Looking to sign up with a stock app UK? Investors can use a stock app on their smartphone to trade stocks and other assets on the move. But which apps are the best? It all depends on what sort of trading the investor has in mind.

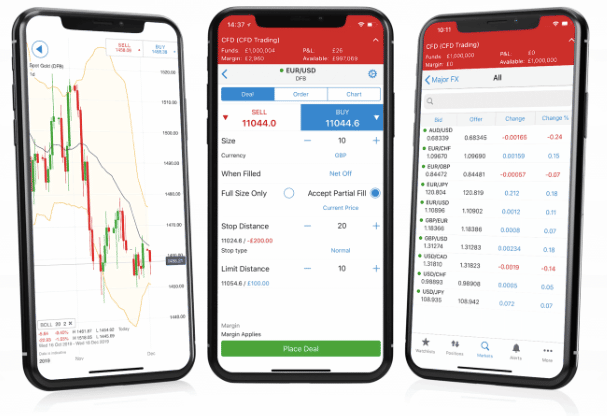

Below we review a wide selection of ten popular stock apps UK. All are accessible from the UK. Some focus on plain share trading, whilst others offer the powerful advantages of CFD (Contract-For-Difference) trading. Further, we outline what key metrics to look out for in a UK stock app, as well as show you how to get signed up and into action.

Popular Stock Apps for Beginners in 2023

Investors can use stock apps UK to buy shares from around the world – as well as to buy shares UK. Popular stock apps include:

- eToro: Overall Best Stock Apps Beginner-friendly broker with social trading and zero commission

- XTB: CFD stock broker with ‘Best Customer Service’ award

- AvaTrade – Stock Trading App offering low spreads and leverage trading

- Skilling – Popular CFD mobile app offering 50X leverage

- Vantage: CFD stock trading with multiple social trading options

- Libertex: Award-winning broker with streamlined share offering

- Pepperstone: CFD share trading with access to key trader platforms

- Plus500: UK-based provider of CFD share dealing with zero commission

- Hargreaves Lansdown: UK-based provider of funds and shares

- Freetrade: UK-based dedicated share trading app with 1m+ clients

- IG – Popular trading platform with over 12,000 stocks

78% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Most Popular Stock Trading Apps in the UK Reviewed

Where to buy the best shares in the UK? Investors can trade online via their desktop or laptop computer – or via a smartphone app. This has made investing much more accessible, with some investors looking for the best ways to invest £20k in the UK via a popular trading app.

Smartphone apps offer the prime advantage of portability. Investors with a stock app UK can keep an eye on exciting stocks as well as their own portfolio wherever they are in the world, as well as take decisive action to wisely invest during inflation.

Investors wanting to go short on a stock, for example, or leverage their trade for amplified gains may be interested in Contracts-For-Difference (CFDs). Many of the stock apps UK available nowadays offer CFDs only.

1. eToro – Overall Best Stock Apps Beginner-friendly broker with social trading and zero commission

eToro’s smartphone app is arguably a good stock trading app for beginners. Certainly Israel-based eToro have built up over 27m registered users through their provision of full-service brokerage and the promotion of social trading.

This share trading app UK offers 3,000+ stocks/ETFs, commodities, indices, forex and crypto. Critically, share trading is commission-free. So, if an investor wanted to buy Amazon stock, for example, only a spread fee will apply (0.3% variable in the case of Amazon). With most brokers, spread fees tend to vary according to liquidity.

eToro’s social trading centres on two tools:

- CopyTrader, which allows users to copy the trading activity of more experienced traders automatically using allocated funds.

- Smart Portfolios, which offer investment templates structured around particular themes or strategies.

Both social trading tools are available on the eToro app. Also included is the handy Watchlist function, which allows investors to keep an eye on interesting assets without buying them.

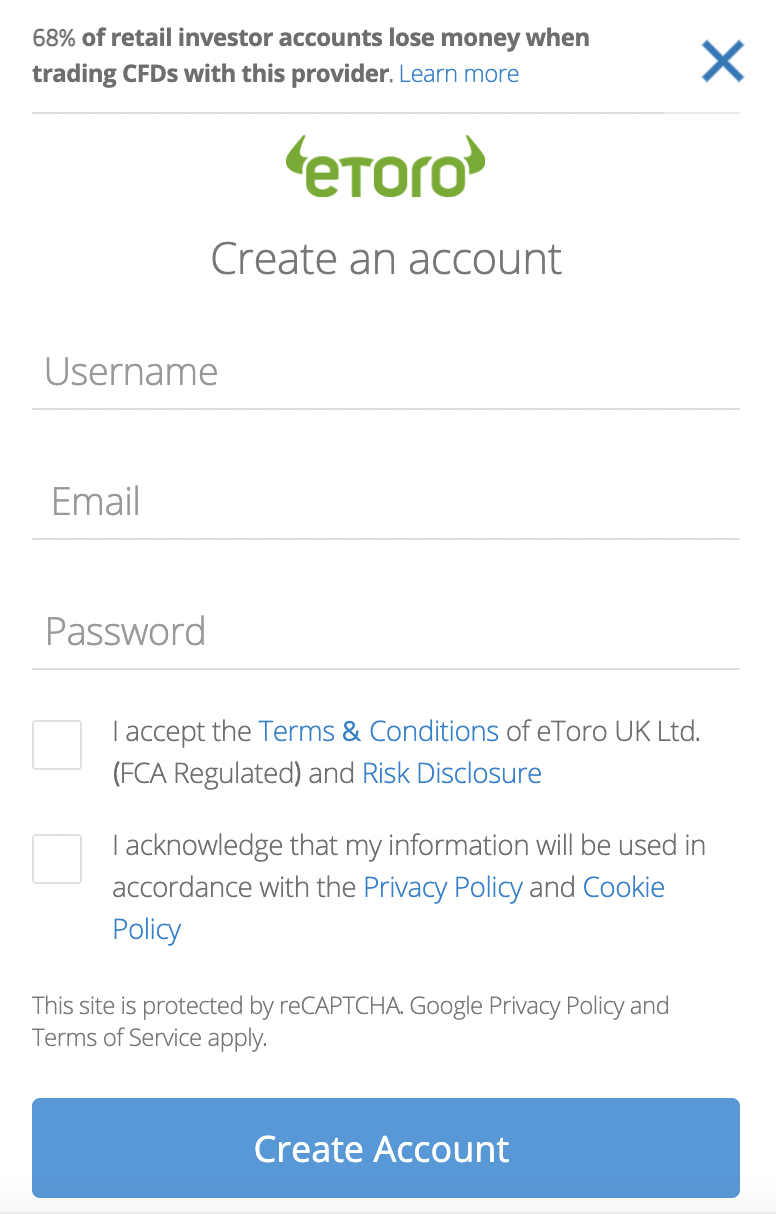

In common with the arrangements offered by other brokers, eToro users can sign up via desktop and then activate the smartphone app – or simply sign up using the app alone.

What We Like

- Regulated by the FCA, ASIC, and CySEC

- Social Trading: CopyTrader and Smart Portfolios

- 3,000+ stocks available commission-free

| Approx Number of Stocks: | 3,000+ |

| Pricing System: | Spread fee (plus overnight fees if CFD trading) |

| Cost of Buying Amazon: | Spread fee (variable) of 0.3% on trade |

| iOS and Android: | Both |

| App Same Functionality as Website: | All stocks available |

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

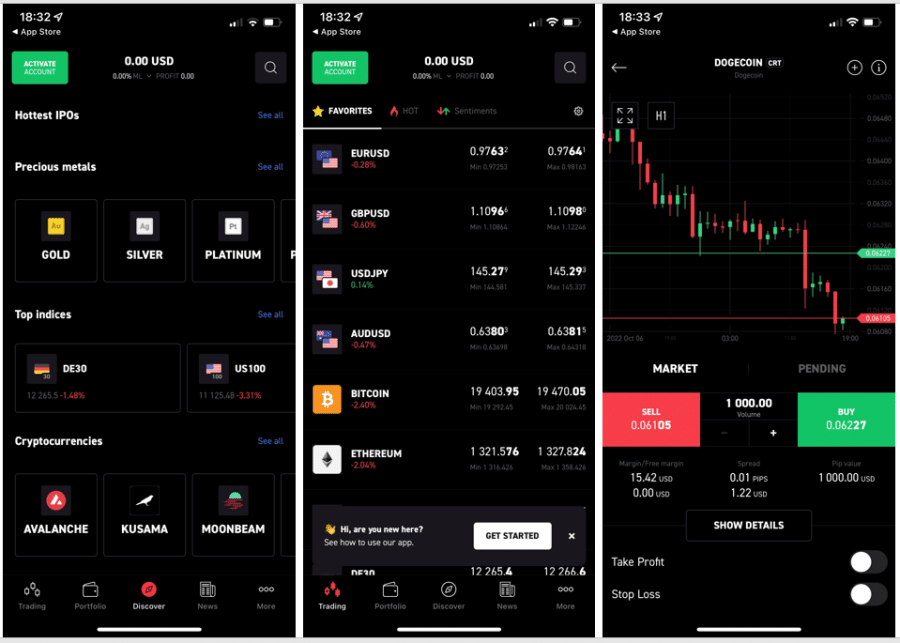

2. XTB - CFD Stock Broker with 'Best Customer Service' Award

XTB is a full-service broker serving 400,000 clients with almost 20 years experience. Although not headquartered in the UK, XTB has an office in London – as well as 13 other countries. Clients can invest in stocks available from international exchanges from many countries in the world.

Via both desktop and smartphone app, XTB offers forex, indice, commodities, crypto and CFD stocks. XTB won Best Customer Service from ForexBrokers.com in 2021

Like eToro, XTB provides a free demo account for stocks.

What We Like

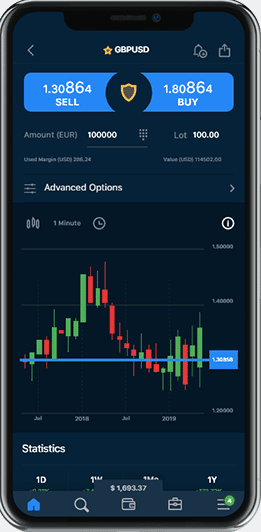

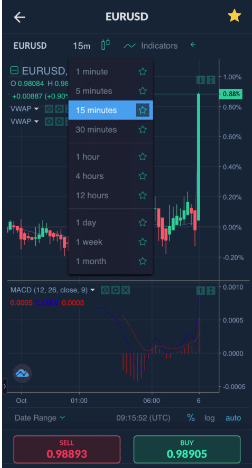

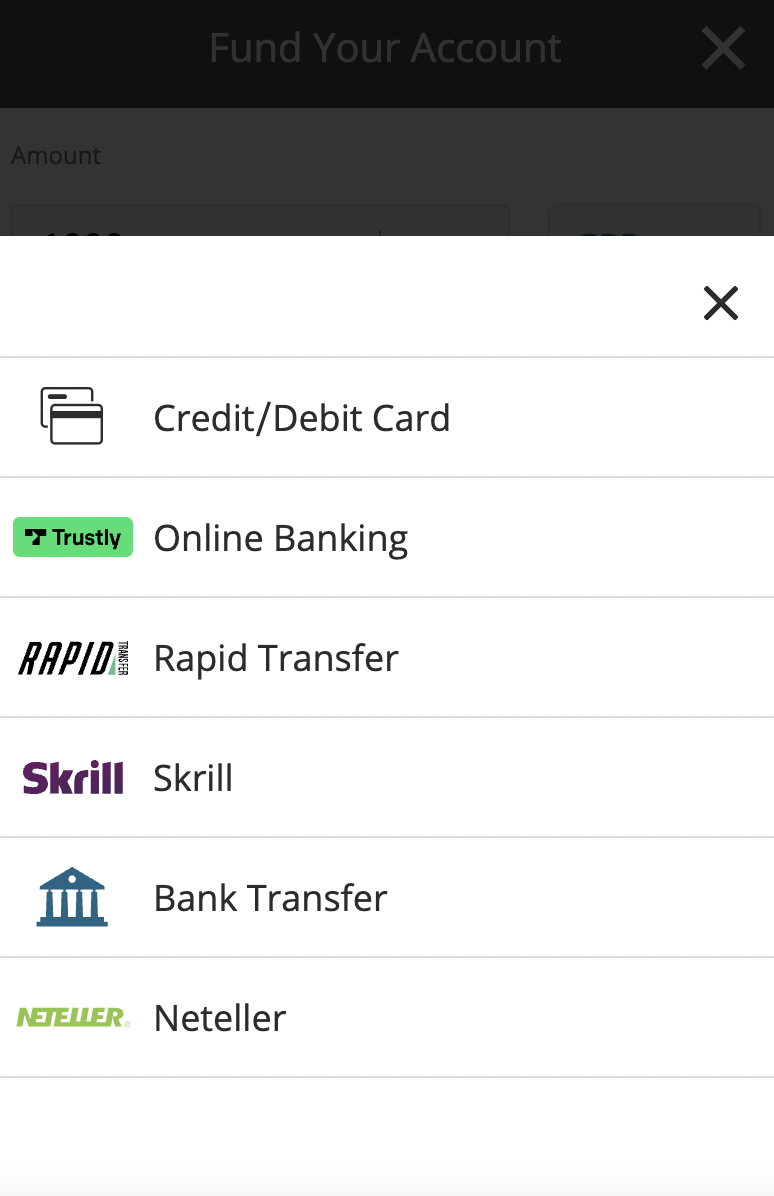

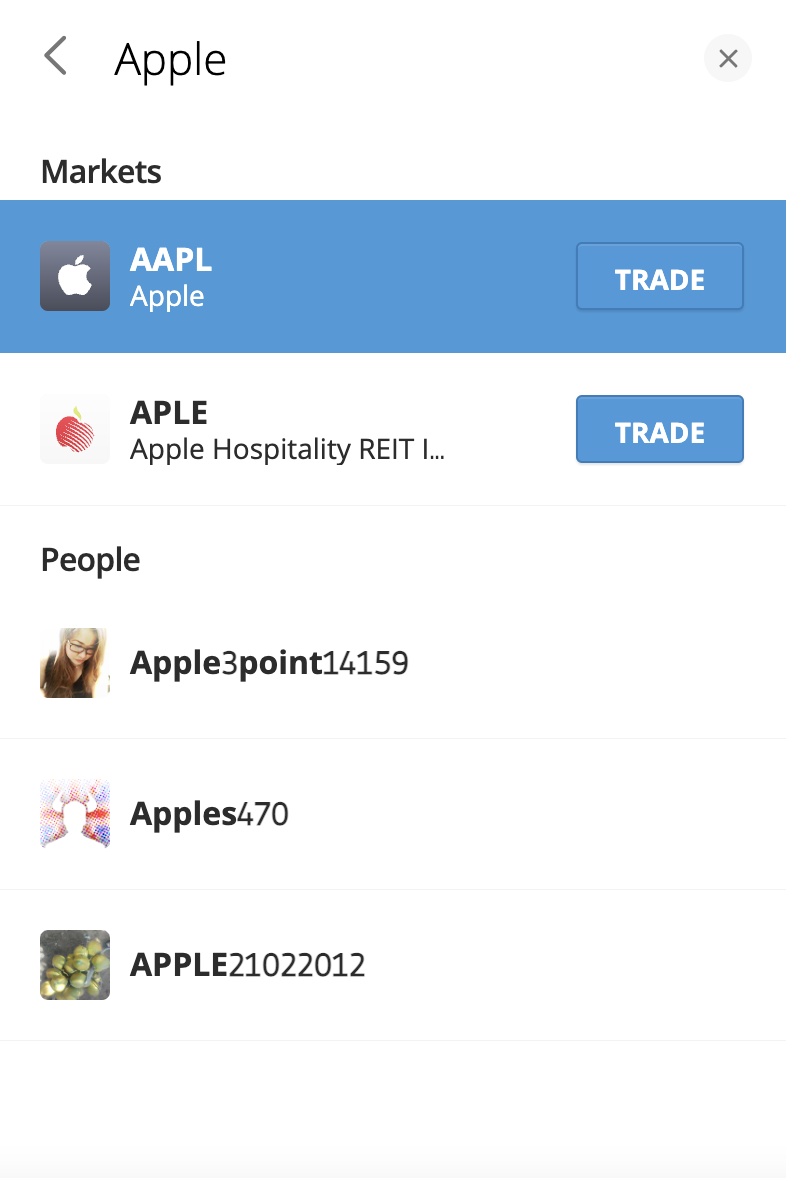

81% of retail investor accounts lose money when trading CFDs with this provider. Our next top mobile trading stock app is AvaTrade, a popular platform with over 300,000 members. On AvaTrade, investors can access more than 90 stock CFDs, such as Apple and Microsoft. The trading app, AvaTradeGO offers a sophisticated trading dashboard that includes a series of charting features and management tools. AvaTrade’s app offers a market trends feature, allowing traders to see the markets develop in real-time and analyze different social trends. The AvaTradeGO app lets all members view their trades and portfolio instantly. Users can access live markets and prices and create watchlists to track their favorite assets. A multi-asset trading platform, AvaTrade also supports commodities and FX trading. AvaTrade was even voted as the number one forex trading app in 2020. In total, more than 1,000 financial instruments can be traded on this platform. Advanced traders can also access MetaTrader 4 and MetaTrader 5 with AvaTrade. These popular web-based trading platforms allow users to trade assets by leveraging a series of technical tools and indicators. Moreover, AvaTrade allows users to apply up to 10x leverage on multiple stock options. AvaTrade charges spread when trading stocks and can charge overnight fees on particular assets as well. After three months of inactivity on AvaTrade, a fee of $50 is charged. An administration fee of $100 is charged after 12 months of inactivity. Interested readers can access the AvaTradeGO app on Google Play and the App store. Charging a minimum deposit of $100, AvaTrade lets users make payments via Credit, Debit card options and multiple e-wallet providers. What We Like 71% of retail investor accounts lose money when trading CFDs with this provider. Through the mobile app, users can also access the copy trading feature, which allows one to copy the trades and strategies of experienced Skilling traders. Beginner investors can access a demo account to practice trading strategies. This CFD broker also lets one invest in FX pairs. Users can also apply up to 50x leverage when trading with Skilling and pay a low spread. Users can benefit from lower spreads on the Premium account but must pay a minimum deposit of $5,000. The standard account offers higher spreads but only requires a minimum deposit of $100. For instance, the average spread on the Amazon stock on the Premium account is 0.37, compared to the 0.72 average spread on the standard account. Skilling supports multiple payment methods, including VISA, MasterCard, and e-wallets such as Skrill. What We Like Vantage offers comprehensive news and market information, as well as powerful charting tools (including Bollinger Bands, MACD, Moving Averages). When it comes to stocks vs. forex trading, the emphasis with Vantage is on forex. But 500+ US stocks - including popular new stocks - are available as CFDs. Vantage offers its own Vantage Social Trading platform, as well as established providers ZuluTrade and DupliTrade. Support for MT4 and MT5 is also available. Trading derivatives carries significant risks. It is not suitable for all investors and if you are a professional client, you could lose substantially more than your initial investment. 250+ tradable assets are on offer including stocks, forex, indices, crypto and ETFs. Libertex offers three trading platforms: Libertex's home platform and MT4/MT5. A slimline selection of shares is available, including popular energy stocks and tech stocks. Libertex's stock app UK has achieved a rating of 4.7/5 from 26k reviews on Google Play from 5m downloads. On the App Store, this stock app UK gained a score of 4.3/5. Note that Libertex. although regulated by the FCA, is in the process of winding down its UK operations. 62.2% of retail investor accounts lose money when trading CFDs with this provider. With a 4.7/5 rating on Trustpilot based on 1,748 reviews, we can conclude that the Pepperstone app is perhaps one of the best stock apps UK according to users. Pepperstone's app is called the Pepperstone cTrader. It has received an average rating of 4.3/5 on Google Play from 2.7k reviews and 4.2/5 on the App Store from 40 reviews. This stock app offers plenty of customisability for expert traders, but does not offer biometric log-in. Pepperstone offers social trading via partner DupliTrade. The broker is regulated by the FCA, CYSEC, BAFIN, ASIC, CMA, DSFA and SCB. Read our extended Pepperstone review. 74% of retail investor accounts lose money when trading spread bets and CFDs with this provider. One of the popular CFD brokers UK, Plus500 bases its global operation in the City of London. Our Plus500 UK review found that this trading platform offers a range of 2,500 CFD instruments in all across shares, forex, indices, commodities and crypto. Shares are only available as CFDs, with convenient leverage and short options. This stock app UK offers a free demo - which is useful for beginners. Plus500 does not charge deposit or withdrawal fees, but does levy a currency conversion fee on trades if applicable. Trades are commission-free, but overnight and spread fees apply. Plus500 is extensively regulated: by the FCA, CySEC, FMA, FSCA and others. Hargreaves Lansdown is headquartered in Bristol, UK. The broker employs over 2,000 staff to service over 1.7m clients. Over £120bn of client funds is entrusted with Hargreaves, which is a FTSE 100 company in its own right regulated by the FCA. Although this broker offers a pricing system based on commission, it is worth noting that spreads on buying and selling prices appear to be tight. For example, Apple is available to buy at $146.17 and to sell at $146.16 - which equates to a very tight spread of 0.006%. The Freetrade brokerage service is available as smartphone app only. Headquartered in London UK, this stock app UK has a fresh, modern feel and offers a maximum of 6,000 shares, ETFs, REITs and SPACs to deal in. Commodities and CFDs are not available. Access to stocks depends on account type: The IG app lets investors set price alerts, receive real-time market updates and enter limit orders and trailing stops. IG's interactive price charts contain 28 technical indicators, including MACD and Bollinger Bands. While the IG app is only available on Android devices, the web-based platform is compatible with iOS as well. One can trade more than 12,000 stock CFDs with IG. Stock trading on IG is commission-based. For instance, the minimum fee for trading stock CFDs on IG is $15. To get started with IG, users are required to make a minimum deposit of $300. When making the deposit with VISA or Mastercard, the platform charges an additional fee of 0.5% and 1% per transaction, respectively. How to judge the most popular trading apps UK? Below are some key features to consider. Whether a broker is providing a London stock exchange trading app or an app that allows international share dealing too, it is important that the broker is regulated somewhere in the world. The range of stocks offered by each stock trading app UK varies massively. Libertex, for example, offers just 50+ stocks. Hargreaves Landsdown offers 1,000+ stocks and over 3,000 mutual funds to browse. Some brokers (like Freetrade) charge a monthly subscription. Others (like eToro) charge zero commission on trades. Most brokers charge a spread fee, which is the difference between the price an investor can buy at, and the price they can sell at, at any given time. The most popular investment apps are always 100% transparent about their fees. Niggles with smartphone apps are common - whether they are stock apps UK or designed for other purposes. We look for high ratings across multiple assessing platforms (like the App Store, Google Play and Trustpilot) as well as a willingness from a broker to remedy user issues promptly. Trading tools fall into two categories: market orders and charting tools. Even penny stock apps UK must set a minimum deposit. Nowadays, investors are not expected to stump up thousands of pounds. The minimum card deposit on eToro, for example, is $50. Most stock market apps UK offer free demo accounts. We recommend investors take advantage. Although there will generally be few hoops to jump through in terms of providing some ID, free demo accounts come with no obligation and investors can learn how a broker's app works without committing funds. Gone are the days when UK stock market apps made it difficult to deposit funds. It is, of course, in the interest of apps to make it easy for clients to deposit funds because then business can be done, and fees earnt! Nowadays, investors can expect to be able to deposit GBP funds via bank card, bank transfer and some payment wallets, notably Skrill, PayPal and Neteller. Many brokers (including eToro) do not charge deposit fees. But currency conversion fees may apply. Ideally UK stock apps should offer 24hr customer service seven days a week via the telephone. We have not identified a broker that offers this, although some offer 24/7 customer service 5 days a week via online ticket system. Using a stock app UK involves the same four basic steps: Below we use eToro's free stock trading app UK as an example. Investors can either sign up with an app direct from their smartphone - or handle the sign-up procedure from the desktop web platform. Either way, the investor will be asked to supply some simple personal details including email, phone number, and National Insurance Number. If an investor already has an account with another stock app UK, the broker may be able to electronically verify their ID without the investor having to do anything; very convenient. Otherwise, proof of ID and address will be required. Depending on the broker, this can be scanned in using the camera on the investor's smartphone, or sent via email. Then, according to Know-Your-Customer regulations, the broker will need to check that the investor is not out of their depth. A series of questions about investing will be asked. Once their account is verified, an investor may deposit funds. eToro is not alone among brokers in offering many convenient ways to deposit funds including bank cards, PayPal, bank transfer, Skrill and Neteller. Once funds are successfully deposited, the user may begin trading. The user can browse through markets and pinpoint stocks of interest. It is then simple to either press 'buy' or 'sell' (depending on whether the investor wants to go long or short), specify the amount to be invested, and execute the trade. The freshly-bought shares will be stored in the investor's portfolio, accessible via the stock app UK. Above we have reviewed ten popular stock investing apps UK. Let us be clear: it is not possible to say that one stock app UK is better than the rest; it all depends on what type of investing the user is aiming for. CFD trading apps - like eToro's for example - are popular with investors who want to benefit from the options of Contracts-For-Difference. Many other brokers offer CFD trading, which allows investors to go short on shares as well as leverage their trade. But overnight fees apply for positions held. Customer service is, of course, a key metric when it comes to stock apps UK. This is difficult to gauge without having an extended relationship with a stock app. Overall, we recommend that investors do their own research when it comes to stock apps UK and take advantage of the free trials offered by many brokers.

78% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Approx Number of Stocks:

2,100+ markets including stocks

Pricing System:

Spread fee plus CFD overnight fee

Cost of Buying Amazon:

0.4% spread fee (variable) plus overnight fee

iOS and Android:

Both

App Same Functionality as Website:

Yes

3. AvaTrade - Stock Trading app offering low spreads and leverage trading

Approx Number of Stocks:

90+ stock CFDs

Pricing System:

Charges spreads

Cost of Buying Amazon:

0.13% spread

iOS and Android:

Both

App Same Functionality as Website:

Not all add-on platforms

4. Skilling - Popular CFD mobile app offering 50X leverage

Approx Number of Stocks:

700+ stock CFDs

Pricing System:

spreads (no commission)

Cost of Buying Amazon:

0.37 (Premium account)

iOS and Android:

Both

App Same Functionality as Website:

Yes

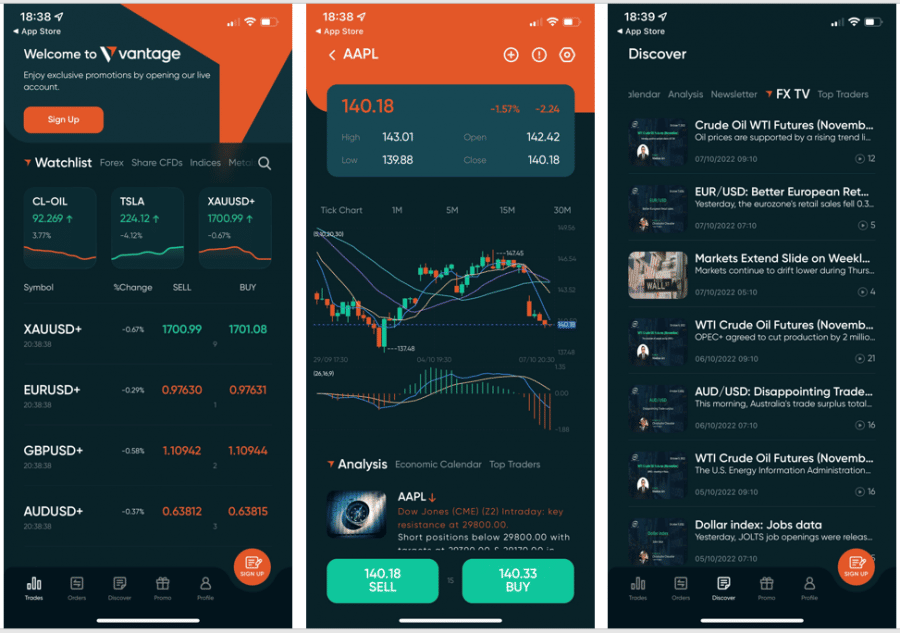

5. Vantage - CFD Stock Trading with Multiple Social Trading Options

What We Like

Approx Number of Stocks:

500 US stocks plus other international stocks

Pricing System:

$0 commission on US stocks

Cost of Buying Amazon:

Spread fee but zero commission

iOS and Android:

Both

App Same Functionality as Website:

Not all add-on platforms

6. Libertex - Award-winning CFD Broker with Streamlined Share Offering

With almost 25 years in business, Libertex is a dedicated CFD broker with 40+ international awards under its belt - including Best CFD Broker Europe 2022 from Global Brands Magazine and Best Trading Platform 2020 from World Finance.

What We Like

Approx Number of Stocks:

50+

Pricing System:

With Investment Account, spread fee only on share purchases; Otherwise commission plus CFD overnight fees

Cost of Buying Amazon:

Commission of 0.0003% plus overnight fee of -0.0302%

iOS and Android:

Both

App Same Functionality as Website:

Yes

7. Pepperstone - CFD Share Trading with Access to Key Trader Platforms

What We Like

Approx Number of Stocks:

900+

Pricing System:

No additional spread fee but 0.1% commission per trade on UK shares, $0.02 per US share

Cost of Buying Amazon:

$0.02 commission per share + spread fee

iOS and Android:

Both

App Same Functionality as Website:

Yes

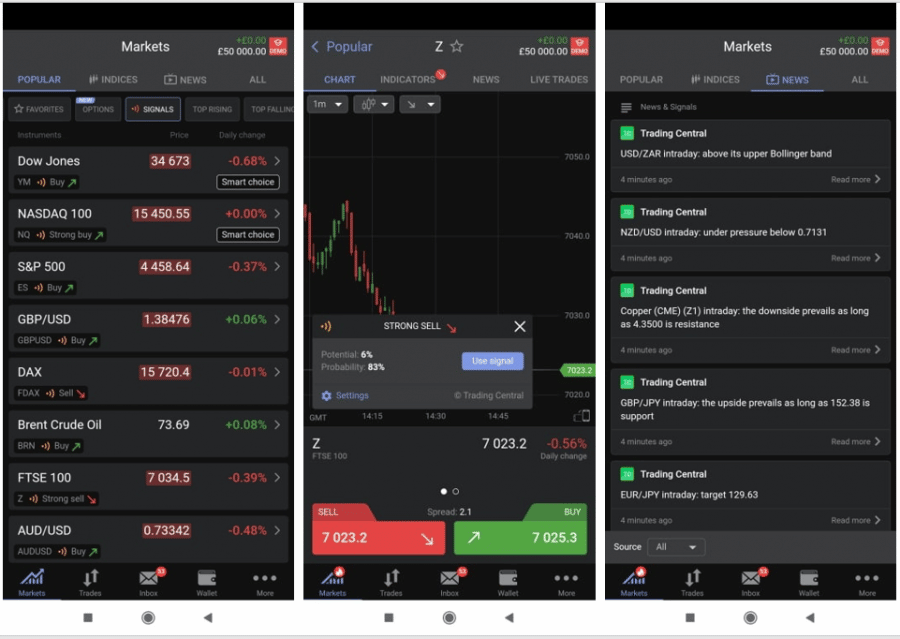

8. Plus500 - UK-based Provider of CFD Share Dealing with Zero Commission

What We Like

Approx Number of Stocks:

500+

Pricing System:

Spread fee plus CFD overnight fees plus currency conversion fee

Cost of Buying Amazon:

Spread fee of 0.75% plus overnight fee of -0.06135% plus currency conversion fee

iOS and Android:

Both

App Same Functionality as Website:

Yes

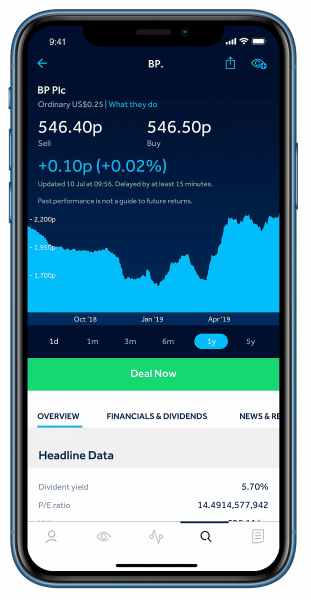

9. Hargreaves Lansdown - UK-based Provider of Funds and Shares

Mutual funds are a popular way for investors to invest in many shares at once to spread risk - and the Hargreaves Lansdown stock app UK offers 3949 of them as well as ETFs, bonds, gilts and shares.

What We Like

Approx Number of Stocks:

1,000+

Pricing System:

Spread plus £5.95 to £11.95 commission based on trading frequency plus FX charge for overseas deals

Cost of Buying Amazon:

0.25%-1% FX charge + $5.95-£11.95 commission plus 0.006% spread

iOS and Android:

Both

App Same Functionality as Website:

Largely

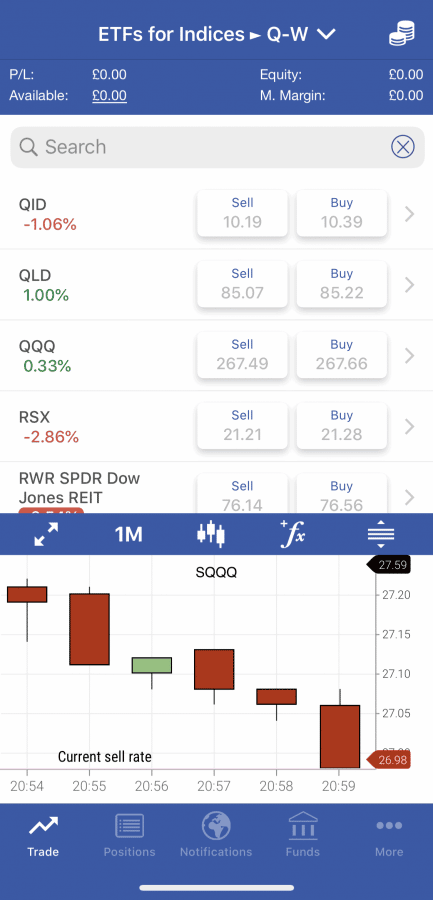

10. Freetrade - UK-based Dedicated Share Trading App with 1m+ Clients

What We Like

Approx Number of Stocks:

6,000+ UK, US and European stocks

Pricing System:

Monthly subscription (£0-£9.99 per month) plus spread fee

Cost of Buying Amazon:

Depends on subscription; zero commission, just spread fee

iOS and Android:

Both

App Same Functionality as Website:

App only

11. IG - Popular trading platform with over 12,000 stocks

What We Like

Approx Number of Stocks:

12,000 + CFD stocks

Pricing System:

Commission-based for stocks

Cost of Buying Amazon:

starts from $15 commission

iOS and Android:

Only Android

App Same Functionality as Website:

Yes

Best Stock Trading Apps UK According to Traders Compared

Broker

Approx. Number of Stocks

Pricing System

Cost of Buying Amazon

eToro

3,000+

Spread fee

0.3% spread fee (variable)

XTB

2,100+ markets including stocks

Spread fee plus overnight fee

0.4% spread (variable) plus overnight fee

Vantage

500+ key US stocks plus others

Zero commission on US stocks

Zero commission but spread fee (variable) applies

Libertex

50+

If standard account, then commission plus overnight fees. If investment account, zero commission applies

Commission of 0.0003% plus overnight fee of -0.0302%

AvaTrade

90+

Spreads applied

0.13% spread

Pepperstone

900+

No additional spread fee but 0.1% commission per trade on UK shares, $0.02 per US share

Spread fee plus $0.02 per share

Plus500

500+

Spread Fee plus CFD overnight fees

Spread fee of 0.75% plus overnight fee of -0.06135%

Hargreaves Lansdown

1,000+ from 15+ international exchanges

Spread plus £5.95 to £11.95 commission based on trading frequency plus FX charge for overseas deals

0.25%-1% FX charge + $5.95-£11.95 commission plus 0.006% spread

Freetrade

6,000+

Monthly subscription (£0-£9.99 per month) plus spread fee

Depends on subscription; zero commission, just spread

Choosing a Stock App in the UK - Key Metrics to Look Out For

Regulation

Range of Stocks

Fees

Mobile Experience

Trading Tools

Minimum Deposit

Demo Account

Payment Methods

Customer Service

How to Use a Stock App in the UK - eToro Tutorial

1. Sign Up

2. Get Verified

3. Deposit Funds

4. Execute a Trade

Conclusion

FAQs

What is the most popular UK stock app?

What is the best stock trading app for beginners in the UK according to traders?