Scalping refers to a trading strategy that aims to make small, but frequent gains from rising and falling asset prices.

In order to scalp successfully, traders will need to have an account with a broker that offers tight spreads, low commissions, and fast execution times, in addition to a range of other important metrics.

In this guide, we discuss and rank the 10 best scalping brokers to consider joining today.

The Best Forex Scalping Brokers List

Below, we list the 10 best scalping brokers in the market right now:

- Capital.com – Overall Best Scalping Broker

- eToro – Low-Cost Scalping Broker With Copy Trading Tools

- XTB – Popular Scalping Broker Offering Free Education

- AvaTrade – Regulated Forex Broker That Supports MT4 and MT5

- Skilling – Access Leverage of 1:500 on Major FX Pairs

- FXTM – Popular Forex Broker With Support for Spot Metals and Stocks

- Interactive Brokers – Access to Interbank Currency Quotes via a True ECN Broker

- FBS – Highest Leverage in the Market at up to 1:3000

- CMC Markets – Trade More Than 330+ Forex Pairs

- FP Markets – Tight Raw Spreads From 0 Pips

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Full reviews of the above scalping brokers can be found in the following sections of this comparison guide.

Best Brokers for Scalping Reviewed

Scalping trading requires optimal brokerage conditions.

This means having access to super-low trading fees and tight spreads, alongside sufficient analysis tools and fast execution speeds. After all, the overarching aim of scalping is to make minute profits – with trades often lasting just a few minutes.

To make an informed decision, consider a provider from the following reviews, whereby we rank the 10 best scalping brokers in the market today.

1. Capital.com – Overall Best Scalping Broker

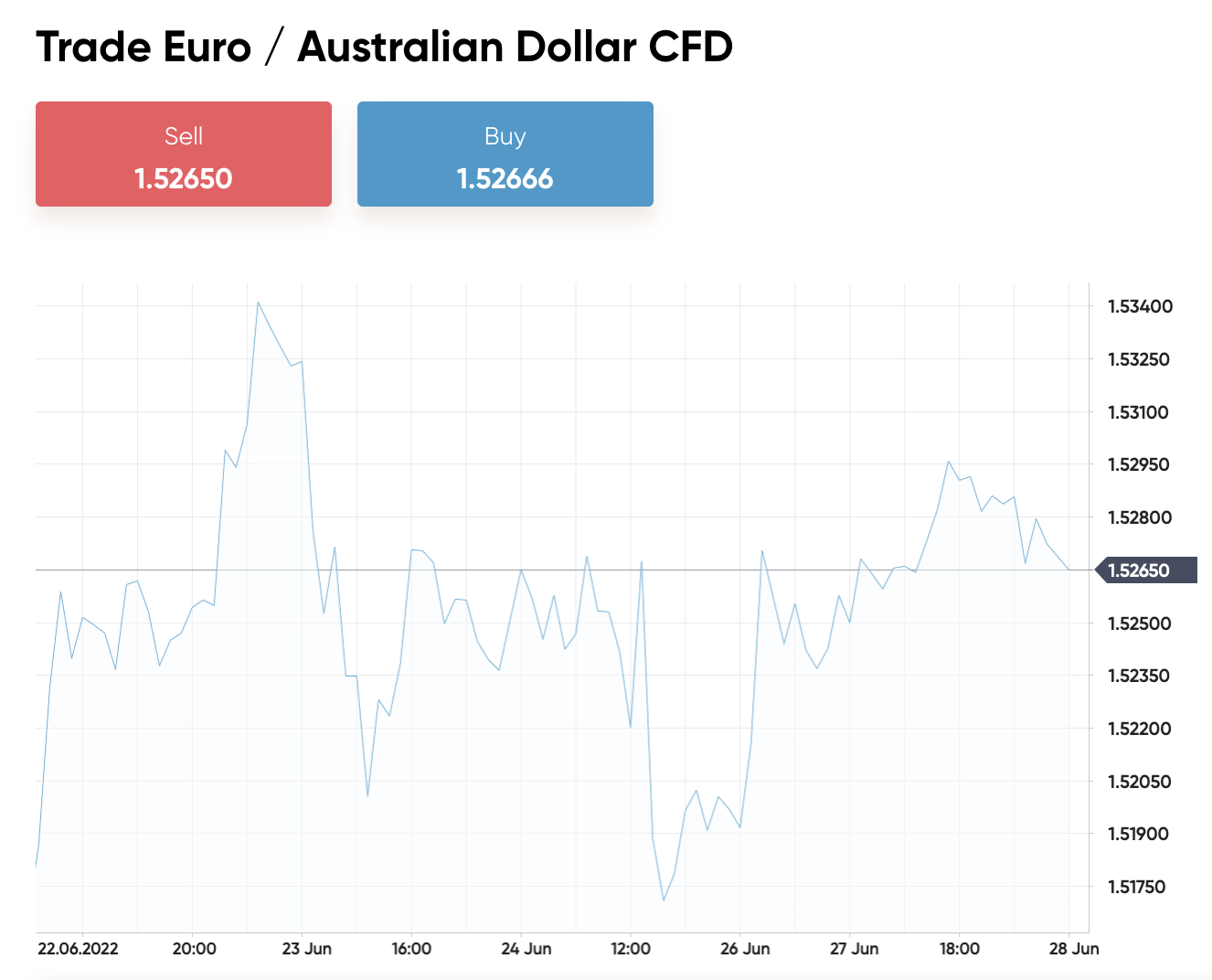

Those in the market for the overall best scaling broker should look no further than Capital.com. First and foremost, the platform is home to thousands of CFDs across multiple asset classes. This is inclusive of indices, forex, cryptocurrencies, commodities, ETFs, and stocks.

As such, scalpers will never be short of trading opportunities. Furthermore, and perhaps most importantly, Capital.com does not charge any trading commissions. Not only that, but spreads at Capital.com are very competitive. As a prime example, EUR/USD can be traded at a spread of just 0.6 pips.

On top of low fees and support for thousands of markets, we also like Capital.com for its trading tools. The primary web trading platform – which can be accessed via a standard browser, offers plenty of technical indicators, pricing feeds, customizable charts, and more. There is also the option to trade at Capital.com via the MT4 desktop software.

Those wishing to engage in scalping trading via their smartphone will likely appreciate the Capital.com app. This trading app is available to download free of charge across both iOS and Android devices, and it offers full functionality. Another core benefit of using Capital.com for scalping purposes is that it offers leverage on all supported markets.

Retail clients will be limited in terms of how much leverage can be applied, albeit, this normally stands at 1:30 on major forex pairs, 1:20 on minors/exotics and gold, and less on other assets. We also like that all markets can be entered with either a buy or sell order. This means that scaling traders can attempt to profit from both rising and falling markets.

In terms of the fundamentals, Capital.com is authorized and regulated by the FCA, CySEC, ASIC, and NBRB. It takes less than five minutes to open a verified account and debit/credit card and e-wallet payments require a minimum deposit of just $20. Capital.com also supports bank wires, but this requires a minimum of $250.

| FX Pairs | 138 |

| Max Leverage | 1:30 for retail clients |

| Commission | 0% on all markets |

| EUR/USD Spread | From 0.6 pips |

| Other Assets | CFDs on stocks, ETFs, indices, commodities, cryptocurrencies |

| Platforms | Web trader, mobile app, MT4 |

| US Clients | No |

| Brokerage Type | CFD |

What We Like

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. eToro – Low-Cost Scalping Broker With Copy Trading Tools

This includes markets not only in the US, but the UK, Germany, the Netherlands, Canada, Hong Kong, and more. In addition to stocks and ETFs, eToro also allows investors to buy cryptocurrency assets like Bitcoin, Shiba Inu, Ethereum, EOS, Dash, and more.

In particular, digital currencies are ideal for scalping strategies due to their volatile nature. eToro is also one of the best forex brokers in the market, with the platform supporting nearly 50 major, minor, and exotic pairs. eToro is also home to more than a dozen indices markets, as well as commodities trading instruments like gold, silver, natural gas, and crude oil.

Just like Capital.com, eToro also allows users to buy and sell assets with leverage. We like that eToro is very transparent with the overnight financing fees that it charges on leveraged trades. This will ensure that scalpers can set clear entry and exit targets. Another top-rated feature at eToro is its Copy Trading service.

Put simply, this allows users to copy the trades of a successful eToro investor. Each position will be added to the user’s portfolio in proportion to the amount invested. We also like eToro for its strong regulatory standing. The broker holds licenses with the SEC and FINRA, as well as the FCA, ASIC, and CySEC.

Accounts at eToro can be opened in a matter of minutes and US clients will be required to meet a minimum deposit of just $10. Most other nationalities will need to cover a minimum deposit of $50. Payments made in US dollars are fee-free, while other currencies attract an FX charge of 0.5%. Supported payment types include debit/credit cards, bank wires, and e-wallets.

| FX Pairs | 49 |

| Max Leverage | 1:30 for retail clients |

| Commission | 0% stocks and ETFs, spread-only on CFDs |

| EUR/USD Spread | From 0.6 pips |

| Other Assets | Stocks, ETFs, indices, commodities, cryptocurrencies |

| Platforms | Web trader, mobile app |

| US Clients | Yes – but for real stocks and cryptocurrencies only |

| Brokerage Type | Broker-dealer, CFD broker |

What We Like

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider

3. XTB – Popular Scalping Broker Offering Free Education

Advanced traders may wish to take advantage of 1:30 leverage trading and choose amongst 48 currency pairs. That’s perfect for scalping traders wanting to profit quickly by increasing the size of their positions. The benefit of trading with XTB is that traders can trade major pairs such as EUR/USD at a spread of 0.1 pips.

The two platforms available are xStation 5 and xStation mobile. Station was vote the Best Trading Platform 2016 by Online Personal Wealth Awards.

No minimum deposit is required to start trading, and traders can also take advantage of microlot trading. Traders can also access crypto, stocks, commodities, ETFs and indices to trade in over 2100 global markets.

| FX Pairs | 48 |

| Max Leverage | 1:30 |

| CommissionS | Spread-only on CFDs |

| EUR/USD Spread | From 0.1 pips |

| Other Assets | Stocks, ETFs, indices, commodities, cryptocurrencies |

| Platforms | xStation 5 and xStation mobile |

| US Clients | No |

| Brokerage Type | CFD broker |

What We Like

Your capital is at risk. 81% of retail investor accounts lose money when trading CFDs with this provider.

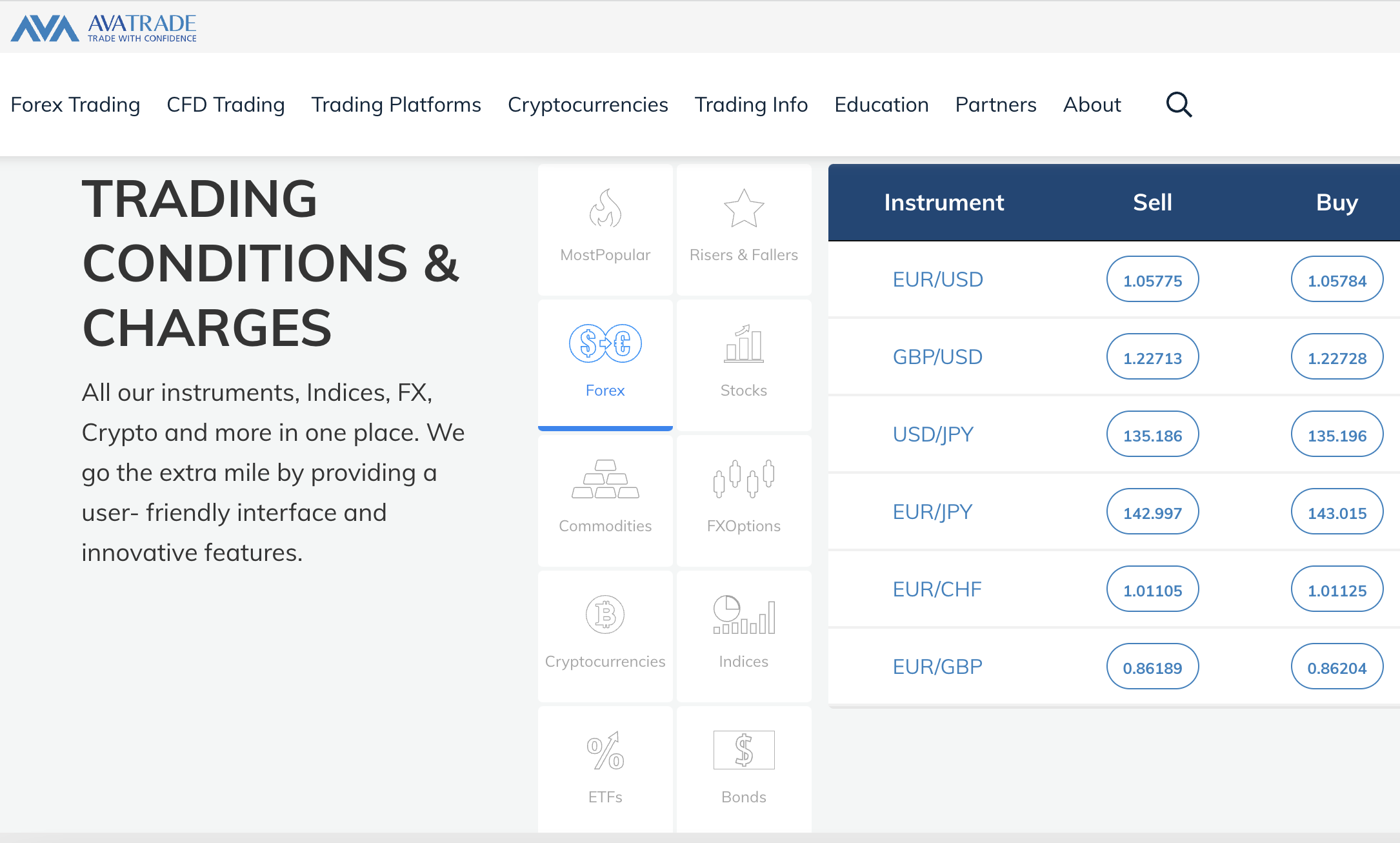

4. AvaTrade – Regulated Broker That Supports MT4 and MT5

All of the markets available on AvaTrade can be traded at 0% commission alongside competitive spreads, which is ideal for scalping strategies. Moreover, AvaTrade supports several third-party trading platforms that are often favored by scalpers. This includes both MT4 and MT5, as well as cTrader.

AvaTrade also offers its own native trading platform – which can be accessed online or via an iOS/Android app. All of the platforms supported by AvaTrade come with advanced trading tools and features. AvaTrade requires a minimum deposit of just $100 when opening an account for the first time. Users can make a deposit via a debit/credit card or bank wire.

| FX Pairs | 55 |

| Max Leverage | Up to 1:400 |

| Commission | 0% |

| EUR/USD Spread | From 0.9 pips |

| Other Assets | CFDs via stocks, indices, commodities, cryptocurrencies |

| Platforms | Web trader, mobile app, MT4, MT5, DupliTrade, ZuluTrade |

| US Clients | No |

| Brokerage Type | CFD (market maker) |

What We Like

5. Skilling – Access Leverage of 1:500 on Major FX Pairs

This means that a trading position of just $10 could be amplified to a $5,000 order. Skilling also stands out for its competitive fee structure. For instance, all supported markets can be traded at 0% commission and the spread on EUR/USD starts at 0.5 pips. There are no deposit or withdrawal fees charged by Skilling either.

All markets at Skilling are represented by CFDs, so scalping traders can attempt to profit from both rising and falling asset prices. This includes stocks, forex, commodities, and digital currencies like Bitcoin and Ethereum. Platforms offered by this broker include support for MT4 and cTrader, as well as a proprietary mobile app for iOS and Android.

| FX Pairs | 74 |

| Max Leverage | Up to 1:500 |

| Commission | 0% |

| EUR/USD Spread | From 0.5 pips |

| Other Assets | CFDs via stocks, indices, commodities, cryptocurrencies |

| Platforms | Web trader, mobile app, MT4, cTrader |

| US Clients | No |

| Brokerage Type | CFD |

What We Like

6. FXTM – Popular Forex Broker With Support for Spot Metals and Stocks

FXTM (Forex Time) is a popular online trading platform that supports a wide selection of markets. This includes dozens of currency pairs, as well as FX indices. The latter allows scalpers to hedge their positions via a group of hand-picked currencies. FXTM also supports spot metals and stocks.

There are several account types to choose from at FXTM. The advantage account is ideal for scalpers, as spreads start at 0 pips and commissions are very competitive. More casual traders might prefer the micro account, which offers commission-free access to the forex markets alongside minimum spreads of 1.5 pips.

Those that are unsure which account type is best might be better off starting off with the demo trading facility. This offers risk-free access to the financial markets, as traders will be entering and exiting positions with paper funds. FXTM supports both MT4 and MT5, as well as its own native mobile app for iOS and Android.

| FX Pairs | Dozens of majors, minors, and exotics |

| Max Leverage | Up to 1:2000 |

| Commission | From 0% |

| EUR/USD Spread | From 0 pips |

| Other Assets | CFDs via spot metals and stock |

| Platforms | Web trader, mobile app, MT4, MT5 |

| US Clients | No |

| Brokerage Type | CFD |

What We Like

7. Interactive Brokers – Access to Interbank Currency Quotes via a True ECN Broker

Interactive Brokers is one of the best US forex brokers for scalping via an ECN account. This global brokerage firm offers access to the tier-one forex markets, which means industry-leading currency prices. In most cases, this will result in spreads of 0 pips on major forex pairs.

The commission charged by Interactive Brokers is very competitive too at just 0.08 and 0.2 basis percentage points. The specific rate will be determined by the amount traded over the course of a 30-day period. In terms of supported markets, Interactive Brokers offers access to more than 100 currency pairs.

We also like Interactive Brokers for its highly sophisticated client portal, which covers a wide selection of charting tools and economic indicators. The IBKR mobile app for iOS and Android is also noteworthy for its analysis tools and fast execution speeds. In addition to currencies, Interactive Brokers also offers futures, options, stocks, ETFs, and more.

| FX Pairs | 100+ |

| Max Leverage | Up to 1:50 for US clients |

| Commission | Between 0.08 and 0.2 bps |

| EUR/USD Spread | From 1/10 of a pip |

| Other Assets | Stocks, futures, options, mutual funds, ETFs, and more |

| Platforms | Client portal, trader workstation, IBKR mobile, IBKR globaltrader |

| US Clients | Yes |

| Brokerage Type | ECN broker with access to interbank quotes |

What We Like

8. FBS – Highest Leverage in the Market at up to 1:3000

While beginners should tread carefully when entering high leverage positions, FBS is undoubtedly one of the best brokers for scalping on margin. Crucially, traders will have the ability to place scalping orders with a maximum leverage limit of 1:3000.

This means that by entering a position worth just $10, this can be amplified to a $30,000 order. When it comes to fees, this varies depending on the chosen account type. For example, there is a zero-spread account that comes with a standard commission of $20 for every lot traded.

Casual investors might prefer the commission-free account, which comes with competitive minimum spreads of 0.5 pips. Perhaps the main drawback with FBS is that it offers just 28 forex pairs, so those seeking exotic currency markets will be disappointed. With that said, the platform also offers metals, indices, energies, stocks, and crypto.

| FX Pairs | 28 |

| Max Leverage | Up to 1:3000 |

| Commission | Depends on the account – from 0% |

| EUR/USD Spread | Depends on the account – from 0 pips |

| Other Assets | Metals, indices, energies, stocks, crypto |

| Platforms | FBS web trader, MT4, MT5 |

| US Clients | No |

| Brokerage Type | ECN, DMA |

What We Like

9. CMC Markets – Trade More Than 330+ Forex Pairs

Those on the lookout for the best brokers for scalping forex might consider CMC Markets. In total, this popular platform offers access to more than 330+ currency pairs. Therefore, unlike FBS, users can speculate on a huge number of emerging and exotic markets.

Moreover, in total, CMC Markets offers more than 12,000 financial markets from a wide selection of other asset classes. This covers stocks and ETFs from multiple international exchanges, as well as treasuries, cryptocurrencies, commodities, and indices.

CMC Markets specializes in CFD instruments, which means that both long and short positions are supported. Moreover, traders can access leverage at competitive funding rates. In terms of fees, CMC Markets is a commission-free brokerage firm. Spreads start from0.7 pips on major pairs, which is ideal for scalping strategies.

| FX Pairs | 330+ |

| Max Leverage | 1:30 for retail clients |

| Commission | 0% |

| EUR/USD Spread | From 0.7 pips |

| Other Assets | Stocks, ETFs, treasuries, indices, cryptocurrencies, commodities |

| Platforms | Web trader, mobile app, MT4 |

| US Clients | No |

| Brokerage Type | CFD |

What We Like

10. FP Markets – Tight Raw Spreads From 0 Pips

The final platform to consider from our list of the best scalping forex brokers is FP Markets. This platform is ideal for scalpers that wish to trade at spreads of 0 pips. This can be achieved by opening a raw spread account, which requires a minimum deposit of $100.

This account type comes with a commission of just $3 for every lot traded. The other option is to open a standard account at FP Markets, which is commission-free. The spread, however, starts at 1 pip on this account type. Both accounts at FP Markets offer leverage of up to 1:500 and all positions are executed at ECN-like pricing.

Advanced traders might elect to connect their FP Markets account to MT4 or MT5. In addition to forex, FP Markets also supports metals, bonds, cryptocurrencies, and energies. Finally, FP Markets is authorized and regulated by ASIC, which is great for safety. However, this does mean that retail clients will be limited in how much leverage they can access.

| FX Pairs | 60+ |

| Max Leverage | 1:500 |

| Commission | From 0% |

| EUR/USD Spread | From 0 pips |

| Other Assets | Metals, bonds, cryptocurrencies, and energies. |

| Platforms | MT4, MT5, mobile app |

| US Clients | No |

| Brokerage Type | CFD |

What We Like

Best Scalping Forex Brokers Compared

Those needing a recap on the best scalping forex brokers reviewed in the sections above can refer to the comparison table below:

| Scalping Brokers | FX Pairs | Max Leverage | Commission | EUR/USD Spread | Other Assets | Platforms | US Clients? | Brokerage Type |

| Capital.com | 138 | 1:30 for retail clients | 0% | 0.6 pips | CFDs on stocks, ETFs, indices, commodities, cryptocurrencies | Web trader, mobile app, MT4 | No | CFD |

| eToro | 49 | 1:30 for retail clients | 0% stocks and ETFs, spread-only on CFDs | 1 pip | Stocks, ETFs, indices, commodities, cryptocurrencies | Web trader, mobile app | Yes | Broker-dealer, CFD |

| AvaTrade | 55 | Up to 1:400 | 0% | 0.9 pips | CFDs via stocks, indices, commodities, cryptocurrencies | Web trader, mobile app, MT4, MT5, DupliTrade, ZuluTrade | No | CFD |

| Skilling | 74 | Up to 1:500 | 0% | 0.5 pips | CFDs via stocks, indices, commodities, cryptocurrencies | Web trader, mobile app, MT4, cTrader | No | CFD |

| FXTM | Dozens of pairs | Up to 1:2000 | From 0% | From 0 pips | CFDs via spot metals and stock | Web trader, mobile app, MT4, MT5 | No | CFD |

| Interactive Brokers | 100 | Up to 1:50 for US clients | Between 0.08 and 0.2 bps | From 1/10 of a pip | Stocks, futures, options, mutual funds, ETFs, and more | Client portal, trader workstation, IBKR mobile, IBKR globaltrader | Yes | ECN |

| FBS | 28 | Up to 1:3000 | From 0% | From 0 pips | Metals, indices, energies, stocks, crypto | FBS web trader, MT4, MT5 | No | ECN, DMA |

| CMC Markets | 330 | 1:30 for retail clients | 0% | 0.7 pips | Stocks, ETFs, treasuries, indices, cryptocurrencies, commodities | Web trader, mobile app, MT4 | No | CFD |

| FP Markets | 600 | Up to 1:500 | From 0% | From 0 pips | Metals, bonds, cryptocurrencies, and energies. | MT4, MT5, mobile app | No | CFD |

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

What is Scalping in Trading?

In a nutshell, scalping is a trading strategy that aims to make small, but very frequent gains. In its most basic form, the trader will enter a position and look to close it within a matter of minutes.

The overarching objective is to take advantage of constant price movements of assets like forex, stocks, indices, and cryptocurrencies.

Due to the fast nature that the investor will enter and exit the market, scalping traders will often look to make gains that amount to a very small fraction of a percentage point.

Although this means that achievable profits are modest in percentage terms, the vast majority of scalping traders will utilize leverage.

Here’s a quick example of how scalping trading works:

- The scalper enters a $1,000 position going long on GBP/USD with an entry price of 1.2400

- Leverage of 1:50 is applied to thfis position

- A few minutes later, GBP/USD has increased to 1.2424

- This amounts to an increase of 0.2%

- Without leverage, the scalping trader would have made a profit of just $2

- However, with leverage of 1:50, this scalping position is amplified to a profit of $100

This is why the best scalping forex brokers in the market will offer suitable levels of leverage, in addition to tight spreads and low commissions.

What Assets Can You Scalp Trade?

Certain assets and financial instruments are better for scalping trading strategies than others.

In the sections below, we briefly explore what markets to look for when choosing the best scalping broker.

Forex Scalping

The vast majority of scalpers will focus on forex. The reason for this is that the forex markets guarantee high levels of liquidity and in the case of majors, super-tight spreads.

Experienced scalpers will often look to trade exotic pairs due to the enhanced volatility on offer. Capital.com is one of the best scalping forex brokers for this purpose, as the platform supports nearly 140 pairs at 0% commission.

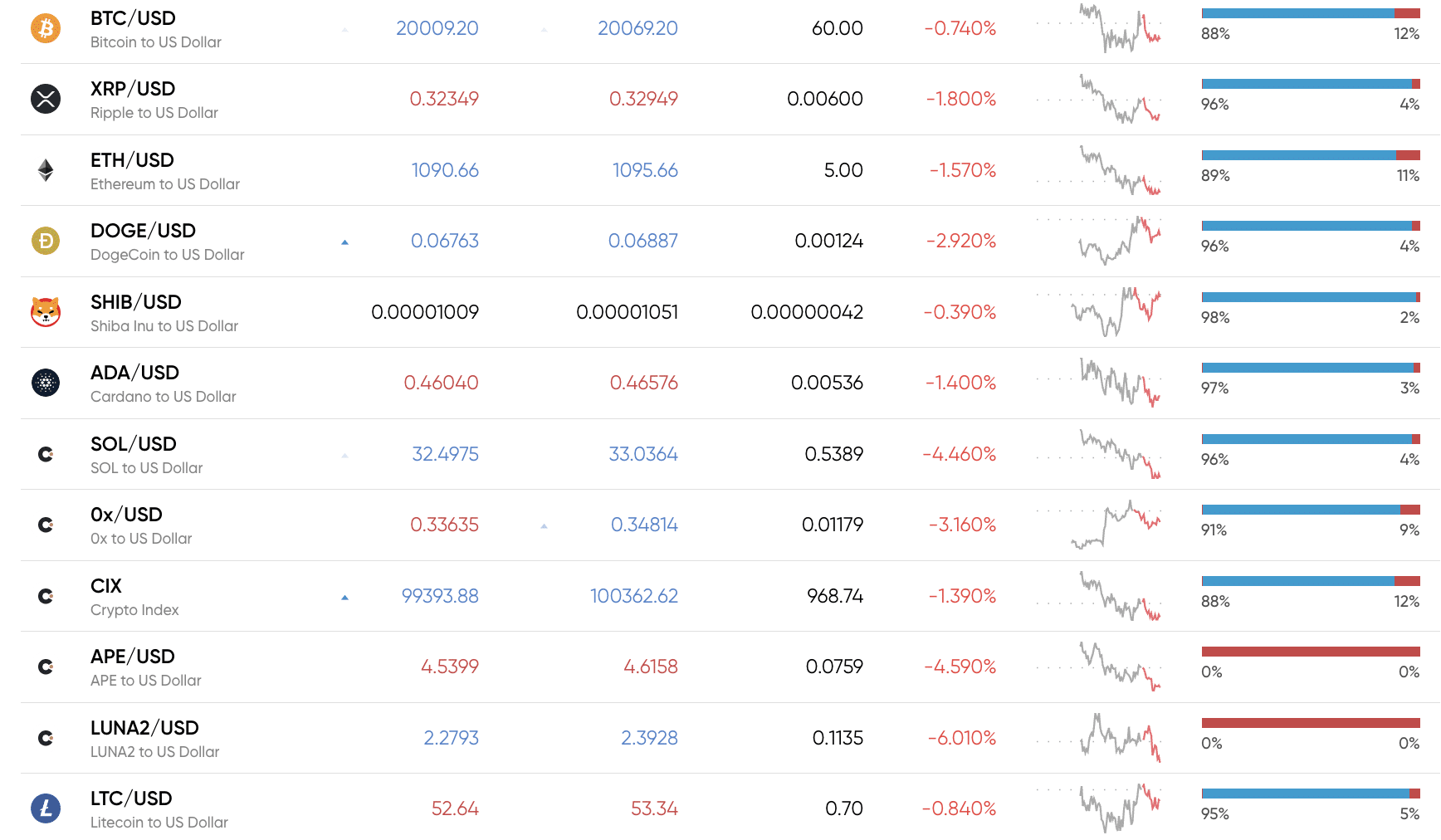

Crypto Scalping

Cryptocurrencies like Bitcoin and Ethereum are also ideal for scalping trading. Just like exotic currency pairs, this asset class is super-volatile.

Moreover, the crypto markets are open on a 24/7 basis, so there are always sufficient levels of trading activity around the clock.

The best crypto scalping platform that we came across is Capital.com, not least because it offers hundreds of pairs at 0% commission.

Stocks Scalping

Those with an intimate knowledge of the stock markets will look to scalp equity price movements throughout the day.

When opting for stocks listed on major markets like the NYSE, NASDAQ, and LSE – scalpers will have access to high levels of liquidity and competitive spreads during standard trading hours.

One of the best platforms for scalping stocks is eToro, which offers thousands of commission-free equities.

Commodities Scalping

The best scalping brokers that we covered today offer a wide range of commodities. This includes everything from oil and natural gas to gold and silver.

Major commodity markets are ideal for scalping, as not only do traders have access to constant flows of volatility, but plenty of liquidity.

Options Scalping

Options scalping can be an effective strategy to undertake, but prior experience is a must. This is because traders will need to understand how options contracts are priced by the broader markets.

Nonetheless, the main benefit of scalping options is that traders are not required to cover the full size of the position up front.

Scalping Trading Strategies

Beginners learning how to scalp for the first time might consider the strategies discussed below:

Look for Support and Resistance Levels

One of the best scalping strategies for beginners to undertake is to identify historical support and resistance levels. These are pricing points that have previously resulted in an asset increasing or decreasing in value.

Once the respective levels have been assessed, the scalping trader can then enter a suitable position.

Stick With Majors

Beginners should also consider the asset class that they speculate on when adopting a scalping trading strategy. Major forex pairs like GBP/USD and EUR/USD are great in this respect, as liquidity levels are super high.

In turn, this means that traders typically have access to tight spreads. Moreover, major forex pairs are a lot less volatile than minors, and certainly exotics. As such, beginners will appreciate the stable price movements that majors offer.

Master the RSI

The relative strength index (RSI) is one of the most important technical indicators for experienced scalping traders. In a nutshell, this indicator offers insight into whether a specific asset is potentially overbought or oversold, in terms of volume.

The general rule of thumb is that if the asset carries an RSI reading of above 70, it could be overbought. This means that the asset could be overvalued and thus, a market correction could be imminent.

On the other hand, an RSI reading of 30 or under could mean that the asset is oversold and thus, a reverse to the upside could be about to happen.

Scalping vs Day Trading

Scalping and day trading – although slightly similar, are two completely different strategies.

- Scalping will often see traders enter a position and then close it within a few minutes.

- Day traders have more flexibility. The main concept is that the position must be closed before the end of the trading day.

Crucially, both scalping and day traders will look to make modest, but frequent gains over the course of the trading session.

This is in stark contrast to longer-term investments, which can see the trader hold a position for several months or even years.

Scalping vs Swing Trading

Swing trading is another popular strategy that many seasoned investors implement. This strategy offers significantly more flexibility in terms of how long the position can remain open.

- In fact, a swing trading position can remain in play for anywhere between a few hours to several weeks.

- The main concept of swing trading is that the investor will look for short-term trends.

- For example, if GBP/USD has been on a downward trajectory for several weeks, the swing trader will aim to profit from this for as long as the trend is active.

And, when the trend looks like it is about to reverse, the swing trader will place an opposite position to benefit from the impending upside.

Is Scalping Profitable?

Whether or not scalping is profitable is down to the individual. For example, a seasoned scalping trader with many years of experience under their belt will have every chance to make consistent gains in a risk-averse manner.

And, with the aid of leverage, a successful scalping trader can make sizable profits. However, at the other end of the spectrum, complete beginners might not be as successful.

After all, in order to make gains, the scalping trader will need to correctly predict the market on a consistent basis. With that said, scalping is often viewed as a lower-risk strategy, as traders are only looking to target very small gains.

Furthermore, with sensible risk management orders in place, losses can be kept to a minimum.

How to Trade With a Scalping Broker

Those who strongly believe that scalping is the best trading strategy for their skillset and financial goals will be pleased to know that it takes less than five minutes to get started with a suitable brokerage account.

In the guide below, we explain how to get started with Capital.com, which we found to be one of the best brokers for scalping. Traders will have access to thousands of commission-free assets, alongside leverage and chart reading tools.

Step 1: Open a Capital.com Account

To open an account with Capital.com, users will need to enter some personal information and contact details.

New users will also need to upload a copy of a government-issued ID for KYC (Know Your Customer) purposes.

Step 2: Deposit Funds

Before the user can begin their scalping trading endeavors, they will need to make a deposit. Capital.com accepts payments via Visa, MasterCard, bank wires, and several popular e-wallets.

The minimum deposit is just $20 unless a bank wire is chosen. In this scenario, the minimum is increased to $250.

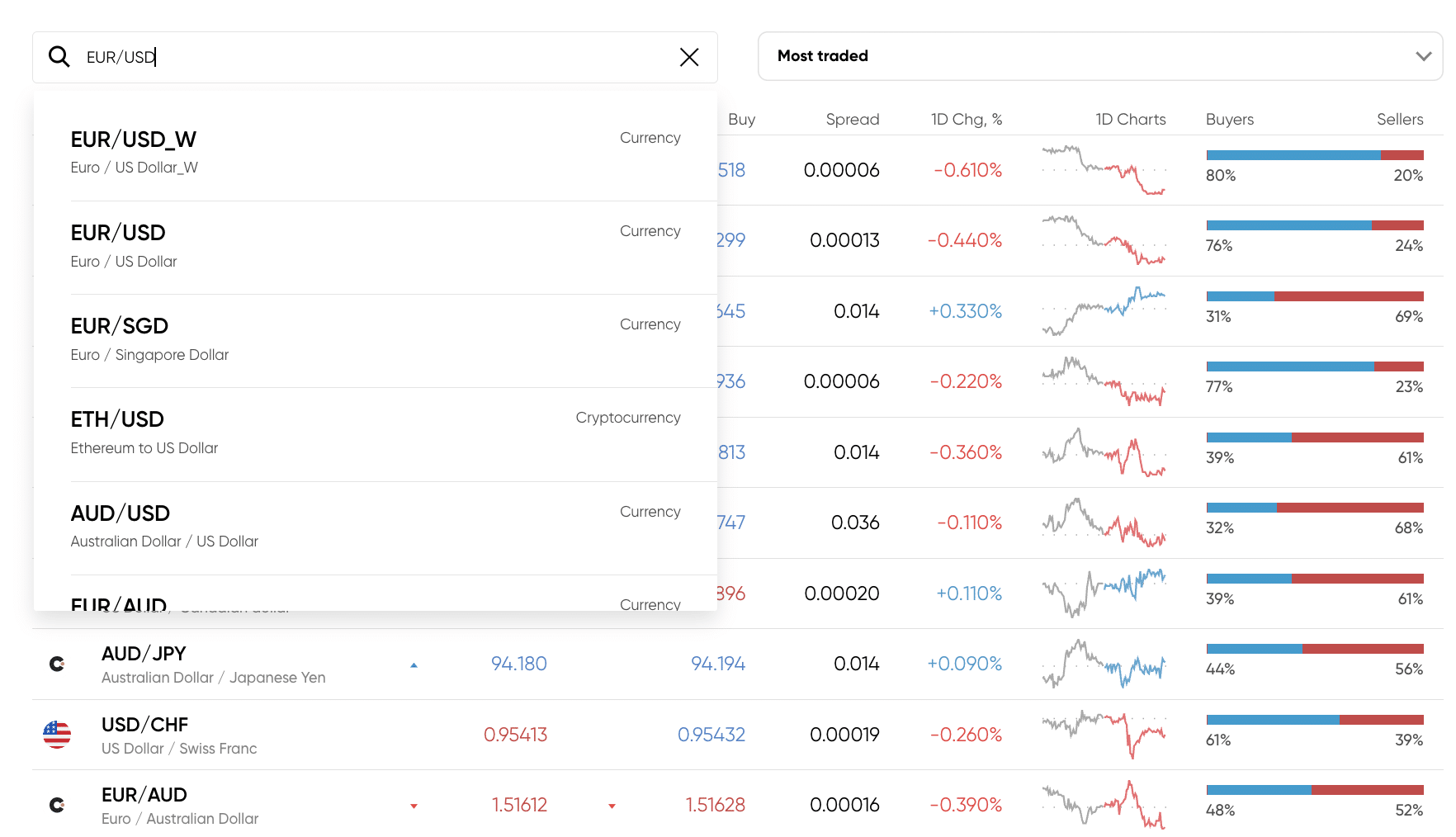

Step 3: Search for Asset

The next step is to determine which asset to scalp. As we mentioned earlier, beginners might be best to focus on major forex pairs.

Therefore, in the example above, we are searching for EUR/USD.

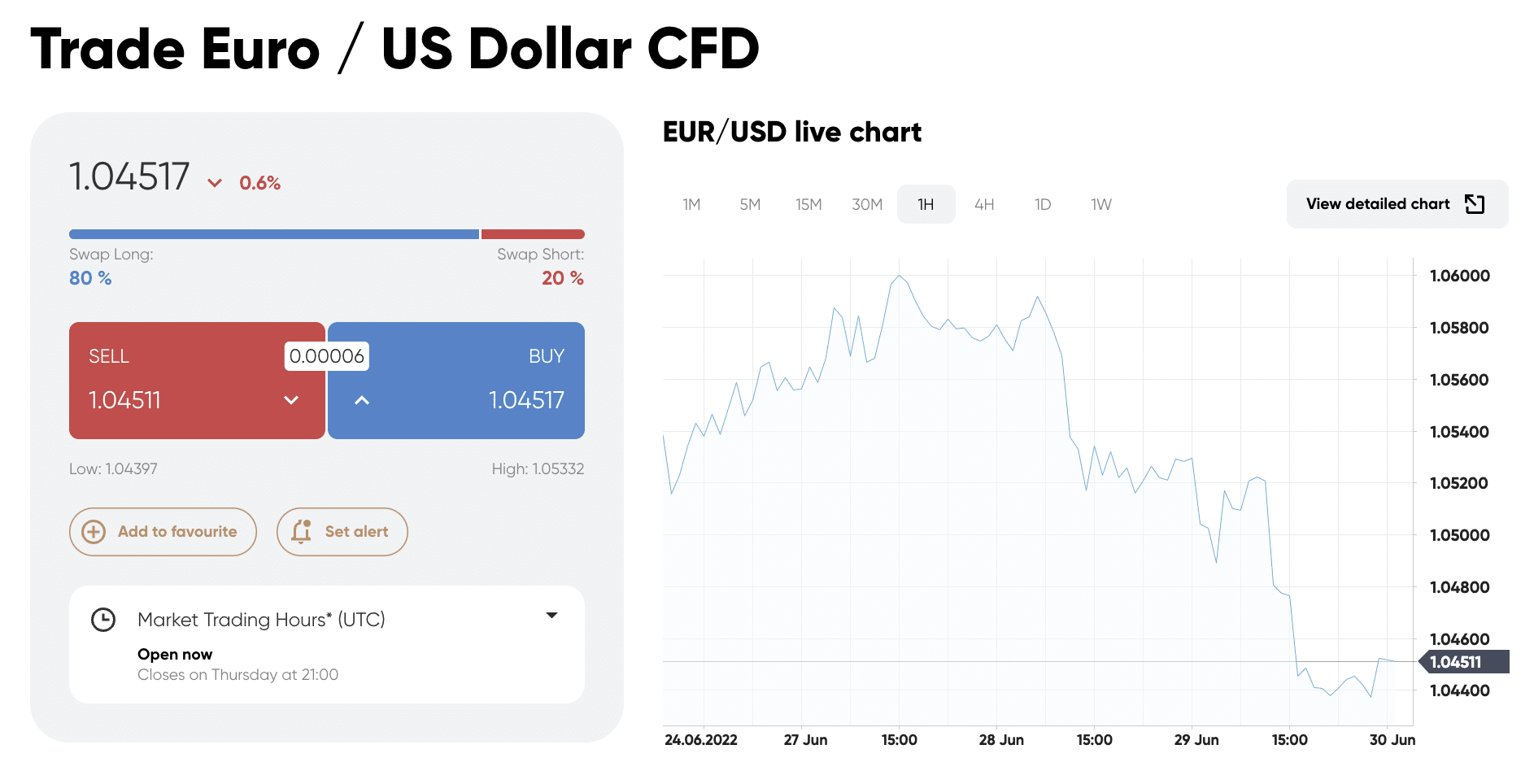

Step 4: Trade

The user will now need to create a trading order. Choose from a buy or sell position depending on the predicted price movement of the asset.

After entering a stake and selecting the desired leverage ratio, confirm the trade.

As noted earlier, a key reason why we found Capital.com to be one of the best brokers for scalping is that the position will be executed on a commission-free basis.

Conclusion

The best scalping brokers in this marketplace will not only offer plenty of tradable markets, but low commissions and tight spreads.

As noted throughout this guide, users should also ensure that the broker offers fast execution speeds and sufficient levels of available leverage.

In terms of pricing, assets, trading tools, and more – we found that Capital.com is the overall best scalping broker to join today. Across thousands of commission-free markets, the platform offers optimal conditions for scalping strategies.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.