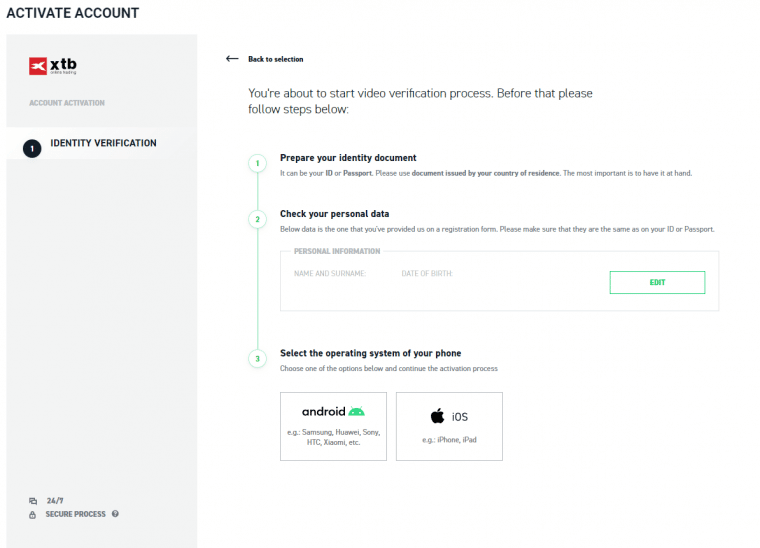

Step 2: Verify Account

Once you’ve filled in all the registration details correctly, you’ll need to activate your XTB account to start live trading. The site will ask for a video verification process which requires the preparation of a valid government document issued by your country of residence. Double-check your personal data and then confirm your smartphone’s operating system.

Step 3: Deposit Funds

Now that your account has been verified, you can start depositing funds. Head to the xStation trading platform and click on ‘deposits’. Choose your payment method, enter the payment information, and select how much you want to deposit. There is no minimum deposit requirement for XTB.

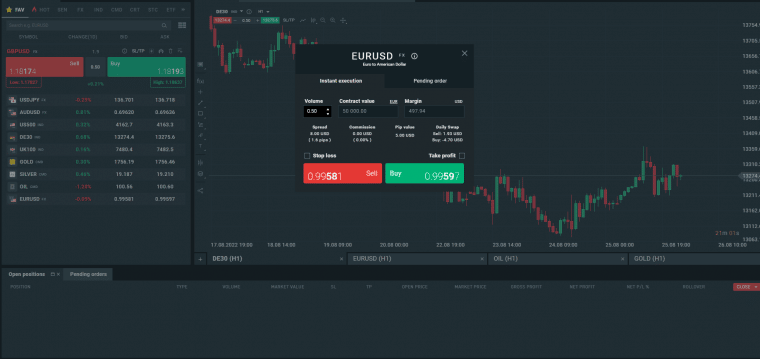

Step 4: Open a Position

To start trading, head to the xStation platform and search for the financial instrument that you want to trade. Fill in the volume and optional stop loss and take profit parameters then click on the green ‘buy’ button to start your trade.

eToro – the Best Alternative to NDD Forex Brokers

eToro is a SEC and FINRA regulated broker that offers over 2,900 shares, 76 cryptocurrencies, 49 forex pairs, and 264 ETFs. More financial instruments can also be traded such as commodities and indices. With all of these assets available, eToro allows for its clients’ to have extremely diverse portfolios for both long and short term time frames.

Particularly for its forex offerings, retail traders can utilize a maximum of 1:30 leverage while professional clients have access to 1:400 leverage. Through CFDs, clients can buy and sell a selection of major and minor currency pairs.

More than broker, eToro is also a social trading platform which is one of its flagship features. The eToro CopyTrader platform lets users automatically copy the best performing traders which they’ve marketed to yield over 30% in yearly profits. Not only is this perfect for beginners because of the chance to follow experienced investors but it’s also a chance for new traders to learn and be part of a collaborative trading community.

eToro accounts require just a $10 minimum deposit for accounts which is also the minimum trade size for opening any position. Learn more about the NDD alternative and its benefits in our eToro review.

Conclusion

Aside from the network of liquidity providers, NDD forex brokers compete against each other through different market offerings and features that benefit the overall trading experience. The best NDD forex broker for any investor will depend on their preferences and experience level.

If the NDD forex brokers on our list do not meet your standards then the recommended alternative is eToro. Given its 0% commissions, huge variety of trading instruments offered, and flagship copy trading platform, eToro’s value proposition stands to benefit the majority of traders. Click on the link below to start trading with eToro.

78% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What are NDD Forex Brokers?

Which is the best NDD Forex Broker?

Is XM an NDD broker?

Is FXCM an NDD broker?