The issue of sustainability has become more pressing than ever, given the rapidly-increasing rate of global warming. Fortunately, eco-conscious investors in the UK have an array of ‘green’ investments at their disposal, ensuring they can make a positive environmental impact through their market activities.

This article discusses the best sustainable investments UK according to industry analysts, diving into what they are and how they can benefit investors. We’ll also explore the various types of sustainable investments before presenting a quick-step guide on investing in an environmentally-friendly asset today.

Top 10 Popular Green Investments UK

Many of the best investments in the UK are considered sustainable since they tend to have the longevity needed for prolonged growth. Listed below are 10 of these assets, each one providing a viable opportunity for socially-responsible investors:

- IMPT (IMPT) – The Best Sustainable Investment UK for 2023

- Enphase Energy Inc (ENPH) – Green Energy Company Focused on Solar Technology

- Global X Wind Energy ETF (WNDY) – Popular Green Energy Investment for Exposure to Wind Power

- Carbon Credits Futures – Widely-Used Asset for Exposure to Carbon Credits Prices

- Ethereum (ETH) – One of the Best Green Investments UK in the Blockchain Sector

- First Solar (FSLR) – Top Solar Stock for an Investment in Green Energy

- Fidelity Clean Energy ETF (FRNW) – Sustainable Investment Fund Focused on Clean Energy

- Cardano (ADA) – Huge Blockchain Project with Sustainability Agenda

- Plug Power (PLUG) – Popular Stock for Investing in Green Technology

- Invesco MSCI Sustainable Future ETF (ERTH) – One of the Largest Global Sustainable Investment Funds

A Closer Look at the Best Sustainable Investments According to UK Analytics

Those looking to invest £5k in the UK may naturally gravitate toward sustainable energy investments, as this area of the market has multiplied over the past few years. Not only do these assets allow investors to make a positive environmental impact, but many of them have generated outsized returns in recent times.

So, without further ado, let’s dive in and take a closer look at the 10 green energy investments listed above:

1. IMPT (IMPT) – The Best Sustainable Investment UK for 2023

The way IMPT’s team looks to revolutionise the carbon credits market is by structuring carbon credits as non-fungible tokens (NFTs). As those who buy cryptocurrency will know, NFTs represent ownership of an underlying asset and are immutable. By taking this approach, the IMPT platform enables users to buy, sell, trade, and speculate on carbon credits easily.

According to data from McKinsey, the carbon credits market could be valued at over $50bn by 2030. Thus, IMPT’s team looks to get ahead of this growth and solidify itself as the go-to for sustainable investors within the crypto space.

Another reason IMPT is considered one of the best green investments is that it enables individuals to obtain carbon credits through their everyday shopping activities. As per IMPT’s whitepaper, the platform has partnered with thousands of leading brands – meaning that whenever an individual shops with one of them, they will earn IMPT tokens.

IMPT tokens are IMPT’s native currency and utilise the ERC-20 structure, meaning they can be listed on major exchanges in the future and stored in the top crypto wallets. Moreover, once enough IMPT tokens have been accrued, users can instantly swap them for a carbon credit – which can be used as an investment vehicle.

IMPT’s team isn’t stopping there, as they will also launch a custom-built social media platform focused on sustainability. This platform will highlight the ‘IMPT Score’ of individuals and businesses, reflecting their environmental impact. The better the impact, the higher the IMPT score – providing a clear incentive for all stakeholders to act in an eco-friendly manner.

Those looking to begin ethical investing in the UK can buy IMPT tokens through the project’s presale phase. At the time of writing, more than $12m has been raised in just over a month – highlighting the colossal hype around the project. Investors can acquire IMPT for just $0.023 per token, although only a finite number of tokens are available at this low price point.

Those looking to keep tabs on IMPT’s progress can join thousands of others on the official Telegram channel.

2. Enphase Energy Inc (ENPH) – Green Energy Company Focused on Solar Technology

One of the most popular sustainable investment companies to emerge over the past few years is Enphase Energy. For those unaware, Enphase Energy is a US-based tech company that develops battery storage, solar micro-inverters, and charging stations for electric vehicles (EVs).

Enphase Energy makes our list of green investing companies as it is one of the few NASDAQ-listed companies to deliver double-digit returns in 2022. Moreover, Enphase Energy has grown revenue and net income in each of the five previous quarters – with net profit margins soaring by a remarkable 191.77% in the most recent quarter.

According to data from Allied Market Research, the global solar energy market is expected to value over $223bn by 2026 – representing a CAGR of 20.5%. Due to Enphase Energy’s focus on solar micro-inverters, the company is well-placed to benefit from this growth and offer a viable opportunity for sustainability-focused investors.

3. Global X Wind Energy ETF (WNDY) – Popular Green Energy Investment for Exposure to Wind Power

Those interested in sustainable investing funds may wish to consider the Global X Wind Energy ETF. As its name suggests, this ETF provides exposure to the global wind energy industry by investing in companies involved in wind energy technology and turbine manufacturing.

As one of the most popular green investment funds in the space, the Global X Wind Energy ETF currently has a stake in 29 different companies, including Northland Power, Vestas Wind Systems, and Orsted A/S. Investors can get involved with this ETF for an annual expense ratio of just 0.50%.

The Global X Wind Energy ETF can be purchased using most top day trading platforms, making it accessible to beginner investors. However, the ETF’s price is down over 33% since its inception – meaning investors may need to be patient before seeing price appreciation.

4. Carbon Credits Futures – Widely-Used Asset for Exposure to Carbon Credits Prices

Carbon credits are one of the most popular green investments in the UK – especially for those looking to invest £10k or more. Each carbon credit acts as a sort of ‘permit’ to emit one tonne of carbon dioxide (CO2), meaning they’re often bought and sold by companies looking to stay within governmental guidelines.

However, retail traders can still get involved in the carbon credits market by purchasing futures. The Intercontinental Exchange (ICE) recently launched 10 nature-based carbon credits futures contracts, allowing investors to gain exposure to the global emissions market up to 2030.

Some trading platforms offer even easier access to the carbon credits futures market. For example, the online broker eToro has a ‘CarbonEmissions’ CFD that reflects the price of European carbon credits. Since this is a derivative instrument, investors can also employ leverage to increase their position size without depositing extra trading capital.

5. Ethereum (ETH) – One of the Best Green Investments UK in the Blockchain Sector

One of the best sustainable investments UK in the blockchain sector is Ethereum. Most people buy Ethereum simply for its value potential, yet the network is also well-suited to eco-conscious investors. This is due to ‘the Merge’, which recently saw Ethereum transition to a Proof-of-Stake (PoS) consensus protocol.

Without getting too complex, this transition means that Ethereum now validates network transactions differently – removing the need for energy-intensive ‘mining’ processes. As a result, Ethereum’s annual energy expenditure is over 99% less than before.

Ethereum is also one of the best green investments since it is at the forefront of innovation within the crypto space. This network is the go-to for decentralised application (dApp) developers, with the previously-mentioned IMPT platform being one of the latest projects to launch on Ethereum. Over the long term, there are likely to be even more green projects that use Ethereum’s technology, making it a hotbed for sustainability.

6. First Solar (FSLR) – Top Solar Stock for an Investment in Green Energy

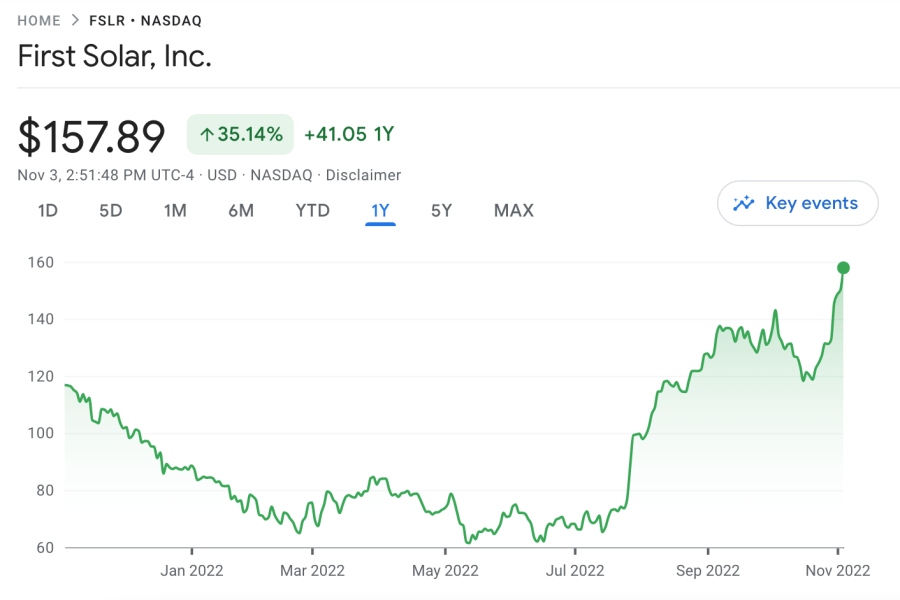

Those looking to begin investing in green energy in the UK may wish to consider First Solar. First Solar is one of the largest US-based producers of solar panels and is listed on the NASDAQ exchange. As per Yahoo Finance, First Solar has a market cap of nearly $17bn and has almost doubled its share price since the turn of the year.

First Solar is well-positioned to benefit from the US government’s ‘Inflation Reduction Act’, which will see $369bn pledged to eco-friendly initiatives. This Act aims to reduce the country’s CO2 emissions substantially – meaning First Solar could be in line for some increased demand going forward.

This government funding has already aided First Solar, as the company recently announced it would be building a massive R&D facility in Ohio. Naturally, this will allow First Solar to increase its output, helping it grasp control of the domestic solar market in the years ahead.

7. Fidelity Clean Energy ETF (FRNW) – Sustainable Investment Fund Focused on Clean Energy

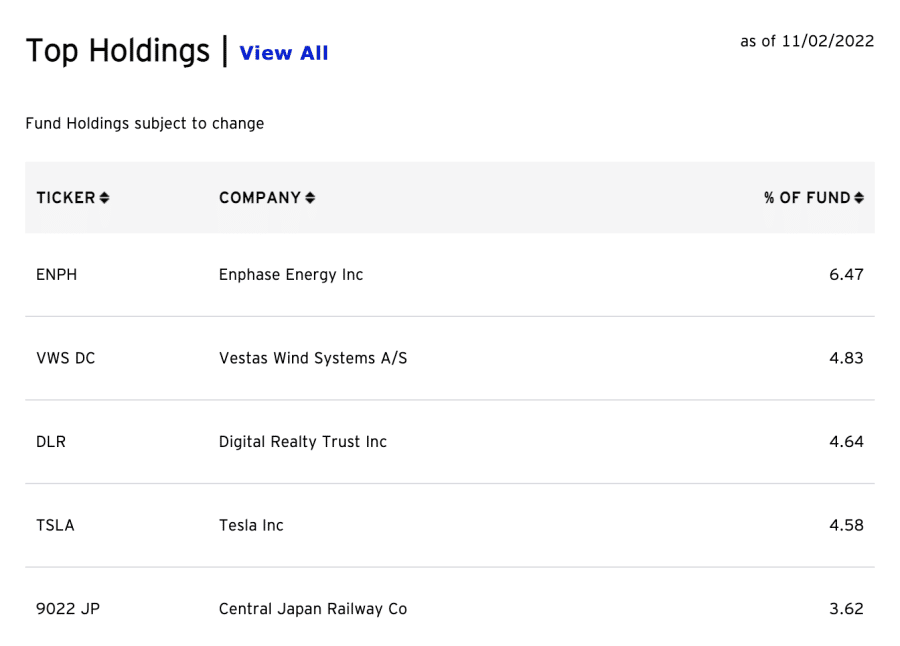

According to industry analysts, the Fidelity Clean Energy ETF is one of the best sustainable investment funds for exposure to the clean energy sector. This fund invests in companies that distribute, produce, or provide technology or equipment related to solar, wind, and hydrogen power.

Those interested in short-term investments may not find the Fidelity Clean Energy ETF appealing, as most of its potential is over the long term. This is because the fund has most of its capital invested in companies still in the growth phase, including Enphase Energy, Plug Power, and Vestas Wind Systems.

Most of this ETF’s exposure is to US companies, although many of its holdings are also based in China and Canada. From a performance perspective, the Fidelity Clean Energy ETF is down over 28% for the year, although much of this can be attributed to adverse economic factors. However, with a gross expense ratio of only 0.39%, this ETF is well-suited for long-term investors.

8. Cardano (ADA) – Huge Blockchain Project with Sustainability Agenda

Cardano is another of the best green investments UK within the crypto space, as this blockchain project has a clear focus on sustainability. As a Proof-of-Stake (PoS) blockchain, Cardano doesn’t require energy-intensive mining to secure the network – meaning its carbon footprint is minimal.

Moreover, Cardano is one of the few green energy investments directly involved in reforestation. Cardano’s team partnered with veritree to create the ‘Cardano Forest’, which will see one million trees planted. In turn, this will have a tangible effect on reducing air pollution and slowing the rate of global warming.

Cardano even has a Group Head of Sustainability and a Head of Sustainability, highlighting how much of the network’s focus is on its environmental impact. Finally, Cardano has even committed to targeting ‘net zero’ emissions and has pledged to evaluate its future investments for sustainability criteria.

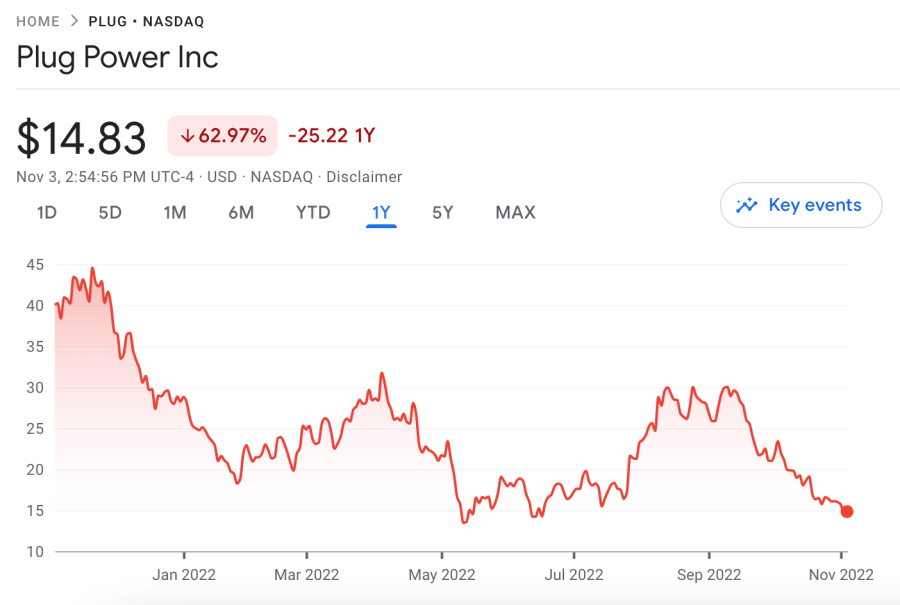

9. Plug Power (PLUG) – Popular Stock for Investing in Green Technology

Plug Power is one of the few green investing companies focused on using hydrogen as an energy source. This US-based company is mainly involved in producing hydrogen fuel cells, which are seen as a viable alternative to ‘traditional’ battery power.

As noted by many analysts, Plug Power is one of the best shares to buy for exposure to the rapidly-growing hydrogen sector. Although the company’s management recently stated that its full-year guidance for 2022 would be below the original estimate, it is still seen as having substantial long-term prospects.

This is because much of Plug Power’s focus is on ‘green hydrogen’, which is much cheaper to produce than non-renewable energy sources. Moreover, Plug Power’s CEO recently stated that he believes green hydrogen will soon be a viable alternative to diesel fuel – meaning the company could be primed for solid growth in the coming years.

10. Invesco MSCI Sustainable Future ETF (ERTH) – One of the Largest Global Sustainable Investment Funds

Rounding off our discussion of the best green investments UK is the Invesco MSCI Sustainable Future ETF. Those interested in sustainable investing funds may find the Invesco MSCI Sustainable Future ETF appealing, as it focuses on assets related to alternative energy, energy efficiency, sustainable water, and other eco-friendly initiatives.

Like most sustainable investment funds, this ETFs value has taken a hit over the past year and is down by 27% YTD. Again, this is mainly due to rising interest rates which have hit growth companies hard – an area that this ETF is hugely exposed to.

Some of the companies that the Invesco MSCI Sustainable Future ETF has holdings in include Enphase Energy, Vestas Wind Systems, and Tesla. Most of the ETF’s investments are in US-based companies, making it a suitable investment vehicle for gaining exposure to the country’s clean energy sector.

What are Green Investments UK?

Green investing in the UK refers to evaluating a potential asset by its environmental impact. Much like ESG investing, green investing emphasises an asset’s sustainability, meaning that ‘unethical’ assets are avoided.

There are different types of green investment assets, such as stocks, crypto, ETFs, and mutual funds. By investing in these assets, investors can ensure their capital is going towards good causes. However, like all investments, attention must paid to the asset’s value potential – as profit will still be one of the main goals.

According to an article from Bloomberg, ESG-focused assets are expected to value $50trn by 2025 – a significant increase from the $35trn valuation seen this year. This highlights the growing popularity of green investments, which have entered the mainstream due to the rapidly-increasing rate of global warming.

Ultimately, the critical differentiator between a green asset and a non-green one is that the former will derive most (or all) of its revenue from eco-friendly activities. As such, most renewable energy companies and recycling firms are considered ‘green’.

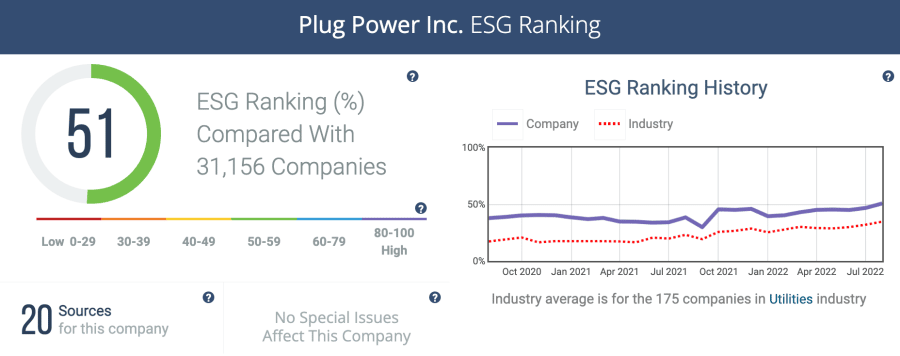

ESG Ratings in Sustainable Investing

ESG investing in the UK is similar to green investing yet includes other factors during the asset-selection process. Let’s take a closer look at the three factors involved:

- Environmental – Environmental factors consider an asset’s climate policies, energy use, pollution level, and other environmental impacts. Naturally, most of the focus of this factor is on CO2 emissions and the asset’s carbon footprint.

- Social – Social factors relate to a company’s relationships with its stakeholders. These include its suppliers, employees, customers, and the local community. Some of the primary considerations with this factor include workplace conditions, charitable donations, and a company’s overall ethics.

- Governance – Governance factors consider how the company is managed and whether it is fully transparent with its financials. This factor also evaluates the company’s board and whether they are involved in corruption or bribery.

Sustainable investing in the UK involves using these three factors to evaluate a potential investment opportunity. One of the most widely-used approaches is to use ESG scores provided by credible institutions like Refinitiv. If an asset has a high ESG score, there’s a good chance it’ll be suitable for sustainability-focused investors.

How to Decide if an Investment is Green

Investing in green energy in the UK can be challenging, primarily due to the concept of ‘greenwashing’. As defined by Forbes, greenwashing is when a company makes false or misleading statements about its environmental credentials, making it more appealing to investors.

So how can market participants avoid these companies and identify green assets? As mentioned in the previous section, using ESG scores from reliable sources is one way to do this, as they provide a quantifiable measure of whether a company is eco-friendly or not.

Another approach is to consider how the company makes its money. For example, if a company is involved in solar power production, there’s a high chance it can be deemed ‘green’. On the other hand, oil companies are not green since their revenues are derived from fossil fuels.

Finally, many green investments in the UK will highlight their sustainability agendas on their websites, making it easy to identify those that are eco-focused. An example of this is IMPT, which clearly states that it only partners with projects that follow Global Certification Protocols, ensuring the platform can make the most positive impact possible.

Why Do People Invest in Sustainable Funds?

More market participants than ever are adding the best sustainable investments UK to their portfolios due to their many benefits. With that in mind, let’s take a closer look at three of the main advantages of this investment strategy:

Promotes Positive Environmental Impacts

Sustainable investing funds are becoming more widespread due to their ability to promote positive environmental impacts. These funds have become increasingly accessible through most stock trading apps, empowering investors to help in the fight against global warming.

This is made possible since sustainable funds help raise awareness of eco-focused assets. A side effect of this is that these assets receive more investment, leading to a more significant capital base. This capital can then be spent on new technologies and improving efficiency – boosting the asset’s environmental impact.

Chance to Generate Sizable Returns

Another benefit of green investment funds is that they have the potential to produce sizable returns. The main reason for this is that most of the assets contained in these funds are in the growth phase. Although growth assets have a higher risk, they can potentially generate outsized returns compared to other asset types.

As an example, Enphase Energy is a company that features in many of the funds listed earlier in this article. At the time of writing, the ENPH share price is up over 60% for the year. In contrast, the S&P 500 is down by 22% – highlighting the potential returns that sustainable assets have.

Helps Foster Technological Innovation

Finally, the best sustainable investment funds are well-placed to promote technological innovation, which can aid the battle against climate change. As noted earlier, these funds help deliver capital to growing companies, which they can use to improve their operations and increase their positive impact.

This also ties into the returns aspect, as many new technologies end up becoming widespread. If investors were able to get in at the ground level with one of these pioneering firms, it could be hugely beneficial to their portfolios over the long term.

Types of Green Investments UK

Green investments are now easily accessible through most day trading platforms and financial asset brokers. However, before investing, market participants must understand the various types of green investments on offer. Let’s take a look at some of the main types below:

Cryptocurrency

Many of the most popular sustainable energy investments of 2023 are in the crypto market. This is mainly due to the benefits of blockchain technology, which empower development teams to create impactful applications that are both safe and decentralised.

As mentioned earlier, IMPT is a prime example of how impactful crypto projects can be. This platform has partnered with an array of leading brands, such as River Island and Kayak, to help reduce CO2 emissions and enable users to access the carbon credits market.

Due to how the IMPT platform is designed, the larger it grows, the higher the positive impact – providing an incentive for individuals and businesses to partner with the platform.

Stocks

Gaining exposure to sustainable investment companies is another popular approach for green investors. This mainly involves investing in companies that produce renewable energy, such as solar, wind, or hydro power.

Investors can create a portfolio of several green energy stocks, thereby increasing their exposure to sustainability-focused assets. However, as noted earlier, these stocks tend to be more volatile than well-established stocks due to them being in the midst of their growth phase.

ETFs

Exchange-traded funds (ETFs) are a pooled investment vehicle that collects investors’ funds and uses them to purchase assets. Much like stocks, ETFs are listed on major exchanges and have a dedicated share price, meaning investors can benefit from price increases.

The list presented earlier in this article highlighted several top sustainable funds focused on areas like clean energy and wind power. Those interested in green investing can usually find an ETF’s holdings on its official website, making it easy to determine whether a fund is as sustainability-focused as it claims.

Carbon Credits

Finally, investors can also buy carbon credits to gain exposure to the carbon offset market. Like other financial assets, the price of carbon credits is affected by supply and demand – meaning the more popular they are, the higher their value.

The most widely-used way to gain exposure to carbon credits is through the futures market. However, crypto projects like IMPT aim to make these assets more accessible to the masses, creating a whole new asset class.

How to Invest Sustainably in the UK

Before concluding this discussion of the best sustainable investments UK, it’s essential to explore the investment process itself. As noted earlier, IMPT is ideal for those interested in ethical investing in the UK, so we’ll use this project as an example.

With that in mind, detailed below are the five steps investors can follow to buy IMPT tokens – thereby gaining exposure to a sustainable asset class:

Step 1 – Open a Crypto Wallet

The first thing investors must do is set up a crypto wallet. Importantly, the wallet must have support for ERC-20 tokens since this is the structure that IMPT uses.

We recommend partnering with MetaMask, as it’s free to download and is well-suited to beginner investors. Simply head over to MetaMask’s website, click ‘Download’, and follow the instructions to create a password and set up the wallet.

Step 2 – Obtain Crypto for Exchange

IMPT’s presale supports both ETH and USDT – so investors must acquire one of these digital currencies to make their investment. Both of these tokens can be purchased using the top crypto exchanges, after which they must be transferred to the crypto wallet created in Step 1.

Step 3 – Link Wallet to IMPT Presale

Head to IMPT’s homepage and click ‘Connect Wallet’. In the pop-up box, choose the relevant wallet provider and follow the instructions to make the link.

Step 4 – Buy IMPT Tokens

Step 5 – Claim IMPT Tokens

Investors will be able to claim their tokens following the conclusion of the third stage of the presale by clicking the ‘Claim’ button on IMPT’s website.

Best Sustainable Investments UK – Conclusion

To conclude, this article has taken an in-depth look at the best sustainable investments UK by presenting an array of well-suited assets to eco-conscious investors.

Leading the way in this regard is IMPT – touted as one of the best ethical investments within the crypto market. By structuring carbon credits as NFTs, IMPT’s team has created a self-sustaining ecosystem that promotes positive environmental change.

IMPT is in the midst of a successful presale phase, which has seen over $12m in funding raised at the time of writing. Investors can still buy IMPT tokens at a significant discount, which could prove lucrative once these tokens are listed on major CEXs and DEXs.