Trading forex can be challenging, especially for beginner traders unaware of which currency pairs offer the most attractive opportunities. However, by building a solid trading plan and identifying currencies that work with it, traders can navigate the markets effectively and have a higher chance of making a profit.

With that in mind, this guide discusses 10 of the best pairs to trade in forex, exploring why they are so popular and the factors that influence their price movements, before presenting two low-spread brokers ideal for FX traders to partner with.

Top 10 Best Forex Pairs to Trade in 2023

Identifying the best pairs to trade in forex can be tricky, especially since market-related events can drastically alter a currency’s value seemingly out of nowhere. However, those wondering how to invest $1,000 (or any amount) in the FX market may wish to consider the list of currency pairs presented below:

- EUR/USD – Best Forex Pair to Trade with Low Spreads

- USD/JPY – Best Currency Pair to Trade with High Liquidity

- GBP/USD – Popular FX Pair Exhibiting Clear Price Action

- USD/CHF – One of the Best Forex Pairs for Scalping

- USD/CAD – Highly-Traded FX Pair with Negative Correlation to Oil

- AUD/USD – Top Currency Pair for Commodity Traders

- NZD/USD – Forex Pair with Positive Correlation to AUD/USD

- GBP/JPY – Popular Forex Pair for Traders with a High-Risk Tolerance Level

- EUR/JPY – Leading ‘Minor’ with Correlation to the Equity Markets

- EUR/GBP – Top Currency Cross with Positive Correlation to USD/JPY

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

Best Pairs to Trade in Forex Reviewed

The list above presents 10 of the most popular forex pairs to trade, each with its own characteristics and price structure. Although the ‘best’ forex pair is hard to nail down since this could change daily, the currencies we’ve listed are all extremely popular with FX traders and tend to offer an abundance of trade opportunities every week.

Bearing that in mind, let’s dive in and explore the best forex pairs to trade in more detail:

1. EUR/USD – Best Forex Pair to Trade with Low Spreads

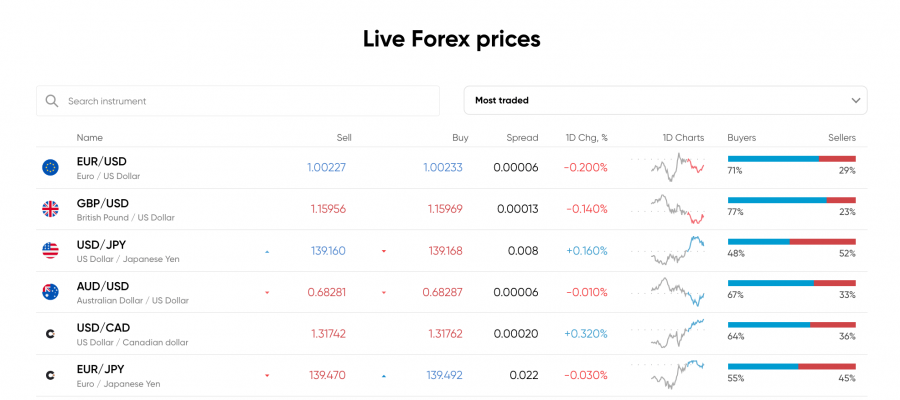

One of the best pairs to trade in forex with low spreads is EUR/USD. This pair pits the Euro against the US Dollar and essentially highlights how many Dollars are needed to acquire one Euro. At the time of writing, EUR/USD is trading at 1.0023 – meaning it would take just over $1 to obtain €1.

EUR/USD is offered as a tradable asset by all of the best forex brokers, making it highly liquid. In turn, this means that traders are often able to buy or sell EUR/USD with extremely tight spreads. For example, leading FX broker Capital.com usually has spreads as low as 0.6 pips for EUR/USD.

A key reason that EUR/USD is considered one of the best currency pairs to trade in forex is that it is less volatile than other pairs. This means price action is easier to predict, ensuring traders can tailor their trading plans to EUR/USD’s movements and achieve positive results.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

2. USD/JPY – Best Currency Pair to Trade with High Liquidity

USD/JPY is another of the best pairs to trade forex with, offered by most trading platforms. This pair shows the US Dollar’s value against the Japanese Yen, essentially acting as a proxy for the health of Asia’s economy.

This currency pair is one of the most liquid in the entire market, given the scale of Japan’s exporting activity. Since a large percentage of these exports are purchased by US companies, the USD/JPY price is vital to determining their cost. Although USD/JPY is still a relatively ‘stable’ currency, it does exhibit higher volatility than EUR/USD.

Another factor to bear in mind is that USD/JPY’s value can shift due to economic events in the US and Asia. These events may include interest rate changes or political affairs, both of which can positively or negatively impact USD or JPY.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

3. GBP/USD – Popular FX Pair Exhibiting Clear Price Action

Many traders argue that the best currency to invest in with straightforward price action is GBP/USD. Investors with a high risk tolerance level wondering how to invest during inflation flocked to GBP/USD, as its price structure presented textbook support and resistance levels that signalled rebounds.

A glance at the price chart will highlight that GBP/USD often respects technical analysis elements, such as daily/weekly support and resistance and the 200-day EMA. Again, this makes GBP/USD significantly ‘easier’ to trade, as it’s less likely that random price action will negate a trader’s idea.

GBP/USD is the world’s third-largest trading pair and is often referred to as ‘Cable’ by FX traders. Again, this pair’s value can be affected by economic events; for example, if the Fed acted to make the US Dollar stronger, then GBP/USD’s price would fall. Regardless, GBP/USD is still considered one of the best forex pairs to trade right now for traders seeking explicit price action.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

4. USD/CHF – One of the Best Forex Pairs for Scalping

Traders wondering, “what is the best pair to trade in forex?” may also wish to consider USD/CHF, which is hugely popular amongst scalpers. For those unaware, scalping is a trading strategy whereby traders look to profit from small price movements in a short timeframe – often minutes (or even seconds).

USD/CHF is popular with scalpers as it tends to be one of the most highly-traded FX pairs, meaning spreads are relatively tight. This is important for scalpers since any hefty fees would eat into the accrued profits, making the strategy ineffective.

Many of the best scalping brokers offer a 0% commission fee structure, meaning that trading USD/CHF can be lucrative if a well-rounded strategy is employed. Notably, USD/CHF often moves in the opposite direction to popular pairs like EUR/USD and GBP/USD, making it a viable option for traders who aren’t open to short selling.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

5. USD/CAD – Highly-Traded FX Pair with Negative Correlation to Oil

Another of the best pairs to trade in forex is USD/CAD. This currency pair determines how many Canadian Dollars can be acquired by one US Dollar. Like the other pairs mentioned up until now, USD/CAD is highly liquid and offered by most of the best trading platforms.

A key point to remember with USD/CAD is that the pair’s price tends to be negatively correlated with the cost of crude oil. This is because oil plays a vital role in Canada’s economy, meaning that when oil’s price rises, the Canadian Dollar also rises since the country generates more revenue per barrel.

Thus, USD/CAD is often considered one of the forex best pairs to trade for those looking to gain indirect exposure to fluctuations in the oil price. However, it’s essential to be aware that USD/CAD is often more volatile than the likes of EUR/USD and GBP/USD – making it more popular with experienced traders.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

6. AUD/USD – Top Currency Pair for Commodity Traders

AUD/USD is the currency pair that trades the Australian Dollar against the US Dollar. Sometimes referred to as the ‘Aussie’, this pair offers a way for traders to gain exposure to the growth (or decline) of Australia’s economy.

Many factors can influence AUD/USD’s price – with commodity prices being one of the main ones. Due to Australia’s geographical setup, the country produces many popular commodities, including coal, iron ore, and copper. When the price of these commodities increases, it provides more revenue for Australia – causing AUD/USD to rise.

Naturally, AUD/USD has a negative forex pairs correlation with USD/JPY and USD/CAD since the latter two are not quoted in US Dollars. In addition, AUD/USD is also popular amongst traders due to its ‘predictable’ price action – the pair often respects significant support and resistance levels and doesn’t tend to spike too aggressively.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

7. NZD/USD – Forex Pair with Positive Correlation to AUD/USD

There is often debate over whether NZD/USD can be considered one of the ‘major currency pairs’, but it remains one of the most highly traded due to its link to New Zealand’s economy. In addition, New Zealand’s FX market is the first to open each day, meaning traders often flock to NZD/USD immediately.

Like Australia, New Zealand is heavily dependent on commodity exports. Thus, NZD/USD’s value tends to fluctuate in line with the price of commodities such as dairy, which inform how much revenue New Zealand is likely to receive.

Interestingly, NZD/USD and AUD/USD are often positively correlated with one another due to the closeness of the two countries. Thus, those interested in how to trade commodities usually keep an eye on these two FX pairs since they tend to provide opportunities when commodity prices are volatile.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

8. GBP/JPY – Popular Forex Pair for Traders with a High Risk Tolerance Level

GBP/JPY is readily available on the best forex trading apps as the most popular FX pair that doesn’t contain USD. Pairs that don’t have USD are dubbed ‘currency crosses’ and allow traders to gain exposure to specific international events that aren’t directly relevant in the States.

One of the critical characteristics of GBP/JPY is that is it deemed one of the most volatile pairs. A glance at the price chart will show this to be accurate, as price increases are usually immediately followed by retracements.

However, risk-seeking investors favour this type of price action, as it means they can profit from both sides of the market. Thus, GBP/JPY is often deemed by traders with high risk tolerance as one of the most volatile forex pairs – although it may not be the best pick for risk-averse traders.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

9. EUR/JPY – Leading ‘Minor’ with Correlation to the Equity Markets

Much like GBP/JPY, EUR/JPY is a currency cross that pits the Euro against the Japanese Yen. EUR/JPY is considered a ‘minor’ within the forex market, meaning this pair is less actively traded than the five ‘majors’.

Due to this, spreads on EUR/JPY are often higher than the likes of EUR/USD and USD/JPY. However, trading EUR/JPY can be beneficial since this pair positively correlates to the equity markets.

This means that investors who usually buy stocks can also take a position in EUR/JPY to gain exposure to movements in the broader equity market. Although this can be effective in many instances, EUR/JPY is frequently volatile, meaning wider stop losses are usually a good idea.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

10. EUR/GBP – Top Currency Cross with Positive Correlation to USD/JPY

Rounding off our list of the best pairs to trade in forex is EUR/GBP. This pair trades the Euro against the British Pound, making it another popular currency cross amongst traders.

EUR/GBP is so popular because its price is affected by two of the world’s strongest economies – the UK and the European Union (EU). As such, there is an abundance of data releases and rate changes that can affect EUR/GBP’s price, making it popular with experienced traders.

It’s not uncommon for EUR/GBP’s value to rise (or fall) by over 1.50% in a single day, making this pair is one of the most volatile on our list. Notably, EUR/JPY also positively correlates with USD/JPY – although the latter is much more ‘stable’ than the former.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

Choosing a Currency Pair When Trading Forex

Now let’s focus on how to choose forex pairs to trade. When making a trading decision, there are three main types of FX pairs to be aware of – majors, minors, and exotics. Let’s take a closer look at each of these types:

Some FX traders also use Fibonacci sequences in forex to try and predict the future price movements of popular currency pairs. By reading our article on ‘What is Fibonacci in forex‘ users can better understand how this popular technical indicator is used to research the foreign exchange markets.

Majors

The ‘majors’ are the currency pairs traded the most in the FX market. Although there is debate surrounding which pairs can be classed as majors, the designation typically applies to the following:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- AUD/USD

Like all pairs, the majors comprise two ISO currency codes, which refer to the three-letter term representing each currency. The base currency is always shown first, with the quote currency shown second.

The majors tend to be the forex pairs with the lowest spreads since they make up most of the trading volume in the FX market. Furthermore, these pairs are often less volatile than others, making them suitable for beginner traders.

Minors

‘Minors’ are forex pairs that do not contain USD but do contain either GBP, EUR, or JPY. For example, EUR/JPY, GBP/JPY, and EUR/GBP are all considered minors.

Minors are sometimes called ‘cross currency pairs’ and account for much less of the daily forex market trading volume. This does make them slightly more volatile than the majors, whilst also being more expensive to trade since spreads will be higher. However, they can benefit traders who are experienced or looking to avoid the US Dollar.

Exotics

Finally, exotic currency pairs are those that are rarely traded and tend to be very illiquid. The price quotes on most of these pairs will contain at least one currency from an emerging country – for example, EUR/TRY, NZD/SGY, and USD/HKD.

Since the trading volume on exotics is low, spreads tend to be very wide, making them expensive to trade. Furthermore, price movements can be highly erratic since many exotic currencies come from countries with an unstable political climate or poor economic health.

What Influences the Price of a Currency Pair?

Traders deciding how to invest $5,000 (or any amount) must be aware of the factors influencing a currency pair’s price. Detailed below are several of these factors, each playing a role in price movements:

Major Macroeconomic Events

Naturally, major macroeconomic events significantly affect a currency’s value. Interest rate fluctuations can affect forex prices worldwide, even if a rate increase/decrease occurs in a different country. Typically, when a central bank raises rates, the country’s currency will also rise – and vice versa.

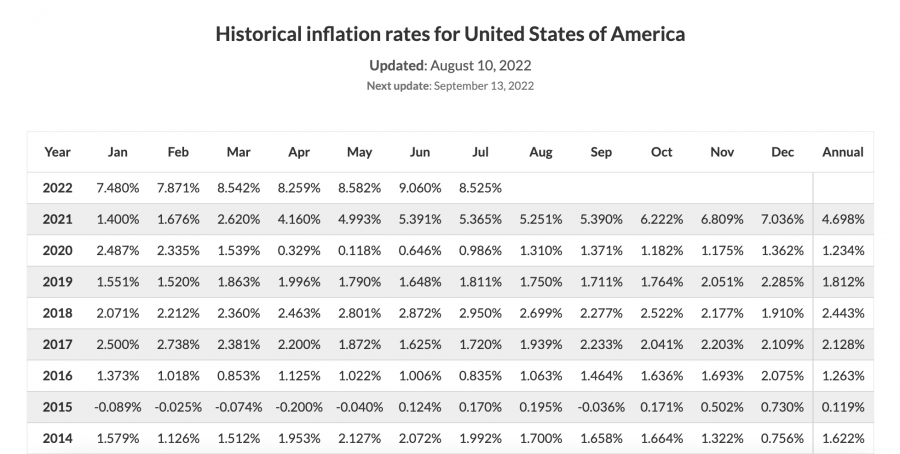

The monetary policies from central banks may not shift currency prices as much if inflation in the country is high, which tends to cause downward price pressure. Aside from rate changes, FX prices can also be affected by noteworthy data releases, such as non-farm payroll (NFP) and consumer price index (CPI).

Political News

Political news can also affect prices, as traders will view specific government figures as good or bad for the country’s economy. Price volatility tends to occur around elections since these represent periods of political instability. Furthermore, all politicians will have their own fiscal and monetary policy ideas, which can influence a currency’s value.

Inflation Level

Inflation is also crucial, as this represents the purchasing power that a currency has. If inflation is low, the country’s currency will usually rise since it can be used to purchase more goods, making it more ‘valuable’.

Stagflation is a market phenomenon with high inflation rates and unemployment levels, while economic growth is negative. This exacerbates the negative effect of high inflation since it drastically reduces the purchasing power of consumers whilst also limiting the options that the central bank has to make amends.

Gross Domestic Product (GDP) Figures

Finally, a country’s GDP can significantly impact its currency’s value. GDP refers to the value of a country’s goods and services over a specific period and tends to be viewed as an indicator of the economy’s health.

When commodity prices are high, this can negatively impact GDP since they often lead to higher inflation. In turn, this will cause downward pressure on a country’s currency since slowed (or negative) GDP growth can hint at an upcoming recession.

Where to Trade Currency Pairs – Forex Brokers with Tightest Spreads Reviewed

Another consideration when trading the best currency pairs is the platform used to facilitate trades. There are many low-spread forex brokers, although not all are made equal.

To help streamline the decision-making process, presented below are two of the most popular online forex brokers offering tight spreads and a user-friendly trading experience.

1. Capital.com – Leading CFD Broker with Tight Spreads

One of Capital.com’s most appealing characteristics is its fee structure. No commissions are charged when a trader places an FX trade, as all of Capital.com’s fees are built into the bid/ask spread. This spread does vary depending on market conditions, although it remains tight across the board.

For example, the spread on EUR/USD can be as low as 0.6 pips during peak trading hours, making it cost-effective to trade with Capital.com. Traders can also open positions using micro lots (0.01 lots) and fund their accounts from as little as $20. Beginner forex traders who are unfamiliar with the concept of Pips will find our article on ‘what is a Pip in forex?‘ a useful educational resource.

What’s more, Capital.com offers over 130 currency pairs to trade, significantly increasing the opportunities for traders. In terms of payment methods, Capital.com is one of the best Skrill forex brokers that currently accepts credit/debit cards, bank transfers, PayPal, Apple Pay and Skrill – all of which are free to use. Withdrawals are also free and can be processed in as little as one business day.

Moving on to the trading experience, Capital.com ensures it appeals to traders of all experience levels through its built-in web trading platform. This platform features real-time price charts with an abundance of technical indicators, making it easy for traders to conduct analysis. Traders can also use Capital.com’s mobile app to open positions, which comes with a price alerts feature. This leading forex broker also allows users to use stop-loss and take-profit orders which are all designed to help hedge against potential losses. Our guide on risk management strategies in forex covers the 10 most popular forex strategies to avert risk when trading currency pairs.

Capital.com is also classed as one of the best MT4 brokers as it offers full support for the platform. Finally, beginner traders can even utilize Capital.com’s free demo account, which comes with $10,000 in virtual money.

| Number of FX Pairs | 130+ |

| Minimum Lot Size | 0.01 |

| Leverage Offered | Up to 30:1 |

| Deposit Fees | N/A |

| Cost to Trade EUR/USD | 0% commission |

| Spread on EUR/USD | Variable (as low as 0.6 pips) |

| Overnight Fees | Long = -0.0076%

Short = 0.0028% |

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

2. eToro – 0% Commission Forex Broker with Copy Trader Feature

As one of the best forex copy trading platforms, eToro offers a seamless way for users to automate the trading process. The ‘Copy Trader’ feature is free to use and allows users to copy the trades placed by other eToro users instantly. The 50 most-copied traders of 2021 generated an average annual profit of more than 30%, highlighting how useful this feature can be.

As a zero-commission broker, eToro charges no transaction fee when a trade is placed. Much like Capital.com, eToro’s cut is taken from the bid/ask spread, which is fixed for currencies. However, the spread remains relatively tight, quoted at one pip for EUR/USD and USD/JPY.

There are 49 currency pairs available to trade with eToro, including majors, minors, and exotics. Users can employ leverage of up to 30:1 on these pairs since they are structured as CFDs, providing scope for higher returns through effective trading.

eToro accepts deposits from just $10 via credit/debit card, bank transfer, or e-wallet – with full support for PayPal, Skrill, and Neteller. Finally, eToro even offers an online trading academy with an array of courses and guides to boost traders’ proficiency.

| Number of FX Pairs | 49 |

| Minimum Lot Size | 0.01 |

| Leverage Offered | Up to 30:1 |

| Deposit Fees | N/A |

| Cost to Trade EUR/USD | 0% commission |

| Spread on EUR/USD | One pip |

| Overnight Fees | Daily = $2.89

Weekend = $8.68 |

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

Best Pairs to Trade in Forex – Conclusion

In summary, this guide has presented an in-depth overview of the best pairs to trade in forex before diving into the key factors to bear in mind that can influence an FX pair’s price.

Those interested in trading any of these pairs can do so by partnering with Capital.com – one of the world’s leading FX trading platforms. Capital.com offers a zero-commission trading structure, tight spreads, and an array of technical indicators, making the trading process frictionless for beginners and experienced pros.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.