In today’s highly-volatile investment environment, finding the best shares to buy is more challenging than ever. Rampant inflation and rising interest rates have prompted mass fear in the markets, leading to a broad sell-off of many asset classes. However, even amidst all this, the stock market still offers enticing opportunities for investors capable of dealing with the risk.

With that in mind, this guide presents 12 of the best shares to buy in the UK, according to several top equity analysts. We’ll discuss each of these shares individually, covering their financials and price history, before presenting a detailed breakdown of the critical factors to consider when looking for companies to invest in.

The 12 Best Shares to Buy Now in the UK According to Analysts

Finding the best investments to add to a portfolio can be challenging, especially given the overwhelmingly negative sentiment towards many asset classes. However, listed below are 12 of the best shares to buy in the UK according to analysts and leading media outlets – each offering the potential for positive returns:

- Dash 2 Trade (D2T) – Overall Best Share to Buy in 2023

- IMPT (IMPT) – One of the Best Shares to Buy Today for Sustainability

- BAE Systems (BA.) – Popular Defense Contractor with Regular Dividend

- Berkshire Hathaway (BRK.B) – Vast Holding Company Owned by Warren Buffett

- iShares Core FTSE 100 UCITS ETF (ISF) – Widely-Used ETF for Exposure to the FTSE 100

- InterContinental Hotels Group (IHG) – Top Hospitality Company Operating in the UK

- Apple (AAPL) – One of the Most Bought and Sold Shares Globally

- Exxon Mobil Corporation (XOM) – Energy Giant with Quarterly Dividend Payments

- British American Tobacco (BATS) – Well-Known Tobacco Company with Solid Branding

- Rio Tinto (RIO) – Huge Mining Company with International Operations

- Enphase Energy (ENPH) – Rapidly-Expanding Solar Energy Company

- Glencore (GLEN) – Enormous Commodities Firm with Strong Financials

Reviewing the Best Shares to Invest in UK

The decision to buy shares shouldn’t be taken lightly, as this asset class tends to be more volatile than other asset classes like bonds and ETFs. Nevertheless, stock trading is perhaps the most popular avenue for investors to generate returns – and with so many companies to choose from, there’s always opportunity in the market.

So, without further ado, let’s take a closer look at analysts’ picks for the best shares to buy now:

1. Dash 2 Trade (D2T) – Overall Best Share to Buy in 2023

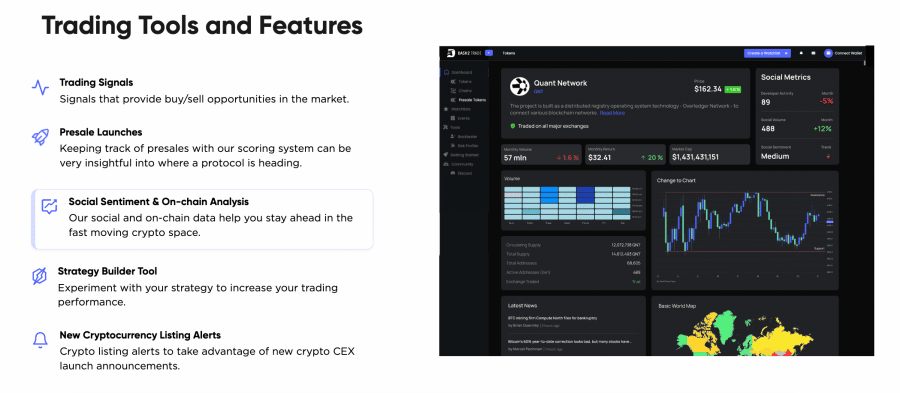

Broadly speaking, Dash 2 Trade is an innovative crypto analytics ecosystem that provides a suite of valuable tools and services to traders and investors. The crypto market can be challenging to navigate, and Dash 2 Trade’s team aim to streamline this process by providing a set of features that empower market participants to make the most effective trading decisions.

Within Dash 2 Trade’s platform, traders can utilize the following:

- Regular trading signals with no directional bias

- Social sentiment analysis aggregated from various sources

- Unique strategy builder with backtesting capabilities

- Crypto presale scoring system

- Real-time alerts for new CEX/DEX listings

- Trading competitions with attractive prizes

- On-chain analysis that identifies trending coins

Those looking to buy cryptocurrency can benefit from these tools, as they enable investors to identify projects with high price potential. Since all the tools are located on one platform, this dramatically speeds up the analysis process – ensuring potentially lucrative opportunities are not missed.

The Dash 2 Trade ecosystem is powered by D2T – the platform’s native ERC-20 token. As noted in Dash 2 Trade’s whitepaper, those who wish to obtain the platform’s full capabilities must own D2T. However, Dash 2 Trade will also offer a free tier with limited features, allowing investors to get a taste of what’s on offer.

Dash 2 Trade’s team aims to become the market leader regarding crypto analytics – and given that an array of highly-experienced traders has designed the platform, there’s every chance they could meet this goal. Dash 2 Trade launched its official presale in October 2022, enabling investors to buy D2T tokens at a significant discount.

An allocation of 35 million tokens will be offered during Stage One of the presale, each priced at just 0.0476 USDT. This is the lowest price they’ll be made available, meaning investors can access Dash 2 Trade’s features with the smallest outlay possible. Those looking for the best way to invest £25k UK in 2023 could find the current Dash 2 Trade presale a good opportunity with strong upside potential. Similarly, for those with a higher risk-tolerance looking for the best way to invest £100k in the UK, Dash 2 Trade shows a lot of upside potential.

Those looking to keep track of Dash 2 Trade’s progress can do so by joining the official Telegram channel.

2. IMPT (IMPT) – One of the Best Shares to Buy Today for Sustainability

Put simply, IMPT is a blockchain-powered ecosystem that revolves around carbon credits trading. Traditionally, carbon credits have been traded in the futures market, which is relatively inaccessible to retail traders. IMPT looks to change this by making these carbon credits accessible to all. In terms of short-term investments in the UK, some traders consider IMPT to be both a good option for short and long-term investing.

The platform does this by structuring carbon credits as non-fungible tokens (NFTs), meaning they can be easily bought, sold, and traded on IMPT’s marketplace. These carbon credits have values informed by the laws of supply and demand, meaning they can even be used as a vehicle for speculation.

According to IMPT’s whitepaper, individuals will also be able to acquire carbon credits through their everyday shopping activities. Whenever an individual shops with one of IMPT’s partner brands, they will earn ‘IMPT tokens’. When enough of these tokens are accrued, the individual can instantly swap them for a carbon credit on IMPT’s marketplace.

The potential for this ecosystem is limitless since IMPT even allows individuals to ‘retire’ their carbon credits, which effectively ‘eliminates’ CO2 from the atmosphere and makes a tangible impact on the environment. IMPT will also be launching an innovative social platform that keeps track of how impactful individuals and businesses are – further incentivizing positive actions. At such a low presale price some investors believe IMPT is the best way to invest £10k in the UK right now.

IMPT’s presale is still ongoing, with over $5m having been raised at the time of writing. Investors can still get involved in Phase 1 of the presale, which sees IMPT tokens priced at just $0.018 – the most significant discount that will be offered. Those looking to learn more about IMPT can do so by joining the official Telegram channel.

3. BAE Systems (BA.) – Popular Defense Contractor with Regular Dividend

Since BA. shares are listed on the London Stock Exchange (LSE), they can be easily bought using most stock trading apps. These shares have been attracting attention recently due to the ongoing war between Russia and Ukraine. This has led to increased defense spending by many Western nations – which is excellent news for BAE Systems’ revenues.

For example, The Guardian notes that UK defense spending could reach £100bn by 2030, which would likely see huge numbers of drones and jets purchased from BAE Systems. Finally, the company even provides a solid dividend yield of 3.16%, which will appeal to passive income investors.

4. Berkshire Hathaway (BRK.B) – Vast Holding Company Owned by Warren Buffett

Those who typically invest in cryptocurrency may find BRK.B shares unsuitable since they are low-volatility and do not provide any crazy returns. This is because Berkshire Hathaway owns around 60 businesses, many of which are involved in the consumer goods market. On top of this, the company also has a vast stock portfolio valued at over $300bn.

As noted by Bloomberg, Berkshire Hathaway engages in regular share buybacks and recently repurchased $1bn worth of shares in Q2 2022. This tends to help prop up the price and, combined with the company’s defensive properties, makes Berkshire Hathaway a suitable option for today’s volatile investing environment.

5. iShares Core FTSE 100 UCITS ETF (ISF) – Widely-Used ETF for Exposure to the FTSE 100

The main reason this ETF is so popular is the FTSE 100’s stellar reputation for providing positive annual returns. According to reports, the FTSE 100 has generated an average annual return of 7.75% since its inception in 1984. This consistent performance has made it the go-to for those who wish to invest passively.

The iShares Core FTSE 100 UCITS ETF also has a total expense ratio of just 0.07%, meaning investors can place their capital in this ETF for years (or decades) without accruing any exorbitant fees. Finally, even though this asset differs slightly from the other stocks on our list, it can still be easily invested in using most online trading platforms.

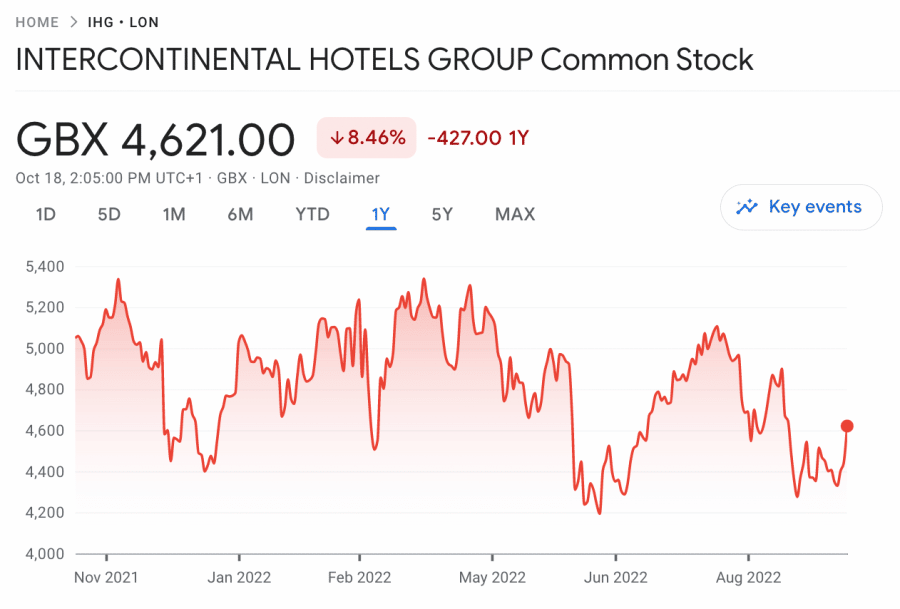

6. InterContinental Hotels Group (IHG) – Top Hospitality Company Operating in the UK

IHG shares have been relatively volatile since the start of 2022, mainly due to rising inflation levels which have created a challenging business environment for hotel chains. However, the company itself has still performed admirably and generated an operating profit of $377m in the first half of the year – around double what it made in the same period in 2021.

Following these stellar results, InterContinental Hotels Group has opted to reinstate its dividend, offering a yield of 2.31% to shareholders. Finally, the company has even sanctioned a $500m share buyback scheme, which hints that its financial position could be better than expected.

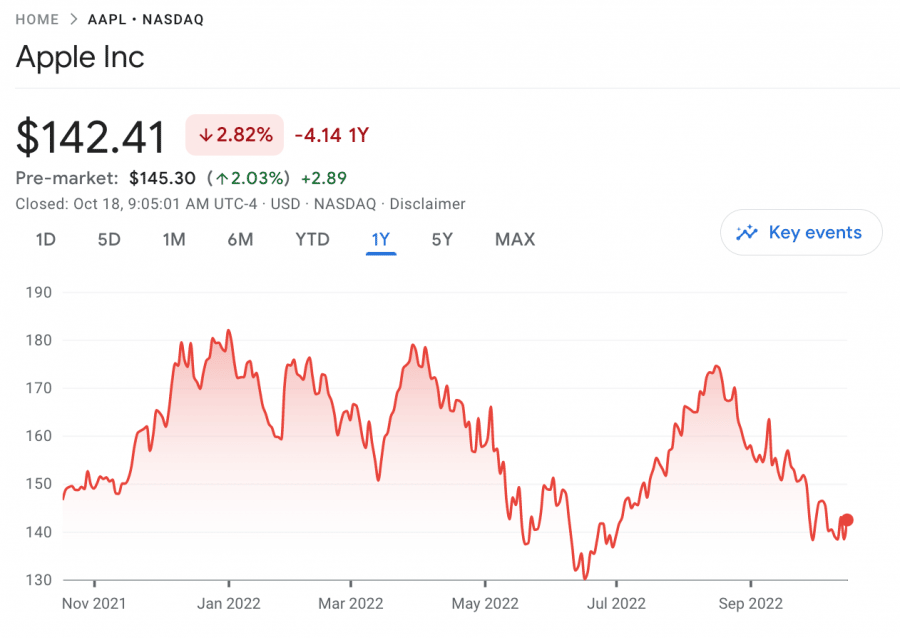

7. Apple (AAPL) – One of the Most Bought and Sold Shares Globally

AAPL shares can be purchased using most day trading platforms and investment apps that offer access to NASDAQ-listed shares. The reason Apple makes our list is that the company’s shares are actually performing better than the S&P 500 index at present. So, although they’re still in the red, Apple’s shares have proven to be relatively resilient.

Apple shares look appealing from a long-term perspective, as the company’s share of the smartphone market is as high as ever. Moreover, Apple is placing greater emphasis on service revenue, with AppleTV+, iCloud, and AppleCare growing rapidly. Finally, the company is also resistant to the adverse effects of inflation due to its exceptional brand power, which means it can continue to offer products at a premium price point.

As one of the FAANG stocks, many investors are looking to buy Apple shares in the UK as part of building a diversified portfolio.

8. Exxon Mobil Corporation (XOM) – Energy Giant with Quarterly Dividend Payments

Since Exxon Mobil is heavily involved in the oil and gas industries, the company has significantly benefitted from the overall increase in energy prices. Moreover, a recent article from Reuters reported that OPEC would be cutting their oil supply by two million barrels per day. This supply reduction will naturally increase the oil price – leading to greater revenues for Exxon Mobil.

Exxon Mobil is even focusing on becoming more sustainable by agreeing on a deal to capture and store carbon dioxide emissions – a process called ‘carbon capture and sequestration’ (CCS). This will make the company more appealing to eco-conscious investors and help XOM shares maintain long-term value.

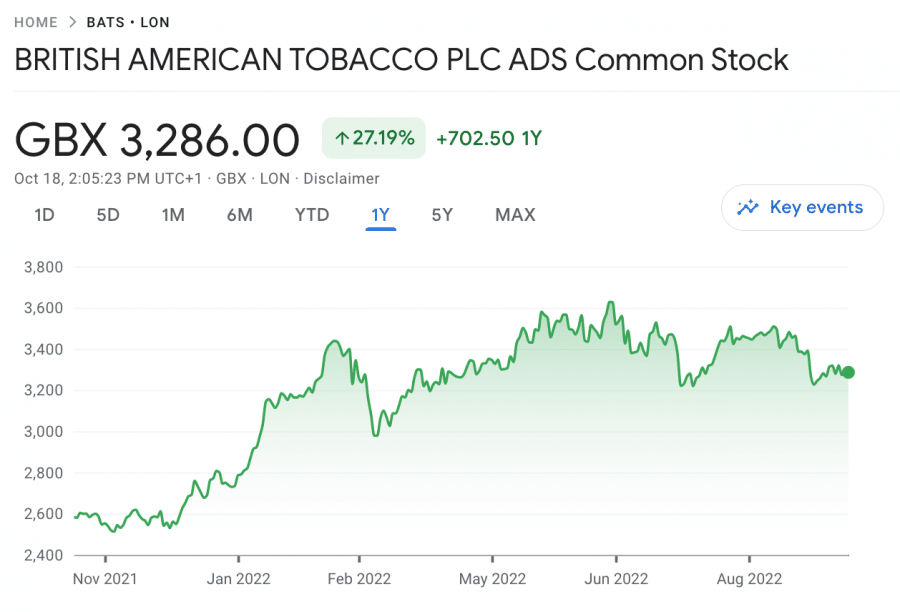

9. British American Tobacco (BATS) – Well-Known Tobacco Company with Solid Branding

British American Tobacco has exceptional staying power, evidenced by its products being available in 180 countries worldwide. The main reason for the company’s success is its brand strength since it owns numerous leading cigarette brands, including Lucky Strike, Pall Mall, and Dunhill.

The company has also expanded into the vaping market and owns Vuse, one of the world’s most popular e-cigarettes. Finally, BATS shares also offer an impressive dividend yield of 6.63% – one of the top 15 highest yields on the FTSE 100.

10. Rio Tinto (RIO) – Huge Mining Company with International Operations

Rio Tinto is a metals and mining company founded in 1873 that has grown exponentially over the past 149 years. RIO shares are listed on the LSE and the ASX, whilst the NYSE offers an ADR linked to the company. At the time of writing, Rio Tinto is one of the largest mining companies globally, just behind Glencore and BHP Group.

One of the main reasons that RIO shares are so popular is that many of the company’s commodities, such as lithium and copper, are critical inputs for making batteries for electric vehicles (EVs). Considering the electric vehicle market is projected to value around $823bn by 2030, these commodities could play a key role in Rio Tinto’s revenue generation.

Although the company’s free cash flow and revenue dropped in the first half of 2022, it still maintains nearly $300m in cash reserves. Rio Tinto did reduce its interim dividend by more than 50% on the back of these figures, although the new yield is still higher than the FTSE 100 average.

11. Enphase Energy (ENPH) – Rapidly-Expanding Solar Energy Company

The company is performing admirably from a financial perspective, increasing revenue by 20% in Q2 2022. Enphase Energy delivered more products in this quarter compared to Q1 2022, whilst the company also grew rapidly throughout Europe.

Notably, Enphase generated a free cash flow (FCF) of $192 million in Q2 2022, which has provided the resources needed to acquire smaller companies operating in the industry. Due to this aggressive strategy, many analysts are touting Enphase Energy as one of the top solar energy stocks on the market right now.

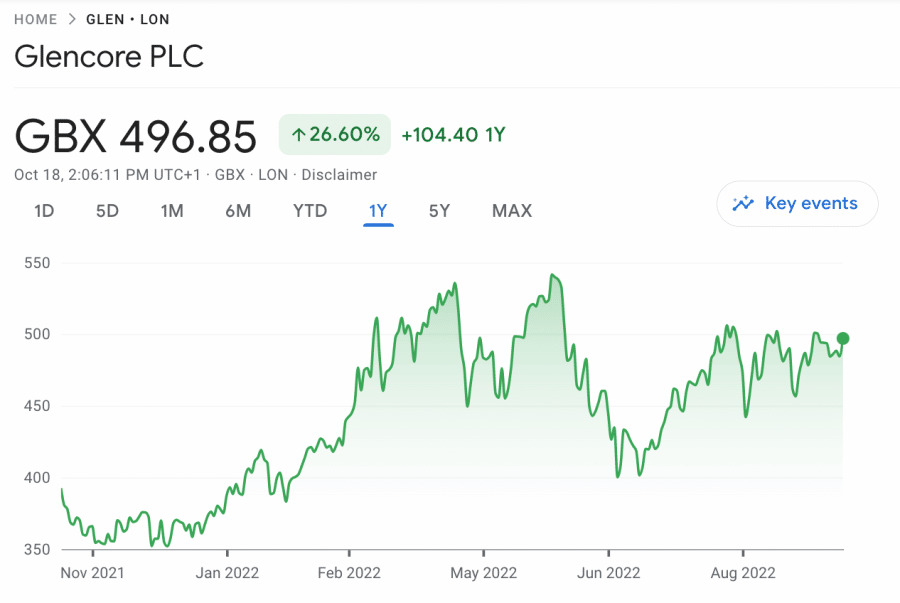

12. Glencore (GLEN) – Enormous Commodities Firm with Strong Financials

Concluding our list of the best shares to buy in the UK, as noted by equity analysts, is Glencore. Glencore is a multinational company involved in the metals and mining industry and has solidified itself as the world’s largest commodity trader.

Many of the commodities Glencore produces are involved in the production of ‘green’ energy, like wind and solar power. As such, demand for these commodities will increase over the coming decade as countries worldwide look to become more sustainable – which is excellent news for Glencore’s top line.

Glencore is also extremely strong from a financial perspective, with EPS coming in at $0.92 during the first half of 2022 – a remarkable 820% increase from the same period in 2021. The company has even reduced its net debt exposure by 62% over the past year, meaning it won’t be affected as severely by rising interest rates.

How to Find the Best Shares to Buy

Whether you’re looking for the best ways to invest £75k in the UK or just interested in diversifying your portfolio picking the right shares of stock to match your risk tolerance and budget is important. Even though more people than ever are opting to invest in Bitcoin and other alternative assets, shares still represent an excellent way for investors to generate a return over the long term. With that in mind, detailed below are some of the most effective strategies that investors can deploy when researching which shares to buy:

Understand the Macroeconomic Situation

When looking for the best shares to buy right now in the UK, the most important thing investors must do is understand the macroeconomic situation. By doing this, investors can identify which sectors are likely to be hampered by the prevailing conditions – and which may be resistant.

For example, rising interest rates mean that companies with substantial debt burdens are now in a precarious position since these debts will become more expensive to service. On the other hand, banking stocks may benefit from rising interest rates, as their lending margins will increase – leading to greater interest income.

Use Reputable Financial Media Outlets

Investors can also find shares to buy by conducting analysis using leading financial media outlets. Outlets like the Financial Times and Bloomberg are great tools for investors, as they showcase accurate data which can inform investing decisions.

Moreover, these outlets also provide objective market updates, which enable investors to keep tabs on current trends. Combining this information with other forms of analysis can help illuminate assets with high value potential.

Review the Company’s Financials

The best shares to invest in in the UK can also be found by conducting an in-depth analysis of the financials of different companies. Although a company’s stock price is typically shaped by supply and demand forces, it can also be affected by metrics like net income, earnings per share (EPS), and net debt.

The most effective way to gain insight into a company’s financial position is to review its earnings reports. These are released either quarterly or bi-annually and reveal critical information like revenue, profits, and margins. By comparing the data in one quarter with the data that was released in the same quarter a year previous, investors can determine whether a company is growing or not.

Seek Out High-Growth Industries

According to analysts, many of the best UK shares to buy now are in high-growth industries. As the name implies, these are industries that are growing at a faster-than-average pace, meaning that companies involved in these industries tend to be performing well.

Some examples of high-growth industries at the time of writing include electric vehicles, casinos, and commercial aircraft manufacturing. Although not all companies operating in these industries will be successful, it’s often a good idea to analyse the top performers and determine whether they represent an effective investment opportunity.

Utilize Social Media

Finally, investors can also uncover shares with high price potential by using social media. Platforms like Reddit and Twitter have become meeting places for retail traders to discuss trending stocks – which tends to create a snowball effect of momentum.

However, it’s important to note that the information presented on these platforms is subjective, so it may be biased. Thus, investors would be wise to combine the insights they receive on social media with other forms of analysis to ensure potential trade ideas have a high chance of success.

Best Shares to Buy in the UK – Conclusion

To conclude, this article has presented a selection of the best shares to buy in the UK, as reported by various leading analysts. Although none of these shares can guarantee a positive return, they may offer investors a ray of hope in today’s testing market conditions.

One asset that stands out from the crowd in this regard is Dash 2 Trade. Although it’s not technically a share, this crypto-based ecosystem offers high value potential thanks to its unique analytics features. Dash 2 Trade was also designed and developed by a team of experienced traders, ensuring all of the ecosystem’s tools can empower investors to make effective decisions.

Dash 2 Trade’s presale is currently ongoing, allowing investors to buy D2T tokens for just 0.0476 USDT. Only 35 million tokens will be made available at this price, allowing investors to access the platform’s features for the lowest outlay possible.