Skrill is a digital wallet service that makes depositing funds to supported forex brokers fast, secure, and seamless. Using the best Skrill forex broker should help streamline positions, lower costs, and improve overall trading conditions.

In this guide, we’ll be reviewing the top forex brokers that accept Skrill payments by going through the pairs offered, spreads, pricing models, and other important broker features. We’ll also be comparing the brokers side-by-side. Let’s begin.

The list below shows the best Skrill forex brokers based on our research.The Best Skrill Forex Brokers in 2023 List

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

Top Skrill Forex Brokers Reviewed

Skrill forex trading brokers provide fast and easy account funding but they’ll need to supplement this with many more important features to stay competitive. In the sections below, we review what makes the top Skrill Forex brokers some of the best trading platforms as well.

1. eToro – Overall Best Skrill Forex Broker with Tight Spreads & Low Trading Fees

eToro is another popular trading platform and is the best Skrill forex broker that offers its own social trading features. What started as a small forex trading platform back in 2007, eToro is now a multi-asset broker with millions of traders worldwide. Thanks to innovative trading features and a collaborative investing community, the platform continues to grow its user base.

Copy trading is eToro’s flagship feature which it has pioneered into the mainstream online investing market with a simple and intuitive interface. Users have an easy time discovering, searching, and analyzing the top investors on the platform for them to start replicating their positions. Both copiers and copy traders have the chance to benefit from this system so there are incentives for both parties to keep investing.

A total of 49 currency pairs are supported on the platform which can be traded through either eToro’s proprietary web trading platform or mobile app. Both platforms support virtual account trading which lets users trade all markets offered in real-time using virtual money. 100,000 USD of virtual equity is credited to new accounts.

Since 2019, eToro has offered 0% commissions for stocks while charging spreads for currency pairs which start at 1 pip for EURUSD, USDJPY, and AUDUSD. In some regions, the platform lets traders buy and sell crypto assets for a 1% fee in addition to the market spread.

Check out our eToro Review to know more broker features and see the section below for other details.

Forex Pairs

49 pairs

Max Leverage

1:30 for retail clients

Pricing

0% commission

Spread for USD/EUR

1 pip

Skrill Deposit Fee

None

Trading Platforms

Proprietary platform

Minimum Skrill Deposit

10 USD for UK/US clients, 50 USD and 200 USD for other countries

Accepts US Clients

No

What We Like

78% of retail investor accounts lose money when trading CFDs with this provider.

2. XTB – Fast Executing Skrill Forex Broker With Proprietary App

Next on our list of top forex brokers is XTB, a lightning-fast forex trading platform with an award-winning proprietary app. xStation, the broker’s web trading program, offers over 2,100 instruments which include CFD trading for forex, commodities, stocks, and ETFs.

With access to some of the deepest liquidity providers, XTB can execute trade orders extremely quickly. The forex broker also offers good customer support that runs 24/5 through live chat and other contact methods.

XTB traders can view the latest market news on xStation and its portable counterpart, xStation mobile. Here, users can view the market sentiment of the top instruments to see how many traders are buying or selling the assets. Because XTB showcases top gainers and losers, it’s also one of the best scalping brokers for those looking to ride extreme price movements.

Client equity protection is held in the highest regard at XTB where users’ funds are not only kept in segregated accounts but also protected for up to 85,000 GBP per person. This is in compliance with the FCA and Financial Services Compensation Scheme.

Note that Skrill deposits for UK and non-EU clients are subject to a 2% fee while EU clients can deposit through Skrill without any fees.

Forex Pairs

48 pairs

Max Leverage

1:30 leverage for retail clients

Pricing

0% commission

Spread for USD/EUR

From 0.1 pips

Skrill Deposit Fee

No fee for EU clients, 2% fee for UK and rest of clients

Trading Platforms

Proprietary platform

Minimum Skrill Deposit

None

Accepts US Clients

No

What We Like

81% of retail investor accounts lose money when trading CFDs with this provider.

3. Pepperstone – Popular Australia-based Skrill Forex Broker

One of the most reliable and trustworthy Skrill forex brokers is Pepperstone, a multi-asset broker that supports many different trading platforms. Pepperstone was founded in 2010 and offers over 60 different currency pairs today.

The Australia-based broker grew in popularity due to providing both CFD and spread betting trading methods. Pepperstone lets its users trade thousands of financial instruments in a tax-efficient manner through spread betting. This trading method is exempt from the capital gains tax, although spread betting costs can vary depending on different circumstances.

Pepperstone traders can utilize spread betting on the top platforms such as Mt4, MT5, and cTrader. CFD trading can also be performed with these platforms as well as with Pepperstone’s TradingView integration. Clients’ funds are held in segregated bank accounts and are never combined with the company’s own assets to ensure maximum security and protection.

There are two account types that can be opened with Pepperstone depending on the trading style and experience of the user. Standard accounts offer low spreads from 0.6 pips and 0% commissions while Razor accounts offer even lower spreads from 0.0 pips with a 3.5 USD commission.

Learn more about the broker’s key features through our Pepperstone review.

Forex Pairs

Over 60 pairs

Max Leverage

1:200 for retail clients

Pricing

3.5 USD per lot for raw accounts, 0% for standard account

Spread for USD/EUR

From 0 pips

Skrill Deposit Fee

None

Trading Platforms

TradingView, cTrader, MT4, MT5

Minimum Skrill Deposit

100 USD

Accepts US Clients

No

What We Like

74% of retail investor accounts lose money when trading CFDs with this provider.

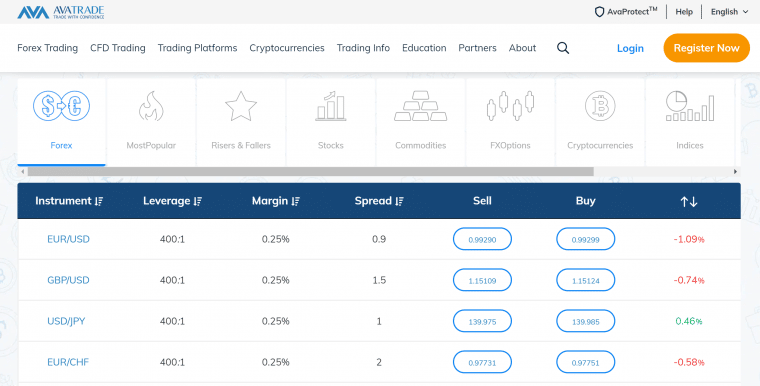

4. AvaTrade – Heavily Regulated Skrill Broker With MT4/MT5 Support

AvaTrade requires a minimum deposit of $100 when opening a new account, which traders can pay by Skrill, credit card, debit card, Neteller, and bank transfer. There are no fees for Skrill deposits, making this a suitable choice for traders who want to fund their trading account with this e-wallet.

Traders at AvaTrade can choose from a wide variety of trading platforms, including MetaTrader 4, MetaTrader 5, and AvaTrade’s own custom trading platform for web, desktop, and mobile. AvaTrade also offers copy trading through Duplitrade and Zulutrade.

Notably, AvaTrade also offers forex options trading. The broker has a dedicated platform, called AvaOptions, for traders to evaluate options strategies in real-time.

Forex Pairs

Over 55 pairs

Max Leverage

1:400 for retail clients

Pricing

0% commission

Spread for USD/EUR

From 0.9 pips

Skrill Deposit Fee

None

Trading Platforms

Proprietary, MT4, MT5, Duplitrade, Zulutrade

Minimum Skrill Deposit

100 USD

Accepts US Clients

No

What We Like

71% of retail investor accounts lose money when trading CFDs with this provider.

Best Skrill Forex Brokers Compared

This section features a table that compares the best Skrill Forex Brokers.

Forex Brokers

Forex Pairs

Max Leverage

Pricing

Spread for EUR/USD

Skrill Deposit Fee

Trading Platforms

Minimum Skrill Deposit

Accepts US Clients

eToro

49 pairs

1:30 for retail clients

0% commission

1 pip

None

Proprietary platform

10 USD for UK/US clients, 50 USD and 200 USD for other countries

No

XTB

48 pairs

1:30 leverage

0% commission

From 0.1 pips

No fee for EU clients, 2% fee for UK and rest of clients

Proprietary platform

None

No

AvaTrade

55 pairs

1:400 leverage

0% commission

From 0.9 pips

None

Proprietary, MT4, MT5, Duplitrade, Zulutrade

100 USD

No

Pepperstone

Over 60 pairs

1:200 for retail clients

3.5 USD per lot for raw accounts, 0% for standard account

From 0 pips

None

TradingView, cTrader, MT4, MT5

10 USD

No

FXPro

70 pairs

1:200 for retail clients

Stocks, Commodities, Indices, Crypto,Futures

1 pip

None

Proprietary platform, MT4, MT5, cTrader

100 USD

No

Plus500

60+ pairs

1:30 for retail clients

0% commission

From 0.8 pips

None

Proprietary platform

100 GBP

No

XM

57 pairs

1:1000 leverage

0% commission

From 1 pip

None

Proprietary mobile app, MT4, MT5

None

No

FXTM

27 pairs

1:2000 leverage

0.4 – 2 USD per lot for Advantage accounts, 0% commission for Micro and Advantage Plus accounts

From 0.0 pips for ECN Prime account; From 1.5 pips for Mirco and Advantage Plus accounts

None

MT4, MT5, Webtrader

None

No

SuperForex

50 pairs

1:2000 for retail accounts

0% commission

From 2.0 pips

None

Proprietary App, MT4

1 USD

No

What is Skrill?

Skrill is an electronic money account service that’s used as a quick and easy way to transfer money, make online payments, and receive money all in one platform. The digital wallet provider was established in 2001 and was previously known as Moneybookers.

Anyone with a registered email address over the age of 18 can create a Skrill account to avail of the different digital wallet services of the provider. With support of over 40 different currencies, Skrill was widely used as a payment method for trading platforms, online gaming, and online stores.

As a digital wallet and provider of electronic money services, Skrill is also licensed and regulated by the FCA and adheres to the top security standards as we’ll mention in the next section.

Most regions in the EU as well as the UK can use local payment methods to fund their Skrill accounts. Bank transfers and other e-wallet services such as Trustly and Paysafecard can be used for depositing funds. Global payment methods such as MasterCard, Visa, Diners Club International, and JCB can also be used to fund Skrill accounts.

In 2018, Skrill released a service that lets its users buy crypto on the platform as well as sell digital assets. Today, this is known as the Skrill Cryptocurrency Service which supports some of the top cryptocurrencies and crypto pairs.

Although this feature is not available in all countries, Skrill looks to expand the cryptos it offers as well as the regions it can provide this service to. Skrill is not a cryptocurrency exchange and only partners with crypto exchanges to provide the purchase and selling of different crypto assets.

Benefits of Using a Skrill Forex Broker

Aside from near instant account funding and a seamless depositing experience, there are plenty more benefits of using a Skrill together with the supported forex broker. Let’s go through some of these benefits to better understand the value of using the best Skrill forex broker.

Fast Transactions with Fewer Fees

From the best Skrill money brokers mentioned earlier, most platforms have no Skrill deposit fees when funding the trading account with the digital money provider. As every trader wants to minimize their costs when moving their money from platform to platform, this will be a huge benefit to anyone who moves their money around often.

In terms of funding actual Skrill accounts, most if not all regions in the EU and UK can fund their Skrill wallets with little to no fees. Local payment methods such as bank transfers and certain e-wallets have zero fees while global payment methods for depositing funds to Skrill accounts range from 0% to 2.5% depending on location and currency.

Industry Standard Security

Two Factor Authentication (2FA) is implemented for all Skrill account holders to take advantage of wherein authentication codes are sent to the mobile phone numbers of users upon logging in. Skrill is also fully PCI compliant with enhanced fraud prevention protocols.

Chargeback protection is also offered for Skrill transactions which are kept private with Secure Socket Layer (SSL) implementations combined with 128-bit encryption for full security.

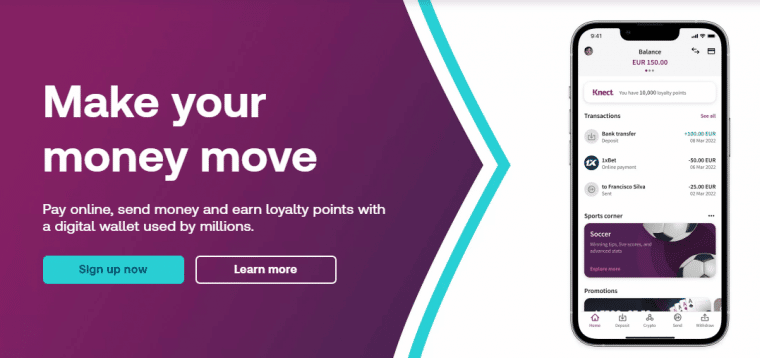

Skrill Loyalty Rewards

Similar to how credit cards feature reward points and loyalty services, Skrill has Knect loyalty points that can be spent for certain benefits. Depending on the country, Knect loyalty points can be earned through completing different transactions, so it’s possible to build reward points by depositing to Skrill brokers.

There are also different Skrill account tiers with more benefits the higher level the account is. Regular Skrill accounts have access to the standard wallet features and loyalty points but the True Skriller accounts have lower transfer fees, refer-a-friend bonuses, and bonus loyalty rewards that are soon to be available.

VIP Skriller is the highest account level which is divided further into Silver, Gold, and Diamond tiers. Forex rates are lower with this account level as well as free bank withdrawals and zero send money fees.

Easy Payments with Skrill Card

Residents of countries in the authorized European Economic Area (EEA) can order a Skrill prepaid card which can be used like a debit card. The prepaid card which can come in both MasterCard and Visa can be used for in-store purchases as well as a means to withdraw cash from ATMs around the world.

Send and Receive with Multiple Currencies

Skrill is supported in more than 140 countries and can hold over 40 different currencies. Additionally, accounts can hold multiple currencies so that users can fund their forex accounts with different supported currencies.

When transferring money or making a transaction through Skrill that requires the conversion of a currency, Skrill uses the exchange rate of the time to complete the transaction. A mid-market rate is used for the transaction as well as a foreign exchange fee of 4.49% (1.99% for VIP Skriller Diamond).

Conclusion

Investors will need to assess different factors when looking for the best Skrill forex broker that’s most suited for their needs. Regulations, trading experience, supported currencies, and trading fees are just some of the key things to consider. From this guide, different forex brokers have their share of benefits and features.

We do find that most traders will benefit from our overall best Skrill forex broker, eToro, as it offers the most forex pairs on our list at 49 pairs, 0% commissions, and high regulation and security. New traders will find plenty of value in the demo accounts offered on the web platform while experienced investors can use all the tools.

If you want to start trading with up to 1:30 leveraged CFDs, competitively low spreads, and minimum trading costs, click on the link below to start trading with eToro.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What are the best Skrill forex brokers?

Does Webull accept Skrill?