Offering a wide variety of payment methods makes forex brokers more accessible to its users. If you are one of the millions of Neteller account holders, then using the best Neteller forex broker will greatly benefit your trading experience.

In this Best Neteller Forex Brokers review, we’ll be taking an in-depth look at the top forex brokers that accept Neteller. Some of the areas that we’ll be discussing include performance, regulations, fees, and other key features.

The Best Neteller Forex Brokers in 2023 List

Here’s a list and short descriptions of our best Neteller forex brokers according to our research.

- eToro – Overall Best Neteller Forex Broker

- XTB – High Performance Neteller Forex Broker With Proprietary App

- Pepperstone – Fast and Reliable Australia-based Neteller Forex Broker

- AvaTrade – Highly Trusted Neteller Broker With Top Platforms

- IC Markets – Powerful Neteller Forex Broker With High Volume

- FxPro – Trusted Neteller Broker With Multiple Forex Pair Offerings

- FBS – Award Winning Neteller Broker With Multiple FX Pairs

- XM – High Leverage Neteller Forex Broker Multiple Platforms

- Oanda – Established Neteller Forex Broker With Low Spreads

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

Top Neteller Forex Brokers Reviewed

Providing clients with more payment options not only makes forex brokers more inclusive but can also be a competitive advantage. The best Neteller forex brokers or forex brokers that accept Neteller should provide a seamless trading experience with a user-friendly interface and high value. Let’s look at the top six best Neteller brokers from our list.

1. eToro – Overall Best Neteller Forex Broker

With more than 20 million registered users across 140 countries, eToro is one of the leading forex brokers that accepts Neteller. Thanks to a very intuitive trading interface, 0% commissions, and many more trading features, the platform continues to benefits users of varying trading backgrounds.

Upon signing up and creating an account on the platform (which takes just minutes), eToro clients have access to a virtual portfolio or paper trading account. With $100,000 in virtual equity to start, traders can start practicing and getting used to the eToro trading platform. All users have access to the virtual portfolio so that even advanced traders can test their new strategies here.

Even before trading starts on eToro, users are already benefiting from market news, analysis reports, and research tabs. TipRanks financial analysts make up most of the research that offer recommended positions on certain instruments. The latest information on many instruments and their industries can also be found when looking into the provided tradable assets. For those looking for the best swap-free forex accounts, eToro offers an Islamic trading account enabling traders to go long or short on FX pairs without having to pay any overnight fees.

When it comes to the actual trading itself, eToro users have access to ProCharts, a cutting-edge technical analysis tool that allows for different indicators to be shown simultaneously. Traders can have the charts of multiple instruments open and quickly trade among them.

Especially when day trading, every second counts and fast executions become more important. As eToro’s users perform repeat trades that are time-sensitive, One-Click trading is an eToro feature that allows for a trade to execute after a single click. These trades have predetermined parameters that can be set beforehand.

Learn more about eToro in our eToro Review. You’ll also find more features listed below.

Forex Pairs

49 pairs

Max Leverage

1:30 for retail clients

Pricing

0% commission

Spread for USD/EUR

1 pip

Neteller Deposit Fee

None

Trading Platforms

Proprietary platform

Accepts US Clients

No

What We Like

78% of retail investor accounts lose money when trading CFDs with this provider.

2. XTB – High Performance Neteller Forex Broker With Proprietary App

Next on our list of the best forex brokers that accept Neteller is XTB, one of the largest and most regulated CFD brokers globally. Aside from forex, XTB supports other top global markets and more than 2,000 tradable assets thanks to almost 20 years of market operations.

XTB is also among the best NDD forex brokers that has access from some of the largest liquidity providers. Its clients have up to 1 million euros, sterlings, or Australian dollars in insurance to keep investments safe. Additionally, the XTB customer support team operates 24 hours a day and 5 days a week.

One of the areas where XTB shines the most is in its proprietary platforms, xStation for desktop and xStation mobile for smartphones. As both MT4 and MetaTrader 5 (MT5) aren’t the most straightforward platforms to use especially for beginners, xStation is an easy-to-use platform with a simple and intuitive design.

There are two account types to choose from with XTB: Standard and Swap Free. Both offer 0% commissions, up to 1:500 leverage, and multi-asset trading. The latter has a slightly larger minimum spread at 0.7 pips while the former starts at just 0.5 pips. More XTB features and details can be found below.

Forex Pairs

48 pairs

Max Leverage

1:30 leverage for retail clients

Pricing

0% commission

Spread for USD/EUR

From 0.1 pips

Neteller Deposit Fee

1%

Trading Platforms

Proprietary platform

Accepts US Clients

No

What We Like

81% of retail investor accounts lose money when trading CFDs with this provider.

3. Pepperstone – Fast and Reliable Australia-based Neteller Forex Broker

Pepperstone is the next best Neteller forex broker due to fast and reliable trading speeds, low costs, and offering multiple ways to trade. Founded in 2010, Pepperstone is a multi-regulated platform that supports trading of over 60 different forex pairs.

Aside from offering some of the most niche and exotic pairs, Pepperstone also has integrations with multiple trading platforms. More than the typical MT4 and MT5 platforms, the Neteller broker uses TradingView, cTrader, and the social trading platform DupliTrade.

One of Pepperstone’s strongest features is trading through spread bets. In fact, the broker is one of the best spread betting platforms. Spread betting is a derivatives-based trading method that lets clients from the UK and Ireland trade tax free. Since traders who use spread betting do not own the underlying asset, they are also exempt from stamp duty fees.

Razor or low spread accounts on Pepperstone have a commission per lot of just $3.5 and the maximum leverage available is 1:200 for retail clients. Read our Pepperstone review to better understand the benefits of spread betting with the broker. Other key features and details can be found below.

Forex Pairs

Over 60 pairs

Max Leverage

1:200 for retail clients

Pricing

$3.5 per lot for raw accounts, 0% for standard account

Spread for USD/EUR

From 0 pips

Neteller Deposit Fee

None

Trading Platforms

TradingView, cTrader, MT4, MT5

Accepts US Clients

No

What We Like

74% of retail investor accounts lose money when trading CFDs with this provider.

4. AvaTrade – Highly Trusted Neteller Broker With Top Platforms

The last platform that we’ll be covering from the best Neteller forex brokers list is AvaTrade. Released in 2006, the multi-asset broker was one of the first trading platforms to allow for retail clients to engage in forex markets. Today, with over 300 thousand registered traders, AvaTrade offers about 1,000 financial instruments including stocks, commodities, indices, and cryptocurrencies.

AvaTrade clients can trade through MT4 and MT5 and can even use expert advisors or automated trading bots commonly utilized in forex. The highly trusted broker is regulated across different regions such as EU, South Africa, Australia, and Japan. Top of the line customer support is offered in the form of live chat, email, and phone contact.

Using AvaTrade on AvaTradeGO or WebTrader gives clients access to AvaProtect, a built-in and exclusive risk management tool that protects certain investments from losses. The app can be downloaded on Google Play and the App Store.

A huge benefit for new registrants on AvaTrade is access to their education pack which provides tutorials, daily videos, and webinars on how to be a better trader. Discover more features of AvaTrade in the section below.

Forex Pairs

55 pairs

Max Leverage

1:400 for retail accounts

Pricing

0% commission

Spread for USD/EUR

0.9 pips

Neteller Deposit Fee

None

Trading Platforms

Proprietary App, MT4, MT5, WebTrader

Accepts US Clients

No

What We Like

Best Neteller Forex Brokers Compared

Below is a table summary to help you compare the best Neteller Forex Brokers.

Forex Brokers

Forex Pairs

Max Leverage

Pricing

Spread for EUR/USD

Neteller Deposit Fee

Trading Platforms

Accepts US Clients

eToro

49 pairs

1:30 for retail clients

0% commission

1 pip

None

Proprietary platform

No

XTB

48 pairs

1:500 leverage

0% commission

From 0.1 pips

1%

Proprietary platform

No

Pepperstone

Over 60 pairs

1:200 for retail clients

$3.5 per lot for raw accounts, 0% for standard account

From 0 pips

None

TradingView, cTrader, MT4, MT5

No

AvaTrade

55 pairs

1:400 for retail accounts

0% commission

0.9 pips

None

Proprietary App, MT4, MT5, WebTrader

No

IC Markets

Over 61 pairs

Up to 1:500 leverage

$3.5 per lot per side for Raw Spread account, 0% commission for Standard account

From 0 pips for Raw Spread account;From 0.6 pips for Standard account

None

WebTrader, MT4, MT5, cTrader. ZuluTrade

No

FXPro

70 pairs

1:200 for retail clients

Stocks, Commodities, Indices, Crypto,Futures

1 pip

None

Proprietary platform, MT4, MT5, cTrader

No

FBS

43 pairs

1:3000 for certain accounts

$6 commission for ECN account, 0% commission for Standard account

From 0 pips

None

Proprietary app, MT4, MT5

No

XM

57 pairs

1:1000 leverage

None

Proprietary mobile app, MT4, MT5

No

BlackBull Markets

27 pairs

1:500 leverage

$6 per lot for ECN Prime account, 0% commission for Standard account

From 0.1 pips for ECN Prime account;From 0.8 pips for Standard account

None

TradingView, MT4, MT5, Webtrader

No

Oanda

70 pairs

1:50 for retail clients

From 0% commission

From 0.7 pips

None

Proprietary, MT4, TradingView

No

What is Neteller?

Neteller is an eWallet that can be used as a fast and secure payment method for transferring money or paying online. Since other methods of transferring money like wire transfers are either too expensive, too slow, or both, Neteller benefits its clients by offering a hassle-free digital wallet.

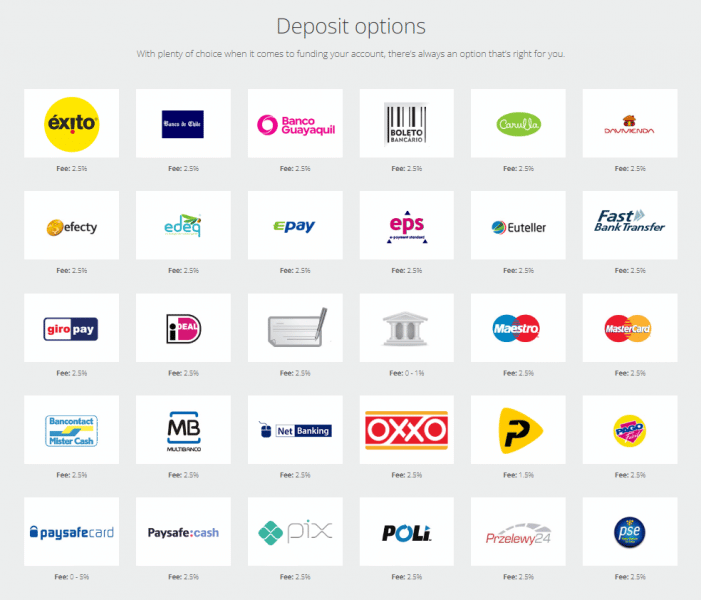

Anyone can join and create a Neteller account for free which they can fund through bank transfer which only has a 1% fee. Another popular method of adding funds to a Neteller account is by credit or debit card which usually reflects on the digital wallet instantly. There are almost 30 other different deposit methods that Neteller accepts which include Euteller, Epay, Maestro debit card, and WebPay.

In terms of withdrawal options, users have the following options and fees:

- Bank Transfer – $10 fee

- MasterCard – 0 to 7.5% fee

- Member Wire – $12.5

- Merchant Sites – 0%

- Money Transfer – 2.99%, minimum fee $0.50

- Skrill – 3.49% fee

- Visa – 0 to .5% fee

Neteller also operates with a loyalty system where higher-tiered loyalty customers get to enjoy special features such as lower transfer fees and exclusive perks. Neteller True accounts have access to upcoming loyalty rewards while Neteller VIP can send money around the world for free and get invited to exclusive promotions and events.

Benefits of Using a Neteller Forex Broker

Neteller is a great solution to sending money online whether it be payment for a platform or simply transferring money to another account. Let’s look at some of the other benefits of using Neteller money brokers.

Quick and Secure Fund Transfers

Compared to other transfer methods like bank transfers and wire transfers which could take days or even weeks, Neteller lets you fund your forex broker account almost instantly. After connecting your Neteller account with your broker account, depositing and withdrawing is easy and seamless.

Additionally, transactions that go through the Neteller payment gateway are 100% guaranteed and secured. Neteller’s online fraud protection is PCI DSS compliant with Two Factor Authentication (2FA) security, zero chargeback risks, and real time monitoring of transactions.

Low Costs and Support for Thousands of Sites

By using a Neteller forex broker, users will be able to spend their earnings through thousands of different merchants and sites that support Neteller. Since these brokers let you withdraw to Neteller, clients can use profits on merchants across the different shopping, gaming, investing, and other Neteller forex trading apps at low costs.

There are zero fees for receiving payments from other Neteller accounts while sending money to other Neteller wallet holders costs just 2.99% of the transaction, minimum of $0.50.

VIP Memberships

As we touched on earlier, Neteller has an entire loyalty program for VIP members. Some of the offers that Neteller VIPs get are tickets to popular sporting events like Champions League finals, Europa League finals, and even the Wimbledon. Other experiences include paid trips to New York, Seychelles, and the Maldives.

These benefits depend on the membership level of the client which rank at Silver, Gold, Diamond, and Exclusive.

Conclusion

Finding the best Neteller trading platform for you will not only depend on your investing strategies and portfolio but also the kind of trading experience you’re looking for. As mentioned above, forex brokers that accept Neteller offer different trading experiences as they target different types of investors.

It might be the case that choosing the overall best Neteller forex broker, eToro, will be the most beneficial for the average trader. With thousands of assets to trade ranging from crypto, forex, and stocks, the platform is one of the best in finding opportunities from the top markets.

Forex traders will find 49 currency pairs to trade from with eToro and can open positions with 0% commission. A leverage of up to 1:30 can be used while accounts are kept safe via negative balance protection. Taking just a few minutes to create an account and requiring just $10 to start, eToro gives a lot of value for most of the traders out there.

If you’re looking to trade with an easy-to-use trading platform, top-class copy trading features, and zero Neteller deposit fees, click on the link below to start trading with eToro.

78% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

FAQs

What are the best Neteller forex brokers?

How can I fund my Neteller forex account?