If you’re looking to gain exposure to the non-fungible token (NFT) scene – users may choose to invest in stocks that are loosely involved in this space.

In taking this approach, you won’t be putting all of your eggs into one basket – like you would do by simply buying an NFT and hoping for its value to increase.

In this guide, we an1alyze 14 popular NFT stocks to watch in 2023.

Popular NFT Stocks in 2023

A list of the popular NFT stocks can be found below.

- RobotEra

- IMPT

- Tamadoge

- Battle Infinity

- Lucky Block

- eBay

- Coinbase

- DraftKings

- Cloudflare

- Mattel

- Heineken

- McDonald’s

- Nike

Before learning how to invest in NFT stocks, be sure to read our full market analysis below.

A Closer Look at the Popular NFT Stocks

There are no pure-play NFT stocks active in the market. This means that when you invest in NFT stocks, you will be buying shares in companies that are involved in other lines of business.

In the sections below, you will find our full analysis of the 14 popular NFT stocks.

1. RobotEra

RobotEra

With TARO, the native cryptocurrency, players have the opportunity to purchase in-game NFTs and while RobotEra is not an NFT stock, this NFT cryptocurrency game has the potential to offer high returns.

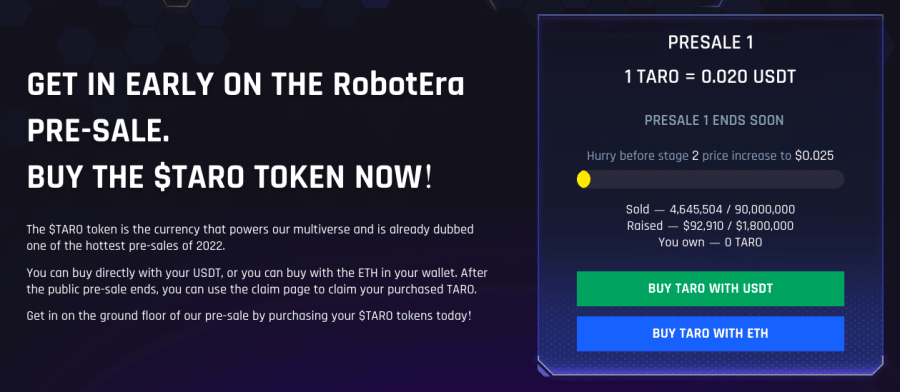

Since TARO is currently on presale, the token is available for just $0.02 in its first stage, but will increase to $0.025 in stage 2 and then $0.032 in the third and final stage – a 60% increase.

The main NFTs on RobotEra are the Robots – which represent a player’s in-game character on the Taro Planet, the virtual world of the RobotEra metaverse.

There are a total of 10,000 Robot NFTs belonging to 7 different campaigns and there are also 7 continents. Land on these 7 continents is minted as NFTs and can be purchased and traded on the RobotEra marketplace, as well as built upon.

Users can create their own NFTs on the Taro Planet to earn more rewards – for instance, you can mint Robot Companions, which are NFTs that assist your Robots in building and creating new structures such as villas, theme parks and more, and can be upgraded, customized and sold on the open market.

The metaverse land offers a variety of opportunities for monetization, including building event spaces and charging admission or selling billboard space to advertisers.

TARO can also be staked to earn APY (Annual Percentage Yield) and gain access to the decentralized autonomous organization (DAO), which will vote on the future of the project.

RobotEra, which is an LBank Labs project, features a doxxed and KYC-verified team, while its smart contract has been audited by SharkTeam.

TARO is currently available to purchase during its first presale round, with 90 million tokens available to purchase for $0.02.

The price of TARO will increase through the stages with 270 million total tokens (15% of the max supply) allocated for the presale, with no vesting period.

Read the RobotEra whitepaper and join the Telegram channel to learn more about this new project.

| Presale Started | Q4 2022 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | 1,000 TARO |

| Max Investment | N/A |

2. IMPT

Very few blockchain projects set out with such lofty ambitions, but IMPT is offering a unique solution to global warming by opening up carbon offsetting to more businesses and individuals.

Users of IMPT can earn IMPT tokens through shopping, with the tokens acquired then able to be converted to carbon credits NFTs.

Credits are already vitally important in the fight against climate change and fund conservation and green projects around the world as they are permits which allow holders to emit greenhouse gas – the voluntary carbon market is expected to grow from $2 billion to $100 billion annually by 2030, according to Bloomberg.

IMPT wants to use blockchain technology to not only make them tradeable for all but to increase transparency and also develop a scoreboard to encourage more carbon offsetting efforts.

As well as being able to buy, sell or hold carbon credits, holders can also retire them – and will receive a unique NFT in return for sending their credit to a burn address.

More than 10,000 retailers and globally recognizable brands – including Samsung and Microsoft – have already partnered with IMPT.

Presale tokens are currently being sold for $0.023 in the second phase, but the price will increase to $0.028 by the third and final phase.

More information on IMPT, carbon credits and their NFTs can be found in the whitepaper. Those interested can join the Telegram group for the latest news.

| Chain | Ethereum |

| Standard | ERC-20 |

| Token Price | $0.023 |

| End Date | January 31 (Phase 2) |

| Vesting | Unlock Token Generation Event |

| Team | Denis Creighton (CEO), Mike English (CTO), Hugh Phelan (CLO) |

3. Tamadoge

The project is not only a meme coin but, unlike top dog Dogecoin, wants to offer long-term utility and value for holders of its native TAMA token.

NFT pets can be minted with the pets the center of the Tamaverse – with the collection of 100 Ultra Rare NFTs becoming the top trending collection on OpenSea when it launched.

Built in the style of 90s craze Tamagotchi, the holders will be able to feed, care for and grow their NFT pets, eventually battling other holders in a play-to-earn game that nets prizes and rewards when players move up a leaderboard.

Unlike Tamagotchi, the pets will be in full 3D before transferring to augmented reality at the end of 2023 – meaning holders can take them out and explore the real world and also hunt for TAMA tokens.

The coin also promises to offer stronger tokenomics than DOGE, which has a circulating supply of 130,000,000,000 and an unlimited max supply. By contrast, TAMA will have a max supply of 2 billion coins and a deflationary mechanism that sees 5% burned during every transaction in the pet store – where pets get their food, toys and treats.

We’ve named TAMA among our hottest cryptocurrencies to buy right now given the continued development of its project and huge potential, with the coin expected to pump again when wider market conditions improve.

Join the Tamadoge Telegram group to keep up to date with the latest news.

4. Battle Infinity

Battle Infinity (IBAT) is another exciting new project that includes NFT ownership and a whole lot more. The revolutionary Metaverse-centric play-to-earn gaming platform takes the best from the worlds of NFTs, virtual worlds, and gaming to create an unrivaled experience.

After listing on decentralized exchange PancakeSwap in mid-August the native IBAT coin pumped more than 700% from its presale price before a retraction and is now an undervalued token.

Battle Infinity comprises six different platforms each of which comes equipped with a series of unique features. Unlike most other NFT stocks, Battle Infinity’s diverse ecosystem expands beyond just the NFT industry.

The team has built a decentralized exchange called Battle Swap which can be used to cash-in rewards for fiat or other cryptocurrencies, the IBAT Battle Arena is an immersive Metaverse world in which players can interact with one another and watch intense battles, and another awesome feature of Battle Infinity is the ability to stake IBAT to earn an impressive APY. On top of these epic features, Battle Infinity also features a dedicated NFT marketplace dubbed the IBAT Battle Market.

On this exciting new version of an NFT marketplace, users can create and sell their own digital assets on top of buying and selling existing Battle Infinity items. This provides users with multiple ways to earn from the NFT marketplace alone. Furthermore, the IBAT Battle Market is the gateway to endowing your Metaverse avatar with cool accessories like new hairstyles and clothing.

There is also the IBAT Premier League a fantasy sports game based on NFT ownership that currently covers cricket and will eventually reach into other sports.

Investors can keep up to date with all things Battle Infinity from the project’s Telegram group.

5. Lucky Block

Lucky Block recently launched its LBLOCK V2 coin – unlike the V1 coin, which had 12% transaction fees, LBLOCK V2 is an ERC-20 token that has 0% fees.

The Lucky Block crypto-NFT platform aims to use their NFT platform to support the platform of these unique digital assets to any other NFT platforms. Initially, the NFTs will be on-chain, but will start to become centralized and stored in the Lucky Block database.

Lucky Block NFT, titled Platinum Rollers Club, comprises 10,000 digital assets that act as an ‘entry ticket’ into exclusive prize draws, including a weekly chance to win $50,000.

In addition, 25 of the NFTs within the Platinum Rollers Club collection are defined as ‘Rare Editions’, meaning the owner is entitled to double the earnings if their number comes up. The platform is aiming to offer unrivalled prizes with a Lamborghini Aventador – worth over $300,000 – a $1 million house and $1 million of Bitcoin some of the prizes on offer.

LBLOCK recently revealed it will burn 1% of the total coin supply on a monthly basis, drastically increasing its scarcity to drive up value.

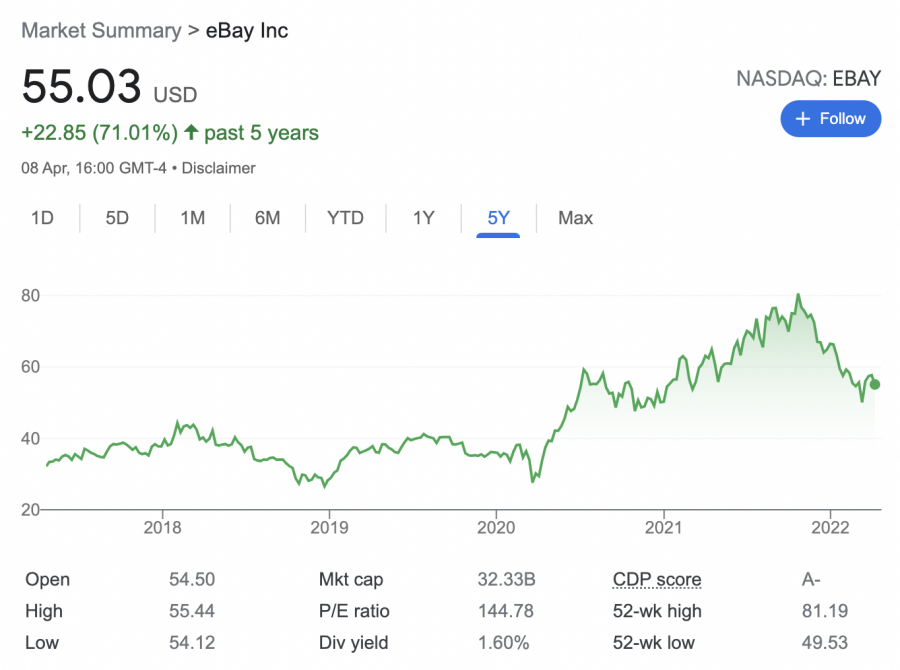

6. eBay

eBay is a global online marketplace that allows users to buy and sell goods from the comfort of home. The firm was founded in 1995 and become a publicly-traded company just three years later. eBay is a global online marketplace that allows users to buy and sell goods from the comfort of home.

The firm was founded in 1995 and become a publicly-traded company just three years later. eBay trades on the NASDAQ exchange and as of writing, carries a market capitalization of over $30 billion. Although eBay specializes in its online marketplace service, the firm has recently ventured into the NFT space.

In a nutshell, the platform now enables trusted sellers to list NFTs for sale. This can be executed via a fixed price or a conventional auction listing. Crucially, eBay will strive to become the go-to place for beginners that wish to buy NFTs, not least because the platform supports traditional payment methods.

In comparison, a number of leading NFT marketplaces only accept cryptocurrency payments. As of writing, eBay offers a wide variety of listings, which includes music NFTs, crypto art, and trading cards. When it comes to revenue, eBay charges NFT sellers a flat commission of 5% of the total sale amount.

This ultimately enables eBay to get a foot into the NFT space without actually taking on any of the perceived risks. Looking at the performance of this top-rated NFT stock, eBay shares are up more than 70% over the prior five years. 12-month returns are less positive, with eBay stocks seeing a decline of 12%.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

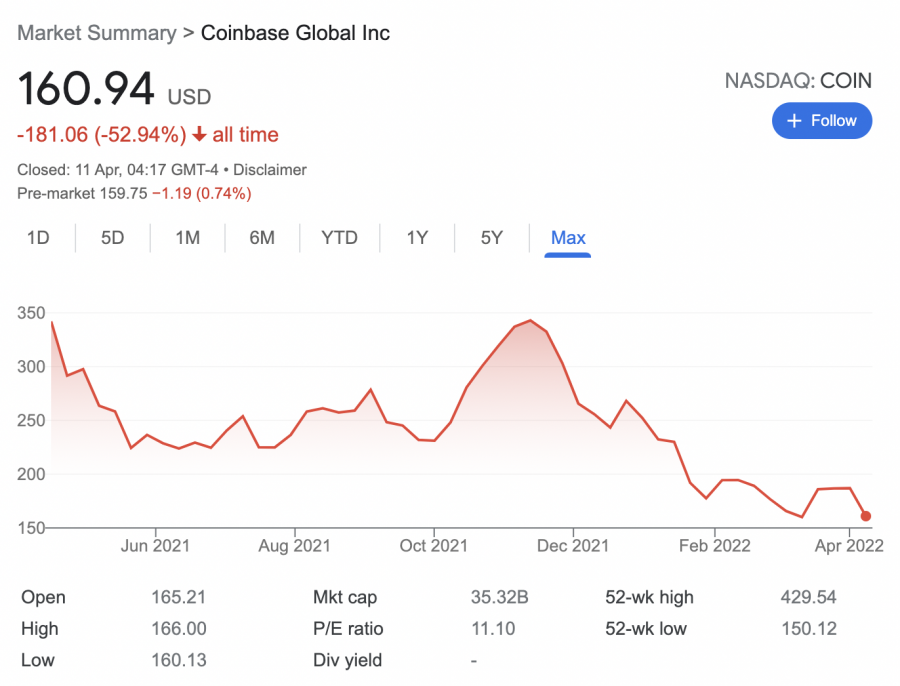

7. Coinbase

Next up on our list of the popular NFT stocks for 2022 is Coinbase. As one of the biggest crypto exchanges globally, it comes as no surprise that Coinbase is looking to take a leading role in the NFT space. With that said, Coinbase – as per its announcement in late 2021, is still working on its NFT venture.

We do, however, know that the platform is building an NFT marketplace that will enable users to buy, sell, and trade non-fungible tokens from a variety of niche angles. In addition to its marketplace, Coinbase is also planning to enable its users to create NFTs directly from within its platform.

And, fully in line with its traditional cryptocurrency exchange services, Coinbase will make the NFT creation as simple as possible. This will ensure that artists from all walks of life can create and market NFTs via a single hub. Looking at Coinbase from an investment perspective, the firm only went public in April 2021. As such, Coinbase is a growth stock with plenty of upside potential.

As of writing, the stocks are trading at more than 50% lower than their initial IPO listing price.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

8. DraftKings

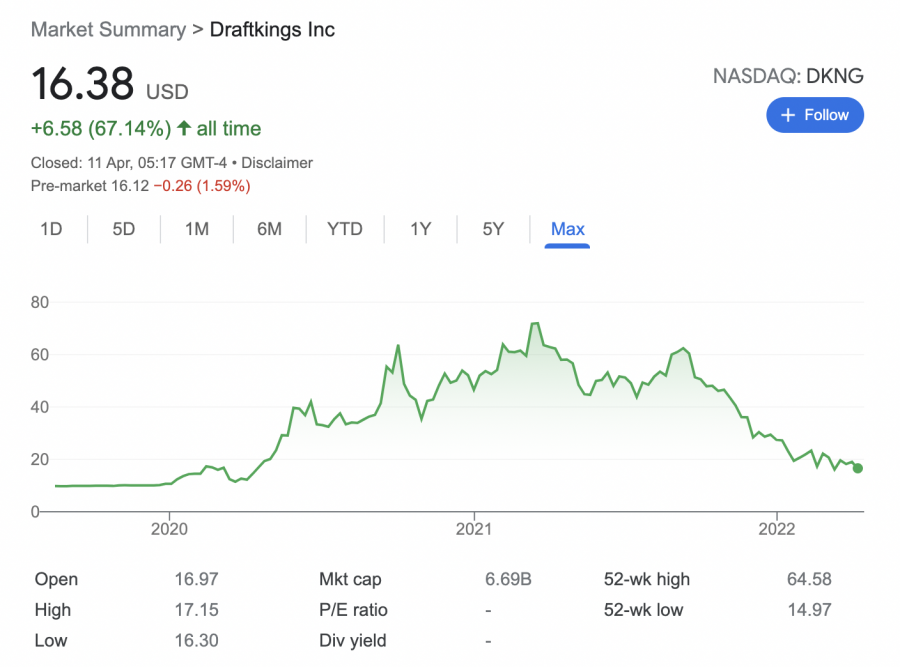

The next NFT stock on our list is DraftKings. Founded in 2012, DraftKings specializes in online betting and sports fantasy contests. Opting for the NASDAQ, DraftKings stocks went public in 2019. Back then, you would have paid just under $10 per share. Based on prices as of writing, the stocks have since increased in value by over 67%.

With that said, the shares are down more than 70% in the prior year, so this is another NFT that can be purchased at a huge discount. In terms of its exposure to NFTs, DraftKings has since launched a program that regularly drops new sports-related tokens. This is through a partnership with Autograph, which consists of signed NFTs from a number of leading sportspeople.

A recent example includes the Tom Brady edition, which consists of 100 NFTs – each of which is priced at $250. DraftKings is also home to a secondary marketplace, which enables users to buy and sell NFTs on a peer-to-peer basis.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

9. Cloudflare

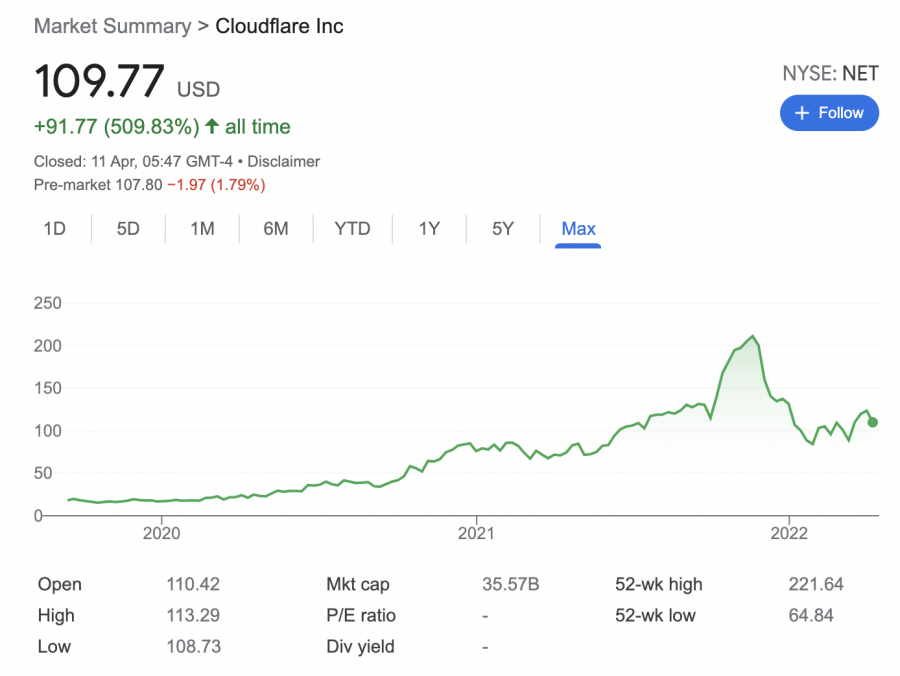

If your main focus when searching for the popular NFT stocks is to invest in companies with huge upside momentum, Cloudflare is well worth a second look. Put simply, Cloudflare is a popular tech stock that is involved in delivering content securely via the cloud. It is home to one of the largest networks in this industry and is able to offer lightning-fast execution speeds.

To ensure the firm continues to innovate, Cloudflare now has the capabilities to support NFTs. The Cloudflare platform, in its current form, does not allow you to create NFTs directly. As such, you would still need to use a third party for this – such as OpenSea.

Once you have the unique token ID for the NFT you have minted, you can securely upload it to your Cloudflare account. In terms of its share price action, Cloudflare is one of the popular performing stocks not only in the NFT space – but in the broader markets. In fact, since Cloudflare was listed on the NYSE in September 2019, its shares have increased by over 500%.

In comparison, the NYSE Composite has increased by just 27% over the same period. In more recent times, Cloudflare stocks have witnessed gains of 57% in the prior year. The NYSE Composite, over the same timeframe, has grown by just 4%.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

10. Mattel

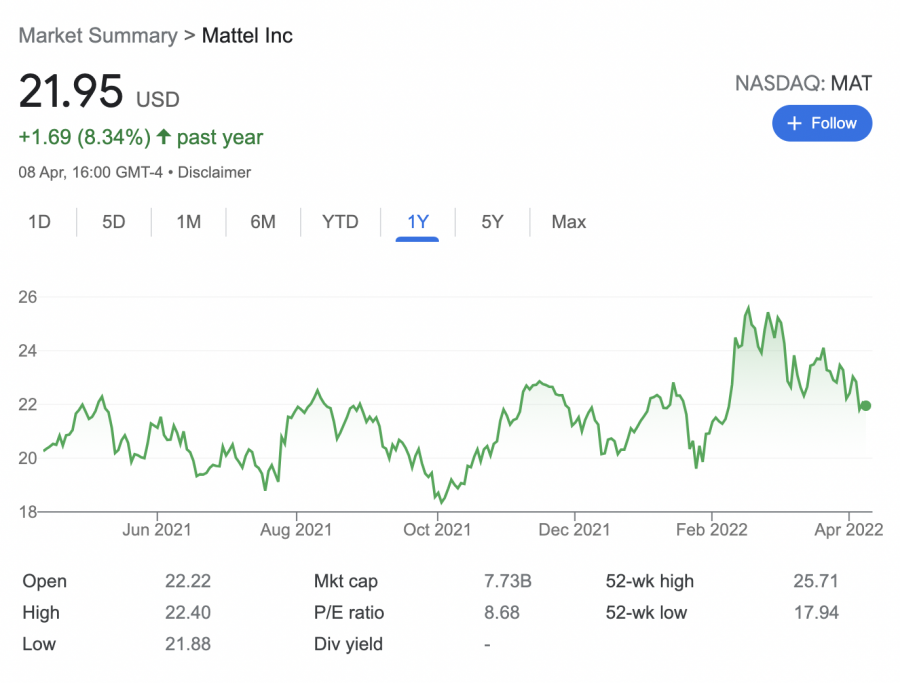

Mattel is an established toy manufacturing company that was first founded in 1945. Moreover, the firm was first listed on the NASDAQ in 1960, which makes it one of the oldest NFT stocks that we will discuss today. On the one hand, Mattel stocks have plateaued in recent years. In fact, the share price of Mattel has barely moved since early 2017.

For instance, over the prior five years of trading, Mattel stocks have grown by less than 1%. Over the prior 12 months, the shares are up just 8%. With that said, Mattel is looking to revitalize its business model by entering the NFT space. Since June 2021, Mattel has been auctioning off NFTs that are linked to its popular toy brands.

Initially, the firm created Hot Wheels NFTs – which were a reasonble success. Customers can now buy Barbie NFTs directly from the Mattel Creations website. In terms of buying Mattel stock, although the firm has been a public company for over six decades, it doesn’t currently pay a dividend. This is because dividends were suspended back in 2018 and are since to resurface.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

11. Twitter

First and foremost, it is important to note that social media giant Twitter does not offer an NFT marketplace of any sort. Moreover, the platform does not allow you to create or store NFTs. Twitter has, however, been indirectly used to promote some of the most successful NFT collections to date.

A prime example of this is the Bored Ape Yacht Club NFT series – which consists of 10,000 unique tokens – many of which are now owned by a full range of A-list celebrities. This includes everyone from Eminem, Mark Cuban, and Snoop Dogg to Justin Bieber, Jimmy Fallon, and Steve Aoki.

Crucially, many of the aforementioned celebrities decided to change their Twitter profile picture to the Bored Ape Yacht Club NFT that they purchased. And therefore, this in itself gave global exposure to the collection. In turn, many Bored Ape Yacht Club NFTs have since sold in the open marketplace for over $1 million.

In terms of how Twitter shapes up as a potential NFT stock for your portfolio, the social media giant has recently seen new life pumped into its shares. This is because it was recently confirmed that Tesla CEO Elon Musk has since purchased a 9.2% stake in the firm. On the day of the announcement, this resulted in Twitter increasing by over 25%.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

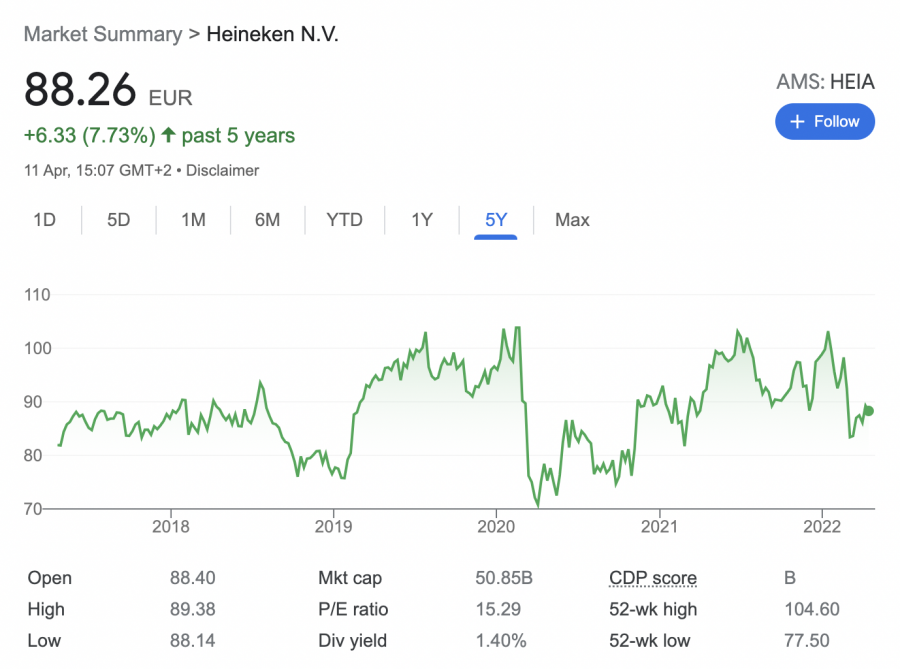

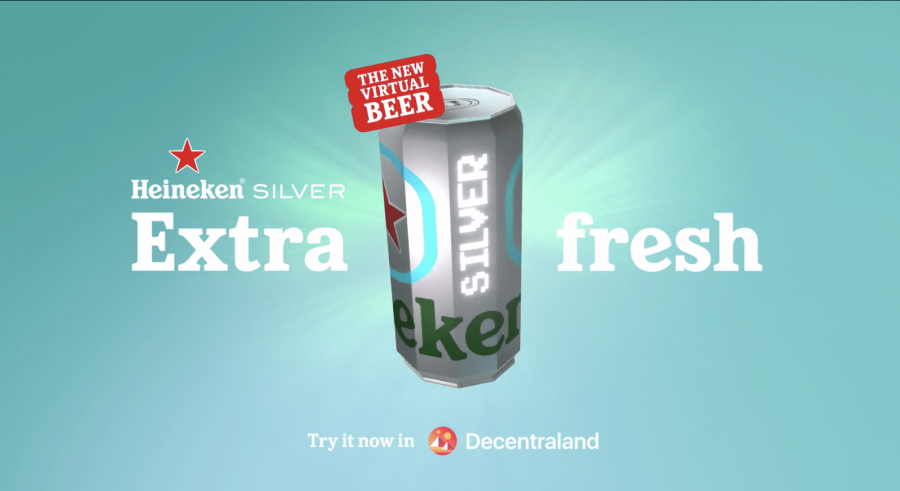

12. Heineken

It was only a matter of time before leading beer companies entered the NFT space. And at the forefront of this is Heineken – which has since dropped its first beer NFT collection. Known as Heineken Silver, this NFT is available to ‘try’ in the Decentraland platform – which is one of the largest Metaverse projects in this industry.

Although Heineken Silver has no clear purpose other than showing that the firm has a satirical take on the NFT revolution, its launch has generated some much-needed publicity. Looking at the share price action of this NFT stock, Heineken has remained somewhat flat in recent years. For instance, over a five-year period, Heineken stocks are up just 8%.

In the prior 12 months, the stocks are down 2%. Moreover, although Heineken is a dividend-paying company, the firm is yielding just 1.3% as of writing. Heineken trades on the Euronext Amsterdam.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

13. McDonald’s

Although you might be surprised to see McDonald’s on our list of the popular NFT stocks, the fast food giant has made its intentions to enter this space clear. First and foremost, McDonald’s has already launched its very first NFT. To honor the 40th anniversary of its popular McRib burger, McDonald’s begun dropping NFTs in late 2021 to mark the occasion via Twitter.

The NFT collection is built on top of the Ethereum blockchain and the firm expects to drop new tokens each year. In addition to its NFT series, it is also believed that McDonald’s is looking to expand its vast restaurant chain into the metaverse.

According to the 10 trademarks that McDonald’s has since filed for approval, the firm aims to offer a “virtual restaurant featuring actual and virtual goods”. Moreover, this will allegedly be in conjunction with a home delivery service. How far management at McDonald’s decides to take its metaverse venture remains to be seen.

However, irrespective of how its NFT and metaverse journey plays out, McDonald’s is still a popular blue-chip stock. Over the prior years, this strong and stable global brand has seen its share price increase by nearly 90%. This is in addition to a running dividend yield of 2.2%, based on prices as of writing.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

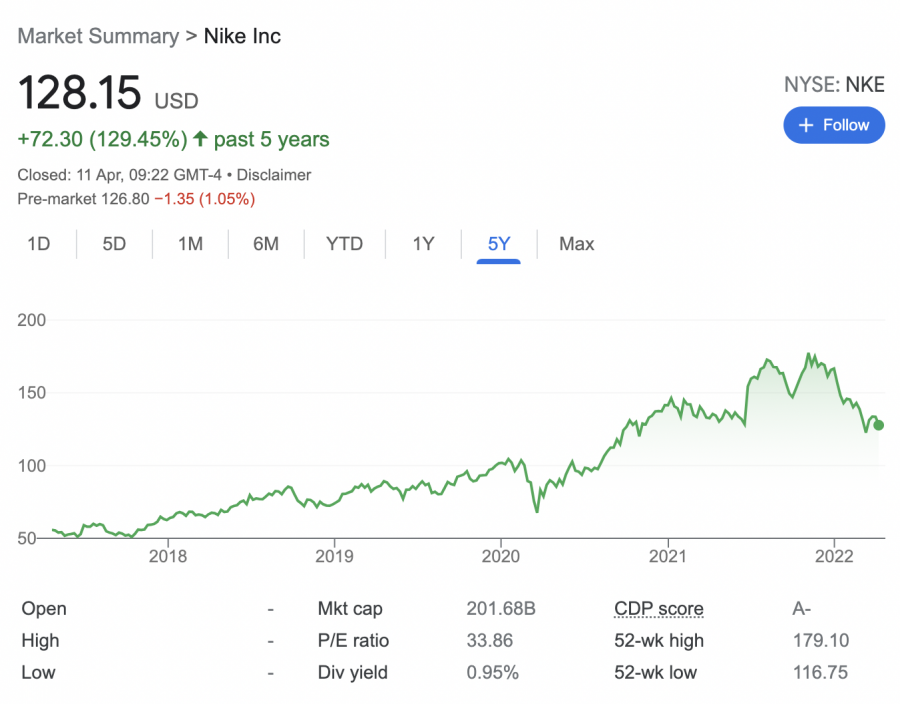

14. Nike

The final company to look at from our list of popular NFT stocks for 2022 is Nike. In a nutshell, Nike recently displayed its appetite to enter the NFT and metaverse industries through its purchase of RTFKT Studios. For those unaware, RTFKT Studios is a leading designer of show NFTs – all of which can be worn, bought, and sold in the metaverse.

RTFKT Studios has already had great success with its virtual sneaker collections, with Elon Musk himself buying a pair for over $90,000. And, with Nike acquiring RTFKT Studios in its entirety, it is likely only a matter of time before the firm starts marketing its digital NFT series. When you consider just how much brand loyalty Nike enjoys, its NFT division could be very successful.

If you share this sentiment, you will be investing in a stock that has generated returns of nearly 130% in the prior five years. The past 12 months have been slightly challenging for Nike, with its stocks dropping in value by 6%. Nike also offers a consistent dividend, which, as of writing, is offering a running yield of nearly 1%.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

What is an NFT Stock?

Put simply, NFT stocks are public companies that in one way, shape, or form are involved in the non-fungible token scene. And, for those unaware, non-fungible tokens are digital assets that operate on top of the blockchain protocol.

However, unlike traditional digital assets like Bitcoin or Ethereum, one NFT is unique from the next. And as such, this enables content creators to represent the value of a product or brand in digital format.

As a prime example, we mentioned earlier that McDonald’s has since released an NFT that allows token holders to own a virtual version of a McRib burger. Then you have Heineken and its Silver edition, which is a virtual beer NFT available in the Decentraland metaverse.

With that being said, all of the 10 companies from our list of the popular NFT stocks are not exclusively involved in this growing industry. This means that instead of investing in pureplay stocks, you will be purchasing shares in companies that specialize in business lines outside of NFTs. That is to say, NFTs represent a very small segment of what the stock does.

This is actually beneficial from an investment perspective for a number of reasons.

- First and foremost, by investing in some of the stocks we discussed today, you can gain exposure to the NFT arena without being overexposed.

- This is in stark contrast to personally buying an NFT from the open marketplace – which is fraught with risk.

- After all, there is no knowing what will happen to the value of your NFT investment over the course of time.

In comparison, if you were to invest in the likes of eBay, Heineken, or Nike – these established firms have solid business models and are dominant in their respective industries.

As such, the risks of investing in high-grade NFT stocks are somewhat modest.

Features of Popular NFT Stocks

Choosing popular NFT stocks for your portfolio is no easy feat. Not only do you need to assess how the stock in question plans to interact and engage with the NFT arena – but how its shares weigh up as a viable investment prospect.

The sections below look at some of the features of NFT stocks.

Type of Exposure to NFTs

The first thing to look at is how your chosen stocks are involved – or looking to get involved, with the NFT industry. At one end of the spectrum, you have platforms like Coinbase – which will enable content creators to mint their own NFTs. Coinbase will also host a marketplace that will enable buyers and sellers to trade NFTs from the comfort of home.

You then have firms like Heineken, McDonald’s, Mattel, and Hasbro – all of which have launched NFTs that represent products that the respective business makes. For instance, Mattel has launched a Barbie and Hot Wheels NFT series. In the case of Hasbro, the firm has minted and launched NFTs linked to its Power Rangers brand.

Another way to gain exposure to this industry is by investing in Cloudflare, which allows token holders to upload their NFT collections to the cloud. Ultimately, there are many angles that established companies can take to gain exposure to NFTs.

Balance Sheet

When companies invest in new and unproven markets like the NFT space, this often requires a significant capital injection. And as such, users can choose to assess the balance sheet of your chosen companies.

For example, established blue-chip stocks like McDonald’s and Nike have robust balance sheets with a sufficient free cash flow levels. This means that they can gain exposure to the NFT scene without needing to dip into much-needed resources.

On the other hand, you then have NFT stocks like Mattel.

Although this established company has been a publicly-traded stock since 1960, the firm has less than $750 million worth of free cash flow – which is a 4% drop year-on-year as per its most recent earnings report.

As such, Mattel will invariably have less resources to amplify its NFT division.

Share Price Performance

When you buy NFT stocks, the overarching objective is to make money in the long run. And in order to do this, you will need to see the value of your chosen NFT stocks increase.

Although past performance is not a surefire indicator of future returns, exploring the recent share price history of an NFT stock is a great way to make an informed decision.

Dividends

Another way that you will make money from an NFT stock investment is if the firm pays dividends.

As noted earlier, although Hasbro has seen its share price dip recently, it is still one of the popular NFT stocks for dividends. Once again, the firm is offering a running dividend yield of 3.3% as of writing.

NFT Penny Stocks

If you’ve got a higher appetite for risk, then you might be in the market for NFT penny stocks. These are stocks with exposure to the NFT industry that trade at below $5 per share.

The popular NFT penny stocks that we identified can be found below:

- Hall of Fame Resort & Entertainment – This NFT penny stock trades on the NASDAQ and as of writing, carries a small market capitalization of just $110 million. Although the shares are down over 70% in the prior year, this is not uncommon for penny stocks.

- Takung Art – This Hong-Kong listed NFT penny stock specializes in fine art and collectibles. Since appointing new co-CEO Kuangtao Wang, Takung Art has announced its ambitions to develop a growing NFT division. As of writing, this NFT penny stock carries a market capitalization of just over $50 million.

- Dolphin Entertainment – Production company Dolphin Entertainment has since launched its own NFT series. The firm is listed on the NASDAQ and carries a market valuation of less than $35 million.

Penny stocks – especially those involved in the unproven NFT industry, can be extremely volatile and speculative. As such, never invest more than you can afford to lose.

Where to Buy NFT Stocks

In order to add the popular NFT stocks to your portfolio today – you need to have an account with an online broker that lists your chosen companies.

Here is a review of a popular stock broker that offers NFT stocks to invest in:

eToro

Notably, US clients are not charged any deposit fees. You can choose from a wide range of payment methods – including Visa, MasterCard, Maestro, ACH, and a domestic bank wire. Moreover, you can even fund your NFT stock purchases with e-wallets like Paypal, Neteller, and WebMoney.

When you have funds in your newly created eToro account, you can proceed to buy NFT stocks on a commission-free basis. And, you only need to risk $10 per NFT stock, as eToro supports fractional shares. This will be of particular use if you are looking to diversify across all of the NFT stocks discussed today and you’re on a budget.

eToro’s commission-free pricing model not only applies to US-listed stocks but to many international exchanges too. This includes NFT stocks from the UK, Canada, France, Hong Kong, Germany, Amsterdam, and more. Crucially, unlike other US-based brokers, you won’t be charged a premium to invest in foreign shares.

This is also the case when you invest in ETFs – all of which are commission-free on the eToro platform. If you’re also looking to diversify into other emerging markets, eToro also offers plenty of metaverse stocks. In fact, you can also invest in cryptocurrency tokens like Bitcoin, Ethereum, Dogecoin, Shiba Inu, and Decentraland.

In addition to being able to invest in stocks, ETFs, and cryptocurrencies on a DIY basis, eToro also gives you access to copy and social trading tools. The former allows you to trade passively by automatically copying the portfolio of an experienced investor. The latter enables you to publicly communicate with other eToro users, ‘Like’ messages, and even add users to your friend list.

Another popular feature offered by the eToro platform is its user-friendly mobile app. Available on iOS and Android, this allows you to buy and sell NFT stocks on the move. eToro is heavily regulated for your safety. For instance, the broker is approved to offer its services in the US. It also holds licenses with the FCA, ASIC, and CySEC.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

There are many established companies from a variety of sectors that have since entered the NFT space. And by investing in such companies, you can gain exposure to NFTs indirectly and in a risk-averse manner.

One of the top alternatives to NFT stocks is RobotEra – an NFT & metaverse platform with play-to-earn elements that allows players to earn rewards in various ways.

TARO, the native cryptocurrency, is available to buy in its first presale round for $0.02.

RobotEra - Next Big Metaverse Game

- Backed by LBank Labs

- Buy, Trade and Develop NFT Land

- Doxxed Professional Team

- TARO Token on Presale Now - robotera.io