Wondering how to avoid swap fees in forex?

Swap-free accounts enable traders to speculate on forex and other popular assets without paying any overnight financing fees. In many cases, this account type is aimed at traders that follow the Islamic faith, due to its avoidance of traditional interest.

In this guide, we compare the best swap-free account brokers for spreads, supported markets, safety, minimum deposits, trading tools, and more.

The Best Swap Free Account Brokers in 2023

For a quick overview of the best swap-free account brokers in the market right now – consider one of the providers listed below:

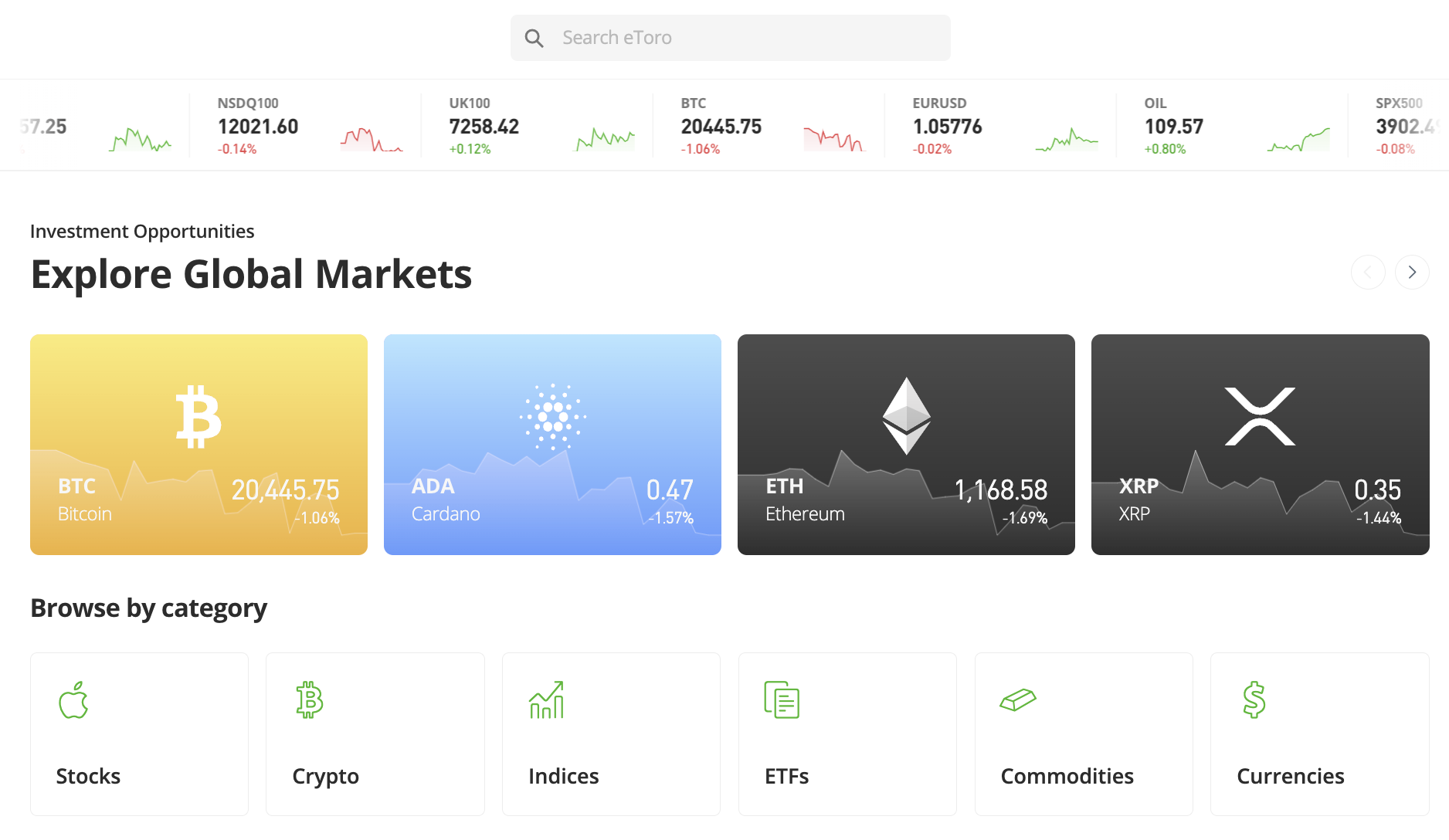

- eToro – Overall Best Swap-Free Account Broker

- Interactive Brokers – Auto Swap Accounts for Large-Scale Forex Traders

- Oanda – Top Swap-Free Forex Broker in the USA

- Avatrade – Swap-Free Accounts at 0% Commission

- XM – No Swap Fees on Any Supported Markets

Just remember that swap-free accounts often come with higher fees in other departments – such as spreads. As a result, it is important to have a firm grasp of what a swap-free account charges before signing up with the respective broker.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider

Best Swap Free Account Trading Platforms Reviewed

In order to select the best swap-free account broker, traders will initially need to explore key metrics surrounding fees, spreads, and minimum deposit requirements.

Regarding the latter, brokers will often require a higher first-time deposit when opening a swap-free account. Additionally, other important factors to assess should include regulation, supported markets, and the availability of trading tools.

Read on to compare our reviews of the best swap-free account brokers in the market today.

1. eToro – Overall Best Swap-Free Account Broker

Swap-free plans at eToro are offered as Islamic accounts, albeit, the two are much the same nonetheless. This is because eToro will not charge interest on positions that remain open for more than 24 hours. Instead, the position will continue to roll over for as long as the trader wishes. In turn, this means that eToro offers interest-free leverage.

In order to open an Islamic/swap-free account here, the trader will need to register some personal information and contact details, before meeting the minimum deposit requirement of $1,000. This minimum is much higher than the $10 requirement stipulated with standard account types.

Nonetheless, after registering, the user will then need to email eToro stating that they wish to transition to an Islamic account. After that, the trader will have access to thousands of low-cost financial markets without needing to worry about overnight financing. In terms of trading fees, stocks and ETFs can be purchased at eToro at 0% commission.

Forex, commodities, and indices are offered as CFD instruments on a spread-only basis. EUR/USD, for instance, can be traded at a spread of 1 pip upwards. Those that wish to invest in cryptocurrency at eToro can do so at a commission of 1%. This is the case across all of its 90+ supported crypto assets.

Leverage limits at eToro are typically restricted to 1:30 on major forex pairs, 1:20 on minors/exotics and gold, and less on other asset classes. When trading CFDs here, both long and short positions are supported. Active day traders will appreciate the real-time pricing charts offered by eToro, in addition to technical indicators and market insights.

eToro is also one of the best Copy Trading platforms in the market, with thousands of verified investors that can be copied. This will appeal to investors that want to actively trade the financial markets but don’t have the time or skill set to do so. The minimum Copy Trading investment amounts to $200 for each trader that is mirrored.

Another option for passive investors is Smart Portfolios. These are professionally managed baskets of stocks and/or crypto assets that are hand-picked by eToro algorithms. The minimum investment across most Smart Portfolios is just $500. eToro is also one of the best swap-free forex brokers for creating strategies in a risk-free environment.

This is because all eToro account holders have access to a free demo facility that comes with $100k in paper money. The demo account at eToro mirrors live market conditions. eToro offers two options when it comes to trading – an online web-based platform or an app for iOS and Android.

In addition to its innovative copy trading tools and paper trading accounts, eToro also offers the best forex bonus offer of 2023. With a deposit of $5,000 or more users can receive a $250 bonus as well as gain exclusive access to the eToro tiered Club program.

Getting money into and out of eToro is simple, not least because it accepts many different payment types. Examples here include debit and credit cards, Paypal, Neteller, Skrill, WebMoney, and bank wires. USD payments are processed fee-free. Non-USD payments attract a fee of 0.5%. eToro is authorized and licensed by the SEC, ASIC, CySEC, and FCA.

Read More: Our comprehensive eToro review can be found here.

| Forex Pairs | 49 |

| Pricing System | 0% on real stocks and ETFs. Spread-only on forex, commodities, indices, and other CFDs. 1% on real crypto assets |

| EUR/USD Spread | From 1 pip |

| Min Deposit | $1,000 on swap-free Islamic accounts |

| Top 3 Features | No overnight fees or leverage interest on Islamic accounts, low fees, and tight spreads, Copy Trading tools to automate the investment process |

What We Like

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider

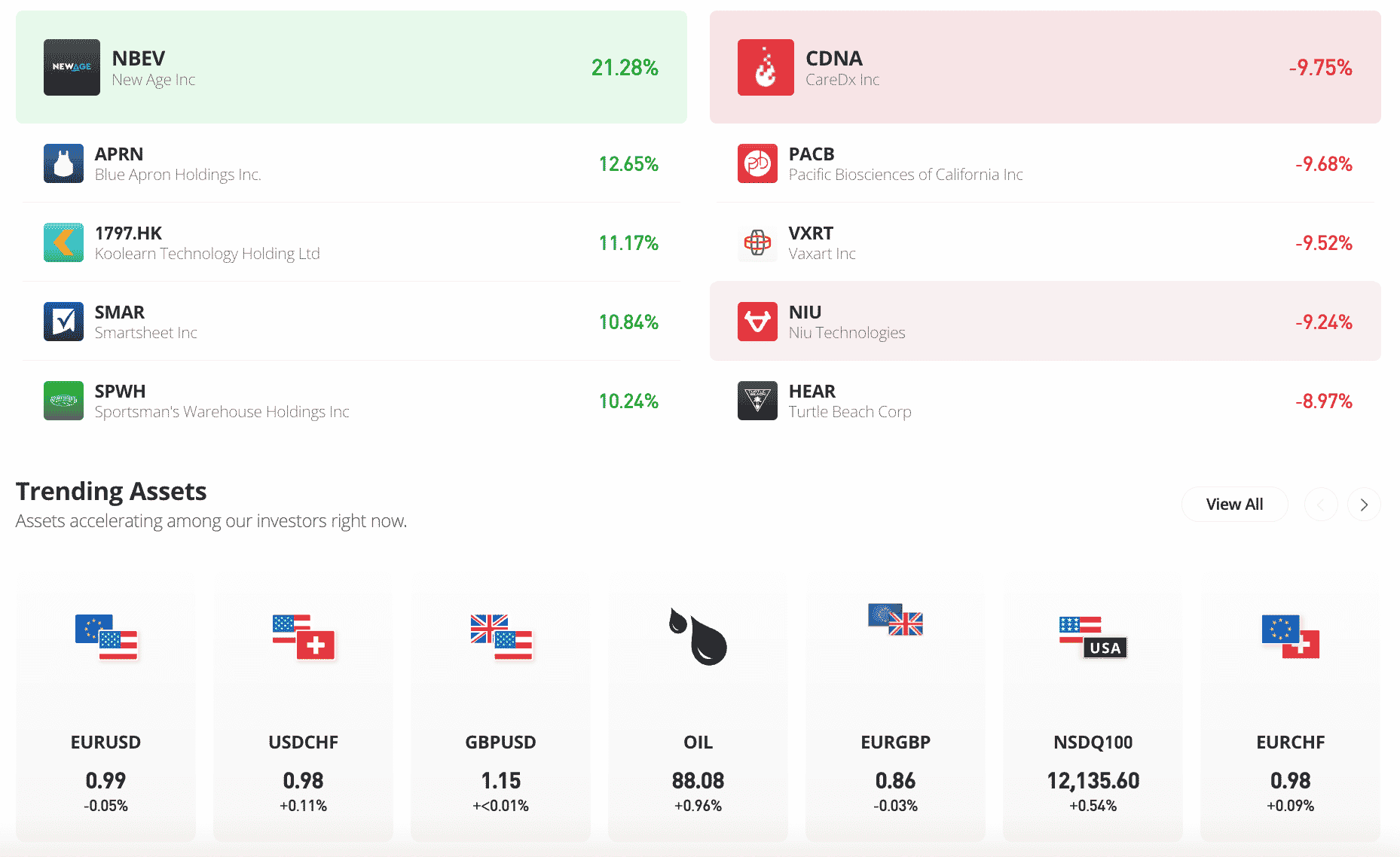

2. Interactive Brokers – Auto Swap Accounts for Large-Scale Forex Traders

Interactive Brokers is a popular brokerage firm that supports clients from many countries and global regions. The platform is home to more than 10,000 markets, which cover everything from stocks, ETFs, and index funds, to forex, commodities, and derivatives.

Although Interactive Brokers does not offer swap-free accounts per se, it does offer a great alternative for those seeking to avoid overnight interest payments. Put simply, auto swap accounts at Interactive Brokers enable currency traders to keep positions open overnight in a cost-effective manner.

The reason for this is that long positions will continuously be offset by those going short on the same position – hence, avoidance of conventional charges for swing traders. However, there is a caveat that should be taken into account – the auto swap plan at Interactive Brokers is only suitable for minimum positions of $10 million or an alternative currency equivalent.

This amounts to a minimum of 100 traditional currency lots, which will be out of reach for the average trader – even with high levels of leverage applied. Nonetheless, serious forex traders with a professional client status might find this account type appealing.

When it comes to standard trading fees, Interactive Brokers is highly competitive – especially when it comes to spreads. The broker offers direct access to interbank quotes, which means that forex can be traded from just 1/10th of a pip. Average commissions on each forex trade will sit between 0.08 and 0.2 bps. Crucially, this commission comes without any markups.

| Forex Pairs | 100+ |

| Pricing System | From 0.08 bps |

| EUR/USD Spread | From 1/10 of a pip |

| Min Deposit | No minimum stated, but auto swap accounts are suitable for minimum positions of $10 million |

| Top 3 Features | Access interbank quotes, deep liquidity levels, competitive spreads |

What We Like

3. Oanda – Top Swap-Free Forex Broker in the USA

Oanda is a popular forex broker that serves clients in the US and 100+ other countries. The platform is heavily regulated and has been offering brokerage services for more than 25 years. Interestingly, Oanda does not require any verification documents to start trading until more than $9,000 has been deposited into the account.

This enables traders to get started in a matter of minutes. Oanda offers swap-free trading accounts to those that wish to avoid paying overnight financing or interest on their positions. In order to benefit from this, traders will need to open a standard account and then email Oanda to request a swap-free alternative.

We should, however, note that, like most swap-free account brokers, users will be required to pay a less competitive spread. For example, the minimum spread on EUR/USD positions amounts to 1.6 pips. With that said, Oanda does not charge any trading commissions on its swap-free accounts.

However, Oanda does charge administration fees on each position, which kicks in five days after opening the account. When trading forex, this amounts to $7 for each lot traded. The swap-free account must have USD as its base currency and the maximum trader size is $10 million.

In terms of supported markets, Oanda offers access to more than 45 forex pairs. Eligible traders will also be able to access CFD markets across indices, stocks, metals, and cryptocurrencies. Oanda also supports popular third-party trading platforms such as MT4 and MT5. There is also an Oanda trading app for iOS and Android users.

| Forex Pairs | 45+ |

| Pricing System | Commission-free, but an administration charge of $7 per lot on swap-free accounts |

| EUR/USD Spread | From 1.6 pips |

| Min Deposit | No minimum stated |

| Top 3 Features | Heavily regulated, fast swap-free accounts opening process, lots of supported trading tools |

What We Like

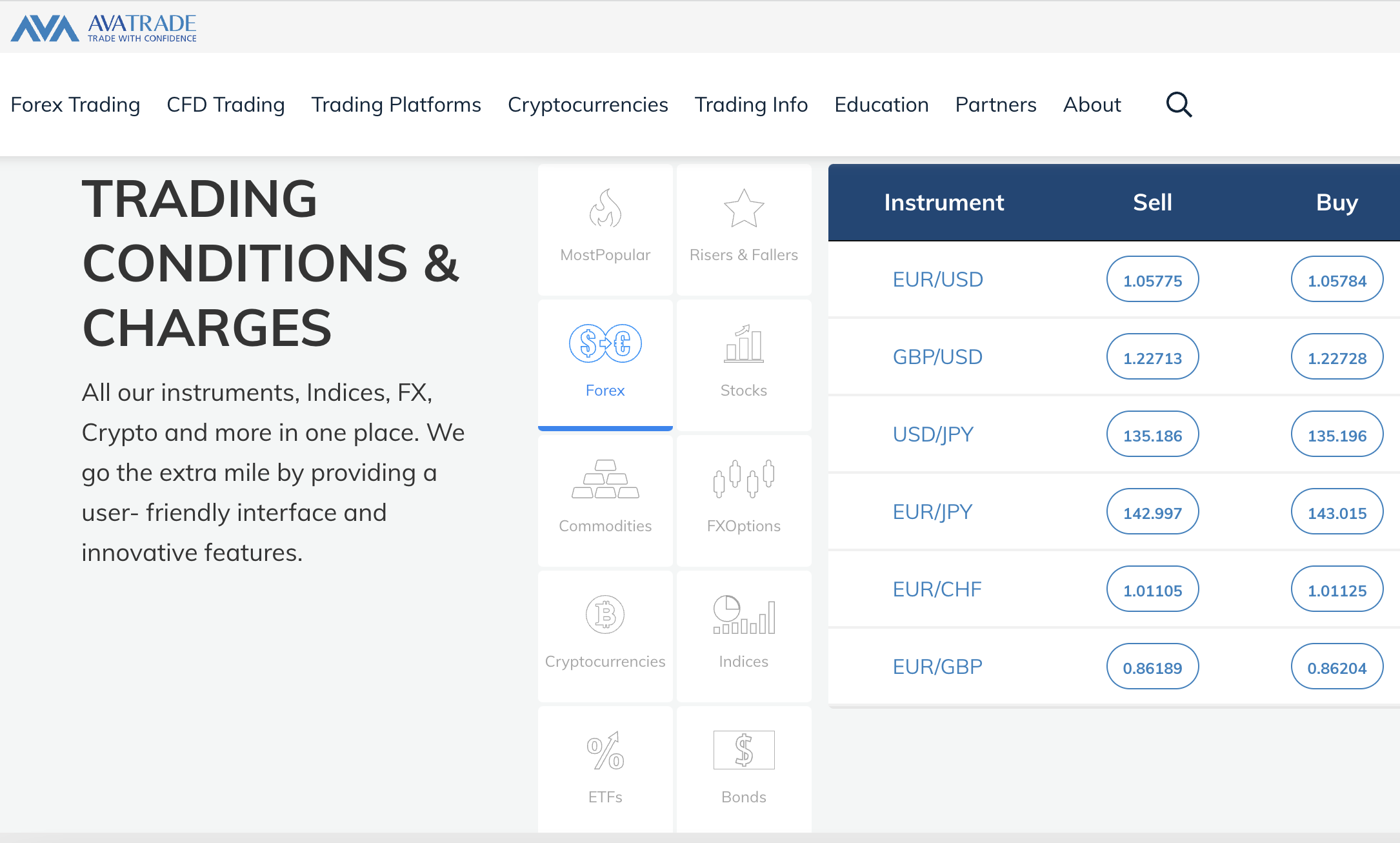

4. AvaTrade – Swap-Free Accounts at 0% Commission

To ensure that followers of the Islamic faith are catered to, AvaTrade offers swap-free accounts. Users will first need to create a standard account and go through the speedy KYC process. After that, the user will need to contact AvaTrade to request being switched over to the swap-free account type. Requests typically take 1-2 days to process.

There are, however, some important considerations to take into account before joining this swap-free broker. First and foremost, AvaTrade notes that even on the swap-free account, positions left open for more than 10 days will start attracting interest. Therefore, it is crucial that AvaTrade users close the position before this timeframe to ensure that interest is avoided.

AvaTrade also notes that while swap-free accounts still benefit from commission-free trading, spreads will be less competitive. As noted earlier, this is how the best swap-free account brokers cover the cost of offering interest-free positions. Additionally, certain currencies cannot be traded on the swap-free account – which includes RUB, ZAR, TRY, and MXN-denominated pairs.

When it comes to the fundamentals, AvaTrade is regulated by multiple financial bodies. It requires a minimum first-time deposit of just $100, and no transaction fees are charged. Payments at AvaTrade can be made online or via the iOS/Android app with a debit/credit card or bank wire.

| Forex Pairs | 55 |

| Pricing System | 0% commission on all markets, but swap-free accounts come with higher spreads |

| EUR/USD Spread | From 0.9 pips on the standard account – swap-free plans will be less competitive |

| Min Deposit | $100 |

| Top 3 Features | Leverage offered on all supported markets, lots of trading platforms to choose from, heavily regulated |

What We Like

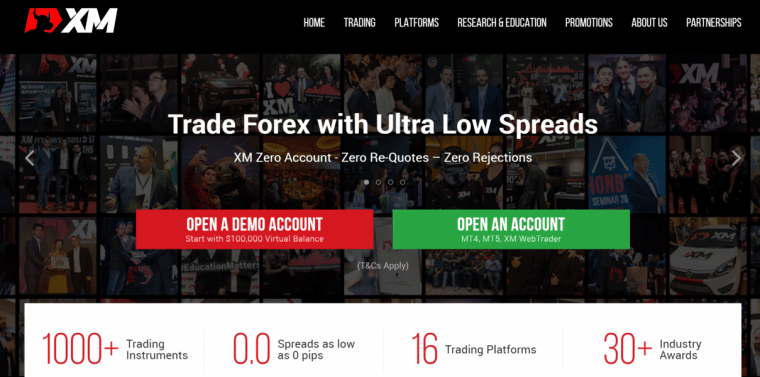

5. XM – No Swap Fees on Any Supported Markets

XM stands out in this marketplace because all supported assets can be traded on a swap-free basis. Traders just need to fill out a form and make a request to XM’s customer support to switch to a swap-free account. Note that swap-free accounts are only available on religious grounds and cannot be opened by traders for other reasons.

XM offers trading on more than 50 currency pairs and more than 1,000+ CFD instruments in total. Traders can access spreads starting from as low as 0.17 pips or use a commission-free ECON trading account to get spreads from 0.0 pips.

This broker doesn’t offer its own custom trading platform, but does provide traders with access to MT4 and MT5. In addition, XM customers have access to professional market research, forex webinars, educational videos, and an economic calendar.

Traders at XM can open a new account with as little as $5.

| Forex Pairs | 50 |

| Pricing System | 0% commission and no swap fees on any supported markets |

| EUR/USD Spread | From 0.17 pips |

| Min Deposit | $5 |

| Top 3 Features | Trade forex from 0.17 pips, minimum deposit just $5, MT4 and MT5 |

What We Like

Your capital is at risk.

Top Swap-Free Account Trading Platforms Compared

To compare the best swap-free brokers that we have reviewed, refer to the comparison table below:

| Swap-Free Account | Swap-Free Account Charges | Min Deposit | Top 3 Features |

| eToro | Wider spreads when compared to standard accounts | $1,000 |

No overnight fees or leverage interest on Islamic accounts, low fees, and tight spreads, Copy Trading tools to automate the investment process

|

| Interactive Brokers | No additional fees, but $10 million minimum trade | N/A | Access interbank quotes, deep liquidity levels, competitive spreads |

| Oanda | Increased minimum spread from 1.6 pips, plus a $7 per lot admin charge | N/A |

Heavily regulated, fast swap-free accounts opening process, lots of supported trading tools

|

| AvaTrade | Wider spreads when compared to standard accounts | $100 |

Leverage offered on all supported markets, lots of trading platforms to choose from, heavily regulated

|

| XM | No additional fees | $5 | Trade forex from 0.17 pips, minimum deposit just $5, MT4 and MT5 |

What does Swap-Free Mean? Overview of Swap-Free Accounts

In a nutshell, swap-free accounts are offered by a selection of online brokers – many of which specialize in forex. Ordinarily, when trading forex online, brokers charge swap fees when a position is kept open overnight. This fee is otherwise known as an overnight financing charge.

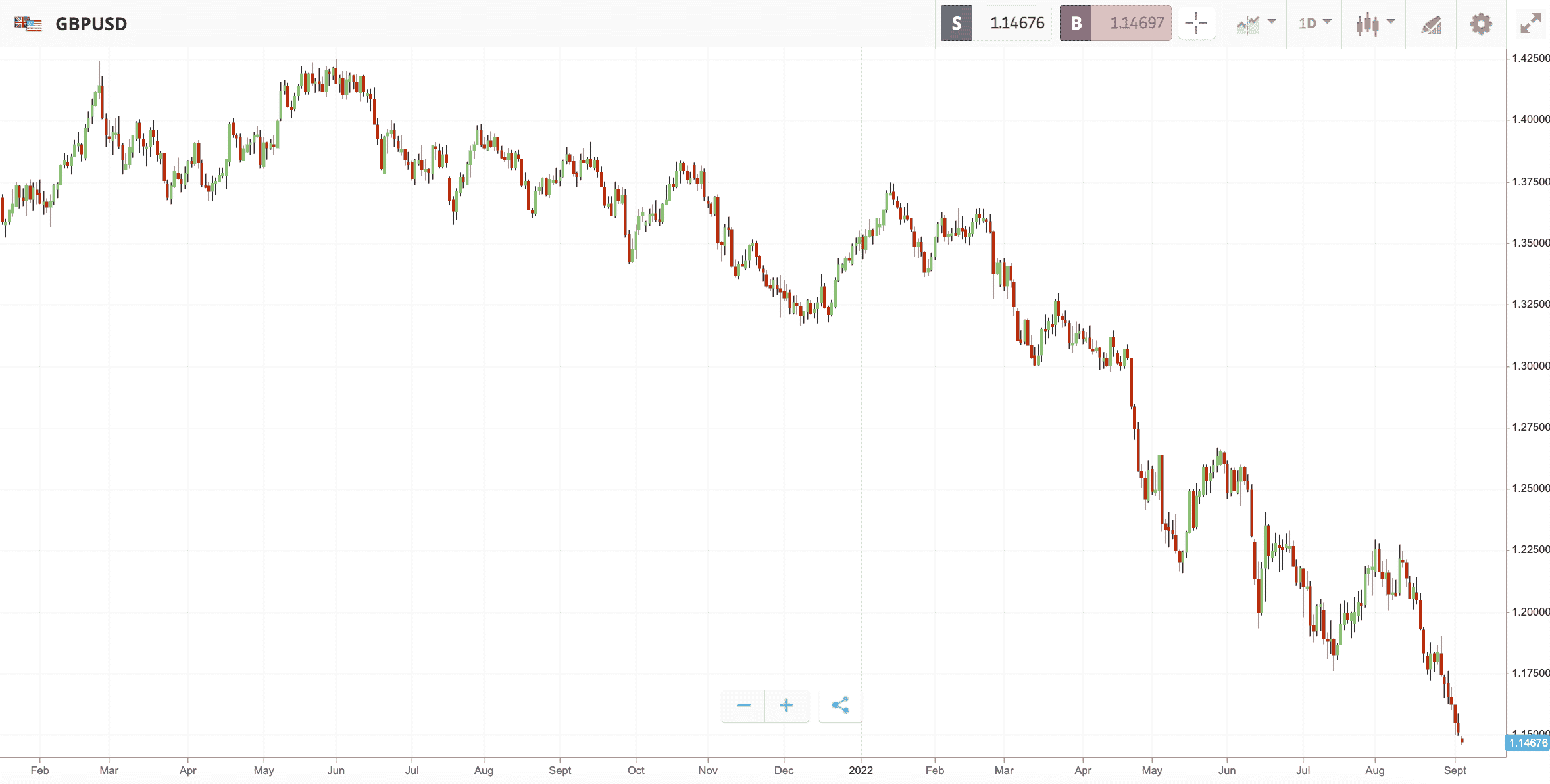

Nonetheless, this often discourages forex traders from keeping positions open past the end of the trading day. This shouldn’t, however, be the case considering that some forex positions require a longer holding duration – especially when an identified trend remains in place for a prolonged period of time.

In addition to offering more flexibility, swap-free accounts are favored by followers of the Islamic faith. The reason for this is that swap fees are defined as interest, which goes against the Riba principles of Sharia law. As a result, swap-free plans are often branded as Islamic trading accounts, albeit, they essentially refer to the same thing.

Opening a swap-free account enables traders to keep positions open overnight without being charged any interest. However, it should be remembered that even the best forex brokers are in the business of making money. As a result, brokers will often charge higher spreads or even administration fees, to cover a lack of swap-related interest.

How do Swap-Free Accounts Work?

It is important to understand how swap-free accounts work before choosing a suitable provider.

The reason for this is that in most cases, swap-free accounts do not actually offer discounted trading fees. On the contrary, fees can and will be charged in other areas, albeit, not in the form of conventional interest.

Here’s what to take into account when searching for the best swap-free account brokers:

Interest-Free Leverage

It is important to remember that most forex traders will require the usage of leverage. After all, currencies are traded in lots, which amount to 100,000 units of the case currency. For example, USD/CAD would amount to a lot size of $100,000.

This means that those unable to deposit and stake $100,000 will need to obtain leverage. And in doing so, this will attract interest fees. Crucially, this would go against the Riba principles of Sharia law.

Therefore, by opening a swap-free account, no interest will be charged on leveraged positions. Traders should, however, check this before opening an account with the chosen provider.

Keep Positions Open Overnight

Overnight financing fees kick in at a certain time every day, depending on the market and respective broker. For example, at eToro, this kicks in at 5 pm, EDT.

- For example, suppose a trader opens a forex position at 3 pm

- Should the position remain open after 5 pm – a swap fee will be charged

- Ordinarily, the only way to avoid this fee is to close the position before the 5 pm cut-off time

Naturally, it is not always possible to close a position manually before the swap fee is taken. Moreover, adopting such a practice would not be financially sensible, considering the impact of spreads.

And therefore, the best swap-free account brokers solve this issue by alleviating overnight financing. In particular, this will appeal to those that have a tendency to swing trade.

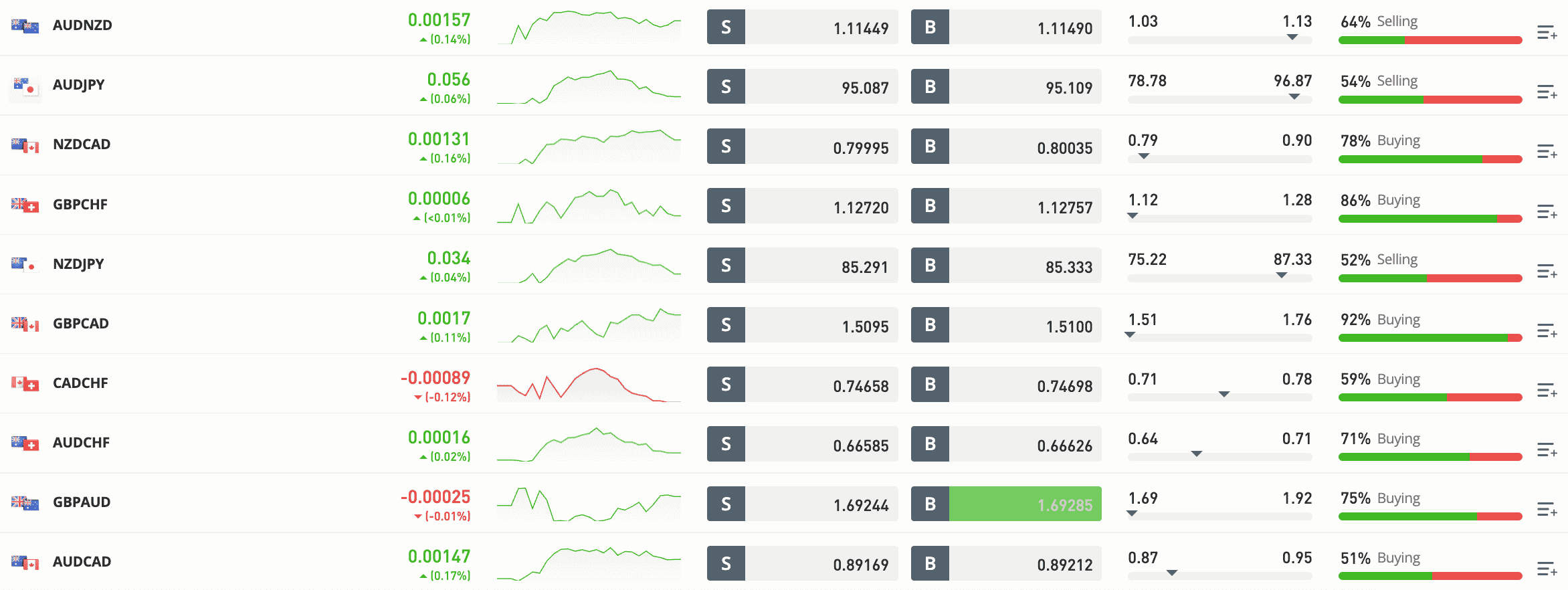

Higher Spreads and Administration Fees

As noted, if brokers do not forward swap fees to their clients, this will ultimately result in lower profit margins for the provider. Therefore, it goes without saying that even the best swap-free account brokers must cover the alleviation of swap fees in other ways.

We found that the most common way for swap-free brokers to achieve this goal is to charge higher spreads.

- For instance, as of writing, standard accounts at Oanda will have access to real-time spreads of 1 pip on USD/EUR.

- However, the lowest EUR/USD spread available on swap-free accounts at Oanda is 1.6 pips.

- Furthermore, Oanda charges an administration fee of $7 per lot, which isn’t implemented on standard accounts.

As a result, it only makes sense to open a swap-free account if certain requirements are in place – such as being a follower of the Islamic faith or having a tendency to swing trade positions over several days or weeks.

How we Select the Best Swap-Free Account Brokers

We spent countless hours reviewing the best swap-free account brokers in this marketplace. However, considering that no two brokers are the same, it is wise for traders to do their own due diligence.

Below, we explain some of the most important aspects to consider when choosing a suitable swap-free broker.

Regulation and Licensing

All of the providers on our list of the best swap-free account brokers are regulated by solid licensing bodies. The respective bodies that each broker is licensed by will vary from one platform to the next.

Nonetheless, to offer some insight, eToro is regulated by the SEC (US), FCA (UK), ASIC (Australia), and CySEC (Cyprus). This means that traders can open a swap-free account without needing to be concerned with the safety of their funds.

Range of Markets

The vast majority of traders will search for swap-free accounts for the purpose of speculating on forex. With that being said, it is not just forex that can be traded in a swap-free manner.

On the contrary, platforms like eToro offer access to leveraged markets across stocks, crypto, ETFs, indices, hard metals, energies, and more.

In the context of forex specifically, it’s best to opt for a swap-free broker that offers a suitable blend of majors, minors, and exotics. Otherwise, traders will be required to open an account with another broker should a particular pair not be supported.

Fees

Fees are a very important metric to grasp when reviewing the best swap-free account brokers. After all, swap-free accounts are usually priced differently from standard brokerage plans.

Below, we cover the main fees that need to be taken into account:

Spreads

The spread is an indirect fee charged by brokers on all buy and sell positions. It effectively amounts to the difference between the bid and ask price of the market being traded.

In the case of swap-free accounts, spreads are usually higher than that of standard plans. This is how the broker can cover the loss of interest that should have been charged on any overnight positions.

Commissions

In addition to spreads, some brokers charge a trading commission. Interactive Brokers, for instance, charges an average position of 0.08 and 0.2 bps.

In comparison, eToro and AvaTrade offer spread-only trading, meaning no additional commissions apply. With that being said, some brokers – although claiming to be commission-free, will charge additional fees when operating a swap-free account.

For instance, at Oanda, no commissions apply, but an ‘administration’ fee of $7 is applied to all forex positions being carried out on a swap-free plan.

| Swap-Free Account | Swap-Free Account Charges |

| eToro | Wider spreads when compared to standard accounts |

| Interactive Brokers | No additional fees, but a $10 million minimum trade |

| Oanda | Increased minimum spread from 1.6 pips, plus a $7 per lot admin charge |

| AvaTrade | Wider spreads when compared to standard accounts |

| XM | No additional fees |

Maximum Swap-Free Duration

Although not overly common, we did come across a number of brokers that implement a maximum swap-free duration. This refers to the number of days that the trade can remain open until swap fees are charged.

- AvaTrade, for example, only permits interest-free positions for up to 10 days when operating a swap-free account.

- Therefore, any positions left open for more than 10 days will incur interest.

- This can be a big surprise for those failing to read the terms and conditions of their chosen swap-free account.

As such, it is important to read the fine print before proceeding with a new swap-fee broker.

Tools and Analysis

Regardless of the market being traded, it is important to choose a swap-free account broker that offers access to a wide range of trading tools.

This should include the likes of real-time pricing charts that can be customized to traders’ liking, alongside economic and technical indicators like the MACD, RSI, and moving averages.

For those looking to incorporate fundamental research into their trading thesis, it’s best to choose a swap-free broker that offers expert market insights and regular economic news updates.

Minimum Deposit

Some swap-free accounts come with a higher minimum deposit threshold. This is an important metric to consider, as the trader must ensure that the minimum falls in line with their investment budget.

Demo Account

One of the best ways to get to grips with swap-free account practices is via a demo facility. Many online brokers offer free demo accounts simply for registering, with all subsequent positions being entered with paper funds.

This means that the trader can practice their strategies without risking any money.

Mobile App

All of the providers that made our list of the best swap-free account brokers offer a proprietary mobile app.

The best swap-free account apps should offer a seamless and flexible trading experience.

Learn More: Read our comparison guide on the best forex trading apps.

Payment Methods

We tend to avoid swap-free brokers that only support deposits and withdrawals via a traditional bank wire. While this payment method might appeal to some, it is a slow and cumbersome way of depositing money.

eToro, for example, in addition to bank wires, supports debit and credit cards that are processed instantly. The aforementioned swap-free broker also supports Paypal, Neteller, and a number of other popular e-wallets.

Customer Service

Many online brokers require the investor to manually request a swap-free account after going through the standard registration process. While in some cases, the request can be facilitated within 24 hours, some brokers can take up to a week.

This is largely down to the level of customer service that the broker offers. We found that the best swap-free account brokers offer support via live chat, with replies rarely taking more than a couple of minutes.

How to Start Trading via a Swap-Free Account With a Regulated Broker

The process required to start trading via a swap-free account is largely the same across most platforms.

To illustrate this, below we explore how to open a swap-free account with eToro.

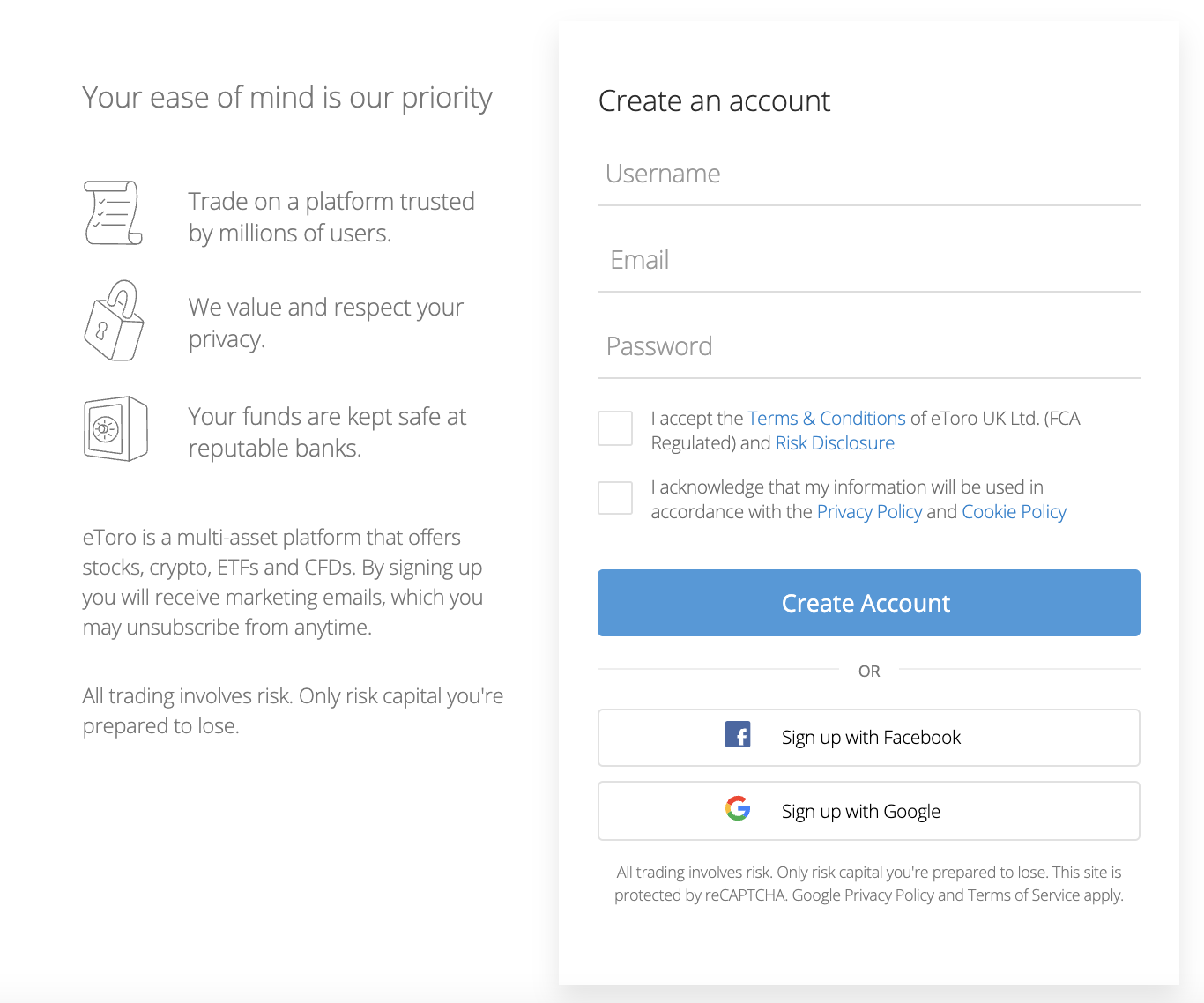

Step 1: Open an eToro Account

The first is to open a standard eToro account. This is required before requesting a swap-free Islamic account.

There are no fees to open an eToro account and the process usually takes about five e minutes. Begin the process by choosing a username and password for the account, and entering an email address.

Be sure to read the terms and conditions, before clicking on ‘Create Account’. eToro will then collect some personal information and additional contact details.

Step 2: Upload ID

All accounts at eToro must be verified. This is a requirement to ensure eToro complies with anti-money laundering regulations as stipulated by its license issuers.

The account can be verified by uploading a copy of a government-issued ID and a recently-issued proof of address.

Step 3: Deposit Funds

We mentioned earlier that the minimum first-time deposit at eToro is $10 for US/UK clients. Elsewhere, it’s $50.

However, in order to be eligible for a swap-free account, a minimum deposit of $1,000 must be met.

There are no fees applied to the deposit when funding an account in US dollars. Those opting for a currency other than USD will pay an FX fee of 0.5% – so that’s $5 when meeting the $1,000 minimum.

Supported payment types are inclusive of debit/credit cards, bank transfers, and an assortment of e-wallets.

Step 4: Request Swap-Free Account

Now that the minimum deposit of $1,000 has been made and the user has been verified, the next step is to request a swap-free account.

This can be achieved through a live chat feature that is available to registered users that are currently logged into their accounts. Simply let the eToro agent know that the minimum deposit has been made and that a swap-free account is required.

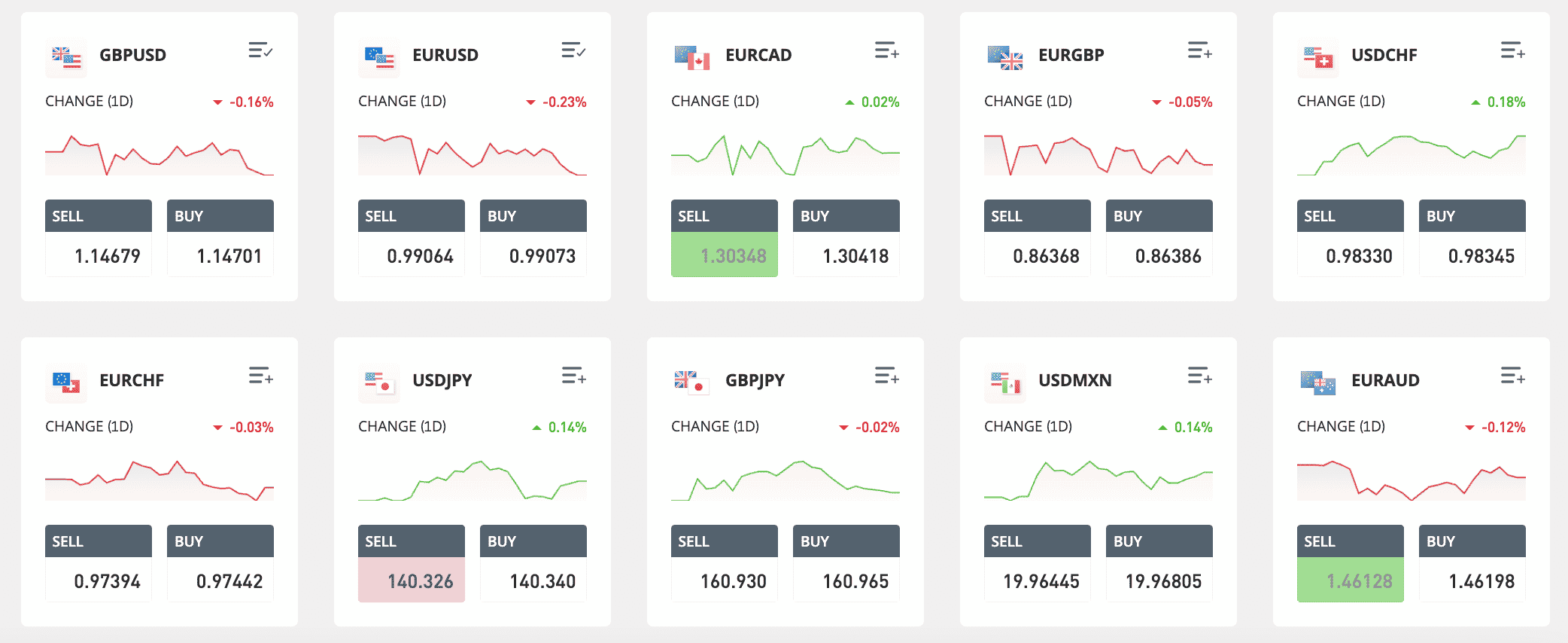

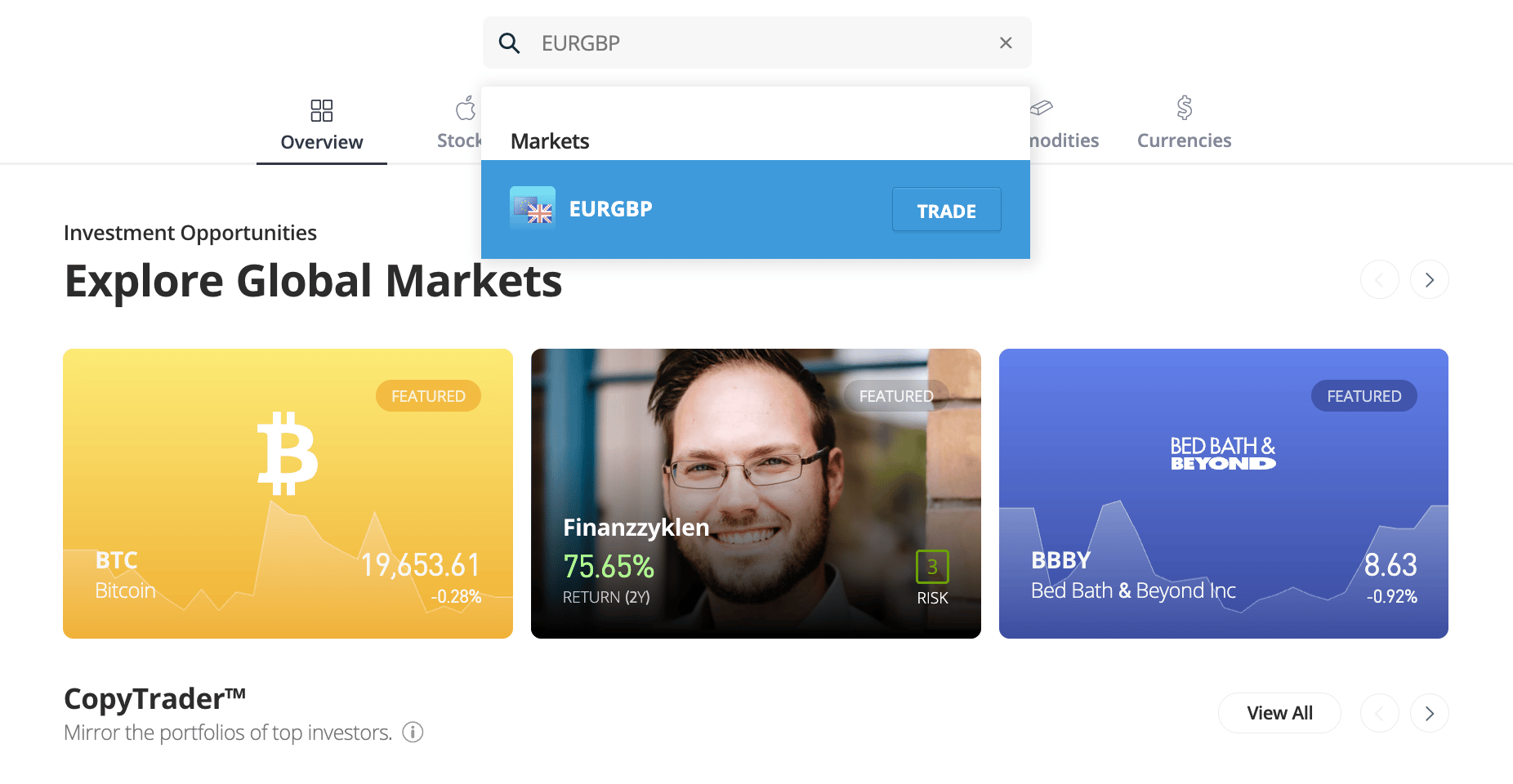

Step 5: Search for Market

eToro is known for its speedy customer support, so the swap-free account request should be granted on a same-day basis.

When confirmation is received, all that is left to do is place a trading order. First, the investor will need to search for the asset that they want to trade.

Above, we are searching for EUR/GBP. Click ‘Trade’ to load the order form for the respective market.

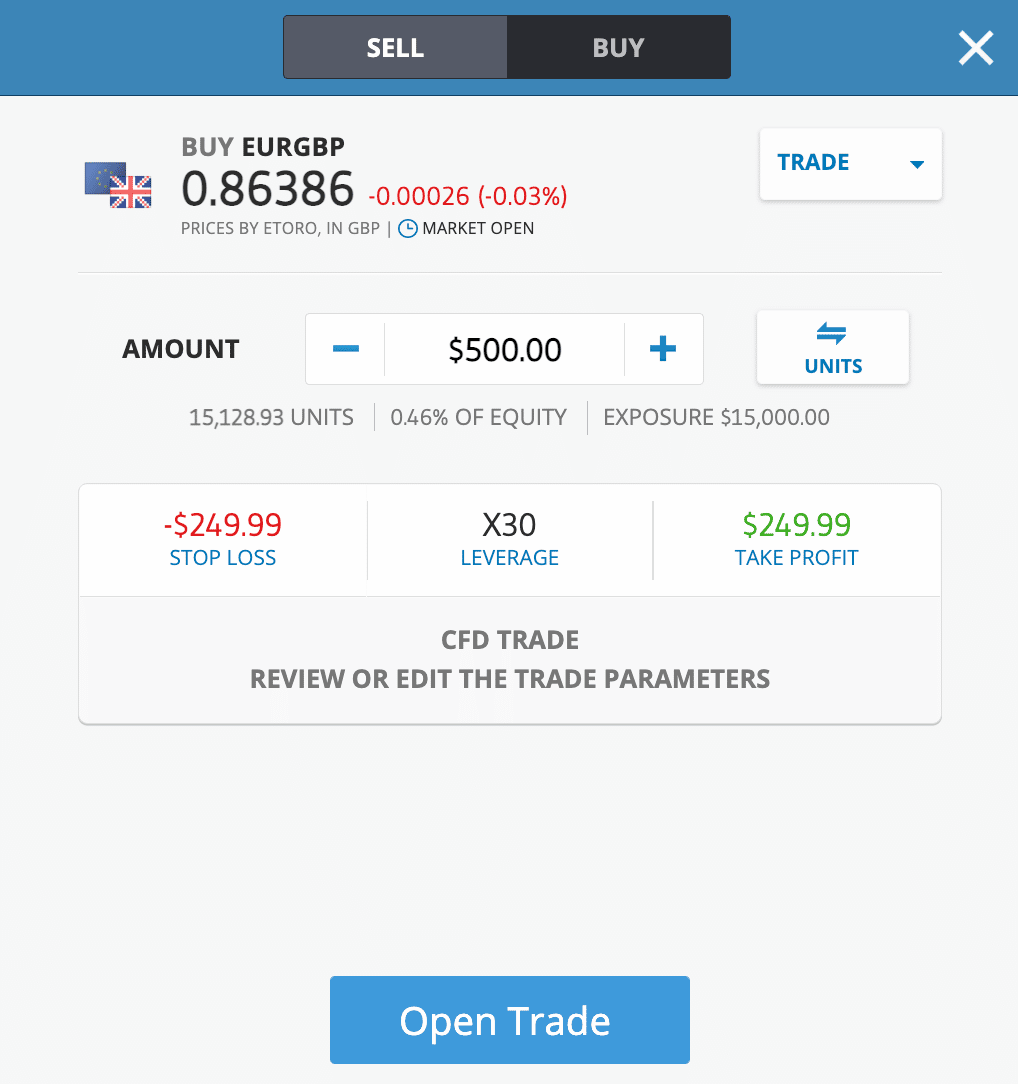

Step 6: Place Trading Order

Finally, the investor will need to place a trading order via their swap-free account.

In the ‘Amount’ field of the order box, type in the total stake. Those seeking leverage, stop-losses, and take-profits can set up a suitable position.

To place the order, simply click on the ‘Open Trade’ button.

Conclusion

While swap-free accounts likely won’t appeal to forex day traders, they can be a highly valuable tool for those that have a tendency to keep positions open for several days or even weeks.

Overall, we found that eToro is one of the best swap-free account brokers in the online space for its simple registration process, strong regulatory standing, and low fee structure.

Plus, the minimum first-time deposit to open a swap-free account is a very transparent $1,000.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider