If you’re looking to embark on an investment journey by buying and selling stocks, crypto, and other assets in one safe place – you’ll need an account with a top-rated trading platform.

We find that the best online trading platforms offer competitive fees and commissions, lots of supported markets, a full suite of tools and features, and superb customer service.

In this guide, we help clear the mist by comparing the very best trading platforms in the market right now.

The Best Trading Platforms to Use in 2023

A list of the best online trading platforms can be found below.

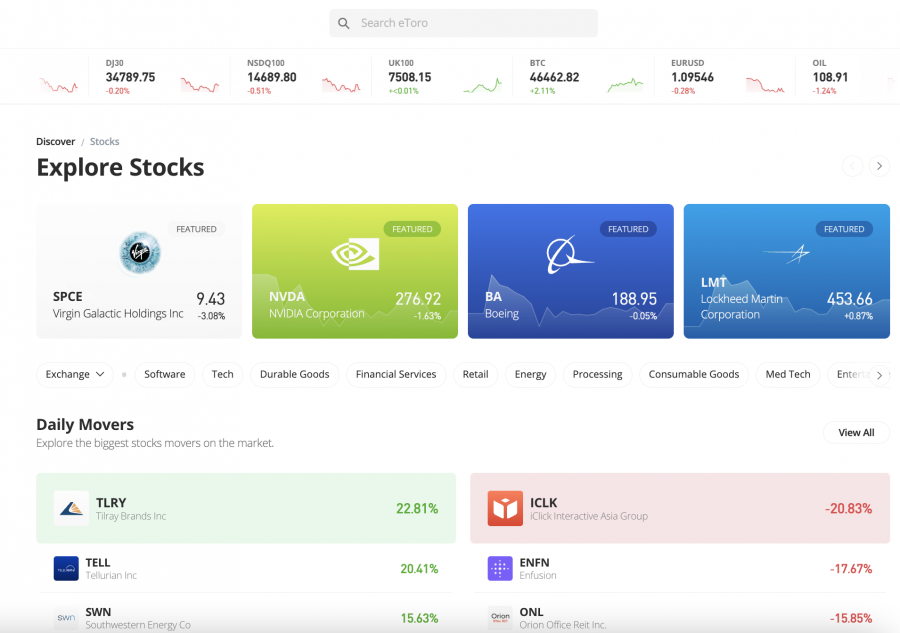

- eToro – Overall Best Trading Platform in 2023

- Crypto.com – Best Crypto Trading Platform for Low Fees

- XTB – CFD Trading Platform for Forex, Stocks, Crypto & More

- Webull – Popular Platform for Trading US Stocks and Crypto

- Coinbase – Good Cryptocurrency Exchange for First-Time Investors

- Binance – Advanced Cryptocurrency Platform With Low Commissions

- Interactive Brokers – Established Trading Platform With Thousands of Markets

- E*TRADE – Great Investment Platform for IRAs

- Schwab – Trade US-Listed Stocks and ETFs at 0% Commission

- Fidelity – Top Trading Platform for Long-Term Investments

- TD Ameritrade – Trusted Brokerage Offering Diverse Trading Markets

- Robinhood – User-Friendly Trading Platform for Beginners

- Ally Invest – Combine Investment and Banking Services via a Single Platform

No two trading platforms are the same – so be sure to read our comprehensive reviews to ensure you choose the best option for you.

While not on our top 12 list, another popular trading platform worth considering is Capital.com. Read our in-depth Capital.com review for more details.

Best Online Trading Platforms Reviewed

In the in-depth reviews below we discuss the overall best trading platforms to consider right now. Whether you’re looking for the best futures trading platforms, or the best place to invest in ETFs most of the brokers we’ve included in this review offer assets and trading features to suit all types of investing.

Each brokerage provider differs in terms of fees, supported markets, user-friendliness, and more – so there should be a platform to suit all requirements.

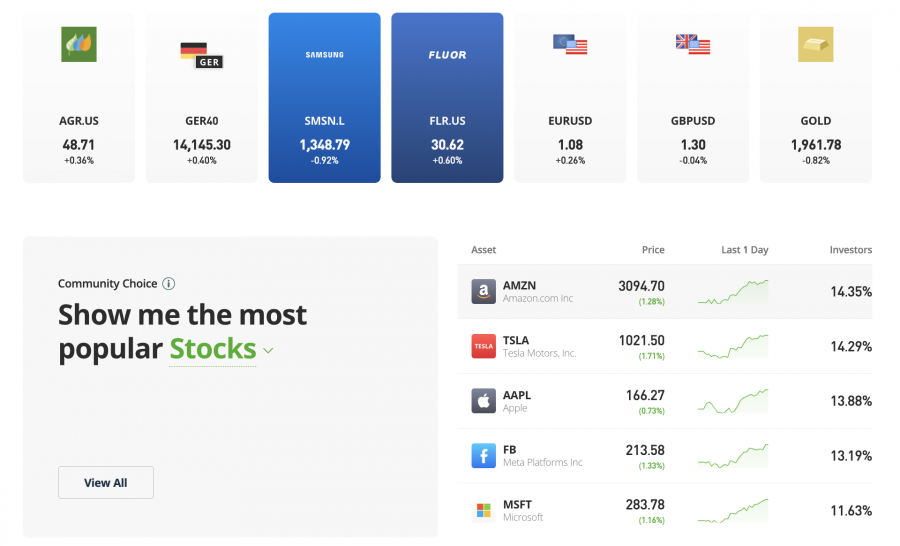

1. eToro – Overall Best Stock Broker for 2023

Then, you will have access to thousands of stocks and ETFs from the US and beyond. This covers markets in the UK, Hong Kong, Canada, Germany, and much more. For example traders can buy DWAC stock with some of the lowest trading fees on the market. The minimum stock trade at eToro is just $10 and no commissions are charged when you place buy and sell orders. Crucially, this is also the case with international stocks. eToro also offers access to the forex markets, meaning traders can use the best forex signals alongside copy trading tools to make the most of their investing strategies.

In addition to stocks and ETFs, this top-rated trading platform also allows you to invest in cryptocurrency. This covers over 70 digital currencies and includes everything from Bitcoin, Cardano, and Shiba Inu to Ethereum, Dogecoin, and Decentraland. The minimum stake when trading cryptocurrency here is also set at $10 and fees are very competitive.

In fact, you will pay a commission of just 1% over the bid-ask spread. eToro is also one of the best copy trading platforms in this space. This means that you can copy the investments of a seasoned trader that you like the look of. There are thousands of verified traders to choose from and you make your decision based on historical ROIs, risk, preferred markets, and more. Copy trading is also considered by some investors as a better alternative to quantitative trading. But what is quant trading? Follow the link to find out more.

Passive traders are also catered for via eToro’s smart portfolios. These are pre-made baskets of assets that are maintained and rebalanced by eToro. Each smart portfolio is tasked with tracking a specific niche market – such as blockchain stocks, renewable energies, or cryptocurrency. No additional fees are charged by eToro when making use of its copy trading tool or smart portfolios.

When it comes to the safety of your investments, this low margin rate broker is a regulated entity with over 25 million registered clients. Licenses have been issued by the FCA, ASIC, and CySEC, and eToro is approved to offer trading services to US residents. eToro also offers a user-friendly stock trading app for iOS and Android smartphones.

We also like the fact that US clients can deposit and withdraw funds without paying any transaction fees. The easiest way to get money into your account is with a debit/credit card or e-wallet, as these payment methods are processed instantly. You can, however, also transfer funds via a bank wire or ACH. For further details on this leading social trading platform, read our eToro review now.

| Assets | Stocks, crypto, ETFs, copy trading, smart portfolios |

| Commissions | 0% stocks and ETFs, 1% on crypto |

| Minimum Deposit | $10 |

| Minimum Trade | $10 |

Pros

Cons

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Crypto.com – Best Crypto Trading Platform for Low Fees

And the platform allows you to deposit funds instantly with ACH on a fee-free basis. Debit and credit cards are also supported but you will be charged 2.99% of the transaction amount. What we also like about Crypto.com is that you can buy cryptocurrency and deposit the tokens into an interest-bearing account.

You’ll have access to APRs of up to 14.5% – but specific interest rates do vary depending on the cryptocurrency. Furthermore, to maximize your interest, you will need to stake CRO tokens and opt for a 3-month term. Alternatively, flexible crypto interest accounts are also offered, albeit, at lower rates.

When it comes to fees, Crypto.com charges a variable commission. This starts at 0.4% per slide but does decrease as your trading volumes surpass certain milestones. Staking CRO tokens also gives you access to lower commissions. If you’re also looking to access non-fungible tokens, Crypto.com offers one of the best NFT marketplaces for this purpose.

| Assets | Crypto |

| Commissions | Up to 0.40% perslide |

| Minimum Deposit | $20 |

| Minimum Trade | No minimum stated |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

3. XTB – CFD Trading Platform for Forex, Stocks, Crypto & More

XTB stands out because it doesn’t charge commissions and doesn’t require a minimum deposit to open a new trading account. Traders can also test out the platform for free with a demo account. XTB offers its own custom trading platform, called xStation 5, which operates on the web and mobile devices. xStation 5 is easy to use, offers advanced technical charting capabilities, and comes packed with technical indicators.

The only fees that traders need to be aware of at XTB are spreads, and they’re very competitive across the board. XTB charges spreads starting from 0.1 pips for forex trading and spreads of around 0.3% for most stock CFD trades. Traders can apply margin up to 500:1 when trading forex, 10:1 when trading stocks, or 5:1 when trading cryptocurrencies.

| Assets | Stocks, crypto, ETFs, indices, forex, commodities |

| Commissions | 0% on all CFDs |

| Minimum Deposit | None |

| Minimum Trade | 0.01 lot |

Pros

Cons

Your capital is at risk. 76% of retail investor accounts lose money when trading CFDs with this provider.

4. Webull – Popular Platform for Trading US Stocks and Crypto

In a similar nature to eToro, Webull also allows you to trade stocks and crypto via one safe hub. Regarding the latter, the platform supports 37 cryptocurrencies – most of which are large-cap tokens. You can trade crypto here from just $1 and there are no commissions charged. Spreads start at 1% when trading Bitcoin and more on other digital currencies.

If you’re more interested in stocks, Webull offers thousands of US-listed markets – all on a commission-fee basis. The minimum stock trade requirement is just $5. Take note, Webull does not offer international shares other than a very modest selection of ADRs. Additionally, you can also trade options and ETFs.

Another drawback with Webull is that domestic bank wires are charged at $8 per deposit. ACH, on the other hand, can be used fee-free. We also found that Webull is lacking when it comes to passive investment tools. Seasoned traders are catered for with a variety of charting features and technical indicators. More experienced and advanced traders may want to explore the best MT5 brokers for more advanced charting tools. There are also educational guides for newbies.

| Assets | Stocks, crypto, ETFs, options |

| Commissions | 0% commission plus spreads |

| Minimum Deposit | $0 |

| Minimum Trade | No minimum stated |

Pros

Cons

Your capital is at risk.

5. Coinbase – Good Cryptocurrency Exchange for First-Time Investors

While Coinbase certainly isn’t the best trading platform for cryptocurrency investments, it does offer a super-simple way for first-timers to gain exposure to this market. This is because beginners can open an account in a matter of minutes and then invest in cryptocurrency instantly with a credit or debit card.

However, Coinbase charges 3.99% on its instant buy feature, which is very expensive. Some US clients will instead opt to deposit funds with ACH and then begin trading crypto once the funds arrive. With that said, it can take up to three working days for ACH transfers to settle and you will still need to pay a commission of 1.49% per slide.

Nonetheless, we like Coinbase for its simplicity and its strong commitment to security and safety. All accounts must set up two-factor authentication and this will be required when you log in or make a withdrawal request. 98% of client cryptocurrencies are stored in secure cold wallets too. The Coinbase crypto wallet is also highly rated.

| Assets | Crypto |

| Commissions | 1.49% commission / 3.99% fee on debit/credit card purchases |

| Minimum Deposit | $50 is recommended by the platform |

| Minimum Trade | No minimum stated |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

6. Binance – Advanced Cryptocurrency Platform With Low Commissions

Binance also offers a wide selection of order types, technical indicators, and chart drawing tools. We also like that Binance is home to the largest amount of liquidity and trading volume in this cryptocurrency industry. On the other hand, Binance also allows US clients to buy 80+ cryptocurrencies instantly with a debit or credit card.

This will cost you a fee of 4.5% alongside an instant buy premium of 0.5%. Although this is expensive, standard trading commissions are very competitive. You will initially pay 0.10% per slide when trading crypto, but fees can be reduced when holding BNB. Higher trading volumes also give you chance to lower your commissions.

| Assets | Crypto |

| Commissions | Up to 0.10% commission / 4.5% + 0.5% fee on debit/credit card purchases |

| Minimum Deposit | Depends on the payment method |

| Minimum Trade | No minimum stated |

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

7. Interactive Brokers – Established Trading Platform With Thousands of Markets

If you’re looking to build a diversified portfolio of traditional assets – Interactive Brokers is one of the best trading platforms for this purpose. Across thousands of US and intentional markets, Interactive Brokers offers everything from stocks and ETFs to fixed-rate bonds and funds.

You also make use of tailor-made financial advice and managed portfolios, as well as access upcoming IPOs. In terms of fees, Interactive Brokers charges nothing in commission when you buy and sell US-listed stocks and ETFs. Foreign equities and other asset classes are charged at a premium and this will depend on your account type and the respective market.

We also like Interactive Brokers for its fractional investment tool – which enables you to trade US-listed stocks from just $1. For a platform that historically catered to seasoned pros, this shows that Interactive Brokers is also looking to attract casual retail clients. Finally, Interactive Brokers offers top-rated customer support across a variety of channels.

| Assets | Stocks, crypto, ETFs, funds, IPOs, bonds, managed portfolios |

| Commissions | 0% on US-listed stocks and ETFs / Variable fees on other markets |

| Minimum Deposit | $0 on standard brokerage account |

| Minimum Trade | $1 on US-listed stocks |

Pros

Cons

8. E*TRADE – Great Investment Platform for IRAs

E*TRADE is perhaps one of the best online trading platforms for long-term investors. You will be able to open an account without needing to meet a minimum deposit and in particular, E*TRADE stands out for its selection of IRAs.

There is a retirement account to suit all objectives – so this is a great way to invest in a tax-efficient way. When adding US-listed stocks and ETFs to your E*TRADE portfolio, no commissions will apply. Other assets are charged at various rates. Access to international stocks is limited here and there is no support for fractional shares.

With a requirement to purchase a minimum of one stock, this platform might not be suitable for casual investors. E*TRADE does, however, offer a trading platform that will suit intermediate and advanced traders. You will have access to plenty of research tools, especially when it comes to fundamental analysis. Accounts can take several days to open – so do bear this in mind.

| Assets | Stocks, ETFs, options, mutual funds, futures, bonds, prebuilt portfolios, IPOs |

| Commissions | 0% on US-listed stocks and ETFs / Variable fees on other markets |

| Minimum Deposit | $0 on standard brokerage account |

| Minimum Trade | No fractional stock purchases |

Pros

Cons

9. Schwab – Trade US-Listed Stocks and ETFs at 0% Commission

In terms of markets, Schwab gives you access to all US-listed stocks, as well as OTC markets and IPOs. International stocks are only offered in the form of ADRs. There are no commissions charged on stocks listed on the NASDAQ and NYSE. If your chosen stock forms part of the S&P 500, you only need to invest $5.

You can also trade a huge variety of other financial markets. This is inclusive of ETFs, index funds, options, bonds, money market funds, and much more. There is also financial advice on offer, but this requires a high minimum capital outlay. Schwab is also popular for its premium analysis tools and market insights. This also includes regular podcasts and workshops.

| Assets | Stocks, ETFs, options, mutual funds, bonds, money market funds |

| Commissions | 0% on US-listed stocks / Variable fees on other markets |

| Minimum Deposit | $0 on standard brokerage account |

| Minimum Trade | $5 minimum on stocks listed on the S&P 500 |

Pros

Cons

10. Fidelity – Top Trading Platform for Long-Term Investments

Although Fidelity offers a range of useful tools for short-term traders, the platform is perhaps best suited for long-term investments. You will find thousands of stocks and ETFs here, alongside index funds and mutual funds. You can also invest in fixed-rate bonds.

All of these products are ideal for buy-and-hold investors, especially if you are thinking about opening a retirement account. On this note, Fidelity offers a great selection of tools that can help you choose the best IRA for your requirements. You can also calculate your monthly cash flow based on your projected investments.

We also like that you can assess whether or not you are on track to meet your retirement objectives in under 60 seconds. If you decide to open a standard brokerage account, no minimum deposit requirements are in place. Moreover, this account type supports fractional stock investments from just $1. No commissions are charged on US-listed stocks.

| Assets | Stocks, ETFs, index funds, mutual funds, bonds |

| Commissions | 0% on US-listed stocks / Variable fees on other markets |

| Minimum Deposit | $0 on standard brokerage account |

| Minimum Trade | $1 minimum on US-listed stocks |

Pros

Cons

11. TD Ameritrade – Trusted Brokerage Offering Diverse Trading Markets

TD Ameritrade is yet another trading platform that offers a huge range of supported markets. With that said, what really sets this platform apart from the rest is its proprietary platform for advanced traders – thinkorswim. This can be accessed online or via downloadable desktop software.

Either way, thinkorswim provides high-level tools that allow you to outperform the markets consistently. For instance, this includes over 400,000 economic indicators, historical and real-time data, customizable charting screens, and the ability to deploy higher advanced orders. Many of the aforementioned tools can also be accessed via the thinkorswim mobile app.

In terms of the specifics, TD Ameritrade offers 0% commission trading on US-listed stocks. Additional fees will apply to non-US stocks and other asset classes. Moreover, when you trade US equities, there is no support for fractional ownership. As such, TD Ameritrade is better suited for those of you that are planning to trade with larger amounts.

| Assets | Stocks, options, ETFs, mutual funds, futures, forex, crypto, bonds, IPOs |

| Commissions | 0% on US-listed stocks / Variable fees on other markets |

| Minimum Deposit | $0 on standard brokerage account |

| Minimum Trade | No support for fractional stocks |

Pros

Cons

12. Robinhood – User-Friendly Trading Platform for Beginners

While this provider lacks advanced tools and features, Robinhood is perhaps the best trading platform for beginners. No minimum deposits are required to get started with Robinhood and the minimum stock trade is just $1. This is also the case with ETFs, crypto, and options.

Moreover, Robinhood is a 0% commission broker across all of its supported assets. US-listed stocks run into the thousands, but international equities are only offered via ADRs. Depositing funds into your Robinhood account can be cumbersome – not least because you will be capped to $1,000 in instant deposits.

Furthermore, you can only deposit funds via ACH or a bank wire. If you want access to margin trading, you will need to open a gold account at $5 per month. The gold account also offers higher instant deposits. Robinhood is also ideal if you want access to educational materials. Finally, many users trade on the Robinhood mobile app – which is very user-friendly.

| Assets | Stocks, options, ETFs, crypto |

| Commissions | 0% on all supported markets |

| Minimum Deposit | $0 on standard brokerage account |

| Minimum Trade | From just $1 |

Pros

Cons

13. Ally Invest – Combine Investment and Banking Services via a Single Platform

If you find it a hassle to transfer funds back and forth between your bank and brokerage accounts, Ally Invest could be one of the best trading platforms for you. This is because Ally Invest offers a variety of financial services via a single hub.

In terms of banking, this is inclusive of checking and savings accounts, retirement plans, mortgages, auto financing, and personal loans. On the brokerage side of things, Ally Invest gives you access to stocks, bonds, funds, and options. Interestingly, there is no support for cryptocurrencies. Moreover, Ally Invest does not allow you to take fractional ownership of assets.

We do, however, like that Ally Invest offers thousands of US-listed stocks and ETFs at 0% commission. You can also get started with a standard brokerage account without needing to meet a minimum deposit. You can fund your account via ACH, a bank wire, or a check. The Ally Invest app connects to your main account – which allows you to trade while on the move.

| Assets | Stocks, bonds, funds, options, ETFs |

| Commissions | 0% on US-listed stocks and ETFs / Variable fees on other markets |

| Minimum Deposit | $0 on standard brokerage account |

| Minimum Trade | No support for fractional stocks |

Pros

Cons

Top Trading Platforms Compared

For a quick summary of our findings when reviewing the best trading platforms for 2023 – check out the comparison table below:

| Commissions | Minimum Deposit | Core Features | |

| eToro | 0% on US and international stocks, and ETFs / 1% on crypto | $10 | Copy trading, smart portfolios, instant free deposits |

| Crypto.com | Up to 0.40% | $20 | Low fees, crypto interest accounts, NFT marketplace |

| XTB | 0% plus spread | None | 0% commission, wide range of markets, no minimum deposit |

| Webull | 0% plus spread | $0 | 0% commission on all markets, $0 minimum balance, great app |

| Coinbase | 1.49% / 3.99% on debit/credit cards | $50 is recommended | Simple way to buy crypto, debit/credit cards accepted, regulated |

| Binance | 0.10% / 4.5% + 0.5% on debit/credit card | Depends on payment method | 0.10% commission, advanced trading tools, supports US dollars |

| Interactive Brokers | 0% on US-listed stocks | $0 | Thousands of markets, trusted reputation, OTC markets |

| E*TRADE | 0% on US-listed stocks | $0 | Great for IRAs, no account minimum, good selection of assets |

| Schwab | 0% on S&P 500-listed stocks | $0 | $5 minimum on stocks, managed portfolios, financial advice |

| Fidelity | 0% on US-listed stocks | $0 | Superb for long-term investments, retirement accounts, $0 account minimum |

| TD Ameritrade | 0% on US-listed stocks | $0 | Thinkorswim platform, premium research tools, advanced trading app |

| Robinhood | 0% on all markets | $0 | 0% commission on all markets, beginner-friendly, $1 minimum trade |

| Ally Invest | 0% on US-listed stocks | $0 | Banking and investment services, robo-advisors, low fees |

How we Select the Best Stock Trading Platforms

In the sections below, we explain how we rank and compare the best online trading platforms in the market. This will also enable you to find a platform that aligns with your trading goals.

Licensing and Trust

We only select brokers that are adequately licensed to offer brokerage services in the US. This typically comes in the form of regulation from the SEC and approval by FINRA.

Any trading platform that does not have the remit to operate in the US should be avoided for your safety. We also prefer trading platforms that have a long-standing track record in space over newly launched providers.

Selection of Markets

You might have noticed from our reviews that the best trading platforms in the market will offer a wide selection of asset classes. For example, eToro gives you access to US and foreign stocks, ETFs, cryptocurrencies, and more.

The likes of Fidelity and Schwab are great for mutual funds and index funds, as well as managed portfolios and financial advice.

Minimum Account Balance

Many trading platforms allow you to open an account without needing to meet a minimum deposit. This allows you to enter the financial markets for the first time without needing to risk too much money.

Don’t forget, if you wish to open a margin account, US clients are required to maintain a minimum balance of $2,000 at all times.

Minimum Trade

Some of the platforms discussed today require you to purchase full shares – such as Ally Invest and E*TRADE.

However, the best trading platforms that we reviewed – which is inclusive of eToro, Webull, and Robinhood, allow you to invest in stocks with just a few dollars.

If fractional trading isn’t supported and you are on a budget, the platform might not be right for your requirements.

Trading Fees and Commissions

If you are buying stocks or ETFs that are listed in the US, all of the trading platforms discussed today allow you to invest at 0% commission. However, other assets – or stocks listed outside of the US, are typically charged at a premium.

As such, this is something to check before opening an account. Take note, if you are interested in buying international stocks, eToro offers access to over a dozen foreign markets at 0% commission.

Trading Tools

If you are a complete beginner that seeks passive investment tools, you will likely find the copy trading feature and smart portfolios available at eToro of interest.

If you are a seasoned pro that wishes to take full control over your investment decisions, then look for a platform that offers highly advanced features – such as economic and technical indicators, alongside chart drawing tools.

Demo Account

Demos accounts are useful for traders of all levels. If you wish to practice a new strategy or simply get to grip with a trading platform that you are looking to join – demo accounts are invaluable.

This is something we look for when reviewing the best trading platforms in the market.

Mobile App

The best online trading platforms also offer a mobile app that links to your account. The app should be fully optimized for Android and iOS and connect to your main trading account.

Deposit Methods

We prefer trading platforms that offer instant and free deposit methods. eToro, for example, allows you to instantly deposit funds via e-wallets and debit/credit cards on a fee-free basis.

Customer Service

We also like trading platforms that offer a seamless 360-degree customer experience. The best providers in this space offer customer support via live chat.

Types of Trading Platforms

While some trading platforms specialize in a specific asset class, others give you access to a wide range of markets.

Below we briefly explain the main type of trading platforms that you will have access to.

Crypto Trading Platforms

Crypto trading platforms allow you to buy and sell digital currencies like Bitcoin and Cardano. Most platforms in this space operate as third-party exchanges, meaning that you will be trading with other market participants.

On the other hand, brokers like eToro and Webull allow you to invest in cryptocurrencies directly – which is more suitable for newbies.

Stock and ETF Trading Platforms

If you’re looking for a platform that offers traditional stocks and ETFs, you’ve got plenty of options. Most stock trading platforms these days offer 0% commission on US-listed equities and ETFs, and in many cases, the ability to invest just a few dollars.

Forex Trading Platforms

Forex – which consists of exchanging currency pairs, is home to the largest trading scene globally. If you’re based in the US, you likely know that the forex trading industry is heavily regulated.

As such, you will need to meet a range of strict requirements – such as keeping a minimum amount of capital in your brokerage account. Nonetheless, the best forex trading platforms in the market offer plenty of currency pairs alongside tight spreads, particularly low spread forex brokers.

Options Trading Platforms

Options are highly complex financial derivatives that allow you to speculate on the future value of an asset without taking ownership upfront.

This essentially allows you to trade with more capital than you have access to. The best options trading platforms for newbies include Webull and Robinhood.

Commodities Trading Platforms

Some of the most traded commodities globally include oil, natural gas, gold, silver, and wheat. Once again, if you’re a retail client based in the US, you might find it difficult to trade these instruments.

You can, however, easily invest in commodity-centric ETFs at eToro on a 0% commission basis.

Day Trading Platforms

The best day trading platforms in the market are suitable for those that wish to speculate on assets through a short-term strategy. You will look to place an order and close the position before the respective market closes on that day.

Take note of the pattern day trading rule in the US. If you are classed as a day trader, the rule states that you must hold at least $25,000 worth of equity in your brokerage account.

Conclusion

This guide has compared the best trading platforms in the market today. We focused on platforms that offer access to a broad selection of markets at competitive fees, alongside suitable trading tools and top-rated customer service.

We concluded that eToro is the overall best trading platform for 2023. The platform offers thousands of 0% commission stocks and ETFs, as well as cryptocurrencies.

You can also invest in copy trading tools and inject capital into a professionally-managed smart portfolio – all without paying additional fees. US clients can get started with a verified eToro account in just five minutes.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.