Crypto staking allows you to earn rewards on your digital assets without having to cash out. In layman’s terms, you can put your idle cryptocurrencies to work and generate a passive income stream while still maintaining ownership of your coins.

This guide explores the 18 best staking coins for 2023. We also discuss the concept of staking in detail and list the top platforms in the market right now for this purpose.

Best Staking Coins for 2023

There are dozens of cryptocurrencies that you can utilize to earn staking rewards.

After considering the interest rates and market conditions on offer, we found that the best staking coins this year are those listed below.

- Meta Masters Guild – Overall Best Staking Coin to Offer High P2E Rewards

- Fight Out – Emerging M2E Crypto With Membership Rewards For Staking

- C+Charge – Popular Green Crypto Coin With Long-Term Staking Benefits

- RobotEra – New Token with Staking Benefits and P2E Rewards

- Calvaria – P2E and F2P Gaming Ecosystem with Token Staking

- Battle Infinity – Staking Coin for the Metaverse

- DeFi Coin – Emerging Staking Coin Offering High Returns

- Lucky Block – Staking Crypto with Daily Rewards

- Quint – Coin Offering Real-World Staking Rewards Alongside Interest

- Ethereum – Staking Coin for Long-Term Investors

- Cardano – Sustainable Staking Coin with High Rewards

- Uniswap – Decentralized Staking Coin For Market-leading Returns

- Solana – Staking Coin with Long-Term Growth Prospects

- Polkadot – Staking Coin Using NPoS Algorithm

- Polygon – Popular Staking Coin for High APY

- Algorand – Staking Coin for PPoS Mechanisms

- Chainlink – Popular Staking Coin to Invest Blockchain Interoperability

- The Graph – Staking Coin with High Growth Potential

As you read on, you will find out why these particular digital assets made our list of top staking coins. Moreover, you’ll have a clearer idea on how to make money with cryptocurrency passively via staking.

We will also show you how you can buy cryptocurrency to stake while paying low fees.

A Closer Look at the Best Staking Tokens

From an investment perspective, the best crypto staking coins are those that offer a high yield. That said, how much you earn will depend on factors such as your chosen platform as well as the staking period.

With this in mind, below we analyze the best staking coins for 2023.

1. Meta Masters Guild – Overall Best Staking Coin to Offer High P2E Rewards

MMG has garnered significant investment through its successful funding drive, surpassing the $2 million USDT goal.

Right now, individuals can purchase $MEMAG tokens at a reduced rate of $0.016 USDT, but this rate will soon rise to $0.019 USDT in the upcoming presale stage.

With its all-in-one platform, MEMAG offers a multitude of features, including the option to stake, trade NFTs in its digital marketplace, earn in-game currency called Gems, and enjoy extra benefits.

By breaking down barriers in the Play-to-Earn industry, the platform allows users to acquire exclusive NFTs and integrate them into their digital wallets, transforming how people engage with their games.

MMG has introduced Gems, an in-game currency, to motivate players to participate in the platform’s games and earn more. Players can accumulate Gems by taking part in various games and swapping them for $MEMAG.

MMG aims to expand its footprint in the gaming world by partnering with leading game developers, as stated in its litepaper. The platform has integrated $MEMAG into its games to incentivize players and drive the adoption of the tokens.

$MEMAG Tokenomics

The $MEMAG token operates on the well-established Ethereum ERC-20 protocol with a fixed supply of 1 billion, out of which 350 million was available during the presale.

Stay informed about MMG by joining its Telegram community for the latest updates and information.

Presale Start Date

11 January

Purchase Methods

ETH, USDT, Transak

Chain

Ethereum

Min Investment

1000 $MEMAG

Max Investment

None

2. Fight Out – Emerging M2E Crypto With Membership Rewards For Staking

With its successful pre-sale rounds, Fight Out has raised over $3.6 million USDT and is scheduled to debut its IEO on April 5th through a centralized exchange. The launch of Fight Out is expected to significantly boost the value of $FGHT, reaching a price of $0.033 USDT.

Ahead of the official launch, buyers can purchase $FGHT tokens at a discounted rate of $0.01825 USDT per token.

Joining Fight Out as a staking member provides a host of perks, including gym membership, complimentary merchandise, and one-of-a-kind fighter NFTs.

The M2E app uses REPS to incentivize users and encourage continued engagement by earning the currency through fitness activities. Users are incentivized to participate in workouts and challenges by the prospect of earning REPS, which can then be redeemed for premium membership perks and NFTs.

Fight Out offers a cutting-edge, immersive experience by enabling users to craft custom-made NFT Avatars reflecting their fitness advancement. This feature provides users with a clear and personal view of their fitness journey, inspiring them to reach their goals.

With confirmed partnerships with famous MMA athletes such as Amanda Ribas and Taila Santos, Fight Out has gained a strong reputation among fitness enthusiasts. These relationships with top UFC stars enhance Fight Out’s dominance in the M2E sector.

The project’s whitepaper thoroughly examines its offerings, giving users a comprehensive understanding of what Fight Out offers.

$FGHT Purchase Bonuses & Tokenomics

The Fight Out project’s $FGHT digital token runs on Ethereum and uses the ERC-20 protocol. In the pre-sale stage, 45% of the total 10 billion token supply is open for investment.

$FGHT tokens grant users participation in platform tournaments and offer a 25% increase in REPS purchases.

To encourage early investment in $FGHT tokens, Fight Out provides a starting bonus of 10% for purchases of $500, which vests over a six-month period.

Keep up with the latest news by joining Fight Out’s Telegram group, which is open to prospective buyers.

Presale Started

14 December 2022

Purchase Methods

ETH, USDT

Chain

Ethereum

Min Investment

None

Max Investment

None

3. C+Charge – Popular Green Crypto Coin With Long-Term Staking Benefits

The project has already attracted substantial investment during its presale, totaling nearly $460,000 USDT.

Early adopters can purchase $CCHG tokens at a discounted rate of $0.013 USDT before the price is expected to increase to $0.0165 USDT in the next presale.

The platform’s cutting-edge technology lets EV owners charge their vehicles while positively impacting the environment through its incentivized program. By using $CCHG tokens for charging payments, EV drivers receive carbon credits which they can accumulate in their digital wallets.

The C+Charge app enhances the charging experience, offering real-time carbon credit tracking, accurate charging station information, clear pricing, convenient payment options, and charging station suggestions.

Its geolocation feature makes locating the nearest charging stations a quick and easy task for EV owners.

The extensive C+Charge whitepaper expands on the platform’s groundbreaking features, including its innovative sustainable reward program.

$CCHG Tokenomics

The exclusive $CCHG token of the C+Charge platform runs on the Binance Smart Chain and is limited to 1 billion units. During the project’s presale, 40% of the total $CCHG tokens will be offered for sale.

The $CCHG tokens are distinctive for their “burning” mechanism, which reduces the supply and increases the token’s value for EV owners each time it is used for charging payments.

Stay up-to-date with the latest developments by joining the C+Charge Telegram Community.

Presale Started

16 December

Purchase Methods

ETH, USDT, Transak

Chain

Binance

Min Investment

None

Max Investment

None

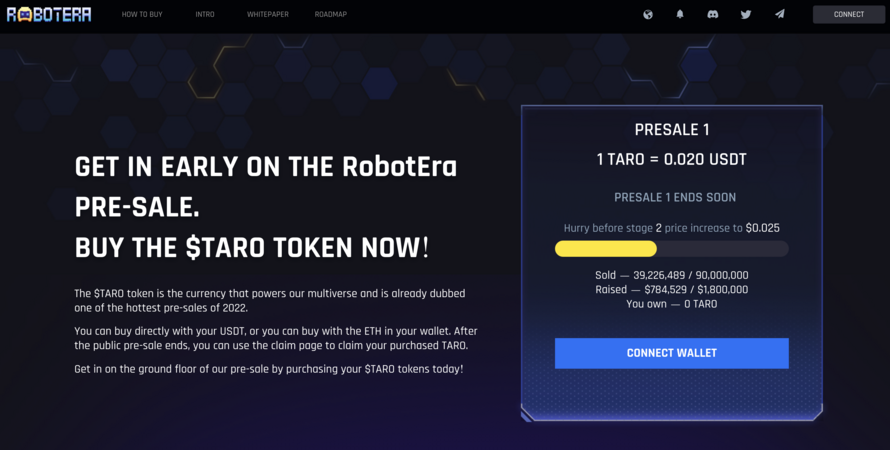

4. RobotEra – New Token with Staking Benefits and P2E Rewards

RobotEra

The project is offering multiple use cases such as voting rights to govern the platform, metaverse land and NFT building and trading and more – RobotEra has just launched its token presale with TARO currently on sale for $0.02.

TARO is currently being distributed via a three-stage presale round – where 270 million coins will be allocated in an effort to raise $6.93 million – with tokens to rise in price to $0.025 in round 2 and $0.032 in round 3.

Built on the Ethereum blockchain, TARO is an ERC-20 token that demonstrates various staking capabilities – for instance, investors can earn passive income by staking TARO to potentially earn a high APY (Annual Percentage Yield).

RobotEra, which is an LBank Labs project, also allows its users to stake TARO to gain access to the decentralized autonomous organization (DAO), with the RobotEra DAO allowing users to make important decisions to decide the future of the platform.

On the metaverse itself, RobotEra allows players to take the form of Robots – which are NFT-minted characters that can buy, trade, create and explore the virtual ecosystem known as the ‘Taro Planet’ and has been named our best crypto game.

With TARO, players can access the marketplace and buy metaverse plots of land that can be monetized through building infrastructure, charging admission on tickets to events and selling billboard space to advertisers.

Players can also upgrade and customize robot companion NFTs, which can then be sold on the open market, or mine the land for resources and minerals.

No coding knowledge will be needed to play the game or build on Taro, with RobotEra featuring custom in-game building tools.

In fact, RobotEra’s founders – who are doxxed and KYC-verified – also believe that new use cases and revenue generation streams will be developed over time, with few limitations put on what can be built and players free to shape the world how they see fit.

Looking to buy TARO and join this upcoming ecosystem? The TARO token presale is currently in stage one with the prices to increase by 60% from current levels by the final stage.

Read the RobotEra whitepaper and join this project’s Telegram to learn more.

| Presale Started | Q4 2022 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | 1,000 TARO |

| Max Investment | N/A |

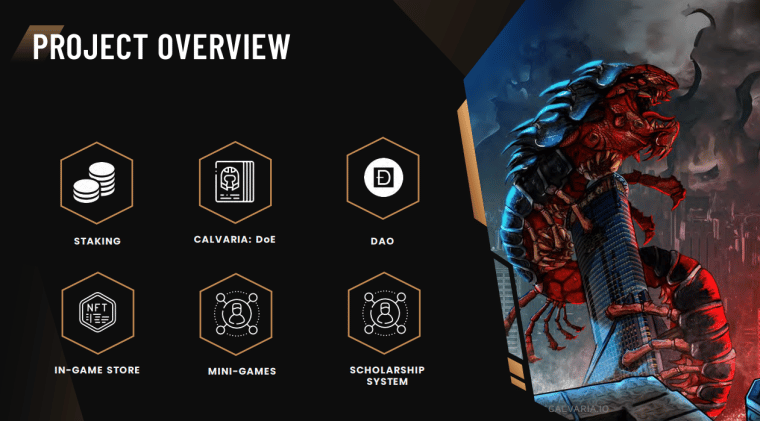

5. Calvaria – P2E and F2P Gaming Ecosystem with Token Staking

Currently, the platform’s presale stages are over as it braces for its upcoming IEO in early Feburuary.

While GameFi and play-to-earn projects saw mass investment in 2022, the 2023 bear run has seen top projects lose huge amounts of investment as well as its player base. While games such as Axie Infinity boasted peak player numbers of nearly 3 million at the end of 2021, that is down to around 150,000 in the last 30 days.

Projects such as The Sandbox and Decentraland have seen huge investment – with market caps nearly worth $1 billion each – but have been dubbed ’empty metaverses’ with just 20,000 combined players in October.

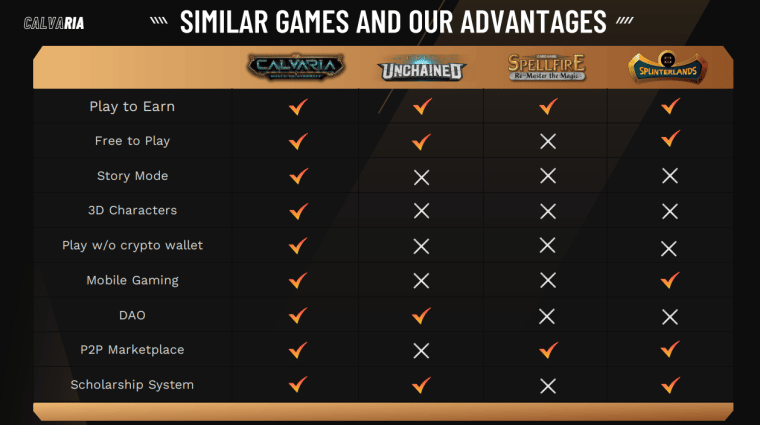

Calvaria has set out to solve two major issues of the GameFi sector – prohibitive costs and a lack of blockchain knowledge – and believes their project will see more adoption from traditional and casual gamers. They will do that by offering Duels of Eternity in two versions – play-to-earn (P2E) and free-to-play (F2P).

The F2P will be the exact same game as the P2E version, without the rewards, with Calvaria believing the strength of the game will entice players onto the blockchain – it will feature a visible tracker to show how much a player could have earned in the P2E version, as well as gamified quests that teach players about the blockchain while offering rewards.

Duels of Eternity is a card-battle strategy game, available on mobile and in 3D, set in the afterlife and features three warring factions which have differing traits and strengths. Players stack their decks and use their knowledge, skill and other assets to win matches, while the game also features a single-player campaign mode.

Cards and assets are fully ownable and tradeable as NFTs, while Calvaria features two tokens – RIA for staking and governance in the DAO and eRIA for rewards.

For more information read the Calvaria whitepaper or join the Telegram group.

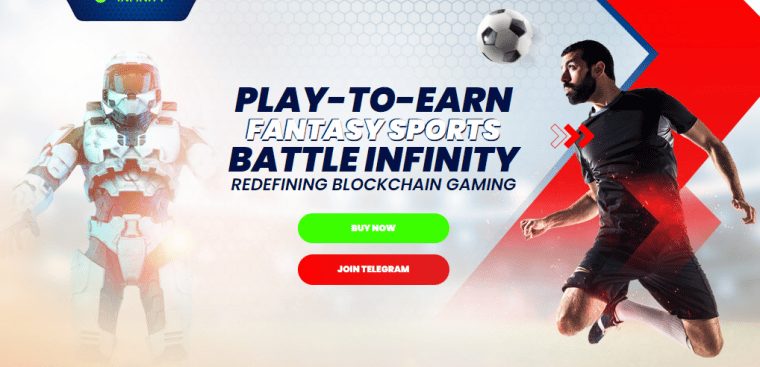

6. Battle Infinity – Staking Coin for the Metaverse

Battle Infinity is a decentralised platform, that leverages blockchain technology in the gaming world by creating multiple play-to-earn protocols and features.

The main project of Battle Infinity is the Battle Arena – a metaverse platform where users can participate and stand a chance to earn rewards on 6 different P2E games. Since GameFi and metaverse-based products promote monetization among customers, Battle Infinity’s ecosystem runs with IBAT – the utility token.

IBAT is built on Binance Smart Chain (BSC) and operate as a BEP – 20 protocol. IBAT tokens can be used to earn rewards on various P2E platforms, such as IBAT Premier League – a sports-fantasy league. IBAT also can be exchanges on a Battle Swap DEX with other popular cryptos. However, the IBAT Battle Stake is an exciting feature for users interested in staking tokens for rewards.

Battle Stake is Battle Infinity’s staking platform, allowing users to lock their IBAT tokens in exchange for interests. For example, the solo staking feature lets users directly stake IBAT and earn a potentially high APY at the end of the lock-up period. There are also duo staking features for users to stake IBAT against another crypto as a pair and earn interest on the investment.

With a large percentage of the circulating supply locked up in staking, the IBAT token price could rise in value as selling pressure will be minimal.

Interested stakers can stay up to date on the platform’s developments by accessing the Battle Infinity Telegram Group.

Cryptoassets are a highly volatile unregulated investment product.

7. DeFi Coin – Emerging Staking Coin Offering High Returns

DeFi Coin is the official token of the DeFi Swap decentralized exchange. It’s one of the top coins for staking in 2023 in large part because it offers outstanding rewards. You can earn up to 75% APY for staking DeFi Coin.

The DeFi swap platform currently offers 4 staking terms for DeFi Coin: 30 days, 90 days, 180 days, or 365 days. Interest for a 30-day staking period starts at 30% APY, while the maximum rate of 75% APY requires locking up your tokens for an entire year.

That’s in line with the long-term approach taken throughout DeFi Swap’s platform. Users are encouraged to hold the coin thanks to the platform’s 10% fee for selling. Those fees are returned as rewards to DeFi Coin holders, making the coin even better for earning yield.

DeFi Coin has seen a dramatic rise in price since the DeFi Swap exchange launched. Prior to the launch, the coin was trading below $0.10 per token. Since the launch, it’s jumped nearly 500% to $0.49 per token. Where DeFi Coin goes from here may depend on how widely the DeFi Swap exchange is adopted by users.

Cryptoassets are a highly volatile unregulated investment product.

8. Lucky Block – Staking Crypto with Daily Rewards

Lucky Block is a relatively new addition to the cryptocurrency market. While it’s not strictly a staking coin, it is an interest-bearing coin, so it serves essentially the same purpose in that sense. The more Lucky Block tokens you hold, the better your chances are to win and earn greater rewards.

Lucky Block operates via smart contracts, which in turn guarantees randomness, credibility, and transparency to the lottery games it offers. Moreover, payouts are also processed in this manner, to ensure that there is no room for error. Given its scope in the online gaming sector, Lucky Block is expected to perform exceptionally well in the lottery sector.

Lucky Block was launched in early 2022 and has already seen its price go up by over 6,000%. The coin runs on the Binance Smart Chain and trades on the Pancakeswap DEX. You can provide liquidity to the LBLOCK/WBNB pool and earn 19% APR.

But built into the platform is a token distribution feature open to all token owners in which a 10% share of the daily lotteries is divided among them. To receive the reward LBLOCK holders need to connect to the app daily to make their claim.

Jackpots are funded by ticket sales and a 12% tax on sales of LBLOCK on DEXs. As per a press release, Lucky Block estimates that this yield to be as high as 19.2% per annum for those who hold $1,000 worth of LBLOCK tokens for at least a year , which makes it one of the best interest-bearing coins to consider, even though it is not strictly a staking coin.

All in all, the digital asset is still in its early stages and has plenty of upside potential.

A word of warning: look out for scammers claiming to be operating Lucky Block staking schemes as there is no traditional staking scheme at this time

Cryptoassets are a highly volatile unregulated investment product.

9. Quint – Staking Coin Offering Real-World Rewards Alongside Interest

The first set of pools are Luxury Raffle Pools. When users stake QUINT tokens to these pools, they are entered into drawings for pricey luxury goods. Raffle prizes can include luxury hotel stays, travel packages, expensive cars, and more.

The second set of pools are Quintessential Pools. These offer guaranteed rewards in the form of airdropped NFTs. The NFTs offer access to complimentary hotel stays, airline tickets, supercar experiences, and much more. The rewards in the Quintessential Pools rotate, but token holders can always expect something luxurious.

In addition to the QUINT token and staking pools, Quint offers a set of custom NFTs. Holding either QUINT tokens or NFTs gives users access to the platform’s exclusive Metaverse Arts Club. This is a social club where users can find like-minded token holders who enjoy a lifestyle of luxury.

Quint is currently available through the Pancakeswap decentralized crypto exchange in exchange for BNB. The coin comes with a 10% transaction fee, which may seem high. However, funds from the transaction fee are being used to develop a play-to-earn crypto game on Quint’s platform, which will be available to Quint token holders in the future.

Cryptoassets are a highly volatile unregulated investment product.

10. Ethereum – Staking Coin for Long-Term Investors

The Ethereum ecosystem continues to grow by leaps and bounds, attracting both developers and investors. However, the world’s second-largest cryptocurrency initially deployed a proof-of-work consensus. This meant that in order to validate any transactions, computers had to perform complex tasks which demanded enormous energy as well as time.

However, as per a recent major development upgrade called the Merge, Ethereum has shifted to the PoS mechanism and thus – is now one of the best staking tokens to consider for generating passive income.

That said, in order to start staking Ethereum by yourself, the requirements are somewhat high – not least because you will need to put up at least 32 ETH coins.

The easiest alternative to this would be to hold your Ethereum coins in a staking pool. In simple terms, this means that you lend your tokens for other validators to use. This way, you do not have to commit such a huge amount of ETH. In terms of the payouts, this will ultimately depend on the staking platform you choose and for how long you lock in your coins.

Cryptoassets are a highly volatile unregulated investment product.

11. Cardano – Sustainable Staking Coin with High Rewards

Cardano is one of the best-known proof-of-stake (PoS) cryptocurrencies of today, with a focus on scalability and sustainability.

The network attempts to solve the energy usage issues involved in mining Bitcoin, thus tagging itself as an eco-friendly crypto when compared to other digital assets.

Since hitting the crypto markets, this digital asset has performed exceptionally well – translating to gains of over 4,500% in value. Moreover, with the network launching its own smart contract facility, Cardano is well-positioned to witness further growth in the future.

Due to its popularity, you will find that several staking platforms list Cardano – such as the likes of Crypto.com and eToro. That being said, for the very same reason, you might find that the interest offered varies widely, from one provider to another.

There are also many providers that allow you to earn interest on Cardano – through crypto lending, an alternative method to staking.

Cryptoassets are a highly volatile unregulated investment product.

12. Uniswap – Decentralized Staking Coin For Market-leading Returns

If you are looking at the best DeFi coins for staking, then Uniswap is a worthy candidate to consider. In fact, Uniswap accounts for around 25% of daily transactions on the Ethereum network. With its latest version Uniswap V3, the protocol has managed to reduce its transaction fees even further, making it one of the top cryptocurrencies to purchase in 2023.

When it comes to staking, Uniswap is highly preferred by passive crypto investors. Not only that, based on its potential, Uniswap is considered one of the most undervalued cryptocurrencies of 2023. By investing in Uniswap, you might benefit from the rising value of UNI coins and will also be able to participate in the decisions on how the network operates.

If you already own UNI coins, you can stake them on Uniswap’s liquidity pools, or earn rewards by depositing your tokens on a platform such as Crypto.com. While staking on the Uniswap network requires you to lock in your assets, third-party providers allow you to withdraw your UNI tokens whenever needed.

Cryptoassets are a highly volatile unregulated investment product.

13. Solana – Staking Coin with Long-Term Growth Prospects

Solana is yet another DeFi token that was designed with scalability in mind. The blockchain facilitates quick transactions and low fees – which subsequently boosted its market performance in 2021. The price of Solana went from around $18 to over $100 in the course of just one year.

Although the value of Solana has dropped since the beginning of 2023, the coin continues to hold its momentum among developers. When you stake this crypto asset, you can expect annual returns in the range of 7 to 11%, depending on the platform you choose.

You can either more your Solana tokens to a wallet that supports staking or deposit your coins to a crypto interest account – such as those offered by Crypto.com. To get started, you can buy Solana from a user-friendly broker like eToro.

Cryptoassets are a highly volatile unregulated investment product.

14. Polkadot – Staking Coin with NPoS Algorithm

Unlike the conventional PoS consensus, Polkadot is built on a nominated proof-of-stake mechanism. In this system, nominators back multiple validators as a show of faith of their behaviour. And as such, if you choose a malicious validator, you are likely to incur a loss.

However, since being a delegator for Polkadot is cumbersome and comes with unfavourable requirements, many investors choose to be nominators or deposit their assets into staking pools. On top of this, Polkadot also pays out attractive token rewards. This is because the rewards are offered in proportion to the work and not to the size of the stake.

On platforms such as Crypto.com, you will be able to obtain an APY as high as 14.5% on Polkadot. In terms of prospective capital gains, Polkadot seems to have strong growth potential because it allows developers to link blockchains and even create new protocols.

Cryptoassets are a highly volatile unregulated investment product.

15. Polygon – Popular Staking Coin for High APY

Polygon is a cryptocurrency that was developed as a means to add scalability to Ethereum. This blockchain provides compatibility for Ethereum-based applications, facilitating interconnectivity. This also makes this digital coin a good option for long-term investment. This year was a good time to earn interest on MATIC, as over the past year Polygon has witnessed a token price increase of over 350%.

Polygon is also one of the best staking coins to be preferred by validators. It only requires one MATIC token to take part in the network and a minimum of two to start staking. If you do not want to become a validator yourself, you can also use platforms such as Crypto.com to generate attractive returns on Polygon.

At the time of writing, Crypto.com offers a high APY of 10% for those holding Polygon tokens for three months. This will, of course, vary depending on the lock-in period and whether or not you decide to stake CRO tokens – which is native to Crypto.com.

Cryptoassets are a highly volatile unregulated investment product.

16. Algorand – Staking Coin for PPoS Mechanism Systems

The majority of the best staking coins we have discussed so far follow a conventional PoS consensus. However, Algorand goes one step further to follow a Pure PoS system that makes this protocol even more efficient. As a result, the Algorand blockchain does not fork but can still facilitate instant transactions.

ALGO is deemed one of the top staking coins because the protocol has very minimal requirements for validators. In fact, unlike its Ethereum counterpart, you only need one ALGO token to start staking. This means that you will find several staking pools for this asset, however, it can also be tricky for platforms to offer high APYs.

Nevertheless, your total returns will ultimately depend on the staking platform you choose. If you buy Algorand and hold the tokens in an interest-earning account, you can expect to make annual returns in the range of 3-10% of your total investment.

Cryptoassets are a highly volatile unregulated investment product.

17. Chainlink – Popular Staking Coin to Invest in Bliockchain Interoperability

Chainlink is considered one of the best cryptocurrencies to invest in right now. It serves as a link between blockchains and real-world data. Among other oracle systems out there, Chainlink appears to be the most advanced since it offers a plethora of integrations and partnerships.

Although staking is yet to be supported within the Chainlink Network itself, you can deposit this cryptocurrency into third-party platforms to generate income on your tokens.

If you choose to buy Chainlink and hold the coins for the long-term while waiting for capital appreciation, you can invest your assets in a crypto interest account and earn up to 9% APY – depending on your chosen platform.

Cryptoassets are a highly volatile unregulated investment product.

18. The Graph – Staking Coin with High Growth Potential

The Graph is an up-and-coming cryptocurrency that aims to create an index system for blockchains. This will make the data available on blockchains easier to access. Moreover, it will also help blockchains be more efficient by moving any unnecessary data to an off-chain protocol.

As is evident, The Graph has sufficient opportunities to rise in value, especially in the long term. The digital coin was released towards the end of 2021 and is still finding its way to popular cryptocurrency exchanges. However, you will still be able to buy The Graph at low fees via the eToro platform.

Since this blockchain leverages the PoS mechanism, this coin can also be staked at a number of prominent platforms – some of which offer double-digit APYs on GRT tokens.

Cryptoassets are a highly volatile unregulated investment product.

Where to Stake Coins

There are dozens of platforms that allow you to generate a passive income on the top staking coins discussed above.

To get the ball rolling, you can consider the three top crypto staking platforms reviewed below. These are not only user-friendly but also let you buy and stake cryptocurrencies at low fees.

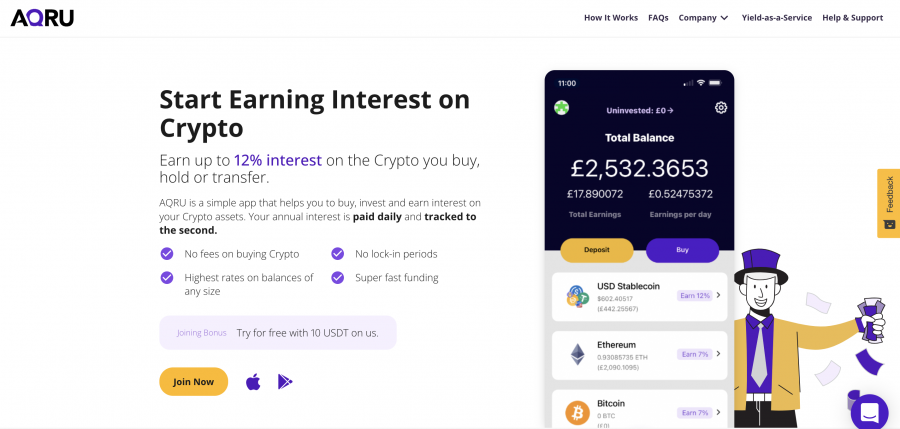

1. AQRU – Overall Best Crypto Staking Platform

If you are a newcomer to the concept of cryptocurrency staking, then AQRU will likely catch your attention with its simple and straightforward interface. This popular crypto lending platform presents you with a user-friendly means to start earning passive income on your digital assets.

This is without having to understand the technicalities or navigate through complex jargon. AQRU is also available in the form of a mobile crypto app, making it easy for you to buy and stake crypto on the go. AQRU lets you earn an APY of 7% on Ethereum, which is one of the best staking tokens that we discussed in this guide.

On top of this, the platform also supports crypto interest accounts, offering the same APY. Furthermore, you will be able to attain up to 12% per year on stablecoins such as Tether, USD Coin, and Dai. It goes without saying that the rates on offer are highly competitive.

AQRU is able to offer a high yield to its users by lending your digital assets to borrowers, however, only after conducting a thorough audit of their resources and assets. You will be able to track your earnings directly from your AQRU dashboard and collect payouts on a daily basis.

When it comes to making a withdrawal, you even have the option to choose between cryptocurrency or fiat money. The best part is that there is no lock-in period involved with AQRU. This means that you can withdraw your digital coins whenever you want.

However, you need to make note of a few conditions. First and foremost, you will need to deposit a minimum of $100 to open an account. Second, although there are no deposit fees charged, you will be liable to pay the equivalent of $20 when withdrawing your money. Moreover, the main drawback is that the platform supports only five digital assets at the time of writing.

| Available Staking Coins | Bitcoin, Ethereum, Tether, USD Coin, and Dai |

| Staking Rewards on Cryptocurrencies | BTC and ETH – 7%

Stablecoins (USDT, USDC, DAI) – 12% |

| Min & Max Staking Amounts | $100 (or equivalent) minimum; no maximum |

| Lock-In Period | Flexible withdrawals |

| Payout Frequency | Daily |

Pros:

Cons

Join AQRU Now

Cryptoassets are a highly volatile unregulated investment product. It is particularly user-friendly and lets you buy all of the best staking coins that we discussed in this guide. When it comes to staking, eToro offers support for three digital assets as of writing – which includes Cardano, Ethereum, and Tron. The interest rates you receive depend on the eToro Club you belong to, which is determined by your realized equity on the platform. For instance, Diamond and Platinum+ members are eligible to earn 90% of the monthly staking yield, whereas Silver, Gold, and Platinum users receive 85%. All eToro users are Bronze members by default and will gain 75% of the monthly yield in return. As you can see, eToro offers some of the highest rewards when it comes to staking. Although supported staking coins are limited right now, you can use this platform to buy dozens of digital currencies. Moreover, eToro comes with an in-built wallet that you can use to store your digital assets for free. When you want to sell your crypto investments, eToro makes facilitates this at super-low fees. To buy crypto, you can deposit funds into your eToro account using a bank transfer, credit/debit card, or e-wallet. Importantly, as long as you are funding your account in US dollars, eToro does not charge any deposit fees. Apart from cryptocurrencies, eToro is also a great broker to use to invest in stocks and ETFs, as well as trade commodities and forex. This platform further shines by offering a beginner-friendly mobile app. Pros: Cons

Cryptoassets are a highly volatile unregulated investment product. If you are looking to buy digital assets, Crypto.com facilitates payments via its app. You can pay for your digital assets with over 20 fiat currencies using your credit/debit card or by making a bank transfer. When it comes to its interest accounts, Crypto.com lets you earn rewards on 50 digital assets – which includes nine of the best staking coins listed in this guide. Once you deposit your tokens into these accounts, Crypto.com will use the funds to faciliate loans for other verified users. Borrowers will repay the loan with interest, which is paid out to you on a daily basis. Furthermore, Crypto.com compounds the interest, giving you the opportunity to boost your long-term gains. In terms of the rates on offer, this depends on the coin as well as the lock-in period you choose. For example, if you choose to buy Ethereum worth $1,000 and hold the tokens in an interest account for three months, you will receive an APY of 5.5%. On the other hand, if you hold Polkadot under the same conditions, you will receive 10%. Flexible plans are also available – however, these are likely to yield much lower interest rates. You can also boost your returns by holding CRO – which is the native digital token of Crypto.com. Pros: Cons

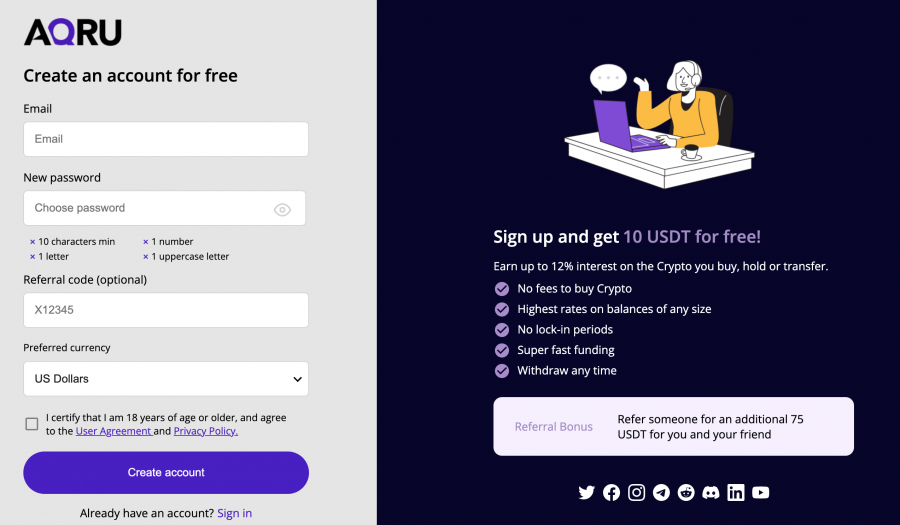

Cryptoassets are a highly volatile unregulated investment product. In simple terms, staking coins are cryptocurrencies that allow you to earn rewards for supporting the PoS process of the respective blockchain. You can do this by opening a node yourself, or by simply depositing your digital assets in a third-party platform that facilitates staking. By adopting this staking strategy for your idle cryptocurrencies, you will be able to earn interest instead of simply holding them in your wallet until you are ready to sell. Here is a quick example of how you can earn rewards via staking: Remember that the returns will be paid out in ETH tokens. On top of this, the value of Ethereum might also increase during the course of staking – which will yield additional gains. As you can see, staking can be an incredibly effortless way to generate passive income – especially when considering the high interest rates offered on crypto assets. If you have read our guide up to this point, you know that staking can indeed be very advantageous. To offer you some more clarity on the subject, below, we have rounded up the benefits of staking: In other words, when you stake cryptocurrencies, you will generate returns regardless of how the digital asset is performing in the market. Moreover, if you do not lock up your coins, you can retrieve them at any point and cash out at your convenience. When it comes to picking the right cryptocurrency to the stake, the decision is not entirely dependent on the APY you receive. If you are wondering which options represent the best staking coins for you, consider the following factors to arrive at your decision. Perhaps one of the first considerations to make is whether you will have to lock in your chosen staking coin for a certain period to receive rewards. As you can imagine, the ideal way would be to choose a flexible plan, which will give you access to your digital assets at all times. While fixed plans might present you with higher APYs, locking in your digital coins could prevent you from taking advantage of a sudden market opportunity. Cryptocurrencies that come with limited circulation might also encourage demand in the market. This can be a useful trait to look for in top staking coins, especially if the token has demonstrated an upside potential. This follows the basic concept of supply and demand. That is to say, when there is a limited number of digital tokens available, demand will potentially rise, which can drive up prices and thus – the staking rewards. Among the best staking coins we noted here, many digital assets, including Chainlink, Algorand, and Uniswap have a limited supply. As we mentioned earlier, you also stand to benefit if the value of your staking coin increases. And this means that you should do your due diligence to find out which cryptocurrencies have the possibility to grow in the future. If a particular digital coin has various applications in the real world, it might be well-positioned to gain more value in the coming years. And as such, the cryptocurrency will continue to attract both demand and rising prices. This way, even if the APY you receive is relatively low, you will still be able to generate profits from the capital appreciation when you are ready to cash out your investment, Although many cryptocurrency platforms offer support for the best staking coins, the processing of buying these digital assets can be challenging, especially for beginners. To help clear the mist, we are now going to walk you through the process of how to buy staking coins via the user-friendly platform AQRU. To begin earning interest on the best staking crypto at AQRU, you will first need to create an account with this platform. To do this, you can head over to the AQRU website and find the ‘Sign Up’ button. As you can see from the image above, you only need to provide your email address and choose a suitable password. You can then use the ‘Create Account’ button to move to the next step. As a licensed platform, AQRU takes the security of your assets seriously. This means that you will have to provide proof of identity before you can access the best crypto staking coins. While the process might seem complicated, it only means that you have to submit the following: AQRU has the entire process automated – so you should receive confirmation in a matter of minutes. Next up, you can add funds to your AQRU account. For this, you can deposit fiat money – such as US dollars, British pounds, or euros. The platform supports two fiat payment methods – bank transfers and credit/debit cards. Moreover, there are no fees charged when making a deposit. Alternatively. if you already own a supported digital asset, you can also perform a crypto transfer. As of writing, AQRU accepts deposits in Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC), and Dai (DAI). Once you have funded your account, you can buy the best staking tokens that you are interested in. AQRU displays the different investment options and the associated percentage of returns. Let’s suppose you want to buy Ethereum and earn returns on your ETH coins. You only have to choose Ethereum and specify the amount you want to invest. After you have confirmed the purchase, your AQRU dashboard will instantly start to show the interest you are earning – second by second. As you can see, AQRU lets you accumulate a passive income on the best staking coins with minimal effort from your end.

By staking your cryptocurrencies, you will earn passive returns without having to cash out your investments. To point you in the right direction, this guide has discussed the 18 best staking coins for 2023 – and which platforms to consider for this purpose. One of our best recommendations is Meta Masters Guild. The platform is the world’s first mobile focused gaming guild with exciting P2E and staking rewards for its players. Currently, buyers can grab the $MEMAG tokens for a presale rate of only $0.016 USDT. Meta Masters Guild - Next Big Crypto Game2. eToro – Best Crypto Staking Platform for Low Trading Fees

Available Staking Coins

Cardano, Tron, Ethereum

Staking Rewards on Cryptocurrencies

Starts at 75%. Varies depending on the eToro Club you belong to

Min & Max Staking Amounts

Investment should generate at least $1 of staking rewards

Lock-In Period

No lock-in period. Should hold an open position for at least nine days for Cardano, and seven days for Tron

Payout Frequency

Monthly

3. Crypto.com – Best Crypto Staking Platform for High-Interest Rates

Available Staking Coins

Earn rewards on 50+ different cryptocurrencies

Staking Rewards on Cryptocurrencies

Up to 14.5%. Depends on the digital coin, the lock-in period, and the CRO tokens you hold

Min & Max Staking Amounts

Minimum – depends on the coin. Maximum – equivalent of $500,000

Lock-In Period

1 month, 3 months, and flexible plans

Payout Frequency

Daily

What are Staking Coins?

Benefits of Staking Crypto

How to Choose the Best Staking Crypto for You

Lock-In Periods

Fixed Supply

Utility of the Coin

How to Buy Stake Coins on AQRU

Step 1: Create an Account

Step 2: Verify Identity

Step 3: Add Funds

Step 4: Access Staking Crypto Coins

Conclusion

Frequently Asked Questions on Crypto Staking Coins

What are the top staking coins?

What is the best coin to stake?

How profitable is crypto staking?

What coin is staked the most?

Which exchange is best for staking crypto?

Read more: