The equity market is ever-changing, with macroeconomic trends prompting many new stocks to become popular. These new stocks sometimes come in the form of an IPO, although many are established companies that experience a sharp upturn in fortunes – leading to more investment from retail and institutional traders.

This guide presents the most popular new stocks to watch in 2023, discussing which companies have the highest potential and how you can make a stock investment today – without paying any commissions.

The 14 Most Popular New Stocks to Watch in 2023

Below are the most popular new stocks to watch this year, derived through extensive research and analysis. In the following section, we’ll discuss each of these stocks individually, highlighting why they are so widely regarded within the equity market.

- FightOut (FGHT) – Best Alternative to Stocks in 2023 with Fitness App and Gyms

- Dash 2 Trade (D2T) – Crypto Intelligence Platform now in Final Presale Phase

- IMPT – Unique Carbon Offsetting Protocol to Help Fight Climate Crisis

- Tamadoge (TAMA) – Exciting New Meme Coin Project

- Battle Infinity (IBAT) – Another Top New Cryptocurrency

- Grab Holdings (NASDAQ: GRAB) – Asia-Based Company with Huge Growth Potential

- Tilray Brands (NASDAQ: TLRY) – Most Popular Cannabis Stock to Invest In

- Rivian Automotive (NASDAQ: RIVN) – Exciting US-Based Electric Vehicle Company

- Nikola Corporation (NASDAQ: NKLA) – New Electric Vehicle Company Set to Explode in 2023

- Atlassian Corporation (NASDAQ: TEAM) – Most Popular New Software Company to Invest In

- Upstart Holdings (NASDAQ: UPST) – New Growth Stock with Innovative Approach to Lending

- Opendoor Technologies (NASDAQ: OPEN) – New Stock for Exposure to the Real-Estate Industry

- Palantir Technologies (NYSE: PLTR) – Popular Growth Stock Managed by PayPal Co-Founder

- Devon Energy Corporation (NYSE: DVN) – Most Popular New Stock to Watch Passive Income

A Closer Look at the Most Popular New Stocks to Watch in 2023

The majority of the most popular new stocks on our list are growth stocks, which have been going through a tough time due to rising inflation and rumored interest rate increases. However, if you buy stocks regularly, you’ll know that these factors are cyclical – meaning these companies could be primed to bounce back soon.

Below we list and review the ten most popular new stocks on the market right now, and some alternative options to investing in stocks:

1. FightOut (FGHT) – Best Alternative to Stocks in 2023 with Fitness App and Gyms

Our top pick for the best new stocks to watch this year isn’t a traditional stock company but a new cryptocurrency project – FightOut.

The move-to-earn project has already secured more than $2 million in less than a week since its presale went live and is our best new crypto to buy.

Investors are excited by the ambitious plans of FightOut, which is developing a fitness app and will also build and develop real-world gyms that are integrated with Web3 technology and features.

FGHT tokens are currently on sale for just $0.016, with the project aiming to secure $100 million – that money will go towards the acquisition and refurbishment of venues (70%), marketing (18%) and product development (12%).

FightOut’s app will use smart technology to build a digital fitness profile of users. A range of metrics – including movement, key effort indicators, sleep and nutrition – will feed into an algorithm, which then tailors a unique workout regime for each user.

The regimes will not just focus on strength and cardio but take a holistic approach that also includes wellness and mental health.

The digital profile is an NFT avatar that is soulbound – meaning it cannot be sold or traded. Users are rewarded for completing workouts and pitting their digital selves against others in daily, weekly and monthly challenges.

A second currency, REPS, will be used for the rewards – existing off-chain and only in the app – and can be redeemed for discounts on app subscriptions and gym membership, apparel, training equipment, supplements and personal training.

The developers are already scouting venues for its first real-world location and is also in contact with world-class athletes to become FightOut ambassadors. They will not only help market the project but also provide exclusive content, including masterclass-style training regimes.

The team are doxxed and have a background in combat sports and fitness app development.

For more information, read the FightOut whitepaper or join the Telegram channel.

| Presale Started | December 14 |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Ethereum |

| Min Investment | N/A |

| Max Investment | N/A |

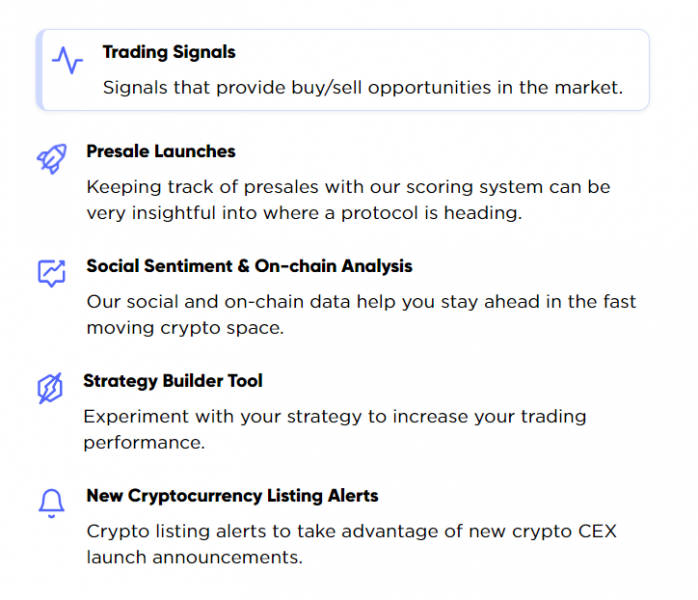

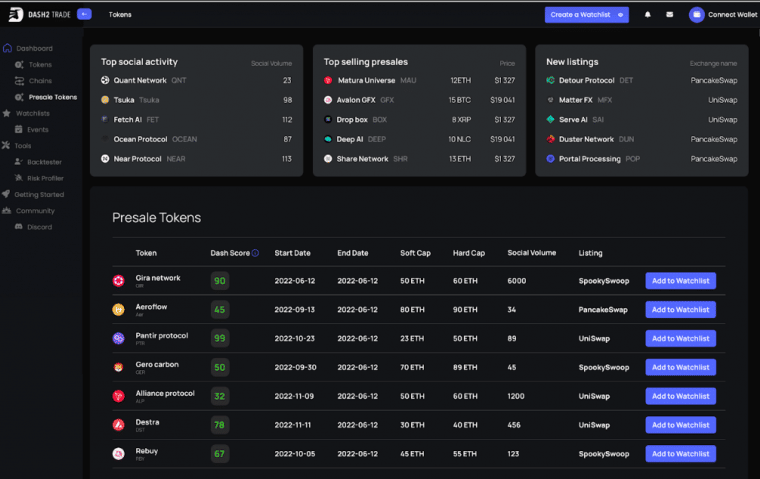

2. Dash 2 Trade (D2T) – Crypto Intelligence Platform now in Final Presale Phase

The protocol is close to reaching the market and is now in the final phase of its presale – with fewer than 65 million tokens remaining on sale.

Investors have been attracted to the low price and high potential of the protocol, which will help its users maximize their crypto earnings through a range of data points, signals, analysis, and insights.

Dash 2 Trade itself is a crypto signals platform that will utilize a variety of metrics to help users – traders and more casual investors – maximize their earning potential.

It will offer trading signals for buying and selling opportunities in the market and also track social sentiment and blockchain data to help spot developing trends.

For traders, the platform will offer a variety of tools and data points to better build trading strategies, as well as a backtesting tool to test them in real-time without risking capital.

Dash 2 Trade is also developing a system to highlight the best new crypto presales, analyzing a variety of data to give a score out of 100 and help investors make better choices.

| Price Stage | Amount Raised In Stage | Token Allocation |

| $0.0476 | $1,666,000 | 35,000,000 |

| $0.0500 | $3,500,000 | 70,000,000 |

| $0.0513 | $3,591,000 | 70,000,000 |

| $0.0533 | $4,663,750 | 87,500,000 |

There will also be alerts for new crypto coin listings and exchange offerings so investors don’t miss out on coins before they pump.

The founders are fully doxxed, KYC-verified by CoinSniper, and have been in the crypto industry for years, with previous project Learn2Trade boasting more than 70,000 global users. The D2T token smart contract has also been audited by SolidProof.

While some crypto presale projects can be risky and turn out to be scams, Dash 2 Trade is a legitimate project that we’ve ranked among our best cryptos to buy under $1.

D2T tokens, which are available for $0.0533 each, allow the holder to gain access to all the tools on the Dash 2 Trade protocol through a three-tiered monthly subscription model.

More information on Dash 2 Trade can be found in the whitepaper or the Telegram group. To enter the presale, read our full how-to-buy guide here.

| Presale Started | October 19 |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Ethereum |

| Min Investment | 1,000 D2T |

| Max Investment | N/A |

3. IMPT (IMPT) – Unique Carbon Offsetting Protocol to Help Fight Climate Crisis

IMPT is another new crypto project that will also have more traditional stock investors interested.

The eco-friendly project has just been listed on leading exchanges Uniswap and LBank after raising more than $20 million during its presale.

Crypto presales tend to perform well even in bear market conditions and can return an ROI of several hundred percent in a short space of time.

Offering a low entry price, IMPT is building a protocol in a vital area – environment, social, and governance (ESG) – which is forecast to be worth a staggering $30 trillion by the end of the decade.

IMPT is one of the first companies to use blockchain technology to help try and ease the climate crisis and global warming.

It will do that by allowing users and retailers to earn IMPT tokens while shopping and on transactions, which can then be converted into carbon credits.

Already big business, carbon credits are effectively a permit to allow businesses to emit carbon into the atmosphere, with one credit equalling one ton of CO2.

They allow for offsetting your carbon footprint and IMPT wants to open them up to all and make them tradeable – as well as reduce fraudulent transactions and increase transparency.

Carbon credits fund green and conservation projects and IMPT will also develop a scoreboard so individuals and businesses can keep track of their efforts.

More than 10,000 retailers and brands have already signed up as partners, including leading companies such as Nike, Dyson, Amazon and Samsung.

More information on IMPT and carbon credits can be found in the whitepaper, and those interested should join the Telegram group for the latest news.

4. Tamadoge (TAMA) – Best Alternative to Stocks in 2023 Exciting New Meme Coin Project

Some market commentators also consider crypto to be easier to beat for retail investors compared to the stock market with its issues of insider trading and manipulation. It’s essential to invest early in crypto projects, however, as crypto assets trend strongly in both directions – pumping more than most stocks as a percentage, but also retracing by a higher percentage.

Tamadoge is a new crypto project that has quickly become one of the top meme coins in the space, remaining in the top 10 by volume since launch.

After going on sale for just $0.01 during the first phase of its presale, TAMA made gains of nearly 2,000% from that price.

With more exchange listings in the pipeline – including a rumored listing on the largest crypto exchange Binance – an NFT collection and play-to-earn game under development, Tamadoge is a meme coin like no other.

The main Tamadoge play-to-earn game, based on 90s craze Tamagotchi, remains in development for next year, with an augmented reality app also in development by Q4 2023.

For all the latest information on the project join the Tamadoge Telegram group.

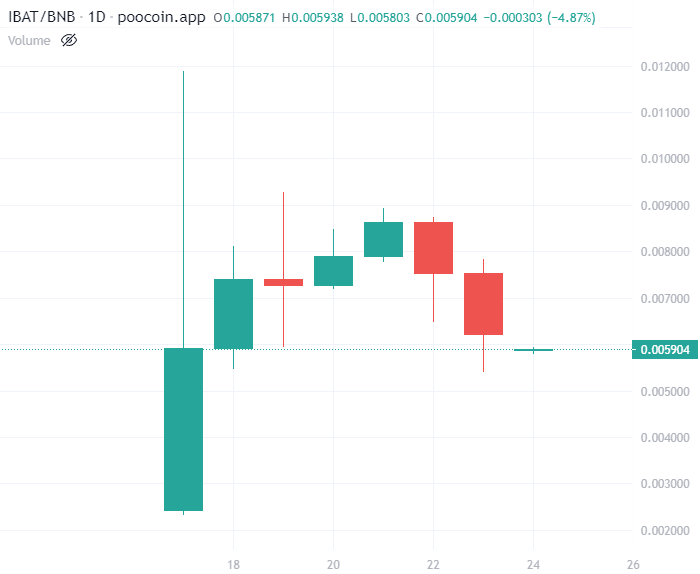

5. Battle Infinity (IBAT) – Another Top New Cryptocurrency

Battle Infinity is another new cryptocurrency to watch this year. After its presale sold out early, the native token IBAT pumped 700% on its first day of trading.

The Battle Infinity project is a decentralised cryptocurrency gaming platform that provides multiple P2E platforms to users and creators. These P2E platforms can be accessed on the Battle Arena – the metaverse platform on which the games exist.

The Battle Arena platform has 6 different P2E games, which operate using the IBAT token as the in-game currency, built on the Binance Smart Chain and based on the BEP-20 protocol.

This play-to-earn platform allows players to earn IBAT tokens which can be converted into another currency using the Battle Swap DEX integrated into the game and all its Battle Arenas.

Its flagship game is the IBAT Premier League, the world’s first decentralized NFT-based fantasy sports game. Players can build their own teams and battle with others, competing for IBAT rewards. Apart from an in-game monetary token, IBAT is also used as a staking asset.

In order to participate in the games, users stake their tokens in order to gain an entry pass. The tokens are then distributed as rewards to winners in the game. To find out more about this P2E platform, join the Battle Infinity Telegram Group or visit the official website below.

6. Grab Holdings (NASDAQ: GRAB) – Asia-Based Company with Huge Growth Potential

Grab Holdings could be one of the most popular penny stocks for 2023, as numerous analysts have displayed enthusiasm over its growth prospects. The company’s recent fiscal 2021 results showed a revenue increase of 44% compared to fiscal 2020, with gross merchandise volume also growing by 29%.

However, Grab Holdings did produce a net loss of $3.55 billion last year – over $800 million more than in 2020. Although this does look worrying, the company has been on an acquisition spree and has partnered with the likes of McDonald’s and Starbucks. Ultimately, if these moves pay off, we could see a rebound in the share price, which is why Grab Holdings is one of the most popular new stocks to watch this year.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

7. Tilray Brands (NASDAQ: TLRY) – Most Popular Cannabis Stock to Watch

This is due to federal legislation, so Tilray mainly operates across the border in Canada. As you might expect, this has drastically reduced the company’s target market, which has prompted investors to turn bearish over the past year.

However, recent news announcements hint that things may be looking up. Tilray’s recent earnings report highlighted a 23% revenue increase from the previous year, driven by a 32% increase in cannabis-based income. Finally, there are rumours that regulation could be passed soon which would allow companies like Tilray to sell their products within the US – meaning TLRY could be one of the most popular new penny stocks to invest in this year.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

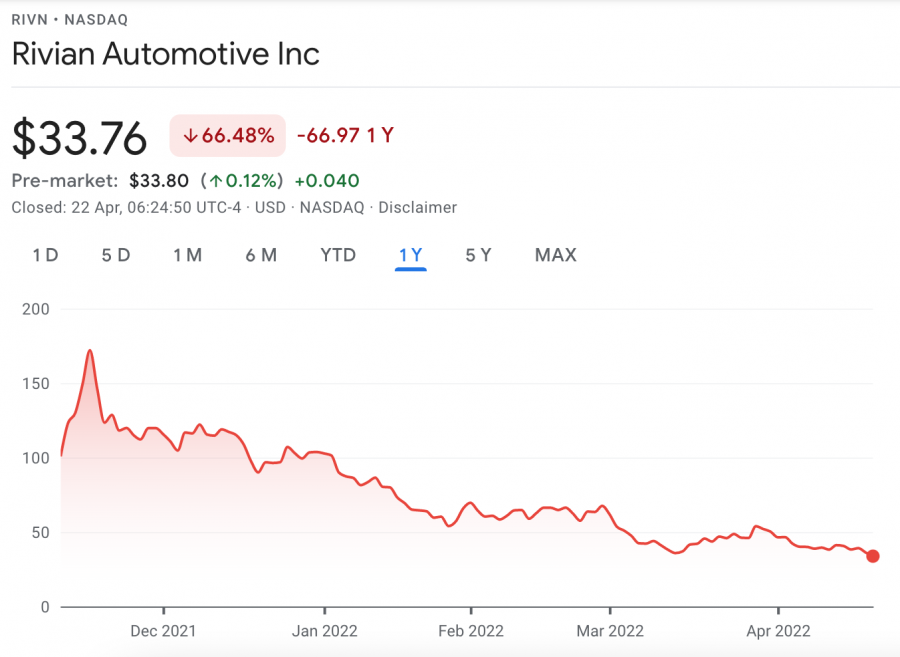

8. Rivian Automotive (NASDAQ: RIVN) – Exciting US-Based Electric Vehicle Company

Rivian was one of the most popular new IPO stocks last year, with shares rocketing by 68% in the days after the company went public. However, since peaking on November 16th, the RIVN share price has plummeted and is now trading around the $32 level – 81% below the all-time high.

Much of this decrease can be attributed to supply chain shortages, which cause chaos for small companies like Rivian. Having said that, Rivian has exceptionally high demand for its products, with the company’s CEO expecting to deliver 25,000 vehicles this year. If this occurs, it’ll highlight that Rivian has turned a corner, providing scope to return to all-time highs – and potentially beyond.

Investors interested in Rivian might also want to read out article on the best renewable energy stocks to watch in 2023.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

9. Nikola Corporation (NASDAQ: NKLA) – New Electric Vehicle Company Set to Explode in 2023

As noted by Forbes, Nikola did not make any revenue whatsoever in 2021 since the company was still developing its vehicles. However, this changed in February 2022, as Nikola delivered its first two ‘Nikola Tre’ vehicles, with more expected to be sold in Q2 2022.

The company’s executives believe that Nikola can deliver between 300 and 500 vehicles this year, resulting in revenue of up to $150 million. Although this is small relative to other EV manufacturers, the company is still investing heavily in production and expects to improve its capacity exponentially in 2023. Although Nikola Corporation’s shares don’t look very promising at present, this could flip rapidly in the near future.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

10. Atlassian Corporation (NASDAQ: TEAM) – Most Popular New Software Company to Watch

The company recently decided to move all of its operations to the cloud, with any remaining physical servers being discontinued by 2024 at the latest. Although this is costing the company money in the short term, the move will bear fruit in the future, making it for clients to purchase additional Atlassian services.

Atlassian already has over 225,000 clients, which allows the company to spend vast amounts on R&D. Although this takes the emphasis off of marketing, it does enable Atlassian to innovate and stay ahead of competitors like Asana. Although TEAM shares are down by 48% from October 2021’s highs, this company’s future looks exceptionally bright, making it one of the most popular new stocks to add to your portfolio.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

11. Upstart Holdings (NASDAQ: UPST) – New Growth Stock with Innovative Approach to Lending

One of the most exciting things about Upstart is that it partners with banks and credit unions and uses AI-powered technology to determine whether a person is creditworthy or not. This removes the need for credit scores and makes the user experience far more appealing. Due to this, Upstart has exhibited solid growth in a financial sense, with 2021 revenue rising by 264% compared to 2020.

Upstart now has over 40 partners for providing credit, with more expected to be added this year. Since Upstart is AI-powered, the more time goes on, the better the algorithms will be – producing optimized results for customers. Although UPST shares have been beaten down in recent months, we believe this company has an exciting future, meaning it’s worth considering as an addition to your portfolio.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

12. Opendoor Technologies (NASDAQ: OPEN) – New Stock for Exposure to the Real-Estate Industry

This business model is for sellers, as Opendoor’s ‘iBuying’ service will provide a cash offer for their home, removing the need for excessive broker fees. Now that Zillow has removed itself from this section of the industry, Opendoor has pretty much all of the market share, providing a tremendous growth opportunity for the business.

In Q3 2021, Opendoor sold nearly 6,000 properties and generated over $2 billion in revenue, which is impressive for a company of its stature. However, this is simply a drop in the ocean compared to the size of the broader US housing market. If Opendoor can continue expanding and attracting users, we should see the company (and its share price) grow over the coming year.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

13. Palantir Technologies (NYSE: PLTR) – Popular Growth Stock Managed by PayPal Co-Founder

Palantir sets itself apart from many new software companies by being consistently profitable and growing its client base. Although shares are down significantly since September 2021’s highs, much of this fall can be attributed to poor sentiment towards growth stocks in general, driven by inflationary fears and rumored interest rate increases.

Palantir’s executives have gone on record as saying that they expect the company to produce annual revenue growth of 30% or more between now and 2025. According to Yahoo Finance, Palantir’s price-to-sales (P/S) ratio is only 15.49, based on the trailing twelve months.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

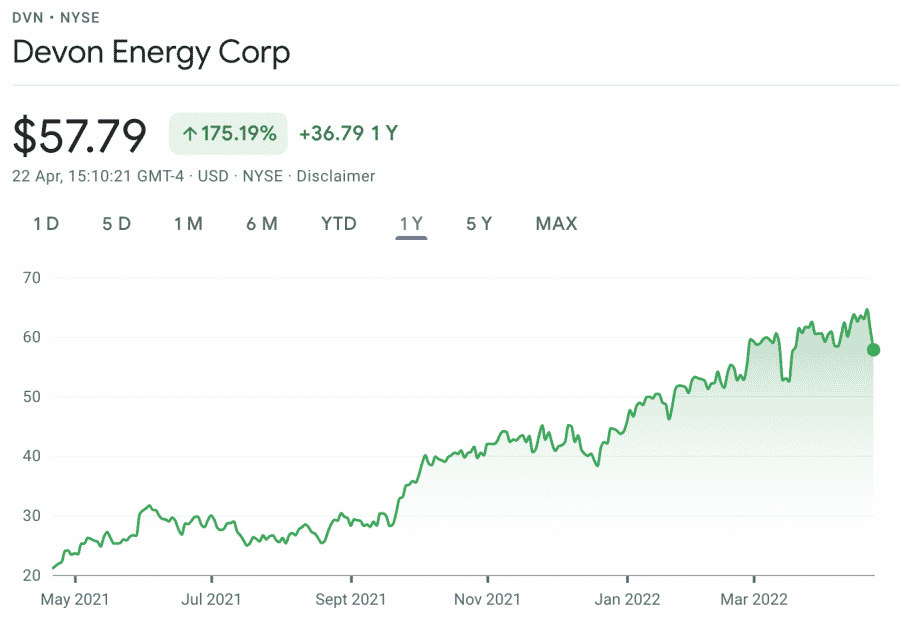

14. Devon Energy Corporation (NYSE: DVN) – Most Popular New Stock to Watch for Passive Income

As expected, Devon Energy has benefitted from the surging oil price driven by the Russia/Ukraine conflict. This allows Devon to produce more revenue for the same amount of produce, leading to considerable increases in free cash flow. Ultimately, the company’s financial position has allowed it to raise dividends every quarter, with yields now sitting at an impressive 6.77%.

This makes Devon Energy one of the most popular dividend stocks on our list, with this year’s stellar performance leading many to suggest that dividends may increase further in Q2 2022. Given that Devon’s execs recently announced a share repurchase program valued at $1.6 billion, we’d expect the share price to increase over the longer term – making DVN shares an exciting prospect for equity investors.

Other stocks which didn’t quite make the list but have been turning heads recently are Lockheed Martin and Medifast.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

How to Find New Stocks

Whether you’re searching for the most popular new stocks or the most undervalued stocks, it’s vital to know where to look. There are thousands of equities to choose from, with more being added every day, meaning that the number of potential opportunities can sometimes be overwhelming.

With that in mind, presented below are four ways to find new stocks in 2023 that have high growth potential:

Scan Social Media Sites

Social media is an excellent tool for finding exciting stocks to invest in – especially when it comes to new meme stocks. Many investors who chose to buy GameStop stock before the short-squeeze got their information from Reddit, which was the first social media network to become aware of the enormous growth opportunity.

Specific subreddits, such as r/WallStreetBets, often discuss the most popular new stocks to be aware of. Aside from Reddit, other networks like Twitter and Instagram are also resources for stocks. However, it’s vital to keep in mind that the opinions on these sites are subjective – meaning you must combine them with your own research to get optimal results.

Keep Tabs on Market News

The stock market is ever-changing, meaning that major news announcements can happen anytime. Often, these announcements can force certain stocks into the mainstream consciousness – with Tilray being a prime example. Thus, it’s wise to keep tabs on major financial news sites to ensure you’re aware of the latest goings-on, enabling you to make investments at the right time.

Look for Earnings Announcements

Earnings announcements are an excellent resource for finding new upcoming stocks. Within these earnings announcements, the company’s CEO or CFO will often talk about future plans – which may include an IPO for non-listed companies. In addition, keeping track of an exciting company’s financials can indicate whether there’s scope to go public in the near future, allowing you to get a head start on other investors.

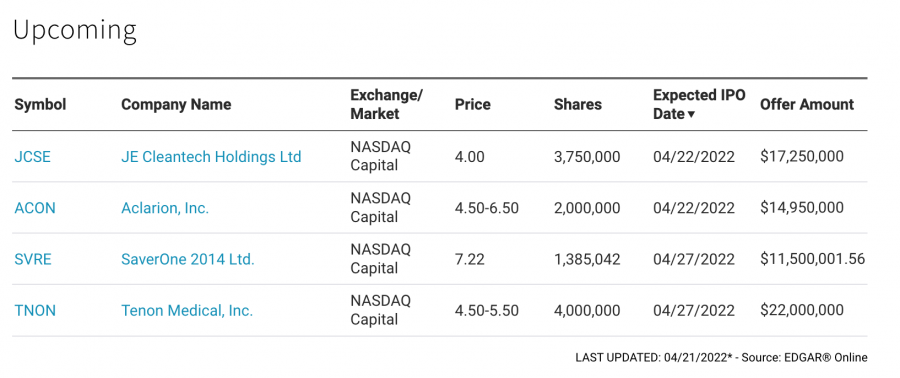

Search for Upcoming IPOs

Finally, searching official websites for upcoming IPOs can be an idea to find new stocks to watch. When it comes to US-based stocks, the websites of major exchanges like the NYSE or NASDAQ often have a page dedicated to upcoming IPOs. Reviewing this page regularly ensures that you don’t miss any investment opportunities, since IPOs often allow you to purchase shares at an attractive price point.

Where to Buy New Stocks

Where to Buy New Stocks

Now that we’ve covered the new stocks coming out and how to choose between them, let’s turn our attention to the investment process. Most of the most popular stock trading platforms will offer the companies listed above for investment. However, even though this improves accessibility, it can make it challenging to decide which platform to partner with.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

Most Popular New Stocks to Watch in 2023 – Conclusion

This guide has discussed a selection of the most popular new stocks to watch this year, covering what they are and why they are so highly regarded. Although new stocks are undoubtedly riskier to invest in, they can provide market-beating returns – making them an exciting prospect for investors with a higher risk tolerance.

We also reviewed various new crypto projects – investing in crypto early can outperform typical stock market returns, albeit with more volatility.

We’ve chosen FightOut as our top new stock to watch because, although it’s not a traditional stock, it is a high-potential project that will appeal to traditional investors.

FightOut is developing a market-leading move-to-earn fitness app and will also build and develop Web3-integrated gyms around the world. FightOut has so far raised more than $2 million in less than a week since its presale went live.

FightOut - Next 100x Move to Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $1M+ Raised

- Real-World Community, Gym Chain

Where to Buy New Stocks

Where to Buy New Stocks