In the previous decade the tech industry has become a major focal point for stock investors. In this beginner’s guide, we give you all the advice you need on how to watch tech stocks from the comfort of home.

We discuss the most popular tech stocks to consider in 2023 and introduce you to the main platforms that you can use to invest in these companies on a commission-free basis.

The 12 Most Popular Tech Stocks to Watch in 2023

The technology sector is vast, comprising hundreds of publicly-listed companies in the US alone.

To help you take advantage of the investment opportunities that this industry presents, we have created a list of the 11 popular tech stocks to watch in 2023.

- Tamadoge – Overall Most Popular Investment

- Battle Infinity – Exciting New Tech and Crypto Gaming Platform

- Amazon – Popular Tech Stock to Watch

- Alphabet – Tech Stock With Long-term Growth Potential

- PayPal – Cheap Tech Stock to Watch During the Market Dip

- Lumen Technologies – Tech Stock for Dividend Seekers

- Apple – Tech Stock Delivering Consistent Product Innovation

- Jack Henry – Leading Provider of Core Banking Software

- Nvidia Corp – Tech Company for Long Term Holdings

- Taiwan Semiconductor – Growth Stock With Leading Market Share

- Nio – Chinese Tech Company Manufacturing EVs

- Meta – Social Media Tech Stock With a Focus on the Metaverse

When thinking of the most popular tech stocks to invest in, it is crucial that you understand how your chosen companies work and what products they offer. After all, research and diligence play a big role in the tech sector.

Therefore, we suggest that you read our guide in full before proceeding with any tech stock investments. Despite not making it on our top-ten list, many investors are looking to buy AT&T stocks in 2023.

For those who are new to the online investment space, you can learn how to buy stocks via credit card here.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

A Closer Look at the Most Popular Tech Stocks to Watch

In the sections below, we profile each of the most popular tech stocks listed above in detail – so you have a firm grasp of the potential risks and rewards of these investments.

1. Tamadoge – Overall Most Popular Investment

Happy to live up to its name as a ‘meme coin’, Tamadoge (TAMA) differs from the likes of Dogecoin and Shiba Inu as it promises real long-term utility and value for holders as well as the potential for huge growth. That comes through the ability for holders to mint its NFT – a 21st century update on the Tamagotchi craze of the 90s, where you will feed and care for your pet for the chance to win prizes.

The pet is at the centre of the ecosystem – you raise it and eventually battle against others in a fun play-to-earn game that will win the user rewards. Later in the project’s roadmap the pet will go from 3D to Augmented Reality (AR) allowing the player to take their pet out into the real world and hunt for TAMA tokens and other prizes.

The token will also have a limited supply of 2 billion and is a deflationary asset – 5% of coins from every transaction are burned, decreasing the total supply and potentially making the coin rarer and more valuable over time.

Tamadoge is already gathering huge attention and hype on social media having rocketed past its beta presale allocation in just two weeks. It is still on presale, however, although the price point is increased once the next target is hit and a new tranche of tokens are released.

The project has also given holders the chance to take part in one of the best and biggest crypto airdrops of the year, with $100,000 of TAMA tokens up for grabs. To keep up to date with all the latest news, join the Tamadoge Telegram group.

2. Battle Infinity – Exciting New Tech and Crypto Gaming Platform

Battle Infinity is another non-traditional tech company that should be considered. Combining the virtual world with gaming elements, Battle Infinity developers designed a play-to-earn platform. Players have access to six platforms, offering numerous benefits such as exploring the Metaverse while interacting with other players and building teams to battle it out in the Battle Arena.

Players can also access the Battle Market, Battle Stake and Battle Swap, to name a few. The platform enables players to buy IBAT, Battle Infinity’s token. Players will be able to buy it on Battle Swap and trade in their rewards earned for other currency. Battle Stake enables players to battle it out to get the best annual percentage yield.

Holding the IBAT token enables players to contribute to the temper-proof ecosystem that the developers designed and they can enter multiple NFT games. Battle Market enables players to buy and sell game assets and characters while profiting from NFT winnings. Consider IBAT as an in-game crypto coin.

The Battle Infinity presale sold out in just 24 days, raising 16,500 BNB or around $5 million at the time of writing, but IBAT will next be listed on decentralised exchange PancakeSwap from August 17. Staying in the loop about Battle Infinity is best done through the Telegram group.

Cryptoassets are a highly volatile unregulated investment product.

3. Amazon – Popular Tech Stock to Watch

Amazon has grown from a small online book store to the largest e-commerce retailer in the last three decades. Today, it is virtually the go-to platform for online shopping and offers its services in over 200 countries across the globe. However, its e-commerce business isn’t the only factor that makes Amazon one of the most popular tech stocks to watch.

The company’s cloud computing product, Amazon Web Services, is the market leader in the space of global digital infrastructure. This segment has gotten stronger over the years and reported a 37% growth in the first quarter of 2022. In addition to this, Amazon has many other notable subsidiaries and acquisitions – such as Whole Foods, Zoox, Twitch, and more.

This diversity is also one of the greatest strengths of Amazon and as an investor, you stand to benefit from it. Moreover, Amazon announced that the company would be splitting its stock on a 20-for-1 basis later in 2022. This move could get Amazon onto the Dow Jones Industrial Average, which can help boost its stock price further.

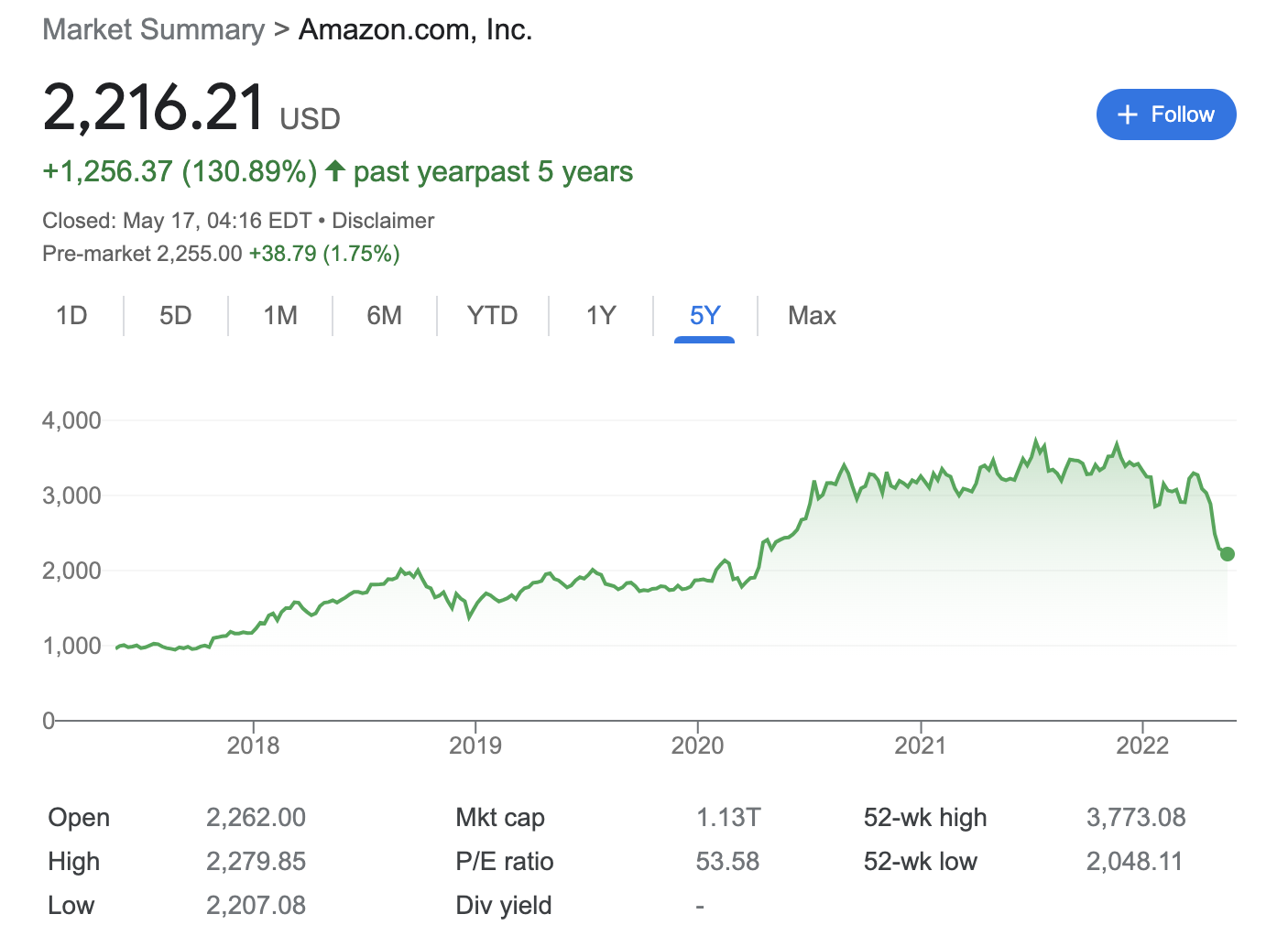

During the last five years, Amazon stock demonstrated an excellent growth of over 130%. Between its cloud-computing services and e-Commerce divisions, Amazon has built two of the most influential industries in the world. This indicates that Amazon is poised to prevail in the tech industry in the upcoming years, despite any short-term uncertainty.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

4. Alphabet – Tech Stock With Long-term Growth Potential

Alphabet is a California-based technology conglomerate holding company, popular for being the parent firm of Google. Needless to say, this is one of the big tech stocks of today and owns several former Google subsidiaries such as Waze, Nest, YouTube, and Fitbit. Moreover, Alphabet is constantly expanding and is even looking into building a blockchain solution for Web3, which is one reason it’s one of the most popular stocks to buy now on Reddit.

Alphabet owns two businesses that are market leaders in their respective categories. The Google Search Engine and YouTube dominate their sectors and as such, advertisers spend heavily on these platforms. In 2021, over 80% of Alphabet’s revenue came from paid advertisements on these two platforms alone.

In comparison, only 11% of the revenue came from its other business such as subscriptions, Google Pay, and Pixel phones. Although Google Cloud remains unprofitable, it contributed 7% of the firm’s total revenue. As you can see, Alphabet has a diversified portfolio within the tech industry.

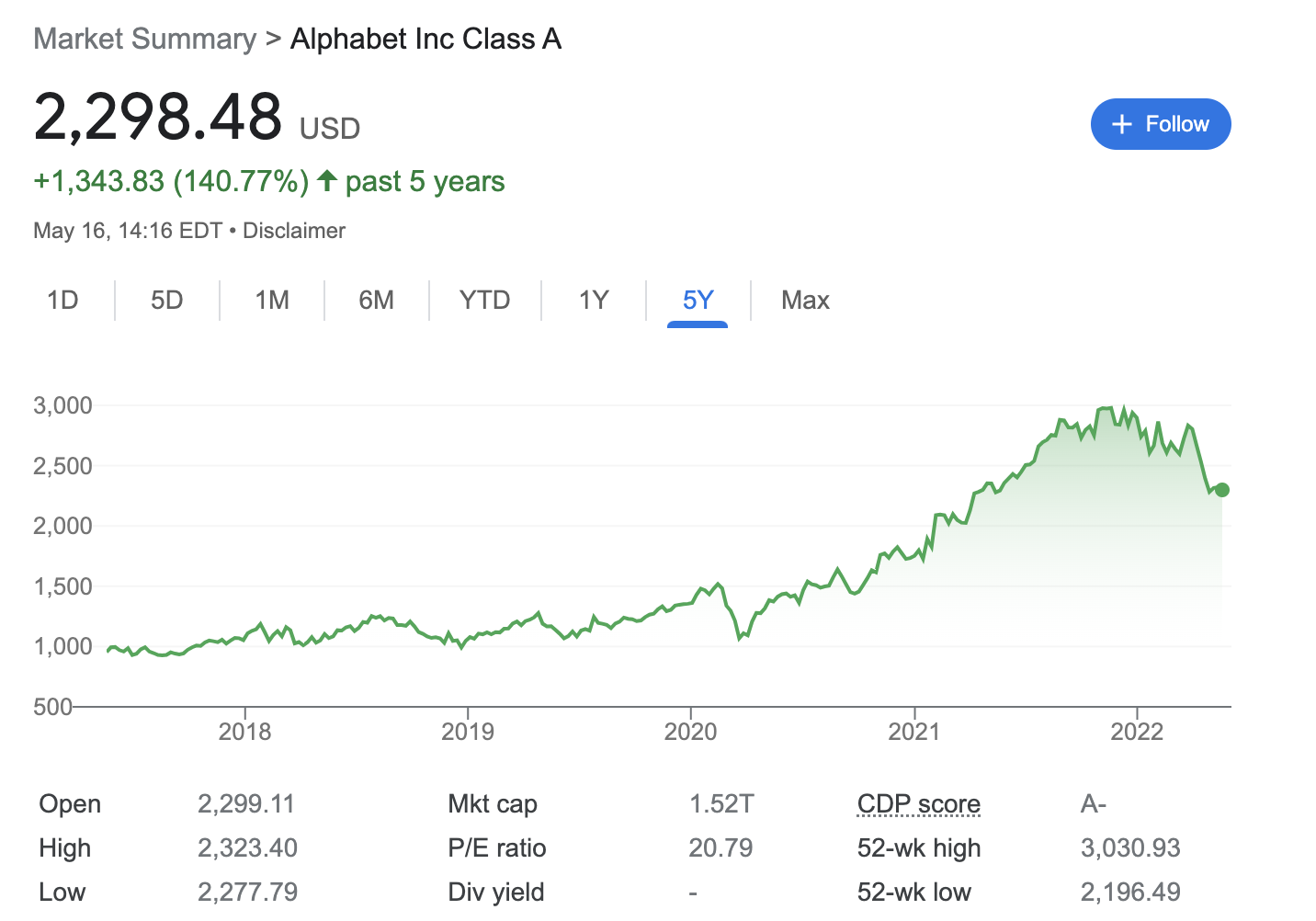

In terms of the stock market performance, Alphabet has recorded a growth of around 140% over the past five years. However, the stock was very volatile during the past few months – much like the rest of the market. Nevertheless, it has outperformed the S&P 500 over the last 12 months.

If you want to buy Alphabet stock, the company has announced a 20-for-1 stock split that is to take place in July 2022. This will make the equity more affordable. Those who invest in this tech stock for the long term are likely to reap the benefits of potential buybacks and cash generation. Nevertheless, you can purchase this stock in fractional quantities via leading online brokers such as eToro.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

5. PayPal – Cheap Tech Stock to Watch During the Dip

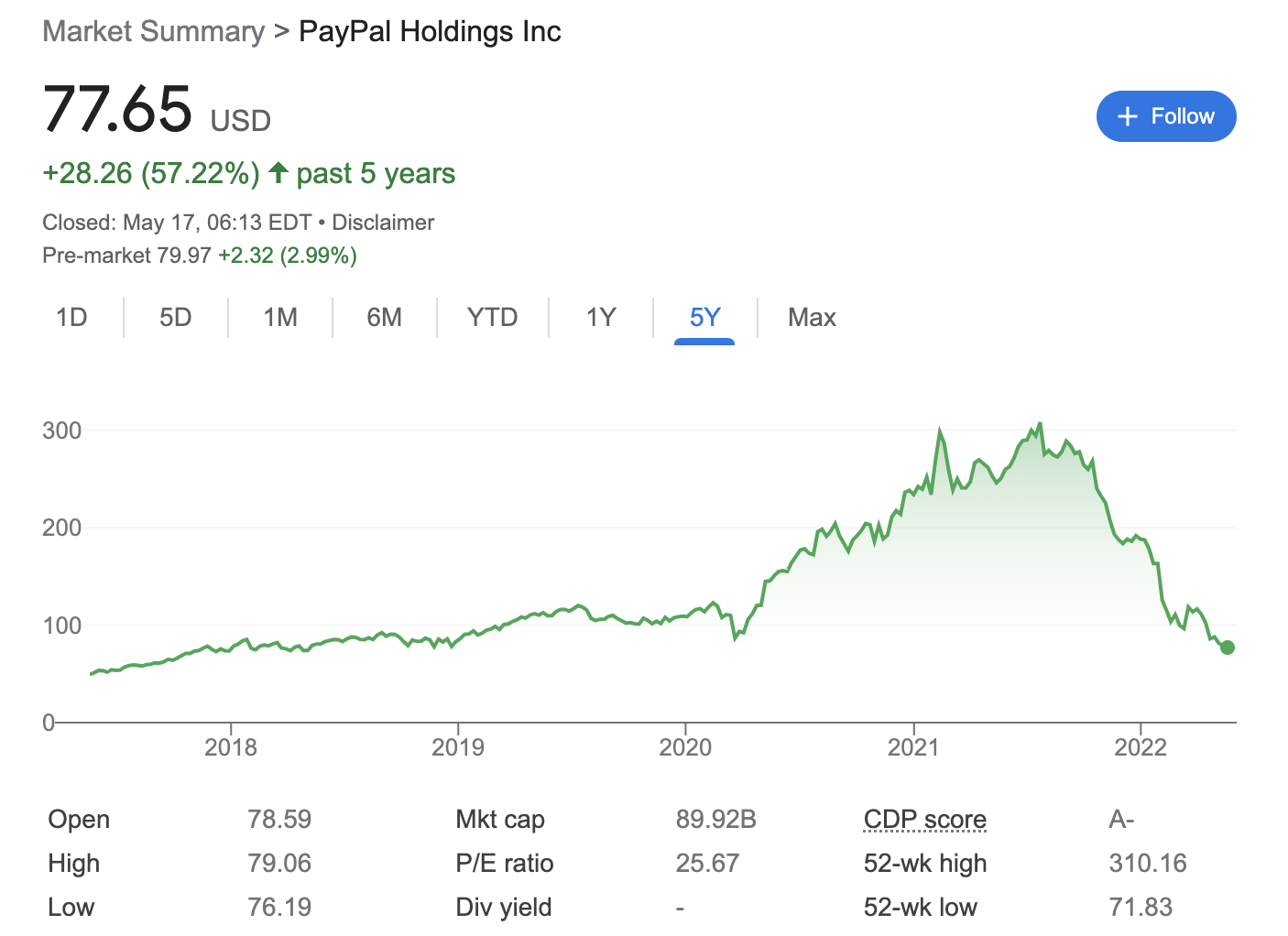

PayPal is one of the tech stocks to have benefited from the COVID-19 pandemic market. This fintech stock rallied by nearly 200% from the start of 2020 through July 2021. However, things have changed since then – PayPal stock is down by around 70% over the course of the last 12 months.

As the world’s largest mobile payment system, PayPal has built a solid reputation. It is the most accepted digital wallet across the US as well as Europe and controls more than 50% of the global payment processing software sector. PayPal is further expanding and has started offering cryptocurrency payments and purchases via its ecosystem.

All in all, PayPal is showing no signs of slowing down. The company has also boasted a consistent track record of sales and earnings growth for over a decade. However, PayPal has issued disappointing profit forecasts for 2022 – which led to investors dumping their stocks. The company cites factors such as higher inflation and supply-chain disruptions for this move.

However, since PayPal has a strong growth strategy, analysts expect the stock to perform better in the coming years. For example, apart from offering support for crypto trading, PayPal also plans to add a high-yield savings product to its digital wallet and plans to introduce additional financial services.

PayPal is also adopting new measures to monetize Venmo more efficiently. In light of these factors, PayPal stock has plenty of potential to amplify its earnings in the long term. This makes PayPal one of the most popular tech stocks to consider right now.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

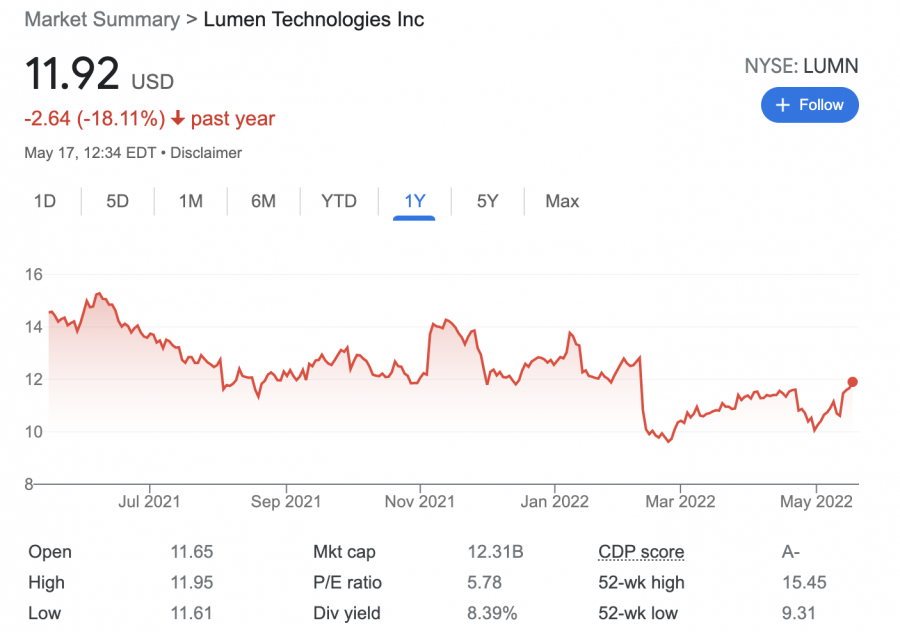

6. Lumen Technologies – Tech Stock for Dividend Seekers

When thinking of the most popular tech stocks to invest in, you might be tempted to sway towards growth companies that offer innovative products. However, the majority of these firms often opt to reinvest their profits for growth and expansion rather than to distribute them among stockholders.

Therefore, if you are looking for the most popular dividend stocks, you will have to consider older but established companies in this sector – such as Lumen Technologies. Lumen is an international company engaged in providing a range of communication and technology services to businesses. Based in America, this firm is a member of the S&P 500 and the Fortune 500.

Its products include broadband. data integration, local and long-distance voice tools, 5G networking, videos, VoIP, information technology, and other ancillary services.

The company is in the process of restructuring its portfolio and plans to sell assets in order to streamline its operations. As a result, the firm anticipates a decrease in its free cash flow. Regardless, Lumen has announced that it will continue paying dividends to its stockholders.

At the time of writing, Lumen offers an extremely high running dividend yield of just under 8.50% – which is a rare occurrence in the tech industry. The company is also poised to benefit from the continued growth of cloud computing services and the popularity of remote working trends.

In addition to this, Lumen has built an extensive fiber network and positions itself as one of the 5g tech stocks of 2023.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

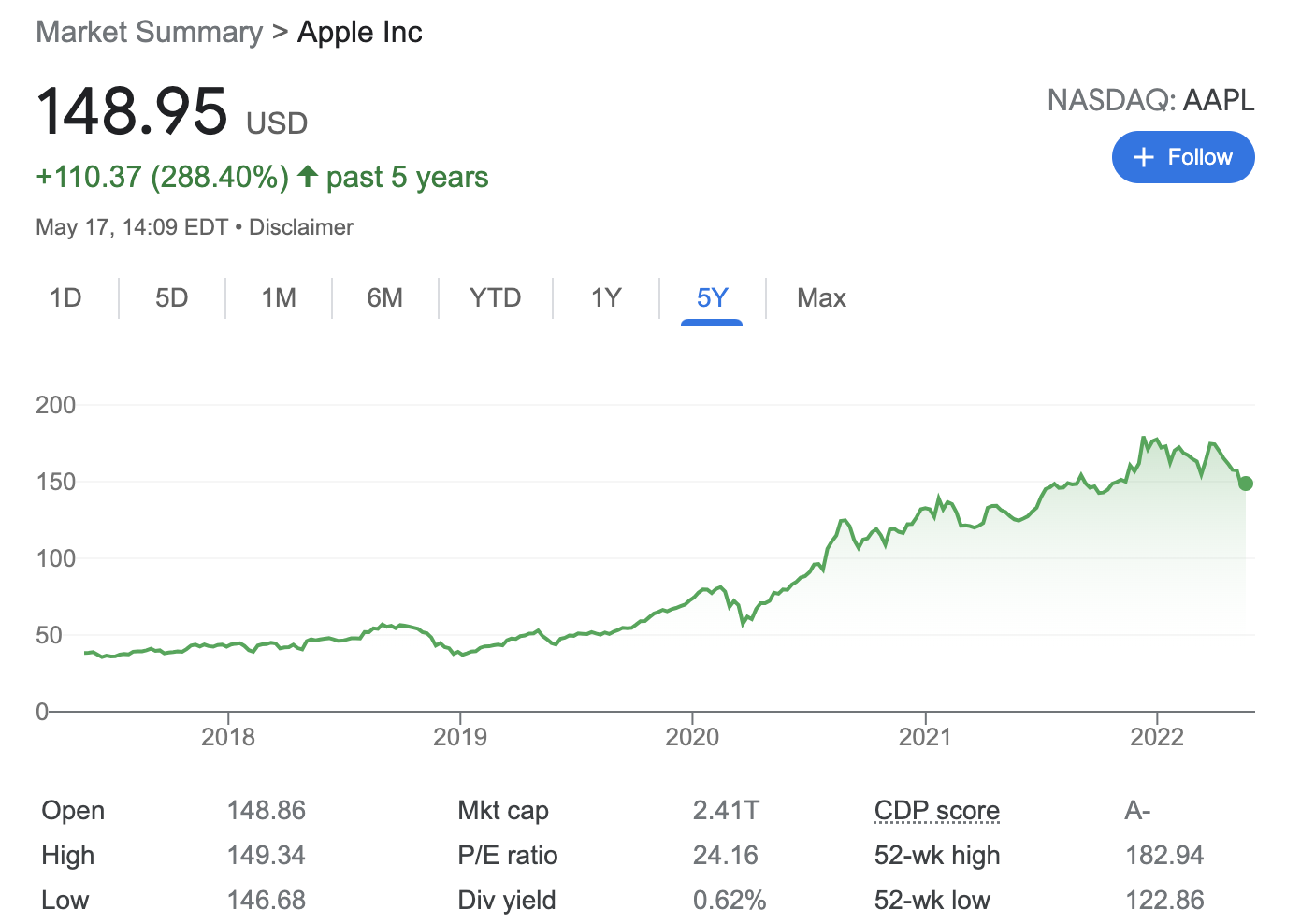

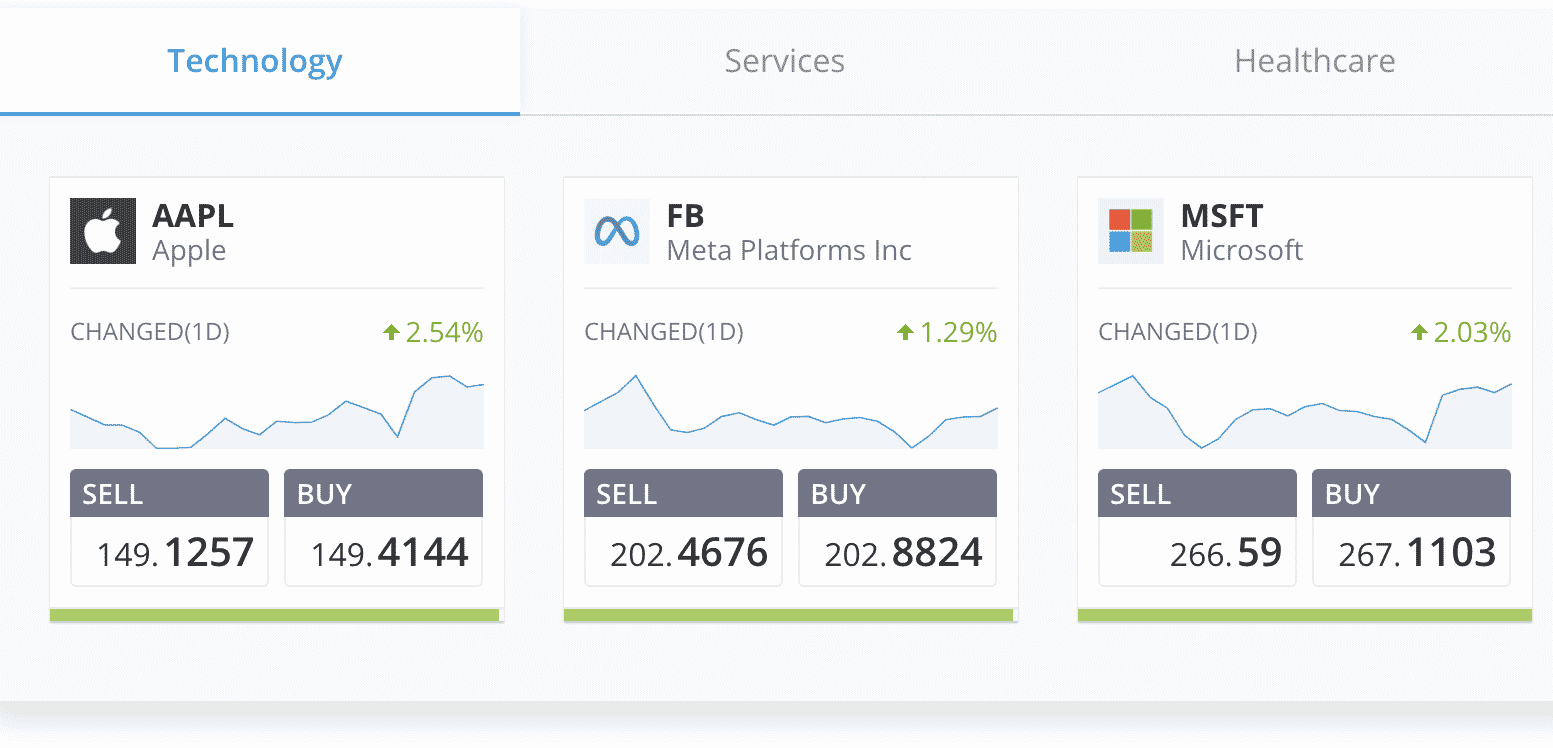

7. Apple – Tech Stock Delivering Consistent Product Innovation

As you likely know, Apple is a giant in the smartphone industry and continues to deliver impressive growth. The company posted strong earnings for Q1 2022, reporting a revenue record of $97.3 billion, up 9% year over year. In the last five years, this tech stock has witnessed its value increase by nearly 290%.

Apple has benefited significantly from the growing adoption of 5G smartphones. In 2021, the company sold over $190 billion worth of iPhones, which made up more than 50% of its total revenue. The 2022 iPhone SE model is expected to boost sales even further, due to its relatively affordable price tag.

Since the beginning of 2022, Apple stock has fallen by nearly 19%. Despite broader turbulence in the stock market, Apple’s business remains robust. At the time of writing, Apple is trading at around $150, which is about 20% below its 52-week high.m Apple has repeatedly succeeded in creating innovative products that bring in billions of dollars in sales.

Moreover, it also offers a running dividend yield of around 0.60%.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

8. Jack Henry – Leading Provider of Core Banking Software

Jack Henry & Associates is a payments technology services company based in the US. It caters primarily to the banking sector, providing software that helps financial organizations execute their business strategies. The firm is a constituent of the S&P 500 index and has over 8,500 clients across the country.

Jack Henry has played a crucial role in assisting banks with their transition to the cyberspace – which has helped them enhance efficiency and boost their revenue. Some of its top clients include First Florida Integrity Bank, Northway Bank, IncrediBank, Washington Trust Bank, PSB, and many more.

With the growth of digital banking services, Jack Henry’s services continue to be high in demand. To drive this demand, Jack Henry is constantly innovating, adding new tools and features to its portfolio. One of its latest products is a lending tool named FactorSoft, which lets banks provide near-real-time services to institutions.

In recent years, Jack Henry has also made substantial investments in payment solutions, and in the prevention of financial crime. All these factors suggest that Jack Henry is one of the most popular tech stocks to watch. On top of this, Jack Henry also offers a running dividend yield of nearly 1.10%, which might be an aspect for income investors.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

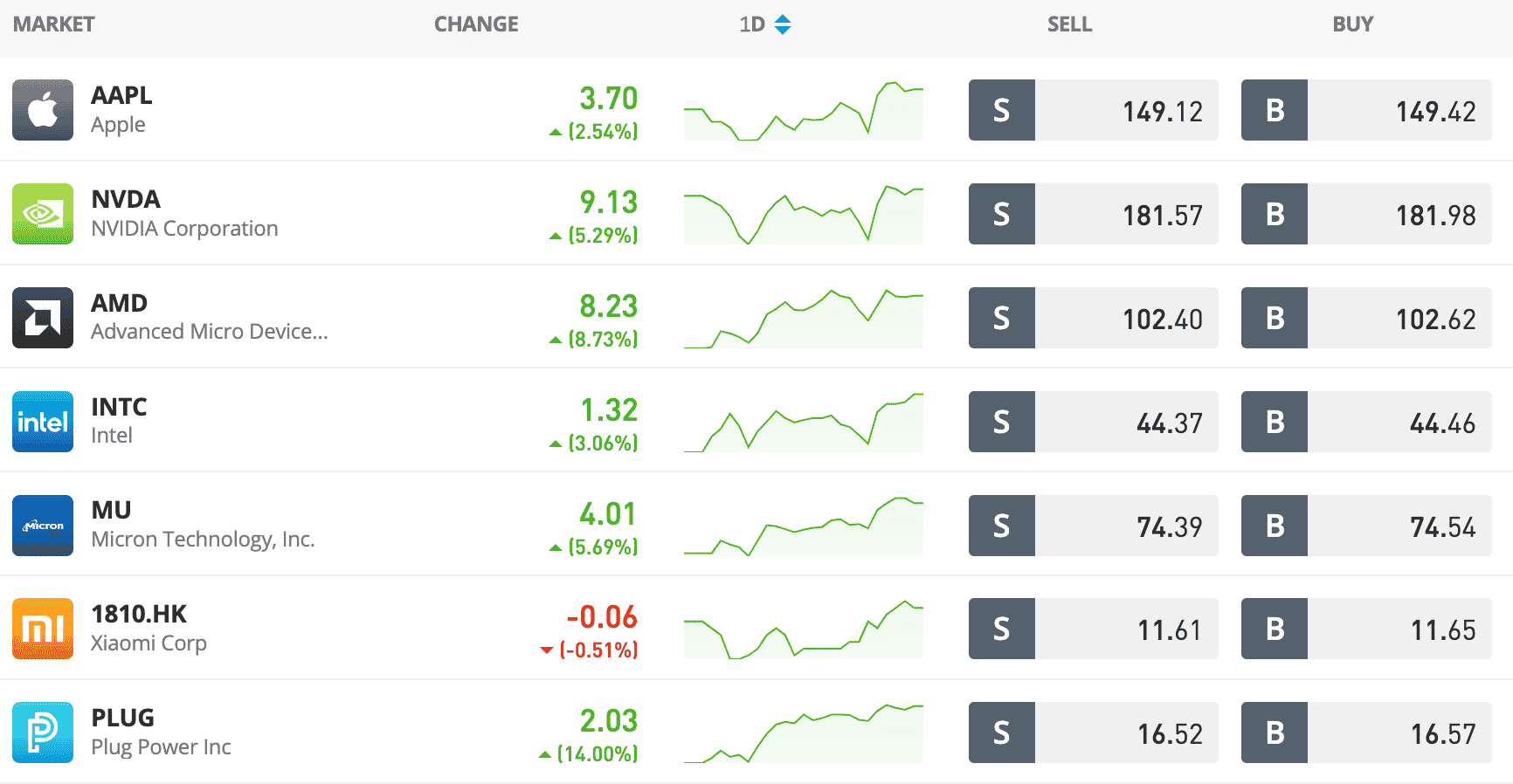

9. Nvidia Corp – Tech Company for Long Term Holdings

Nvidia is a dominant force in the computing chip space. The company is known for its Graphics Processing Units (GPUs) and is one of the top contenders in the cloud computing and AI spaces. It has sold its graphics cards for use in personal computers and gaming consoles for more than 20 years.

Nvidia is heavily invested in gaming and identifies this sector as its largest source of income. In fact, this segment accounted for over 40% of the company’s top-line revenue in the fiscal year of 2022. According to management, Nvidia sees a revenue opportunity of $100 billion from this industry.

Nvidia is set to reap profits from the automotive market too, which can supercharge its growth over the long term. Top car manufacturers such as Hyundai, Mercedes, Tata Motors’ Jaguar, Volvo, and Land Rover have already partnered with Nvidia for its full-stack autonomous driving platform.

Over the past five years, Nvidia stock has generated a return of over 430% for its investors. The stock has stumbled a bit since the turn of 2022, caused by broader tech market conditions. In any regard, the long-term outlook seems incredibly bright for Nvidia, making it one of the most popular tech stocks for 2022.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

10. Taiwan Semiconductor – Growth Stock With Leading Market Share

Another leading firm in the growing computer chip market is Taiwan Semiconductor. Although based in Taiwan, you can invest in this tech stock via the NYSE. This company does not design computer chips – instead, it manufactures them for third-party customers such as Apple, AMD, Marvell, and even Nvidia.

This way, companies are able to delegate their manufacturing expertise to Taiwan Semiconductor, thus saving time and money. This business model has allowed Taiwan Semiconductor to lock in its most prominent customers and take over 50% of the total market share in the semiconductor manufacturing industry.

Unless there is an extreme change in industry demand, Taiwan Semiconductor will be able to grow its business steadily as the years go by. In other words, Taiwan Semiconductor has a defensible market position. The company reported its earnings for Q1 2022 in April, and it crushed the estimates of Wall Street analysts.

It grew its revenue by 35% and increased its guidance to 20% for 2022. However, if you are viewing Taiwan Semiconductor as the most popular tech stock to watch, there are some other considerations to make. Since the beginning of 2022, the stock value of Taiwan Semiconductor has fallen by nearly 30%.

Apart from the general market slump, another reason for this is the geopolitical risks faced by Taiwan. Russia’s invasion of Ukraine has led to fears that China might do the same to Taiwan, which will likely have a hugely negative impact on the stock. As these geopolitical worries ease, the market sentiment could become more bullish toward Taiwan Semiconductor.

Put another way, this market downturn might be an opportunity for you to watch this tech stock

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

11. Nio – Chinese Tech Company Manufacturing EVs

When considering the most popular tech stocks to watch, you should not hesitate to look past software companies. And if you wish to diversify internationally, Nio is a prominent company that can give you exposure to the Chinese markets. Nio is a leading name in the Chinese electric-vehicle field and specializes in the designing and manufacturing of premium EVs.

Nio’s EVs boast advanced technological features such as autonomous driving – making it one of the most popular Chinese tech stocks to consider in 2023. Moreover, it also designs digital cockpits that support virtual reality shops. The company is also expanding its EV charging network across China and Europe.

Although headquartered in China, Nio stock is primarily listed and traded on the NYSE. And you can invest in this company via an online broker like eToro without paying any commission – even if you’re based in the US. That being said, like other Chinese tech stocks, Nio has taken a beating in the stock market in recent months.

Over the past year, Nio stock has decreased by over 50%. This downtrend was caused by political and regulatory fears, along with increased supply chain costs and lockdowns in China. Nevertheless, Nio continues to strategize for its future growth and is planning to launch new EV models by the end of 2022.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

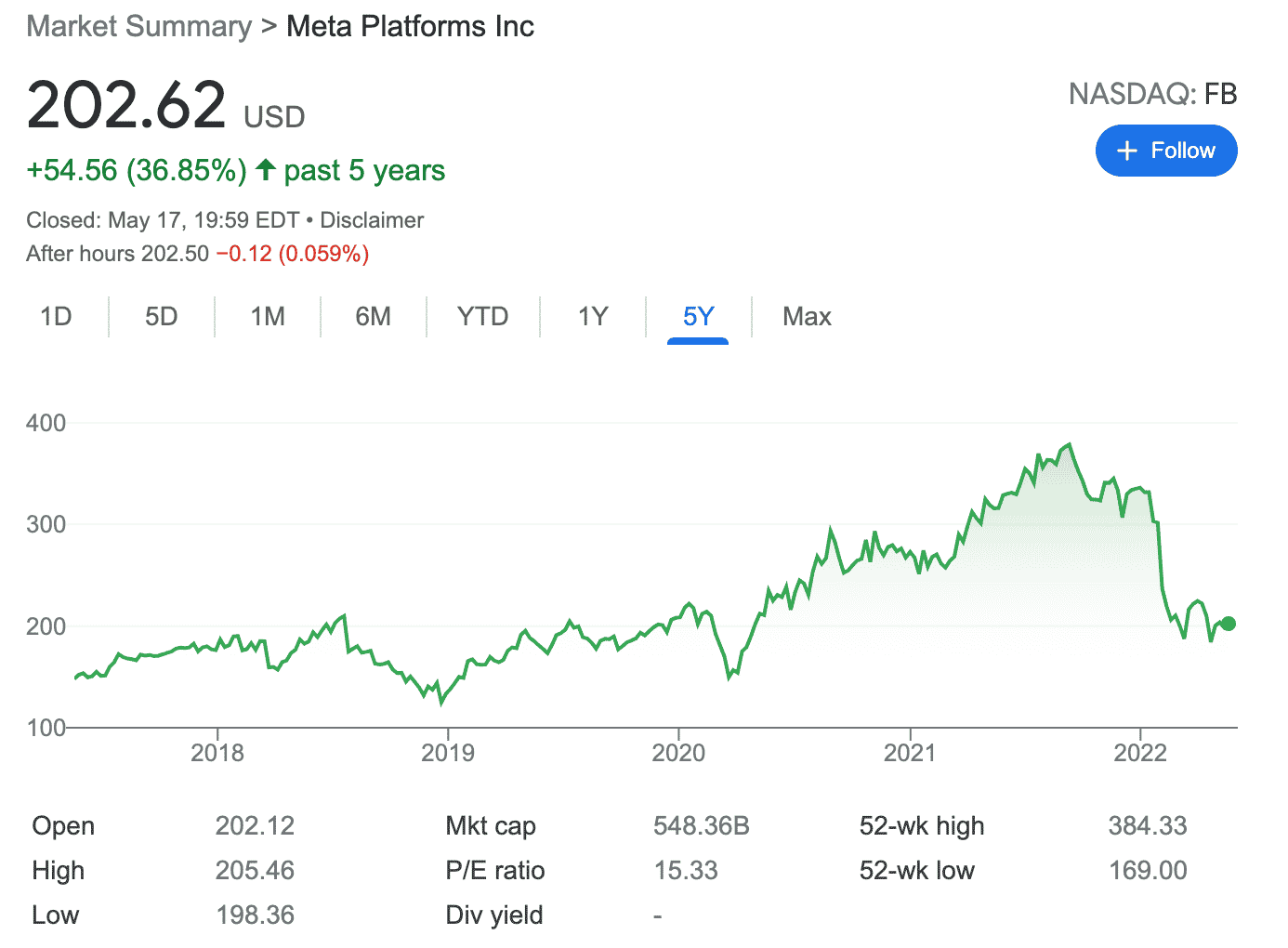

12. Meta – Social Media Tech Stock With a Focus on the Metaverse

Meta is the parent company of the social media behemoth, Facebook. It also owns other notable companies such as Instagram, Whatsapp, and Giphy. Meta generates a large portion of revenue from advertisements on these platforms. Big corporations are spending millions of dollars in advertising to get their products in front of social media users,

Both Facebook and Instagram are also encouraging small businesses to use their paid advertising services to reach a wider audience. However, social media is only one segment of Meta’s investments.

Meta is already making a serious effort to diversify its revenue stream. It is no longer focused on just its social media network. Instead, Facebook has already revealed its plans to capitalize on the growth of the metaverse. The company made an investment of $10 billion into the development of the metaverse in 2021 alone.

Now, Meta is focusing on ways to monetize this investment. It has already built a virtual-reality social platform named Horizon Worlds, which is now in the beta stage of testing. The platform allows developers and creators to sell digital items and experiences via this virtual world.

However, Meta saw its stock value decline by nearly 40% during the first four months of 2022, amidst a broader sell-off in the tech sector. However, its latest earnings report for Q1 2022 has beat the expectations of analysts, which might improve the stock price moving forward. Regardless, in light of its growth potential, Meta is one of the most popular long-term tech stocks to watch. Read our guide on how to buy Meta stock for more details.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

How to Judge the Most Popular Tech Stocks to Watch

There are hundreds of companies that can give you exposure to the tech industry. After all, any company that sells a product or service that is infused with technology belongs to this sector.

However, this means that it can be a headache picking the tech stocks that work most popular for your portfolio.

If you are unsure about where to start when selecting tech stocks, you can use the following guidelines.

Study the Balance Sheet

One of the first things to evaluate when investing in tech stocks is whether the firm has a healthy balance sheet. In simple terms, this means that the firm should have more cash than debt.

It is also important to understand that many tech companies often have a high debt ratio due to the considerable expenditures on research and development.

But, this can also make way for opportunities for a steady stream of growth in the future, fueled by a pipeline of new products and features.

Therefore, instead of looking for companies with no debt, you will want to search for those with manageable liabilities – so that they don’t run the risk of going bankrupt, especially in such a volatile economy.

For instance:

- Alphabet reported total long-term debt of $14.7 billion for Q1 ending on March 31, 2022.

- This might seem like an incredibly overwhelming amount at first. However, the company also has $133.9 billion as cash on hand.

- Put otherwise, this net cash implies that Alphabet does not have a heavy debt load.

Therefore, there is no need to concern yourself too much with the debt, as long as the company has enough net cash to attend to any immediate threats.

On the other hand, if you choose to invest in a tech company that has a weak balance sheet, you might be adding a huge layer of unnecessary risk to your portfolio.

Research the Stocks’ Position in the Industry

The tech industry is evolving at an unparalleled pace. When investing your money in a tech stock, it is crucial to learn more about the company’s standing in its target market, along with the advantages and disadvantages of its product portfolio.

In addition to this, you should also learn about its competitors. For instance, a company that makes most of its money from a technology that is being faded out could be a risky investment.

Instead, you might want to allocate your money on a firm that has some staying power.

Oftentimes, the most popular tech stocks are those that have multiple streams of income. Similarly, you should also try to understand the nuances of the industry in which the company operates.

There are many categories within the tech sector – such as IT, social media, hardware, automotive, software, and semiconductors. The future of the tech stock you choose will depend on the broader industry’s growth.

Recurring Revenue Growth

Having a recurring revenue stream indicates that the tech company offers products that customers pay for on an ongoing basis.

Unlike one-off sales, these recurring deals are predictable and tend to be more stable. This allows the company to plan for future growth needs more effectively.

- For example, social media companies like Meta (Facebook) can look at their advertisement sales as recurring in nature.

- Similarly, tech companies like Adobe also rely on subscriptions to generate revenue on a recurring basis.

If you are an investor looking for tech stocks with a lower risk profile, you might prefer companies that make their revenue from such business models.

If a company has a recurring revenue growth in the range of 20% or more, this shows that the firm is able to expand within the market it serves.

Are Tech Stocks a Sound Investment?

Technology companies are some of the most highly valued businesses in the stock market.

As we noted above, several tech-related companies have witnessed tremendous gains in recent years. Given the growth of this sector, it is no wonder that investors are piling into tech stocks.

Below, you will see some of the possible benefits of opting to invest in the most popular tech stocks today.

High Returns

Investing in fast-growing tech brands can be a very effective way to boost returns. Some of the most popular tech stocks in the market have a history of generating triple-digit returns in a single year of trading.

While S&P 500 has struggled with a five-year total return of 68%, the tech-heavy NASDAQ has increased by almost double at around 120% during the same time period.

Chance to Diversify

One good thing about the tech industry is that it gives you several options in terms of diversification, allowing you to choose an investment that works most popular for your knowledge base and financial goals.

You can add diversity to your portfolio just by investing your money into different companies within the tech sector.

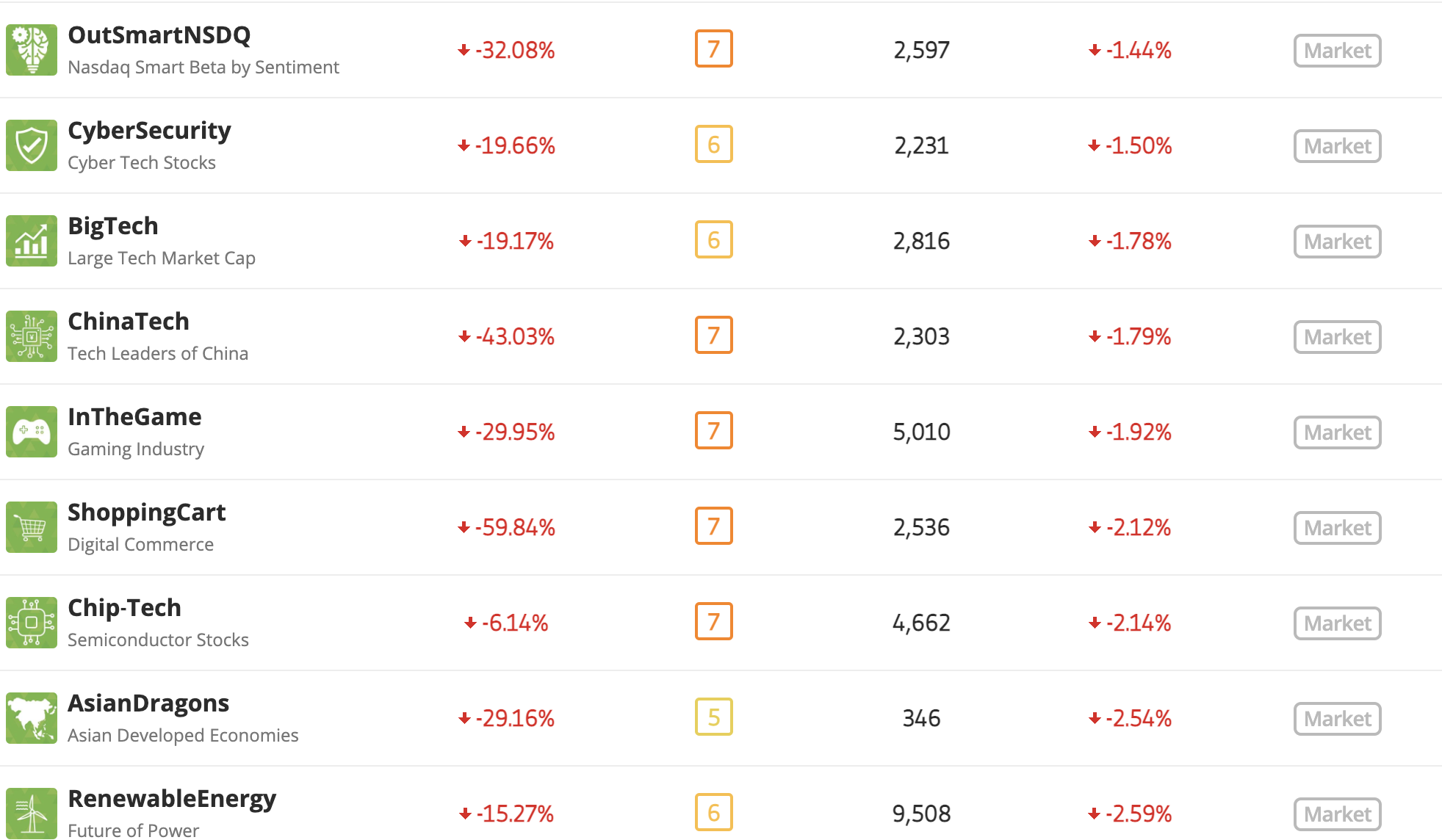

- The easiest way to diversify would be to invest in ETFs and indices that focus on tech stocks.

- For instance, the ARK Innovation ETF bets on several high-flying tech stocks.

You can access these ETFs through brokers like eToro without paying any commission.

eToro also gives you access to managed portfolios that are tech-oriented. These are over 20 different tech-focused smart portfolios on eToro that lets you diversify into different facets of this industry.

The broker provides detailed information on each portfolio such as the weightage, risk score, and returns generated – making it possible for you to arrive at an informed decision.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Invest in Innovations

The most popular tech stocks in the market are constantly innovating. Owning stocks of innovative firms gives you an opportunity to contribute to a project you believe in.

It will also let you participate in gains from a technology that can shape the way we lead our life. For example, smartphones have completely transformed the way we interact with the world.

Moreover, technology is an enjoyable topic for many investors, which makes the prospect of research less of a burden.

Risks of Investing in Tech Stocks

While there are plenty of reasons to get executed about tech stocks, this sector isn’t without its risks.

As such, when learning how to watch tech stocks for your portfolio, you should first consider the potential drawbacks.

Competition

The tech sector is constantly chasing new trends.

Sometimes, regardless of how solid a company is, a new competitor can start chipping away at its market share.

For instance:

- Facebook was unrivaled in the social media space for a number of years.

- For Facebook, no competitor has been as threatening as TikTok, a video platform that has taken the world by storm.

- TikTok is also the fastest-growing app in history, captivating younger audiences.

Similarly, Taiwan Conductor is also facing severe competition from the likes of Samsung and Intel, which are releasing new products to attract prospective clients.

As you can see, at any point, well-established companies can have their businesses disrupted by new players with a stronger offering.

Therefore, it is pertinent to keep up with the trends in the tech space, in order to evaluate your portfolio and update it accordingly.

Regulatory Backlash

The increased regulation and government scrutiny can also lead to a backlash against tech stocks. This can affect the market performance of tech stocks as well as future prospects.

As you might know already, Facebook has faced several lawsuits over a privacy breach that resulted in the leaking of personal information of more than 530 million users.

The company has also been under scrutiny for how it utilizes user data. Such data breaches and revelations can spur regulators to pass new laws, which can impede the growth of the broader tech sector.

Understanding the Business Might be Complicated

As we pointed out earlier, it is imperative that you understand a company’s product portfolio in order to analyze its future prospects.

However, discovering the latest technologies can be challenging and might involve a steep learning curve for many.

This can add to the risk when deciding which tech stocks to invest in. Therefore, you have to ask yourself if you want to invest in a company that you might not fully understand.

Tech Penny Stocks

It seems that new technologies are being developed every day. Your next big investment opportunity might not be a well-established company, but rather upcoming tech stocks.

These new tech stocks can potentially soar if their products are widely adopted.

Here are some of the tech stocks under $5 that you can consider investing in right now.

- Exela Technologies – This is a business process automation company that offers a wide range of services including accounting software, HR, and legal management.

- American Virtual Cloud Technologies – This company offers cloud-based services in the digital communication sector. It gained the attention of investors as one of the most popular meme stocks of 2021.

- TD Goldings – This China-based holding company operated a digital platform that offers commodity trading and supply chain management solutions.

While at first glance the above companies might look like undervalued tech stocks, they can be especially risky. This is due to their lack of history and low liquidity in the stock market.

Therefore, you should be careful before considering whether to invest in tech penny stocks.

Where to Buy Tech Stocks

Before you can buy tech stocks, you need to choose a trustworthy broker. Preferably, a broker that is regulated by a top financial authority.

Moreover, you will also need to consider the investment costs and minimum trading requirements.

eToro – Overall Most Popular Broker to Buy Tech Stocks

One of the main reasons why we prefer this broker is that you can buy stocks on eToro at 0% commission. This means that you do not have to pay any dealing charges when you invest in tech stocks. Moreover, eToro also covers the cost of deposits for US-based users.

You can fund your account by making a bank transfer, or using your debit/credit card, all without paying any additional charges. It even supports modern payment methods such as PayPal, Neteller, and Skrill. The minimum stake required to buy tech stocks is only $10, which means that with just $100, you can have a diversified portfolio of ten different equities.

Safety and security-wise, eToro is regulated on multiple fronts – by the SEC in the US, the FCA in the UK, ASIC in Australia, and CySEC in Cyprus. You can get started on this platform with a minimum deposit of just $10, and open an account in less than 10 minutes.

eToro is also particularly popular among millennials because of its social trading features. It comes with an innovative copy trading tool that allows you to repeat the trades of experienced investors on the platform. This gives the opportunity to create a portfolio, without even having to be an expert in stock investing.

As we noted earlier, this broker also gives you the option to invest in the tech industry via its smart portfolios. These track a specific collection of tech stocks and allow you to diversify into this sector. You can also use eToro to buy cryptocurrency at a flat fee of just 1% and trade other markets such as forex and commodities on a spread-only basis.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

Finding trending tech stocks is one way to figure out what broader market sentiment currently looks likes.

However, before you invest in the most popular tech stocks that the market has to offer, it is important that you research the business and understand what you are putting your money into.

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption

Battle Infinity - New Metaverse Game

- Listed on PancakeSwap and LBank - battleinfinity.io

- Fantasy Sports Themed Games

- Play to Earn Utility - IBAT Rewards Token

- Powered By Unreal Engine

- Solid Proof Audited, CoinSniper Verified