Payoneer is a secure and highly reputable global payment service that helps users and businesses digitally send and receive money. For traders and investors, the best Payoneer forex brokers should offer an excellent trading experience while keeping fund transfers safe and simple.

In this review, we’ll be showcasing the most crucial and essential features that make the top Payoneer forex brokers better than the rest. Some of the areas that we’ll be looking into include broker fees, trading instruments supported, spreads, and other key aspects. Let’s dive in.

For your reference, here’s our list of the best Payoneer forex brokers according to our own research.The 9 Best Payoneer Forex Brokers in 2023 List

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

Top Payoneer Forex Brokers Reviewed

Payoneer can be used to fund many of the best forex brokers through a few methods, but there are other key features that set each broker apart. After going through the sections below, you’ll find out what some of the best Payoneer forex brokers have to offer.

1. eToro – Overall Best Payoneer Forex Broker

Next on our list is eToro, another multi-asset broker with 0% commissions trading and an excellent user interface. Aside from being easy to use, what makes eToro one of the best Payoneer forex brokers is its flagship feature, CopyTrader.

CopyTrader is eToro’s copy trading component which replicates the positions of other traders on the platform. With this, traders can profit from the positive earnings of the investors on their CopyTrader portfolio. eToro does this better than the other brokers on our list thanks to how well their social trading technology is integrated on the app.

As early as 2012, eToro had already rolled out its mobile trading app which remains available today in both Google Play Store and the App Store. The app made it possible to open and close positions on the go as forex markets run 24 hours a day. Features on the eToro web trading platform are also offered on the app, including 49 forex pairs to choose from and access to CopyTrader.

Traders looking for a more diverse portfolio can enjoy the +3,000 stocks, 76 cryptocurrencies, 23 commodities, 265 ETFs, and 16 indices on their platform. Additionally, eToro can accommodate both long-term investing and short-term trading strategies as users have the option of actually owning the stocks when they buy shares or using CFDs.

More details and features can be found in our eToro Review as well as in the table and list below.

Forex Pairs

49 pairs

Max Leverage

1:30 for retail clients

Pricing

0% commission

Spread for USD/EUR

1 pip

Trading Platforms

Proprietary platform

Minimum Deposit

10 USD for UK/US clients, 50 USD and 200 USD for other countries

Accepts US Clients

No

What We Like

78% of retail investor accounts lose money when trading CFDs with this provider.

2. XTB – Trusted Payoneer Forex Broker With Web Trading

As one of the frontrunners among European forex and CFD brokers, XTB gives its 495,000 traders access to the largest markets in the world. The broker comes with a fast and smooth proprietary trading platform called xStation which accepts accounts of all sizes.

As a no dealing desk or NDD forex broker, XTB connects its users with major liquidity providers that create a market with low forex spreads and fast trading speeds. The platform is fully transparent and there is no conflict of interest when opening trades since XTB lets its users trade directly with liquidity providers.

Anyone can create an XTB account in just minutes and even try to register for a demo trading account which can be used for risk-free trading for 4 weeks. This paper trading account includes $100,000 virtual equity for traders to get accustomed to the platform.

Forex Pairs

48 pairs

Max Leverage

1:30 leverage for retail clients

Pricing

0% commission

Spread for USD/EUR

From 0.1 pips

Trading Platforms

Proprietary platform

Minimum Deposit

None

Accepts US Clients

No

What We Like

81% of retail investor accounts lose money when trading CFDs with this provider.

3. Libertex – Well Regulated Payoneer Forex Broker with Top-rate Platform

With almost 3 million clients, Libertex is another popular forex broker in Europe that can be funded with a Payoneer account. Since the platform is licensed with the top regulatory commissions in the industry, it’s a highly reputable and established multi-asset broker.

Libertex supports trading in many different platforms including MT4, MetaTrader 5 (MT5), its own web trading platform, and the Libertex trading app. 51 forex pairs are supported by the broker with a maximum of 1:30 leverage. Over 100 trading tools and some of the best forex signals can be accessed in the platform with plugins.

Some of the other tradable assets on Libertex are stocks, ETFs, cryptocurrencies, and commodities including gold, oil, and gas. Analytical reports and top market reviews with key trading insights can be found on the research section of the platform. More on Libertex features can be found in the section below.

Forex Pairs

51 pairs

Max Leverage

1:30 leverage for retail clients

Pricing

From 0% commission

Spread for USD/EUR

From 0.3 pips

Trading Platforms

Proprietary, MT4, MT5

Minimum Deposit

100 EUR

Accepts US Clients

No

What We Like

62.2% of retail investor accounts lose money when trading CFDs with this provider.

4. Pepperstone – Top Payoneer Forex Broker With Spread Betting

Pepperstone is a reputable Payoneer forex broker with support for multiple platforms, low spreads, and a high percentage fill rate. The broker’s best known for being a top spread betting broker which allows users to trade with certain tax exemptions in the UK.

A total of over 60 major, minor, and exotic currency pairs are offered on Pepperstone which can be traded with a low commissions account or 0% commissions account. The high leverage broker has an above-average maximum leverage of 1:200 for forex trading. Indices, cryptocurrencies, commodities, stocks, and even currency indices are also supported.

Three main platforms can be used for trading on Pepperstone, namely cTrader, MT4, and MT5. Additionally, Pepperstone clients who have accumulated high volumes of trades can avail of the Active Trader program which gives forex and indices trading discounts and higher priority client support.

More Pepperstone key account and trading features can be found in our Pepperstone review as well as in the table and list section below.

Forex Pairs

Over 60 pairs

Max Leverage

1:200 for retail clients

Pricing

3.5 USD per lot for raw accounts, 0% for standard account

Spread for USD/EUR

From 0 pips

Trading Platforms

TradingView, cTrader, MT4, MT5

Minimum Deposit

100 USD

Accepts US Clients

No

What We Like

74% of retail investor accounts lose money when trading CFDs with this provider.

Best Payoneer Forex Brokers Compared

This section features a table that compares the best Payoneer Forex Brokers.

| Forex Brokers | Forex Pairs | Max Leverage | Pricing | Spread for EUR/USD | Trading Platforms | Minimum Deposit | Accepts US Clients |

| eToro | 49 pairs | 1:30 for retail clients | 0% commission | 1 pip | Proprietary platform | 10 USD for UK/US clients, 50 USD and 200 USD for other countries | No |

| XTB | 48 pairs | 1:30 leverage | 0% commission | From 0.1 pips | Proprietary platform | None | No |

| Libertex | 51 pairs | 1:200 leverage | From 0% commission | From 0.3 pips | Proprietary, MT4, MT5 | 100 EUR | No |

| Pepperstone | Over 60 pairs | 1:200 for retail clients | 3.5 USD per lot for raw accounts, 0% for standard account | From 0 pips | TradingView, cTrader, MT4, MT5 | 10 USD | No |

| AvaTrade | 55 pairs | 1:400 for retail accounts | 0% commission | 0.9 pips | Proprietary App, MT4, MT5, WebTrader | 100 USD, EUR | No |

| IG | Over 80 pairs | 1:200 for retail clients | 0% commission for CFD account, variable commission for DMA account | From 0.6 pips | Proprietary web platform, MT4, L2 dealer, mobile app | None | Yes |

| CMC Markets | Over 330 pairs | 1:30 leverage | 0% commission on forex | From 0.7 pips | Proprietary platform, MT4 | None | No |

| XM | 57 pairs | 1:1000 leverage | 0% commission | From 1 pip | Proprietary mobile app, MT4, MT5 | None | No |

| BlackBull Markets | 27 pairs | 1:500 leverage | $6 per lot for ECN Prime account, 0% commission for Standard account | From 0.1 pips for ECN Prime account;From 0.8 pips for Standard account | TradingView, MT4, MT5, Webtrader | None | No |

What is Payoneer?

Servicing the global commerce industry, Payoneer is a payments solution that’s designed to help different businesses and professionals to send and accept money quickly and securely. The platform was founded in New York City back in 2005 and now has over 5 million users, 24 global offices, and supports over 35 different languages.

Users from Payoneer’s 190 supported countries can open accounts and start receiving payments from around the world while also being able to withdraw their funds to their local bank accounts. This makes Payoneer a business enabler as contractors, suppliers, and even business expenses can be paid through the platform.

Payoneer is a solution for businesses of all sizes. Freelancers can send payment requests to their clients who also have accounts while ecommerce sellers can view all their in-store payments on the app. SMBs and even larger enterprises can use their account balance to pay VAT obligations and even perform mass payouts for expenses.

Benefits of Using a Payoneer Forex Broker

In this section of the review, let’s look through some of the benefits of using a Payoneer forex broker and the value that Payoneer accounts offer.

Ultimate Security and Data Protection

Since Payoneer handles all the digital funds of its clients, the platform makes user security its biggest priority. Customer funds are held in segregated and safeguarded accounts in compliance with the laws for financial institutions. The clients’ funds remain liquid, are not used for loans, and are not affected by the company’s operations.

As a regulated entity from multiple government regulatory bodies, Payoneer is also obligated to protect its users’ funds from money laundering. Money transfers or payments are fully secure and audited as per the legal requirements from global financial regulators.

Low Fees, No Hidden Costs

Payoneer has minimal fees and keeps its costs transparent so that its clients can worry less and do more. Payments between Payoneer account holders is completely free. When sending payment requests to non-Payoneer clients, they have the option to pay via credit cards for a 3% fee or ACH bank debit for 1% (US only).

For withdrawals from Payoneer to local bank accounts of a different currency, up to a 2% transaction fee is given. Withdrawing locally with the same currency will only have a flat transaction fee of 1.50 USD, EUR. or GBP. All other fees are fully shown on the Payoneer website.

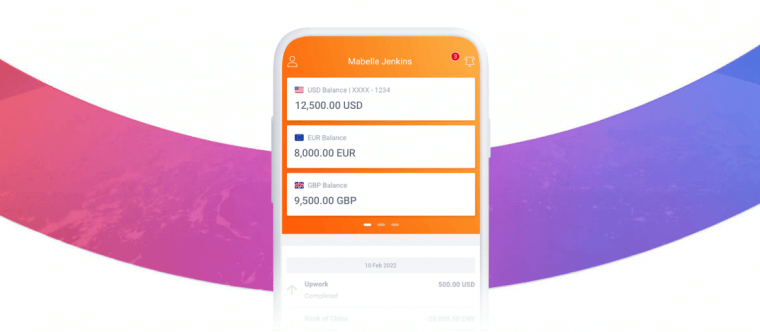

Multi-currency Platform

Aside from being more accessible to sole account holders and businesses, having many different currencies in one platform makes transferring these currencies easier and more cost efficient.

After opening a Payoneer account, users can already hold multiple currencies all inside the app. USD, EUR, CAD, GBP, JPY, AUD, and CNH are all the currencies that can be stored with Payoneer globally. Other supported currencies will vary from time to time and depending on the region of the client.

Access to Digital and Physical Payoneer Mastercard

Funding the best Payoneer forex broker for you is especially easy with the Payoneer Mastercard. The card is supported globally just like any other MasterCard. This means that it can be used to withdraw cash at ATMs as well as make online purchases. A digital version of the card can also be used to make online payments.

Card delivery for the commercial Payoneer Mastercard is free with an annual card fee of 29.95 USD.

Conclusion

Finding the best Payoneer forex broker that will truly match an investor’s strategies, risk management, and other trading needs will require research and possible testing of different platforms. In this review, we’ve only looked into the most important and relevant areas of the best Payoneer forex brokers.

With all of this considered, our findings still point to eToro as the overall favorite broker for Payoneer account holders due to the ease of use of its platform, 0% commissions, and its secure trading. Support for 49 major, minor, and exotic pairs means that new forex traders to the most advanced and niche forex traders have a lot of tradable currencies to work with.

If you want to start trading with low spreads, 1:30 leveraged forex CFDs, and an award-winning platform, click on the link below to start forex trading with eToro.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What are the best Payoneer forex brokers?

How do I fund my Payoneer account?