While many investors will opt to take a long-term strategy over many years or even decades, short-term investing in the UK offers plenty of opportunities too.

This means opening a position with the view of making gains in the space of a few months, weeks, or days.

The purpose of this beginner guide is to explore the best short-term investments in the UK for 2023.

The best short-term investments in the UK to consider gaining exposure to in 2023 are listed below: The above list of short-term investment options covers digital assets, crypto presales, stocks, and more. Read on to learn more about each investment.The 10 Best Short-Term Investments UK for 2023

A Closer Look at the Best Short-Term Investments in the UK

In this section, we explore 10 of the best short-term investments in the UK to consider today.

Across each investment, we highlight the risk and potential reward to take into account, alongside the fundamentals of how to enter a position. This encompasses everything from smaller investments to those with a larger pocket looking for the best ways to invest £500k in the UK.

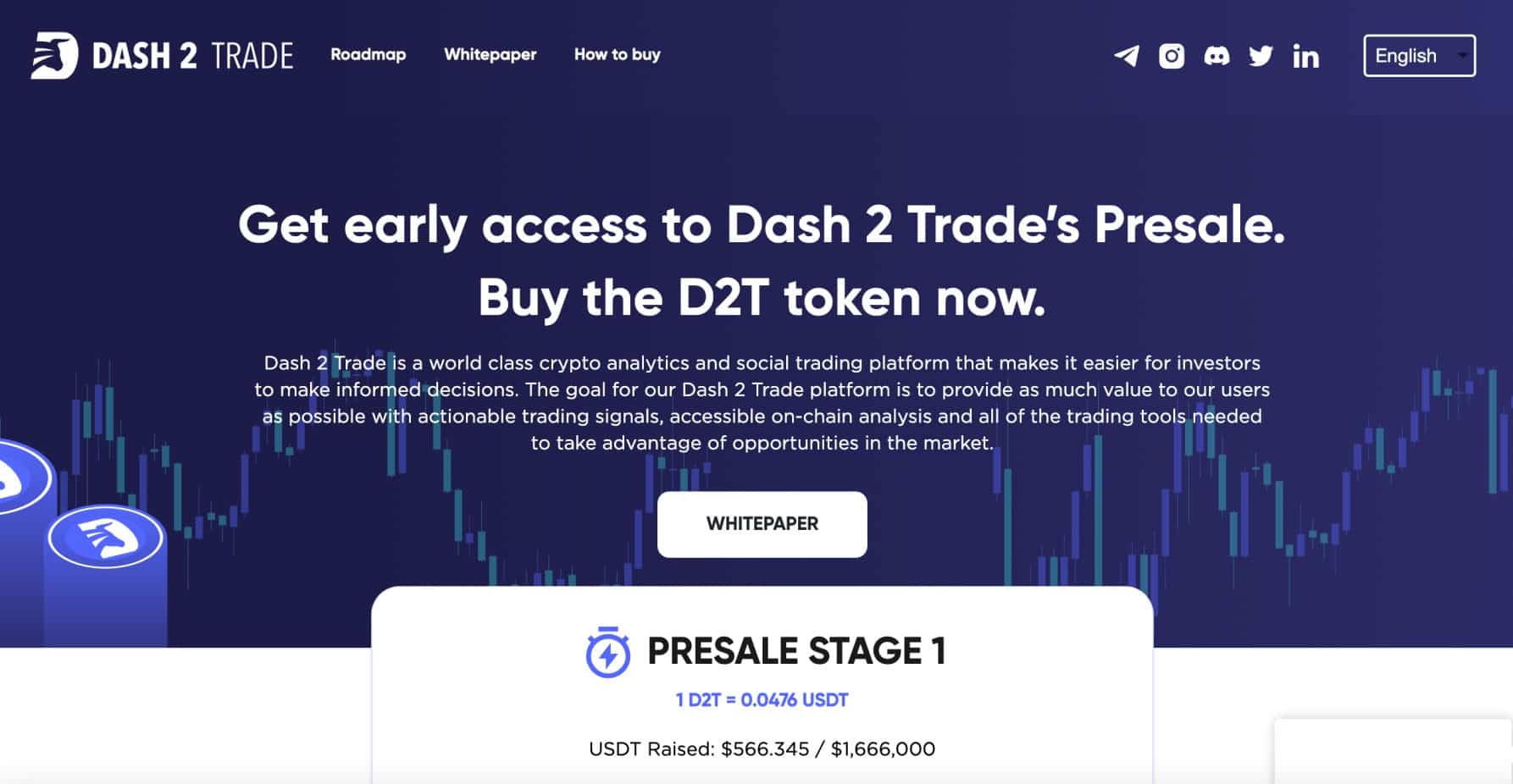

1. Dash 2 Trade – Overall Best Short-Term Investment in the UK

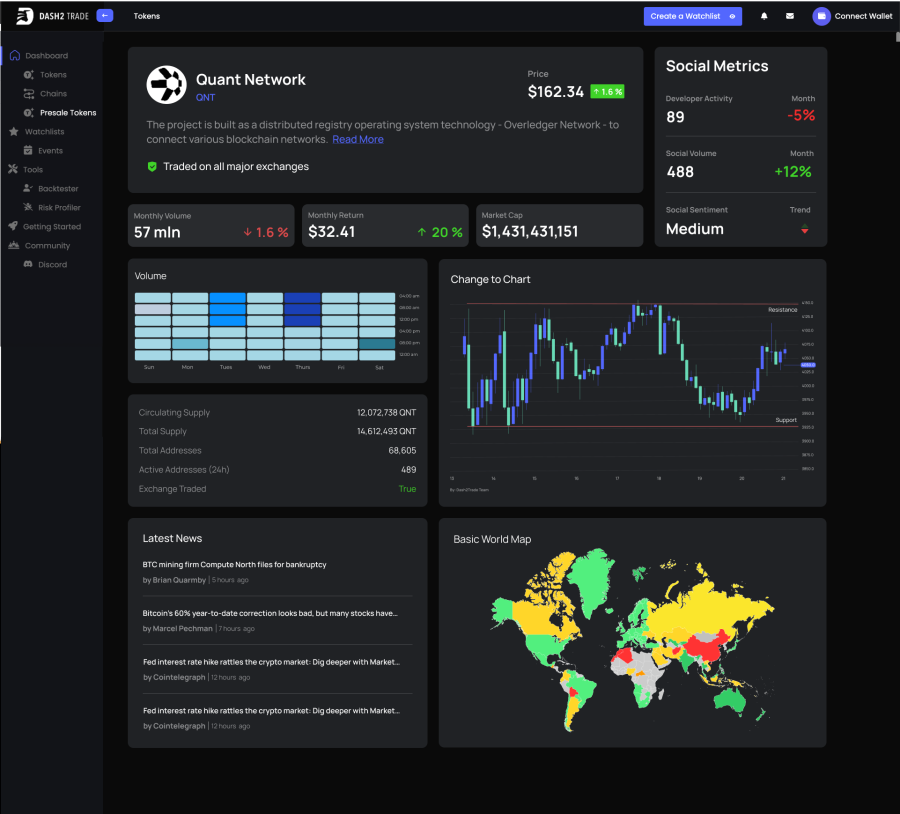

The overall best short-term investment in the UK as of writing is Dash 2 Trade – a brand new crypto asset project that offers an attractive upside potential. Dash 2 Trade is building the crypto industry’s first analytics terminal for investors to gain an intimate insight into the best trading opportunities that the market had to offer.

Some of the core features that the Dash 2 Trade terminal will offer include:

- Real-time trading signals on which coin to buy or sell, alongside the required entry and stop-loss order price

- Strategy-building tools and backtesting facilities

- Alerts on new exchange listings, social media metrics, and on-chain statistics

- Insights into the best upcoming presale launches

- Social investing tools, such as trading competitions and an open forum to share ideas

- According to some traders Dash 2 Trade is one of the best ways to invest £75k in the UK right now.

Crucially, the Dash 2 Trade terminal will give investors the best chance possible of outperforming the crypto markets around the clock. From an investment perspective, Dash 2 Trade will operate as a self-sufficient entity, considering that to access the full functionality of the analytics terminal, members will need to sign up for the premium subscription plan – paid for in D2T tokens.

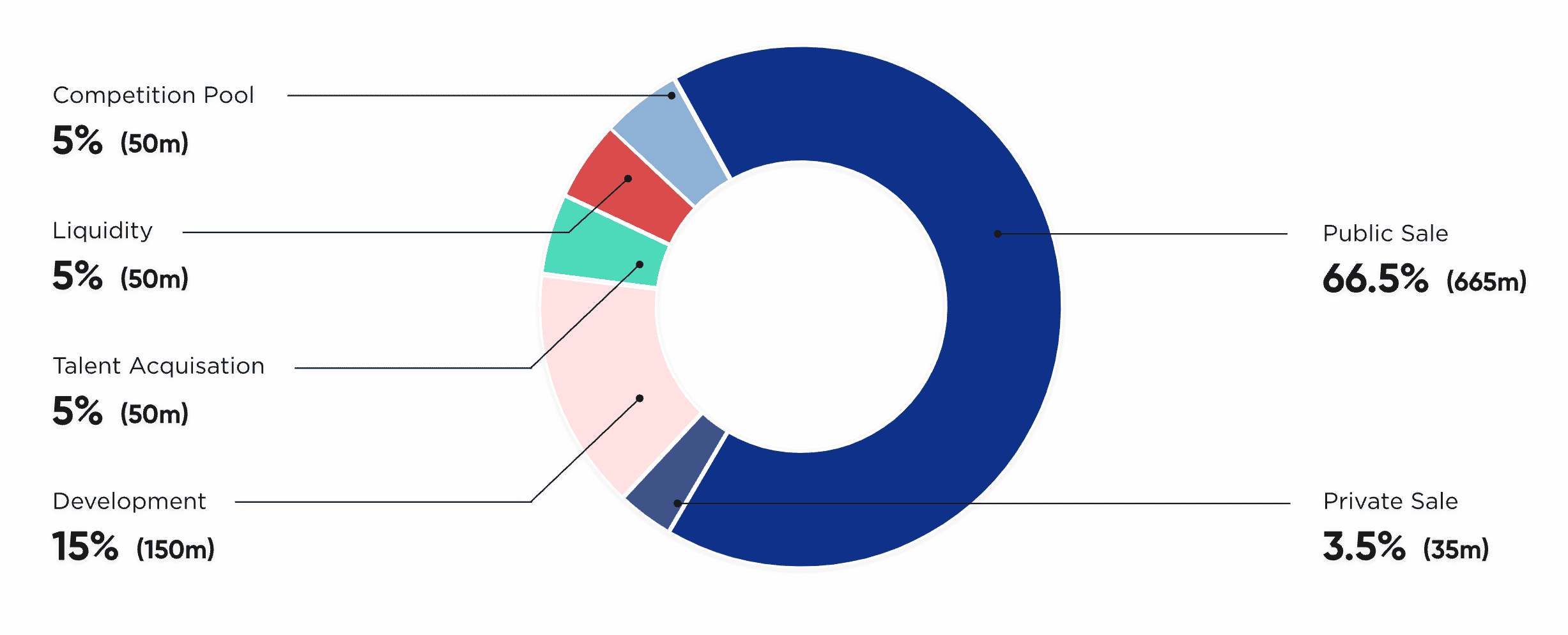

Wondering how to invest in the UK according to Reddit groups? As a brand new project, Dash 2 Trade is offering its native crypto asset – the D2T token, to the general public via a presale launch. This is somewhat similar to a stock IPO, insofar as Dash 2 Trade will raise funds from investors. And in return, investors will secure an allocation of D2T tokens at the best price possible.

After the presale sells out, the D2T trade token will then list on a variety of crypto exchanges, which enables traders from all over the world to gain access to the project. The initial presale – which is currently ongoing, is priced at $0.0476 per D2T token. This amounts to approximately 4p, so a £100 investment would secure approximately 2,500 tokens.

In terms of the upside potential, cryptocurrencies in general are speculative assets. However, as we discuss shortly, even though 2022 has been an overly negative year for the crypto markets, many projects have generated significant gains. For instance, after the recently completed Tamadoge presale, TAMA tokens witnessed growth of over 10x.

For more information on how to buy D2T tokens via the Dash 2 Trade presale, scroll down toward the end of this guide. In the meantime, consider downloading the project’s whitepaper or joining the Dash 2 Trade Telegram group for real-time updates.

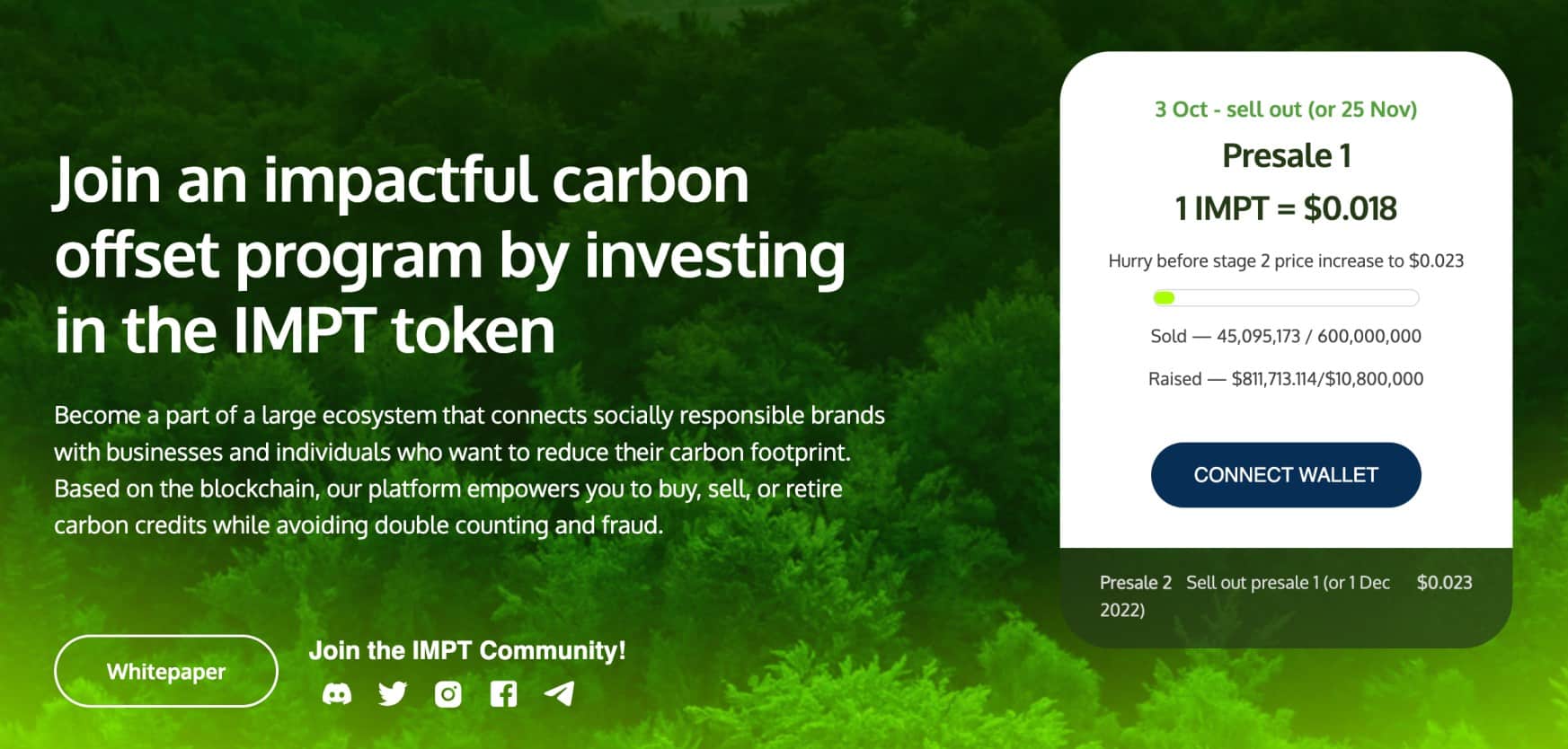

2. IMPT – Green-Focused Blockchain Ecosystem Offering Access to the Carbon Credit Markets

Those with an interest in presales might also consider IMPT as one of the best short-term investments in the UK. In a similar nature to Dash 2 Trade, this is yet another highly-anticipated project that is in its infancy.

IMPT is building a blockchain-based carbon credit ecosystem that enables stakeholders to offset their emissions.

- For those unaware, many developed economies – including the UK, have carbon emissions limits in place.

- This means that companies can only release a certain amount of carbon into the atmosphere each year.

- Should a business require more than the allowances permit, it will need to purchase carbon credits from the open market.

- With this in mind, carbon credit trading is now a multi-billion dollar industry.

However, the key issue is that the carbon credit arena is highly fragmented. IMPT aims to solve this problem by offering a single dashboard that enables buyers and sellers to trade carbon credits through crypto assets.

The process works as follows. Both businesses and individual investors can sign up for the IMPT dashboard and buy IMPT tokens. The IMPT tokens will then be converted to carbon credits and minted into NFTs. Businesses that require additional carbon emissions for the year can subsequently use IMPT to purchase credits from its secondary marketplace.

On the other hand, environmentally-conscious consumers can offset their carbon footprint by burning their IMPT tokens. Another angle that will appeal specifically to short-term investors is that IMPT tokens offer exposure to rising carbon credit prices. This means that if global prices rise, and IMPT tokens follow suit, investors can look to cash out at a profit.

When it comes to the fundamentals of its presale, the fundraising campaign has already collected over $6.2 million from early investors. The remaining $4 million raised in the current batch of tokens will obtain a cost price of $0.018. After that, the next batch of tokens will be priced 27% higher at $0.023.

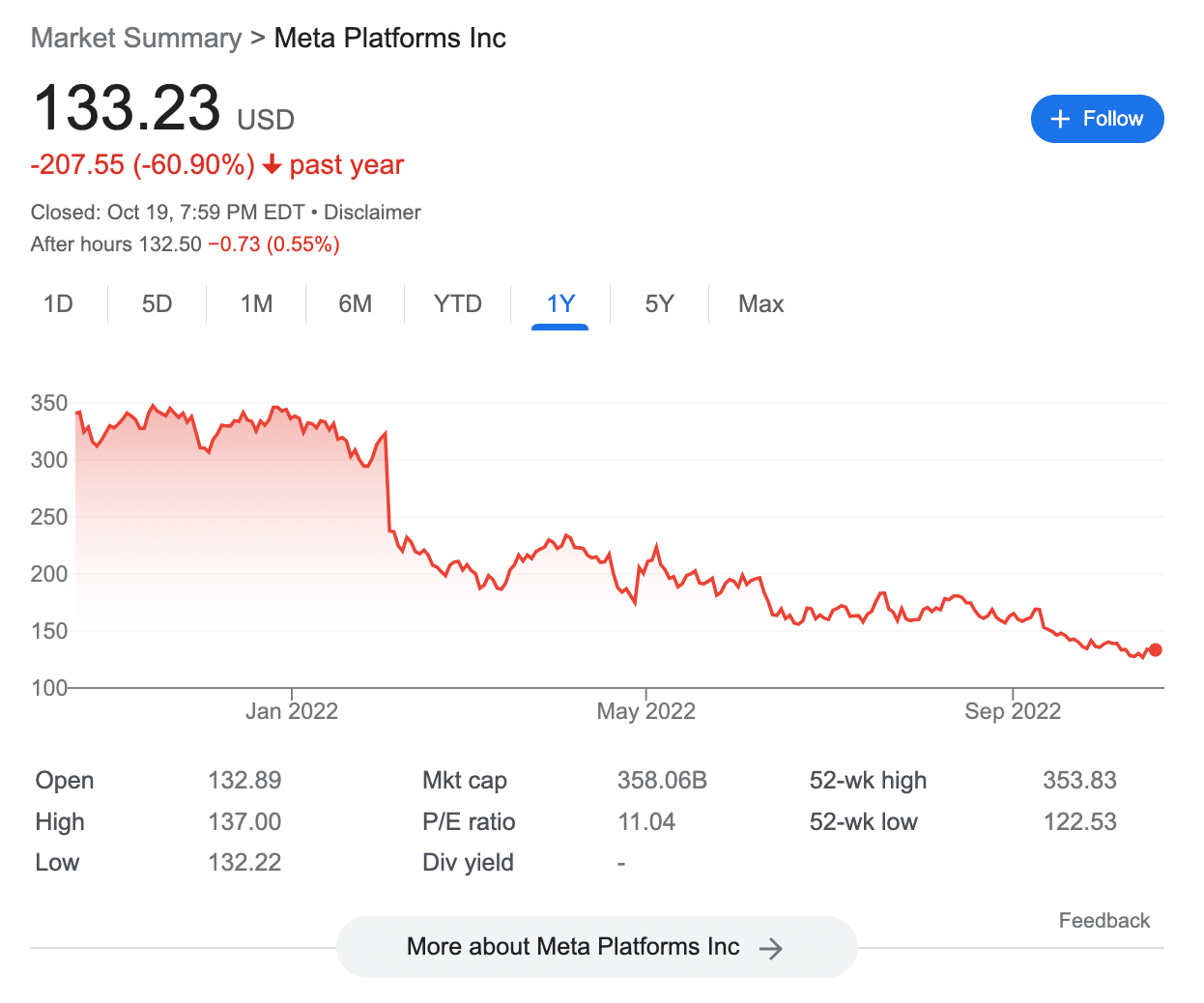

3. Meta Platforms – Social Media Stock Trading 60% Below its All-Time High

In addition to crypto, there are plenty of short-term stock investments in the market. Perhaps the best short-term investment in the UK in this regard is to buy shares in undervalued companies. Some analysts in this market argue that Meta Platforms stock fits this criterion. The reason for this is that Meta Platforms is trading 60% below its prior all-time high.

This stands at just over $353 per stock, which Meta Platforms achieved in September 2021. For those unaware, Meta Platforms is the parent company of the world’s largest social media site – Facebook. In addition to Instagram and WhatsApp, Meta Platforms owns dozens of startups – most of which are involved in creating innovative technologies such as augmented and virtual reality.

Crucially, Meta Platforms boasts approximately 3 billion monthly active users. This means that nearly 40% of the world’s population logs into at least one Meta Platforms product throughout the month. With all that being said, recent quarterly results have been somewhat disappointing since the turn of 2022.

For instance, its most recent earnings report highlighted a 0.885% decline in revenue, and net income dropped by 35.66%. Earnings per share declined by 31.86%. However, the sharp nature of its share price decline means that some investors believe Meta Platforms stock is undervalued.

In addition to its 3 billion monthly active users, Meta Platforms has more than $40 billion worth of cash and short-term investments on its balance sheet. Moreover, its total liabilities of $44.01 billion is minute when compared to its $169.78 billion in assets. As such, Meta Platforms has a highly robust balance sheet.

4. USD/TRY – Capitalize on the Capitulating Value of the Turkish Lira

Those in the market for the best short-term investments in the UK might also consider speculating on currencies. The forex market is the largest financial trading space globally, with many trillions of pounds worth of currencies changing hands each day. The concept is simple – investors speculate on whether a currency pair will rise or fall and if correct, will make a profit.

There are dozens of forex pairs that can be traded online, most of which come in the shape of majors and minors. However, one currency, in particular, that might interest both short and long-term traders is the Turkish lira. Put simply, the lira remains one of the worst-performing currencies globally and this has been the case for well over a decade.

As the Turkish economy continues to struggle, the lira remains in free fall against major currencies. This decline has been amplified in recent months as the US dollar becomes a safe haven for institutional investors and banks. Consider this – over the prior 12 months alone, USD/TRY has increased by 95%.

This means that in just a year of trading, the US dollar now buys 95% more Turkish lira. Over a 5-year period, the decline of the lira against the US dollar stands at 406%. In terms of how to access this market, the best forex brokers in the UK support USD/TRY on a commission-free basis. CFD brokers in the UK typically offer leverage of 1:20 on this currency pair.

5. Tamadoge – Play-to-Earn Gaming Project Entering the Augmented Reality Space

One of the best short-term investments in the UK for those with an interest in web 3.0 gaming is Tamadoge. In a nutshell, Tamadoge is building a play-to-earn game that rewards players for engaging with its ecosystem. Tamadoge is somewhat similar to the traditional Tamagochi game from the mid-90s, which required players to look after a virtual pet.

Only in the case of Tamadoge, virtual pets are backed by NFTs that are stored on the Ethereum blockchain. Moreover, each virtual pet is unique from the next and will have its own traits. To earn real-world crypto rewards – paid in TAMA tokens, players will need to enter battles with their virtual pets.

This will incentivize players from all over the world to participate in the Tamadoge ecosystem. Moreover, players can breed their virtual pets to create new NFTs and even feed and train them to increase their strength. Not only will Tamadoge be accessible in a metaverse world setting, but the game will eventually offer immersive experiences through augmented reality.

Unlike Dash 2 Trade and IMPT, Tamadoge has already completed its presale campaign. In fact, Tamadoge raised its funding target of $19 million in just two months. The TAMA token has since been listed on a variety of exchanges and subsequently produced gains of 10x for early investors.

In terms of the upside potential, the market capitalization of Tamadoge tokens currently stands at just over $31 million. In comparison, other play-to-earn games in this market – such as Decentraland, the Sandbox, and Axie Infinity, carry a market capitalization of $1.1 billion, $1 billion, and $820 million, respectively. Therefore, plenty of upside is on the table.

In addition to its TAMA token, Tamadoge is also launching its own collection of NFTs. Each NFT can be purchased through OpenSea and there are three variants – ultra-rare, rare, or common. Naturally, the rarer the NFT, the more value it will have within the Tamadoge gaming ecosystem.

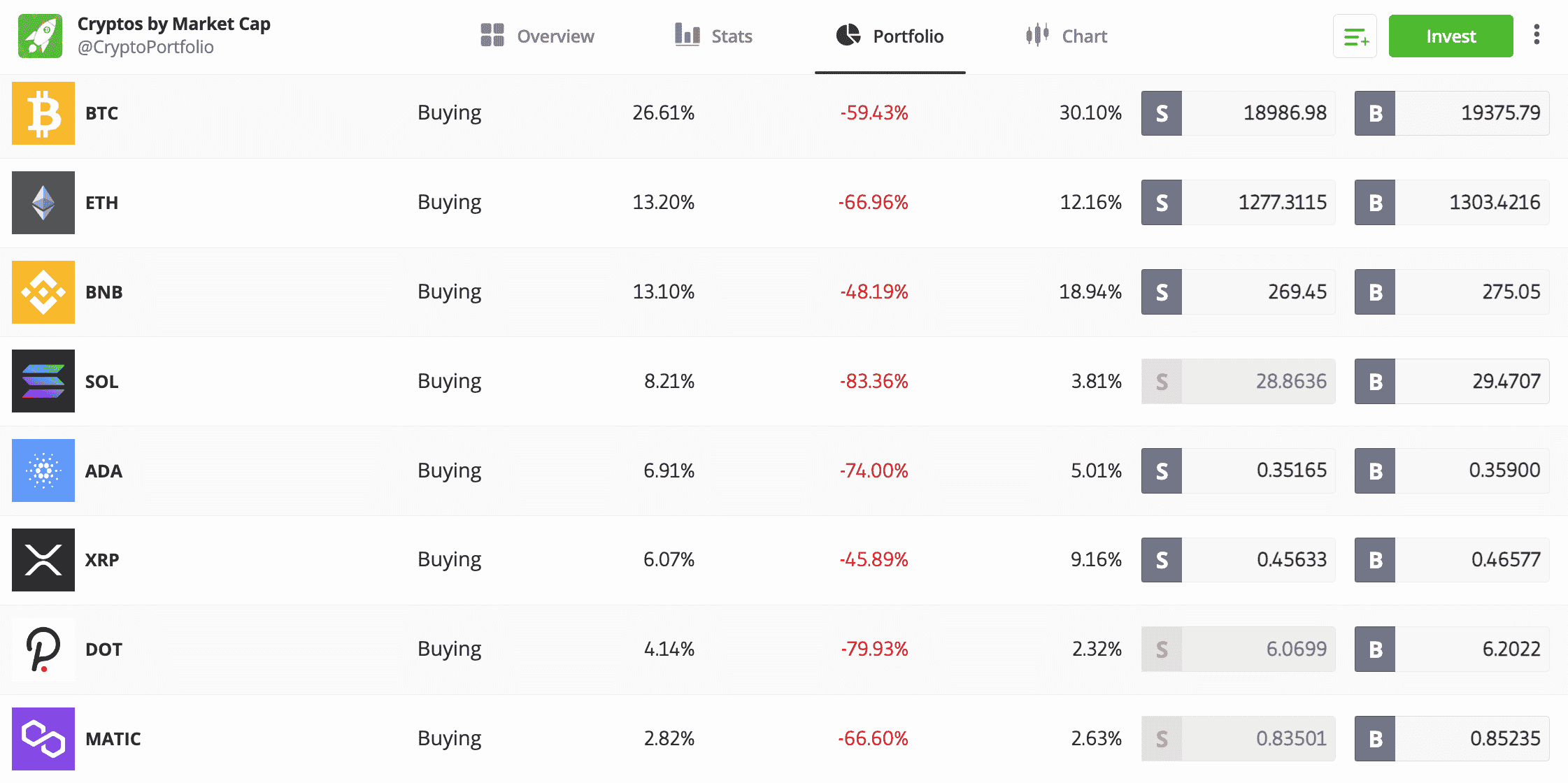

6. Crypto SmartPortfolio – Invest in 20 Different Crypto Assets via a Single Managed Portfolio

With more than 21,000 crypto assets in this industry, this offers a wide range of opportunities for short-term investors. However, equally, this makes it a complex task to know which tokens to buy and sell. With this in mind, FCA-regulated broker eToro has created an innovative SmartPortfolio that offers diversified and passive access to this market.

The ‘Cryptos by Market Cap’ SmartPortfolio at eToro contains 20 different cryptocurrencies. As the name suggests, the SmartPortfolio is weighted by market capitalization. In simple terms, this means that the more valuable the crypto asset is the more it contributes to the SmartPortfolio in percentage terms.

For example, Bitcoin and Ethereum have a weighting of 26.6% and 13.205 respectively. After that, BNB, Solana, and Cardano have a weighting of 13.1%, 8.2%, and 6.9% respectively. Other crypto assets in this SmartPortfolio include Ripple, Polkadot, Uniswap, Algorand, and more.

As the Cryptos by Market Cap SmartPortfolio is professionally managed, eToro will regularly balance the basket of assets. This will reflect the market capitalization of each cryptocurrency at any given time. Moreover, In terms of performance, this SmartPortfolio generated gains of 201% in 2020 and 167% in 2021. 2022 has been disappointing, with losses of 62%.

However, this is reflective of the broader crypto bear market rather than the SmartPortfolio itself. The minimum investment in this SmartPortfolio is $500 (about £445) and there are no management fees.

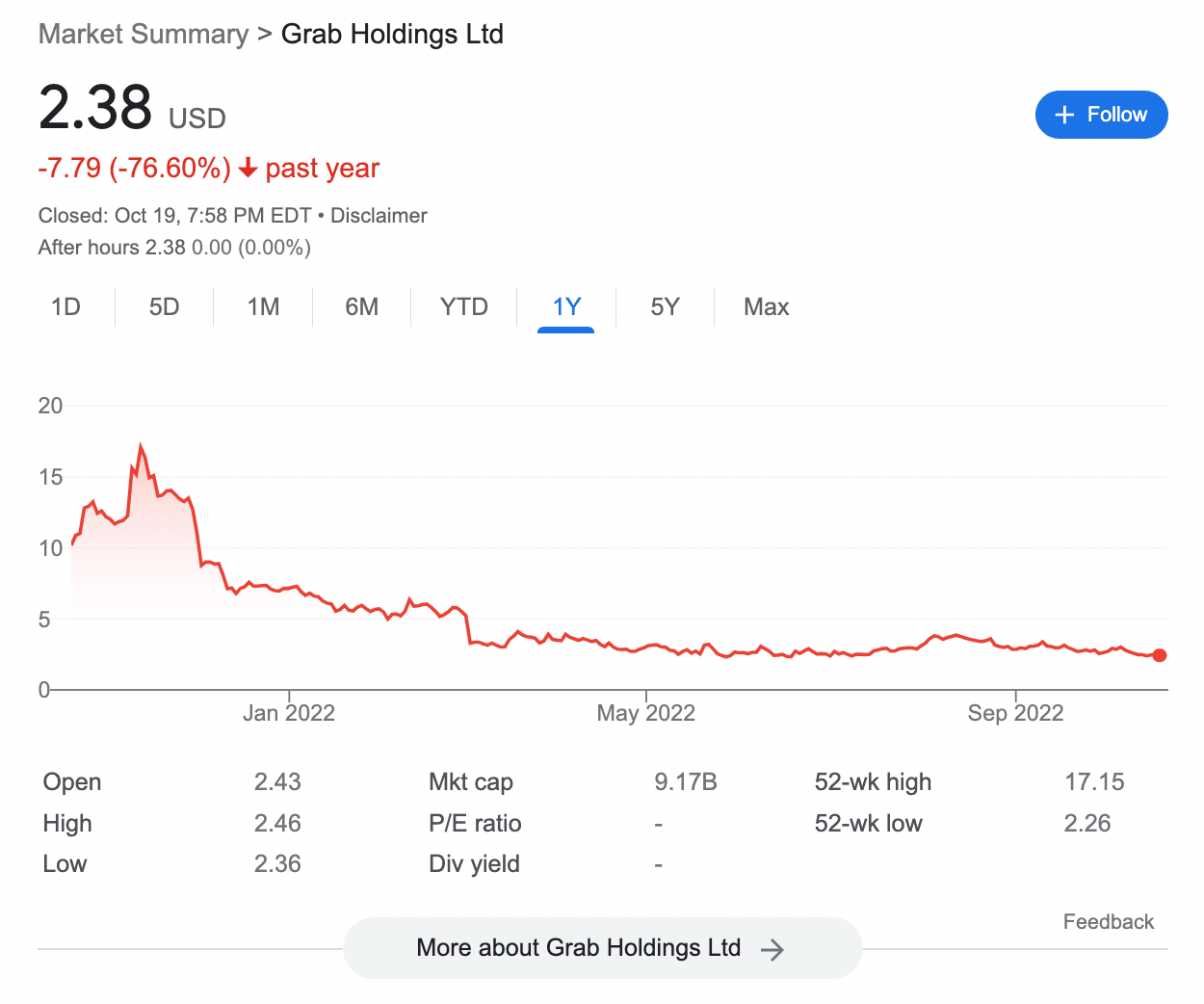

7. Grab – Ride-Hailing Super App That Dominates the South-East Asian Market

The next option to explore when searching for the best short-term investments in the UK is Grab. In a nutshell, Grab is a market leader in the South-East Asian ride-hailing space. In a similar nature to Uber, Grab offers not only taxi services, but food deliveries, personalized shopping, hotel bookings, and more.

Grab operates in some of the highest-growth emerging markets in the region – including Thailand, Indonesia, the Philippines, and Singapore. Grab went public in December 2020 – opting to list on the tech-heavy NASDAQ exchange. However, its US listing has been nothing short of a disaster. In fact, as of writing, Grab stock is 80% down from its IPO price.

With that said, some analysts argue that the share price capitulation of Grab is unjustified. In particular, the firm’s most recent results were very positive. Revenues were up 78% and net income rose by 28%. Net profit margins increased by 60% and its cost of revenue improved by 26%. Additionally, Grab’s earnings-per-share beat expectations by 17%.

With a market capitalization of just $9 billion, there is plenty of upside for those looking to make UK short-term investments.

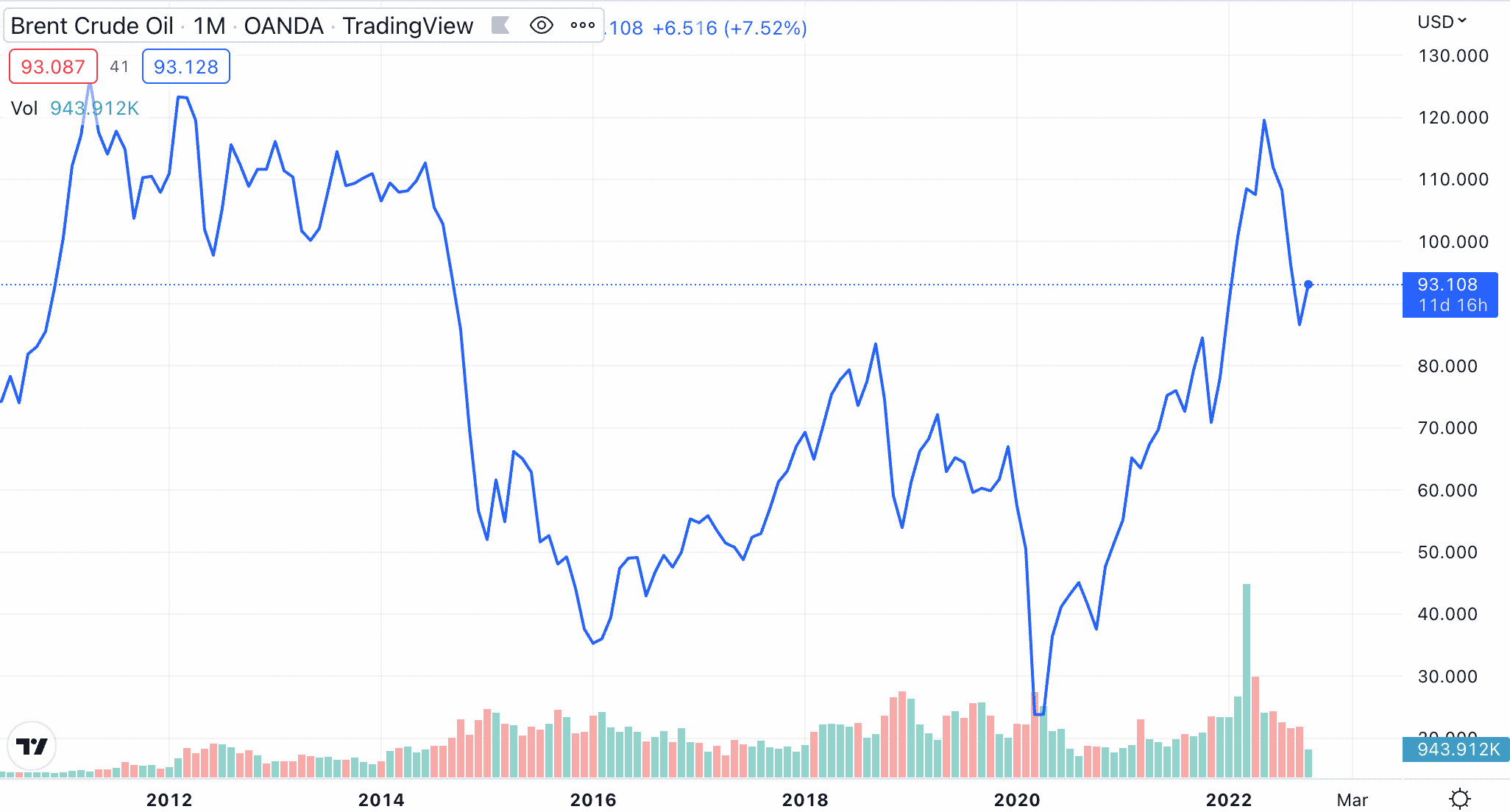

8. Crude Oil – Trade the Global Price of Oil as Prices Continue to Rise

It is no surprise that energy prices in the UK continue to hit record highs. And the overarching reason for this is global crude oil prices. Since hitting lows of under $20 per barrel in the midst of the pandemic in 2020, oil has since surpassed $100. As of writing, oil is trading in the $90-$95 range.

There are many reasons for the ever-increasing price of oil. First and foremost, the Russia-Ukraine war has resulted in a significant reduction in supply. Moreover, supply chain issues in general have resulted in increased energy prices, in addition to an overheated global economy. In addition, OPEC continues to reject calls from the US to cut production output.

From a short-term investment perspective, there are many to gain exposure to crude oil prices in the UK. Perhaps the easiest option is to trade CFDs (contracts-for-differences) that track global spot prices in real-time. Oil CFDs can be traded commission-free at many brokers in the UK in addition to leverage of 1:10.

This means that for every £1,000 position entered, a stake of just £100 is required. Moreover, when trading oil CFDs, traders can elect to go long or short. This means that traders can speculate on both rising and falling oil prices. Another option is to buy and sell oil stocks or invest in an ETF that specifically holds energy futures.

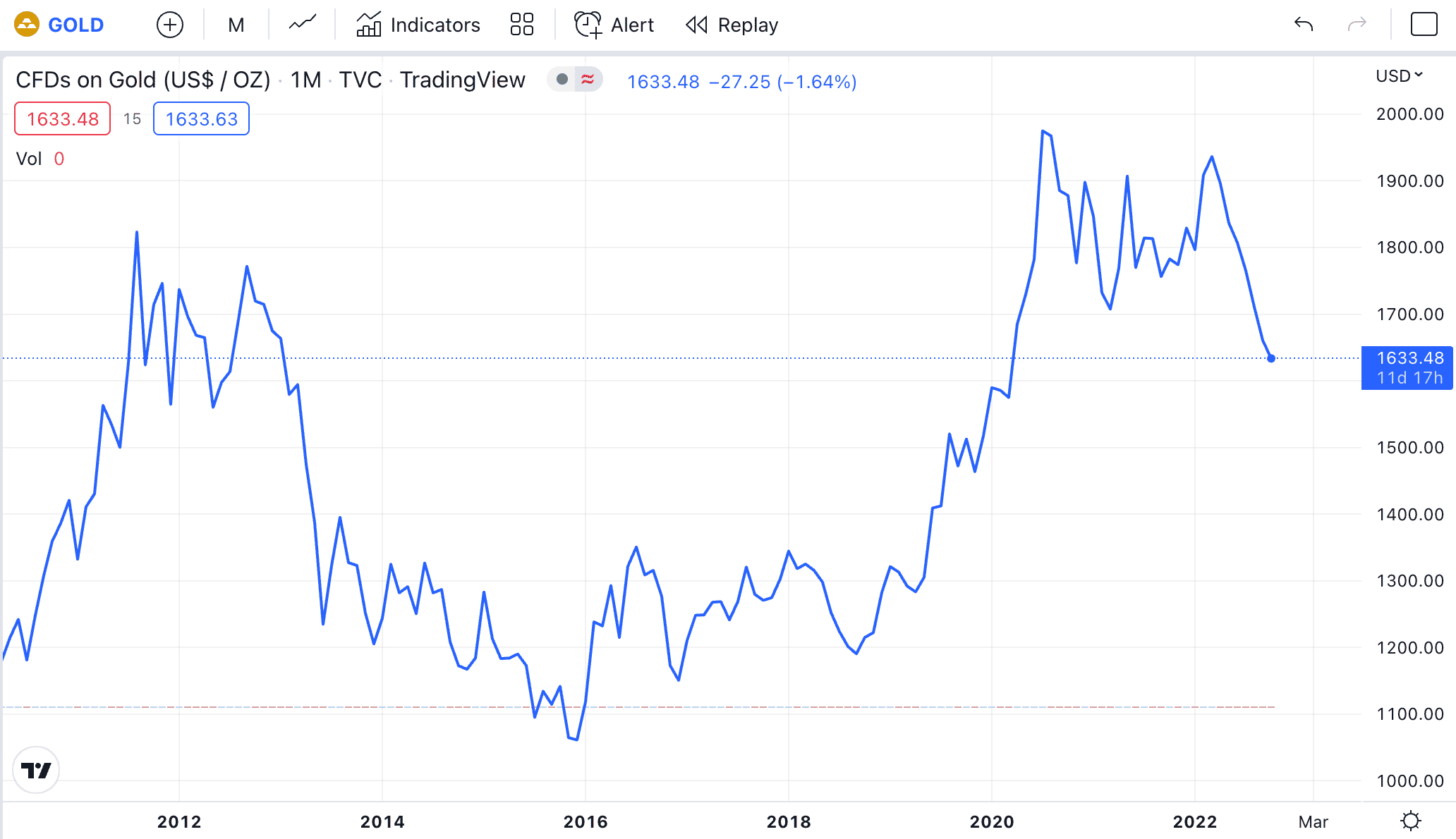

9. Gold – Build a Short-Term Position in Gold to Hedge Against Falling Stock Prices

For many, gold is the best short-term investment in the UK to make in times of economic uncertainty. Considering that inflation levels are sky-high and an extended recessionary period is likely, institution investors are expected to turn to gold After all, gold is viewed as a store of value and a safe haven asset to hold when the wider stock markets are down.

Gold is finite, its supply is limited, and most importantly – gold has been used for thousands of years as a medium of exchange. During the prior recession – the 2008 financial crisis, gold performed very well. Investors that believe the same will happen again during the next recessionary period can easily gain exposure to this commodity.

Just like oil, gold can be traded via CFDs in the UK. Most brokers permit leverage of 1:20 when trading gold. This means that for a position size worth £1,000, an account balance of just £50 is required. Another way to enter a short-term investment in gold is via an ETF that is physically backed by the commodity.

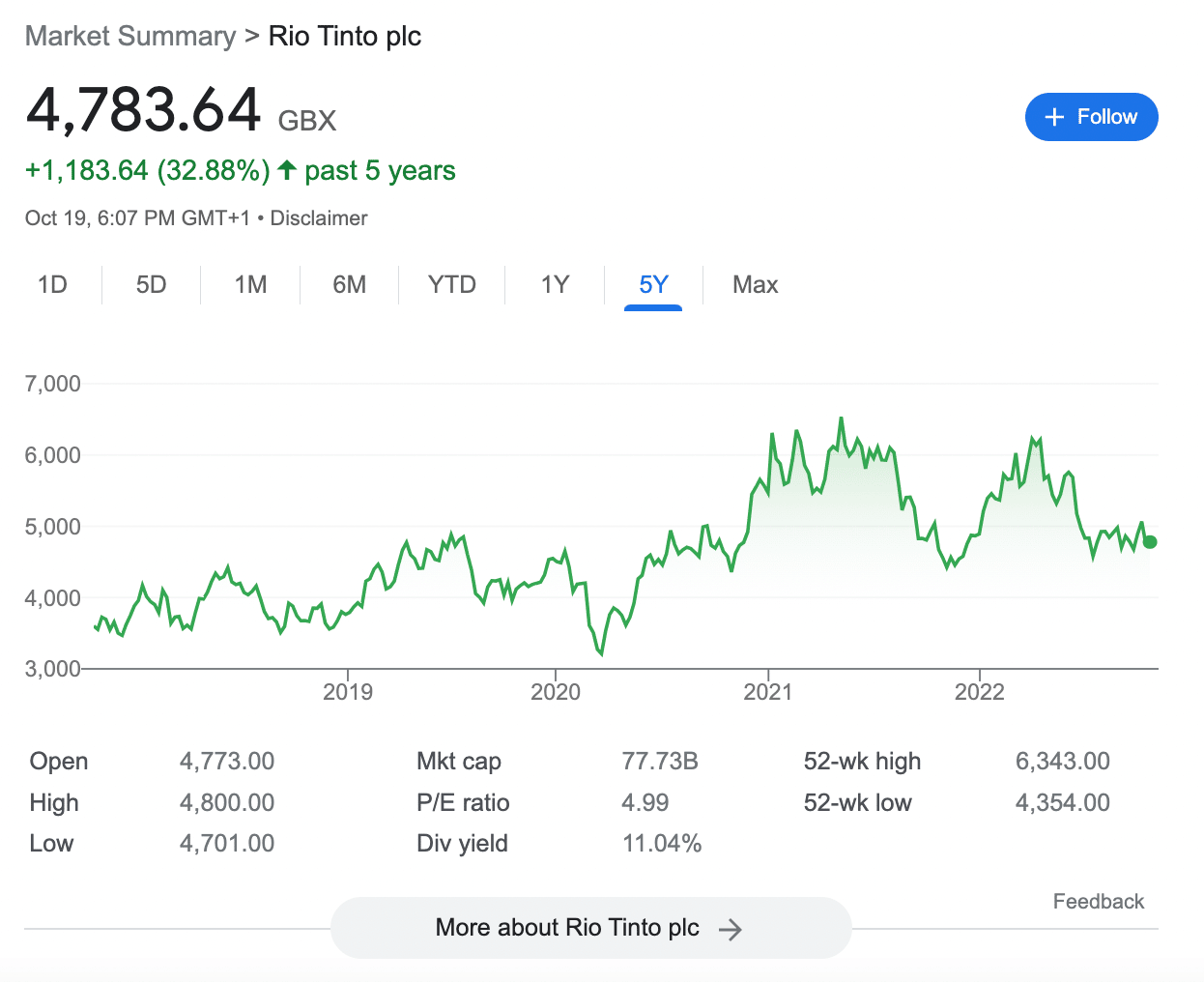

10. Rio Tinto – Double-Digit Running Dividend Yield

Rio Tinto is a global mining company that has a dual listing on the London Stock Exchange. The firm is involved in the exploration of a wide range of commodities, including copper, iron ore, diamonds, uranium, and other raw materials.

Those in the market for the best short-term investment in stocks will appreciate that of writing, Rio Tinto stock is offering a running dividend yield of over 11%. This large-cap stock might also appeal to longer-term investors, not only because it continues to outperform the FTSE 100.

Over the prior five years of trading, the FTSE 100 is down 8% while Rio Tinto stock is up 32%. Moreover, although Rio Tinto is UK-listed, it largely deals in foreign currencies as per its global operations. At a time when GBP is trading at record lows, this is beneficial to Rio Tinto.

Short-Term Investing UK Explained

Short-term investments are defined as asset classes that are traded over the course of a few months, weeks, or even days. The asset class traded via a short-term strategy will be readily convertible to cash. This means that at any given time during standard market hours, the investors can cash out their short-term investment back to pounds and pence.

In comparison to long-term investments, short-term positions will look to take advantage of ever-changing market trends. For instance, when oil hit $91 per barrel in 2022, short-term speculators would have entered a position with the view of making a profit once global demand for energy increased.

Similarly, when governments around the world closed their borders in the midst of the pandemic, short-term speculators likely would have short-sold airline stocks. Ultimately, short-term investing can be more profitable than holding assets for longer periods of time. However, short-term strategies require investors to actively research the market.

As a result, when assessing the best short-term investments in the UK, it is important to have a firm understanding of macroeconomic conditions. For example, with inflation levels continuing to increase, many short-term traders are looking to gain exposure to high-growth markets like crypto assets and commodities.

Short-Term vs Long-Term Investing – Which is Best?

The vast majority of investors in the UK will take a long-term approach to investing. This means holding the best investments UK in a portfolio for many years or even decades. The idea is that by holding long-term, investors can ride out shorter-term volatility.

- The S&P 500, for example, has generated annualized gains of 10% since its inception in 1926.

- This will likely appeal to investors that wish to build a risk-averse portfolio for their retirement.

- However, shorter-term volatility in itself presents many opportunities for investors.

- This is because traders can actively enter and exit positions depending on which asset classes are trending.

- For instance, while the broader stock markets are down in 2022, oil companies are generating sizable gains for shareholders.

Equally, many newly launched crypto projects have gone on to witness gains of 10x and more since completing their presale campaign. As such, the ongoing Dash 2 Trade presale is proving popular with short-term investors.

Benefits & Potential Risks of UK Short-Term Investments

In terms of the benefits, many short-term investments offer the opportunity to generate regular gains as per current trends.

For instance:

- As noted above, with energy prices at record highs, oil and natural gas stocks are generating notable short-term returns.

- Moreover, short-term investments enable investors to maximize their capital, rather than leaving it to sit in a long-term asset that might take many years to truly blossom.

- Short-term investments are highly liquid too. This means that at any given time, short-term investments can be converted to cash.

- This is even the case with crypto assets that trade on public exchanges.

On the flip side, short-term investments won’t be for everyone. The overarching reason for this is that attempting to outperform and time the market consistently is no easy feat.

Furthermore, short-term trading strategies require investors to dedicate ample time to the research process. This means analyzing microeconomic and technical data on a day-by-day basis.

Ultimately, those without the required skill set or time to actively research and trade the market might be more suited for long-term investments.

How to Find the Best Short-Term Investments with High Returns

In terms of how to find the best short-term investments in the UK, this will require investors to actively research the market – looking for opportunities to enter and exit positions.

We expand on this sentiment in the sections below by exploring the best ways to find short-term trading opportunities.

Fundamental Research

A good starting point when searching for the best short-term investments in the UK is to perform daily fundamental research.

This means reading financial news websites to assess the current state of the economy and whether any core developments have been made.

For example, when OPEC recently announced that it would not be reducing oil production output, the price of the commodity went on an extended upward trajectory.

Support and Resistance Levels

Another way to find suitable short-term investment opportunities is to explore support and resistance levels.

- Support levels are a pricing point where an asset traditionally finds ‘support’ from the markets. This means that a declining price will often see a fast reversal at the identified support level.

- Resistance levels are a pricing point where an asset traditionally finds ‘resistance’. As such, if the price of the asset is on an extended upward run it might find a fast reversal.

To offer some insight, Bitcoin has a significant level of support at the $19-20,000 level. This means that traders will often buy Bitcoin when it is hovering around this price point.

Look for High-Quality Crypto Presales

In a similar way to stock IPOs, crypto presales enable investors to buy into a project at the best price possible. This is because the crypto presale will offer investors an incentive to get in early.

After the presale concludes, the cryptocurrency token will be listed on a public exchange at a higher price. As such, this often offers an immediate upside. This is one of the reasons that some investors consider crypto presales to be one of the best ways to invest £100k in the UK in 2023.

As we discussed earlier, Dash 2 Trade is currently engaged in one of the hottest crypto presales of the year. By purchasing the D2T token during phase 1 of the presale, investors will pay just $0.0476.

Conclusion

This guide has analyzed 10 of the best short-term investments in the UK. Each and every asset class and market discussed are accessible to retail clients in the UK – often from a minimum of just a few pounds when using a suitable online broker.

Perhaps the stand-out short-term investment that we came across during the analysis process was Dash 2 Trade.

This newly founded blockchain project is building an analytics terminal that will offer access to real-time crypto trading signals alongside professional-grade data.

The presale is currently live, meaning that investors in the UK can gain exposure to Dash 2 Trade at the lowest price possible.