Looking for the best sectors to invest in 2023? With the influential S&P 500 index down 16% this year, investors are looking for specific business sectors that are doing better – as well as financial instruments that are weathering the global economic downturn well.

Below we outline some of the best sectors to invest in right now according to market analysts and traders. We consider examples of sectors that are good for varied investor objectives such as growth, fixed-income, ethical investing and long-term prospects. Top of the list goes to crypto presales for their formidable ability to return short-term rewards; we consider three presale gems that may have flown under your radar until now.

The 10 Best Sectors in Invest in 2023

With a global energy crisis in full swing, few investors will have missed the oil and gas industries raking in spectacular revenues this year. According to some investors, oil and gas exploration is certainly one of the best sectors to invest in 2023 for the speculator looking to back profits. But what do other sectors offer?

- Crypto Presales: Best Sector to Invest in Now for Short-Term Gains

- Renewable Energy: One of the Most Popular Sectors to Invest in for Long-Term Gains

- Utilities: Top Industry to Invest in 2023 for Dividends

- Government Bonds: One of the Top Sectors to Invest In For Risk Management

- Mutual Funds: One of the Best Performing Sectors During Recessions

- ETFs: Leading Sector to Invest in Now For Diversification

- Oil and Gas Energy: Popular Sector to Invest in as Energy Prices Continue to Rise

- REITs: Popular Option for Investors Looking for Steady Dividend Income

- Financial Services: One of the most Popular Sectors to Invest in for Future Growth

- Commodities: Safe-haven Sector for Investors Interested in Reducing Portfolio Volatility

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members

A Closer Look at the Best Sectors to Invest in

With crypto bellwether Bitcoin down over 60% YTD, critics have their knives out for the crypto sector. It certainly has not been one of the best sectors to invest in 2023 so far on a general, indexed basis. But, with 21,000+ crypto on the market and more coming through, there are some genuine growth opportunities in the key area of crypto presales.

1. Crypto Presales – Best Sector to Invest in Now for Short-Term Gains

The best cryptos to trade can return excellent asset growth very quickly. As astute investors, we therefore expect crypto investing to be risky; there is no such thing as a free lunch, after all.

To outsiders, the fall of the FTX Exchange in Q4 2022 has made the world of cryptocurrency seem even riskier. But insiders know differently. In his comparison of the fall of FTX with the collapse of the Bitcoin exchange Mt. Gox in 2008, E. Jardine of blockchain analytics experts firm Chainanalysis concludes that, ‘there’s no reason to think the industry can’t bounce back from this, stronger than ever.’

The best crypto presales offer investors the chance to get in on new crypto at the earliest stage possible. And the way that presales are run means that early investors are guaranteed to make a paper profit. That is because the price of the token in question rises according to a guaranteed schedule with each stage of a crypto presale.

Investors are rushing to get involved with three crypto presales in particular:

Dash 2 Trade (D2T) – Revolutionary Crypto Analytics and Signals Platform in Presale Now

Built by traders, for traders, Dash 2 Trade is a powerful new investor platform with exciting presales potential.

With even the best altcoins suffering in the current crypto winter, crypto investors need all the help they can get to pick winners. And Dash 2 Trade comes to the rescue with a stellar range of tools and market intelligence.

Dash 2 Trade users get hot signals on what tokens to buy when – hand-curated by dedicated quant developers using analysis of on-chain metrics. And it is not just a numbers game with Dash 2 Trade.

Users can benefit from cutting-edge analysis of social media sentiment to spot the best emerging cryptos. And, when investors want to commit, they can use the Dash 2 Trade strategy builder and trading bot to try out profitable strategies. What’s more, there is even a special section where exciting crypto presales are rated across key criteria.

Canny investors can buy the D2T token now in presale stage 3 for just 0.0513 USDT. Their investment is guaranteed to rise in value, with the price going up to 0.0533 in stage 4 and eventually reaching 0.0662 USDT in stage 9. That is a total presale price increase of 39%.

| Price Stage | Amount Raised In Stage | Token Allocation |

| $0.0476 | $1,666,000 | 35,000,000 |

| $0.0500 | $3,500,000 | 70,000,000 |

| $0.0513 | $3,591,000 | 70,000,000 |

| $0.0533 | $4,663,750 | 87,500,000 |

Dash 2 Trade is allocating 262,500,000 D2T tokens for the presale to target a total hard cap of $13.4M.

Launched by the team behind successful signals platform Learn 2 Trade, Dash 2 Trade benefits from an existing community of 70,000 crypto enthusiasts. Check out the latest news as it comes in on the Dash 2 Trade Telegram feed.

How to Buy D2T

Investors may buy D2T in just four steps:

- Set up a MetaMask crypto wallet.

- Connect the wallet to the Dash 2 Trade presale platform.

- Purchase D2T using Tether (USDT) or Ethereum (ETH).

- Obtain your D2T tokens when the presale phase completes.

| Min Investment | 1000 D2T |

| Max Investment | NA |

| Purchase Methods | ETH, USDT |

| Blockchain | Ethereum (ERC-20 token) |

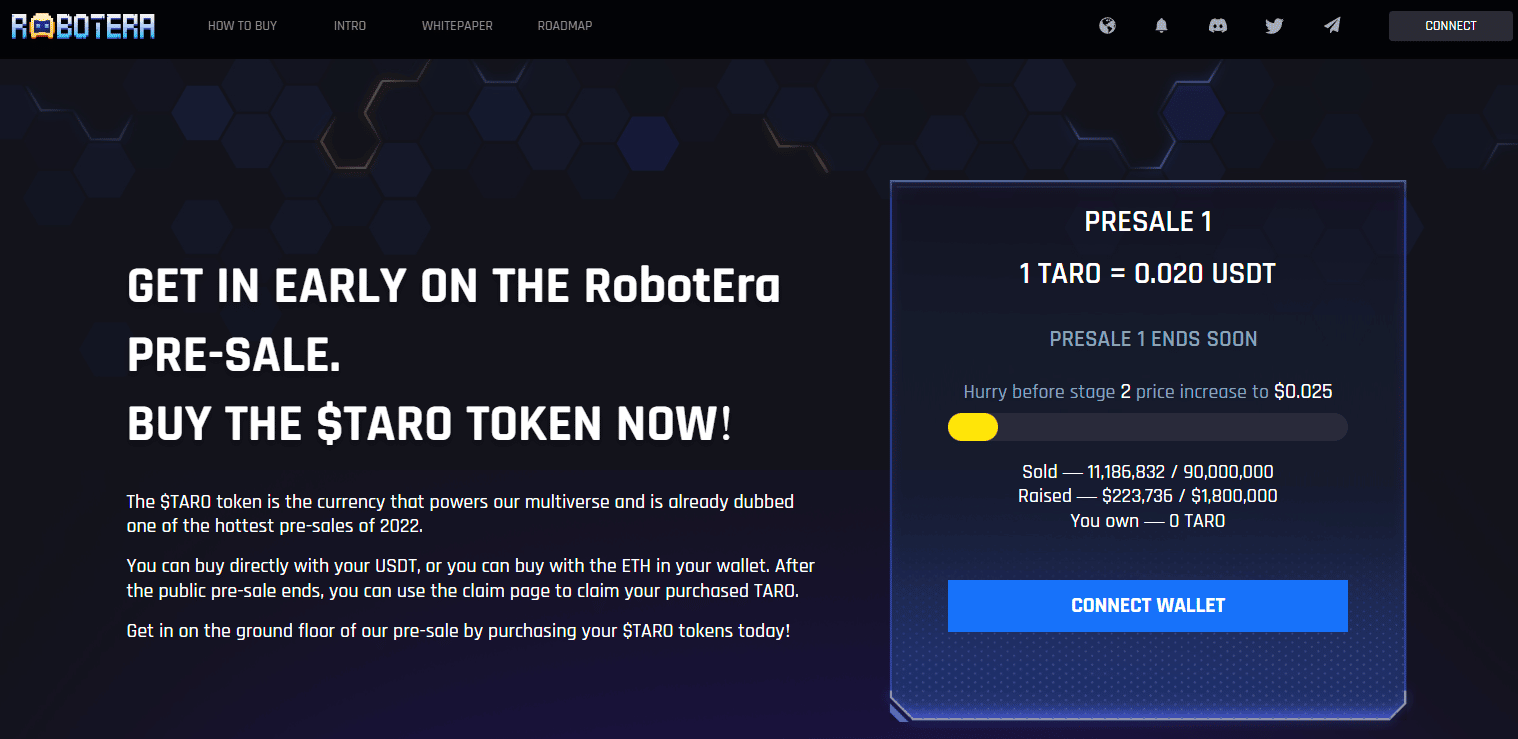

RobotEra – Stunning Play-to-Earn Metaverse Project in Presale Now

The RobotEra team has a whole raft of exciting developments in store for players, including Virtual Reality. Right now a key feature of the project is the emphasis on community, centered on the RobotEra DAO. Get the juicy details on the project with the RobotEra whitepaper.

The in-house token TARO is central to a lot of RobotEra mechanics. And – thanks to the presale – investors can buy into this next crypto to explode without taking the plunge into the world of TARO.

Investors keen to avoid missing out can get their hands on TARO right now at true bargain basement prices. With stage 1 of the presale on now, TARO is priced at $0.020 – with the price guaranteed to increase to $0.025 in stage 2. That is a guaranteed paper profit of 25%.

With TARO soon to be launched on leading exchanges, investors should get in now and buy while the TARO price is low.

To keep bang up to date with RobotEra developments, keep an eye on the RobotEra Telegram page.

How to Buy TARO

Investors can obtain TARO in just four steps:

- Set up a MetaMask crypto wallet (or a Trust wallet if using a mobile).

- Connect the wallet to the RobotEra presale platform.

- Buy TARO using Tether (USDT) or Ethereum (ETH).

- Receive your D2T tokens when the presale phase completes.

| Min Investment | NA |

| Max Investment | NA |

| Purchase Methods | USDT and ETH |

| Blockchain | Ethereum |

IMPT – Pioneering Blockchain Carbon Offsetting Project in Presale Now

With IMPT, retail investors no longer need to figure out how to invest in carbon credits. Not only does the IMPT platform allow regular consumers to do their bit for the environment by buying and selling authentic carbon credits. But, with IMPT, you can earn tokens towards carbon credits when you do your shopping. IMPT has partnered with over 10,000 top brands – including Amazon, Microsoft and Lego – to give users IMPT tokens whenever they buy.

What really makes IMPT stand out is the genius stroke of matching the blockchain with carbon credits. A growing problem with carbon credits is double-counting and fraud – but the immutable ledger of the blockchain solves that. With IMPT – which is shaping up to be the best of the best carbon offset programs – users can be sure their carbon credits are the real deal.

With stage 2 of the presale underway, the IMPT token is currently available for $0.023. Stage 3 will see the price rise to $0.028, so it pays for investors to buy now. Stage 2 ends on 31st January, 2023 – or before then if the allocated tokens sell out. Given that stage 1 of the presale sold out in just four weeks, this is definitely a case of the early bird catches the worm!

How to Buy IMPT

Investors can buy IMPT in four steps:

- Set up a MetaMask crypto wallet.

- Connect the wallet to the IMPT token presale platform.

- Purchase using Tether (USDT), Ethereum (ETH) or fiat currency with credit card.

- Get your IMPT tokens when the presale phase ends.

| Min Investment | $30 recommended |

| Max Investment | NA |

| Purchase Methods | ETH, USDT, fiat |

| Blockchain | Ethereum (ERC-20 token) |

2. Renewable Energy: One of the Best Sectors to Invest in Long-Term

Renewable energy means energy that is not depleted when it is used. So, fossil fuels like oil and gas are not renewable forms of energy. But wind and solar power, for example, are – as well as hydroelectric, geothermal, tidal and biomass energy.

With the global economy in a panic over energy supply, one might assume that investors would have flocked to renewable energies. Rather, the money has gone into the more trusted field of oil and gas exploration. When in crisis, the markets turn to old favorites. Hence the benchmark S&P Global Clean Energy Index is down 1% since the new year.

Investors researching how to invest in clean energy may rightly wonder whether green investing has had its day. But, with scientists agreed that the climate crisis is here to stay, many investors are firm in their belief that the best renewable energy stocks represent one of the best sectors to invest in 2023 for long-term growth.

3. Utilities: One of the Best Industries to Invest in 2023 for Dividends

Investors seeking the best way to invest $100k (or indeed any amount) would inevitably have their eye drawn to the utilities sector at some point. Utility stocks – which means companies that provide everyday amenities like electricity, gas and water – are considered to be safe investments. That is because their products have a steady demand. Utility stocks tend to offer regular dividends too, with many paying 60%-70% of earnings back to investors.

So does Utilities number among the best sectors to invest in 2023? Year-To-Date the sector is down just -1.39%, with losses among water companies offset by growth in power producers. By sub-sector breakdown YTD:

- Utilities is down 2%

- Electric Utilities is down 2%

- Independent Power Producers and Energy Traders is up 17.2% (no surprises there)

- Multi-Utilities is down 1.7%

- Water Utilities is down -19.9%

4. Government Bonds: One of the Top Sectors to Invest In For Risk Management

In 2022, though, rising inflation has seen bond values fall at the same time as stock markets. So bonds have not had a good year.

However, when it comes to risk, Government bonds issued by the US Treasury are definitely one of the best sectors to invest in 2023 for investors who want to guarantee that they get their money back. US Treasury bonds score one of the highest credit ratings of any fixed income instrument on the planet. $23 trillion of these bonds are in issuance, divided into:

- Maturities (lasting 1 month to 1 year)

- Notes (lasting from 2 years to 10 years)

- Bonds (lasting 20 to 3o years)

I Bonds are a popular way for US investors to gain exposure to government bonds. I Bonds are protected against inflation. Currently the yield offered is 6.89%. I Bonds are available from the US Goverment’s TreasuryDirect website for a minimum investment of $25.

5. Mutual Funds: One of the Best Performing Sectors During Recessions

Despite the popularity of Exchange-Traded Funds (ETFs), many investors continue to invest in mutual funds. Between 2009 and 2021, the number of mutual funds more than doubled, from 66,400 to over 131,000 (data from Statista.com).

Mutual funds are generally thought to be instruments offering relatively-low risk – although this does depend on the nature of the fund.

Investors can opt for single-sector funds, for example, like the Fidelity Select Semiconductors Portfolio (FSLEX). This invests in semi-conductor companies like NVIDIA and Marvell Technology. Although down 28.6% YTD, investors figuring how to invest $10k would have seen greater returns with this fund than in the S&P 500 Index for many years (shown below).

More conservative investors looking for a steady ship to wait out recession may, on the other hand, opt for a Target Retirement Fund. This type of fund aims to provide a safe haven for retirement savings, adjusting investors’ exposure as their time with the fund progresses. One example is the State Street Target Retirement 2060 Fund (SSDWX). This has averaged a return of 7.51% since its launch in 2014.

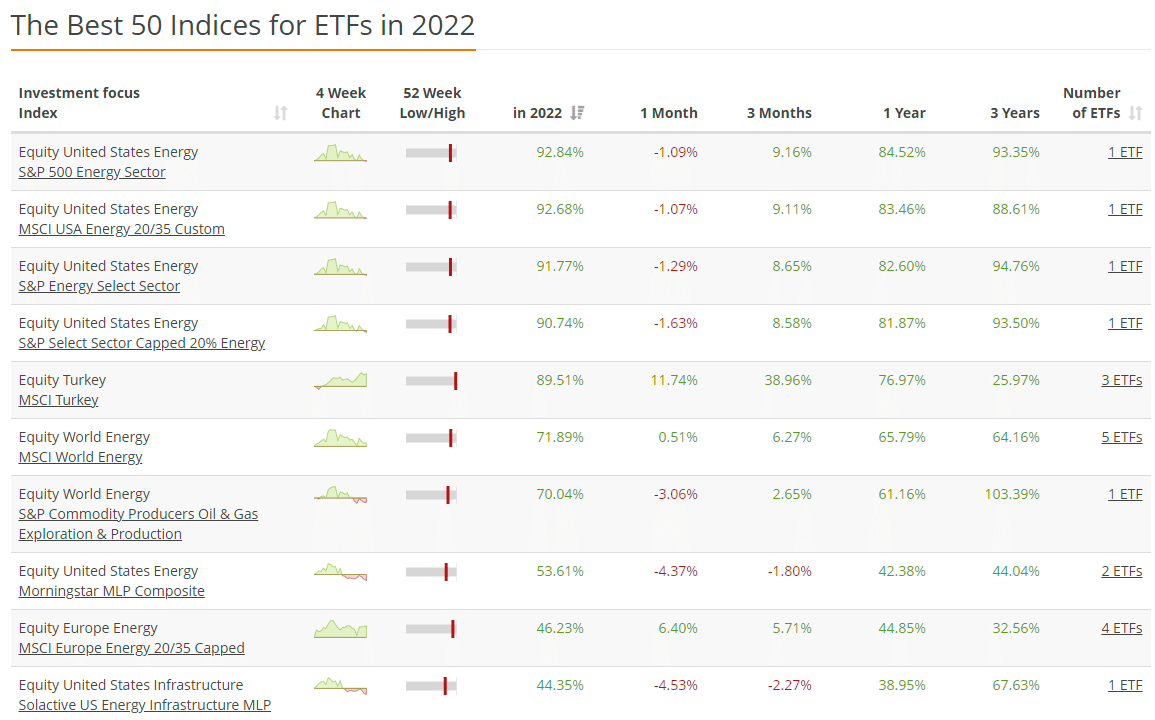

6. ETFs: Best Sector to Invest in Now For Diversification

As a sector of financial instruments, ETFs have soared in popularity. In September 2022, the number of ETFs hit 3,000 for the first time, registering a 30% increase since the end of 2020. But is it worth investing in ETFs right now?

In January 2023, the oldest ETF – the SPDR S&P 500 ETF (SPY) – will be 30 years old. Since its launch, ETFs with broad coverage have been joined by ‘thematic’ ETFs which focus on single sectors and concepts.

‘Investors now are really spoiled for choice among just being able to pick not only the big sector funds or the big overall funds but any kind of fund they think might be interesting.’ Says. N. Colas, founder of DataTrek Research.

- Energy hawks in 2022 could, for example, have used the Direxion Daily Energy Bull 2X ETF to leverage their gains in the rocketing oil and gas sector (certainly one of the best sectors to invest in 2023).

- ETFs are available for crypto too, including the best Bitcoin ETFs.

7. Oil and Gas Energy: Popular Sector to Invest in as Energy Prices Continue to Rise

Undoubtedly one of the best sectors to invest in 2023, oil and gas has had a stellar year. Thanks to market fears over energy supply sparked by the ongoing Ukraine crisis, the Energy Select sub-sector of the S&P 500 Index has delivered a return of 65.15% YTD off the back of gains among the best oil stocks.

In November 2022, the price of oil has slumped to a 10-month low – and oil stocks have reflected that. But some analysts see no short-term fix to the disruption to global energy supplies, and are convinced that oil and gas remains one of the best sectors to invest in now.

Investors agreeing with this proposition might choose to commit some funds to the Energy Select Sector SPDR ETF. This ETF has returned over 70% YTD. It tracks the Energy Select Index pictured above. 22.9% of its portfolio is invested in Exxon Mobile, and 19.5% in Chevron; both oil giants.

8. REITs: Popular Option for Investors Looking for Regular Dividend Income and Steady Capital Appreciation

Looking for the best sectors to invest in long term? Earlier in the year, Real Estate Investment Trusts did not look like one of the best sectors to invest in 2023. Investing in REITs is a great way for regular investors to get a piece of the property market as well as earn high dividends – but REITs are vulnerable to increasing interest rates because they borrow heavily to expand.

REITs are back in the black for October 2022, with 81% of REITs registering a positive return:

- Large-cap REITs: 2.92%

- Micro-cap REITs: 7.36%

- Mid-cap REITs: 8.11%

- Small-cap REITs: 12.85%

The National Association of Real Estate Investment Trusts (NAREIT) is the US trade organization for REITs. The body testifies to the enduring popularity of REITs, with 145m Americans already invested via investment funds and retirement savings.

- NAREIT reports that the average REIT dividend is around 3%. This compares well to the S&P 500 Index average dividend of less than 1.5%.

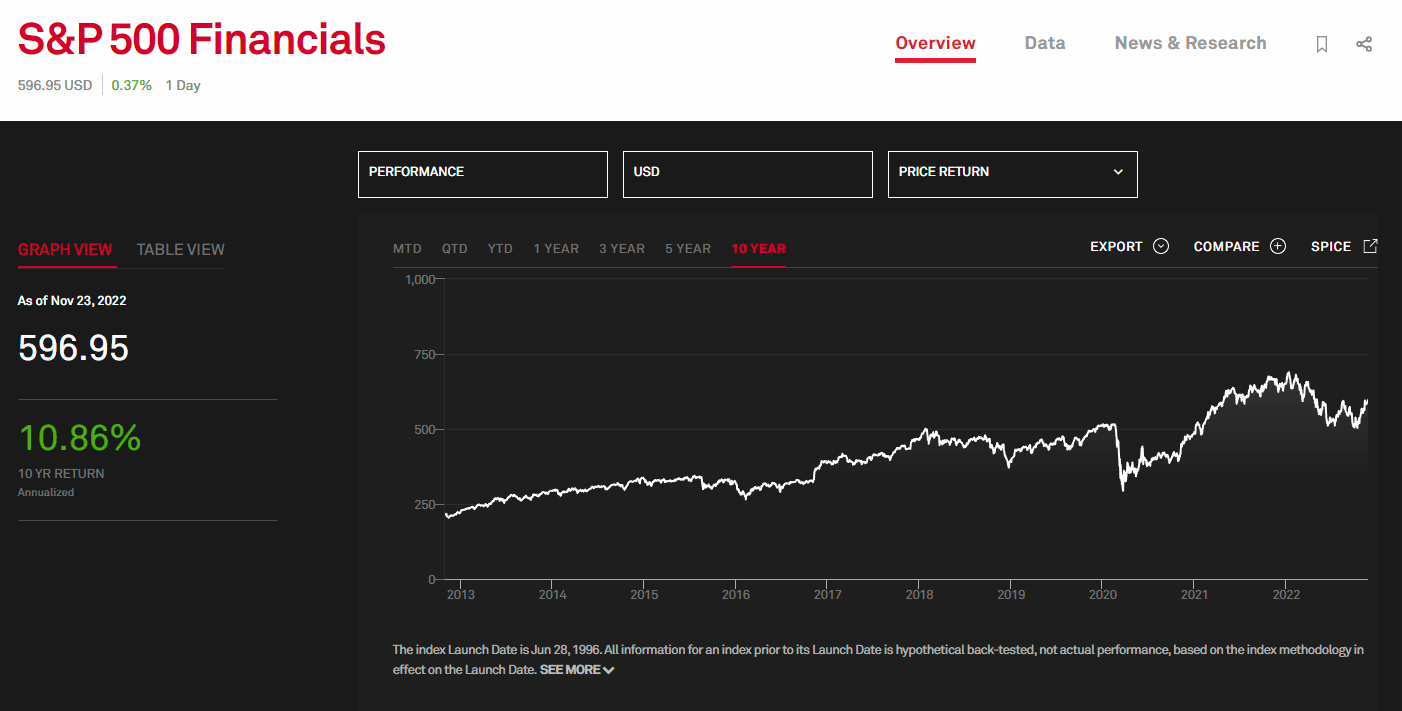

9. Financial Services: One of the Best Sectors to Invest in for Future Growth

The key S&P Financials Index is down 8.2% YTD – compared to a fall of 16% for the S&P 500 index as a whole. So, by comparison with the whole stock market, the financial sector is not doing badly.

This sector, though, was always going to be hit hard by general economic downturn. Year-To-Date, all sub-sectors are down but one:

- Asset Management and Custody Banks: -18.9%

- Consumer Finance: -14.2%

- Financial Exchanges: -20.6%

- Investment Banks: -2.4%

- Regional Banks: -22.4%

- Reinsurance: 20.1%

Reinsurance is when insurance companies insure their own insurance activities. The fact that this sub-sector is up 20% shows how perilous times have been.

Over the long-term, the story is far more positive. The index has returned an average annual 10.86% since 2013. We can see from the chart below that the long-term trend is up – despite the correction sparked by the Pandemic of 2020 and then the inflation/Ukraine crisis of 2022.

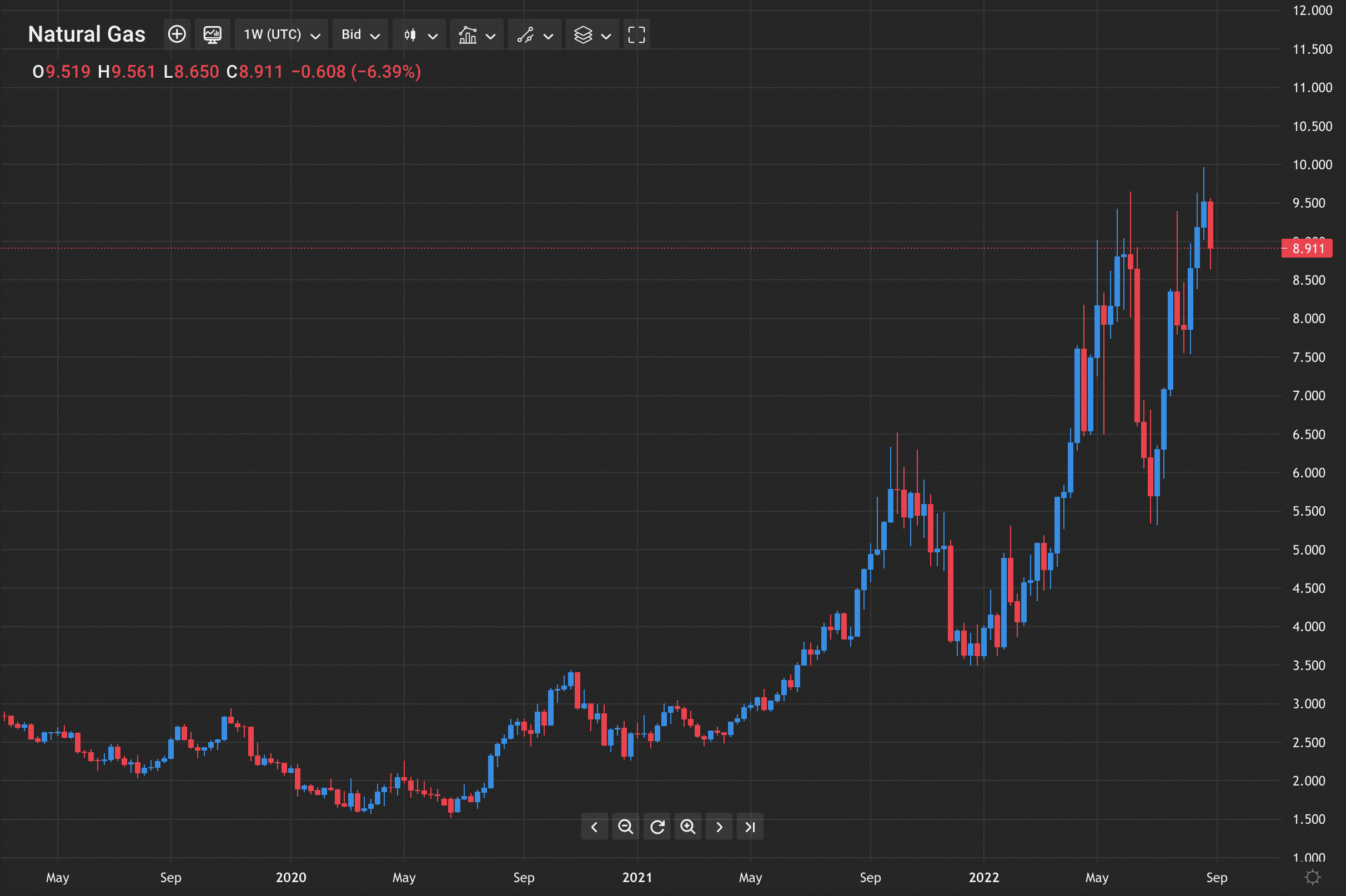

10. Commodities: Safe-haven Sector for Investors Interested in Reducing Portfolio Volatility

Like bonds, commodities are traditionally held to be contrarian investments. Historically, the value of many commodities has gone up when regular stock markets go down. This relationship appears to have gone haywire over recent years, with the price of gold – for example – dropping over 2022 as stocks dropped.

Commodities remain, however, a popular choice for many investors who want to diversify their portfolio with different asset types.

Investors learning how to invest in commodities will soon learn that volatility works both ways:

- An investor figuring how to invest $1k, for example, would have made 365% on their investment if they had bought natural gas on January 4th, 2022 and sold on August 29th, 2022.

- But if they had invested $1k on June 6th, 2022 and sold on June 27th, 2022, their initial investment would be down to less than $740.

Types of Sector to Invest in

With so many sectors to choose from it’s important that you conduct your own market research and only invest capital that you can afford to lose.

Crypto Presales

Buying coins pre-launch is recognized as a risky but potentially supremely-rewarding way to get one step ahead in the overcrowded crypto sector.

Renewable Energy

Overshadowed in 2022 by conventional energy stocks, renewable energy and the best sustainable investments are widely held to have a bright long-term future.

Utilities

Featuring largely value stocks rather than growth stocks, utilities is held to be one of the best sectors to invest in during inflation because utilities companies tend to be less leveraged than tech stocks, for example (although there are exceptions!).

Government Bonds

I Bonds and Treasury Inflation-Protected Securities (TIPS) are two types of bonds issued by the US Treasury – demonstrably making this one of the best sectors to invest in during inflation, as both assets are devised to shield the user from inflation eating away at gains.

Mutual Funds

Mutual funds are a sector of instruments trickier to access than ETFs, but offering the same strength of risk management through diversification. Investors are nowadays even welcome to check out the best crypto mutual funds.

ETFs

Like mutual funds, ETFs offer in-built diversification, but may be traded via regular online brokerages just as easily as shares.

Oil and Gas Energy

Definitely one of the best sectors to invest in 2023, oil and gas is predicted by some analysts to continue to offer strong returns into 2023.

REITs

The law obliges REITs to pay out 90% of their income back to investors. Some investors thus opt for the Global X SuperDividend REIT ETF (SRET). This ETF invests in 30 REITs with the best dividend yields.

Financial Services

Sensitive to inflation and rising interest rates, the financial services sectors has not had a stellar year – but remains one of the best industries to invest in 2023 for long-term prospects according to many analysts.

Commodities

An asset sector with mixed fortunes in 2022, commodities are often to be found in portfolios held by investors wary of investing in stocks alone.

How to Find the Best Sectors with Highest Upside Potential

- Do Your Own Research. Check out which sectors are doing well by searching for S&P industry sector indices online. But remember that past performance is no guarantee of future performance.

- If the investor is dead-set on high upside potential, the best biotech stocks and best tech stocks are traditional areas of interest. However, do remember that high potential reward generally comes with high potential risk. The investor should not commit money they cannot afford to lose.

- To track down short-term gain opportunities, the crypto sector is an obvious and exciting destination. Get help to sort the wheat from the chaff with one of the best crypto signals platforms like crypto presale gem Dash 2 Trade.

Conclusion

Above we have reviewed ten popular investment sectors. We have observed that investors deciding which sectors to invest in now might choose to get involved in crypto presales. So we have reviewed three presales that are the talk of the town right now: sleek new analytics platform Dash 2 Trade, RobotEra’s TARO (set to be one of the best metaverse coins) and IMPT (one of the greenest cryptocurrencies).

With clever tokenomics and an experienced management team, Dash 2 Trade stands out as as investor platform with a great future. And, with the price of the D2T token guaranteed to rise over the remaining six stages of the presale, canny investors are rushing to get involved.

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members