Spread betting is considered a viable alternative to traditional investing in the UK since all profits are exempt from taxation. This is because spread betting is considered ‘gambling’ rather than investing, providing a straightforward way for market participants to speculate on an asset’s price.

This guide will review the best spread betting platforms in the United Kingdom, covering which brokers have the lowest fees and most appealing features, before presenting a detailed walkthrough on how to begin spread betting today.

The Top Spread Betting Platforms in the UK

Listed below are some of the most popular spread betting brokers in the United Kingdom. We’ll review each of these brokers in the following section, covering their fees, features, and safety.

- SpreadEx – Best Overall Spread Betting Platform UK 2023

- Pepperstone – Top Financial Spread Betting Broker with MT4 Support

- AvaTrade – Best UK Spread Betting Platform for Asset Selection

- IG – One of the Top UK Spread Betting Brokers with FCA Regulation

- FXCM – Leading Spread Betting Platform with TradingView Integration

- FxPro – Best Spread Betting Platform in the UK for Mobile Trading

- Markets.com – User-Friendly Spread Betting Broker with Huge Educational Library

- Vantage Markets – Best Spread Betting Broker in the UK with ECN Account

- City Index – Popular Spread Betting Platform with Super-Fast Execution

- CMC Markets – Best UK Spread Betting Broker for Experienced Traders

Best UK Spread Betting Brokers Reviewed

Many of the best day trading platforms now offer spread betting services due to the popularity of this approach in the UK. However, not all are made equal since some charge lower fees and offer more appealing features than others.

With that in mind, let’s dive in and examine the most popular spread betting platforms in the UK.

1. SpreadEx – Best Overall Spread Betting Platform UK 2023

SpreadEx is a UK-based company that offers both financial spread betting services and a world renowned UK betting site. It is considered to be one of the best in providing top-quality services in both areas, which isn’t surprising considering it has been around for over 20 years.

SpreadEx provides investors with access to over 10,000 financial markets globally and stocks with a market cap of £1,000,000.

| Available Assets | Forex, indices, ETFs, stocks & commodities |

| Pricing Structure | Variable spread |

| Spread for EUR/USD | From 0.6 pips |

| Minimum Deposit | £2 |

| Top Features |

|

What We Like

Your capital is at risk.

2. Pepperstone – Top Financial Spread Betting Broker with MT4 Support

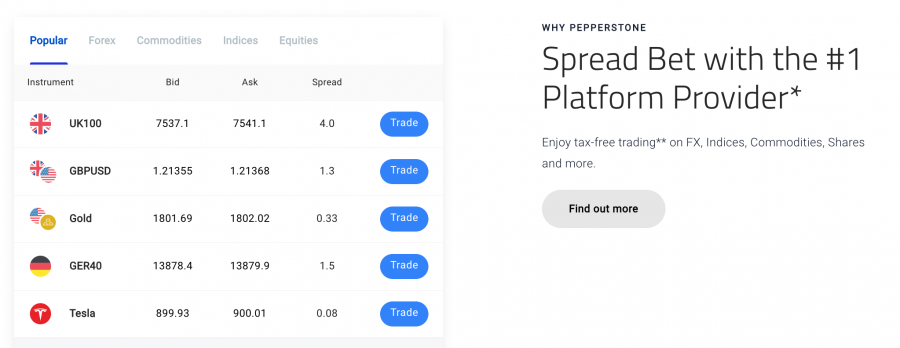

As well as offering some of the best investments in the UK, Pepperstone offers commission-free trading on its Standard account, with spreads averaging just 0.87 pips for EUR/USD. Users can spread bet on stocks, commodities, indices, and currencies – and can even trade using MT4. This feature enables advanced traders to employ custom trading strategies and use automated trading systems.

Pepperstone also has a ‘Razor’ account, which charges a commission on each trade, yet can offer spreads as low as 0.0 pips since it offers ‘raw’ pricing. Moving on to deposits, Pepperstone has no minimum deposit threshold and accepts funding via credit/debit card, bank transfer, or PayPal.

Pepperstone charges no non-trading fees, meaning no deposit, withdrawal, or inactivity fee. The platform also has extensive analysis resources, including daily trade ideas and an in-depth newsfeed. Finally, Pepperstone even has 24/5 customer support via live chat, telephone, or email.

| Available Assets | Currencies, stocks, commodities, indices |

| Pricing Structure | Variable spread on Standard account; commission on Razor account |

| Spread for EUR/USD | Average of 0.87 pips on Standard account; as low as 0.0 pips on Razor account |

| Minimum Deposit | N/A |

| Top Features |

|

What We Like

Your capital is at risk.

3. AvaTrade – Best UK Spread Betting Platform for Asset Selection

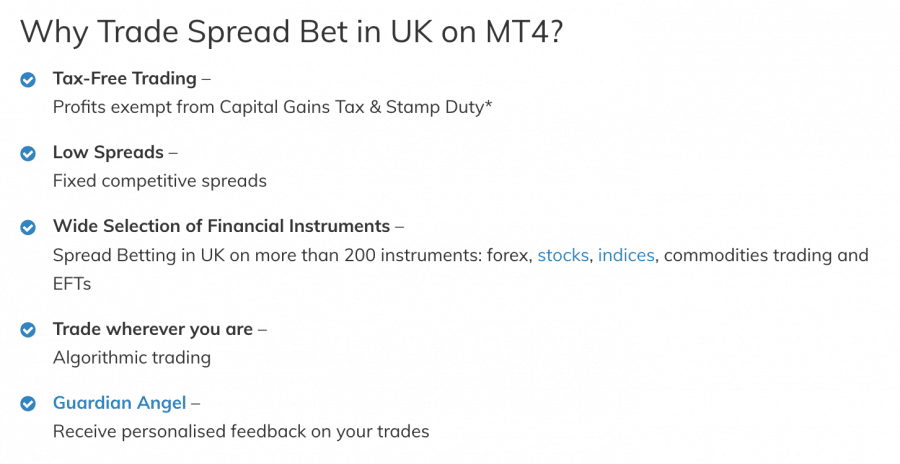

All trades are commission-free and feature competitive spreads – especially when currency trading. Users can trade over 200 financial instruments and benefit from AvaTrade’s ‘Guardian Angel’ feature, which provides feedback on a user’s trades.

AvaTrade’s spread betting account links directly to MT4, which is excellent news for FX traders. Although the minimum deposit is slightly higher at £100, users can fund their accounts using various methods, including PayPal, Neteller, Skrill, and Klarna.

AvaTrade even has a ‘Trading Central’ feature, which provides regular trade ideas backed by technical analysis. Finally, the platform also boasts a vast educational library, with tutorials and videos targeted at new traders.

| Available Assets | Currencies, stocks, ETFs, commodities, indices, bonds |

| Pricing Structure | 0% Commission + Spread |

| Spread for EUR/USD | Average of 0.9 pips |

| Minimum Deposit | £100 |

| Top Features |

|

What We Like

Your capital is at risk.

4. IG – One of the Top UK Spread Betting Brokers with FCA Regulation

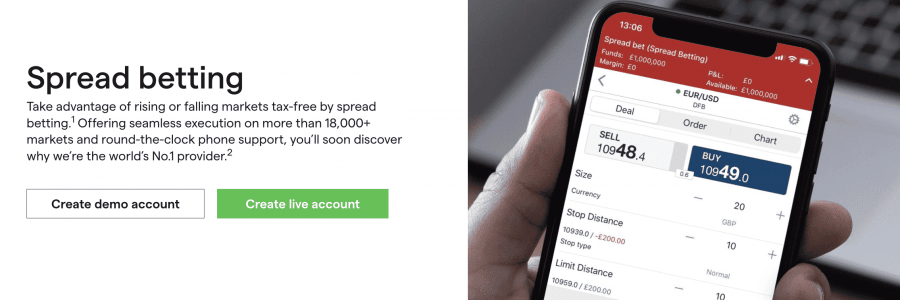

IG allows users to spread bet on over 18,000 markets, only charging the spread when a position is opened. Spreads can be as low as 0.6 pips for FX trading and 0.1 points for shares, making IG a cost-effective broker to partner with. IG also offers extensive leverage facilities, reaching up to 30:1 for currencies and 5:1 for stocks.

Account opening is quick and easy, although the minimum deposit threshold is £250, which is the highest on our list. However, deposits and withdrawals are free to make, and IG accepts all major credit/debit cards, along with bank transfers and PayPal.

IG also offers negative balance protection, ensuring users can’t lose more than they have in their trading balance. Finally, IG’s array of trading platforms stands out from the crowd due to their user-friendly nature – with clients even able to use MT4 for spread betting.

| Available Assets | Stocks, currencies, ETFs, bonds, indices, commodities |

| Pricing Structure | From £3 on real stocks; spread-only on non-stock CFDs and spread betting |

| Spread for EUR/USD | From 0.6 pips |

| Minimum Deposit | £250 |

| Top Features |

|

What We Like

5. FXCM – Leading Spread Betting Platform with TradingView Integration

Like most spread betting brokers, trades are commission-free, although FXCM’s spreads are slightly higher on average than others on our list. There are no deposit, withdrawal, or monthly account fees, although a fee is charged after one year of inactivity.

FXCM excels when it comes to the trading experience, as users can open positions via the browser-based platform or mobile app. Interestingly, FXCM can integrate with the super-popular TradingView platform, allowing users to place trades directly from the charts.

| Available Assets | Stocks, currencies, indices, commodities |

| Pricing Structure | 0% commission + Variable spread |

| Spread for EUR/USD | Average of 1.2 pips |

| Minimum Deposit | £50 |

| Top Features |

|

What We Like

6. FxPro – Best Spread Betting Platform in the UK for Mobile Trading

FxPro allows users to spread bet on FX, stocks, indices, and commodities, making the account creation process as quick and easy as possible. The minimum deposit to begin spread betting is just £100, which can be facilitated via credit/debit card, bank transfer, PayPal, Neteller, and Skrill.

In terms of regulation, FxPro is covered in the UK by the FCA, providing a high level of investor protection. Finally, FxPro has some of the best customer support on our list, offering a handy ‘call back’ feature, along with live chat options.

| Available Assets | Stocks, currencies, indices, commodities |

| Pricing Structure | 0% commission + Variable spread |

| Spread for EUR/USD | Average of 1.70 pips |

| Minimum Deposit | £100 |

| Top Features |

|

What We Like

7. Markets.com – User-Friendly Spread Betting Broker with Huge Educational Library

Markets.com features instant execution and tight spreads, which is ideal for day traders. The broker even provides a free demo account feature, allowing beginners to experience the markets risk-free before trading for real.

Like other brokers, Markets.com provides commission-free trading services, and spreads can be as low as 0.4 pips for heavily-traded pairs like EUR/USD. Although the minimum deposit is set at £100, account funding is free to complete, whilst withdrawals are also free. Finally, Markets.com even has full support for PayPal and Skrill deposits.

| Available Assets | Stocks, currencies, bonds, ETFs, indices, commodities |

| Pricing Structure | 0% commission + Variable spread |

| Spread for EUR/USD | Average of 0.4 pips |

| Minimum Deposit | £100 |

| Top Features |

|

What We Like

8. Vantage – Best Spread Betting Broker in the UK with ECN Account

This broker offers up to 30:1 leverage when spread betting, allowing users to boost their potential winnings (and losses). Notably, Vantage even provides a ‘RAW’ account which uses the ECN system – meaning spreads can be as low as 0.0 pips on specific instruments.

Vantage allows users to experience the markets in a risk-free manner via the free demo account feature, which acts much like the real account. Finally, Vantage’s account-opening process is one of the most streamlined on our list, taking less than five minutes to complete.

| Available Assets | Stocks, currencies, indices, commodities |

| Pricing Structure | 0% commission + Variable spread ($3 per lot on RAW account) |

| Spread for EUR/USD | As low as 0.0 pips on RAW account |

| Minimum Deposit | £200 |

| Top Features |

|

What We Like

9. City Index – Popular Spread Betting Platform with Super-Fast Execution

Over one million people use City Index for spread betting since the platform provides more than 8,500 markets to trade. City Index’s best feature is its fast execution speeds, which average at just 0.05s – ideal for scalpers.

Spread betting with City Index is commission-free, and spreads tend to average below one pip for most popular currency pairs. Finally, City Index also offers a suite of trading tools, including a newsfeed, economic calendar, and performance analytics.

| Available Assets | Stocks, currencies, bonds, ETFs, indices, commodities |

| Pricing Structure | 0% commission + Variable spread |

| Spread for EUR/USD | Average of 0.9 pips |

| Minimum Deposit | £100 |

| Top Features |

|

What We Like

10. CMC Markets – Best UK Spread Betting Broker for Experienced Traders

CMC Markets is regulated by top-tier entities such as the FCA and is even listed on the LSE. The trading experience with CMC Markets is top-notch, as the web-based platform and mobile app offer advanced technical indicators and fundamental data.

There is no minimum deposit threshold with CMC Markets, and users can fund their accounts via credit/debit card, bank transfer, or PayPal. Finally, CMC Markets also has fantastic customer support options, including live chat, telephone, and email support.

| Available Assets | Stocks, currencies, bonds, ETFs, indices, commodities |

| Pricing Structure | 0% commission + Variable spread |

| Spread for EUR/USD | Average of 0.7 pips |

| Minimum Deposit | N/A |

| Top Features |

|

What We Like

Top UK Spread Betting Platforms Compared

To help streamline the decision-making process even further, the table below compares the key factors to bear in mind when choosing which of the best spread betting platforms in the UK to partner with:

| Platform | Available Assets | Pricing Structure | Minimum Deposit | Top Features |

| Pepperstone | Currencies, stocks, commodities, indices | Variable spread on Standard account; commission on Razor account | N/A |

|

| AvaTrade | Currencies, stocks, ETFs, commodities, indices, bonds | 0% Commission + Spread | £100 |

|

| IG | Stocks, currencies, ETFs, bonds, indices, commodities | From £3 on real stocks; spread-only on non-stock CFDs and spread betting | £250 |

|

| FXCM | Stocks, currencies, indices, commodities | 0% commission + Variable spread | £50 |

|

| FxPro | Stocks, currencies, indices, commodities | 0% commission + Variable spread | £100 |

|

| Markets.com | Stocks, currencies, bonds, ETFs, indices, commodities | 0% commission + Variable spread | £100 |

|

| Vantage | Stocks, currencies, indices, commodities | 0% commission + Variable spread ($3 per lot on RAW account) | £200 |

|

| City Index | Stocks, currencies, bonds, ETFs, indices, commodities | 0% commission + Variable spread | £100 |

|

| CMC Markets | Stocks, currencies, bonds, ETFs, indices, commodities | 0% commission + Variable spread | N/A |

|

How We Select the Best UK Spread Betting Platforms

Much like when deciding which of the best forex brokers to partner with, it’s vital to understand the factors influencing a spread betting platform’s viability. With that in mind, detailed below are some of the essential elements to keep in mind when making a decision:

Regulation

When spread betting shares (or any other asset), regulation is one of the most important factors to consider. It’s wise to partner with an FCA-regulated broker since they offer the highest level of investor protection in the UK. Some brokers are even covered under the FSCS, protecting investors in the unlikely instance that the broker becomes insolvent.

Asset Selection

The best spread betting brokers in the UK all offer a wide range of tradable assets, such as stocks, currencies, commodities, and ETFs. Furthermore, many top platforms will offer international markets, ensuring traders can benefit from an abundance of opportunities. For those wondering what the best way to invest £20k in the UK choosing a broker that supports a wide range of financial assets is important especially when trying to build a diversified portfolio.

Spreads

Much like the process to buy cryptocurrency, spread betting also involves considering the size of the bid/ask spread on an asset. The spread tends to be tighter for highly-traded instruments (e.g. EUR/USD, Apple shares, etc.), although it will vary from platform to platform.

Fees

Most spread betting accounts will not charge commissions, instead opting to take their cut through the bid/ask spread. However, there are also non-trading fees to be aware of, including deposit, withdrawal, and inactivity fees. Finally, some brokers that don’t offer GBP as a base currency may charge a small conversion fee on GBP deposits.

| Platform | Monthly Account Fees? |

| Pepperstone | No |

| AvaTrade | No |

| IG | No |

| FXCM | No |

| FxPro | No |

| Markets.com | No |

| Vantage | No |

| City Index | No |

| CMC Markets | No |

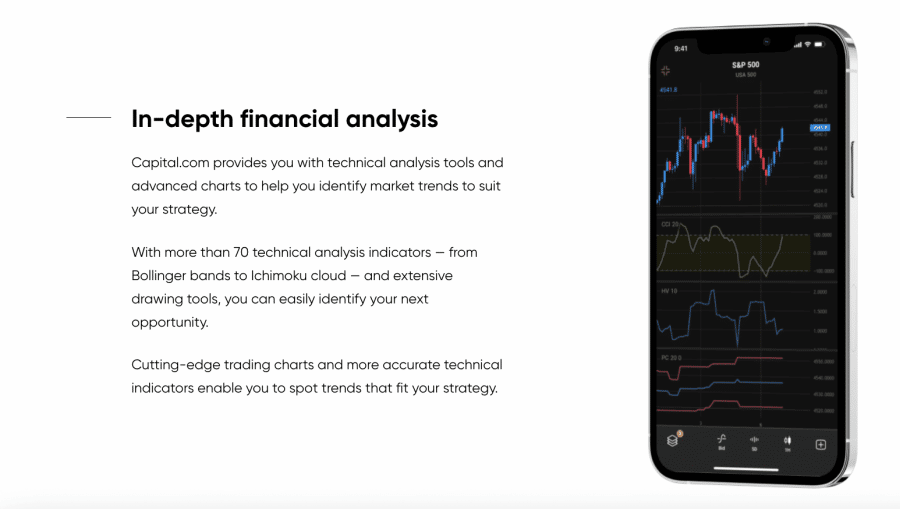

Tools & Analysis

Choosing a broker with extensive trading and analysis tools can be highly beneficial, especially when forex spread betting. Keep an eye out for platforms that offer numerous technical indicators and order types since these can boost market effectiveness.

Mobile App

Spread betting brokers with a user-friendly mobile app are ideal for trading on the go since they make it easy to open and close positions.

Minimum Deposit

Those wondering how to buy shares (or any other supported asset) using a spread betting broker must also consider the broker’s minimum deposit threshold. Most of the platforms reviewed in this guide have a low barrier to entry – for example, eToro’s minimum deposit amount is only £8.

Demo Account

Spread betting brokers with a free demo account can be ideal for beginner traders. These demo accounts provide a risk-free way to learn the ropes before entering the market with real money.

Payment Methods

Customer Service

Finally, it’s wise to partner with a spread betting broker that offers extensive customer support options. The best platforms provide live chat or telephone support with quick response times.

Spread Betting Explained

Spread betting is an investment process whereby any accrued profits are exempt from taxation. Since spread betting is a type of ‘derivative trading’, the underlying asset is never owned, which is the case with traditional stock investing.

Although forex spread betting is perhaps the most popular, participants can trade thousands of markets, including stocks, ETFs, indices, commodities, and more. Instead of basing returns on the asset’s price, spread betting involves betting on ‘points’ of movement, with the participant deciding how much they’d like to stake per point.

Spread betting allows participants to go long and short while offering scope to magnify potential winnings (and losses) through leverage. Finally, spread betting shares and other assets is usually a cost-effective way of speculation since most brokers offer a commission-free approach.

Spread Betting vs CFD Trading

Spread betting, and CFD trading, are similar in many ways – yet there are some key differences to be aware of. Let’s take a look at how these two approaches line up:

- Spread Betting – The main difference between spread betting and CFD trading is how they are taxed. As noted earlier, spread betting profits are tax-free, yet this isn’t the case with CFD trading. Furthermore, spread betting positions have a fixed expiry date, whilst CFD positions have no expiry date.

- CFD Trading – On the other hand, CFD trades are subject to Capital Gains Tax – yet are exempt from Stamp Duty since the underlying asset is never owned. CFD losses are tax deductible, which tends to appeal more to experienced traders. Finally, CFD positions are based on the asset’s open and close price, whilst spread betting positions are based on ‘points’ movement.

What Assets Can You Spread Bet in the UK?

The great thing about spread betting in the UK is participants can speculate on thousands of different markets. These include:

- Stocks

- ETFs

- Indices

- Currencies (FX)

- Commodities

- Bonds

Each platform will have its own asset selection, so some may not offer specific asset classes. Notably, cryptocurrency derivatives are banned in the UK – so those looking to buy Bitcoin (or other cryptos) using a spread betting platform will not be able to do so.

Benefits of Spread Betting

Spread betting has an array of benefits when compared to ‘traditional’ investing. Detailed below are three of the most prominent:

Tax-Free Profits

Naturally, the UK spread betting tax rules make this strategy appealing to traders and investors. Since the basic rate of Capital Gains Tax (CGT) in the UK can be up to 20%, depending on the trader’s income level, spread betting can be an effective way to retain a more significant share of any accrued profits.

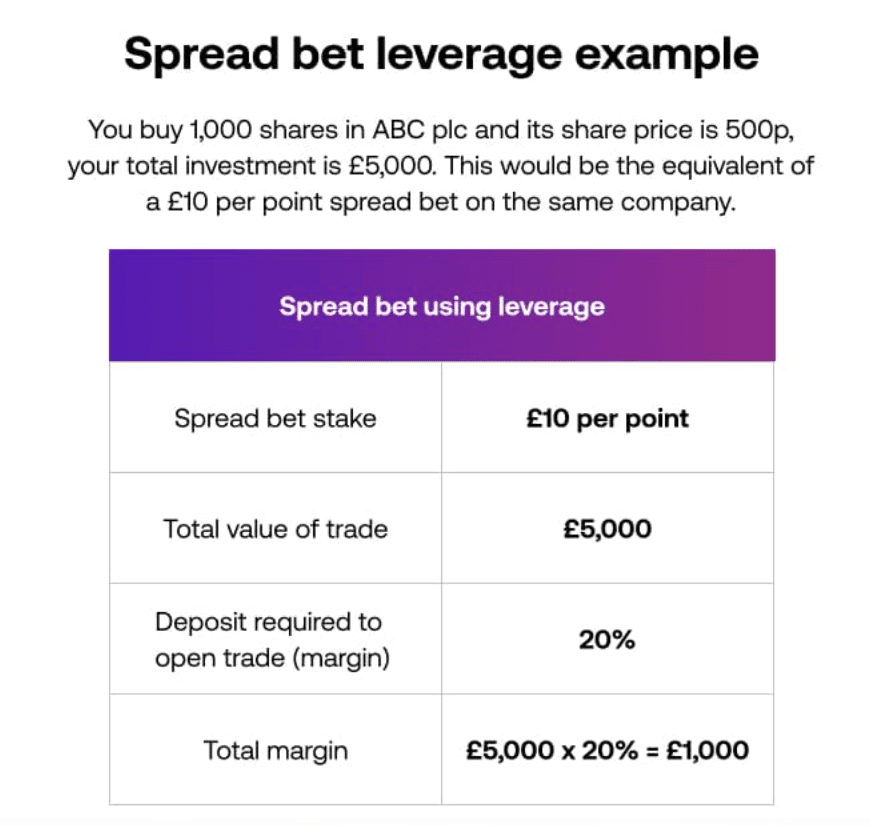

Can Employ Leverage

Another significant benefit of spread betting is that traders can employ leverage, magnifying potential winnings (and losses). Maximum leverage ratios will vary depending on the asset but tend to be up to 30:1 for FX traders and 5:1 for stock trades.

Cost-Effective Form of Trading

Finally, spread betting tends to be commission-free since most platforms only make their ‘cut’ through the bid/ask spread. Due to this, spread betting can be a cost-effective way to speculate on an asset’s price movements – which is magnified even further when the tax benefits are considered.

Tax on Spread Betting UK

The UK spread betting tax rules are very different to ‘traditional’ investing. The critical thing to remember is that spread betting is not taxable in the UK. This means that positions are free from Capital Gains Tax (CGT) and Stamp Duty.

Essentially this means that those making profits through spread betting do not need to report them to HMRC. However, gains are only tax-free if spread betting is not the participant’s primary source of income. As always, tax rules are subject to change, so it’s wise to review them regularly.

Best Forex Signals UK

Our recommended forex signals provider is Learn2Trade – one of the leading financial education companies in the trading space. Learn2Trade has a community of over 70,000 active traders, offering up to five trading signals every day. These signals contain the asset to be traded, the trade’s direction, and an entry/exit point.

Trade ideas arrive in real-time through Telegram, meaning traders can act immediately. Not only this, but the Learn2Trade team also provide daily technical analysis and trading tips to boost traders’ effectiveness in the market.

A subscription to Learn2Trade’s forex signals costs just £40 per month; however, if a 6-month subscription is purchased, the monthly price equates to just £21.50. Finally, Learn2Trade even offers a free forex signals Telegram group, which provides three signals per week, with a success rate of over 75%.

Your capital is at risk. There is no guarantee that you will make money when using this signal provider.

Best Spread Betting Brokers – Conclusion

This guide has presented a detailed overview of the best spread betting platforms in the UK before showcasing how to begin spread betting with a top broker today.

Those looking to find the best broker for spread betting should look no further than SpreadEx, as this platform charges no commissions and offers extremely tight spreads.

Your capital is at risk.